Why Crypto ETFs Are Revolutionizing Digital Asset Investing

A crypto etf is an exchange-traded fund that gives you exposure to cryptocurrencies through your regular brokerage account – no digital wallets or private keys required. These funds either hold actual cryptocurrencies, track crypto futures contracts, or invest in blockchain-related companies.

Top Crypto ETF Options by Category:

- Bitcoin Spot ETFs: Direct Bitcoin exposure (iShares Bitcoin Trust – IBIT, Fidelity Wise Origin Bitcoin – FBTC)

- Ethereum Spot ETFs: Direct Ethereum exposure (iShares Ethereum Trust – ETHA, Fidelity Ethereum Fund – FETH)

- Multi-Coin Baskets: Diversified crypto exposure across multiple coins

- Blockchain Equity ETFs: Companies building crypto infrastructure (Bitwise Crypto Industry Innovators – BITQ)

- Futures-Based ETFs: Indirect exposure through derivatives contracts

The crypto ETF market has exploded to over $114 billion in assets under management across 84 different funds. For young professionals looking to add digital assets to their portfolios, these ETFs solve major pain points like security risks, tax complexity, and 24/7 trading stress.

The biggest advantage? You can hold many crypto ETFs in tax-advantaged accounts like IRAs, RRSPs, and TFSAs – something impossible with direct cryptocurrency ownership.

Key crypto etf vocabulary:

– crypto market

– crypto market cap

– cryptocurrency trading for beginners

What Is a Crypto ETF & How It Works

A crypto etf operates just like any traditional ETF you might already own. You can buy and sell shares during regular market hours through your existing broker – no need to steer cryptocurrency exchanges at 3 AM or worry about losing access to your digital fortune.

Here’s what makes these funds brilliant: while you’re sleeping peacefully, professional fund managers handle all the technical stuff. They either buy and store actual cryptocurrencies in ultra-secure cold storage facilities, or they create exposure through carefully managed futures contracts.

The beauty of this regulated wrapper approach can’t be overstated. Blockchain technology and decentralization make cryptocurrencies powerful, but they also mean there’s no customer service hotline if you accidentally delete your wallet. ETFs solve this headache by bringing institutional-level security and familiar regulatory oversight to crypto investing.

According to scientific research on portfolio diversification, proper asset allocation can significantly reduce portfolio risk. Crypto ETFs make this diversification accessible through traditional brokerage trading hours.

Key Mechanics of a Crypto ETF

The magic behind these funds is surprisingly straightforward. When demand for a Bitcoin ETF increases, institutional players called “authorized participants” deliver actual Bitcoin to the fund. In return, they receive fresh ETF shares to sell on the market.

Expense ratios range from essentially free (some funds waive fees temporarily) up to 2.50% annually, with most settling around 0.87%. These costs cover everything from high-tech security systems to regulatory compliance and professional management.

The underlying assets determine how closely your ETF tracks the actual cryptocurrency price. Spot ETFs holding real Bitcoin typically mirror the price almost perfectly, while futures-based funds might wiggle a bit due to contract mechanics.

Collateral requirements and custodial cold storage add another layer of protection. Unlike keeping crypto on your phone or laptop, these funds use military-grade security systems. Your investment stays safe while you focus on your financial goals instead of cybersecurity.

Spot vs. Futures vs. Equity: Types of Crypto ETF Explained

Choosing the right crypto etf is like picking the perfect surfboard – each type handles the waves differently. Let’s break down the three main flavors so you can find your ideal match.

Spot ETFs are the straightforward option. These funds actually buy and hold real cryptocurrency in secure, cold storage facilities. When you invest in a Bitcoin spot ETF, your money literally goes toward purchasing actual Bitcoin that sits safely locked away in institutional vaults.

Futures-based ETFs take a different approach entirely. Instead of holding actual cryptocurrency, they invest in futures contracts – essentially betting on where crypto prices will go in the future. These contracts are cash-settled, meaning no real Bitcoin or Ethereum ever changes hands.

Equity ETFs follow the classic “pick-and-shovel” strategy from the gold rush days. Rather than digging for gold themselves, smart investors sold shovels to miners. Similarly, these funds invest in companies that benefit from crypto growth – mining operations, exchanges, blockchain technology firms, and payment processors.

Here’s how the three stack up side by side:

| Type | Direct Crypto Exposure | Volatility | Fees | Tax Treatment |

|---|---|---|---|---|

| Spot ETF | High | High | 0.25-0.75% | Capital gains |

| Futures ETF | Medium | High | 0.65-0.95% | Complex (K-1 forms) |

| Equity ETF | Low | Medium-High | 0.47-0.85% | Standard equity |

Spot Crypto ETF Benefits & Drawbacks

Spot crypto ETFs are the crowd favorites for good reason. With over $50 billion in assets flowing into funds like iShares Bitcoin Trust, investors clearly appreciate the straightforward approach of actually owning the underlying cryptocurrency.

The beauty of spot ETFs lies in their simplicity. Your fund’s performance tracks almost perfectly with Bitcoin or Ethereum prices because the fund managers buy and store the real deal. No complex derivatives, no rolling contracts – just pure, direct exposure to crypto price movements.

Tax season becomes much friendlier too. Instead of wrestling with complicated partnership documents, you’ll receive standard 1099 forms just like your other investments.

But let’s be honest about the downsides. You’re signing up for the full roller coaster ride of crypto volatility. When Bitcoin decides to take a 20% nosedive overnight, your ETF shares are coming along for the trip.

Futures-Based Crypto ETF Pros & Cons

Futures-based funds were actually the first crypto etf products to get regulatory approval in the United States. They solved the early regulatory puzzle by using established futures markets instead of requiring direct cryptocurrency custody.

The regulatory clarity is their biggest selling point. Since futures contracts trade on familiar exchanges like the Chicago Mercantile Exchange, regulators felt more comfortable approving these products first.

However, futures come with some sneaky costs that can surprise investors. Contango – when future contracts cost more than current prices – slowly drains returns over time. It’s like paying a premium for the privilege of owning a promise instead of the real thing.

Blockchain Equity & Covered-Call Income ETFs

For investors who want crypto exposure with potentially less drama, blockchain equity funds offer an intriguing middle path. These funds invest in companies riding the crypto wave rather than the cryptocurrencies themselves.

The pick-and-shovel approach has historical precedent. During the California Gold Rush, many equipment sellers made more consistent profits than the actual miners. Similarly, crypto exchanges, mining companies, and blockchain technology firms can benefit from crypto adoption regardless of daily price swings.

Some funds get creative with income strategies too. Covered-call ETFs write options against their holdings to generate monthly distributions. While this creates regular income, it also caps your upside potential.

Top Crypto ETF Categories to Watch in 2025

The crypto etf landscape continues evolving rapidly. Based on our analysis of current market trends and regulatory developments, several categories stand out for 2025. The Trump administration’s crypto-friendly appointments have created what industry experts call “a seismic shift forward for the industry.”

With over $114 billion in total assets under management across 84 crypto ETFs, the market has reached critical mass. But not all categories are created equal. We’re seeing clear winners emerge based on investor flows, regulatory clarity, and institutional adoption.

More info about Crypto Market trends suggest that 2025 will be the year of mainstream adoption, with traditional financial advisors finally comfortable recommending crypto exposure to their clients.

Large-Cap Bitcoin Spot ETF (Flagship Category)

Bitcoin spot ETFs have become the flagship crypto etf category, and for good reason. iShares Bitcoin Trust (IBIT) alone holds over $56 billion in assets – more than many traditional sector ETFs. The fund’s 0.25% expense ratio is significantly below the industry median of 1.00%.

These funds offer the purest Bitcoin exposure available in ETF form. They hold actual Bitcoin in institutional-grade cold storage, typically through partnerships with established crypto custodians like Coinbase Prime. The security infrastructure rivals that of major banks.

What makes these particularly attractive is their tax efficiency. Unlike futures-based funds that generate complex K-1 tax forms, spot ETFs provide standard 1099 documents. You can also hold them in retirement accounts – something impossible with direct Bitcoin ownership.

Ethereum Spot & Staking ETFs

Ethereum ETFs represent the next frontier in crypto etf evolution. With Ethereum’s transition to proof-of-stake consensus, new opportunities have emerged for yield generation through staking rewards.

iShares Ethereum Trust (ETHA) offers straightforward Ethereum exposure with a current blended expense ratio of just 0.12% on the first $2.5 billion in assets. But more innovative products are emerging that capture staking yields.

The Bitwise Trendwise Ethereum and Treasuries Rotation Strategy ETF (AETH) takes a momentum-based approach, rotating between Ether futures and U.S. Treasuries based on market signals.

Multi-Coin Basket & Index ETFs

Diversification within crypto remains challenging, but basket ETFs are solving this problem. These funds spread risk across multiple cryptocurrencies, reducing the impact of any single token’s volatility.

European crypto ETNs offer some of the best examples. The ETC Group’s diversified basket ETP covers approximately 85% of overall crypto market capitalization in one product. This market-cap weighting approach automatically adjusts exposure as different cryptocurrencies gain or lose prominence.

Blockchain Equity & Income ETFs

For investors seeking crypto exposure with potentially lower volatility, blockchain equity funds offer compelling alternatives. The iShares Blockchain and Tech ETF (IBLC) had a 1-year total return of 66.69% as of June 30, 2024, while maintaining exposure to established technology companies.

These funds typically invest in three categories: crypto miners, crypto exchanges and service providers, and blockchain technology companies. The diversification across different business models can provide more stable returns than direct crypto exposure.

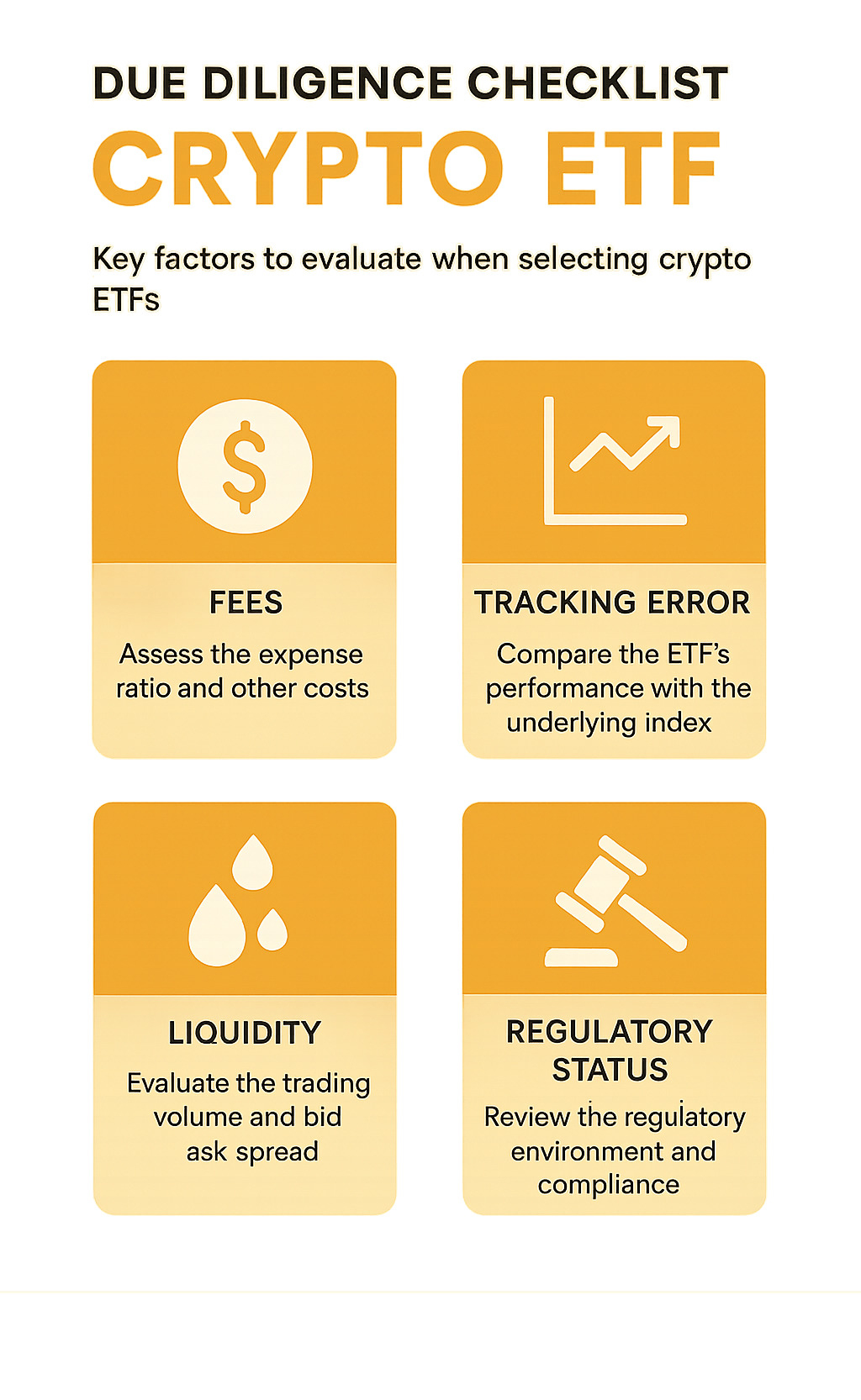

How to Choose the Right Crypto ETF for Your Portfolio

Choosing the perfect crypto etf for your portfolio doesn’t have to feel like solving a puzzle. With 84 different options available, the key is matching what you want with what each fund actually delivers.

Think about your investment personality first. Are you the type who checks your portfolio daily and can sleep soundly even when Bitcoin drops 20% overnight? A spot Bitcoin ETF might be your match. Prefer something with a bit more cushion? Rotation strategies or blockchain equity funds could be better fits.

Your timeline matters just as much as your risk tolerance. If you’re investing for retirement decades away, you can probably handle more volatility. But if you’re saving for a house down payment in two years, you’ll want something more stable.

The account type you’re using makes a huge difference too. Canadian investors have a sweet deal – they can hold most crypto etf products in RRSPs and TFSAs for tax-free growth. U.S. investors can use IRAs for most crypto ETFs, though some futures-based funds create complications.

Scientific research on portfolio diversification shows that adding alternative assets like crypto to a traditional portfolio can actually improve your risk-adjusted returns when done thoughtfully.

More info about How to Safely Invest in Digital Currencies provides additional insights on managing risks when investing in crypto-related products.

Fees, Spreads & Hidden Costs

The sticker price on a crypto etf tells only part of the story. While Bitcoin spot ETFs like IBIT charge just 0.25% annually, complex rotation strategies can cost over 1%. But here’s what most investors miss – the real cost includes several hidden fees.

Bid-ask spreads are the silent wealth killers. Popular funds typically have tight spreads under 0.05%, but smaller or specialized funds might hit 0.50% or more. If you’re buying $10,000 worth of shares, a 0.50% spread costs you $50 right off the bat.

Many new crypto ETFs launch with promotional fee waivers that sound great but don’t last forever. ETHA’s current 0.12% fee only applies to the first $2.5 billion in assets.

Total expense ratios range dramatically across different strategies. Spot ETFs typically charge 0.25% to 0.75%, futures-based funds run 0.65% to 0.95%, and equity-focused funds fall somewhere between 0.47% to 0.85%.

Tax Hacks & Registered Accounts

Here’s where crypto etf investing gets really interesting from a tax perspective. Unlike direct cryptocurrency ownership, ETFs open up powerful tax-advantaged strategies that can boost your wealth building.

Canadian investors hit the jackpot here. Both spot Bitcoin ETFs and Bitcoin futures ETFs qualify for RRSPs and TFSAs. Imagine putting $6,000 into your TFSA and watching it grow completely tax-free – no capital gains, no income tax, ever.

U.S. investors get similar benefits with IRAs, though the rules get trickier with futures-based funds. Spot ETFs provide the cleanest tax treatment with standard 1099 forms that your tax software handles automatically.

The wash-sale rule creates an interesting twist. While it doesn’t apply to direct cryptocurrency purchases, it does apply to crypto ETFs. You can’t sell a Bitcoin ETF at a loss and immediately buy the same fund back. But here’s the clever part – you could potentially sell one Bitcoin ETF at a loss and immediately buy a different Bitcoin ETF to maintain your crypto exposure.

Risks, Volatility & Regulatory Watchlist

Crypto etf investing isn’t for the faint of heart. Despite the regulated wrapper, you’re still exposed to the extreme volatility that makes cryptocurrencies both exciting and terrifying. Some crypto ETFs that gained near 100% in 2023 had previously lost more than 80% in 2022.

Market swings represent the most obvious risk. Bitcoin can easily move 10-20% in a single day, and your ETF will follow. Unlike traditional assets, crypto markets never close, so you might wake up to significant overnight moves that occurred while stock markets were closed.

Regulatory risk remains significant despite recent approvals. Future policy changes could limit crypto ETF operations, affect tax treatment, or even force fund closures. The regulatory landscape is still evolving, particularly around staking rewards and more complex fund structures.

Custody risks, while minimized through institutional-grade storage, haven’t been eliminated entirely. Even professional custodians can face security breaches or operational failures. The collapse of exchanges like FTX reminded everyone that crypto infrastructure remains fragile.

Scientific research on climate metrics has introduced ESG considerations into crypto investing. Bitcoin’s energy consumption creates sustainability concerns that some investors want to avoid.

Frequently Asked Questions about Crypto ETF Investing

What is a crypto ETF?

Think of a crypto etf as your gateway to digital assets without the headaches. These exchange-traded funds give you exposure to cryptocurrencies through the same brokerage account you use for regular stocks and bonds – no need to figure out confusing crypto exchanges or worry about losing mysterious private keys.

Here’s how it works: You buy shares of a fund that does all the heavy lifting for you. The fund either holds actual cryptocurrencies like Bitcoin or Ethereum in super-secure storage, invests in crypto futures contracts, or owns shares of crypto-related companies. You just own a piece of that fund.

The beauty is in the simplicity. These funds trade on major stock exchanges during normal business hours, just like buying Apple or Microsoft stock. Professional fund managers handle all the technical stuff – security, storage, regulatory paperwork – while you get clean, regulated exposure to the crypto world.

No more staying up at night wondering if your digital wallet is safe. No more trying to remember 12-word recovery phrases. Just straightforward investing through your regular broker.

Can I hold a crypto ETF in my retirement account?

Absolutely, and this is where crypto etf products really shine! Most crypto ETFs can live happily in your tax-advantaged retirement accounts. Canadian investors can use their RRSPs and TFSAs, while Americans can typically use traditional and Roth IRAs.

This is a game-changer compared to buying crypto directly. Imagine your Bitcoin ETF doubling in value inside your TFSA – that’s completely tax-free growth. Try doing that with actual Bitcoin and you’ll be hit with capital gains taxes.

The tax benefits get even better. Instead of dealing with the messy tax reporting that comes with direct crypto ownership, most ETFs send you clean, simple tax forms. Spot ETFs typically provide standard 1099 forms that your tax software handles automatically.

Just one heads up: some futures-based crypto ETFs generate complex K-1 partnership forms that might not play nice with retirement accounts. When in doubt, check with your account provider about specific fund eligibility. But for most popular crypto ETFs, retirement account investing is smooth sailing.

How do crypto ETFs differ from buying crypto directly?

The differences between crypto etf ownership and buying crypto directly are like the difference between staying at a hotel versus camping in the wilderness – both get you there, but the experience is completely different.

Trading hours represent the biggest practical difference. ETFs only trade during stock market hours (9:30 AM to 4:00 PM Eastern), while crypto markets never sleep. Some investors love the forced break from 24/7 price watching, while others miss the ability to react to overnight news.

You don’t actually own the cryptocurrency when you buy ETF shares. Think of it like owning shares in a company that owns real estate – you benefit from the property’s value changes, but you can’t move into the building. With crypto ETFs, you can’t transfer tokens to other wallets or use them to buy things.

Management fees are the trade-off for convenience. ETFs typically charge between 0.25% and 2.00% annually, which direct ownership avoids. But consider what you get for those fees: professional security, regulatory oversight, simplified taxes, and retirement account eligibility.

For most people, especially those building long-term wealth, the convenience and peace of mind far outweigh the costs. You’re paying for professional management of something that’s frankly pretty complicated to do safely on your own.

Conclusion & Next Steps

The crypto etf landscape has transformed from a niche experiment into a $114 billion cornerstone of modern investing. What started as a way to bring Bitcoin to traditional brokerages has evolved into a sophisticated ecosystem with 84 different funds serving every type of investor.

For our Finances 4You community, these funds solve a fundamental challenge. You want exposure to digital assets that could boost your wealth-building journey, but you also need the security and simplicity that fits your busy professional life. Crypto etf products deliver both.

The beauty lies in the options. Young professionals building their first investment portfolios might start with a low-cost Bitcoin spot ETF like IBIT, allocating just 2-3% of their portfolio to test the waters. Mid-career investors with higher risk tolerance could explore Ethereum ETFs or diversified crypto baskets.

Our analysis reveals a clear pattern among successful crypto etf investors. They start small, think long-term, and choose quality over complexity. A simple Bitcoin ETF in your TFSA or IRA often outperforms elaborate strategies loaded with fees and complications.

The regulatory foundation keeps strengthening. Spot ETF approvals in both Canada and the United States have created the stability institutional investors demand. As traditional financial advisors become more comfortable recommending crypto exposure, we expect these funds to transition from “alternative investments” to standard portfolio components.

But let’s be honest – crypto remains volatile and speculative. Even wrapped in the safety of an ETF structure, you’re still riding the wild swings of an emerging asset class. Never invest more than you can afford to lose, and always consider how crypto fits your overall financial picture.

The infrastructure is built. The products are proven. The regulatory clarity exists. Whether you’re ready to add crypto etf exposure to your portfolio depends on your personal risk tolerance and investment timeline.

More info about Digital Currency Investment provides additional resources for building your crypto investment strategy within a diversified portfolio framework.

The digital asset revolution isn’t coming – it’s here. The question is whether you’re positioned to benefit from it responsibly.