Why Understanding Crypto Bubbles Can Protect Your Wealth

A crypto bubble happens when digital asset prices shoot up way beyond their real value, driven by hype and speculation rather than fundamentals. These bubbles always burst, often wiping out 80-90% of value in months.

Quick Crypto Bubble Facts:

– Definition: Rapid price inflation driven by speculation, not utility

– Warning Signs: Parabolic price charts, celebrity endorsements, mainstream media hype

– Historical Impact: Bitcoin crashed 80% in 2018, from $19,783 to $3,100

– Recovery Time: Major bubbles typically take 2-4 years to fully recover

– Key Lesson: Every crypto boom has ended in a devastating bust

As young professionals building wealth, understanding these market cycles is crucial. Sir Isaac Newton famously lost a fortune in the South Sea Bubble, saying “I can calculate the movement of the stars, but not the madness of men.” The same psychology drives crypto bubbles today.

Recent data shows crypto bubbles are getting more extreme. The 2018 crash was worse than the dot-com bubble’s 78% collapse. In 2022, the total crypto market lost over $2 trillion from its peak. Yet each cycle also brings innovation – just like how the dot-com crash left us with Amazon and Google.

The key is learning to spot these bubbles before they pop. With the right tools and knowledge, you can protect your portfolio and even profit from market cycles.

Crypto bubble vocabulary:

– crypto market

– crypto market cap

– cold wallet crypto

Understanding the Crypto Bubble Phenomenon

Picture this: your neighbor who’s never invested in anything suddenly starts talking about getting rich quick with some new cryptocurrency. Your barista is checking coin prices between customers. Even your grandmother is asking about Bitcoin at family dinner.

When everyone’s talking about crypto, you’re probably witnessing a crypto bubble in action.

A crypto bubble happens when digital asset prices shoot up way beyond what they’re actually worth. It’s like a popularity contest gone wild – everyone wants in, prices go crazy, and reality eventually crashes the party hard.

The crypto market is especially bubble-prone because it combines digital scarcity with pure human emotion. When someone tells you there are only 21 million Bitcoin that will ever exist, and the price is “going to the moon,” your brain starts doing funny things. Add 24/7 trading, social media hype, and the herd instinct we all have, and you’ve got a recipe for spectacular booms and devastating busts.

What Is a Crypto Bubble?

A crypto bubble is what happens when cryptocurrency prices inflate like a balloon filled with hot air instead of solid fundamentals. The greater fool theory kicks in – people buy overpriced assets hoping to sell them to an even bigger fool later.

Here’s how asset mispricing works in crypto: A new coin launches with promises of revolutionizing everything. Early investors make massive gains. Word spreads. More people pile in. Prices go parabolic. Then someone asks, “But what does this thing actually do?”

Silence.

Rapid price appreciation becomes the only selling point. When Bitcoin jumped from $1,000 to nearly $20,000 in 2017, it wasn’t because Bitcoin suddenly became 20 times more useful. It was pure speculation feeding on itself.

Historical Crypto Bubbles and Crashes

Every crypto bubble teaches us something new about human nature and market psychology.

The 2011 Wake-Up Call

Bitcoin’s first real bubble took it from about $1 to nearly $30, then crashed over 90% back to $2. This happened because a single article introduced Bitcoin to people who’d never heard of it.

2017-2018: The ICO Madness

This was crypto’s coming-of-age bubble. Bitcoin peaked at $19,783 while the total crypto bubble reached $830 billion. During the ICO mania, people threw money at any project with “blockchain” in the name. Over 800 ICOs raised $20 billion, but 80% turned out to be worthless or outright scams.

The crash was brutal. By late 2018, the market had lost 80% of its value – worse than the dot-com bubble.

2021-2022: The Everything Bubble

Pandemic stimulus money flooded into everything, including crypto. Bitcoin hit $67,566 while the total market exceeded $3 trillion. The bubble burst in 2022, erasing over $2 trillion in value and taking down major players like Terra Luna and FTX.

For the latest market data for Bitcoin, you can see how these market cycles continue repeating. Each crash leaves the market more mature, but human nature ensures the patterns remain the same.

Drivers and Warning Signs of a Crypto Bubble

Picture this: It’s 2021, and your neighbor who’s never invested in anything suddenly starts talking about how they made $50,000 on Dogecoin. Your social media feed is flooded with crypto success stories. Even your grandmother asks about Bitcoin at dinner. This is exactly how crypto bubbles begin to form.

Multiple forces typically converge to create these market frenzies. Excessive leverage acts like gasoline on a fire – when people borrow money to buy crypto, small price movements get amplified dramatically. Add in loose monetary policy from central banks, and suddenly everyone’s looking for higher returns than traditional savings accounts offer.

The psychology behind crypto bubbles is fascinating and predictable. Retail FOMO – that gnawing fear of missing out – drives people to make irrational decisions. They see others getting rich and think “Why not me?” This creates a herd mentality where everyone follows the crowd instead of doing their own research.

External factors often provide the spark that ignites these bubbles. Regulatory rumors can send prices soaring or crashing overnight. Liquidity changes also play a huge role – when institutions suddenly pour money into crypto or pull it out, the effects ripple through the entire market.

Crypto Bubble Red Flags

Smart investors learn to spot the warning signs before disaster strikes. Parabolic price charts are perhaps the biggest red flag – when you see those vertical lines shooting straight up, it’s rarely sustainable.

Celebrity endorsements should make your alarm bells ring. When Kim Kardashian promotes a crypto token or Matt Damon appears in Super Bowl ads telling you “fortune favors the brave,” it’s often a sign we’re near the top.

TikTok trends about crypto are another massive warning sign. When teenagers are making videos about guaranteed crypto gains and “diamond hands,” the market has probably gone too far.

On the technical side, exchange outages during price spikes indicate overwhelming speculative activity. On-chain whale movements also matter – when large holders start moving their crypto to exchanges, they might be preparing to sell.

Indicators & Metrics to Watch

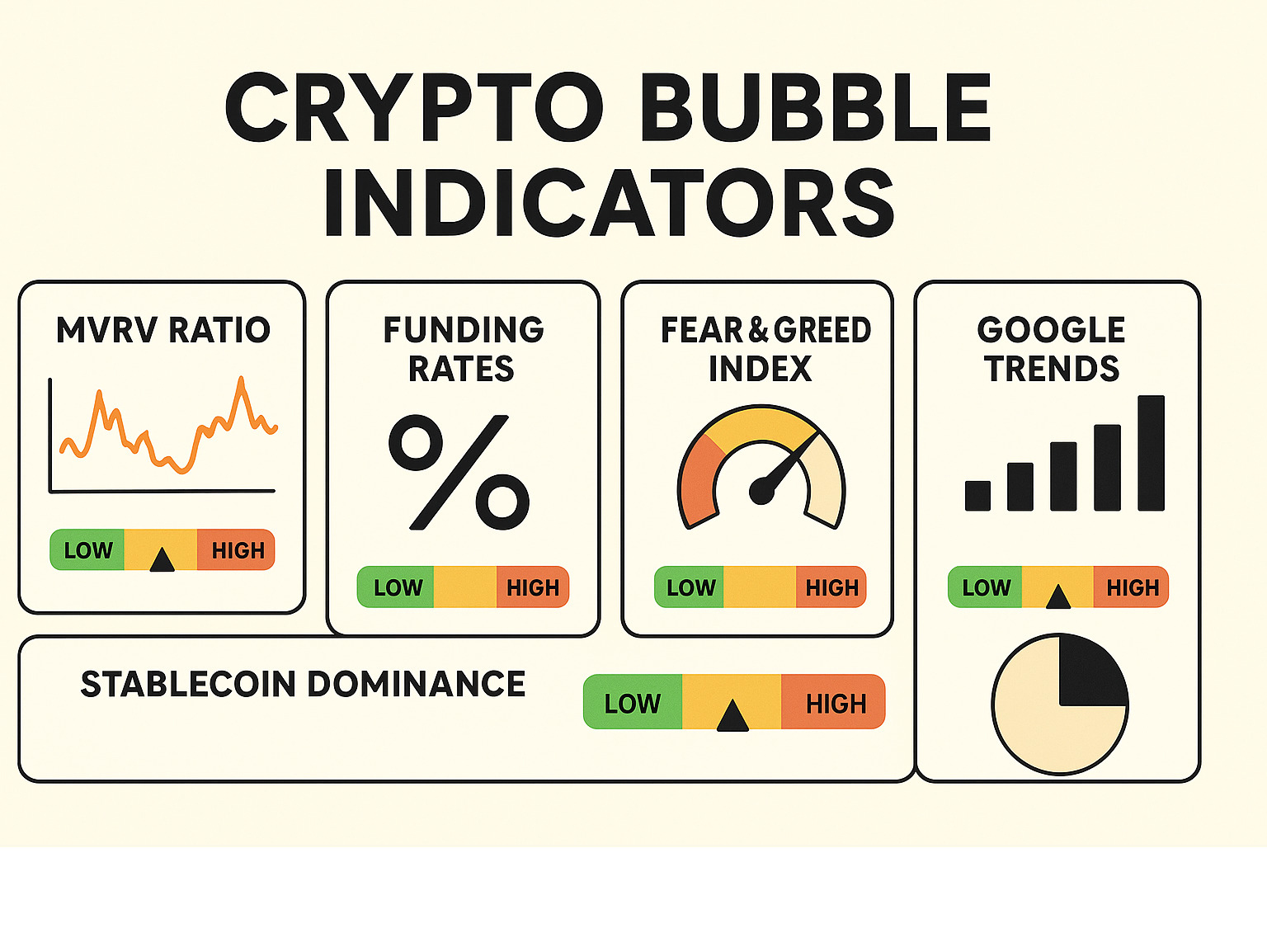

While emotions drive bubbles, smart money uses data to make decisions. The MVRV ratio compares market value to realized value, essentially showing whether most holders are in profit or loss. When this ratio gets extremely high, it often signals a bubble forming.

Funding rates in derivatives markets tell us how much leverage people are using. Google Trends data for crypto searches also provides insight. When search volume for terms like “how to buy Bitcoin” explodes, new money is flooding in.

Stablecoin dominance acts like a fear gauge for crypto markets. The Fear & Greed Index measures market sentiment from extreme fear (0) to extreme greed (100). Readings above 80 have historically preceded major corrections.

The key is watching multiple indicators together rather than relying on just one. When several metrics flash warning signs simultaneously, it’s time to reassess your crypto allocation and risk management strategy.

Case Studies: Lessons from Recent Crashes

The crypto world has witnessed some spectacular collapses that offer crucial lessons about how crypto bubbles form and eventually burst. These aren’t just abstract market movements – they represent real money lost by real people who got caught up in the hype.

The Terra-Luna ecosystem collapse in May 2022 stands out as perhaps the most dramatic crypto bubble burst in history. In just one week, $45 billion in value simply vanished. LUNA tokens that traded at $119.51 became virtually worthless, while TerraUSD (UST), supposedly a stable dollar-pegged coin, crashed to just 10 cents.

The FTX exchange collapse in November 2022 sent shockwaves through the entire crypto industry. FTT, the exchange’s native token, lost 80% of its value in a single day, erasing over $2 billion. But the real damage went deeper – the bankruptcy revealed massive fraud, with customer funds illegally used for risky trading bets.

Celsius Network’s freeze showed what happens when yield chasing goes horribly wrong. The lending platform promised returns of 18% or more, attracting billions in customer deposits. When market conditions changed, they simply froze all withdrawals, trapping customer funds indefinitely.

Even meme coins weren’t immune to crypto bubble dynamics. Dogecoin surged an incredible 20,000% in one year, largely fueled by Elon Musk’s tweets and social media hype. Then reality hit – the coin crashed 93% from its peak.

How Terra-Luna Amplified the Crypto Bubble

The Terra-Luna collapse perfectly demonstrates how complex algorithmic mechanisms can turn a crypto bubble into a death spiral. UST stablecoins were created by burning LUNA tokens, and vice versa. This created what economists call a reflexive loop – as demand for UST grew, more LUNA was burned, pushing LUNA’s price higher.

But this mechanism worked in reverse during stress. When UST lost its dollar peg, the system tried to restore it by minting massive amounts of new LUNA tokens. This created hyperinflation that destroyed LUNA’s value, which in turn made UST’s peg even more unstable.

The UST depeg triggered a liquidity spiral that no amount of intervention could stop.

What the FTX Collapse Teaches About Leverage

The FTX bankruptcy revealed how excessive leverage and poor risk management can destroy even the most trusted crypto companies. The transparency gaps were staggering. FTX had made off-balance-sheet loans to Alameda Research, a trading firm owned by the same person. Customer funds were used for risky proprietary trading without proper disclosure.

This collapse emphasized crucial lessons: always use regulated exchanges when possible, never leave large amounts on any single platform, and remember that in crypto, you often don’t know who you’re really dealing with until it’s too late.

Visualization & Tracking Tools to See Bubbles Form in Real Time

The great news about today’s crypto bubble environment is that we have incredible tools to spot trouble before it hits. Unlike investors in previous decades who relied on newspaper reports and gut feelings, we can now watch market psychology unfold in real-time through sophisticated visualization platforms.

Interactive bubble charts are perhaps the most intuitive way to see the entire crypto market at once. These platforms display each cryptocurrency as a colored bubble, where the size shows market cap and the color indicates whether prices are rising or falling.

Heat maps take a different approach, using color-coding to show which sectors are experiencing the most activity. When you see everything turning bright red during a bull run, that’s often your first warning that a crypto bubble might be forming.

The real game-changer is on-chain analytics. These tools track actual blockchain activity – things like whale movements, exchange inflows, and network congestion. When you see large holders suddenly moving Bitcoin to exchanges, that’s often a sign they’re preparing to sell.

Sentiment tracking rounds out the picture by monitoring what people are actually saying. These platforms scan millions of social media posts, news articles, and Google searches to gauge market emotions.

Building Your Own “Bubble Radar”

Think of creating your monitoring system like building a personal early warning system. You want multiple data sources feeding you information so you’re never caught off guard.

API feeds from major exchanges give you real-time price data, but the magic happens when you combine this with on-chain metrics from blockchain analytics platforms. Social sentiment data from Twitter, Reddit, and news aggregators adds the human element.

Setting up automated alerts is crucial because bubbles can form quickly. You want notifications for unusual price movements, volume spikes, extreme sentiment readings, and regulatory announcements.

Risk categorization helps you make sense of all this data. Think of it like a traffic light system: green zones indicate normal conditions, yellow zones suggest liftd speculation, and red zones signal bubble territory where you should prepare for exits.

When to Act on the Signals

The hardest part isn’t spotting bubbles – it’s having the discipline to act on what you’re seeing. Profit-taking during good times feels counterintuitive, but it’s essential for long-term wealth building.

Gradual exits work better than trying to time the perfect top. Consider selling 25% of your position at each major milestone as prices rise. Rebalancing your portfolio regularly ensures crypto doesn’t become too large a portion of your wealth.

After bubbles burst – and they always do – having a systematic re-entry plan positions you for the next cycle. These visualization tools make that process much more systematic and less emotional.

Regulation, Media & Politics: External Forces Shaping a Crypto Bubble

Politics, media coverage, and government policies don’t just influence crypto bubble formation – they often provide the exact spark that ignites or extinguishes them. When China banned Bitcoin mining in 2021, the price initially crashed 50%. But when El Salvador made Bitcoin legal tender, markets rallied.

Regulatory decisions create some of the most dramatic bubble moments. When the SEC approves or rejects ETF applications, billions of dollars can flow in or out overnight. Global stablecoin regulations directly impact market liquidity, while exchange licensing changes can reshape entire trading ecosystems.

The political landscape has become especially interesting lately. Recent analysis shows how “perceived proximity to the White House” can inflate crypto values beyond reason. Elliott Management, a major activist investor, recently warned that crypto faces an “inevitable collapse” after political proximity inflated current valuations.

Traditional media cycles follow amazingly predictable patterns. Coverage starts with skepticism during early adoption, moves to curiosity as prices rise, then enthusiasm during rapid growth. At bubble peaks, you’ll see euphoria in headlines everywhere.

Scientific research on media hype confirms that media coverage intensity correlates strongly with both bubble formation and bursting. When your local news starts running Bitcoin stories every night, it might be time to take some profits.

The Role of Celebrity & Social Media Hype in a Crypto Bubble

Social media has turned crypto bubble formation into a high-speed phenomenon. What used to take months now happens in weeks or even days, thanks to viral content and celebrity influence.

Elon Musk’s tweets perfectly illustrate this power. His social media posts sent Dogecoin from fractions of a cent to $0.74 – a gain that made some people millionaires overnight while others lost everything when reality set in.

The 2021 Super Bowl ads featuring crypto companies marked an important psychological moment. When major brands spend millions on prime-time celebrity endorsements, it often signals that the bubble is approaching dangerous territory.

TikTok crypto influencers created another dangerous dynamic by promoting risky investments to young audiences who often invested money they couldn’t afford to lose. Many celebrity-endorsed tokens turn out to be rug pull scams designed to exploit their followers’ trust.

Policy Moves That Can Burst or Inflate Bubbles

Government policies have enormous power to either fuel or deflate crypto bubbles. Interest rate changes create some of the most predictable patterns. When rates are low, investors chase riskier assets like crypto for higher returns. When rates rise, safer government bonds become attractive again.

Quantitative easing programs flood markets with liquidity that needs somewhere to go. Much of this money eventually finds its way into crypto during bubble periods. Exchange bans can instantly eliminate trading venues and crash prices, while tax policy creates powerful incentives that shape investor behavior.

Smart wealth builders monitor policy calendars and regulatory announcements just as closely as technical indicators.

Frequently Asked Questions about Crypto Bubbles

How can I tell if a crypto bubble is about to burst?

Spotting a crypto bubble before it pops is like watching storm clouds gather – the signs are there if you know what to look for. Technical warning signs often appear first. When price charts go completely vertical – what traders call “parabolic” – it’s usually unsustainable.

Derivatives markets start flashing red. Funding rates – the cost of holding leveraged positions – spike to extreme levels. Social media becomes a goldmine of warning signals. When your barista starts explaining DeFi protocols or your grandmother asks about buying Dogecoin, the bubble is likely near its peak.

Market structure changes provide the final clues. Exchange websites crash from traffic overload. New crypto projects raise millions without even having working products. The key insight? No single indicator is perfect, but when multiple warning signs align, it’s time to protect your wealth rather than chase quick profits.

Are all rapid price rises in crypto bubbles?

Not every rocket ship price movement is a crypto bubble – some represent genuine breakthrough moments in the technology. Legitimate growth looks different from speculation. When Bitcoin jumped after Tesla announced their $1.5 billion purchase, that reflected real institutional adoption.

Real growth usually comes with measurable fundamentals. Network usage increases, developer activity grows, and actual businesses start building on the platform. Bubble characteristics are quite different. Prices shoot up based on stories and promises rather than working technology.

Here’s a practical test: if you can’t explain why a cryptocurrency deserves its current valuation based on actual usage or adoption, it might be bubble territory.

What should new investors do during a crypto bubble?

If you’re just finding crypto during a bubble period, you’re facing both opportunity and extreme danger. Start with education, not investment. Learn what blockchain technology actually does and why it matters.

Risk management becomes absolutely critical during bubble periods. Never invest more than you can afford to lose completely. Dollar-cost averaging works better than trying to time the market. Avoid the obvious traps – celebrity endorsements mean nothing, and projects promising guaranteed returns are usually scams.

Focus on established cryptocurrencies rather than the latest trending tokens. Bitcoin and Ethereum have survived multiple crashes and have real developer communities building on them. If you’re finding crypto during a bubble, consider waiting for the inevitable crash to start investing seriously.

Conclusion

Understanding crypto bubbles isn’t just about protecting your money – it’s about positioning yourself to thrive in one of the most dynamic markets of our time. These boom-and-bust cycles aren’t going anywhere. They’re woven into the fabric of how emerging technologies grow and mature.

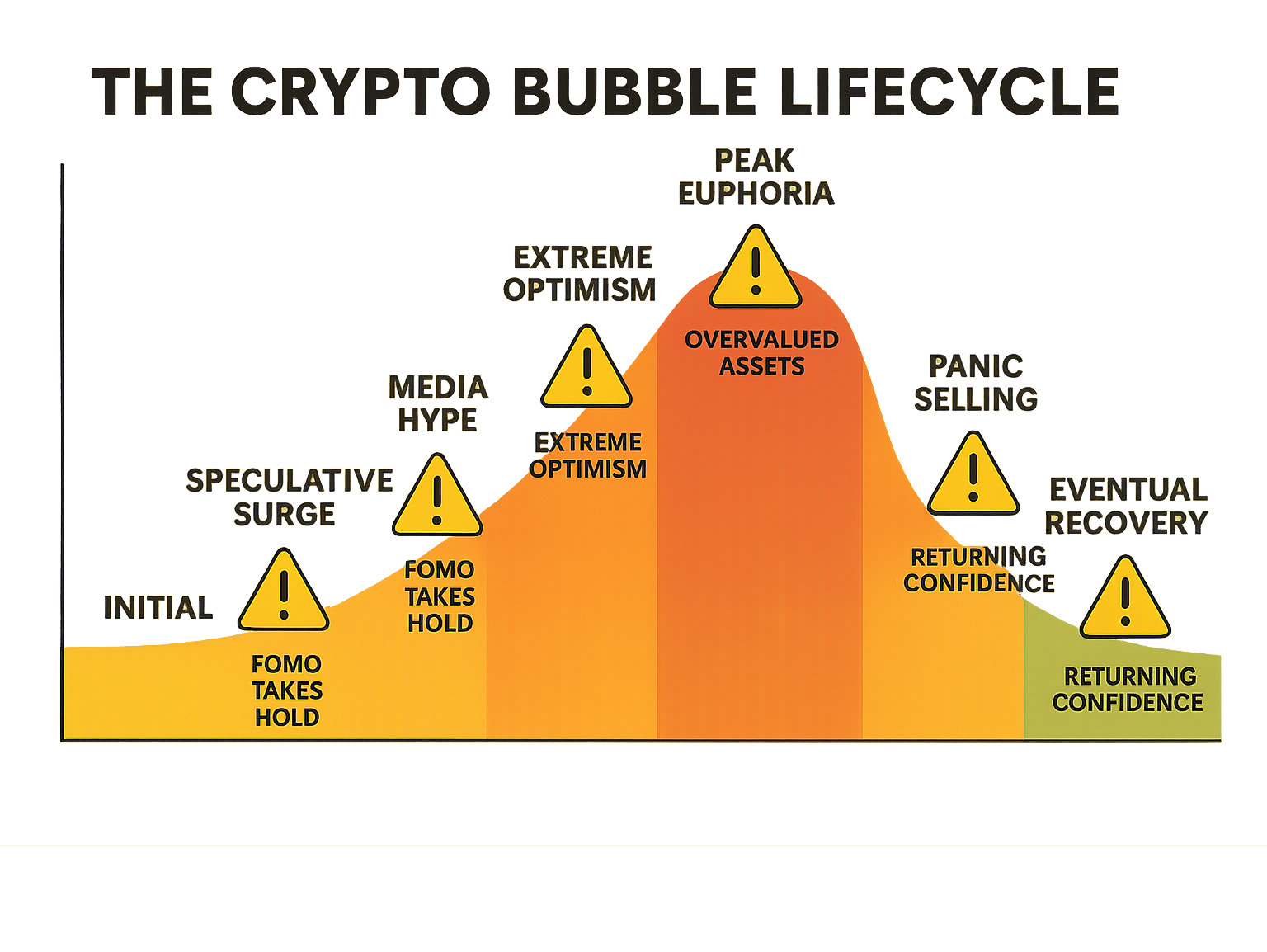

Market cycles are as predictable as the seasons. Each crypto bubble teaches us something new, but the underlying patterns remain remarkably consistent. Prices surge beyond reason, euphoria takes hold, reality sets in, and prices crash back to earth. Rinse and repeat.

The investors who build lasting wealth in crypto aren’t the ones chasing quick profits or following TikTok trends. They’re the disciplined ones who take profits during bubbles and accumulate during crashes. They understand that crypto is a marathon, not a sprint.

Think about it this way: every major crash has been followed by new all-time highs. The 2018 crash that wiped out 80% of Bitcoin’s value? Bitcoin eventually went on to hit $67,000. The key is surviving the winters to enjoy the springs.

History doesn’t repeat, but it sure does rhyme. The technology behind each cycle evolves – we’ve gone from simple digital payments to smart contracts to NFTs to DeFi. But human psychology? That stays exactly the same. Greed, fear, FOMO, and panic drive markets just like they did during the tulip mania of 1637.

This is where aligning crypto with your broader wealth goals becomes crucial. At Finances 4You, we see too many people treating crypto like a casino instead of what it should be – one piece of a comprehensive wealth-building strategy. Your crypto allocation should match your age, risk tolerance, and financial timeline.

The next crypto bubble is coming. We don’t know when, we don’t know what will trigger it, but we know it’s inevitable. The question isn’t whether you’ll see another bubble – it’s whether you’ll be ready for it.

Remember Sir Isaac Newton’s expensive lesson: “I can calculate the movement of the stars, but not the madness of men.” Even brilliant minds can fall victim to market mania. But with the right knowledge, tools, and most importantly, discipline, you can steer these cycles successfully.

The crypto market rewards patience over panic, education over emotion, and strategy over speculation. Whether you’re building your first investment portfolio or optimizing an existing one, understanding these bubble cycles is essential for long-term success.

For more info about financial planning that incorporates crypto intelligently into your overall wealth strategy, our team can help you develop an approach that captures the upside while managing the inevitable volatility.

The future belongs to those who prepare for it. The next crypto bubble will create both millionaires and casualties. Which one will you be?