Why Business Financial Planning Is Your Key to Success

Business financial planning is the process of creating a roadmap that guides your company’s financial decisions, tracks performance, and ensures sustainable growth. It combines strategic goal-setting with detailed financial projections to help you make informed decisions about your business’s future.

Core Components:

– Cash flow projections – Track money in and out

– Income statements – Monitor revenue and expenses

– Balance sheets – Understand assets and liabilities

– Break-even analysis – Know when you’ll be profitable

– Scenario planning – Prepare for different outcomes

– Risk management – Protect against financial threats

Key Benefits:

– Make smarter business decisions

– Secure funding from investors or lenders

– Avoid cash flow problems

– Set realistic growth targets

– Monitor performance with clear metrics

The statistics are sobering: only about half of small businesses stay open for five years, and only a third make it to the 10-year mark. The businesses that survive and thrive almost always have one thing in common – they plan their finances carefully.

Think of business financial planning like a GPS for your company. Without it, you’re driving blind. With it, you can steer challenges, spot opportunities, and reach your destination faster.

Business financial planning terms to know:

– cost of financial planner

– finance planner notion

– personal finance consulting

What Is Business Financial Planning and Why It Matters

Business financial planning is your systematic approach to understanding where your money comes from, where it goes, and how to make it work harder for you. Think of it as creating a financial GPS for your business journey.

Research from the SBA shows that businesses without proper financial planning face much steeper odds of failure. When you dig into why businesses close their doors, it’s rarely because they had a bad product or service. More often, it’s because they ran out of cash or made financial decisions without proper planning.

Your financial plan becomes your crystal ball, helping you answer the big questions that keep business owners awake at night. How much money will you need to get through the slow season? Your cash flow projections will show you. Is that new hire worth the investment? Your budget analysis will tell you.

The magic happens when business financial planning transforms from a chore into your competitive advantage. Suddenly, you’re not just reacting to financial surprises – you’re anticipating them.

Lenders and investors can spot a well-planned business from a mile away. When you walk into a bank with detailed financial projections and clear assumptions, you’re demonstrating that you understand your business inside and out.

For detailed research on small business survival rates and financial planning best practices, the SBA’s learning platform offers valuable insights backed by solid data.

Core Benefits at a Glance

Profitability becomes predictable when you understand your numbers deeply. Instead of wondering why some months are great and others are terrible, you’ll spot the patterns and double down on what works.

Cash flow stability might be the most important benefit of all. Running out of cash kills more businesses than any other single factor. Your financial plan shows you exactly when money will be tight and when it will be flowing freely.

Strategic alignment ensures your money follows your dreams. Your biggest business decisions stop being gut calls and start being data-driven choices.

Key Components of a Comprehensive Business Financial Plan

Think of your business financial planning framework as the dashboard of your company’s financial health. Just like a pilot needs multiple instruments to fly safely, you need several key components working together.

The foundation starts with your income statement, which shows whether you’re actually making money after all expenses are paid. Your balance sheet provides a snapshot of what you own versus what you owe at any given moment.

Cash flow projections are perhaps your most critical tool. They track the actual timing of money moving in and out of your business. You might be profitable on paper but still struggle to pay bills if your cash flow timing is off.

Operating budgets keep you on track by setting spending limits for different areas of your business. Your KPI dashboard tracks the metrics that matter most – customer acquisition costs, profit margins, or inventory turnover rates.

Smart business owners also prepare scenario analyses – different versions of their financial projections based on optimistic, pessimistic, and realistic outcomes. Contingency planning includes emergency funds and backup strategies for when things don’t go as expected.

For more detailed guidance on managing this critical component, check out our comprehensive guide on understanding cash flow.

Cash Flow Projection Essentials

Cash flow projections are where the rubber meets the road in business financial planning. You can be profitable on paper and still go out of business if you run out of cash to pay your bills.

The secret lies in understanding that timing is everything. Just because you made a $10,000 sale doesn’t mean you have $10,000 in your bank account today. If your customer pays in 60 days, you need to bridge that gap somehow.

Collections management becomes your best friend here. Track how long it actually takes customers to pay, not how long you hope they’ll take. On the flip side, disbursement planning helps you map out when money leaves your business.

Building Realistic Budgets

Creating budgets that actually work requires balancing your growth ambitions with financial reality. Start with cost control as your foundation. Separate your fixed costs like rent from variable costs like materials.

Variance analysis is your reality check. Compare what actually happened to what you budgeted every month. Your budget should get more accurate over time, not less.

For a practical tool to get started, explore our detailed budget worksheet guide that walks you through the process step by step.

Step-by-Step Guide to Creating Your Business Financial Plan

Building a solid business financial planning foundation is manageable when you break it down into clear steps. Think of it like following a recipe – each ingredient matters, and the order makes all the difference.

Start with a strategic review of where your business is heading. Are you planning to hire more staff? Launch a new product line? Your financial plan needs to support these dreams, not just track what happened last month.

Data gathering comes next. Pull together your financial statements, talk to your sales team about pipeline opportunities, and check with operations about any upcoming changes.

When you move into forecasting, resist the urge to be overly optimistic or pessimistic. Build three versions: what you hope will happen, what you expect will happen, and what you’ll do if things get tough.

Your financing strategy should answer: where will the money come from? Whether you’re bootstrapping, applying for loans, or pitching to investors, each path requires different preparation.

Implementation is where good plans come to life. Assign someone to monitor progress monthly, set up tracking systems, and create regular check-in meetings.

Finally, accept iteration. Your financial plan should be a living document that evolves with your business. Review it quarterly and adjust as needed.

For detailed guidance on creating financial projections, refer to BDC’s comprehensive planning guide.

Business Financial Planning Roadmap: 7 Actions

Set clear financial goals that you can measure and track. Instead of “make more money,” define specific targets like “reach $750,000 in revenue with a 12% profit margin by December.”

Analyze your current position honestly. Look at your cash flow patterns, identify your most profitable products, and understand your real costs.

Create detailed projections that map out the next 12-18 months month by month. Include seasonal variations and known upcoming expenses.

Perform break-even analysis to understand exactly how much you need to sell to keep the lights on.

Develop your funding strategy before you need the money. Banks want to see planning, not desperation.

Plan for contingencies by maintaining cash reserves and establishing credit lines while your business is strong.

Implement monitoring systems that give you regular feedback on performance versus projections.

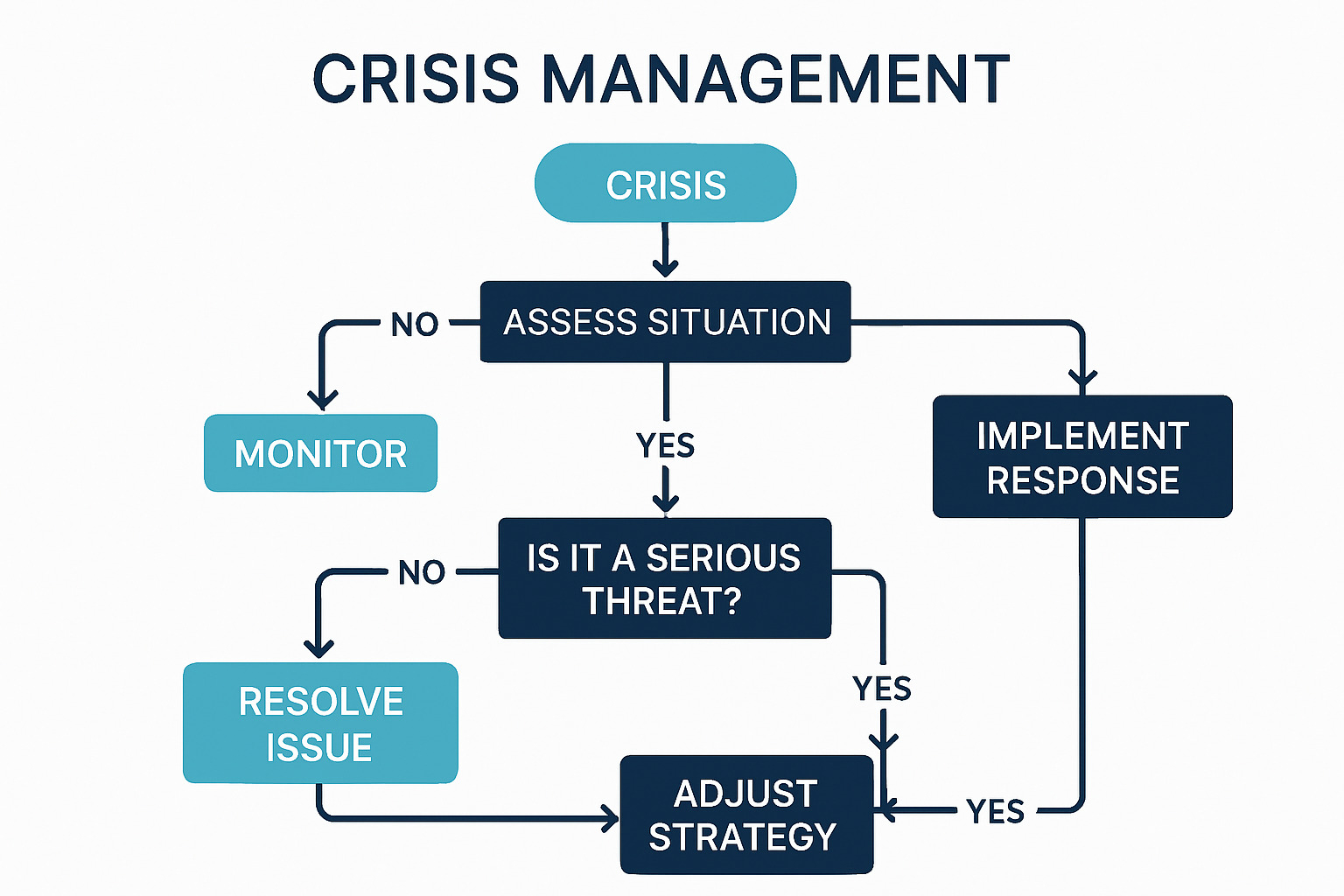

Scenario Planning & Contingencies

Smart business financial planning means expecting the unexpected. Your best-case scenario helps you prepare for growth. The worst-case scenario stress-tests your business against major challenges. Your most likely scenario becomes your primary planning tool.

Emergency reserves should cover three to six months of operating expenses. Insurance coverage protects against risks that could devastate your business. The goal isn’t to predict the future perfectly – it’s to be prepared for different possibilities.

Monitoring, KPIs, and Adjusting Your Plan Over Time

The most successful businesses treat their financial plans as living documents that evolve with real-world results. This means rolling up your sleeves monthly to see what’s actually happening versus what you thought would happen.

Variance tracking is your best friend here. When you compare actual results to projections each month, patterns start to emerge. These insights help you make smarter decisions going forward.

Creating visual dashboards transforms boring spreadsheets into something you’ll actually want to look at. Focus on the numbers that directly impact your business decisions.

Financial ratios give you a health check for your business. Your current ratio shows whether you can pay short-term bills. Your debt-to-equity ratio reveals how much you’re relying on borrowed money. Your gross profit margin indicates whether your pricing strategy is working.

Trend analysis helps you see the forest through the trees. These longer-term patterns often matter more than monthly blips.

For comprehensive guidance on financial management and KPIs, explore our finance management guide.

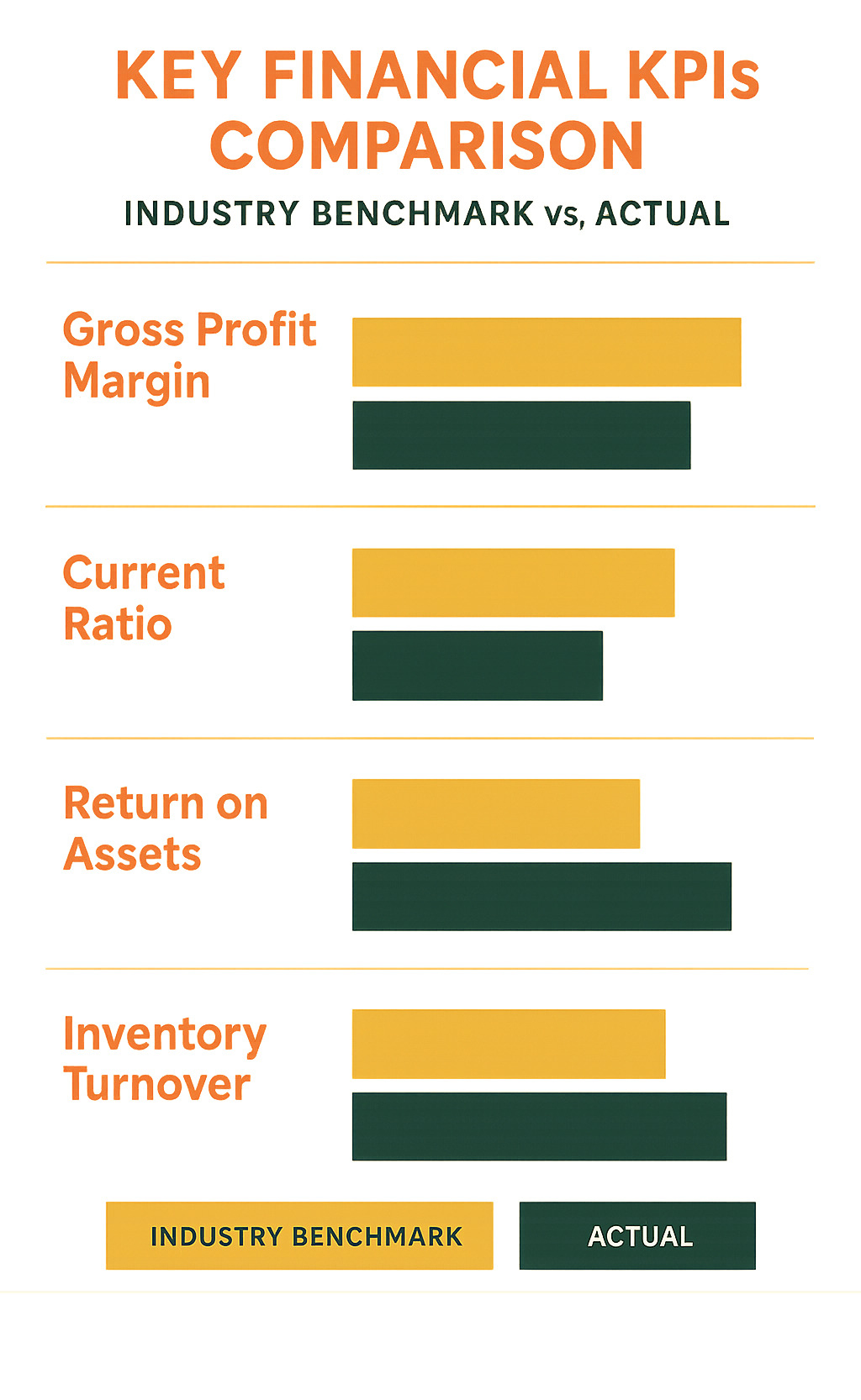

Using KPIs to Drive Business Financial Planning Success

Key Performance Indicators turn your business financial planning from a dusty binder into a powerful management tool. You don’t need to track fifty different metrics to be successful.

Return on Assets (ROA) tells you how hard your assets are working. Current ratio is like checking your business’s pulse – divide current assets by current liabilities to see if you can handle short-term bills.

Gross margin reveals whether your pricing strategy is working. Days Sales Outstanding (DSO) measures how quickly customers actually pay you. Customer Acquisition Cost (CAC) versus customer lifetime value determines whether your growth is profitable.

Working capital shows whether you have enough cushion to handle day-to-day operations without scrambling for cash.

The magic happens when you track these KPIs consistently over time. Monthly snapshots show what’s happening now, but quarterly and yearly trends reveal where your business is really headed.

Tailoring Business Financial Planning for Different Business Sizes

One size doesn’t fit all when it comes to business financial planning. The key is matching your planning approach to where your business actually is.

Startups live in survival mode. Focus on weekly cash flow projections for your first year because running out of money is an immediate threat. Keep things simple but accurate.

Small to Medium Enterprises have proven their business model works but are juggling growth with stability. You need annual budgets with quarterly check-ins. Start breaking down finances by department and focus on working capital management.

Large enterprises focus on multi-year strategic plans, complex budgeting processes involving multiple departments, and comprehensive risk management frameworks.

| Business Size | Primary Focus | Planning Horizon | Key Challenges |

|---|---|---|---|

| Startup | Survival & Proof of Concept | 12-18 months | Cash runway, market validation |

| SME | Growth & Stability | 1-3 years | Working capital, scaling systems |

| Large Enterprise | Strategy & Governance | 3-5 years | Complexity, compliance, risk management |

Special Considerations for Small Businesses

Small businesses face unique financial planning challenges. Bootstrapping often becomes an art form – you’re constantly looking for ways to minimize fixed costs while maximizing what you can accomplish.

SBA loans can be a game-changer, offering better terms than traditional bank loans. Simple, cloud-based accounting platforms can handle most small business needs perfectly well.

Take advantage of free mentorship resources like SCORE mentors and Small Business Development Centers.

Scaling Up: Mid-Market & Enterprise Tactics

As your business grows, ERP systems start making sense, connecting financial planning with operations for real-time visibility.

Departmental budgeting becomes essential when you can no longer keep track of everything in your head. Formal governance structures create freedom through clear processes and spending authorization limits.

Common Mistakes to Avoid and Risk-Management Best Practices

Even dedicated entrepreneurs can fall into common traps that derail their financial success.

The biggest mistake? Overoptimism. Smart business owners use conservative assumptions and stress-test their projections against reality.

Expense underestimation runs a close second. Adding a 10-20% contingency to major expense categories isn’t pessimistic – it’s realistic planning.

Ignoring cash flow timing trips up many profitable businesses. Creating detailed cash flow projections and maintaining adequate cash reserves can mean the difference between thriving and surviving.

Outdated plans are silent killers. Monthly reviews with quarterly updates keep your planning relevant and actionable.

Many businesses fall into the single scenario trap. Creating multiple scenarios with contingency responses gives you flexibility when the unexpected happens.

Inadequate insurance leaves businesses vulnerable to catastrophic losses. Comprehensive coverage, professional liability insurance, and key person life insurance are essential protections.

Cyber risk deserves special attention. A ransomware attack can destroy years of financial planning overnight. Regular backups, cyber security insurance, and incident response plans are necessities.

For more insights on protecting your business’s financial foundation, explore our guide on building business credit.

The goal isn’t to avoid all risks – it’s to understand them, plan for them, and position your business to weather whatever storms may come.

Frequently Asked Questions about Business Financial Planning

How often should I update my financial plan?

Think of your business financial planning like checking your GPS while driving – you need regular updates to stay on track, but you don’t need to obsess over every small detour.

For most businesses, a monthly review works best for comparing actual results to your projections. This keeps you close enough to spot problems early but not so frequent that you’re constantly reacting to normal business fluctuations.

Quarterly updates are perfect for making bigger adjustments to your annual forecasts. Markets shift, customer behavior changes, and new opportunities emerge – your financial plan should reflect these realities.

Once a year, give your plan a complete overhaul. This annual comprehensive review should align with your strategic planning process and incorporate everything you’ve learned over the past twelve months.

Here’s the reality check: if your business operates in a volatile market or you’re managing tight cash flow, you might need weekly reviews. On the flip side, if you’re running a stable, mature business with predictable patterns, quarterly check-ins might be sufficient.

The key is finding a rhythm that keeps you informed without creating busywork. Your financial plan should serve you, not the other way around.

What financial statements are mandatory?

Every solid business financial planning foundation rests on three essential financial statements – think of them as the three legs of a stool that keeps your business stable.

The Income Statement (also called Profit & Loss) shows whether you’re making money. It tracks your revenue, subtracts your expenses, and tells you what’s left over. This statement answers the fundamental question: “Is my business profitable?”

Your Balance Sheet is like a financial snapshot taken at a specific moment. It shows what you own (assets), what you owe (liabilities), and what’s truly yours (equity). Think of it as your business’s net worth statement.

The Cash Flow Statement tracks the actual movement of money in and out of your business. This one’s crucial because you can be profitable on paper but still run out of cash – and cash pays the bills.

Beyond these core three, smart business owners often add budget-versus-actual reports to see where their projections missed the mark. Some businesses also benefit from departmental income statements or customer profitability reports, but start with the basics first.

These statements work together to tell your business’s complete financial story. The income statement shows profitability, the balance sheet shows stability, and the cash flow statement shows liquidity.

How does a financial plan attract investors?

When investors or lenders review your business financial planning documents, they’re essentially asking one question: “Can I trust this person with my money?”

A well-prepared financial plan demonstrates fiscal responsibility better than any sales pitch. It shows you understand where every dollar comes from and where it goes. Investors have seen too many entrepreneurs who can talk passionately about their product but can’t explain their unit economics.

Your financial projections reveal growth potential and help investors understand the size of the opportunity. They want to see realistic revenue growth, expanding margins, and a clear path to scale. But here’s the catch – overly optimistic projections actually hurt your credibility.

Smart investors appreciate risk awareness. When your plan includes multiple scenarios and contingency strategies, it shows you’ve thought beyond the happy path. They know challenges will arise, and they want to back entrepreneurs who are prepared.

The professional management aspect can’t be overstated. A comprehensive financial plan signals that you’re running a real business with proper systems, not just winging it and hoping for the best.

When seeking funding, your plan should clearly show how you’ll use their money and what returns they can expect. Vague statements like “marketing and growth” won’t cut it. Investors want to see specific allocations and measurable outcomes.

Most importantly, realistic assumptions trump flashy projections every time. Experienced investors would rather see conservative estimates that you exceed than aggressive targets that leave you scrambling to explain shortfalls.

Conclusion & Next Steps

Creating a solid business financial planning foundation isn’t just about crunching numbers – it’s about building a bridge between your business dreams and financial reality. At Finances 4You, we know that your business often represents the biggest piece of your wealth puzzle, which makes smart financial planning essential for both business success and personal financial security.

Start Where You Are, Not Where You Think You Should Be

The best financial plan is the one you actually use. Begin by understanding your current financial position, then build from there.

Over the next month, focus on getting your financial house in order. Review your existing financial statements, set up basic cash flow monitoring systems, and create a straightforward six-month cash flow projection.

Building Momentum Over the Next Quarter

Spend the next 90 days developing comprehensive projections. Create those business financial planning scenarios we discussed – best case, worst case, and most likely outcomes.

Set up regular financial check-ins. Monthly reviews work well for most businesses, but check in weekly if cash flow is tight.

The Long Game: Your Year-Ahead Strategy

Over the next 12 months, work toward integrating your business planning with your personal wealth management goals. When your business financial health aligns with your personal net worth objectives, you create a powerful wealth-building engine.

Remember: Plans Are Made to Be Adjusted

Your financial plan should be a living document that grows with your business. The businesses that thrive aren’t necessarily the ones with perfect plans – they’re the ones that plan carefully, monitor closely, and adjust quickly when needed.

Effective business financial planning gives you the foundation to weather storms and capitalize on opportunities. Your future self will thank you for the planning work you do today.

For advanced strategies on positioning your business for long-term success, check out our comprehensive guide on business structure optimization.

Your business’s financial future starts with the decisions you make right now. Take that first step, stay committed to the process, and watch as your business success translates into personal wealth that aligns with your life goals.