The Credit-Building Puzzle: Why It Matters

How to build credit is a question that confuses many Americans, especially those just starting their financial journey. If you’re looking for the quickest path to building credit, here’s what you need to know:

Quick Guide to Building Credit:

1. Become an authorized user on someone else’s credit card

2. Apply for a secured credit card with a deposit as low as $200

3. Get a credit-builder loan from a credit union or online lender

4. Have rent and utility payments reported to credit bureaus

5. Make all payments on time and keep balances below 30% of your limit

Building credit often feels like a frustrating chicken-and-egg problem: you need credit to build credit. But even with no credit history, you have options to start establishing your financial foundation.

Why does this matter? Your credit score affects everything from your ability to rent an apartment to the interest rates you’ll pay on loans. It can even impact your insurance premiums and job prospects. As Rod Griffin from Experian notes, “The lower a person’s score, the more likely they are to achieve a 100-point increase… simply because there is much more upside, and small changes can result in greater score increases.”

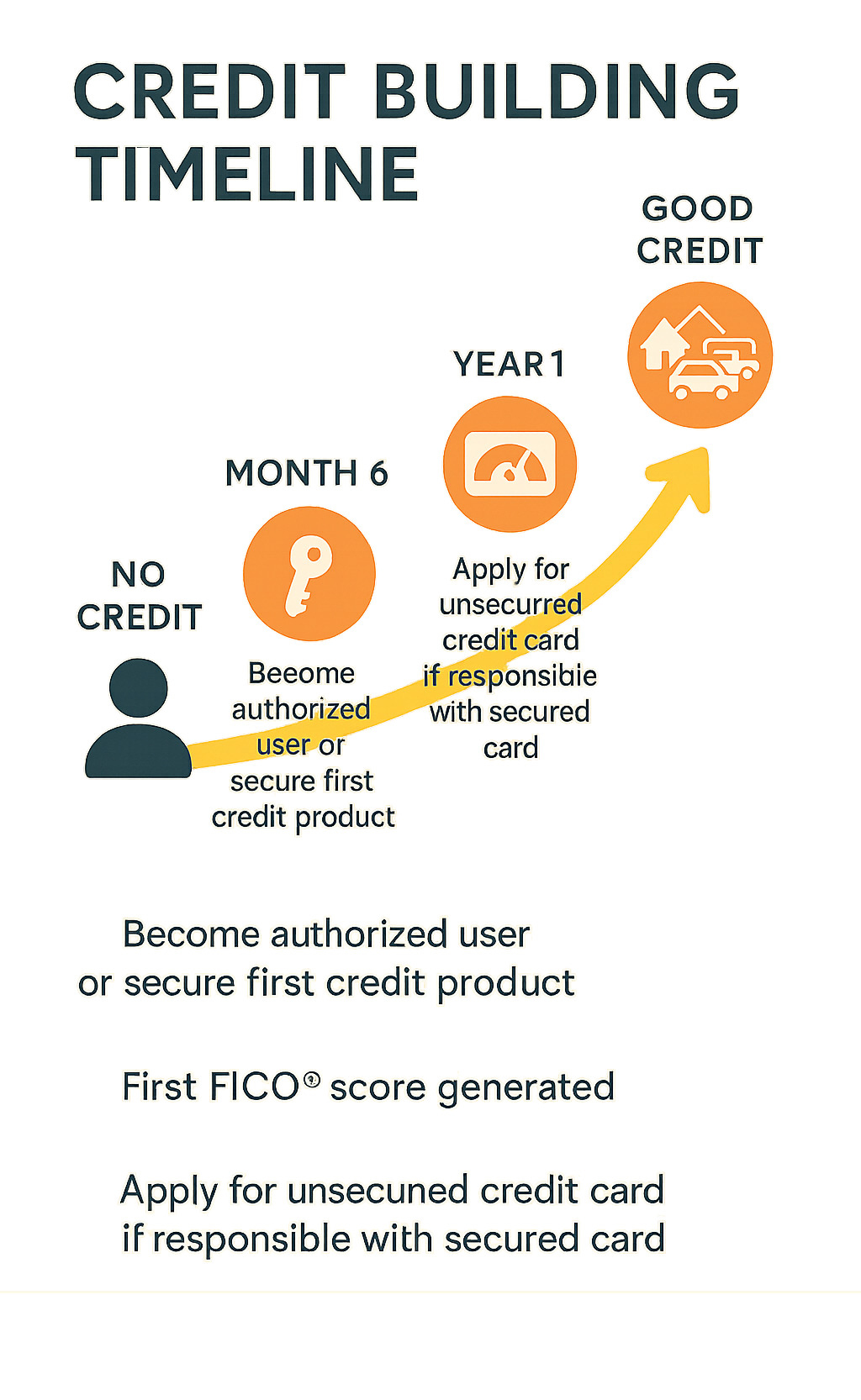

The good news is that you can establish a FICO® score in as little as six months with the right strategy. Whether you’re a young adult, recent graduate, immigrant, or someone who’s simply avoided credit until now, the path to good credit starts with understanding your options and being consistent with your approach.

Understanding Credit & Why It Matters

Ever wonder what people mean when they talk about “good credit”? At its heart, credit is simply your financial reputation – the story of how you’ve handled borrowed money throughout your life. When someone checks your credit, they’re really asking: “Can I trust this person to pay me back?”

Your financial story gets collected by three major credit bureaus – Equifax, Experian, and TransUnion. These companies compile everything from your payment history to account balances into detailed reports that follow you throughout your financial life.

From these reports comes a simple three-digit number – your credit score – that gives lenders a quick snapshot of your creditworthiness. Most scores come from either FICO® or VantageScore models and range from 300 to 850, with higher being better.

What makes up this magical number? The FICO® model breaks it down into five key ingredients:

- Payment history (35%): The single biggest factor is simply whether you pay your bills on time

- Amounts owed (30%): How much of your available credit you’re currently using

- Length of credit history (15%): How long you’ve been using credit

- Credit mix (10%): Whether you’ve handled different types of credit successfully

- New credit (10%): How frequently you’re applying for new accounts

Why should you care? Good credit is essentially a key that open ups financial freedom. It can save you thousands of dollars through lower interest rates on loans and credit cards. It helps you get approved for apartments and even affects your insurance premiums. In some cases, it might even influence whether you get that dream job!

More info about credit reports

What Is a Credit Score?

Think of your credit score as a financial report card – a simple number that sums up your entire credit history. Most scores range from 300 to 850, with higher numbers signaling to lenders that you’re a safer bet.

Where do you stand? Here’s how the ranges typically break down:

- Exceptional (800-850): You’re in the credit elite – congratulations!

- Very Good (740-799): Doors are wide open for excellent rates

- Good (670-739): You’ll qualify for most credit with decent terms

- Fair (580-669): You can get credit, but expect higher interest rates

- Poor (300-579): Credit will be harder to come by and much more expensive

It’s not just banks looking at your score. Landlords check it before renting to you, insurance companies use it to set your premiums, and some employers (with your permission) review it during hiring, especially for financial positions. Your credit score follows you almost everywhere!

How Long It Takes to Generate a Score

Starting from zero? You’ll need a little patience. FICO® won’t generate a score until you’ve had at least one account open for six months and reported to at least one credit bureau. This is commonly called the “six-month rule.”

VantageScore is a bit more forgiving and can sometimes generate a score faster – potentially as soon as your first account appears on your credit report.

Many people struggle with having a “thin file” – meaning fewer than five credit accounts. This makes it harder to build a robust score. You might face this challenge if you’re:

- Just starting your adult financial journey

- Recently moved to the United States

- Someone who’s preferred cash over credit

- Getting back into the credit game after years away

If you’ve recently immigrated, it’s worth noting that your credit history doesn’t pack its bags and follow you to America. Even if you had sterling credit in your home country, you’ll typically need to build your U.S. credit profile from the ground up.

Main Drivers of Your Score

Understanding what truly moves the needle on your credit score helps you make smarter decisions. Let’s look closer at what really matters:

Payment history (35%) is the heavyweight champion of credit factors. Just one payment reported 30+ days late can significantly damage your score, and that mistake can haunt your credit report for seven years! The flip side? Every on-time payment strengthens your financial reputation. Setting up automatic payments can be a lifesaver here.

Credit utilization ratio (30%) measures how much of your available credit you’re using. If your credit card has a $1,000 limit and you’re carrying a $300 balance, you’re at 30% utilization. Financial experts typically recommend keeping this number below 30%, but those with the highest scores often maintain utilization below 10%. This shows lenders you’re not dependent on borrowed money to make ends meet.

Length of credit history (15%) looks at how long you’ve been in the credit game. This includes the age of your oldest account, the average age of all accounts, and how recently you’ve used certain accounts. This is why closing old credit cards can sometimes hurt your score – it can reduce your credit history length.

Credit mix (10%) considers whether you’ve successfully handled different types of credit. Having both revolving accounts (like credit cards) and installment loans (like auto loans or mortgages) shows versatility in managing different financial obligations.

New credit inquiries (10%) track how many times you’ve recently applied for credit. Multiple applications in a short period can make lenders nervous that you’re in financial trouble. The good news? If you’re shopping for specific loans like mortgages or auto loans, multiple inquiries within a short window (typically 14-45 days) usually count as just one inquiry.

Scientific research on credit score factors

How to Build Credit: Your 5-Step Starter Plan

So you’re ready to start your credit journey? Whether you’re still in high school, navigating college life, fresh out of school, or new to the American financial system, I’ve got you covered. Building credit doesn’t have to be complicated—what matters most is starting somewhere and staying consistent. Let’s walk through this together, step by step.

Step 1: Open the Right Starter Account – How to Build Credit Begins Here

Your credit-building journey typically starts at the bank. While a checking or savings account won’t directly boost your credit score, these accounts serve as your financial foundation and are often prerequisites for credit products.

Once you’ve established basic banking, it’s time to consider your first credit account. For most beginners, a secured credit card makes perfect sense. These cards require a refundable security deposit—usually between $200 and $500—which then becomes your credit limit. This deposit reduces the lender’s risk, making approval much more likely even if you’re starting from zero.

When shopping for a secured card, look for one that reports to all three major credit bureaus (some don’t!), charges minimal fees, and offers a clear path to graduate to an unsecured card after responsible use.

College students have another excellent option: student credit cards. These products are specifically designed with students in mind, featuring more lenient approval requirements and sometimes even rewards for good grades.

If those options don’t work out, consider a store credit card from your favorite retailer. While they typically carry higher interest rates and limited usability, they’re often easier to qualify for and can serve as your first step on the credit ladder.

At this stage, it’s all about establishing good habits—not maximizing rewards or benefits. Your future self will thank you for focusing on the fundamentals first.

Step 2: Become an Authorized User

Want to give your credit journey a head start? Consider becoming an authorized user on someone else’s credit card account. This strategy (sometimes called “piggybacking”) allows you to benefit from the primary cardholder’s credit history without taking on the legal responsibility for payments.

Here’s the beauty of this approach: when a trusted family member or friend adds you as an authorized user, their account history typically appears on your credit report. This means you instantly gain the advantage of their payment history, account age, and credit utilization—three key factors in credit scoring.

The ideal arrangement is with someone who has maintained the card for several years, keeps their balances low relative to their limits, and has a perfect payment record. Just make sure their card issuer reports authorized users to all three credit bureaus (not all do).

What’s particularly nice about this strategy is that you don’t necessarily need to use the card or even have it in your possession. It’s like having training wheels for your credit journey—you get the benefit without the full risk.

Just be sure to have clear conversations about expectations. While the primary account holder remains legally responsible for all charges, miscommunications can strain even the closest relationships.

Step 3: Use a Credit-Builder Loan or Secured Loan

Credit-builder loans offer a unique approach to establishing credit. Unlike traditional loans where you receive money upfront, these special products essentially help you save while building credit.

Here’s how they typically work: You apply for a small loan (usually $300-$1,000), but instead of giving you the money immediately, the lender deposits it into a locked savings account. You make monthly payments for 6-24 months, and the lender reports these payments to the credit bureaus. Once you’ve paid in full, you receive the money plus any interest earned (minus fees).

With monthly payments as low as $25, these loans are accessible to most budgets. Think of it as a forced savings program with the added benefit of building credit history. You’ll find these loans at community banks, credit unions, and online lenders specializing in credit building.

The approval process typically focuses on your income and ability to make payments rather than your existing credit—making these an excellent option for true beginners. It’s like getting credit for saving money—a win-win for your financial future.

Step 4: Report the Bills You Already Pay

Did you know you might already be making payments that could boost your credit score? Traditionally, rent and utility payments only appeared on your credit report if you fell behind. But now, several services can help you get credit for these regular payments.

Your monthly rent is likely one of your largest expenses, and rent reporting services can help this responsibility reflect positively on your credit. These services work with your landlord to verify and report your on-time payments to one or more credit bureaus. Some charge a fee, while others might be offered through your property management company.

Beyond rent, you can add utility and phone payments to your Experian credit report through Experian Boost, a free service that connects to your bank account to identify eligible bill payments. Users see an average FICO® Score increase of 13 points—not bad for bills you’re already paying!

The credit-building landscape continues to evolve, with new services allowing you to report payments for streaming subscriptions, insurance premiums, childcare costs, and even medical bills. By leveraging these tools, you’re adding positive information to your credit report without taking on additional debt.

Step 5: Pay On Time & Keep Balances Low — Core of How to Build Credit Fast

No matter which credit-building tools you choose, two fundamental habits form the foundation of excellent credit: timely payments and low utilization. Master these, and you’re well on your way to credit success.

Payment history accounts for 35% of your FICO® Score, making it the single most influential factor. Even one payment that’s 30+ days late can significantly damage your progress and stay on your report for seven years. To stay on track, set up calendar reminders a few days before due dates, enable automatic payments for at least the minimum amount due, or consider paying bills immediately upon receipt rather than waiting for the due date.

Almost equally important is your credit utilization—how much of your available credit you’re using at any given time. This factor makes up 30% of your score, and lower is definitely better. Aim to keep your utilization below 30% across all cards, though those with the highest scores typically maintain single-digit utilization (under 10%).

The best approach? Pay your balance in full each month to avoid interest charges while keeping your reported utilization low. If you need to make a larger purchase, consider making a payment before your statement closing date to reduce the balance that gets reported to the bureaus.

These habits don’t just help you build credit—they form the foundation of healthy financial management that will serve you throughout life. Creating and following a budget is essential to managing your credit use responsibly and avoiding the debt trap that catches so many Americans.

Credit-Building Tools: From Secured Cards to Rent Reporting

Now that you understand the basics of how to build credit, let’s explore your toolkit of options. Think of these tools as different instruments in your financial orchestra – each plays its own role, but they sound best when working together.

| Feature | Secured Credit Card | Credit-Builder Loan | Authorized User | Rent Reporting |

|---|---|---|---|---|

| Cost | $0-$49 annual fee + deposit | $0-$15 monthly + interest | Usually free | $0-$100+ annually |

| Credit impact | Moderate to high | Moderate to high | Moderate | Low to moderate |

| Time to see results | 1-6 months | 1-24 months | 1-2 months | 1-3 months |

| Risk level | Low | Very low | Low (for you) | Very low |

| Best for | Active credit users | Disciplined savers | Those with trusted contacts | Renters with stable housing |

Secured Credit Cards Explained

Think of a secured credit card as credit with training wheels. You provide a security deposit – typically around $200 – which becomes your credit limit. It’s your money protecting both you and the lender from overextension.

What makes a good secured card? Look for one that reports to all three major credit bureaus (this is non-negotiable!). The best cards also offer a clear graduation path to an unsecured card, charge minimal fees, and return your deposit after responsible use.

Using your secured card effectively is straightforward but requires discipline. Make small, manageable purchases, keep your balance below 30% of your limit, and pay in full each month. After about 6-12 months of this responsible behavior, many issuers will consider upgrading you to a traditional credit card and returning your deposit.

Your deposit isn’t a fee – it’s more like money you’re temporarily setting aside. You’ll get it back when you close the account in good standing or upgrade to an unsecured card.

Credit-Builder Loans & Installment Options

Credit-builder loans flip the traditional lending model on its head in a clever way. Instead of receiving money upfront, you make payments first, then receive the funds afterward. It’s like paying yourself while building credit.

Here’s the magic: you apply for a small loan (typically $300-$1,000), but instead of handing you the cash, the lender deposits it into a locked savings account. You make monthly payments of around $25-$150 for 6-24 months. Each payment gets reported to the credit bureaus, building your history. Once you’ve paid in full, you receive the money plus any interest earned (minus fees).

“It’s like forced savings with a credit-building bonus,” as one of our clients described it. Community banks and credit unions often offer these loans at reasonable rates (usually under 16% APR), making them accessible even to those with modest incomes.

For a slightly different approach, some financial institutions offer secured personal loans using your existing savings as collateral. These function more like traditional loans but are easier to qualify for when you’re just starting out.

Authorized Users & Co-Signers

Sometimes the fastest path to credit involves a helping hand from someone who’s already established. Becoming an authorized user on a family member’s credit card account allows you to “piggyback” on their credit history. Their account appears on your credit report, potentially giving your score a significant boost.

The ideal arrangement involves a trusted person with a long-standing account, excellent payment history, and low utilization. You don’t even need to use the card to benefit from it – though clear boundaries about usage should be established regardless.

A co-signer relationship goes deeper, with both parties equally responsible for the debt. Your co-signer’s good credit helps you qualify for accounts you couldn’t get alone, but they’re putting their own credit on the line. If you miss payments, their score suffers too.

“If you’re fortunate enough to have someone willing to co-sign, treat that trust like gold,” advises our financial counseling team. This arrangement works best with crystal-clear communication and rock-solid commitment to making payments on time.

Alternative & Emerging Options

The credit-building landscape is evolving faster than ever, with innovative products designed specifically for credit newcomers.

Credit-building debit cards offer an intriguing hybrid approach. They connect to your existing bank account like a normal debit card but report payment activity to credit bureaus. This gives you the safety of spending only money you already have while building credit history.

Subscription and bill-reporting services have expanded beyond just rent reporting. Now your Netflix subscription, gym membership, and even cell phone payments can potentially help build your credit through specialized reporting services.

Fintech apps dedicated to credit building continue to launch, combining credit education, spending analysis, and automated savings alongside their credit-building features. Many offer user-friendly interfaces that make tracking your progress satisfying and simple.

Programs like UltraFICO™ and Experian Boost™ represent a significant shift toward considering alternative data in credit scoring. By analyzing your banking activity and utility payments, these programs provide a more complete picture of your financial responsibility – perfect for those with thin credit files.

At Finances 4You, we’re excited to see these innovations creating more opportunities for consumers to establish credit through everyday financial activities. The path to good credit is becoming more accessible and diverse – no matter where you’re starting from.

Habits, Monitoring & Protection for Long-Term Success

Building credit isn’t just about opening accounts—it’s about cultivating financial habits that will serve you for decades. Think of it as tending a garden: the seeds you plant today (your accounts) need regular care (good habits) to flourish over time.

Good Habits That Grow Credit

Your day-to-day financial behaviors have a profound impact on your credit health. The good news? These habits are simple to understand, even if they take discipline to maintain.

Pay everything on time, every time. I can’t stress this enough—your payment history makes up 35% of your FICO score. Even one missed payment can haunt your credit report for seven years. Setting up automatic payments or calendar alerts can be a lifesaver here. I personally use my phone’s calendar with alerts three days before each bill is due.

Keep those credit utilization ratios low. Aim to use less than 30% of your available credit. Credit score superstars (those with scores above 800) typically keep their utilization in the single digits. If your limit is $1,000, try to keep your balance under $300—or better yet, under $100.

Treat old accounts like old friends—don’t abandon them. The length of your credit history matters significantly. That first credit card you got in college? Keep it open with occasional small purchases to maintain the relationship with both the card issuer and the credit bureaus.

Diversify your credit mix as you mature financially. Think of this like a balanced investment portfolio—having different types of credit (cards, auto loans, mortgages) shows lenders you can juggle various financial responsibilities successfully.

Space out your credit applications like you would space out plants in a garden—giving each one room to establish roots. Each application typically triggers a hard inquiry, which can temporarily ding your score by 5-10 points.

Regularly check your credit reports to catch errors and track your progress. Think of this as your financial health check-up. More info about boosting score

Mistakes to Avoid

Even one misstep can set back months of careful credit building. Here are the pitfalls to steer clear of:

Late payments are like credit score kryptonite. A single payment that’s 30+ days late can drop your score by 80+ points if you have good credit—and the damage lingers for years.

Maxing out credit cards signals financial distress to lenders, even if you’re making payments on time. It’s like running at your maximum heart rate constantly—eventually, something’s going to give.

Closing old credit accounts might seem logical if you’re not using them, but it can backfire by shortening your credit history and increasing your utilization ratio. That old, dusty account is actually working in your favor behind the scenes.

Applying for multiple accounts in a short timeframe can make you look financially desperate. Lenders get nervous when they see someone suddenly seeking lots of credit.

Ignoring your statements and credit reports is like driving with your eyes closed. You might miss fraudulent charges or reporting errors that could damage your score if left uncorrected.

Co-signing without serious consideration puts your credit at the mercy of someone else’s financial habits. Only co-sign if you’re prepared (both financially and emotionally) to take on the debt yourself.

Monitoring & Disputing Your Credit

Keeping a watchful eye on your credit is essential for both building and protecting it. Here’s how to stay vigilant:

Access your free credit reports from Equifax, Experian, and TransUnion at AnnualCreditReport.com. This is the only officially authorized source for free reports guaranteed by federal law. During normal times, you get one free report from each bureau annually, though during the pandemic, weekly access was temporarily available.

Use free credit score services that many banks, credit unions, and credit card issuers now offer. While these might use educational scores rather than the exact FICO scores lenders see, they’re great for tracking trends and progress over time.

Set up fraud alerts if you suspect your information has been compromised. This adds a verification layer before new credit can be opened in your name, like adding an extra lock to your front door.

Consider a credit freeze for maximum protection. This completely blocks access to your credit report, making it impossible for identity thieves to open accounts in your name. You’ll need to temporarily lift the freeze when you want to apply for credit yourself. You also might consider a credit freeze

When you spot errors on your credit report, dispute them promptly. The process is straightforward: contact the credit bureau showing the error, explain what’s wrong and why, and provide supporting documentation. The bureau typically has 30-45 days to investigate, and if the information can’t be verified, it must be removed from your report.

Quick Wins to How to Build Credit Fast

While building excellent credit is generally a marathon, not a sprint, these strategies can give you some quicker improvements:

Ask for a credit limit increase on your existing cards. If approved without a hard inquiry (request a “soft pull” review), this immediately lowers your utilization ratio. It’s like magically making your gas tank bigger without adding more gas.

Make mid-cycle payments before your statement closes. Credit card companies typically report your balance to credit bureaus when they generate your statement. Paying down your balance before this date can significantly lower your reported utilization.

Negotiate with collection agencies for a “pay-for-delete” arrangement. While not all agencies will agree to this, some will remove negative items from your credit report in exchange for payment. Always get these agreements in writing before sending any money.

Add utility and subscription payments through services like Experian Boost. This free service can immediately add positive payment history to your Experian credit report by giving you credit for bills you’re already paying.

Become an authorized user on a well-established account with perfect payment history. This can add years of positive history to your credit report almost instantly—like getting credit for someone else’s good homework.

Frequently Asked Questions about How to Build Credit

How many cards should I open when starting?

When you’re first building credit, simplicity is your friend. Start with just one credit card and use it responsibly for at least six months before considering adding another. This allows you to establish good habits without becoming overwhelmed by multiple payment dates and credit limits.

Think of it like learning to juggle—start with one ball before adding more. Too many new accounts at once can result in multiple hard inquiries, reduce your average account age, and increase the temptation to overspend.

Once you’ve demonstrated responsible use with your first card, you might consider adding a second card with different benefits or rewards. Quality always trumps quantity in your credit portfolio.

Can rent and utilities really boost my score?

Yes, they can—though the impact varies depending on the scoring model and reporting method. Traditionally, these payments only appeared on credit reports when something went wrong (like missing payments). But this landscape is changing rapidly.

Rent payments can now be reported through specialized services like Rental Kharma, RentTrack, or PayYourRent. Some property management companies offer this service directly. VantageScore fully incorporates this rent data, while FICO scores consider it to varying degrees depending on the version.

Utility and phone payments can boost your Experian-based credit scores through Experian Boost. Users see an average 13-point increase in their FICO Score based on Experian data—not earth-shattering, but certainly helpful, especially if you’re on the border between credit score categories.

While these alternative data points won’t have as dramatic an impact as traditional credit accounts, they can be particularly valuable for those with limited credit history or those recovering from past credit mistakes.

How do I move from a secured to an unsecured card?

Transitioning from a secured to an unsecured credit card is a significant milestone in your credit journey—like graduating from training wheels to a regular bicycle. Here’s how to make this transition smoothly:

First, choose a secured card with a clear upgrade path. Some issuers like Find and Capital One automatically review your account for an upgrade after 6-12 months of responsible use.

While using your secured card, focus on building positive habits: make regular purchases, pay your balance in full each month, never miss a payment, and keep your utilization below 30%. These behaviors demonstrate to the issuer that you’re ready for an unsecured card.

Monitor your credit score as it improves. Once it reaches the mid-600s or higher, your chances of qualifying for an unsecured card increase significantly.

If your issuer doesn’t automatically review your account, be proactive and request an upgrade directly after 6-12 months of on-time payments. A simple phone call can sometimes be all it takes.

If your current issuer doesn’t offer an upgrade path, you can apply for a new unsecured card once your credit score has improved. After approval, you can close your secured card and receive your deposit back.

The best part? When you upgrade with the same issuer, your account history typically transfers to the new unsecured card, preserving your credit history length. This preservation of history is why upgrading is often better than closing one account and opening another.

Conclusion

So you’ve made it to the end of our credit-building journey! If you were feeling overwhelmed about how to build credit when you started reading, I hope you’re now feeling confident and equipped with a clear path forward.

Building credit from scratch is a bit like planting a garden – it takes time, attention, and consistent care, but the rewards are absolutely worth it. The financial doors that open with good credit can truly change your life.

Remember those key pillars we discussed? Your payment history and credit utilization are the heavy hitters – get those right, and you’re already ahead of the game. Making every payment on time and keeping your balances low will take you far on this journey.

The beautiful thing about credit building is that you have options. Whether you start with a secured card that requires just a small deposit, become an authorized user on a family member’s account, or take out a credit-builder loan, there’s a path that fits your specific situation. And don’t forget about those alternative methods like reporting your rent or utility payments – sometimes the everyday bills you’re already paying can help boost your score.

Good credit habits aren’t complicated, but they do require vigilance. Setting up payment reminders, regularly checking your credit reports for errors, and being thoughtful about new credit applications will protect the progress you make. Think of monitoring your credit like checking the weather before heading out – it just becomes part of your routine.

Patience truly is a virtue when it comes to credit building. While that first FICO® Score takes at least six months to generate, each responsible month adds another brick to your financial foundation. The person with excellent credit didn’t get there overnight – they built it one payment at a time, just like you will.

At Finances 4You, we’ve seen countless people transform their financial futures by understanding and improving their credit. The principles never change: consistency in your payments, responsibility with your balances, and knowledge about how the system works will always serve you well.

Your credit journey doesn’t end here. As your profile strengthens, you’ll qualify for better cards, lower interest rates, and more favorable terms on everything from mortgages to car loans. The financial flexibility you gain will create opportunities you might not even be considering right now.

Ready to deepen your credit knowledge even further? Our comprehensive guide to credit scores and reports dives into even more detail about how these important financial tools work.

Remember – your credit score isn’t just a number. It’s a reflection of your financial reliability and a key that open ups better financial opportunities. The steps you take today to build and protect your credit will pay dividends for years to come.

1 thought on “No Credit? No Problem! How to Build Credit Easily”

Pingback: From Credit Zero to Hero – Raise Your Score by 100 Points Quickly - Finances 4 You

Comments are closed.