Why Personal Finance Calculators Are Your Financial Game-Changer

A personal finance calculator is an online tool that helps you model different money scenarios by plugging in your numbers and getting instant results. Here’s what you need to know:

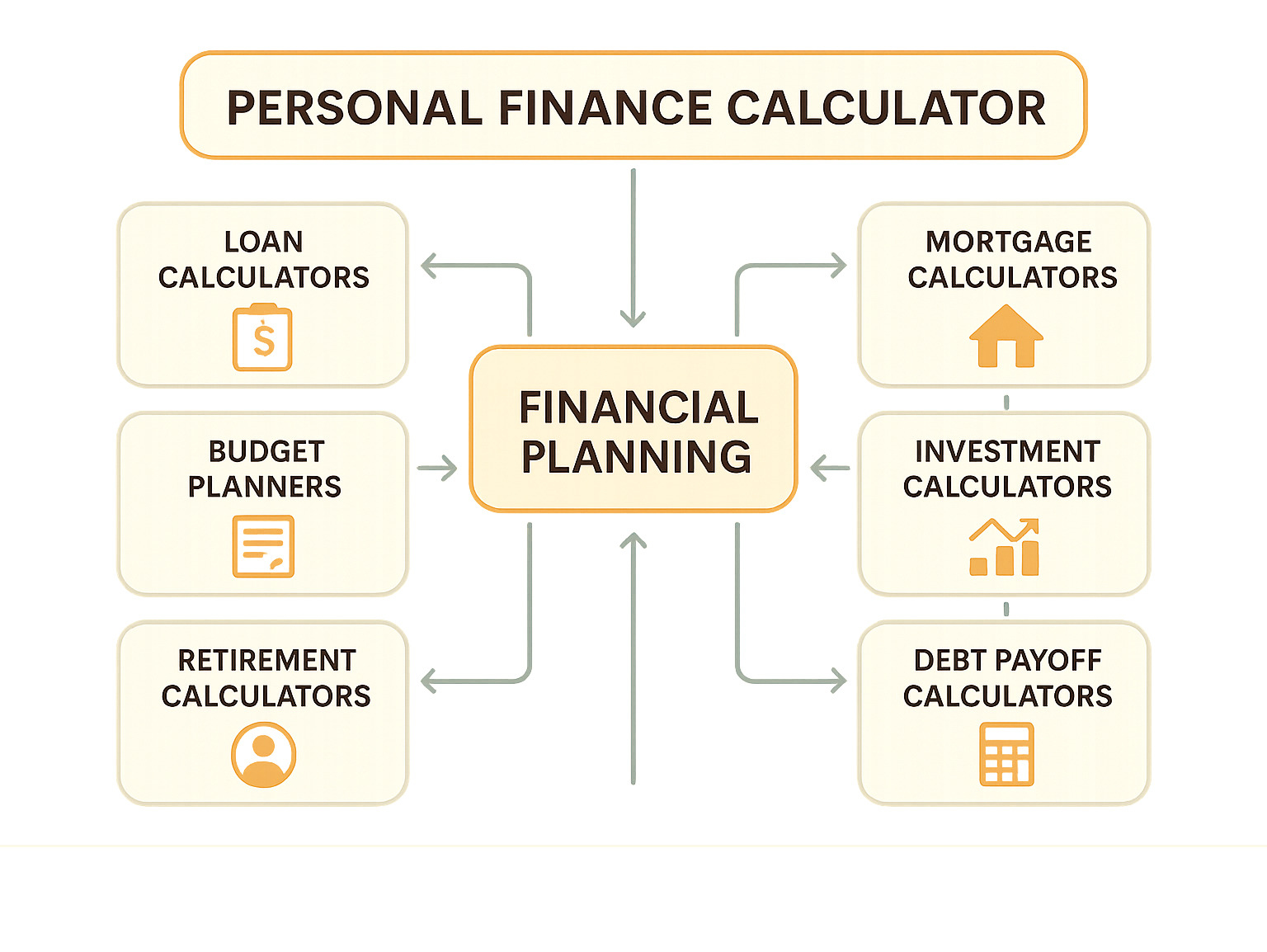

Most Popular Types:

- Loan calculators – estimate monthly payments and total interest costs

- Mortgage calculators – determine home affordability and payment schedules

- Budget planners – track income, expenses, and savings goals

- Investment calculators – project growth using compound interest

- Retirement calculators – estimate future income needs

- Debt payoff calculators – compare repayment strategies

Key Benefits:

- Get instant answers to “what if” scenarios

- Compare different financial strategies side-by-side

- Make data-driven decisions instead of guessing

- Plan for major purchases and life goals

Think of these tools as your financial GPS. They won’t make decisions for you, but they’ll show you exactly where different paths lead.

Whether you’re trying to pay off debt faster, figure out if you can afford that house, or see how much you need to save for retirement, calculators give you the numbers you need to move forward with confidence.

The best part? Most are completely free and available 24/7. You can run scenarios at 2 AM in your pajamas without scheduling an appointment or feeling judged.

But not all calculators are created equal. Some have outdated assumptions, others push specific products, and many don’t explain their limitations clearly.

Why a Personal Finance Calculator Belongs in Every Toolkit

We believe every Canadian should have access to quality financial planning tools. A personal finance calculator transforms abstract money questions into concrete, actionable answers. Here’s why these tools are essential:

Decision-Making Power: Instead of wondering “Can I afford this?” you get definitive numbers. For example, if you’re considering a $350,000 loan at 4.25% interest over 30 years, a calculator instantly shows your monthly payment would be $1,722. No guesswork required.

Time-Saving Efficiency: What used to require hours of manual calculations or expensive consultations now takes minutes. You can compare multiple scenarios in the time it takes to drink your morning coffee.

Scenario Planning: Life rarely goes according to plan. Calculators let you model different situations – what if interest rates rise? What if you get a raise? What if you make extra payments? Having these answers ahead of time reduces financial stress significantly.

Stress Reduction: Money anxiety often comes from uncertainty. When you know exactly how much you need to save for retirement or how long it’ll take to pay off debt, you can sleep better at night.

How Accurate is a Personal Finance Calculator?

The accuracy of a personal finance calculator depends on several factors. Most calculators use proven mathematical formulas, but they’re only as good as the data you put in and the assumptions they make.

Algorithm Assumptions: Many calculators assume interest rates remain constant throughout the loan term, which rarely happens in real life. They also typically assume you’ll make every payment on time and never miss a due date.

Daily Interest Calculations: Most loans calculate interest daily, even if you make monthly payments. Quality calculators account for this, but simpler ones might use monthly interest calculations that can throw off your results.

Data Quality: Your results are only as accurate as the information you provide. If you estimate your income or forget about certain expenses, your calculations will be off.

The key is understanding that calculators provide estimates, not guarantees. They’re excellent for planning and comparison purposes, but real-world results may vary based on market conditions, life changes, and other factors.

What Data Should You Gather Before Using a Personal Finance Calculator?

Before diving into any personal finance calculator, gather these essential pieces of information:

Income Details:

- Gross monthly income from all sources

- Net take-home pay after taxes and deductions

- Any variable income like bonuses or commissions

- Expected future income changes

Expense Information:

- Fixed monthly expenses (rent, insurance, loan payments)

- Variable expenses (groceries, entertainment, utilities)

- Annual expenses broken down monthly (property taxes, vacations)

- Emergency fund contributions

Debt Balances and Terms:

- Current balances on all credit cards, loans, and mortgages

- Interest rates for each debt

- Minimum monthly payments

- Remaining terms on loans

Time Horizons:

- When you want to achieve specific goals

- Your expected retirement date

- Major life events coming up (marriage, kids, home purchase)

Having this information ready ensures you get the most accurate results from your calculations.

Types of Calculators and When to Use Them

Understanding which calculator to use for your specific situation is crucial. Each type serves different purposes and provides unique insights into your financial picture.

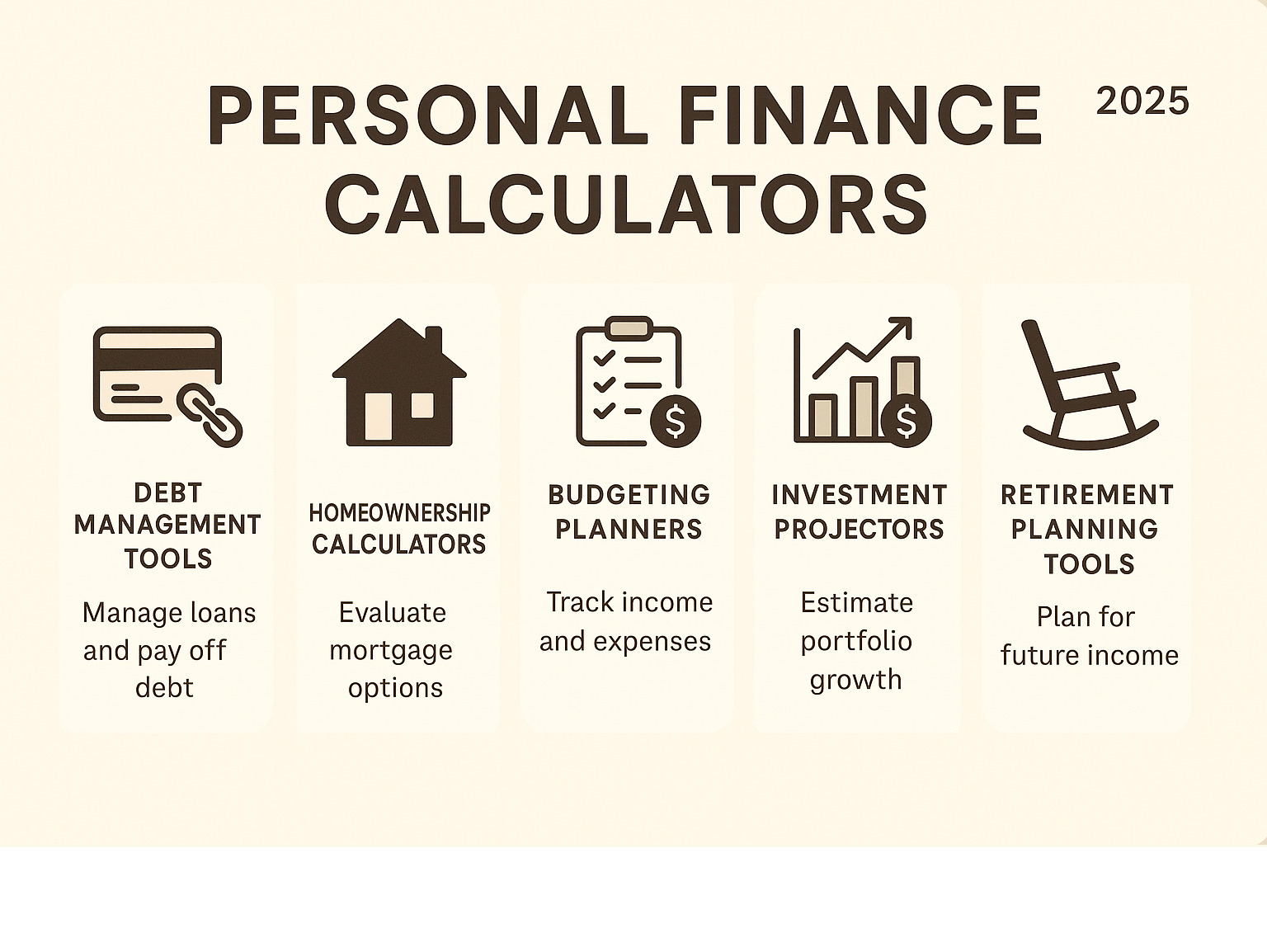

Loan & Debt Repayment Tools

These calculators help you understand the true cost of borrowing and develop strategies to pay off debt faster.

Line-of-Credit Calculators: Perfect for understanding how much you can borrow and what your payments will look like. Unlike fixed loans, lines of credit offer flexibility in how much you borrow and when you pay it back.

Debt Consolidation Tools: These show you the potential savings of combining multiple debts into a single payment. For example, if you have three credit cards with different interest rates, a consolidation calculator can show whether combining them saves money.

Credit-Card Payoff Calculators: These tools reveal the shocking truth about minimum payments. Credit cards often carry high interest rates that make repayment schedules extremely lengthy if you only pay the minimum amount.

Amortization Schedules: These break down exactly how much of each payment goes toward principal versus interest over the life of your loan. Early payments are mostly interest, while later payments tackle more principal.

For comprehensive budget planning, check out our Comprehensive Budget Worksheet to integrate your debt repayment strategy with your overall financial plan.

Mortgage & Home-Ownership Tools

Buying a home is likely the largest financial decision you’ll make. These calculators help you steer the process intelligently.

Payment Schedule Calculators: These show your monthly mortgage payment based on purchase price, down payment, interest rate, and loan term. They also break down how much goes to principal, interest, property taxes, and insurance.

Prepayment Savings Tools: These demonstrate how extra payments can dramatically reduce your total interest costs. Even an extra $100 per month can save tens of thousands over the life of your mortgage.

Mortgage Qualifier Tools: These help you understand how much home you can afford based on your income, expenses, and debt. Lenders typically want your housing costs to be no more than 28% of your gross income.

Closing Cost Calculators: These estimate the various fees you’ll pay when buying a home, including legal fees, land transfer taxes, and inspection costs.

The Government of Canada provides an excellent Mortgage Calculator that includes Canadian-specific features like different payment frequencies and prepayment options.

Budget & Cash-Flow Planners

Budgeting calculators help you understand where your money goes and identify opportunities to save more.

Spending Trackers: These categorize your expenses and show you spending patterns. You might be surprised to learn you’re spending $200 per month on coffee and takeout.

Savings Target Tools: These calculate how much you need to save monthly to reach specific goals. Want to save $10,000 for a vacation in two years? You’ll need to save about $417 per month.

Zero-Based Budget Calculators: These ensure every dollar has a purpose by allocating all income to expenses, savings, or debt repayment.

Emergency Fund Calculators: These help determine how much you should keep in your emergency fund based on your monthly expenses and job security.

For detailed budgeting strategies, explore our guide on Personal Budgeting. The government also offers a comprehensive Budget Planner that provides personalized advice based on your input.

Investment & Retirement Projections

These calculators help you plan for long-term financial goals and understand the power of compound interest.

Compound Interest Calculators: These show how your money grows over time when you reinvest your returns. The results can be eye-opening – starting to invest at 25 versus 35 can mean hundreds of thousands of dollars in additional retirement savings.

RRSP Calculators: These help you understand the tax benefits of contributing to your Registered Retirement Savings Plan and how much you should contribute annually.

FIRE Calculators: FIRE (Financial Independence, Retire Early) calculators help you determine how much you need to save to retire early and live off your investments.

Asset Mix Tools: These help you determine the right balance of stocks, bonds, and other investments based on your age, risk tolerance, and time horizon.

Understanding your net worth trajectory is crucial for long-term planning. Our guide on How to Track Your Net Worth Over Time provides strategies for monitoring your progress and aligning your wealth with your age group.

Choosing the Right Personal Finance Calculator for Your Goal

Not all calculators are created equal. Here’s how to choose the right tool for your specific needs:

Goal Alignment: Start with your objective. Are you trying to pay off debt, buy a house, or plan for retirement? Different goals require different calculators with specific features.

Required Inputs: Some calculators need extensive information, while others work with basic inputs. Choose tools that match the level of detail you’re comfortable providing.

User Experience: The best calculator is one you’ll actually use. Look for clean interfaces, clear explanations, and mobile-friendly designs.

Mobile Access: Since you might want to run calculations on the go, ensure your chosen tools work well on smartphones and tablets.

Privacy Controls: Consider what personal information you’re comfortable sharing and whether the calculator requires registration or stores your data.

| Calculator Type | Required Inputs | Best For | Key Features |

|---|---|---|---|

| Loan Calculator | Amount, rate, term | Comparing loan options | Payment schedules, total interest |

| Mortgage Calculator | Price, down payment, rate | Home buying decisions | Amortization, prepayment options |

| Budget Planner | Income, expenses | Monthly planning | Spending categories, savings targets |

| Investment Calculator | Principal, rate, time | Long-term growth | Compound interest, regular contributions |

| Debt Payoff | Balances, rates, payments | Debt elimination | Multiple strategies, timelines |

Red Flags and Limitations to Watch

Be aware of these common issues with financial calculators:

Static Interest Rates: Many calculators assume interest rates never change, but variable-rate loans and credit cards can fluctuate significantly over time.

Outdated Tax Tables: Tax rules change annually, and calculators that use old tax brackets or rates will give inaccurate results.

Promotional Bias: Some calculators are designed to promote specific products or services. Be skeptical of tools that consistently recommend the same solution regardless of your inputs.

Missing Disclaimers: Quality calculators clearly explain their assumptions and limitations. Be wary of tools that present results as guarantees rather than estimates.

Always remember that rates quoted are typically for information purposes only and not guaranteed. Your actual rates may vary based on credit history, market conditions, and other factors.

Protecting Your Data Online

When using online calculators, protect your personal information:

Encryption: Look for “https://” in the URL and a lock icon in your browser, indicating the site uses encryption to protect your data.

Cookies and Tracking: Be aware that some calculators use cookies to track your usage and may share data with third parties.

Incognito Mode: Consider using your browser’s private or incognito mode when using financial calculators to prevent storing sensitive information.

Two-Factor Authentication: If a calculator requires creating an account, enable two-factor authentication for additional security.

Turning Results into a Winning Financial Plan

Getting results from a personal finance calculator is just the beginning. The real value comes from turning those numbers into actionable strategies.

SMART Goals: Transform calculator results into Specific, Measurable, Achievable, Relevant, and Time-bound goals. Instead of “save more money,” aim for “save $500 per month for 24 months to build a $12,000 emergency fund.”

Automation: Use your calculator results to set up automatic transfers and payments. If your budget calculator shows you can save $300 monthly, automate that transfer to happen on payday.

Review Cycle: Schedule regular check-ins to compare your actual progress against your calculator projections. Monthly reviews work well for budgets, while annual reviews suit long-term goals.

Accountability Partners: Share your calculator-based goals with trusted friends or family members who can help keep you on track.

For more strategies on automating your financial success, check out our guide on Personal Finance Automation.

Integrate Calculator Insights into Daily Money Habits

Transform your calculator results into daily financial habits:

Automatic Transfers: Set up automatic transfers to savings accounts based on your budget calculator results. If you can save $400 monthly, automate $200 transfers on the 1st and 15th of each month.

Debt Snowball: Use debt payoff calculator results to implement the debt snowball method. Pay minimums on all debts, then put extra money toward the smallest balance first.

No-Spend Challenges: If your budget calculator shows you’re overspending in certain categories, try targeted no-spend challenges. Skip restaurant meals for a week or avoid impulse purchases for a month.

Sinking Funds: Create separate savings accounts for irregular expenses identified in your budget calculator. Set aside money monthly for car maintenance, holiday gifts, or vacation costs.

When to Re-Run Your Numbers

Your financial situation changes over time, so your calculator results need updating:

Rate Changes: When interest rates change significantly, re-run mortgage and loan calculators to see how it affects your payments and total costs.

New Debt: Any time you take on new debt or pay off existing debt, update your debt payoff and budget calculators.

Salary Increases: When your income changes, revisit budget and savings calculators to optimize your new financial capacity.

Life Milestones: Major life events like marriage, having children, or buying a home require recalculating most of your financial projections.

We recommend reviewing your calculations at least quarterly, or whenever your financial situation changes significantly.

Frequently Asked Questions about Personal Finance Calculators

Why should I trust a free online calculator?

Free calculators can be highly reliable when they come from reputable sources. Government agencies like the Financial Consumer Agency of Canada offer over 10 different calculators that are regularly updated and thoroughly tested. Banks and established financial institutions also provide quality tools, though they may have some promotional bias.

The key is understanding that these calculators are educational tools, not guarantees. They use proven mathematical formulas but make assumptions about future conditions that may not hold true.

How often are interest rates updated inside these tools?

This varies significantly by calculator. Government and bank calculators typically update rates regularly – sometimes daily for mortgage calculators. However, some independent calculators may use static rates that become outdated quickly.

Always check when the calculator was last updated and compare the rates shown with current market rates. If there’s a significant difference, look for a more current tool.

Can a calculator replace professional financial advice?

No, calculators are tools to help you make informed decisions, but they can’t replace personalized professional advice. A financial advisor can help you understand how different strategies work together, account for your unique circumstances, and adjust for factors that calculators can’t consider.

Think of calculators as your research tools – they help you ask better questions and understand your options before meeting with a professional.

Conclusion

At Finances 4You, we believe that informed financial decisions start with good information. Personal finance calculators provide the foundation for understanding your options and planning your financial future.

These tools have democratized financial planning, giving everyone access to the same mathematical models that professionals use. Whether you’re calculating loan payments, planning for retirement, or optimizing your budget, calculators help you move from guessing to knowing.

Remember to revisit your calculations regularly as your situation changes. Interest rates fluctuate, incomes change, and life throws curveballs that require adjusting your financial plans.

The most important step is getting started. Pick one calculator that addresses your most pressing financial question and run some scenarios. You might be surprised by what you find about your financial possibilities.

For more comprehensive financial planning tools and strategies, explore our collection of Best Online Calculators for Your Financial Planning. Your future self will thank you for taking control of your finances today.