Why Credit Score Improvement Matters More Than You Think

Credit score improvement is one of the most powerful financial moves you can make, yet it’s often overlooked until you need it most. With the average U.S. credit score sitting around 718, there’s room for most people to climb higher and open up better financial opportunities.

Quick Credit Score Improvement Strategies:

- Pay bills on time – Makes up 35% of your FICO® Score

- Keep credit utilization below 30% – Accounts for 30% of your score

- Don’t close old credit accounts – Preserves your credit history length

- Dispute errors on credit reports – Can boost scores within 30-45 days

- Become an authorized user – Inherit someone else’s good credit history

Your credit score affects way more than just loan approvals. It impacts your insurance rates, rental applications, and even job prospects. A score above 760 typically gets you the best interest rates, potentially saving you thousands over the life of a mortgage or car loan.

The good news? Even small improvements can make a big difference. Among users who saw increases with tools like Experian Boost, the average jump was 13 points. And if your score is currently low, you’re more likely to see dramatic gains – sometimes up to 100 points – because small changes have outsized effects.

But here’s the reality: credit score improvement takes consistency, especially when you don’t feel motivated. That’s exactly what we’ll tackle in this guide.

Credit score improvement terminology:

– how to build credit

– how to check your credit score

– how to improve credit score after hard inquiry

Credit Score 101: The Number That Guides Your Financial Life

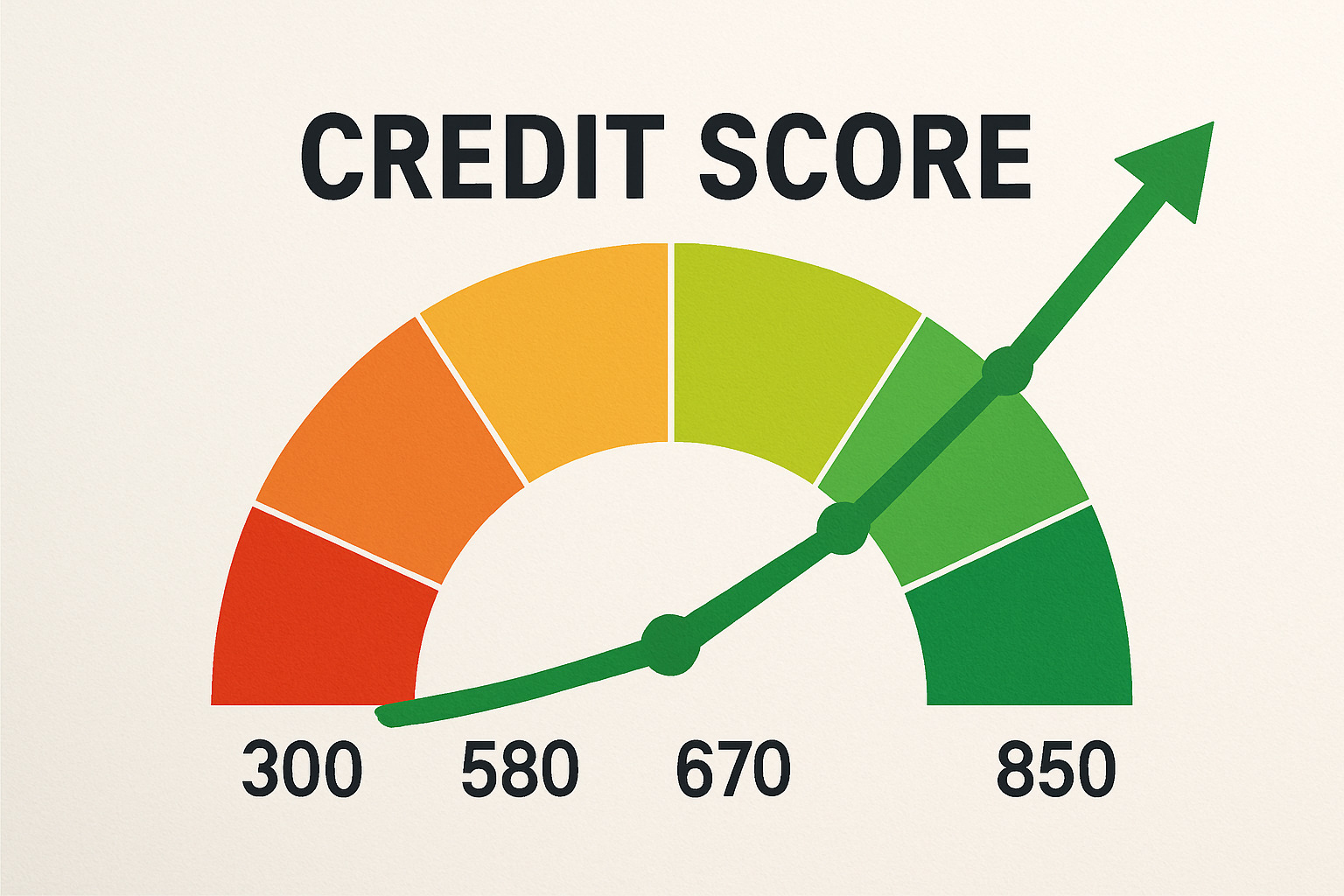

Your credit score is like a financial report card that follows you everywhere. This three-digit number, ranging from 300 to 850, tells lenders, landlords, and even some employers how trustworthy you are with money.

Most lenders rely on FICO® Scores – about 90% of top lenders use them when making decisions. You might also see VantageScore on some credit monitoring apps, but FICO® remains the gold standard that really matters.

Here’s how the credit score ranges break down: Exceptional scores (800+) put you in the top tier with access to the best rates available. Very Good (740-799) means you’re above average and will get favorable terms. Good (670-739) represents average creditworthiness with decent options. Fair (580-669) is below average, which often means higher rates or security deposits. Poor (300-579) indicates significant credit challenges with very limited options.

How a Score Is Calculated

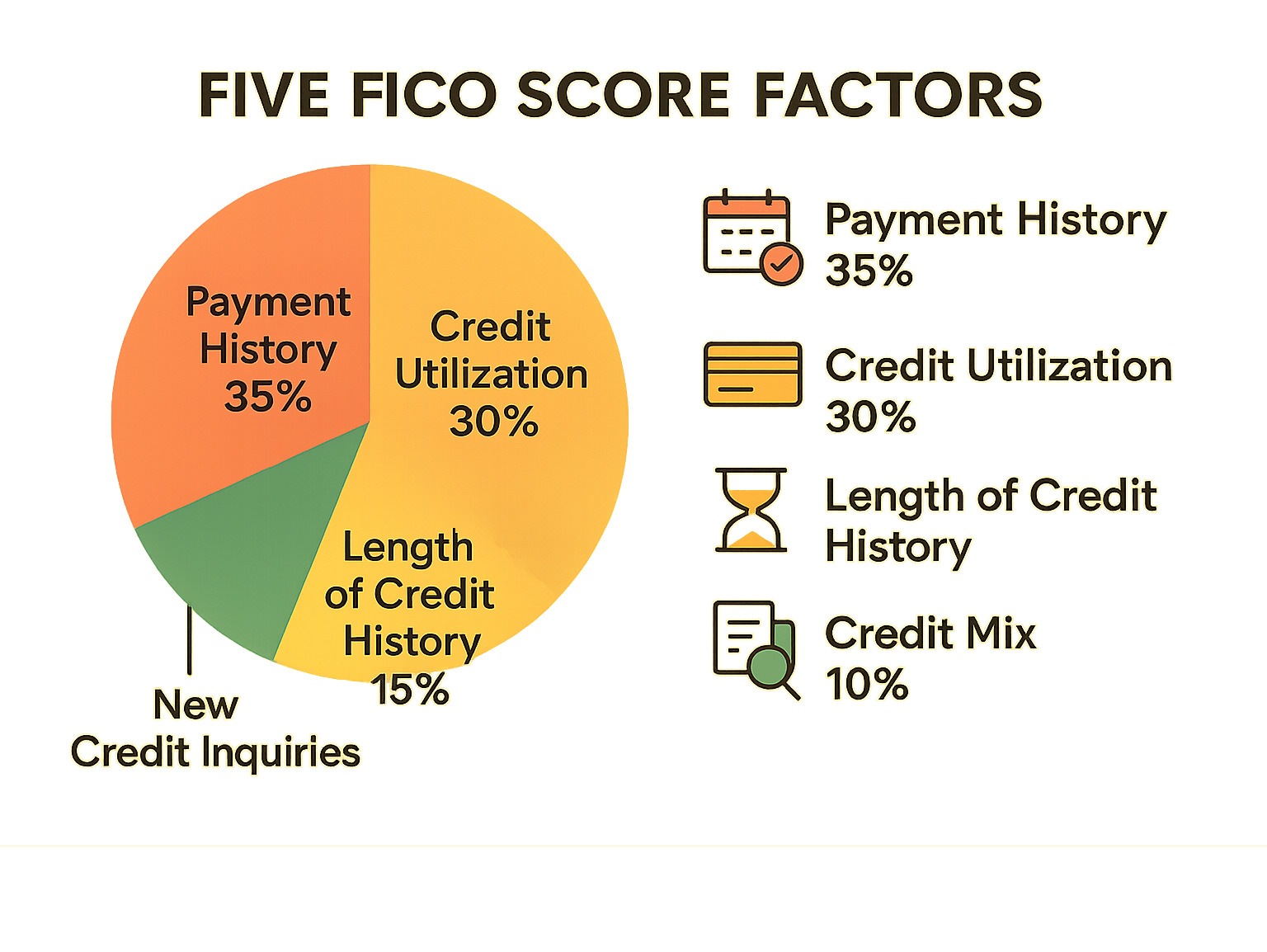

Understanding what goes into your credit score is the foundation of effective credit score improvement. FICO® uses five key factors, and knowing their weights helps you prioritize your efforts.

Payment history carries the most weight at 35% of your score. This tracks whether you pay your bills on time, how late any payments were, and how recently late payments occurred. Even one 30-day late payment can hurt your score for up to seven years, which is why setting up automatic payments can be such a game-changer.

Credit utilization makes up 30% and measures how much of your available credit you’re actually using. If you have $10,000 in credit limits and carry $3,000 in balances, your utilization is 30%. The magic number to aim for is keeping this below 30%, but people with the highest scores typically stay in single digits.

Length of credit history accounts for 15% of your score. This includes how long your oldest account has been open, the age of your newest account, and the average age of all your accounts. It’s why financial experts always say to keep old credit cards open, even if you don’t use them much.

Credit mix represents 10% and looks at the variety of credit types you manage. Having both revolving credit (like credit cards) and installment loans (like auto loans or mortgages) shows you can handle different kinds of debt responsibly.

New credit inquiries round out the final 10%. Each time you apply for credit and trigger a hard inquiry, it can temporarily lower your score by a few points. Multiple inquiries in a short period can compound this effect, though inquiries for the same type of loan within a 14-45 day window typically count as just one.

Why Credit Scores Matter for Everyday Decisions

Your credit score reaches into more areas of your life than you might realize. Mortgage rates show the biggest impact – the difference between a good credit score and an excellent one can save you tens of thousands of dollars over a 30-year mortgage. Auto loan approval and rates depend heavily on your score too. Renting an apartment often requires a credit check, and insurance rates in many states factor in credit-based insurance scores. Job screening for certain positions may include a credit report check.

The good news is that credit score improvement is absolutely possible with the right strategies and patience.

The Five Core Factors Behind Credit Score Improvement

Think of credit score improvement as building a house – you need a solid foundation and the right materials in the right proportions. The five core factors work together like a recipe, and understanding each ingredient helps you cook up a better credit score.

For a comprehensive understanding of how these factors work together, check out our Complete Guide to Understanding Credit Scores and Reports.

Payment History: The 35 Percent Powerhouse

Your payment history is the heavyweight champion of credit factors, making up more than a third of your score. Setting up automatic payments is honestly the best gift you can give your future self. Even if you only automate the minimum payment, you’ll never accidentally miss a due date again.

Late fees aren’t just expensive – they’re score killers. A single 30-day late payment can drop your score by 60-110 points, depending on where you started. The higher your score, the harder you fall. That’s why automation is so powerful for credit score improvement.

Credit Utilization: Keep It Below 30%

Your credit utilization ratio is the second most important factor, and it’s one of the fastest ways to see results. The secret is in the timing. Credit card companies typically report your balance to the credit bureaus on your statement closing date, not your payment due date. So paying down your balance before your statement closes can dramatically improve your reported utilization.

Making multiple payments throughout the month keeps your running balance low and shows consistent financial management. When you’re ready to ask for credit limit increases, do it strategically. After six to twelve months of solid payment history, most card companies are happy to bump up your limit.

| Utilization Rate | Score Impact | What This Means |

|---|---|---|

| 0-9% | Excellent | You’re in the sweet spot for top scores |

| 10-29% | Good | Solid territory, but there’s room to grow |

| 30-49% | Fair | Your score is probably feeling the squeeze |

| 50%+ | Poor | Time for some serious balance-paying action |

Length of History & Credit Mix

Your credit history is like a fine wine – it gets better with age. Keeping old accounts open preserves your credit history length, which makes up 15% of your score. Even if you never use that old card, it’s working behind the scenes to boost your average account age.

Got an old credit card with an annual fee that’s bugging you? Don’t close it – downgrade it instead. Most card companies will happily switch you to a no-fee version of the same card.

The authorized user strategy is particularly powerful if you’re just starting out or rebuilding credit. When a trusted family member adds you to their well-managed, long-standing account, you inherit that positive history.

Credit mix accounts for 10% of your score, but don’t go opening accounts just to check boxes. Let your credit mix develop naturally as life happens.

New Credit & Hard Inquiries

Hard inquiries make up the smallest slice of your credit score pie at just 10%, but they can still sting if you’re not strategic. The rate-shopping window is your friend when you’re looking for mortgages, auto loans, or student loans. Multiple inquiries for the same type of loan within 14-45 days count as just one inquiry.

Space out your credit card applications over several months. Applying for multiple cards in a short period sends up red flags and can hurt your score more than the individual inquiries would suggest.

Proven Strategies for Rapid Credit Score Improvement

Ready to see real results? These proven tactics can deliver meaningful credit score improvement in just weeks or months, especially if your score is currently sitting below 650.

For those looking to make dramatic changes, our guide on How to Improve Credit Score by 100 Points dives even deeper into advanced strategies. And remember, you can get your free credit reports from AnnualCreditReport.com as recommended by the Consumer Financial Protection Bureau.

Pay Down Balances Strategically

How you pay down your balances can make a huge difference in how quickly you see credit score improvement. It’s not just about paying more – it’s about paying smarter.

The avalanche method focuses your extra payments on the card with the highest interest rate while making minimum payments on everything else. This saves you the most money over time and often improves your overall utilization ratio faster.

The snowball method takes a different approach – you tackle the smallest balance first, then roll that payment into the next smallest balance. It might not save you as much in interest, but the psychological wins can keep you motivated.

Mid-cycle payments are a game-changer that most people overlook. Instead of making one monthly payment, try making several smaller payments throughout the month. This keeps your running balance low and can dramatically improve the balance that gets reported to credit bureaus.

Dispute Errors Like a Pro

Credit report errors are shockingly common – studies show that about 25% of consumers have errors that could affect their creditworthiness. Disputing these errors is one of the fastest paths to credit score improvement, often showing results within 30-45 days.

Start by getting all three of your credit reports from Experian, Equifax, and TransUnion. Look for accounts that don’t belong to you, incorrect payment histories, wrong balances or credit limits, accounts showing as open when they’re closed, or duplicate accounts.

When you find an error, be specific in your dispute. Don’t just say “this is wrong” – explain exactly what’s incorrect and provide supporting documentation. Keep detailed records of everything.

Become an Authorized User for a Fast Boost

This strategy is like getting a head start in a race. When someone adds you as an authorized user on their credit card, you can inherit their positive payment history and low utilization – sometimes seeing credit score improvement within 30 days.

The key is choosing the right person and the right account. You want someone with excellent credit who keeps their balances low and never misses payments. Their oldest account is usually the best choice since it adds the most to your credit history length.

Report Rent & Utility Payments

Traditional credit scoring ignores some of your most consistent payments – rent, utilities, phone bills, and even streaming services. New tools are changing this, and they can provide quick credit score improvement for people who pay these bills on time.

Experian Boost is a free service that lets you add utility, phone, and streaming payments to your Experian credit report. Users typically see an average increase of 13 points, and it happens almost immediately after you connect your bank account.

Rent reporting services like RentTrack and PayYourRent can get your rental payments added to your credit reports for a small monthly fee. If you’re paying rent anyway, why not get credit for it?

The bottom line? These strategies work best when you use them together. Pick two or three that fit your situation and commit to them for at least 90 days.

Sustainable Habits for Long-Term Credit Score Improvement

Quick wins are great, but sustainable credit score improvement requires building good financial habits that last. Here’s how to create systems that work even when motivation is low.

For comprehensive credit building strategies, explore our How to Build Credit guide. The Consumer Financial Protection Bureau also provides excellent guidance on improving your credit score.

Using Secured Credit Cards & Credit-Builder Loans

Think of secured credit cards as training wheels for your credit journey. You put down a cash deposit – say $200 – and that becomes your credit limit. It might feel backwards to “borrow” your own money, but these cards are incredibly effective for building or rebuilding credit.

The beauty of secured cards lies in their accessibility. Even if you’ve had credit challenges in the past, you can usually qualify for one. Just make sure you choose wisely. Look for cards that report to all three credit bureaus, have low or no annual fees, and offer a clear path to upgrade to an unsecured card.

Credit-builder loans work differently but achieve the same goal. The lender holds your “borrowed” money in a savings account while you make monthly payments. Once you’ve paid off the loan, you get all your money back plus any interest earned. It’s essentially a forced savings plan that builds credit at the same time.

Keeping Old Accounts Open—Or Downgrading Instead of Closing

Here’s where many people make a costly mistake. They get excited about cleaning up their finances and decide to close old credit cards. Don’t do it! Those old accounts are like fine wine – they get better with age.

If you’re staring at an annual fee on a card you rarely use, call the card issuer and ask about downgrading to a no-fee version of the same card. Most companies would rather keep you as a customer than lose you entirely.

For cards you decide to keep but don’t want to use regularly, try the “sock drawer method.” Put a small recurring charge on each card – maybe your Netflix subscription – then set up autopay and tuck the card away. This keeps the account active without requiring you to think about it.

Monitoring Progress Without Hurting Your Score

The key to long-term credit score improvement is staying informed without obsessing over every small change. Most banks and credit card companies now offer free credit score monitoring as a perk. These services use soft inquiries that don’t affect your score, so check as often as you like.

Set up a monthly credit check-in on your calendar. During this time, review your credit score, look for any changes, and check for potential errors on your reports.

Don’t panic if your score drops a few points from month to month. Credit scores naturally fluctuate based on timing factors. Focus on the overall trend over several months rather than small variations.

Building excellent credit is a marathon, not a sprint. The habits you build today will serve you for decades to come.

Common Pitfalls That Stall Credit Score Improvement

Even with the best intentions, it’s easy to make mistakes that slow your credit score improvement. Here are the most common traps and how to avoid them.

If you’ve recently had hard inquiries, check out our guide on How to Improve Credit Score After Hard Inquiry for specific recovery strategies.

Myth-Busting: Quick Fix Promises vs Reality

The Seven-Year Rule: Most negative items fall off your credit report after seven years, but their impact diminishes over time. A three-year-old late payment hurts much less than a recent one.

Paid Collections Confusion: Paying off a collection account doesn’t remove it from your report, but newer scoring models (FICO 9 and VantageScore 3.0+) ignore paid collections entirely.

Goodwill Letters: These are letters asking creditors to remove negative marks as a gesture of goodwill. They’re not guaranteed to work, but they’re worth trying if you have an otherwise good relationship with the creditor.

Credit Repair Scams: Be wary of companies promising to remove accurate negative information or guarantee specific score increases. Legitimate credit repair focuses on disputing actual errors, which you can do yourself for free.

Financial Discipline When You “Don’t Feel Like It”

Let’s be honest – sometimes you just don’t feel like managing your credit. Here’s how to maintain credit score improvement momentum during those times:

Automate Everything Possible: Set up automatic payments for at least the minimum amounts on all accounts. This prevents damage even when you’re not actively managing your finances.

Create Accountability: Share your credit goals with a trusted friend or family member who can check in on your progress and provide encouragement.

Use Visual Reminders: Put sticky notes on your bathroom mirror, set phone wallpapers, or use other visual cues to remind yourself of your credit goals.

Celebrate Small Wins: Acknowledge every 10-point increase or successful month of on-time payments. Small celebrations maintain motivation for long-term success.

Focus on Systems, Not Goals: Instead of focusing on reaching a specific score, focus on maintaining the systems that improve credit (autopay, low utilization, regular monitoring).

Frequently Asked Questions about Credit Score Improvement

Let’s tackle the most common questions we hear about credit score improvement. These are the real concerns people have when they’re working to build better credit.

How long does it take to see meaningful credit score improvement?

This is probably the question we get asked most, and honestly, the answer depends on your starting point and specific situation.

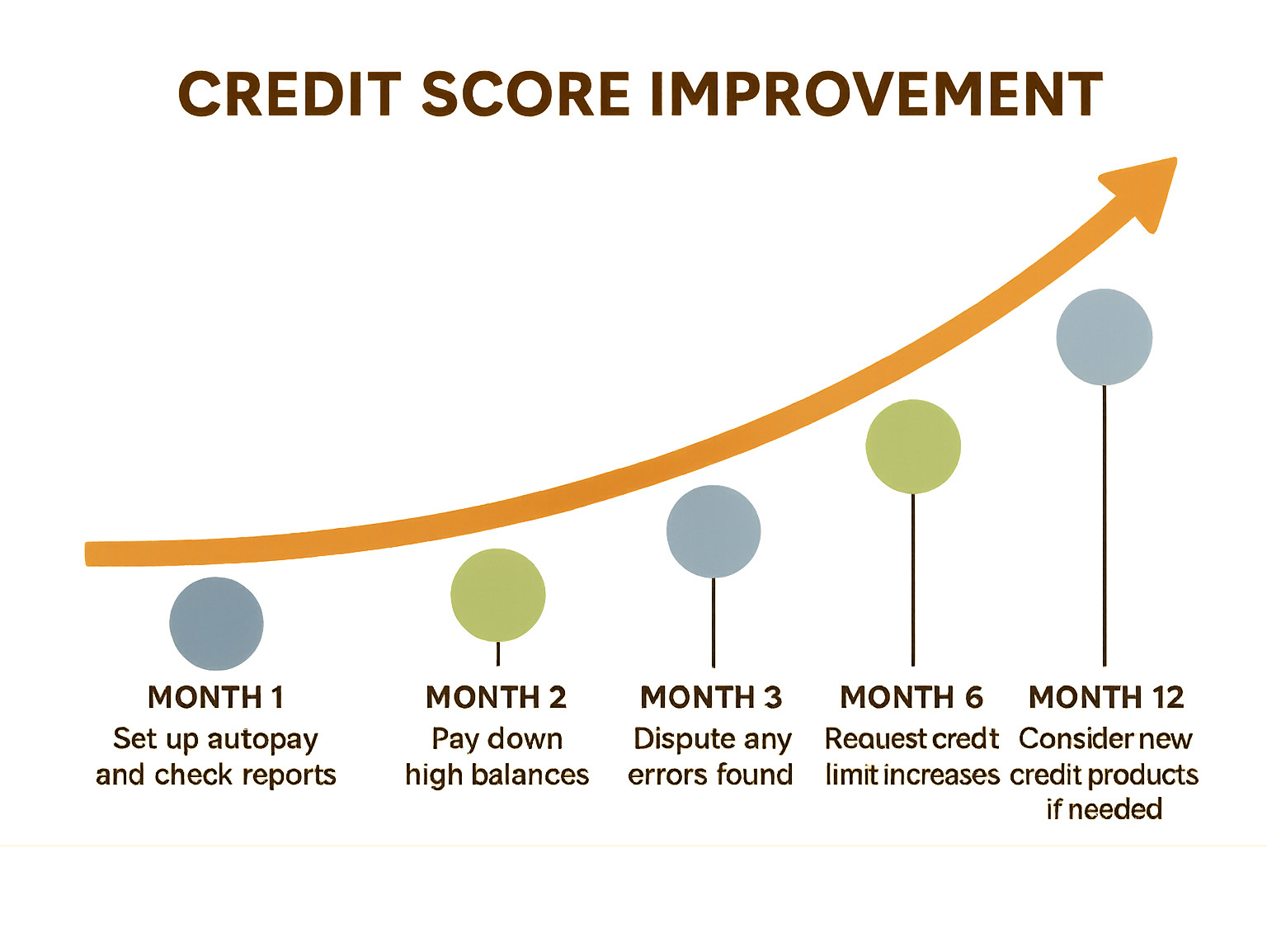

If you’re looking for quick wins, you might see changes within 30 days. Becoming an authorized user on someone’s well-managed account can boost your score almost immediately. The same goes for paying down high credit card balances or successfully disputing errors on your credit report.

Most people see real progress within 1-3 months of consistent effort. This is when your on-time payments start showing up regularly and your lower credit utilization gets reflected in your score.

If you’re recovering from serious credit mistakes or building credit from scratch, give yourself at least 6 months to a year. Major negative events like bankruptcy or foreclosure take time to fade in importance, even as you build positive payment history.

Here’s something encouraging though – people with lower starting scores often see the most dramatic improvements. If your score is currently in the 500s, a 50-point jump is much more achievable than if you’re already in the 700s trying to reach 800.

Should I close unused credit cards to help my score?

This might seem logical – fewer cards means less temptation to overspend, right? But closing credit cards usually backfires when it comes to credit score improvement.

Closing cards hurts your credit utilization ratio, which is 30% of your credit score. Let’s say you have $5,000 in total credit limits and $1,000 in balances – that’s a healthy 20% utilization. Close a card with a $2,000 limit, and suddenly you’re at 33% utilization with the same debt.

Your credit history length also takes a hit, especially if you close an older account. That 8-year-old card you never use? It’s actually helping your average account age, which is part of the 15% credit history factor.

Instead of closing unused cards, try these strategies: downgrade to a no-fee version if there’s an annual fee you don’t want to pay. Use the card occasionally for small purchases like a monthly streaming service, then set up autopay to handle it.

The only time closing makes sense is when you absolutely cannot resist the temptation to overspend, or if you’re paying a high annual fee and can’t downgrade.

Can I get credit for rent or streaming payments?

Finally, a way to get credit for all those bills you’re already paying on time! The credit industry is slowly recognizing that rent and utility payments show financial responsibility, even if they’re not traditional credit accounts.

Experian Boost is probably your best bet – it’s free and lets you add utility, phone, and streaming service payments to your Experian credit report. Users typically see their FICO® Score increase by an average of 13 points. Just remember, this only affects scores based on your Experian report, not necessarily the other two bureaus.

Rent reporting services like RentTrack and others will report your rental payments to credit bureaus for a small monthly fee. This is especially valuable if you have a thin credit file and need to build payment history.

While these alternative payments can help with credit score improvement, traditional credit products like credit cards and loans still carry the most weight in scoring models. Think of rent and utility reporting as a helpful boost, not a replacement for responsible credit card use.

Conclusion

Congratulations! You’ve just learned everything you need to know about credit score improvement, even when motivation runs low. The truth is, you don’t need to feel excited about credit every single day – you just need systems that work without constant attention.

Think of your credit score like a garden. You don’t need to water it every hour or check on it constantly. But with consistent payment history through autopay, smart utilization management, and keeping those old accounts open, your credit score will grow steadily in the background.

The beauty of credit improvement lies in its compounding nature. That 20-point increase you see in three months might seem small, but it opens doors to better interest rates, easier rental approvals, and lower insurance premiums. Over time, these savings add up to thousands of dollars – money that stays in your pocket instead of going to lenders and service providers.

At Finances 4You, we’ve seen how proper credit management helps people align their net worth with their age group and achieve bigger financial goals. Whether you’re 25 and building credit for your first apartment or 45 and preparing for a mortgage refinance, the principles remain the same.

Start with just one action this week. Maybe it’s setting up autopay on all your accounts, or checking your credit report for errors, or simply committing to check your score monthly. Small steps taken consistently beat grand gestures that fizzle out after a few weeks.

Every financial expert started somewhere. Your credit score today doesn’t define your financial future – your actions from this point forward do. Be patient with yourself, celebrate the small wins, and trust the process. Your future self will thank you when that excellent credit score opens doors you didn’t even know existed.

Ready to take your credit knowledge even deeper? Our Complete Guide to Understanding Credit Scores and Reports covers advanced strategies and insider tips that can accelerate your progress even further.