Why Starting Early is Your Biggest Financial Advantage

The best retirement plans for young adults are those that maximize time and compound interest to build substantial wealth over decades. Here are the top options:

Top Retirement Plans for Young Adults:

- 401(k) – Employer-sponsored with matching contributions (up to $23,000 in 2024)

- Roth IRA – Tax-free growth and withdrawals (up to $7,000 in 2024)

- Traditional IRA – Tax-deductible contributions (up to $7,000 in 2024)

- SEP IRA/Solo 401(k) – High-limit options for self-employed (up to $69,000 in 2024)

Your 20s and 30s might feel like the wrong time to think about retirement. You’re building your career, managing debt, and dealing with lifestyle inflation that comes with a higher salary. But here’s the truth: time is your superpower when it comes to retirement planning.

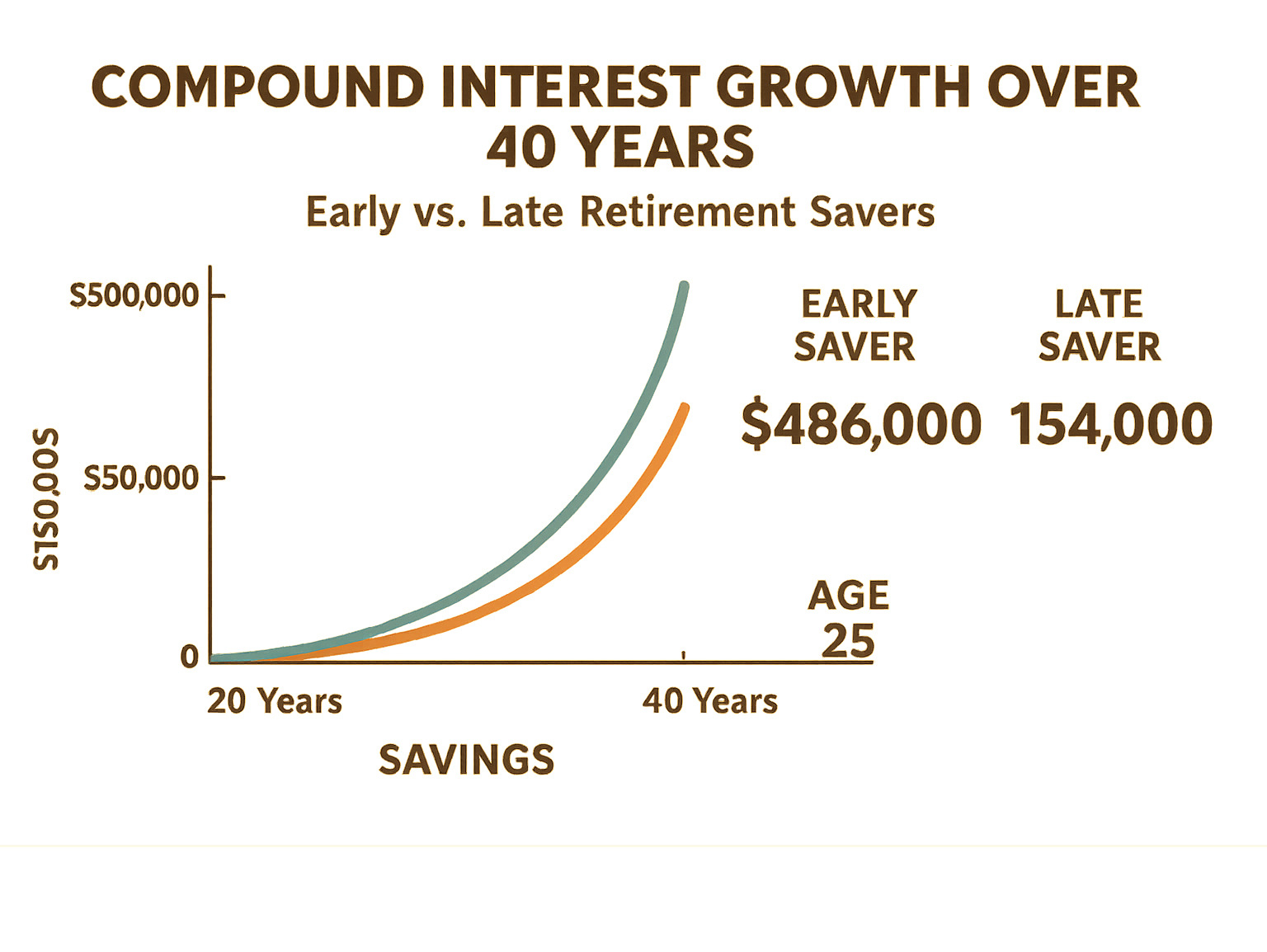

Consider this powerful example from the research: Contributing just $3,500 annually to a Roth IRA from ages 16 to 21 can grow to over $1 million by age 68. That’s the magic of compound interest working over four decades.

The math is simple but striking. To save $100,000 for retirement with 5% annual interest, you need to save $243 per month over 20 years versus $643 per month if you wait and only save for 10 years. Starting early means you earn $18,875 more in interest while saving $400 less per month.

As one financial expert put it: “The most important financial decision you can make when you’re young is to get into the habit of saving regularly. Where you invest matters less than the fact that you’ve decided to invest.”

Simple guide to best retirement plans for young adults:

Why You Can’t Afford to Wait: The Power of Starting Early

Think of compound interest as your money making money, and then that money making even more money. It’s like a snowball rolling down a hill – it starts small but gets bigger and bigger as it picks up speed. This isn’t just financial theory; it’s the real reason why the best retirement plans for young adults focus on starting as early as possible.

Let’s talk numbers that will make your jaw drop. A 30-year-old earning $52,936 annually who saves 15% in a traditional 401(k) with a 2% annual salary increase and 6.96% average return could accumulate $1,701,383 by age 65. Wait just five years until age 35 to start, and that number drops significantly – that’s the true cost of waiting.

Here’s another way to think about it: If you need to save $100,000 for retirement at 5% annual interest, starting with 20 years means you’ll save $243 per month. Wait until you only have 10 years? You’ll need to save $643 per month – nearly three times as much! Over the longer timeframe, you’ll actually earn $18,875 more in interest while saving $400 less per month.

But here’s the example that really shows the magic of starting early. A teenager who contributes just $3,500 annually from ages 16 to 21 (that’s only $21,000 total) can watch their account grow to over $1 million by age 68, assuming 8% annual growth. Yes, you read that right – six years of modest contributions can create a seven-figure retirement account.

Starting early does more than just maximize your money’s growth potential. It builds good financial habits that will serve you for life. When you automate your retirement contributions in your 20s, you learn to live on less than you earn – which is honestly the foundation of all wealth building.

The best part? Starting early also reduces future financial stress. While your friends in their 40s are panicking about retirement savings, you’ll be watching your account grow steadily, knowing you made the smart choice when it mattered most.

The Power of Compound Interest in Investing dives deeper into how this mathematical miracle can work for you, no matter where you’re starting from. The key is simply to start – and start now.

A Guide to the Best Retirement Plans for Young Adults

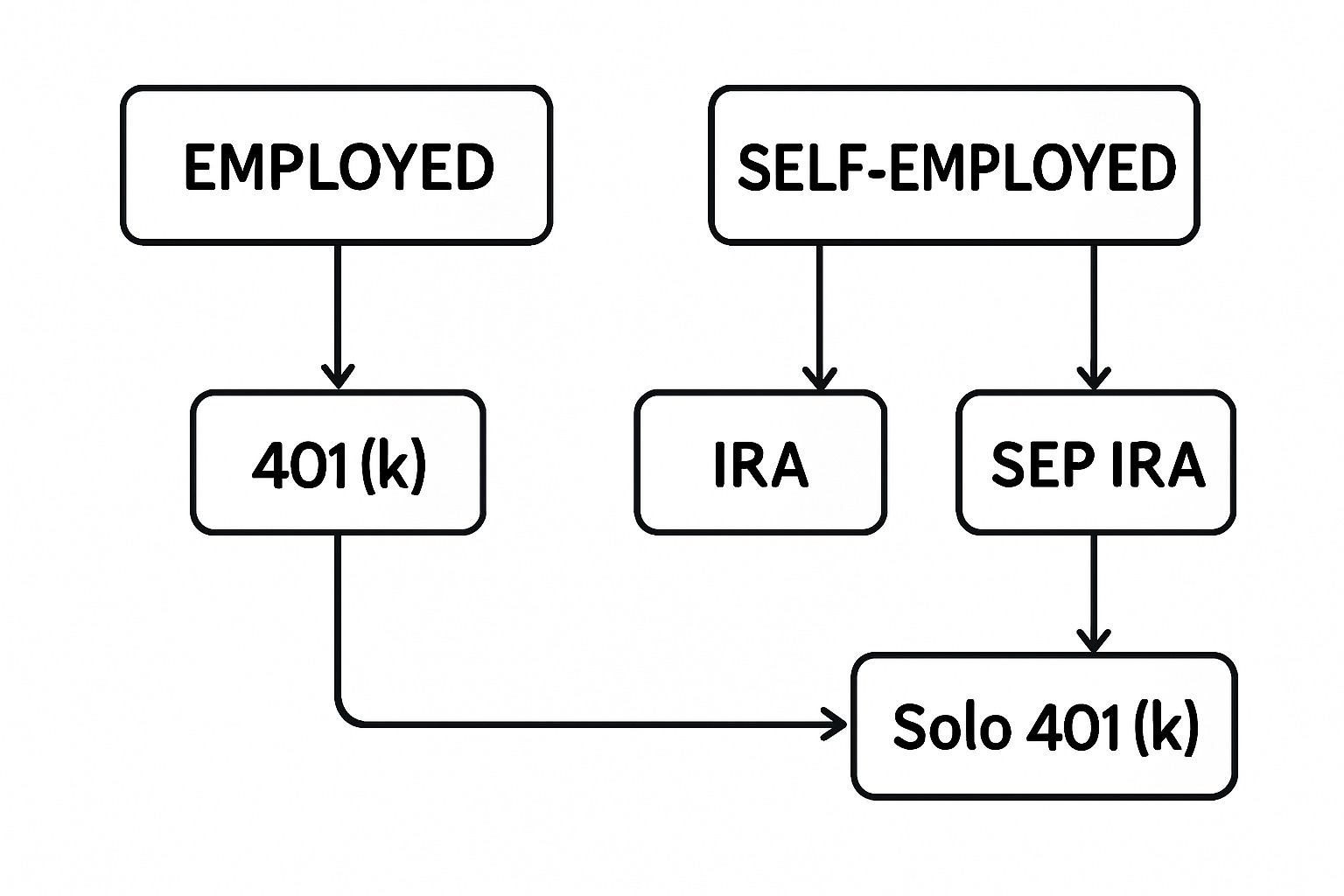

Picking the best retirement plans for young adults starts with one question: who signs your paycheck? Employees usually begin with an employer-sponsored plan, while freelancers need an individual or self-employed option. No matter which route you take, every plan offers two core advantages—tax breaks and decades of compound growth.

For a quick overview, scan Top Retirement Saving Options: 401k, IRA, and More.

Employer-Sponsored Plan: The 401(k)

A 401(k) lets you divert part of each paycheck into a tax-deferred account and often comes with employer matching—free money you should never leave behind.

- 2024 contribution limit: $23,000

- Traditional (pre-tax) and Roth (after-tax) versions are widely available.

- Pros: high limits, automatic payroll deposits, match.

- Cons: fewer investment choices, possible fees, early-withdrawal penalties.

Roth IRA: Young Saver’s Favorite

A Roth IRA is funded with after-tax dollars, so every qualified withdrawal in retirement is tax-free—perfect if you expect higher future tax rates.

- 2024 limit: $7,000 (under age 50)

- Income cap for single filers: $146,000.

- Contributions (not earnings) can be pulled out any time without tax or penalty.

Traditional IRA

Contributions may be tax-deductible today, but both principal and earnings are taxed later.

| Feature | Roth IRA | Traditional IRA |

|---|---|---|

| Tax break | Later (tax-free withdrawals) | Now (tax deduction) |

| 2024 limit | $7,000 | $7,000 |

| RMDs | None | Begin at 73 |

| Early access | Contributions penalty-free | 10% penalty before 59½ |

Self-Employed Options: SEP IRA & Solo 401(k)

If you’re your own boss, you also control your retirement perks:

- SEP IRA – Contribute up to 25% of net earnings, max $69,000 (2024). Easy set-up; works even if income swings.

- Solo 401(k) – For businesses with no employees except a spouse. Combine employee ($23,000) and employer contributions for the same $69,000 limit. Roth Solo 401(k)s are becoming common.

For set-up details, see 401k Plans for Self-Employed.

Smart Strategies to Maximize Your Retirement Savings

Automation turns good intentions into results. Once you schedule transfers, saving for the best retirement plans for young adults happens without relying on willpower.

- Pay yourself first. Route 401(k) or IRA money out of every paycheck before you touch it.

- Grab the full employer match. A 50% match on 6% of pay is an instant 50% return.

- Raise contributions 1% each year. You’ll hardly notice, but a typical earner could end up with six figures more by retirement.

- Direct windfalls—bonuses, tax refunds—into your account. They weren’t in your budget, so you won’t miss them.

- Slash high-interest debt. Every dollar not spent on 18% credit-card interest can compound for you instead.

Need more ideas? Visit How to Save for Retirement and Investing 101: A Beginner’s Guide to Growing Your Money.

Navigating Your Choices and Avoiding Common Pitfalls

Choosing among the best retirement plans for young adults boils down to matching the plan to your job type and tax outlook.

- Employee with match? Contribute at least enough to capture that match.

- Lower tax bracket now, higher later? Favor Roth accounts.

- Higher bracket now, lower later? Traditional accounts may help.

- Freelancer? Compare SEP IRA simplicity with Solo 401(k) higher limits.

- Want flexibility? Mix Roth and Traditional for tax diversification.

Hidden Threats

- Inflation – At 2.5% a year, today’s $50,000 needs nearly $82,000 in 20 years. Invest, don’t just save.

- Early withdrawals – A $10,000 raid at age 30 could cost over $100,000 in lost growth. Keep an emergency fund so retirement money stays untouched.

Read more mistakes to avoid in Avoid These Common Retirement Planning Mistakes.

Frequently Asked Questions about Retirement Planning for Young Adults

How much should I save?

Aim for 15% of gross pay, including any employer match. Can’t hit that yet? Start smaller, lock in the match, then nudge the rate up each year.

What if I can’t afford much now?

Even $25 a week gets compound interest working. Consistency matters more than amount—raise contributions as debts shrink and income rises.

Roth vs. Traditional—what’s the real difference?

Roth = pay tax now, withdraw tax-free later; Traditional = tax break now, pay tax later. Pick based on whether your tax rate is likely to be higher now or in retirement. The IRS Roth comparison chart has the fine print.

Conclusion: Secure Your Financial Future Today

Starting your retirement planning journey as a young adult isn’t just smart – it’s one of the most powerful financial decisions you’ll ever make. The best retirement plans for young adults all share one incredible advantage: they harness the unstoppable force of time and compound interest to build wealth that seemed impossible just decades earlier.

Think about it this way: that teenager who invested $3,500 annually for just six years will have over $1 million by retirement. A 30-year-old consistently saving 15% of their income can accumulate more than $1.7 million by age 65. These aren’t fantasies – they’re the predictable results of starting early and staying consistent.

The beauty of retirement planning lies in its simplicity. You don’t need to pick the “perfect” plan or save enormous amounts right away. Whether you start with a 401(k) that captures your employer’s matching contributions, open a Roth IRA for tax-free growth, or choose a high-limit plan as a self-employed individual, the most important decision is simply to begin.

Consistency beats perfection every single time. The young adult who saves $200 monthly for 40 years will far outpace someone who saves $800 monthly for just 10 years. This is why developing the habit of regular saving matters more than the specific dollar amount you start with.

Your retirement plan will evolve as your life changes. You might begin with a simple Roth IRA in your early twenties, add a 401(k) when you land your first corporate job, and later explore self-employed options if you start your own business. This progression is natural and expected.

At Finances 4You, we understand that aligning your net worth with your age group is a key goal of financial planning. Our mission is to provide the curated insights and practical guidance that help you steer these important financial decisions with confidence. We’re here to help you turn abstract retirement goals into concrete financial reality.

The research is clear, the math is undeniable, and the opportunity is right in front of you. Your future self – the one enjoying financial security and freedom in retirement – is counting on the decisions you make today. The best retirement plan is the one you actually use, so choose your path and take that first step.

Ready to dive deeper into retirement planning? Explore our comprehensive resources at Comprehensive Retirement Planning for ongoing guidance and insights. We’re here to support you on this journey, one contribution at a time.