Why Retirement Planning Matters for Your Future

Comprehensive retirement planning is the process of creating a detailed financial strategy that enables you to maintain your desired lifestyle after you stop working. It involves more than just saving money—it’s about building a roadmap that addresses all aspects of your financial future.

For those searching for guidance on retirement planning, here’s a quick overview:

| Key Component | What It Includes |

|---|---|

| Income Planning | Social Security, pensions, investments, part-time work |

| Expense Estimation | 70-80% of pre-retirement income typically needed |

| Account Selection | 401(k), IRA, Roth IRA with 2024 contribution limits: $23,000 for 401(k), $7,000 for IRAs |

| Asset Allocation | More aggressive when younger, more conservative near retirement |

| Risk Management | Protection against inflation, market volatility, healthcare costs |

Planning for retirement isn’t something you can put off until your 60s. The earlier you start, the more time your money has to grow through compounding—one of the most powerful forces in finance.

As Ed Slott, recognized by The Wall Street Journal as “The Best Source for IRA Advice,” notes: “Every dollar you save now will be much appreciated later.”

The reality is that 68% of Americans define “retiring well” as having the financial freedom to live comfortably. Yet many people find themselves unprepared when retirement arrives. Starting with a clear plan today makes all the difference tomorrow.

Whether you’re in your 30s and just beginning to think about retirement or approaching your golden years, a comprehensive approach ensures you’re addressing all crucial elements: savings goals, investment strategies, tax planning, healthcare costs, and leaving a legacy if that’s important to you.

Remember: Your retirement plan is a roadmap to your future that will evolve over time as your life changes.

Defining Comprehensive Retirement Planning

Comprehensive retirement planning is like creating a detailed roadmap for your financial future – not just focusing on a savings number, but embracing the full picture of your financial life. It’s about connecting all the pieces of your financial puzzle to create a complete view of your retirement journey.

When we talk about replacing your working income, most financial experts recommend aiming for about 70-80% of what you earned before retirement. Why not the full 100%? Well, certain expenses naturally fade away – you’ll no longer be putting money into retirement accounts, you can say goodbye to work-related costs, and many retirees find themselves in lower tax brackets.

One cornerstone of a solid retirement strategy is figuring out how much you can safely withdraw from your savings. The famous “4% rule” suggests taking out 4% of your portfolio in your first retirement year, then adjusting for inflation after that. While this gives you a starting point, your personal withdrawal plan should be as unique as your fingerprint – custom specifically to your situation and goals.

Two major challenges make retirement planning tricky: we’re living longer, and prices keep rising. With many Americans now enjoying life well into their 80s and 90s, your retirement savings might need to support you for 30+ years. Meanwhile, inflation silently chips away at your purchasing power – what costs $50,000 today could require $90,000 in just two decades, even with modest 3% inflation.

Why Comprehensive Retirement Planning Matters to Every Age

Comprehensive retirement planning isn’t just for folks with gray hair – it matters at every stage of life, though what you focus on will naturally evolve over time.

Young Adulthood (20s-30s)

When you’re just starting your career, retirement can feel like it belongs in another lifetime. But here’s the truth: this is actually the most powerful time to begin planning, thanks to the magic of compound growth.

“The average age for first-time investors is 33,” our research team at Finances 4You has found. “But starting even five years earlier can make a dramatic difference in your ultimate retirement nest egg.”

Young adults should focus on establishing retirement accounts early, building strong saving habits (even small amounts count!), embracing appropriate investment risk while time is on your side, and never leaving free money on the table through employer matches.

Middle Age (40s-50s)

As you hit your stride in your career and reach peak earning years, retirement planning becomes more tangible. Now’s the time to accelerate your savings (aiming for 15% or more of your income), refine your vision of what retirement looks like, begin exploring healthcare options for your future, and take advantage of catch-up contributions once you turn 50.

Pre-Retirement (Late 50s-Early 60s)

With retirement on the horizon, your focus shifts to finalizing your retirement date, creating a detailed budget for your next chapter, determining the best Social Security claiming strategy for your situation, shifting toward more conservative investments to protect what you’ve built, and making concrete plans for healthcare coverage.

Retirement Years

Even once you’ve retired, planning continues as you implement your withdrawal strategy, manage required minimum distributions (RMDs), adjust your spending during market downturns, and address legacy and estate considerations.

The Five Pillars of Comprehensive Retirement Planning

A truly comprehensive retirement planning approach stands on five essential pillars:

-

Cash Flow Planning: Ensuring your retirement income can support your lifestyle throughout your golden years. This includes optimizing Social Security benefits, making smart pension decisions, and creating sustainable withdrawal strategies from your investments.

-

Investment Strategy: Building an appropriate mix of assets that balances growth potential with risk management, adjusting as you move through different life stages.

-

Risk Management: Protecting against threats to your financial security, including market ups and downs, inflation eating away at your purchasing power, unexpected healthcare costs, and the possibility of outliving your money.

-

Tax Efficiency: Keeping more of your hard-earned money by minimizing taxes both while building your nest egg and during the withdrawal phase through strategic use of different account types and withdrawal sequencing.

-

Estate Planning: Making sure your assets go where you want them to, potentially reducing estate taxes, and planning for who will make decisions if you’re unable to.

Each pillar needs your attention for a truly robust retirement plan. Neglecting any one area is like building a beautiful house but forgetting the roof – even the most diligent efforts in other areas can be undermined.

From Dreams to Targets: Setting Lifestyle & Money Goals

Imagine waking up on a Monday morning with no alarm, no commute, and the entire day stretching before you filled with possibilities. That’s retirement—but what exactly will you do with all that freedom?

The foundation of comprehensive retirement planning isn’t just about numbers—it starts with painting a vivid picture of your future life. Without a clear vision, calculating how much money you’ll need is like trying to pack for a trip when you don’t know the destination!

Begin by having an honest conversation with yourself (and your partner, if applicable) about what truly matters to you. When do you hope to step away from your career? Some of us dream of early retirement at 55, while others might prefer working until 70 to maximize Social Security benefits. Your ideal living situation matters too—will you stay put, downsize to a condo, or perhaps relocate to that beach town you’ve always loved?

“I spent years helping clients with retirement planning,” shares Maria, a Finances 4You retirement specialist, “and I’ve noticed the happiest retirees have one thing in common: they’ve thought deeply about what will fill their days with purpose.”

Will you pursue passions like gardening, woodworking, or painting? Perhaps you’ll volunteer at the local animal shelter or work part-time at a bookstore just for fun. Many retirees find that a phased retirement—gradually reducing hours rather than stopping cold turkey—provides both financial and psychological benefits, easing the transition from full-time work to full-time leisure.

Once your retirement vision takes shape, it’s time to transform those dreams into SMART goals:

– Specific: “Travel abroad twice yearly” instead of just “travel more”

– Measurable: “Budget $10,000 annually for travel”

– Achievable: Ensure your goals align with your financial reality

– Relevant: Goals should reflect what truly matters to you

– Time-bound: “Starting at age 67” gives your goal a timeline

Don’t forget to learn more about the best way to plan for retirement as you develop your personalized roadmap.

Estimating Annual Expenses & Building a Retirement Budget

Creating a realistic retirement budget isn’t the most exciting part of planning, but it’s absolutely crucial for comprehensive retirement planning. Think of it as the blueprint for your dream retirement home—without it, you’re just guessing.

Start by dividing your expected expenses into two buckets:

Essential expenses keep the lights on and food on the table—these include housing costs (mortgage or rent, property taxes, maintenance), healthcare premiums and out-of-pocket costs, utilities, groceries, transportation, and insurance. These needs must be covered by guaranteed income sources if possible.

Discretionary expenses make retirement enjoyable—travel trips, dinner with friends, golf club memberships, spoiling grandchildren, and supporting causes you care about. These can be more flexible during market downturns.

While the classic advice suggests budgeting for 70-80% of your pre-retirement income, this one-size-fits-all approach doesn’t work for everyone. Some retirees actually spend more in their active early retirement years as they check off bucket list items and travel extensively.

Housing typically represents your largest expense category, so consider it carefully. Will your mortgage be paid off before retirement? Might downsizing free up equity and reduce ongoing costs? Would relocating to a more affordable area stretch your savings further?

Healthcare deserves special attention too. Medicare kicks in at 65, but it won’t cover everything. Budget for Medicare Part B premiums ($174.70/month for most people in 2024), supplemental insurance, prescription drug coverage, and routine dental and vision care. And don’t ignore the elephant in the retirement planning room—potential long-term care needs, which can quickly deplete savings.

The retirement budget you create today won’t remain static. Inflation will steadily increase your costs over time, particularly for healthcare which historically outpaces general inflation. That $4 coffee might cost $7 twenty years from now!

Want to dig deeper into the numbers? Check out our detailed guide on how much money you really need to retire.

Calculating “Your Number” With Online Tools

“What’s your number?” This seemingly simple question—how much you need to save before retirement—is actually quite complex. Fortunately, several approaches can help you nail down this crucial figure.

The Multiplier Method offers a quick ballpark estimate: multiply your final annual income by 10-12. For someone earning $100,000 pre-retirement, this suggests aiming for $1-1.2 million in savings. This method is simple but doesn’t account for your specific spending plans or other income sources.

For greater precision, try the Income Replacement Method. First, calculate your expected annual retirement expenses. Then subtract guaranteed income sources like Social Security and pensions. Finally, multiply the remaining amount by 25 (assuming the traditional 4% withdrawal rate).

For example, if you’ll need $80,000 yearly and expect $30,000 from Social Security, you’d calculate: ($80,000 – $30,000) × 25 = $1,250,000 in required savings.

“When I ran these numbers for myself,” shares Thomas, a recent Finances 4You client, “I realized I needed to either save more aggressively or adjust my retirement lifestyle expectations. That clarity was actually a relief—I finally had a concrete target.”

For the most accurate projections, leverage technology. The Social Security Administration offers excellent free tools at their retirement planning page to estimate your future benefits. Many financial institutions also provide robust retirement calculators that factor in inflation, investment returns, and tax considerations.

Financial advisors and sophisticated planning software often employ Monte Carlo simulations—running thousands of potential market scenarios to show the probability of your plan succeeding under various conditions. This approach helps account for market volatility and sequence-of-returns risk (the danger of poor investment returns in early retirement).

These calculations provide estimates, not guarantees. Life happens—markets fluctuate, health situations change, and priorities shift. The most successful retirees revisit their numbers regularly, making adjustments as needed rather than treating their plan as a static document that gathers dust.

As you refine your retirement number, keep in mind that flexibility may be your most valuable asset. The ability to adjust spending during market downturns or postpone major purchases can significantly increase your plan’s resilience.

Funding the Future: Accounts, Contributions & Asset Allocation

Building your retirement nest egg is a bit like planting a garden – you need the right containers (accounts), quality seeds (contributions), and proper arrangement (asset allocation) to help everything flourish. Let’s break down these essential elements of comprehensive retirement planning in a way that makes sense for your financial journey.

Think of retirement accounts as specialized containers designed to help your money grow with tax advantages. Most people have access to several types, each with its own unique benefits.

Your workplace likely offers a 401(k), 403(b), or 457 plan where you can sock away up to $23,000 in 2024. If you’re 50 or older, you get an extra bonus – you can contribute an additional $7,500 as a “catch-up” contribution. Don’t leave any employer matching funds on the table – that’s essentially free money boosting your retirement savings!

For smaller businesses, SIMPLE IRAs allow contributions up to $16,000, with a $3,500 catch-up provision for those over 50. These plans are simpler for employers to administer but still offer valuable tax benefits.

Beyond workplace plans, Individual Retirement Accounts (IRAs) give you personal control over your retirement savings. In 2024, you can contribute up to $7,000 to a Traditional or Roth IRA, with an extra $1,000 allowed if you’re over 50. Traditional IRAs typically offer tax deductions now, while Roth IRAs provide tax-free withdrawals later – a trade-off worth considering based on your current and expected future tax situation.

One often overlooked retirement savings powerhouse is the Health Savings Account (HSA). If you have a high-deductible health plan, an HSA offers a remarkable triple tax advantage: tax-deductible contributions, tax-free growth, and tax-free withdrawals for medical expenses. In 2024, you can contribute $4,150 for individual coverage or $8,300 for family coverage, with an extra $1,000 allowed for those 55 and older. After age 65, you can use HSA funds for any purpose (though non-medical withdrawals will be taxed as income).

| Account Type | 2024 Contribution Limit | Catch-Up Contribution (Age 50+) | Tax Treatment of Contributions | Tax Treatment of Withdrawals |

|---|---|---|---|---|

| Traditional 401(k) | $23,000 | $7,500 | Pre-tax | Taxed as income |

| Roth 401(k) | $23,000 | $7,500 | After-tax | Tax-free (qualified) |

| Traditional IRA | $7,000 | $1,000 | Pre-tax (if eligible) | Taxed as income |

| Roth IRA | $7,000 | $1,000 | After-tax | Tax-free (qualified) |

| HSA | $4,150 (individual) $8,300 (family) | $1,000 (age 55+) | Pre-tax | Tax-free for medical; taxed for other uses after 65 |

Maximizing Tax-Advantaged Accounts & Catch-Ups

Smart comprehensive retirement planning means making the most of every tax advantage available to you, especially as retirement approaches.

When deciding where to put your retirement dollars, consider this sensible order: First, contribute enough to your employer plan to get the full match – that’s an immediate return on your investment that’s hard to beat anywhere else. Next, if you qualify, max out an HSA for those triple tax benefits. Then, fund a Roth IRA if your income allows it. After that, circle back to your employer plan and contribute up to the limit. Finally, consider regular brokerage accounts for additional savings.

The government recognizes that many people find themselves playing catch-up with retirement savings later in life. That’s why they allow those special “catch-up” contributions I mentioned earlier. Starting in 2025, there’s an even bigger opportunity coming – if you’re between 60 and 63, you’ll be able to add an extra $11,250 to your 401(k) each year, thanks to the SECURE 2.0 Act.

Employer matches can significantly boost your retirement savings. If your company offers a typical match – say, 50% of your contributions up to 6% of your salary – that’s like getting an automatic 3% raise that goes straight to your future. On a $100,000 salary, that’s $3,000 in free retirement money every year!

For higher earners who bump into Roth IRA income limits, the “backdoor Roth” strategy offers a workaround. This involves making non-deductible contributions to a Traditional IRA, then converting those funds to a Roth IRA. It requires careful execution and documentation, but can be well worth the effort.

As financial educator Lisa explains, “Tax-advantaged accounts are the cornerstone of efficient retirement saving. I appreciate having a holistic forecast tool that helps me optimize across different account types.”

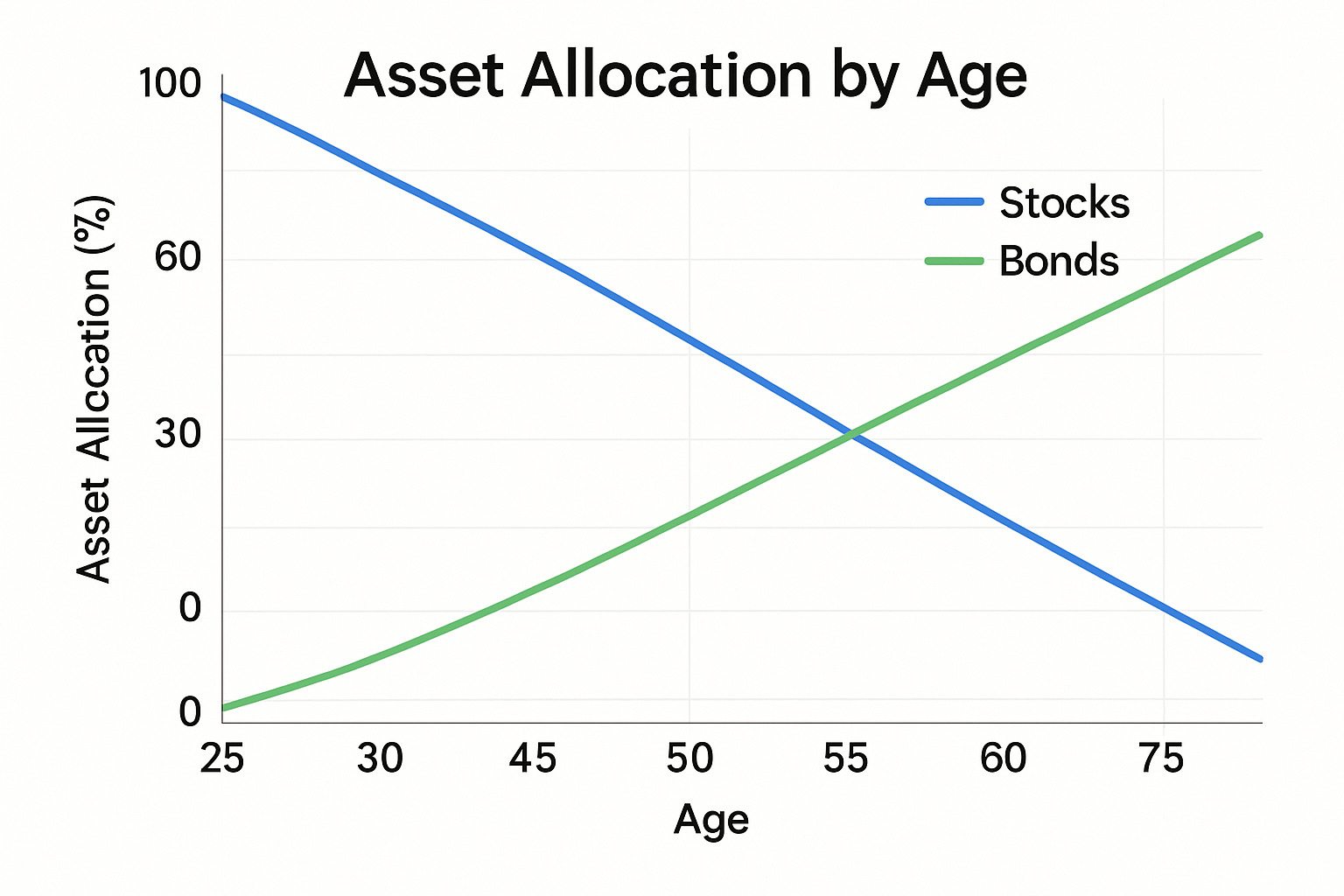

Asset Allocation During Work & Retirement

How you divide your money among different types of investments – stocks, bonds, cash, and other assets – is crucial to your comprehensive retirement planning success. This mix should evolve as you move through different life stages.

During your working years, when retirement might be decades away, time is your ally. You can generally afford to take more risk for potentially higher returns. A common rule of thumb suggests subtracting your age from 110 or 120 to find your stock allocation percentage. So at age 30, you might have 80-90% in stocks, with the remainder in bonds and cash. This approach balances growth potential with your personal risk tolerance.

As retirement appears on the horizon (about 5-10 years out), preserving what you’ve built becomes increasingly important. This is the time to gradually shift to a more conservative mix by reducing stock exposure and increasing bonds and other income-producing investments. Many successful retirees also build a cash buffer during this period to cover initial retirement expenses without having to sell investments in a potential down market.

Once retirement begins, several thoughtful strategies can guide your asset allocation decisions. The popular “bucket strategy” divides your savings into three parts: a short-term bucket with 1-2 years of expenses in cash; a mid-term bucket with 5-8 years of expenses in bonds and income investments; and a long-term bucket with remaining funds in growth-oriented investments. This approach gives you peace of mind knowing your immediate needs are covered while the rest of your money continues growing.

Another approach is creating a “bond ladder” – a series of bond investments that mature in successive years, providing predictable income streams throughout retirement. This strategy can help manage interest rate risk while generating reliable income.

The “glide path approach” involves gradually decreasing your stock allocation throughout retirement – perhaps starting at 50% stocks at retirement and moving toward 30% in later years. Interestingly, some newer research suggests a “U-shaped approach” might work better for some people – starting retirement more conservatively, then actually increasing stock allocation in mid-retirement, before becoming more conservative again in later years.

Whatever strategy you choose, regular rebalancing is essential to maintain your target allocation as market movements naturally shift your portfolio’s weightings. Most experts recommend reviewing your allocation at least once a year or after significant market movements.

Managing Risks, Taxes, and Legacy

Even the best retirement plans face unexpected challenges. A truly comprehensive retirement planning approach anticipates these problems and prepares for them proactively.

The stock market’s natural ups and downs can significantly impact your retirement nest egg, especially during what experts call the “retirement red zone”—those crucial years just before and after you stop working. To weather these storms, consider diversifying across different types of investments, keeping adequate cash reserves for immediate needs, and using bonds to provide stability when stocks become volatile.

One particularly sneaky risk is what financial planners call “sequence of returns risk.” This occurs when the market takes a downturn right as you begin withdrawing from your retirement accounts. Even if the market recovers later, those early withdrawals during down years can permanently damage your portfolio’s long-term health. To protect yourself, consider keeping 1-2 years of expenses in cash, being flexible with your withdrawal amounts during market downturns, or exploring guaranteed income products for your essential expenses.

“The timing of market returns matters just as much as the returns themselves,” explains retirement researcher Wade Pfau. “A bad sequence in the first few years of retirement can derail even the most carefully constructed plan.”

When to claim Social Security represents another crucial decision. While you can start as early as 62, your benefits will be permanently reduced by up to 30% compared to waiting until your full retirement age (67 for those born in 1960 or later). Patient retirees who delay claiming until age 70 receive an impressive 8% annual boost for each year they wait beyond full retirement age.

Roth conversions—moving money from Traditional IRAs to Roth accounts—can create tax-free income streams for your future. This strategy works particularly well during years when your income is lower, perhaps during the gap between retirement and when Social Security begins. It can also reduce those mandatory withdrawals that kick in at 73, and since Roth IRAs don’t require distributions during your lifetime, they make excellent legacy vehicles.

Don’t forget the paperwork that protects your loved ones: wills and trusts to direct your assets, powers of attorney for financial and healthcare decisions, properly updated beneficiary designations, and even a plan for your digital assets like online accounts and social media profiles.

Protecting Your Plan From the Big Three Risks

Three major threats can undermine even the most carefully constructed retirement plans: inflation, longevity, and healthcare costs. Addressing these is essential for comprehensive retirement planning.

Inflation silently erodes your purchasing power over time. At just 3% annual inflation—a relatively modest rate—prices double in about 24 years. That morning coffee that costs $5 today might cost $10 in your mid-retirement years. To fight this invisible enemy, maintain some stock exposure throughout retirement, consider Treasury Inflation-Protected Securities (TIPS) for a portion of your bond allocation, include some real estate investments which often keep pace with inflation, and explore I Bonds for part of your fixed-income strategy.

Living longer than expected might sound wonderful—until you consider the financial implications. According to the CDC’s latest research, today’s 65-year-old men can expect to live approximately 17 more years, while women typically live nearly 20 more years. But remember, these are just averages—many people live well into their 90s or beyond.

To manage this longevity risk, consider planning for a 30+ year retirement, delaying Social Security to maximize your guaranteed lifetime income, exploring longevity insurance that begins payments at an advanced age (like 85), and maintaining some growth investments even in your later years.

Healthcare costs represent perhaps the most unpredictable expense in retirement. The average 65-year-old couple retiring today might need more than $300,000 just for healthcare throughout retirement—and Medicare only covers about 62% of typical expenses. Long-term care adds another layer of concern, with assisted living averaging $54,000 annually and nursing home care often exceeding $100,000 per year.

Smart strategies for handling healthcare costs include maximizing HSA contributions during your working years (these accounts offer triple tax advantages), purchasing appropriate Medicare supplemental insurance, exploring long-term care insurance options, and considering continuing care retirement communities that provide a spectrum of care options as your needs change.

Crafting a Tax-Smart Withdrawal Strategy

How you withdraw money in retirement can be just as important as how you saved it. A thoughtful withdrawal strategy is a cornerstone of comprehensive retirement planning and can potentially add years to your portfolio’s lifespan.

The traditional advice suggests withdrawing from your accounts in this order:

1. Take required minimum distributions (RMDs) first, since they’re mandatory

2. Tap taxable brokerage accounts next

3. Draw from tax-deferred accounts like Traditional IRAs and 401(k)s

4. Save tax-free Roth accounts for last

This approach aims to preserve tax-advantaged growth as long as possible. However, blindly following this sequence isn’t always best for everyone.

A more sophisticated approach considers your tax situation each year. You might intentionally withdraw from traditional IRAs to “fill up” lower tax brackets, then switch to Roth withdrawals when additional income would push you into a higher bracket. During market downturns, consider Roth conversions—you’ll pay taxes on a smaller balance and enjoy tax-free growth when markets recover.

“The tax code is complicated, but the concept is simple,” says retirement tax expert Ed Slott. “You want to pay taxes when your tax rate is lowest, whether that’s now or in the future.”

Required minimum distributions (RMDs) begin at age 73 (increasing to 75 by 2033) and can force withdrawals that push you into higher tax brackets. Consider Roth conversions before RMDs begin, explore qualified charitable distributions (QCDs) to donate directly from your IRA to charity (available after age 70½), or continue working past 73 (which allows you to delay RMDs from your current employer’s plan).

Having different account types gives you valuable flexibility to manage taxes. Use traditional accounts for withdrawals up to your standard deduction (essentially tax-free), Roth accounts for tax-free income when needed, and taxable accounts for capital gains treatment (potentially at lower rates than ordinary income).

Estate & Legacy Essentials

Estate planning ensures your assets are distributed according to your wishes and minimizes complications for your loved ones. As part of comprehensive retirement planning, it deserves careful attention.

Everyone needs these essential documents:

Your will directs the distribution of probate assets and names guardians for minor children. A durable power of attorney authorizes someone to manage your finances if you become incapacitated, while a healthcare power of attorney designates someone to make medical decisions if you cannot. Your living will or advance directive specifies your wishes for end-of-life care, and a HIPAA authorization allows designated individuals to access your medical information.

Don’t overlook your beneficiary designations on retirement accounts, life insurance policies, and certain other assets—these pass directly to named beneficiaries, bypassing your will entirely. Review these designations regularly, especially after major life events like marriage, divorce, births, or deaths.

Trusts serve various purposes in estate planning. A revocable living trust avoids probate and provides for management of assets if you’re incapacitated. Irrevocable trusts may provide tax benefits or asset protection, while a charitable remainder trust provides income during your lifetime with the remainder going to charity.

In our digital age, don’t forget your online presence. Create an inventory of digital accounts and assets, document how to access passwords and security information, and include instructions for these accounts in your estate plan.

If philanthropy matters to you, consider qualified charitable distributions from IRAs (available after age 70½), donor-advised funds for tax-efficient giving, or charitable remainder trusts that provide income while supporting causes you care about.

“Estate planning isn’t just for the wealthy,” explains estate planning attorney Mark. “It’s about ensuring your wishes are honored and making things easier for your loved ones during an already difficult time.”

Review, Stress-Test & Adjust Your Plan Regularly

Creating a retirement plan isn’t a “set it and forget it” endeavor. Think of your comprehensive retirement planning as a living document that grows and evolves with you throughout your life journey.

Just as you wouldn’t take a cross-country road trip without occasionally checking your map and gas gauge, your retirement plan needs regular attention to ensure you’re still on the right path.

“The only constant in life is change,” as the saying goes, and this certainly applies to retirement planning. Your goals, health situation, family dynamics, and the economic landscape will shift over time. That’s why scheduling an annual financial checkup is so important.

During this yearly review, take time to celebrate progress toward your savings goals, reassess whether your investment mix still matches your risk tolerance, and update your budget projections. It’s also the perfect opportunity to review insurance coverage and double-check that your beneficiary designations still reflect your wishes.

Life has a way of throwing curveballs when we least expect them. Major life events like getting married (or divorced), welcoming a child, changing jobs, receiving an inheritance, facing a health crisis, or losing a spouse should trigger an immediate plan review. These pivotal moments often change both your financial picture and your priorities.

Nancy, a recent retiree from Oregon, shares: “When my husband passed away unexpectedly, I was grateful we had just updated our retirement plan. Having clear documentation of our finances gave me one less thing to worry about during an incredibly difficult time.”

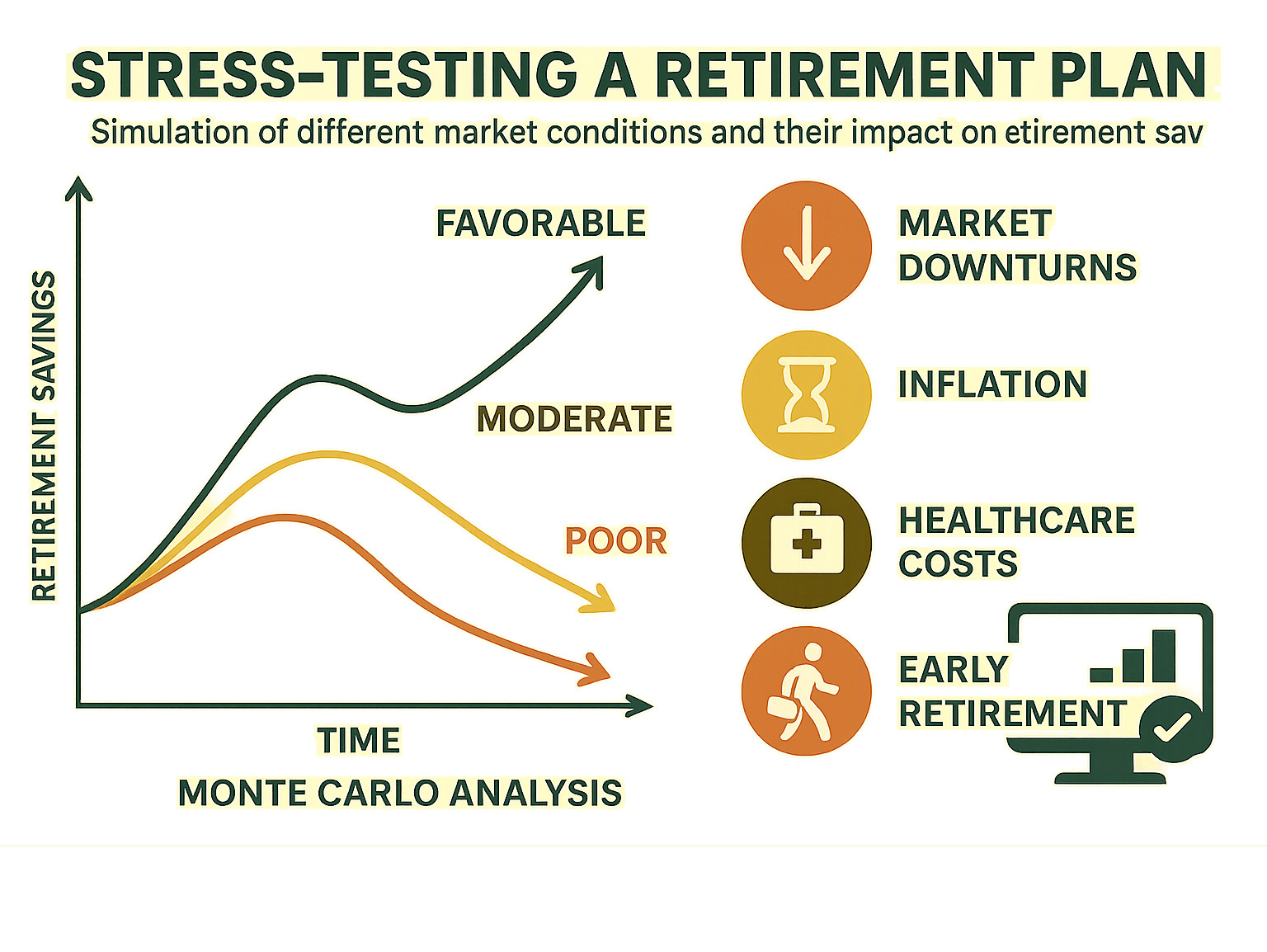

Stress-Testing Your Plan

How confident are you that your retirement plan can weather life’s storms? Stress-testing helps build that confidence by showing how your plan might perform under challenging conditions.

Think of stress-testing as a financial fire drill. You’re not expecting your house to burn down, but you want to be prepared just in case. Similarly, you should test how your retirement plan would hold up under various challenging scenarios:

Market downturns can be particularly devastating if they occur early in retirement. How would your plan fare during a severe drop like we saw in 2008 or 2020?

Inflation spikes eat away at purchasing power over time. What if inflation averages 5% instead of the more typical 3%? Would your income keep pace?

Longevity is wonderful but requires financial preparation. If you live to 95 or even 100, will your money last?

Healthcare costs often surprise retirees with their magnitude. How would a major long-term care event affect your financial security?

Early retirement, whether by choice or necessity, gives your money less time to grow and more years to cover. Could your plan accommodate retiring 3-5 years earlier than expected?

Many financial professionals use Monte Carlo analysis to assess retirement plan durability. This approach runs thousands of simulations with varying investment returns to determine the probability of your plan’s success. While an 80-90% success rate is generally considered reasonable, your personal comfort level might differ. Some people sleep better knowing they have a 95% chance of success, while others are comfortable with a slightly higher risk level.

Having a Plan B provides invaluable peace of mind. This might include identifying which expenses you could reduce if necessary, exploring part-time work options that you’d find fulfilling, considering whether your home equity could provide additional resources, or researching lower-cost locations where your retirement dollars might stretch further.

DIY Tools & When to Seek Professional Advice

Today’s digital world offers an abundance of tools for those comfortable managing their own comprehensive retirement planning. From sophisticated retirement calculators to Social Security optimization tools, budget apps, tax planning software, and asset allocation analyzers – the DIY planner has never had more resources at their fingertips.

These tools can help you create and monitor a solid retirement plan. However, they do have limitations. They may not fully account for complex tax situations, unusual financial circumstances, or the emotional aspects of financial decision-making – like how you might actually react during a market downturn.

Robert, a self-directed investor from Arizona, notes: “I’ve always managed my own investments, but as retirement approached, I realized there were aspects of tax and distribution planning that were beyond my expertise. Getting professional help with those specific areas was one of the best decisions I made.”

Consider working with a financial advisor when your situation includes complexities like business ownership, stock options, or multiple properties. The years immediately before and after retirement are particularly critical times when professional guidance can add significant value. Major life transitions, a lack of confidence in your financial knowledge, difficulty sticking with your plan, or the need for specialized expertise in areas like tax or estate planning are also good reasons to seek help.

If you decide to work with an advisor, look for credentials that demonstrate expertise and a commitment to ethical standards. The CFP® (Certified Financial Planner), CPA/PFS (Personal Financial Specialist), or ChFC (Chartered Financial Consultant) designations all require rigorous education and testing.

Choose advisors who operate under a fiduciary standard, meaning they’re legally obligated to put your interests first. Understand how they’re compensated – whether through fees, commissions, or a combination – and find someone with experience addressing your specific needs.

You can verify an advisor’s credentials and check for any disciplinary history through FINRA’s BrokerCheck.

As one client shared with us: “I feel more in control of my decisions now, and I appreciate getting the knowledge directly rather than having to go through a gatekeeper.”

Milestone Checklist by Age

Your comprehensive retirement planning journey has different priorities at different life stages. Think of these milestones as friendly guideposts helping you stay on track:

In your 20s and 30s, focus on building strong foundations. Establish retirement accounts like 401(k)s and IRAs, build that crucial emergency fund, and don’t leave free money on the table – maximize those employer matching contributions. Your youth gives you the luxury of time, so an aggressive investment allocation (80-90% stocks) makes sense. Consider Roth contributions while you’re likely in lower tax brackets, and if eligible, begin HSA contributions for triple tax advantages.

Your 40s are prime time to accelerate your retirement preparations. Aim to increase contributions to 15-20% of your income and refine your target retirement age and savings goal. This decade often brings competing priorities, so carefully evaluate college funding versus retirement saving – remember, your children can borrow for education, but you can’t borrow for retirement. Review insurance coverage and begin basic estate planning with wills and powers of attorney.

When you reach your 50s, exciting new opportunities appear. At age 50, you can begin making catch-up contributions to retirement accounts. Estimate your Social Security benefits, explore long-term care insurance while you’re still relatively young and healthy, and create a draft retirement budget. Consider strategies to pay off debt before retirement and begin transitioning to a somewhat more conservative asset allocation.

Your 60s bring several critical milestones. At age 59½, penalty-free withdrawals from retirement accounts become available. Age 62 marks the earliest eligibility for Social Security benefits, though claiming this early permanently reduces your benefit amount. Medicare eligibility begins at 65. This decade is when you’ll finalize your retirement date and budget, develop a withdrawal strategy across your various accounts, and review and update estate planning documents.

In your 70s and beyond, you’ll implement the plans you’ve so carefully crafted. Age 70 represents the maximum delayed retirement credits for Social Security, while Required Minimum Distributions (RMDs) now begin at age 73. Focus on implementing a tax-efficient withdrawal strategy, reviewing and adjusting your asset allocation for income and longevity, considering Roth conversions to manage future RMDs, and refining your legacy and charitable giving plans.

“It’s never too early—or too late—to take steps toward a secure retirement,” advises retirement planning expert Alex Graesser. “The best time to start is always now, regardless of your age.”

Frequently Asked Questions about Comprehensive Retirement Planning

How often should I rebalance my portfolio?

Remember when you set up that perfect investment mix? Over time, as markets move, your carefully planned allocation can drift off course. Most financial experts suggest looking at your portfolio at least once a year to see if it needs realignment.

“I check my portfolio every January—it’s become a New Year’s tradition alongside making resolutions I probably won’t keep,” jokes Michael, a Finances 4You reader who’s been investing for 25 years.

You’ll want to consider rebalancing when your actual allocation drifts about 5% or more from your target. Other good times to rebalance include after major market swings (like the 2020 pandemic plunge), when you make big deposits or withdrawals, or when your life circumstances change significantly.

Some people prefer calendar-based rebalancing (every December, for example), while others use the threshold approach (rebalancing only when allocations drift beyond set percentages). If making these decisions feels overwhelming, many retirement plans and robo-advisors offer automated rebalancing to take the emotion out of the process.

What’s a safe withdrawal rate today?

The famous 4% rule has been retirement planning’s North Star for decades—withdraw 4% of your portfolio the first year, then adjust that amount for inflation every year after. But today’s landscape of longer lifespans and potentially lower market returns has many experts suggesting a more nuanced approach.

“The 4% rule was never meant to be carved in stone,” explains retirement researcher Sarah. “It’s more like a starting point for conversation.”

Some recent research points to a more conservative 3-3.5% initial withdrawal rate, especially for those with long retirement horizons. Others advocate for flexibility—increasing withdrawals slightly in strong market years and trimming back during downturns.

Your personal “safe” rate depends on several factors:

– How your investments are allocated between stocks, bonds, and other assets

– How long you expect to live (family history can be a clue)

– What other income sources you have (pensions, rental income, etc.)

– How willing you are to adjust your spending when markets struggle

– Whether leaving money to heirs is important to you

The key is reviewing your withdrawal strategy regularly throughout retirement rather than setting it once and forgetting it. Comprehensive retirement planning means staying flexible as conditions change.

When is the best time to claim Social Security?

Ah, the million-dollar question! You can start collecting as early as 62, but your benefits will be permanently reduced by up to 30% compared to waiting until your full retirement age (between 66-67 for most people today). Hold out until 70, and your monthly check grows about 8% each year beyond full retirement age.

“Social Security claiming is one of the few places where procrastination can actually pay off,” notes retirement educator James with a smile.

The right timing depends on your unique situation:

– Your health history and family longevity (good genes might mean waiting pays off)

– Your spouse’s age and earnings (married couples should coordinate their strategy)

– Whether you have enough savings to bridge the gap if you delay

– Your current and projected tax situation

– Whether you plan to work part-time in early retirement

As a general rule, if you expect to live beyond about age 80, waiting often provides more lifetime income. For married couples, it’s especially valuable for the higher earner to delay if possible, as survivor benefits will be based on that larger amount.

This is definitely an area where getting professional advice can be worth every penny. The right Social Security claiming strategy could add tens of thousands of dollars to your retirement income over your lifetime—making it a crucial element of comprehensive retirement planning.

Conclusion & Next Steps

The journey of comprehensive retirement planning is a lot like planning a cross-country road trip. You need a destination in mind, a good map, the right vehicle, and the flexibility to handle unexpected detours. At Finances 4You, we believe that taking this holistic approach—one that addresses your income needs, investment strategy, tax situation, healthcare costs, and legacy wishes—creates the strongest foundation for the retirement you’ve been dreaming about.

After reading through this guide, I hope you’re taking away these essential insights:

First, time truly is your greatest ally. Starting early gives your money decades to grow through the magic of compounding, but please don’t be discouraged if you’re getting a later start—meaningful progress can happen at any age with the right strategy.

Having a clear vision of your retirement lifestyle isn’t just fun daydreaming—it’s actually crucial for calculating how much you’ll need and staying motivated during the saving years. Close your eyes for a moment and really picture yourself in retirement. What are you doing? Where are you living? This vision becomes your financial North Star.

Your tax-advantaged accounts are retirement planning superpowers. At minimum, contribute enough to capture any employer match (that’s literally free money!), and remember that those catch-up contributions after 50 can make a tremendous difference in your final numbers.

Finding your comfort zone with investments is deeply personal. Your asset allocation should balance growth potential against your risk tolerance, gradually becoming more conservative as retirement approaches—but not too conservative to outpace inflation.

Healthcare costs deserve special attention in your planning. Medicare is wonderful, but it doesn’t cover everything. Factor in those premiums, supplemental insurance, and the possibility of long-term care needs when building your retirement budget.

Being tax-smart about withdrawals can add years to the life of your nest egg. Coordinate withdrawals across your different account types to minimize your lifetime tax burden—this is one area where professional guidance often pays for itself many times over.

Life changes, markets fluctuate, and laws evolve—which means your retirement plan should be a living document. Schedule annual check-ins to review and adjust your strategy as needed.

While many people successfully manage their own retirement planning, there’s no shame in seeking professional guidance, especially for complex situations involving business ownership, equity compensation, or significant estates.

At Finances 4You, we’re committed to being your partner throughout this journey. Our team constantly monitors changes in tax laws, investment strategies, and retirement planning best practices so you don’t have to.

Ready for your next step? Explore our full Retirement Resource Guide where you’ll find additional tools, calculators, and deep-dive articles on specific retirement topics that matter to you.

The work you put into retirement planning today is a gift to your future self. As the Chinese proverb wisely reminds us: “The best time to plant a tree was 20 years ago. The second best time is now.” Your retirement tree is waiting to be planted—or nurtured if you’ve already begun.