Why Understanding Crypto Crashes Is Essential for Modern Investors

A crypto crash happens when digital currency prices plummet by 30% or more in a short period, wiping out hundreds of billions in market value. Here’s what you need to know:

Key Facts About Crypto Crashes:

– Definition: Price drops of 30%+ within days or hours

– Frequency: Major crashes occur every 2-3 years historically

– Triggers: Regulatory changes, exchange failures, geopolitical events

– Impact: Bitcoin has crashed 80%+ from peaks multiple times

– Recovery: Markets have historically bounced back, but timing varies

The cryptocurrency market just experienced another dramatic selloff. Bitcoin dropped 4% to around $99,300 following U.S. airstrikes on Iran, while Ethereum shed nearly 10%. The total crypto market tanked about 7% in a single day, falling below the crucial $3 trillion mark.

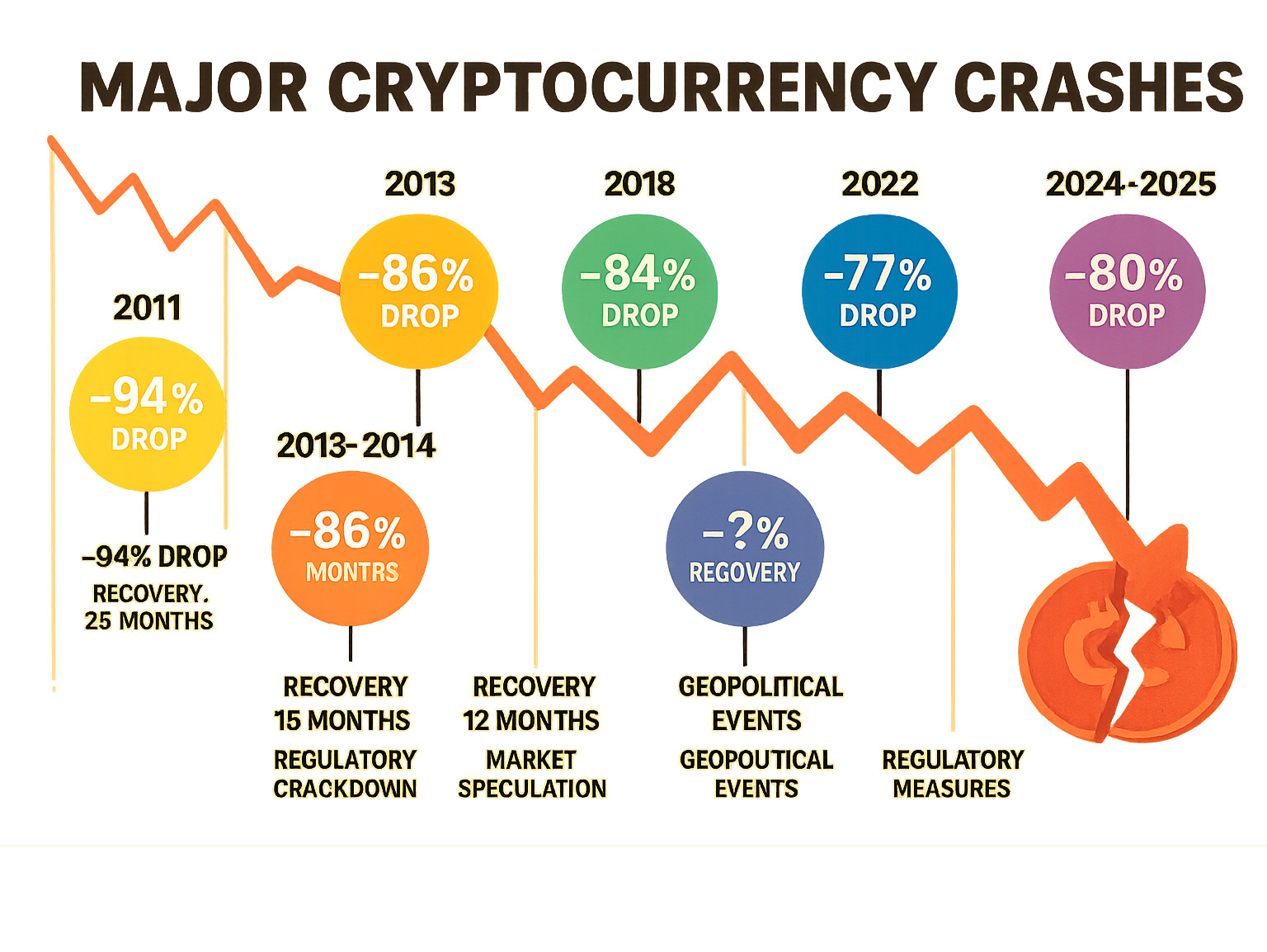

This isn’t unusual. Since 2011, crypto has endured at least seven major crashes. The 2018 collapse saw cryptocurrencies fall 80% from their peak – worse than the dot-com bubble’s 78% decline.

What makes crypto crashes different from stock market corrections? They happen faster, go deeper, and recover on unpredictable timelines. Unlike traditional markets with circuit breakers, crypto trades 24/7 with no safety nets.

Understanding these market meltdowns isn’t just academic. For high earners dealing with lifestyle inflation, crypto often represents both opportunity and major risk. The same volatility that creates wealth can destroy it overnight.

Basic crypto crash glossary:

– crypto market

– crypto market cap

– cold wallet crypto

What Exactly Is a Crypto Crash?

Think of a crypto crash like a financial avalanche. It’s not just any price drop – it’s when digital currencies plummet by 30% or more in a matter of days or even hours. This massive selloff wipes out hundreds of billions in market value, leaving investors stunned and portfolios devastated.

The key difference between a crash and a correction comes down to speed and severity. A correction is like a gentle slope downward – prices decline gradually over weeks. A crypto crash, on the other hand, is like falling off a cliff. It happens fast, hits hard, and often catches everyone off guard.

Here’s how crashes and corrections stack up against each other:

| Crash | Correction |

|---|---|

| 30%+ drop in days/hours | 10-20% drop over weeks |

| Panic selling dominates | Gradual profit-taking |

| High volume spikes | Moderate, steady volume |

| Often triggered by major events | Usually technical exhaustion |

| Breaks through all support levels | May hold at key price levels |

Understanding this difference matters for your money. Corrections can actually be healthy – they let overheated markets cool down. But crashes often signal deeper problems, like exchange failures, regulatory crackdowns, or major technological issues.

The crypto market’s 24/7 nature makes these crashes even more brutal. Unlike traditional stock markets with circuit breakers that pause trading, crypto never sleeps. When panic sets in, there’s nothing to stop the avalanche.

Historical Patterns of a Crypto Crash

Every few years, crypto follows the same dramatic script: explosive growth, mainstream excitement, then devastating crashes.

The 2011 Growing Pains

Bitcoin was still a baby back then. A single blog post on Slashdot sent prices from 7 cents to over a dollar. But the real drama came later when Bitcoin hit $32, only to crash 93% down to $2.

The 2013 Mt. Gox Disaster

Bitcoin climbed from around $10 to over $1,000 – a mind-blowing 10,000% gain. Then reality struck hard. Mt. Gox, which handled 70% of all Bitcoin trades, filed for bankruptcy after hackers stole 850,000 bitcoins. By January 2015, Bitcoin had crashed 84.6% to $172.

The 2018 ICO Bubble Burst

Bitcoin peaked near $20,000 in December 2017, with people mortgaging houses to buy crypto. The crash that followed was epic – Bitcoin fell 83.8% to below $3,500 by December 2018. The entire crypto market lost over $600 billion in value.

The 2021 Leverage Liquidation

May 19, 2021, became known as “Black Wednesday” in crypto circles. Bitcoin dropped 30% to $31,000, Ethereum fell 40%, and Dogecoin plunged 45% in a single day. This crypto crash wiped out $1 trillion from the total market cap.

The 2022 TerraUSD Meltdown

The algorithmic stablecoin TerraUSD was supposed to maintain a $1 peg through clever algorithms. Instead, it collapsed spectacularly, losing its peg and wiping out $45 billion in a week.

Each crash follows a eerily similar pattern: euphoric rises, mainstream media attention, institutional warnings that get ignored, then sudden panic selling.

Root Causes: From Regulation to War Headlines

Every crypto crash has a story behind it. After studying years of market meltdowns, we’ve noticed they rarely happen randomly. Instead, specific events create perfect storms that send prices tumbling.

Government crackdowns remain the biggest threat to crypto stability. When China banned Bitcoin mining for the third time, prices dropped 30% overnight. The SEC’s enforcement actions against major exchanges create similar panic waves.

The Federal Reserve’s monetary policy hits crypto particularly hard. When the Fed raises interest rates, suddenly those “boring” Treasury bonds start looking pretty attractive compared to volatile digital assets. This shift in investor psychology often triggers massive selloffs.

Technology failures can destroy billions in value within hours. The Mt. Gox hack didn’t just lose 850,000 bitcoins – it shattered trust in the entire ecosystem. When people can’t trust the infrastructure, they sell first and ask questions later.

Then there’s the speculation bubble effect. When your barber starts talking about meme coins, it’s usually a warning sign. The 700% rally in Pepe coin before the March 2024 crash perfectly illustrated this pattern. Social media amplifies both greed and fear, turning small price moves into massive swings.

The interconnected nature of crypto makes crashes worse than they need to be. Scientific research on DeFi contagion shows how one protocol’s failure can cascade through the entire system like dominoes falling.

Political & Geopolitical Shockwaves and the Crypto Crash

Global politics can trigger crypto crashes faster than you can say “breaking news.” The recent U.S. airstrikes on Iran immediately pushed Bitcoin below $100,000 as scared investors rushed toward traditional safe havens. Trump’s tariff announcements had a similar effect, dropping Bitcoin to nearly $75,000.

Here’s the thing about crypto during political chaos: it doesn’t behave like gold or bonds. Those assets have decades of institutional backing and central bank support. Crypto is still the new kid on the block, so when uncertainty hits, investors often dump it first.

The spectacular collapse of three crypto-friendly banks in March 2023 tells this story perfectly. Silvergate, Silicon Valley Bank, and Signature Bank held over $400 billion in assets, but their heavy exposure to crypto clients made them vulnerable. When confidence cracked, deposits fled at digital speed.

Political uncertainty creates a unique challenge for digital assets. Unlike traditional investments with government backing or regulatory protection, crypto trades in a gray area where policy changes can reshape entire markets overnight.

Spotting the Next Crypto Crash Before It Happens

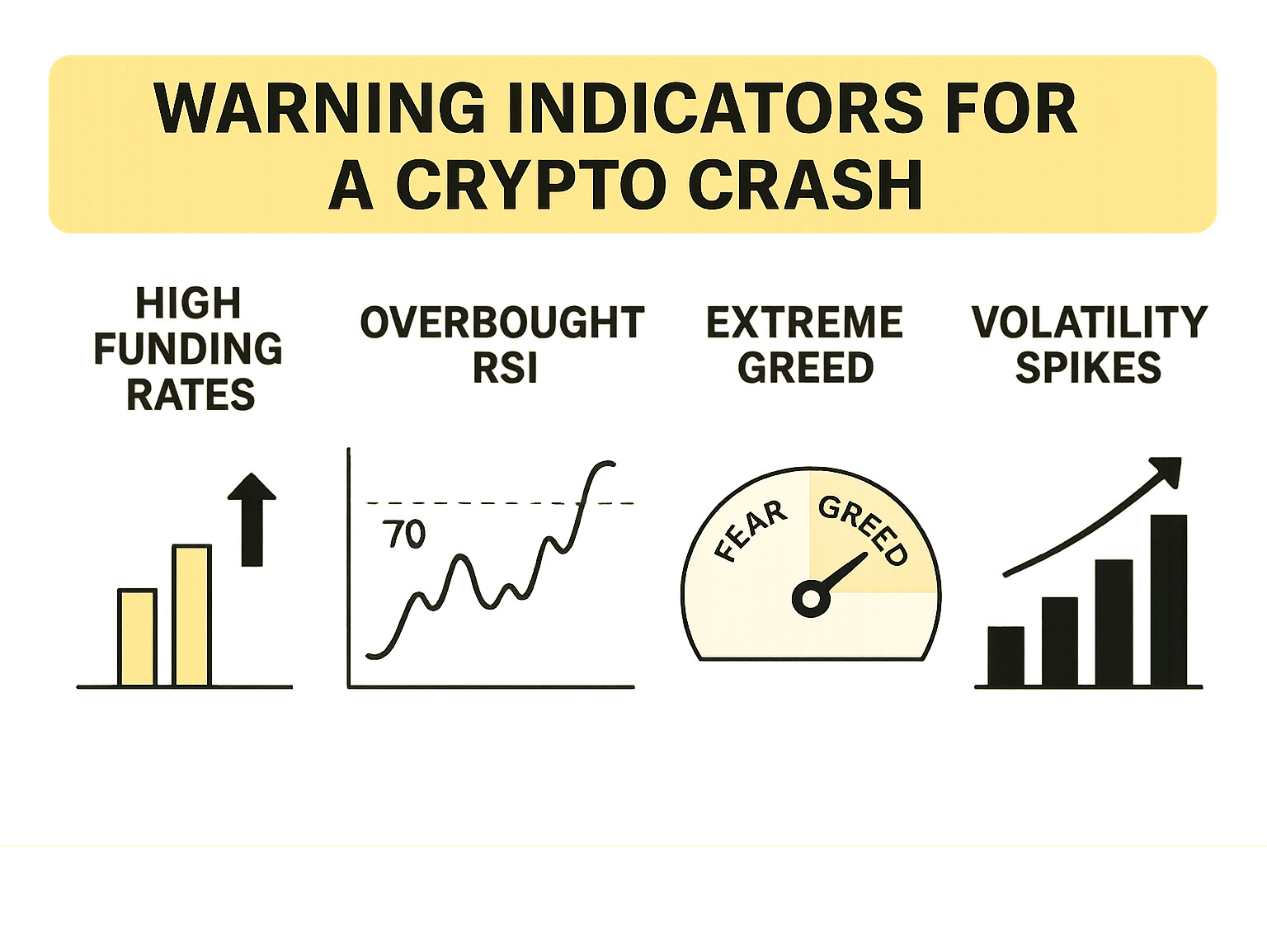

The good news? Crypto crashes rarely happen without warning. After studying every major crash since 2011, we’ve spotted clear patterns that emerge before markets collapse. Think of these as your financial smoke detectors – they won’t prevent the fire, but they’ll give you time to get out safely.

The first red flag is meme coin mania. When joke cryptocurrencies start making serious gains, smart money starts heading for the exits. Remember Pepe coin’s ridiculous 700% rally right before the March 2024 crash? That wasn’t coincidence. When your barista starts asking about Dogecoin derivatives, it’s time to reassess your risk.

Extreme funding rates in futures markets tell an even clearer story. These rates show how much traders pay to bet on higher prices with borrowed money. When funding rates hit 100% annualized or higher, it means too many people are making the same leveraged bet. That’s when small price drops can trigger massive liquidation cascades.

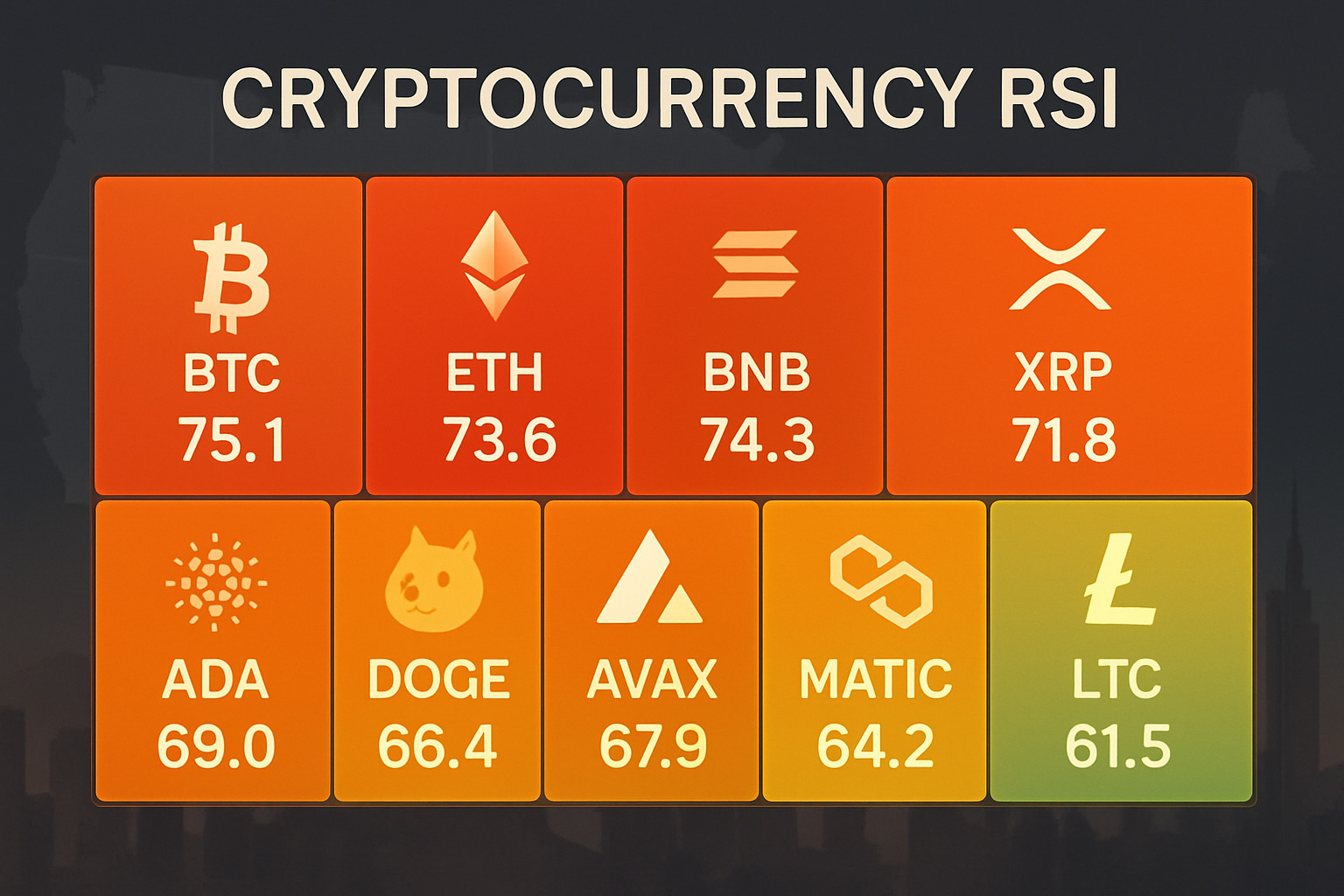

The RSI heatmap provides another crucial warning signal. This technical indicator measures buying pressure across multiple cryptocurrencies on a scale of 0-100. When the average RSI readings climb above 70, it signals widespread overbought conditions. Markets rarely stay this hot for long without cooling off dramatically.

Perhaps the most reliable indicator is the Fear & Greed Index. This sentiment gauge has only hit “extreme greed” levels (80-100) three times since 2018. Each time preceded a major crash. When everyone feels invincible, that’s precisely when you should feel worried.

Finally, watch for volatility spikes that seem to come out of nowhere. The Bollinger Band Width Percentile measures these sudden changes in market behavior. High volatility might look bullish on the surface, but it actually signals unstable conditions that often precede major selloffs.

For broader strategies on navigating market uncertainty, our guide on Investing in Uncertain Times offers additional insights.

Early-Warning Dashboards for a Crypto Crash

Professional traders don’t rely on gut feelings – they use data dashboards that track market health in real time. You can access many of these same tools without paying professional fees.

The TradingView TOTAL chart shows the entire cryptocurrency market capitalization, not just individual coins. This bird’s-eye view helps you see when broad market trends are shifting. When TOTAL breaks below key support levels with heavy selling volume, it often signals trouble brewing across all cryptocurrencies.

Social sentiment tracking platforms like LunarCrush and Santiment monitor what people are actually saying about crypto on social media. These tools measure mention volume, sentiment scores, and engagement metrics. Extreme readings in either direction – whether euphoric or panicked – often precede major price moves.

On-chain data analysis reveals what’s happening behind the scenes. Metrics like “hot supply” track recently moved Bitcoin, which can signal retail FOMO or institutional distribution. When hot supply jumps from $17.5 billion to $40 billion in just five weeks, as happened recently, it suggests dangerous levels of speculative activity.

The perpetuals and derivative leverage data shows how much borrowed money is flowing into crypto bets. High leverage ratios create fragile market conditions where small price moves trigger cascading liquidations. When everyone’s betting the same direction with borrowed money, the market becomes a house of cards.

DIY Risk Tools

You don’t need a Bloomberg terminal to protect your portfolio. Simple risk management techniques can save you from devastating losses during a crypto crash.

Stop-loss orders act as your automatic exit strategy. Set these orders to sell your positions if prices drop 15-20% below your entry point. Yes, you might get stopped out during temporary dips, but you’ll avoid the 50-80% crashes that can wipe out years of gains.

Dollar-cost averaging removes emotion from your investment decisions. Instead of trying to time the market, invest fixed amounts regularly regardless of price. This strategy smooths out volatility and prevents you from putting all your money in at the worst possible moment.

Hedging means keeping some powder dry. Hold stablecoins or traditional assets as a buffer against crypto volatility. When crashes happen, you’ll have capital ready to buy at lower prices instead of watching helplessly as your portfolio evaporates.

Cold storage discipline protects you from exchange failures that often accompany market crashes. Keep the majority of your holdings offline in hardware wallets. Not your keys, not your crypto – especially during times of market stress when exchanges face liquidity pressures.

Contagion: When Crypto Crashes Hit Traditional Finance

The 2023 banking crisis showed us something scary: crypto crashes don’t stay in their own corner anymore. They can knock down traditional banks faster than you’d expect.

Silvergate Bank learned this the hard way. After FTX collapsed, crypto companies rushed to pull their money out. The bank lost half its deposits in just a few days. Silicon Valley Bank and Signature Bank followed like dominoes, creating the biggest banking crisis since 2008.

Here’s what made it worse: these banks had concentrated most of their crypto client deposits without FDIC insurance protection. When panic hit, there was no safety net. The Federal Reserve had to step in and guarantee deposits to prevent the whole financial system from freezing up.

Research from the Federal Reserve Bank of Chicago confirmed what many suspected: banks built around crypto and venture capital were at the center of these failures. When your business model depends on one volatile sector, you’re asking for trouble.

For detailed analysis of this risk, see the Latest analysis on bank contagion.

The scary part? This interconnection between crypto and traditional finance keeps growing. What starts as a digital asset selloff can quickly become everyone’s problem.

For more insights on managing finances during uncertain times, explore our Digital Currencies and the Future of Banking guide.

How a Crypto Crash Ripples Across Markets

Modern crypto crashes spread like wildfire across all markets. Bitcoin now moves in sync with tech stocks, especially the Nasdaq. When crypto tanks, it often drags down the broader stock market with it.

The May 2022 crash perfectly illustrated this. Bitcoin’s collapse happened alongside a massive tech stock selloff. Investors treated crypto like any other risky asset – when fear hit, they sold everything at once.

Stablecoins make the problem worse. When TerraUSD lost its dollar peg in 2022, it didn’t just hurt that one coin. It triggered selling across the entire crypto market and raised serious questions about other “stable” cryptocurrencies.

The global nature of crypto trading creates 24/7 contagion. A crash that starts in Asia doesn’t wait for American markets to open. It keeps rolling through European and American trading sessions, creating non-stop volatility that traditional markets simply can’t match.

This cross-asset correlation means your diversified portfolio might not be as protected as you think. When a major crypto crash hits, it can pull down your tech stocks, growth investments, and even some bonds.

Playing Defense: Strategies to Survive a Crypto Crash

When a crypto crash hits, your survival depends on preparation, not panic. The investors who weather these storms best aren’t the ones who predict crashes perfectly – they’re the ones who build strong defenses before trouble strikes.

Never put all your eggs in the crypto basket. This sounds obvious, but it’s amazing how many people ignore this basic rule when prices are soaring. The smartest approach is keeping crypto to no more than 10% of your total investment portfolio. This way, even if crypto goes to zero tomorrow, you’ll still have 90% of your wealth intact.

Spread your remaining assets across stocks, bonds, real estate, and other traditional investments that have proven themselves over decades.

Cash is your secret weapon during crashes. Keep 5-10% of your investment money in cash or short-term bonds. This isn’t dead money – it’s opportunity money. When everyone else is panicking and selling quality assets at fire-sale prices, you’ll have the ammunition to buy.

The psychological side of crashes often hurts more than the financial side. Your brain will scream at you to either sell everything or double down with money you can’t afford to lose. Both reactions usually end badly. Build your emotional resilience by limiting doom-scrolling during volatile periods.

Focus on quality over quantity when the market gets rough. Bitcoin and Ethereum have survived multiple crashes because they solve real problems and have strong communities. Meanwhile, thousands of “revolutionary” altcoins have vanished into digital dust. During crashes, stick with cryptocurrencies that have proven track records, institutional support, and genuine use cases.

For deeper insights into building a solid crypto foundation, check out our guides on Crypto Investing 101 and How to Safely Invest in Digital Currencies.

Long-Term Opportunities After a Crypto Crash

Here’s the counterintuitive truth about crypto crashes: they often create the best buying opportunities for patient investors. Those brave souls who bought Bitcoin at $3,500 during the brutal 2018 crash were rewarded handsomely when it hit $69,000 in 2021.

Crashes clear the deck of weak projects and speculative nonsense, making room for real innovation to flourish. The DeFi revolution bloomed after 2018’s crypto winter. NFTs and Layer 2 solutions emerged from 2020’s volatility.

Regulatory clarity often follows chaos. When crypto markets implode, governments are forced to create clearer rules. While this might seem scary in the short term, it’s actually bullish long-term. Clear regulations help legitimate projects succeed while weeding out scams and bad actors.

Adoption curves don’t move in straight lines – they zigzag higher through boom-bust cycles. Each crash proves the market’s resilience and brings crypto closer to mainstream acceptance.

The key is thinking in years, not months. If you believe crypto has a future (and the evidence suggests it does), then crashes are temporary setbacks in a longer story of growth and adoption.

Frequently Asked Questions about Crypto Crashes

Why do crypto crashes happen so suddenly?

Crypto crashes feel like lightning strikes because digital markets never sleep. While stock exchanges close overnight and have built-in safety nets called circuit breakers that pause trading during extreme moves, crypto exchanges keep running 24/7. When panic starts, there’s nothing to stop the avalanche.

Think of it like a domino effect with rocket fuel. The crypto market runs on massive amounts of borrowed money – what traders call leverage. When prices start dropping, these leveraged positions get automatically liquidated to prevent even bigger losses. This creates a chain reaction where selling triggers more selling.

The numbers from recent crashes tell the story. In just 24 hours during the latest selloff, 742,683 traders got liquidated for a staggering $2.26 billion in losses. That’s not just bad luck – it’s the market structure working against panicked investors.

Social media makes everything worse. A single tweet or news headline can spread fear across the globe in minutes. Unlike traditional markets where institutional investors might step in to stabilize prices, crypto often lacks these “adults in the room” during crisis moments.

How can I tell if this dip is a true crypto crash?

Not every price drop deserves the crypto crash label. Real crashes have specific fingerprints that separate them from normal market corrections.

The magnitude matters most. We’re talking about drops of more than 10% across major cryptocurrencies within a single day. The recent selloff that pushed Bitcoin below $99,300 and Ethereum down nearly 10% fits this pattern perfectly.

Volume tells the real story. During genuine crashes, trading volume explodes as everyone rushes for the exits at once. The recent 180.61% surge in trading volume shows real panic, not just casual profit-taking.

Technical levels break down during true crashes. When Bitcoin closes below its 50-day and 200-day moving averages with heavy volume, it signals that the market structure has shifted from bullish to bearish. The total crypto market cap falling below $3 trillion was another key technical breakdown.

Sentiment shifts dramatically. The Fear & Greed Index recently plummeted from 57 to 39 in just days. This kind of rapid sentiment change typically accompanies real crashes rather than minor corrections.

Most importantly, true crashes have fundamental triggers – not just technical chart patterns. Recent examples include the U.S. airstrikes on Iran and proposed tariff policies. These external shocks create the fear that drives genuine market crashes.

Will future regulations make crypto crashes less severe?

Regulation in crypto is like medicine – the right dose can heal, but too much can kill the patient. The relationship between rules and market stability isn’t straightforward.

Good regulations actually reduce crash severity by creating confidence. The approval of Bitcoin ETFs brought institutional money into crypto and helped stabilize prices during smaller selloffs. When investors know their funds are protected and markets operate fairly, they’re less likely to panic.

But sudden regulatory announcements often trigger immediate crashes. China’s repeated mining bans have caused multiple market meltdowns over the years. The fear of the unknown creates more volatility than the regulations themselves.

The crypto industry clearly sees regulation as crucial for long-term stability. They spent $135 million on political campaigns in 2024 to elect crypto-friendly legislators. This investment suggests future regulations will likely support rather than restrict the market.

Smart regulations could target the biggest crash triggers. Requiring stablecoin issuers to hold full reserves would prevent TerraUSD-style collapses. Forcing exchanges to carry insurance would reduce the Mt. Gox-type failures that destroy confidence. Limiting excessive leverage could prevent the liquidation cascades that amplify every selloff.

The goal isn’t to eliminate volatility – that’s part of crypto’s DNA. Instead, thoughtful regulation could remove the systemic risks that turn normal corrections into devastating crypto crashes. Based on current political trends, we’re likely moving toward this more balanced approach.

Conclusion

Crypto crashes aren’t glitches in the system – they’re built into the DNA of digital asset markets. Think of them like storms in the financial world: you can’t prevent them, but you can definitely prepare for them.

Here’s what we’ve learned from decades of crypto market chaos. Crashes follow surprisingly predictable patterns. They usually start with wild speculation, get triggered by regulatory bombshells or tech failures, and end with massive liquidations. The warning signs are often there if you know where to look.

The most important takeaway? Don’t try to outsmart the market. Instead, focus on what you can control: your risk management, emotional discipline, and investment strategy.

Every major crypto crash has eventually led to recovery and new all-time highs. Bitcoin crashed 93% in 2011, 84% in 2014, 83% in 2018, and still came back stronger each time. But here’s the catch – recovery timelines are unpredictable, and not every cryptocurrency survives the journey.

At Finances 4You, we’re passionate about helping you build wealth that matches your life stage. Crypto can absolutely play a role in that journey, but only when it’s part of a balanced approach. Never put more than 10% of your portfolio into crypto, no matter how tempting the potential gains look.

The next crash is coming – that’s as certain as the sunrise. What we can’t predict is whether it’ll be triggered by a regulatory crackdown, a major exchange hack, or some geopolitical event we haven’t even imagined yet.

But here’s the thing: preparation beats prediction every time. Keep your emergency fund stocked, diversify beyond crypto, and maintain the emotional discipline to stick to your strategy when everyone else is panicking.

Successful investing isn’t about avoiding all risks – it’s about taking smart, calculated risks that align with your goals and sleep-at-night factor. Stay curious, stay diversified, and never invest money you can’t afford to lose completely.

For more strategies on building resilient wealth through market ups and downs, check out our comprehensive guide on Investing in Uncertain Times.