Why Every Crypto Investor Needs a Reliable Calculator

A crypto calculator is a digital tool that automatically computes your cryptocurrency profits, losses, and returns by using real-time market data and your transaction details. These calculators eliminate manual math errors and provide instant analysis of your crypto investments.

Key Types of Crypto Calculators:

– Profit/Loss Calculator – Shows gains or losses from buy/sell prices

– ROI Calculator – Calculates percentage returns on investment

– Market Cap Calculator – Projects price if coin reaches another’s market cap

– DCA Calculator – Models dollar-cost averaging strategies

– Tax Calculator – Estimates capital gains tax obligations

The crypto market’s extreme volatility makes accurate profit calculations essential for smart decision-making. With Bitcoin’s price swinging thousands of dollars in days and altcoins experiencing even wilder moves, manual calculations quickly become overwhelming.

Modern crypto calculators solve this by connecting directly to exchanges and wallets through secure APIs. They track your transactions automatically and update profit/loss figures in real-time as prices change.

The math is straightforward: Profit = (Sale Price – Purchase Price) × Quantity – Fees. But when you’re tracking multiple coins across different exchanges with varying fee structures, the complexity multiplies fast.

That’s where dedicated crypto calculators become invaluable. They handle the heavy lifting while you focus on strategy.

Crypto calculator terms to remember:

– crypto

– crypto market

– crypto bubble

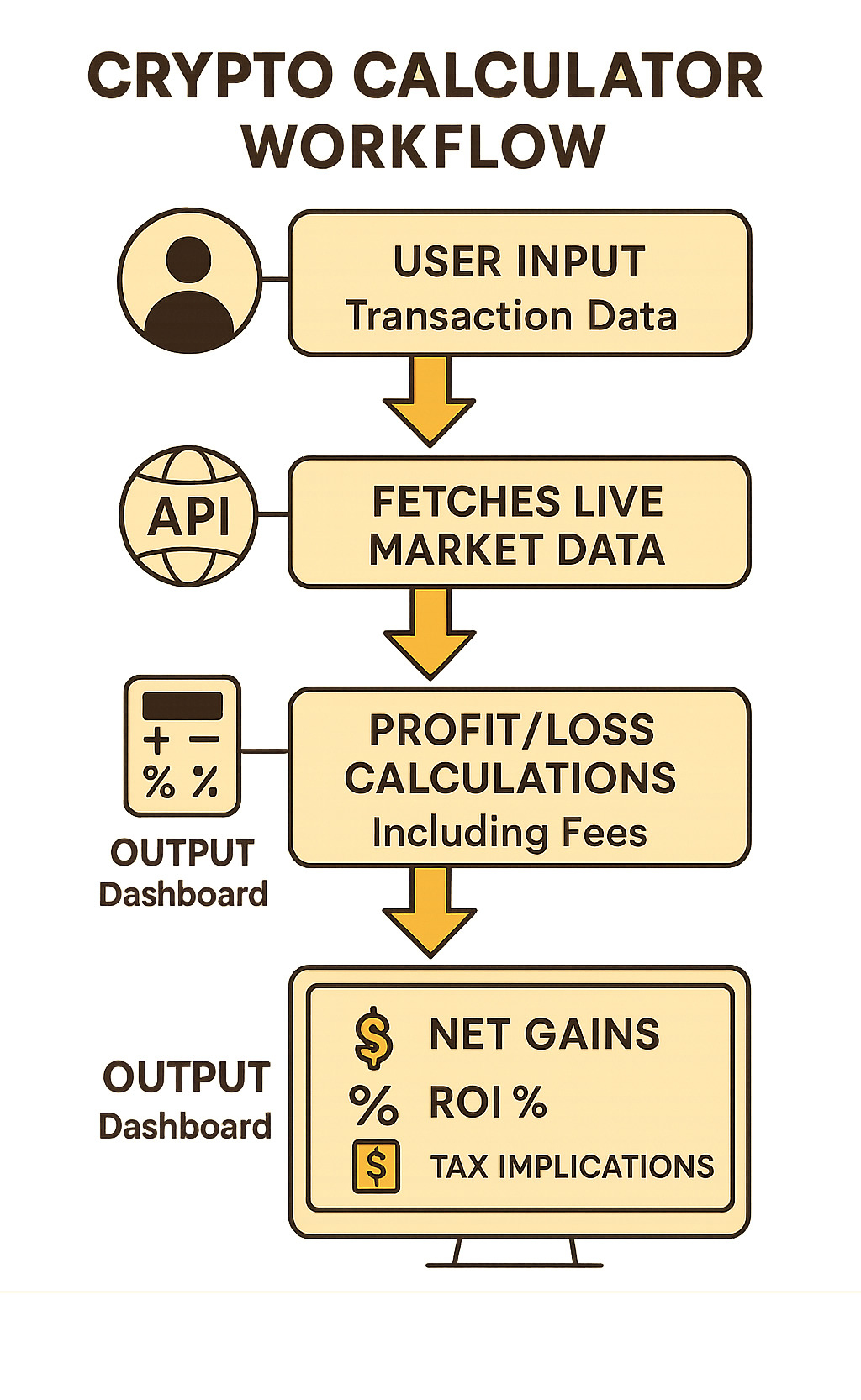

How a Crypto Calculator Works

Ever wondered what happens behind the scenes when you plug numbers into a crypto calculator? It’s actually pretty fascinating how these tools work their magic.

Think of a crypto calculator as your personal financial detective. It’s constantly gathering clues from multiple sources to solve the mystery of your profits and losses. The algorithm logic at its heart processes data streams from exchanges around the world, crunching numbers faster than you could ever do by hand.

The real power comes from live price feeds that connect through APIs – basically digital bridges that let the calculator talk directly to exchanges. These connections ensure you’re seeing current market prices, not yesterday’s news.

Here’s where it gets interesting: your cost basis (what you paid including fees) gets compared to your proceeds (what you’d get after selling and fees). The calculator automatically factors in those pesky trading fees that can eat into your returns. It even accounts for slippage – that annoying difference between the price you expected and what actually happened.

Market cap calculations add another layer of complexity. When you dream about your small-cap coin reaching Bitcoin’s market cap, the calculator considers circulating supply and market dynamics to give you a reality check (or fuel your dreams).

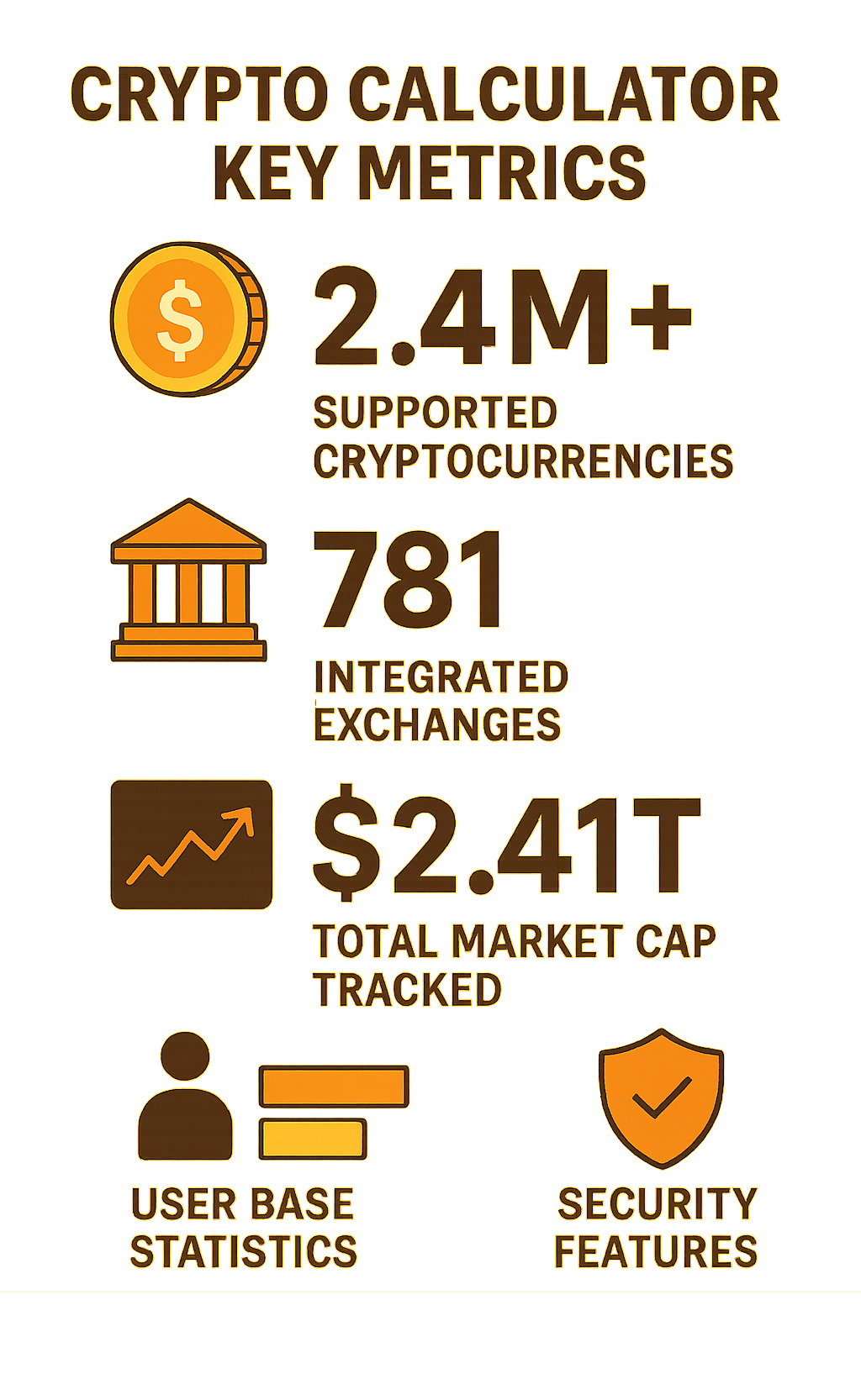

With latency minimized through frequent updates, modern calculators handle over 2.4 million cryptocurrencies across 781 exchanges globally.

More info about Cryptocurrency Trends

Crypto Calculator Inputs You Must Know

Getting accurate results from any crypto calculator is like baking a cake – you need the right ingredients in the right amounts. Miss one key input, and your calculations could be way off.

Your buy price and sell price are the foundation. Don’t just use the market price you saw on your phone – use your actual transaction prices. That flash crash or spike when you bought makes a real difference in your calculations.

The investment amount tells the whole story. Whether you threw in $50 or $5,000 affects everything from fee percentages to tax brackets.

Trading fees can be sneaky profit killers. Most exchanges charge around 1% or less, but some premium services charge more. As one crypto expert wisely noted: “If you’re paying more than 1% in exchange fees, it’s probably time to look for a new crypto exchange.”

Your holding period becomes crucial come tax time. Hold for over a year, and you might qualify for better long-term capital gains rates. The calculator needs this timeline to estimate your tax obligations accurately.

Don’t forget about currency pairs either. Trading Bitcoin for Ethereum involves different math than Bitcoin for dollars. With two volatile assets, the calculations get more complex than your typical crypto-to-cash scenario.

Crypto Calculator Outputs & Accuracy

A quality crypto calculator doesn’t just spit out one number and call it a day. You’ll get a whole dashboard of insights that help paint the complete picture of your investment performance.

Net profit/loss shows your bottom line after all fees are accounted for. But the ROI percentage is where things get interesting – it lets you compare how your crypto performed against other investments.

The break-even price is like your financial GPS, showing exactly where you need to sell to get your money back. This becomes incredibly useful when markets are volatile and you’re trying to decide whether to hold or fold.

CAGR (Compound Annual Growth Rate) helps put longer-term holdings in perspective. The crypto market’s 5-year average CAGR of 119.90% sounds impressive, but individual coins tell very different stories.

Now, let’s talk about accuracy. These calculators are pretty smart, but they’re not crystal balls. Factors affecting accuracy include data quality, market volatility, and how well the calculator handles complex scenarios like hard forks or airdrops.

The sensitivity to market changes means a calculation showing 50% gains can flip to 20% losses faster than you can say “diamond hands.” That’s why savvy investors use these tools for scenario planning rather than absolute predictions.

Popular Types of Crypto Calculators

When you’re diving into cryptocurrency calculations, you’ll quickly find that not all crypto calculators are created equal. Each type serves a specific purpose, and understanding these differences can save you time and help you make better investment decisions.

Profit and loss calculators are the workhorses of crypto math. They handle the bread-and-butter calculations of buying and selling, showing you exactly how much you’ve gained or lost on specific trades.

ROI calculators take things a step further by focusing on percentage returns over time. Instead of just showing dollar amounts, they reveal which investments performed best relative to your initial stake.

Market cap forecast tools answer those exciting “what if” questions that keep crypto investors up at night. What would happen if your favorite altcoin reached Ethereum’s market cap? These calculators crunch the numbers to show realistic price targets based on market capitalization scenarios.

Dollar-cost averaging (DCA) planners have become increasingly popular as more investors adopt systematic approaches. These tools model how regular purchases smooth out the market’s notorious volatility.

Tax estimators might not be the most exciting calculators, but they’re arguably the most important. These tools help you understand capital gains obligations before you sell, preventing nasty surprises come tax season.

Future value calculators round out the toolkit by projecting portfolio growth based on various assumptions. They’re excellent for long-term planning, though remember that crypto’s volatility makes any projection more art than science.

| Calculator Type | Primary Use Case | Best For |

|---|---|---|

| Profit/Loss | Basic trade analysis | Individual transactions |

| ROI | Performance comparison | Portfolio evaluation |

| Market Cap | Price potential | Research and speculation |

| DCA | Investment planning | Long-term strategies |

| Tax | Compliance preparation | Year-end planning |

Selecting the Right Crypto Calculator

Choosing the right crypto calculator isn’t a one-size-fits-all decision. Your specific situation determines which tools will serve you best.

Portfolio size plays a huge role in this decision. If you’re working with a small portfolio and making occasional trades, simple profit and loss tools will handle everything you need. But as your holdings grow and diversify, you’ll appreciate the comprehensive features of more sophisticated platforms.

Trading frequency matters just as much. Day traders need real-time calculations with lightning-fast updates to make split-second decisions. If you’re more of a long-term holder, tools that update daily or weekly will work perfectly fine.

Tax complexity varies dramatically depending on where you live and how actively you trade. Simple buy-and-hold strategies require basic capital gains calculations that most calculators handle easily. However, if you’re into staking rewards, DeFi yields, and complex token swaps, you’ll need sophisticated tax calculators.

Automation needs depend on your technical comfort level and available time. Manual entry works great for simple portfolios, but as complexity grows, automated API connections become essential.

Security considerations can’t be overlooked when selecting tools that connect to your exchange accounts. Look for calculators that use read-only API keys, which allow access to your transaction history without giving permission for unauthorized trading.

Step-by-Step Guide: Using a Crypto Profit Calculator

Getting started with a crypto calculator doesn’t have to feel overwhelming. Think of it like following a recipe – once you know the ingredients and steps, the process becomes second nature.

Your first step involves gathering the right information. Head to your exchange account and dig up your trade history. You’ll want the exact price you paid when buying, the current market price (or your selling price), and don’t forget those pesky trading fees. They might seem small, but they add up faster than you’d think.

The actual calculation process follows a pretty standard pattern across most tools. Start by picking your base currency – whether that’s USD, EUR, or whatever you’re most comfortable with. Then select your cryptocurrency from the dropdown menu. Input how much you invested initially, add your buy and sell prices, and here’s the crucial part: include both your entry fees and exit fees. This step separates accurate calculations from wishful thinking.

Once you’ve mastered the basics, scenario analysis becomes your secret weapon. Try plugging in different selling prices to see how various exit strategies might play out. These “what-if” projections can save you from making emotional decisions when the market gets crazy – and trust me, it will get crazy.

More info about How to Safely Invest in Digital Currencies

Crypto Calculator Walk-Through Example

Let’s work through a real example that shows how this all comes together. Imagine you decided to buy 0.5 Bitcoin when it was trading at $40,000. Your exchange charged you a $50 trading fee. Your total investment comes to $20,050 (that’s 0.5 × $40,000 + $50 in fees).

Fast forward to today, and Bitcoin is sitting pretty at $65,000. You’re thinking about selling, and your exchange will charge another $50 fee on the way out. Your proceeds would equal $32,450 (0.5 × $65,000 – $50 in exit fees).

Here’s where the crypto calculator makes life simple. Your profit calculation shows $32,450 – $20,050 = $12,400 profit. That represents a solid 61.8% return on your investment – not too shabby!

But the real power comes from modeling different scenarios instantly. What happens if Bitcoin rockets to $80,000? Your profit jumps to $19,900. What if it drops to $35,000? You’d be looking at a $2,600 loss instead. Having these numbers at your fingertips helps you make decisions based on facts, not fear.

Don’t underestimate the importance of fee inclusion in your calculations. Without accounting for those $100 in total fees, the same trade would show $12,500 profit instead of the actual $12,400. On larger trades, this difference can represent thousands of dollars in unexpected costs.

Determining the Best Time to Take Profit

Using a crypto calculator for profit-taking decisions takes some of the guesswork out of one of investing’s trickiest questions. While there’s no magic formula for perfect timing, having clear numbers helps you think more objectively.

Percentage targets work well for many investors. Some people lock in gains when their coins rise 20% or 50%, while others prefer a more gradual approach. One popular strategy involves selling 20-25% of your holdings at predetermined profit levels. This way, you secure some gains while keeping skin in the game for potential future upside.

Benchmark anchoring gives you another useful reference point. The S&P 500 has historically returned about 11% annually. When your crypto holdings are significantly outperforming traditional markets, it might make sense to take some profits off the table. Your calculator can show you exactly how your returns compare.

Incremental selling reduces the pressure of trying to time the perfect exit. Instead of going all-in or all-out, you might sell 25% at 50% gains, another 25% at 100% gains, and continue scaling out as prices rise. The beauty of using calculators for this approach is that you can model these scenarios ahead of time, before emotions kick in during those heart-pounding market peaks.

Product Roundup: Top Tools That Handle the Math

When you’re ready to stop wrestling with spreadsheets and manual calculations, the right crypto calculator can transform your investment tracking experience. Today’s tools offer impressive automation capabilities that make portfolio management almost effortless.

The best platforms connect directly to your exchange accounts through secure APIs, automatically importing every trade and updating your profit calculations in real-time. No more hunting through transaction histories or trying to remember what you paid for that Bitcoin purchase six months ago.

Multi-currency support has become a game-changer as the crypto world expands. Leading platforms now track over 2.4 million different cryptocurrencies and handle conversions between hundreds of crypto and fiat currency pairs.

Privacy matters when dealing with financial data. Some calculators operate entirely in your browser, keeping your information local. Others store data in the cloud for convenient cross-device access. The sweet spot for many users is read-only API access – this lets tools import your transaction history without gaining permission to actually trade on your behalf.

Real-time alerts add another layer of convenience. Imagine getting notified the moment your portfolio hits that profit target you set, or when a position drops to your predetermined stop-loss level.

Videos NewsAcademyResearchVideosGlossary

Integrated Portfolio Trackers with Built-In Crypto Calculators

Think of these platforms as your crypto command center. Integrated portfolio trackers combine powerful crypto calculator functionality with comprehensive investment monitoring, creating a one-stop solution for serious investors.

The magic happens through automatic data import. Connect your exchange accounts once, and these platforms continuously sync your transaction history. No more manual entry, no more missed trades, and definitely no more calculation errors at 2 AM when you’re trying to figure out your tax situation.

Dashboard analytics turn raw numbers into visual stories. Beautiful charts and graphs show your portfolio’s journey over time, making it easy to spot winning strategies and identify areas for improvement.

Mobile access keeps you connected wherever life takes you. The best platforms offer full-featured mobile apps that sync seamlessly with their desktop versions.

Security isn’t an afterthought with quality platforms. Military-grade encryption and regular third-party security audits protect your sensitive financial data. You can connect your accounts with confidence, knowing your information stays private and secure.

Stand-Alone Crypto Calculator Apps & Web Tools

Sometimes you don’t need a full portfolio management suite – you just want quick, accurate calculations. Stand-alone crypto calculator tools excel at this focused approach, offering rapid conversions and profit calculations without the complexity.

These converter-focused tools shine when you need instant answers. How much would you make if Bitcoin hits $100,000? What’s your current Ethereum position worth in dollars? Simple calculators give you answers in seconds, not minutes.

Minimal setup appeals to users who value simplicity. Many web-based calculators require zero registration – just enter your numbers and get immediate results. Perfect for quick “what-if” scenarios or double-checking your mental math.

When markets move fast, rapid conversions become essential. Prices can swing dramatically in minutes, and you need tools that keep pace. The best calculators update prices frequently and process calculations instantly.

Offline functionality provides peace of mind during internet outages or travel. Some mobile apps store recent price data locally, ensuring you can still calculate profits even when connectivity is spotty.

Risks, Limitations & Security Considerations

Let’s be honest – no crypto calculator is perfect. While these tools make our lives easier, they come with real risks that every investor should understand.

Data breaches pose the biggest threat to your privacy. When calculator providers get hacked, your transaction history and portfolio details could end up in the wrong hands. Even though most platforms use military-grade encryption, hackers are getting smarter every day.

API misuse creates another headache. When you connect your exchange account to a calculator, you’re opening a door between your money and the internet. Read-only API keys prevent unauthorized trading, but they still create potential attack vectors for creative hackers.

Here’s where many investors trip up: overreliance on projections. Just because the crypto market exploded 3,121.82% in 2016 doesn’t mean your portfolio will do the same. Historical performance is like looking in the rearview mirror while driving – useful for context, but terrible for navigation.

Tax misreports can land you in hot water with the IRS. Calculator estimates work great for simple buy-and-sell scenarios, but they often miss complex situations involving staking rewards, DeFi yields, or multiple tax jurisdictions.

The biggest reality check? Market volatility makes every calculation temporary. Your calculator might show a $10,000 profit at lunch, but crypto markets don’t take lunch breaks. By dinner, that profit could be a $5,000 loss.

Mitigating the Downsides of Relying on a Crypto Calculator

Smart investors don’t put all their trust in one tool. Cross-checking results across multiple calculators helps spot discrepancies before they become expensive mistakes. Different platforms use different data sources, so a little verification goes a long way.

Keep manual logs as your backup plan. Yes, spreadsheets are boring, but they’re also reliable. Track your major transactions independently to verify calculator accuracy and keep your tax preparer happy.

Conservative assumptions protect you from overoptimism. When projecting future values, use realistic growth rates instead of best-case scenarios. The crypto market’s wild swings make conservative planning your friend, not your enemy.

Secure key storage isn’t optional – it’s essential. Store your API keys and passwords in encrypted password managers, not in browser bookmarks or sticky notes on your monitor.

Finally, conduct regular security audits of your connected accounts. Check your exchange and wallet access logs monthly to make sure only authorized tools have access. It takes five minutes and could save you thousands.

Calculators are tools, not crystal balls. Use them wisely, but always keep your critical thinking cap on.

Frequently Asked Questions about Crypto Calculators

How accurate is a crypto calculator?

The accuracy of a crypto calculator really comes down to what you put into it and where it gets its data. When you’re looking at past trades and you input your exact transaction details – including those pesky fees that always seem higher than expected – most calculators nail the numbers pretty well.

But here’s where things get tricky. Real-time calculations are only as good as the moment you’re looking at them. In the wild world of crypto, where Bitcoin can swing thousands of dollars while you’re having lunch, those “accurate” calculations can become ancient history faster than you can say “diamond hands.”

The biggest headaches come from fee calculations and tax implications. Exchange fee structures change more often than fashion trends, and tax rules? Well, they’re about as clear as mud and vary depending on where you live and how long you’ve held your coins.

Price data quality makes a huge difference too. Some calculators grab prices from just one exchange, while the smart ones pull data from multiple sources. Think of it like asking one person versus polling the whole room – you’ll get a more reliable answer from the crowd.

Can a crypto calculator help with taxes?

Absolutely! Many crypto calculator platforms have jumped on the tax bandwagon and include features to estimate your capital gains and losses. It’s like having a tax assistant that never takes coffee breaks.

These tools can crunch through your transaction history and figure out holding periods, which matters a lot for your tax bill. In the U.S., if you hold crypto for less than a year, you’ll face higher short-term capital gains rates. Hold for over a year, and you get the friendlier long-term rates.

But here’s the reality check – crypto taxes can get complicated fast. We’re talking about staking rewards, DeFi yields, airdrops, and hard forks that create tax events you probably didn’t even know existed. It’s like a tax obstacle course designed by someone with a twisted sense of humor.

For simple buy-and-sell situations, calculators work great. But if you’re deep into the crypto ecosystem with complex transactions, you’ll want professional tax software or an advisor who speaks crypto. While calculators give you helpful ballpark figures, they shouldn’t be your only guide when serious money is on the line.

Does a crypto calculator support every coin and fiat pair?

The top crypto calculator platforms are pretty impressive these days – some track over 2.4 million different crypto assets. That’s more cryptocurrencies than most people even know exist, though let’s be honest, many of those are probably dead projects or meme coins from 2017.

For practical purposes, quality calculators cover all the coins you’ve actually heard of. Bitcoin, Ethereum, and the major altcoins work seamlessly with all the big fiat currencies like USD, EUR, GBP, and JPY. It’s the crypto equivalent of speaking multiple languages fluently.

The challenge comes with newer or smaller cryptocurrencies. That hot new token your friend keeps talking about might not show up in calculators immediately. Price data depends on exchange listings and trading volume, so obscure coins often get left out in the cold.

Some calculators go the extra mile and include quirky options like gold (XAU), silver (XAG), or even Bitcoin subunits like satoshis. It’s like having a Swiss Army knife for crypto conversions – you might not need all the tools, but it’s nice to know they’re there when you do.

Conclusion

The world of crypto calculator tools has transformed from basic math helpers into powerful investment companions that can make or break your financial success. These digital assistants eliminate those embarrassing calculation mistakes and provide insights that would take hours to figure out manually.

Here’s the truth about successful crypto investing: it’s not just about finding the next big coin that everyone’s talking about. The real winners understand their actual returns, manage risk like pros, and make smart decisions based on solid data. A quality crypto calculator gives you exactly this kind of analytical foundation.

At Finances 4You, we’re passionate about helping people make informed decisions that lead to real wealth building. Whether you’re carefully tracking your first $100 Bitcoin purchase or juggling a complex portfolio with dozens of different coins, the right calculator tools help ensure your crypto investments actually support your bigger financial picture.

But let’s be honest – calculators are incredibly useful tools, not magical crystal balls. They’re fantastic at crunching current numbers and showing you different “what if” scenarios, but they can’t predict whether Bitcoin will hit $100,000 next year or crash to $20,000.

The crypto market’s impressive 119.90% five-year CAGR shows just how much money can be made, but it also reminds us why accurate tracking and smart planning matter so much. When you’re dealing with investments that can swing 20% in a single day, you need tools that help you stay grounded and focused.

Let technology handle all the complex math while you focus on what really matters: building wealth that makes sense for your age and financial goals. After all, the best investment strategy is one you can actually stick with through both the exciting bull runs and the nerve-wracking bear markets.