Taking Your First Steps Into Investing

Beginner investing doesn’t have to be complicated or scary. If you’re looking to start investing but don’t know where to begin, here’s what you need to know:

Quick Start Guide to Beginner Investing:

- Start with any amount – even $50/month can grow significantly over time

- Open an investment account – choose between a retirement account (IRA, 401(k)) or standard brokerage

- Pick a simple strategy – index funds or ETFs offer instant diversification

- Invest regularly – set up automatic contributions to benefit from dollar-cost averaging

- Stay invested – the magic happens when you give your money time to grow

Investing might seem intimidating when you’re just starting out. The financial jargon, market fluctuations, and endless options can make anyone’s head spin. But here’s the truth: investing is one of the most powerful tools for building wealth, and getting started is much simpler than you might think.

“Investing is the best way to build wealth. Period,” as many financial experts say. And they’re right. While your savings account might earn 1-2% interest, the stock market has historically returned around 7-10% annually over the long term.

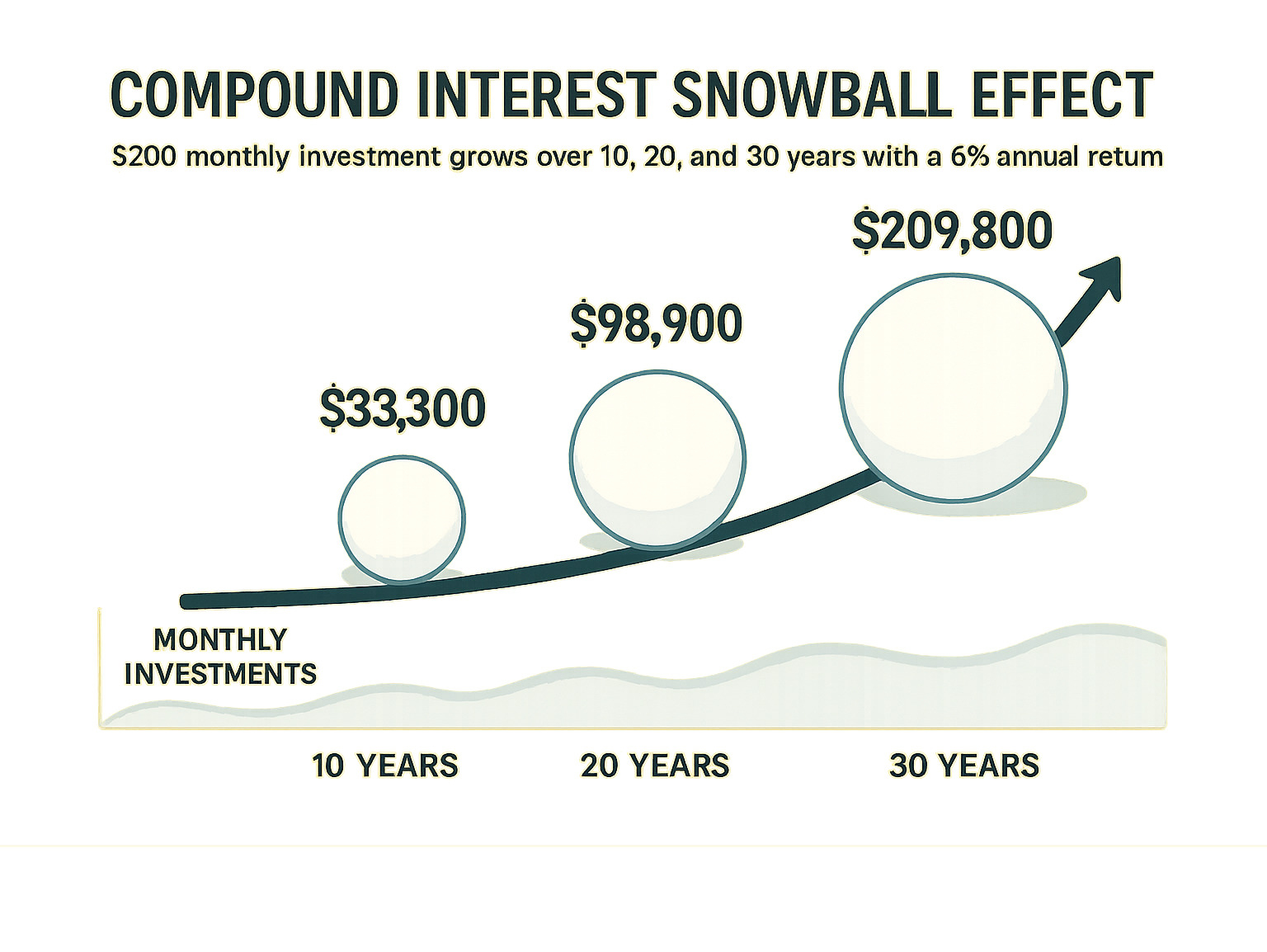

The most important step? Just starting. As the data shows, if you invest $200 every month for 10 years and earn a 6% average annual return, you’ll have $33,300 at the end of that period. Of that total, $24,200 is what you contributed, and $9,100 is interest earned – that’s money making money for you!

You don’t need to be rich to begin. Thanks to fractional shares and commission-free trading, you can start with whatever amount feels comfortable. Many platforms have no minimum requirements, allowing you to begin with as little as $1.

The best time to start investing was yesterday. The second best time is today. Why? Because of compound interest – what Einstein reportedly called “the eighth wonder of the world.” The longer your money has to grow, the more powerful the compounding effect becomes.

Simple guide to beginner investing terms:

Beginner Investing 101: Why, How Much & When

Want to know the single best thing you can do for your future self? Start investing early. Thanks to compound interest, your money doesn’t just grow—it snowballs over time, picking up momentum like a boulder rolling downhill. The longer it rolls, the bigger it gets!

Financial experts typically recommend investing 10-15% of your income each year for retirement. Don’t panic if that sounds like a lot right now! Even starting with just $50 or $100 a month puts you miles ahead of those who haven’t started at all.

“But why not just save my money in a bank?” While your savings account might earn a modest 1-2% interest, inflation typically runs at 2-3% annually. That means your “safe” money is actually losing purchasing power every year. Yikes! Beginner investing helps you stay ahead of inflation and build real wealth over time.

Before jumping into the investing pool, make sure you’ve got these two financial life preservers:

- An emergency fund covering 3-6 months of expenses (so you never have to raid your investments when life happens)

- A plan to tackle high-interest debt, especially those credit cards charging 15-25% interest

Once these foundations are in place, you’re ready to begin your wealth-building journey!

What “beginner investing” really means

Beginner investing isn’t about becoming the next Wall Street wizard or picking the stock that’ll make you an overnight millionaire. It’s about understanding a few core principles and starting with simple, proven strategies.

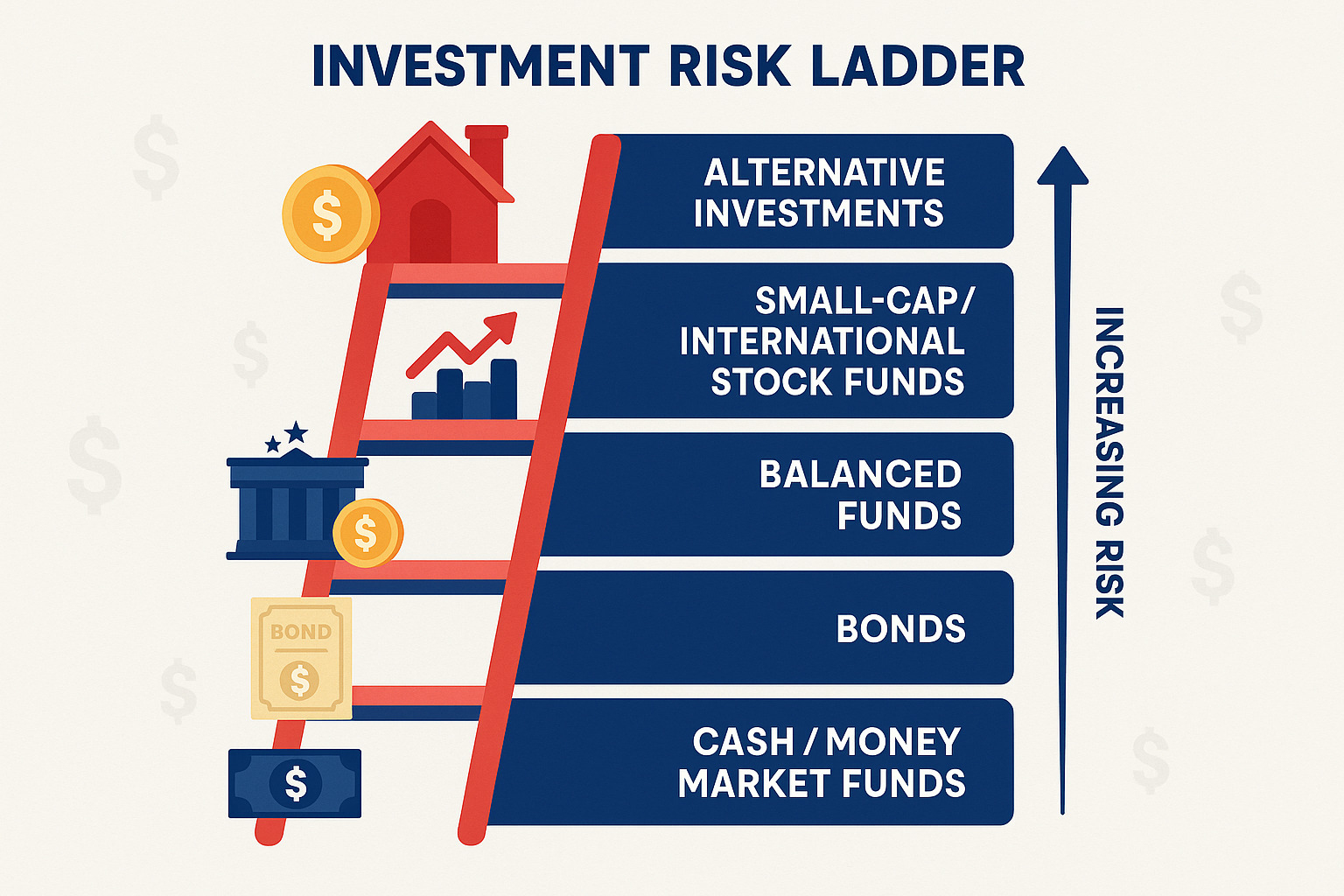

At its heart, investing is a balancing act between risk and potential reward. Higher potential returns generally come with higher risks—like a seesaw where you decide where to sit. As you’re just starting out, finding your personal comfort zone on this spectrum is key.

Your time horizon—how many years until you’ll need the money—plays a crucial role in your approach. For retirement that’s decades away, you can weather market storms and take more calculated risks. For a home down payment you’ll need in three years? You’ll want to be much more conservative. Understanding this relationship between time and risk is the foundation of smart beginner investing.

How much money do I need to begin?

One of the most beautiful developments in modern investing is that the “price of admission” has dropped dramatically. You no longer need thousands of dollars to start!

Thanks to fractional shares, you can now buy tiny slices of expensive stocks. Instead of needing $3,000+ for a single Amazon share, you could invest just $50 and own a small piece of the company. It’s like being able to buy a single slice of pizza instead of the whole pie!

Many investment platforms now offer zero-commission trading, meaning you won’t pay fees when buying or selling most stocks and ETFs. This has thrown the door wide open for new investors to start small.

Dollar-cost averaging—investing a consistent amount regularly regardless of market ups and downs—is perfect for beginners. By investing, say, $200 monthly, you naturally buy more shares when prices drop and fewer when prices rise. This approach takes the stress out of timing the market and can lower your average cost per share over time.

While no one can predict the future, history gives us some guidance: the stock market has delivered average annual returns of 6-10% over the long term. Your personal results will vary year to year, but this range gives you a reasonable expectation for planning purposes.

When should I start? Yesterday—here’s why

The opportunity cost of waiting to invest is staggering. Consider this eye-opening example: if you invest $1,000 at age 25 and earn an average 8% annual return, that $1,000 could grow to over $21,000 by age 65. Wait until you’re 35 to make that same investment? It would only grow to about $10,000. That’s the price of a decade’s delay!

Many people put off investing because they’re trying to “time the market”—waiting for the perfect moment when stocks are at their lowest. Here’s the truth: even professional investors with advanced degrees and powerful computers can’t consistently predict market movements. As the wise saying goes, “Time in the market beats timing the market.”

Patience might be the most valuable asset in your investing toolkit. The market will have its mood swings—sometimes euphoric, sometimes gloomy—but historically, it has trended upward over longer periods. By staying invested through these cycles rather than jumping in and out, you position yourself to capture the full power of compounding returns.

The best investment strategy is the one you can stick with consistently. Start where you are, with what you have, and give your future self the gift of financial growth!

Beginner Investing Accounts: Picking the Right Home for Your Money

Finding the perfect home for your investment dollars might sound complicated, but it’s actually one of the most straightforward parts of your investing journey. Think of investment accounts as different types of soil – each nurturing your money in unique ways.

When I first started investing, choosing between account types felt overwhelming. But trust me, once you understand the basics, you’ll see how each option serves a specific purpose in your financial garden.

Here are the main types of investment accounts you should know about:

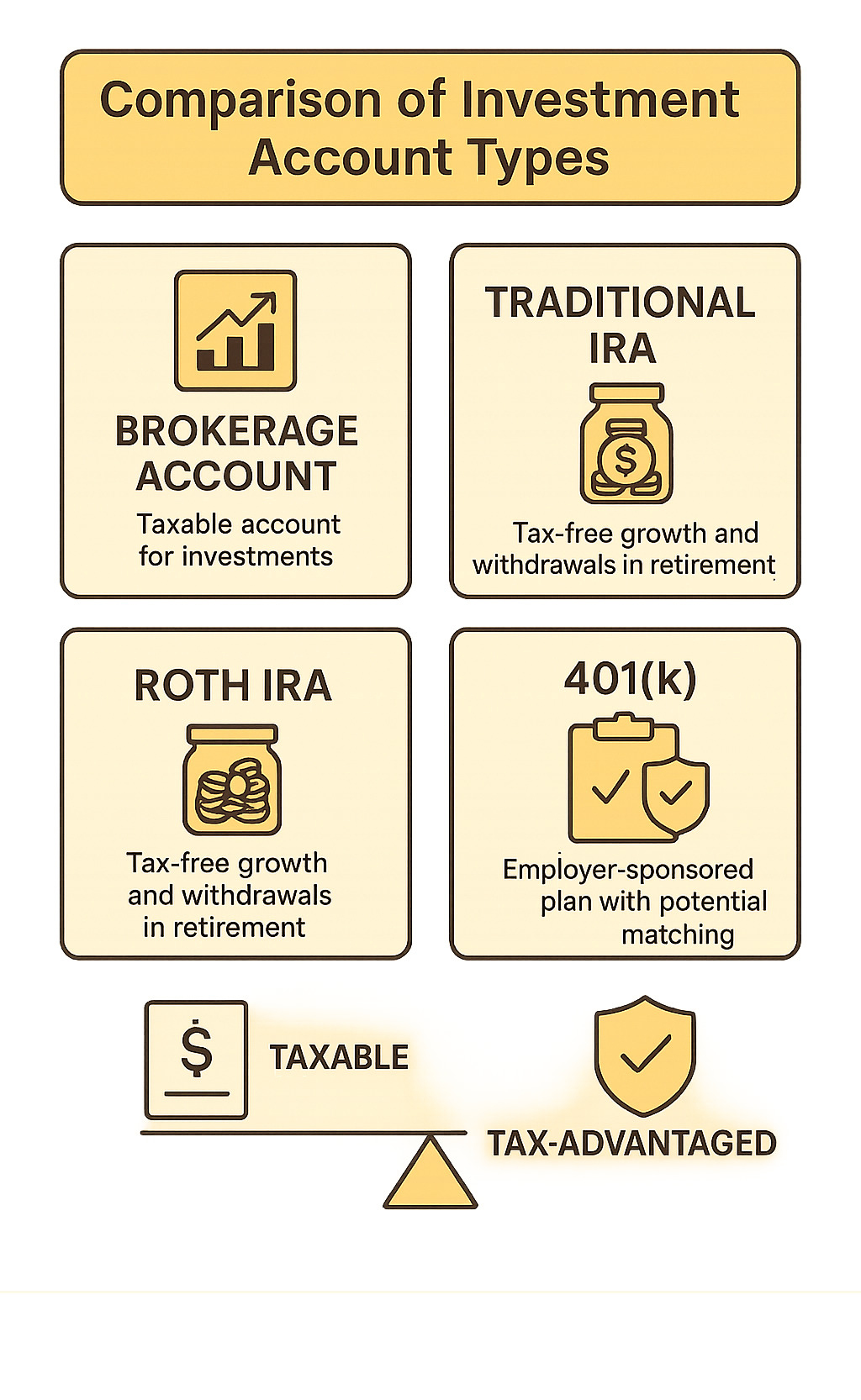

A brokerage account is like your financial freestyle zone – a standard, taxable investment account with no special tax perks, but also no restrictions on when you can take your money out. Need cash for a vacation next year? No problem!

A Traditional IRA (Individual Retirement Account) offers potential tax deductions now, reducing your current taxable income. Your money grows tax-deferred until retirement, meaning you’ll pay taxes only when you withdraw.

The Roth IRA flips this approach – you contribute after-tax dollars (money you’ve already paid taxes on), but the magic happens later when qualified withdrawals in retirement are completely tax-free, including all your hard-earned growth.

Your employer might offer a 401(k) plan where contributions typically come out pre-tax, lowering your current taxable income. The real treasure here? Many employers match a portion of your contributions – that’s literally free money waiting for you to claim it!

Peace of mind comes standard with most investment accounts, as they’re protected by the Securities Investor Protection Corporation (SIPC). This safeguards securities in your account up to $500,000 (including up to $250,000 in cash) if your brokerage firm ever fails – though such failures are rare.

Tax-advantaged vs taxable: which first for beginner investing?

If you’re just starting your beginner investing journey, I recommend prioritizing tax-advantaged accounts first. Why leave money on the table? Especially if your employer offers a 401(k) match – that’s an immediate 50% or 100% return on your investment in many cases, something you simply won’t find anywhere else in the investing world.

Understanding when you pay taxes is the key difference between tax-advantaged accounts:

With pre-tax contributions like Traditional IRAs and 401(k)s, you’re essentially telling the government, “Not now, thanks!” You skip taxes today but will pay them when you withdraw in retirement. This works wonderfully if you expect to be in a lower tax bracket when you retire.

With post-tax contributions like Roth IRAs and Roth 401(k)s, you’re saying, “I’ll pay now to play tax-free later.” You pay taxes on contributions today, but your future self will thank you when withdrawals in retirement – including all that growth – come out completely tax-free.

These special accounts do have annual limits on how much you can contribute. For 2024, you can put up to $23,000 in your 401(k) (plus an extra $7,500 if you’re 50+), while IRAs cap at $7,000 (with an additional $1,000 for those 50+).

The trade-off for these tax perks? Limited access to your money. Generally, withdrawing from retirement accounts before age 59½ triggers penalties, though certain exceptions exist for first-time home purchases, education expenses, and other specific situations.

Once you’ve maximized your tax-advantaged options (or if you want money you can access anytime), a standard brokerage account makes perfect sense as your next investment home.

Opening your first account step-by-step

Opening an investment account is surprisingly simple – most people complete the process online in about 15 minutes, about the time it takes to brew and enjoy a cup of coffee. Here’s what you’ll need handy:

Your personal information including Social Security number, date of birth, address, and employment details will be required first. Financial institutions need to verify your identity through Know Your Customer (KYC) requirements, so have a government-issued ID ready. You’ll also need your banking information to fund your new investment account.

When choosing where to open your account, consider these factors: account minimums (many brokers now offer $0 minimums), available investment options, educational resources (especially valuable for beginner investing), user interface quality, mobile app functionality, customer service reputation, and fee structures.

After your account application is approved (usually within minutes), you’ll need to add funds. Most brokers allow simple electronic transfers from your bank account, typically taking 1-3 business days to process. Some even offer instant verification methods to speed things up.

With your funded account, you’re ready for the exciting part – making your first investment! At Finances 4You, we typically recommend starting with broad-based index funds or ETFs that instantly diversify your portfolio across hundreds or thousands of companies.

The hardest part of investing is often just getting started. Once your account is open and your first investment is made, you’ve already accomplished something significant that many people never do. From there, consistent contributions and patience will help your money grow into something meaningful over time.

Starter Portfolio & Strategies: Stocks, Bonds, Funds and ETFs

When you’re just dipping your toes into the investing world, simplicity is truly your best friend. The good news? You don’t need a complicated portfolio with dozens of different investments to build wealth effectively. In fact, many financial experts I’ve spoken with recommend starting with just a handful of broadly diversified funds.

Let me walk you through the main types of investments you should know about as you begin your journey:

- Stocks are like tiny ownership slices of a company. When you buy Apple stock, you literally own a small piece of Apple!

- Bonds are essentially loans you make to governments or corporations. They pay you interest over time and return your principal when they mature.

- Mutual Funds pool money from many investors (like you!) to purchase a collection of stocks, bonds, or other securities.

- Exchange-Traded Funds (ETFs) work similarly to mutual funds but trade like stocks throughout the day on exchanges.

- Index Funds (a type of mutual fund or ETF) simply aim to track the performance of a specific market index, like the S&P 500.

Think of investments as climbing a risk ladder. At the bottom rung, you have safer options with lower potential returns. As you climb higher, both risk and potential reward increase:

Building a diversified core in beginner investing

One approach I love recommending to new investors is the “three-fund portfolio.” It’s beautifully simple yet incredibly effective. Here’s what it includes:

- A total U.S. stock market index fund

- A total international stock market index fund

- A total bond market index fund

With just these three funds, you’ll own pieces of thousands of companies and bonds across the globe. It’s like having the entire investment world in your pocket!

How you divide your money between these three depends on your age and comfort with risk. If you’re in your 20s or 30s, you might put 70% in U.S. stocks, 20% in international stocks, and 10% in bonds. As you get closer to retirement, you’d gradually increase that bond percentage for more stability.

Diversification isn’t just a fancy investing term—it’s your safety net. When tech stocks are struggling, maybe healthcare stocks are thriving. When the U.S. market hits a rough patch, international markets might be soaring. By spreading your investments around, you’re not putting all your eggs in one basket.

Choosing between active, passive, and robo options

As you start your beginner investing journey, you’ll need to decide which approach fits your style:

Active investing is like being the chef who carefully selects every ingredient. You (or a fund manager) pick individual stocks or actively managed funds trying to beat the market. While the potential rewards can be higher, here’s the reality check: research consistently shows that most active managers fail to outperform simple index funds over the long haul.

Passive investing is more like following a trusted recipe. You buy index funds or ETFs that simply track market benchmarks. It’s less glamorous but offers broad diversification and lower costs. The scientific research is compelling here—passive approaches have historically outperformed most active strategies over time. The SEC has excellent scientific research on index funds worth reading.

Robo-advisors are like having a personal sous chef. These digital platforms build and manage diversified portfolios of low-cost ETFs based on your goals and risk tolerance. They handle the details while you focus on the big picture.

Pay close attention to expense ratios—the annual fees funds charge. They might seem small, but they compound just like your returns do! As of December 31, 2024, Vanguard’s average mutual fund and ETF expense ratio is just 0.07%, compared to the industry average of 0.44%. That difference could mean tens of thousands of extra dollars in your pocket over decades.

Robo-advisors typically charge around 0.25% of your balance plus the underlying fund expenses—significantly less than traditional financial advisors who might charge 1% or more.

How often—and how much—should you invest?

Consistency beats perfect timing every single day of the week. Rather than trying to guess market highs and lows (which even professionals can’t do reliably), set up automatic, regular contributions. This approach, called dollar-cost averaging, is like the tortoise in the race—slow, steady, and surprisingly effective.

The benefits are numerous: it removes emotional decision-making, builds a disciplined savings habit, potentially lowers your average cost per share over time, and automatically takes advantage of market dips.

As for how much to invest, aim for 10-15% of your income if possible. But here’s what I really want you to know: starting with whatever amount you can afford right now is infinitely better than waiting until you can invest “enough.” Even $50 or $100 a month will grow significantly over time.

Here’s a real-life example that still amazes me: increasing your monthly investment from $200 to $300 might not feel like much today, but that extra $100 per month could grow to more than $100,000 over 30 years (assuming a 7% annual return). Small changes, massive results!

Whether you choose to invest weekly, bi-weekly, or monthly doesn’t matter nearly as much as sticking with your plan through market ups and downs. The magic happens not in the timing but in the staying.

At Finances 4You, we’ve seen time and again that the investors who succeed aren’t necessarily the ones with the most complex strategies—they’re the ones who started early, stayed consistent, and kept things simple.

Managing Risk, Fees & Common Rookie Mistakes

Let’s face it – even the best-laid investment plans can hit a few bumps along the way. As you start on your beginner investing journey, knowing the common pitfalls can save you from costly mistakes down the road.

Market volatility is simply part of the investing experience. Those ups and downs you see in your account balance? Totally normal. The secret isn’t avoiding volatility – it’s developing the emotional resilience to ride the waves without panicking. History shows us that markets have always recovered eventually, though sometimes that “eventually” takes longer than we’d like.

Something many new investors don’t consider is sequence-of-returns risk – basically, the timing of when you experience good or bad returns matters tremendously. This becomes especially crucial as retirement approaches, when a significant market downturn could take a serious bite out of your nest egg just when you need it most.

Then there’s fee drag – the silent wealth killer. Those seemingly small percentage fees compound against you over time, potentially costing you tens of thousands of dollars over your investing lifetime. A 1% difference in fees might not sound like much today, but over 30 years? It could mean the difference between a comfortable retirement and having to work extra years.

While diversification is your friend, it does have its limits. Spreading your investments across different assets won’t eliminate all risk, and going overboard with too many investments can actually water down your returns. Balance is key.

The most common rookie mistakes I see investors make are surprisingly predictable:

Emotional decision-making tops the list – buying when everyone’s excited (and prices are high) or selling when everyone’s panicking (and prices are low). Your emotions are often your portfolio’s worst enemy.

Putting all your eggs in one basket is another classic blunder. I’ve seen too many people bet everything on a single “can’t-miss” stock or sector, only to watch it underperform.

Overlooking fees might seem minor in the short term, but those expense ratios compound against you year after year.

Trying to time the market is a game even the professionals rarely win consistently. The data is clear – time in the market beats timing the market.

Checking your portfolio obsessively often leads to anxiety and knee-jerk reactions. Consider setting a regular schedule for portfolio reviews instead of watching every market movement.

For a deeper dive into avoiding these common pitfalls, our guide on Top 5 Common Investing Mistakes and How to Avoid Them offers practical strategies to keep you on track.

Cutting costs: expense ratios, commissions, account fees

The magic of compound interest works in reverse when it comes to fees – they compound against you, silently eroding your returns year after year.

Let me put this in perspective: If you invest $100,000 over 30 years earning 7% annually, the difference between paying a 0.07% expense ratio versus the industry average of 0.44% amounts to over $100,000! That’s right – the seemingly small difference of 0.37% could cost you six figures over time.

The fee landscape for investors includes several categories worth understanding:

Expense ratios are the annual management fees funds charge, expressed as a percentage of your investment. The difference between Vanguard’s average of 0.07% and the industry average of 0.44% might seem small, but as we’ve seen, it adds up dramatically.

Trading commissions have largely disappeared for stocks and ETFs at most brokers (thankfully!), but they may still apply for certain investments or account types.

Account maintenance fees are becoming increasingly rare, but some brokers still charge them – especially for smaller accounts. Always check the fine print.

Advisory fees come into play if you’re using a financial advisor or robo-advisor. These typically range from 0.25% for robo-advisors to 1% or more for traditional financial advisors.

Load fees are sales charges on some mutual funds that can take a significant bite out of your investment right from the start. In today’s competitive landscape, there’s rarely a good reason to pay these.

That many mutual funds have minimum investment requirements, typically $500-$3,000, though some brokers now offer ways around these minimums through fractional shares or their own fund offerings.

Risk-management checklist for beginner investing

Managing risk isn’t about avoiding it entirely – it’s about taking the right kinds of risks for your situation. Here’s a practical checklist to help you steer the waters:

First, match your asset mix to your time horizon. The longer you have until you need the money, the more stock exposure you can generally handle. If you’re investing for a goal that’s 30 years away, you can ride out market volatility. For next year’s vacation fund? Not so much.

Diversify thoughtfully – not just across asset classes (stocks, bonds, etc.) but within them too (different sectors, geographies, company sizes). This helps ensure that when one area struggles, others might pick up the slack.

Rebalance your portfolio at least once a year. This disciplined approach forces you to sell some of what’s performed well and buy more of what’s lagged – essentially “buying low and selling high” automatically.

Always maintain a solid emergency fund of 3-6 months of expenses. This prevents you from having to sell investments at potentially inopportune times just to cover unexpected costs.

Only invest money you won’t need soon. The stock market is no place for your down payment fund if you’re house hunting this year.

Understand what you own. If you can’t explain how an investment works to a friend, it might be too complex for your portfolio.

Perhaps most importantly, stay the course during market downturns. Volatility isn’t your enemy – your reaction to it might be.

Market dips aren’t disasters – they’re discounts! When stocks go “on sale,” it’s actually an opportunity to buy quality investments at lower prices. At Finances 4You, we’ve found that investors who maintain perspective during market turbulence are far more likely to reach their long-term financial goals.

Level Up: Automate, Secure, and Keep Learning

Once you’ve set up your investment accounts and chosen your strategy, it’s time to make your investing life easier and more effective. The secret weapon that successful investors swear by? Automation.

Think of automation as your personal investment assistant that never sleeps, gets emotional, or forgets to invest during market dips. Most investment platforms let you schedule automatic transfers from your bank account weekly, bi-weekly, or monthly – whatever rhythm works best for your budget. Even better, you can set these transfers to automatically purchase your chosen investments, creating a “set it and forget it” system that builds wealth while you sleep.

Your portfolio will naturally drift from your target allocation as different investments grow at different rates. That’s where rebalancing alerts come in handy – they’ll notify you when it’s time to sell a bit of your winners and buy more of your underperformers to maintain your desired investment mix. This helps you naturally “buy low and sell high” without trying to time the market.

Security isn’t the most exciting part of investing, but it’s absolutely essential. Always enable multifactor authentication on your financial accounts – that extra verification step beyond your password might seem like a small hassle, but it’s like adding a steel door to protect your growing wealth.

It’s also important to understand protection limits. SIPC coverage protects up to $500,000 in securities and $250,000 in cash if your brokerage firm fails (though it won’t protect against normal market losses). FDIC insurance covers bank deposits up to $250,000 per depositor, per bank. Knowing these limits helps you structure your accounts appropriately as your wealth grows.

The journey of beginner investing doesn’t end after your first few trades – it evolves. The financial world constantly changes, and continuing your education helps you adapt and make smarter decisions. For quality resources to expand your knowledge, check out our guide on Where to Learn About Investing: Courses, Books, Websites.

Staying safe while investing online

Cybersecurity is as important as your investment strategy. Your growing wealth deserves strong protection.

Create strong, unique passwords for each of your financial accounts – and please, don’t use “Password123” or your birthday! Enable multifactor authentication everywhere it’s offered; that extra verification step is like having a security guard checking IDs at your financial doorstep.

Be extremely cautious about phishing attempts. Legitimate financial institutions won’t send you emails asking for account information or passwords. When in doubt, go directly to your brokerage’s website by typing the address yourself rather than clicking links.

Setting up account alerts is like having a personal security system – you’ll receive notifications for all account activities, making it easy to spot anything suspicious immediately. Keep your devices and apps updated, as these updates often include critical security patches.

Avoid checking your investments while sipping a latte on public Wi-Fi. These networks can be hunting grounds for hackers looking to intercept your financial data. If you suspect any fraudulent activity, don’t wait – contact your brokerage’s fraud hotline immediately to freeze your account.

Growing your knowledge after your first trade

The most successful investors never stop learning. After you’ve made your first investments, keep building your financial wisdom through multiple channels.

Financial podcasts make learning convenient – transform your commute or workout into an investing masterclass. Classic investing books like “The Intelligent Investor” by Benjamin Graham or “A Random Walk Down Wall Street” by Burton Malkiel offer timeless wisdom that has guided generations of successful investors.

Want to test new strategies without risking real money? Stock market simulators let you practice in a consequence-free environment. Community forums connect you with fellow investors who can share insights, mistakes, and successes – sometimes the best lessons come from others’ experiences.

Stay informed about market trends by following reputable financial news sources, but remember – daily market movements are usually just noise for long-term investors. For deeper understanding of specific topics, online courses can help you master concepts from tax-efficient investing to retirement planning.

Investing truly is a marathon, not a sprint. At Finances 4You, we’ve seen that your investing knowledge compounds over time just like your investments do – small, consistent additions eventually create remarkable results. The investor who commits to lifelong learning typically outperforms even those with higher starting capital but fixed mindsets.

Frequently Asked Questions about Beginner Investing

Do I need to be debt-free before I invest?

The debt-versus-investing question keeps many potential investors on the sidelines, but the answer isn’t black and white.

Not all debt is created equal. Those high-interest credit cards charging 18% or more? Yes, tackle those first. You’ll essentially earn a guaranteed 18% “return” by paying them off, which beats what most investments can reliably deliver.

But don’t let lower-interest debts like mortgages or federal student loans stop your investing journey completely. This is especially true if your employer offers a 401(k) match – that’s immediate free money you shouldn’t leave on the table!

Many successful investors follow this balanced approach:

- Build a small emergency cushion first (even just $1,000)

- Eliminate those high-interest debts that keep you up at night

- Capture your full employer match (don’t walk past free money!)

- Expand your emergency fund to cover 3-6 months of expenses

- Work on moderate-interest debts while continuing to invest

- Max out your retirement accounts when possible

- Expand into taxable investments as your financial situation improves

As one of our beginner investing clients recently told us, “I wish I hadn’t waited until my student loans were completely gone to start investing. Those five years of compound growth I missed can never be recovered.”

What if the market crashes right after I start?

It’s the nightmare scenario many new investors fear: you finally work up the courage to invest, and boom – the market tanks. While this timing would certainly feel awful, it’s actually not the disaster you might imagine.

Think of it this way: if you’re investing for retirement in your 20s, 30s, or 40s, you’re playing a decades-long game. Market crashes are like unexpected sales for long-term investors. Your regular contributions buy more shares at lower prices during downturns, potentially boosting your returns when markets eventually recover (and historically, they always have).

The absolute worst move during a market crash is panic-selling. This locks in your losses permanently and leaves you on the sidelines when the recovery begins. Market timing doesn’t work – even for professionals.

As Warren Buffett famously advises, “Be fearful when others are greedy, and greedy when others are fearful.” A market crash early in your investing journey might actually be a blessing in disguise – if you have the emotional fortitude to stay the course.

Is crypto a good idea for beginner investing?

Cryptocurrency has created both overnight millionaires and devastating losses. With its wild price swings and complex technology, is it appropriate for beginner investing?

For most new investors, we recommend establishing a solid foundation with traditional assets before venturing into crypto territory. Stocks, bonds, and index funds have decades (or centuries) of historical data, regulatory oversight, and investor protections that cryptocurrencies simply don’t offer yet.

If you’re still curious about crypto after building your core portfolio, consider these guardrails:

Only invest money you can truly afford to lose completely. Think of it as entertainment money, not retirement savings.

Keep it tiny relative to your overall investments – many financial advisors suggest 5% or less of your portfolio.

Do your homework beyond just price charts. Understand the technology, use cases, and competitive landscape.

Prepare yourself mentally for extreme volatility – 50% drops can happen practically overnight.

Take security seriously by learning proper storage methods to protect your digital assets.

Cryptocurrency exchanges typically lack SIPC protection, meaning if the platform goes bankrupt (which has happened), your assets could disappear. Traditional brokerages offer much stronger investor protections.

As one Finances 4You reader shared: “I allocated 3% of my portfolio to crypto after building my emergency fund and maxing out my Roth IRA. The small allocation means I can participate without risking my financial future, regardless of whether crypto booms or busts.”

Conclusion

Taking those first steps into the investing world can feel like venturing into unknown territory. But remember—every successful investor once stood exactly where you are now, uncertain but hopeful.

The beauty of beginner investing is that the hardest part is simply getting started. Once you’ve taken that leap, momentum builds naturally.

Let’s take a moment to reflect on your new investing roadmap:

-

Build your foundation first: Make sure you’ve got that emergency fund in place and tackled any high-interest debt that’s eating away at your financial progress.

-

Choose accounts that reward you: Tax-advantaged accounts like 401(k)s and IRAs should be your first stop—they’re like getting a discount on your future.

-

Accept simplicity: Those broad-based index funds and ETFs might not be exciting dinner conversation, but they’re quietly working behind the scenes, spreading your risk across hundreds or thousands of companies.

-

Put your investing on autopilot: When you automate your contributions, you’re essentially paying your future self first—before you can talk yourself out of it.

-

Watch those fees like a hawk: Even a fraction of a percentage point in fees can snowball into thousands of lost dollars over decades.

-

Stay steady when markets wobble: Market downturns aren’t a bug in the system—they’re a feature. Your patience during these times is literally worth money.

-

Never stop learning: Your financial education is a lifelong journey that pays dividends in more ways than one.

At Finances 4You, we believe your investing strategy should evolve as you do. That’s why we’ve developed tools to help you benchmark your net worth against others in your age group—giving you the confidence of knowing where you stand and where you’re headed.

Starting small is absolutely fine. In fact, it’s perfect. That $50 monthly contribution might seem insignificant today, but decades from now, it could represent thousands of dollars thanks to the quiet magic of compound interest. As your income grows, so too can your contributions.

The most expensive mistake in investing isn’t choosing the wrong fund—it’s waiting too long to begin.

Ready to dive deeper into specific investing strategies? Explore more investing guides from our team at Finances 4You. We’re committed to walking alongside you on your journey toward financial confidence, one thoughtful step at a time.