Why Crypto Exchanges Are Essential for Modern Traders

A crypto exchange is a digital marketplace where you can buy, sell, and trade cryptocurrencies like Bitcoin, Ethereum, and thousands of other digital assets. These platforms act as the bridge between traditional money and the crypto world.

Quick Answer: What is a crypto exchange?

– Digital marketplace for buying and selling cryptocurrencies

– Centralized exchanges (like Binance, Coinbase) hold your funds

– Decentralized exchanges (like Uniswap) let you keep control of your assets

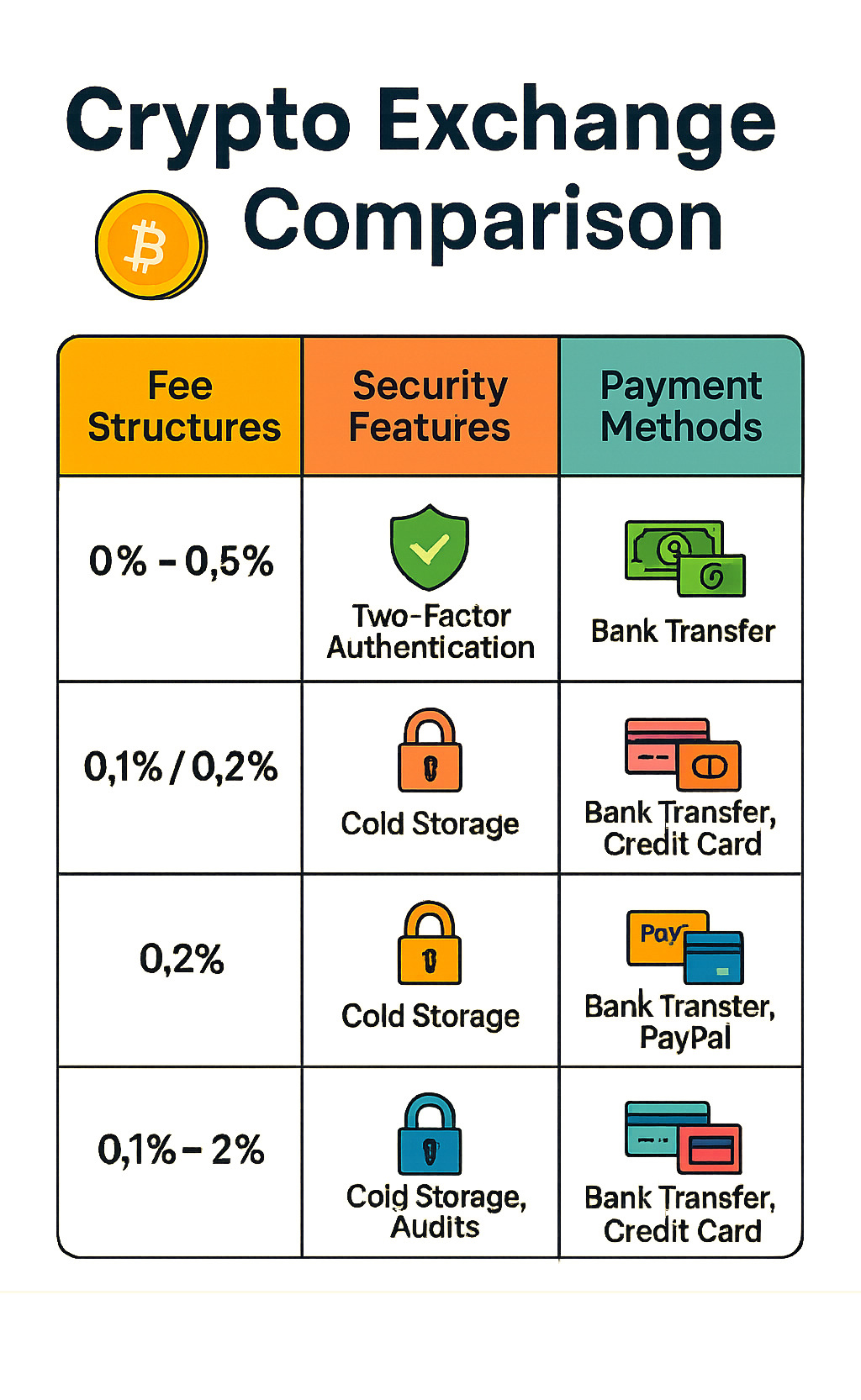

– Fee structures range from 0% to 2% per trade

– Security features include cold storage and two-factor authentication

The crypto exchange landscape has exploded in recent years. Binance alone serves 235 million users across 180+ countries, while Kraken processes over $207 billion in quarterly trading volume.

Not all exchanges are created equal. Some charge hefty fees that eat into your profits. Others have been hacked, leaving users empty-handed. The key is finding platforms that balance ease of use with rock-solid security.

Whether you’re looking to buy your first Bitcoin or execute complex trading strategies, choosing the right crypto exchange can make or break your experience. The best platforms offer intuitive interfaces, competitive fees, and bank-level security.

Quick crypto exchange terms:

– crypto market

– cryptocurrency trading for beginners

– crypto calculator

Crypto Exchanges: How They Work & Main Types

Think of a crypto exchange as a busy digital marketplace where millions of people come together to trade cryptocurrencies. Unlike a traditional farmers market where you haggle face-to-face, these platforms use sophisticated technology to match buyers and sellers instantly.

Every crypto exchange needs to solve one fundamental challenge: How do you fairly match someone wanting to buy Bitcoin with someone wanting to sell it? The answer comes down to two main approaches.

Order books are like a giant bulletin board showing all the buy and sell requests at different prices. When you want to buy Bitcoin at market price, the exchange’s matching engine instantly pairs you with the best available seller. This system works beautifully for popular trading pairs.

Liquidity pools take a completely different approach. Instead of matching individual traders, these pools contain reserves of different cryptocurrencies locked in smart contracts. When you trade, you’re swapping directly with the pool, and prices adjust automatically based on supply and demand.

Understanding whether an exchange is centralized or decentralized is crucial because it affects everything from your security to your privacy.

Centralized Crypto Exchange Essentials

Centralized exchanges are the most popular type of crypto exchange because they’re designed to feel familiar. They work similarly to traditional stock brokers – you deposit your money, they hold it for you, and they handle all the technical details.

When you deposit funds on a centralized exchange, your cryptocurrencies go into the platform’s custody system. The best exchanges use a smart combination of hot wallets (connected to the internet for quick trading) and cold storage (completely offline for maximum security). Most reputable platforms keep around 90% of user funds in cold storage.

The real magic happens with the matching engine – the software brain that processes trades. Modern exchanges can handle millions of orders per second while maintaining lightning-fast response times.

What makes centralized exchanges appealing is their user-friendly experience. They offer instant buy options, customer support when things go wrong, and easy ways to deposit regular money from your bank account. The trade-off? You’re trusting the exchange to keep your funds safe.

Decentralized Crypto Exchange Mechanics

Decentralized exchanges flip the entire concept on its head. Instead of handing over your cryptocurrencies to a company, you keep full control through self-custody while smart contracts handle the trading automatically.

Most decentralized platforms use AMM pools (Automated Market Maker pools) instead of traditional order books. These pools contain pairs of cryptocurrencies locked in smart contracts. When you want to trade, you’re making a swap with the pool rather than finding another individual trader.

Anyone can become a liquidity provider by depositing equal values of two cryptocurrencies into a pool. In return, they earn a share of the trading fees from everyone who uses that pool.

The benefits include better privacy (no lengthy verification processes), immunity from traditional exchange hacks, and true ownership of your assets. However, they typically cost more to use due to blockchain network fees and can feel overwhelming for newcomers.

Choosing the Right Platform: Features, Fees & Security

Finding the perfect crypto exchange feels a bit like dating – you want someone reliable, trustworthy, and who won’t surprise you with hidden costs. With careful research, you can find a platform that checks all your boxes.

Your biggest ongoing expense will be trading fees. While some exchanges charge up to 2% per trade, others offer rates as low as 0.1% for market orders. If you’re trading regularly, those fees add up quickly.

Security should be your top priority. The crypto world has seen spectacular exchange failures over the years, with billions of dollars vanishing. The exchanges that survive treat security like their religion – cold storage, multi-signature wallets, and regular security audits aren’t nice-to-haves, they’re necessities.

Don’t underestimate the power of a clean, intuitive interface. When markets are moving fast, the last thing you need is a confusing platform that makes you second-guess every click.

Trading Fees on a Crypto Exchange

Fee structures can be surprisingly complex. Most exchanges use a maker-taker model. If you place a limit order that sits on the order book, you’re a “maker” adding liquidity. Market orders that execute immediately make you a “taker” removing liquidity. Makers typically pay lower fees as a reward for providing liquidity.

Volume discounts can slash your costs dramatically if you’re an active trader. Many platforms offer tiered pricing where your fee rate drops as your monthly trading volume increases. Some provide additional discounts if you hold their native tokens.

Watch out for hidden costs that nibble away at profits. While most exchanges offer free deposits via bank transfer, withdrawal fees vary widely. Currency conversion fees can also catch you off guard.

Security Checklist for Your Crypto Exchange

Security breaches make dramatic headlines, but they’re avoidable if you choose your platform wisely. The exchanges that get hacked are usually the ones cutting corners on security measures.

Cold storage isn’t optional – it’s the foundation of exchange security. The best platforms keep 90% or more of user funds completely offline in air-gapped systems.

Multi-signature security adds another crucial layer of protection. This requires multiple cryptographic signatures to authorize any transaction, so even if hackers compromise one key, your funds stay locked down tight.

Enable two-factor authentication on every account, period. Use an authenticator app rather than SMS whenever possible – phone numbers can be hijacked through SIM swapping attacks.

For deeper insights into security best practices, the Scientific research on security best practices from regulatory authorities offers valuable guidance.

Must-Have User Features

The best crypto exchange platforms understand that trading is just one piece of the puzzle. You need tools that work seamlessly together.

Mobile apps aren’t luxury features anymore – they’re essential. Markets don’t sleep, and neither do opportunities. You need the ability to check positions, set alerts, and execute trades whether you’re commuting or relaxing.

API access opens up possibilities for serious traders. Whether you want to automate trading strategies or integrate with portfolio management tools, robust APIs give you the flexibility to build what you need.

Staking services turn your idle crypto into an income stream. Some platforms offer annual rewards up to 15% on certain cryptocurrencies.

Smooth fiat integration makes the difference between a platform you’ll actually use and one that sits empty. Look for exchanges that support your preferred payment methods.

For a comprehensive approach to crypto investing that complements smart exchange selection, check out our guide on More info about investing safety.

Using a Crypto Exchange Step-by-Step

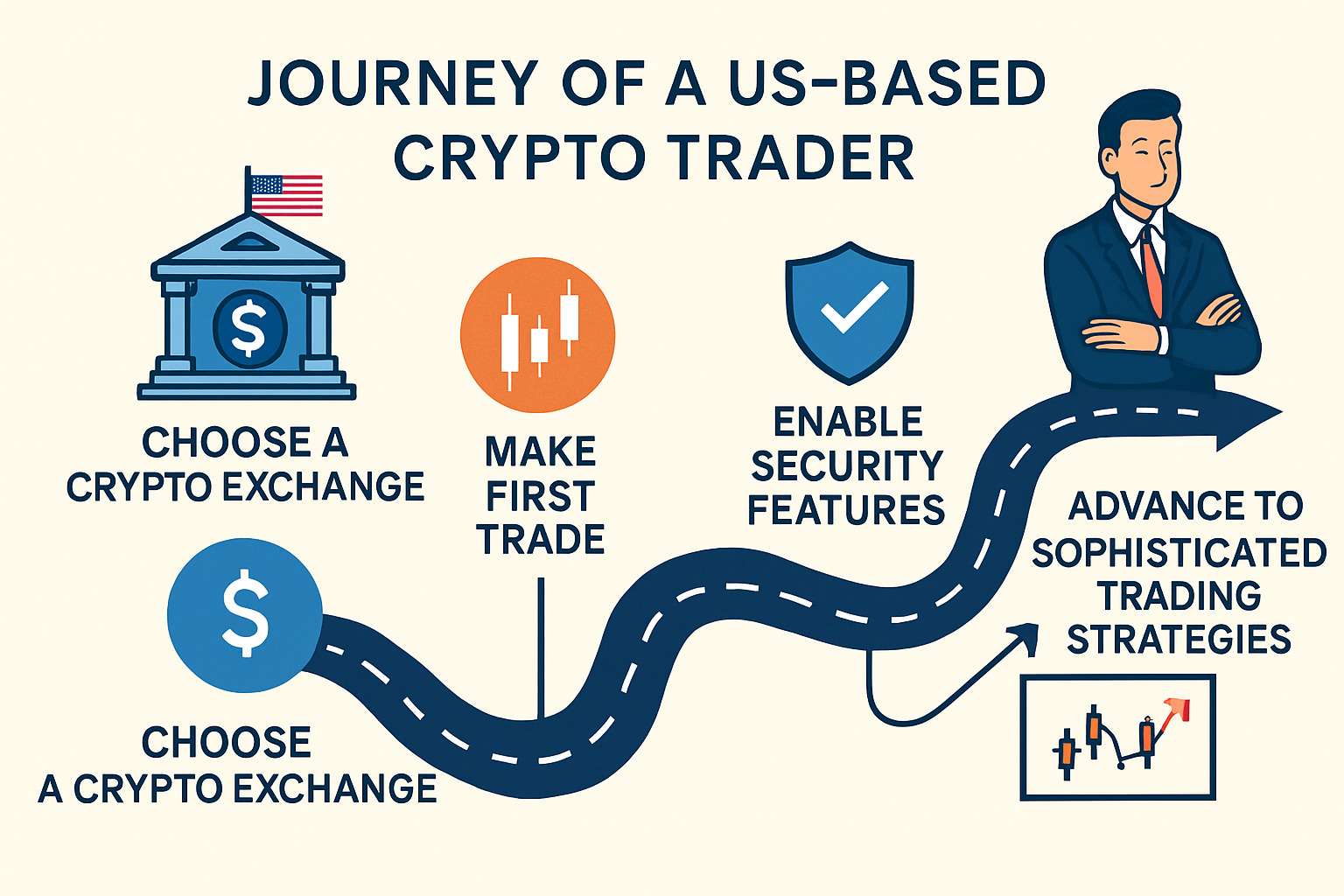

Taking your first steps into crypto exchange trading doesn’t have to feel overwhelming. Think of it like opening your first bank account – there are a few hoops to jump through initially, but once you’re set up, the process becomes second nature.

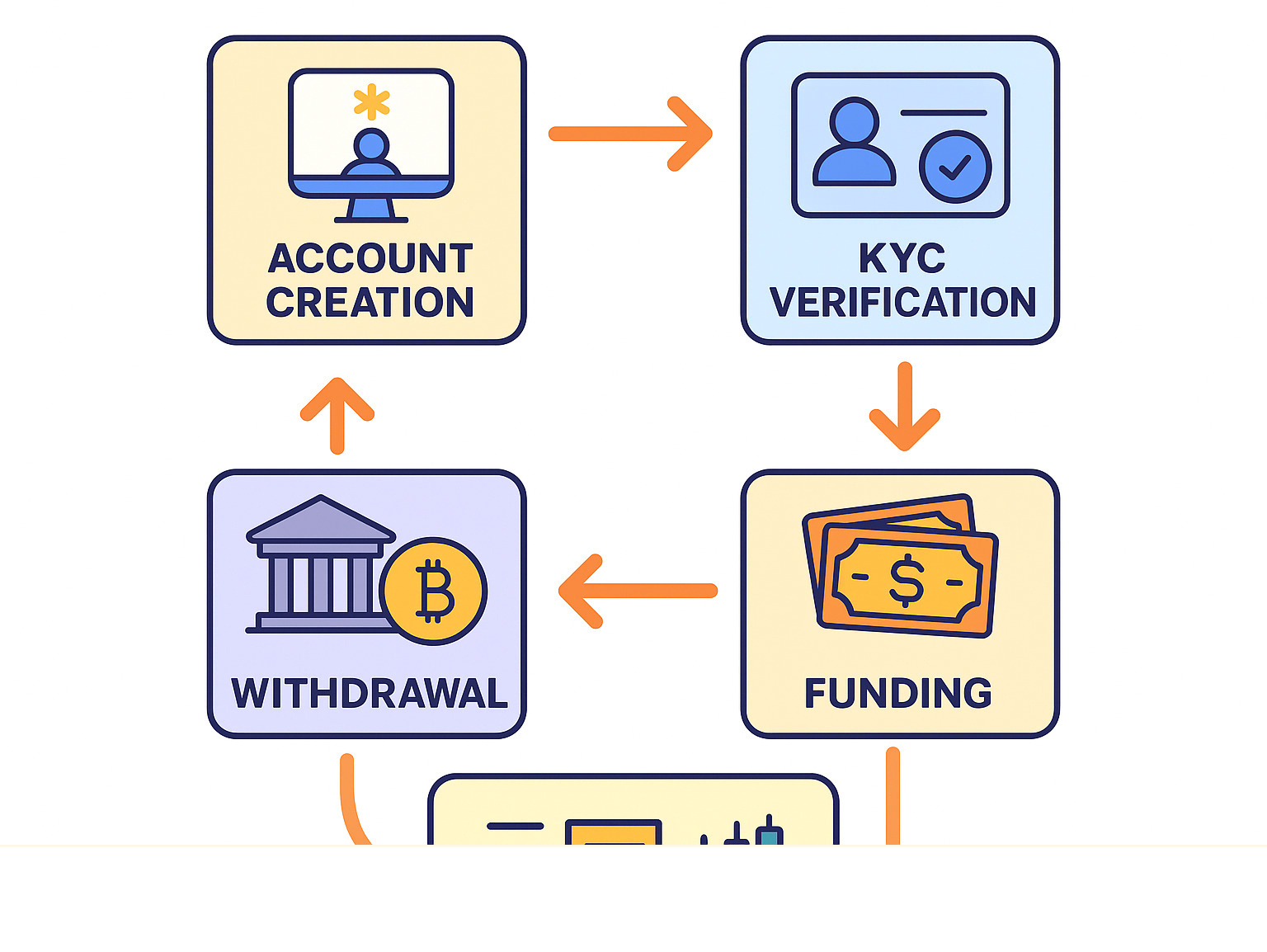

The journey starts with account setup, which usually takes about 10 minutes. You’ll provide basic details like your name, email, and phone number.

KYC (Know Your Customer) verification is where the crypto exchange world meets traditional finance regulations. You’ll upload a government-issued ID and sometimes proof of address. This isn’t the exchange being nosy – it’s protecting you and ensuring legal operation. Processing times vary from instant approval to several days.

Once verified, deposits can happen through multiple channels. Bank transfers are typically the most wallet-friendly option for fees, but you’ll wait 1-3 business days. Credit card deposits hit your account instantly but come with higher fees.

The trading interface is where you’ll spend most of your time. Modern exchanges cater to different experience levels. Beginners can stick with simple buy/sell buttons, while experienced traders get access to advanced charts and technical analysis tools.

Funding Your Account

Getting money into your crypto exchange account opens up several pathways, each with distinct advantages.

Bank wires and ACH transfers represent the most cost-effective route for substantial deposits. Yes, you’ll wait several business days, but your wallet will thank you when you’re not paying premium fees.

If you’re in Canada, e-Transfer has become incredibly popular. Many platforms process these within minutes, and some don’t charge fees for this deposit method.

Credit and debit cards offer instant gratification – your funds appear immediately, ready for trading. The trade-off comes in fees ranging from 2-4%, but sometimes market timing makes this premium worthwhile.

Stablecoins present an interesting option for users already holding crypto elsewhere. Transferring USDT or USDC can be faster and cheaper than converting to fiat and using traditional banking.

Executing a Trade on Your Chosen Crypto Exchange

Understanding order types transforms you from a nervous beginner into a confident trader.

Market orders are your “I want it now” option. Click buy or sell, and the crypto exchange matches you with the best available price instantly. Perfect when you want immediate execution.

Limit orders give you control. You set your desired price and wait for the market to come to you. This approach often gets you better prices, but there’s no guarantee your order will fill.

Stop-loss orders act like your trading safety net. Set them below your purchase price, and they’ll automatically sell if the market drops to that level.

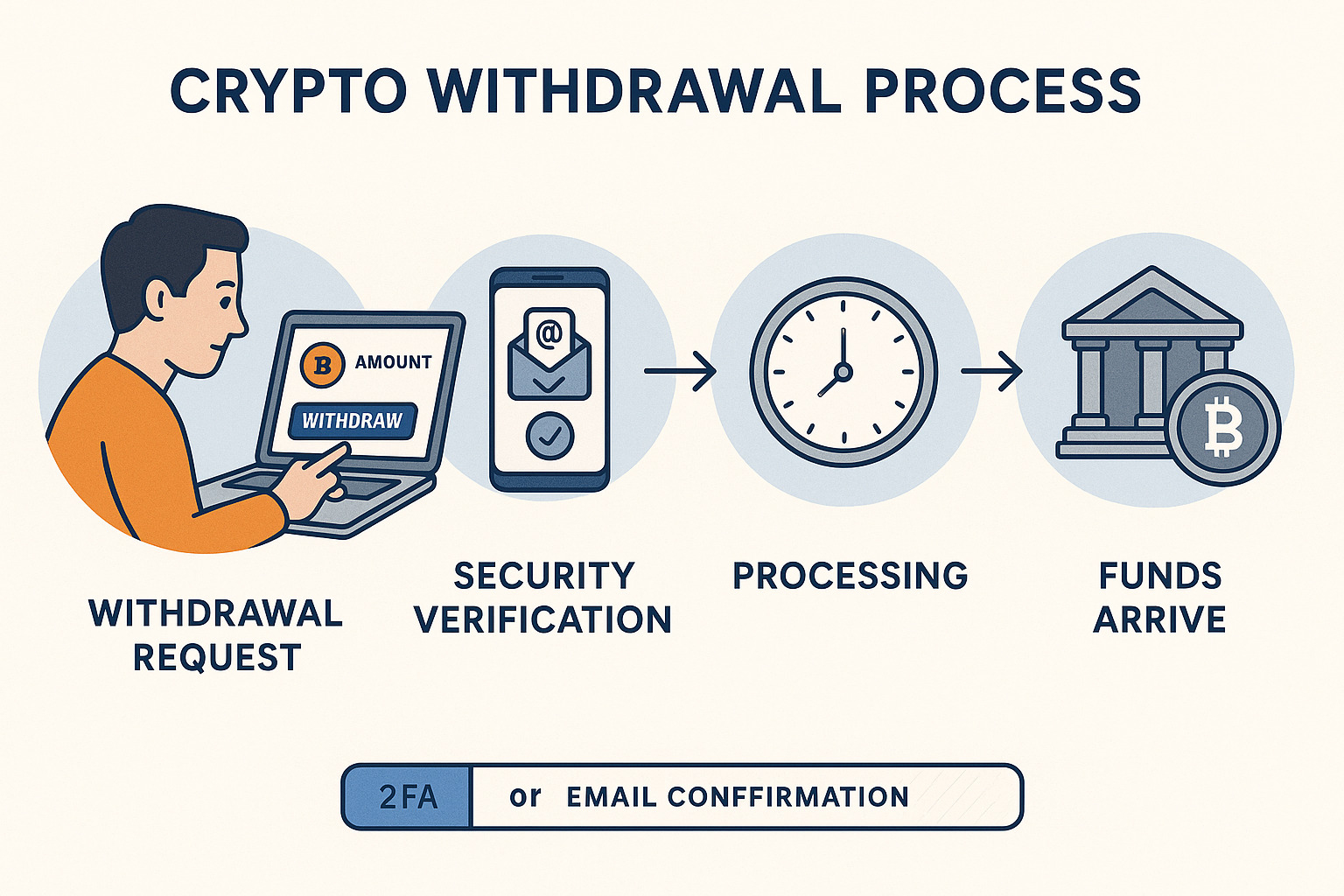

Cashing Out Securely

Converting your crypto gains back to spendable money requires understanding both the mechanics and the paperwork that follows.

Fiat withdrawals typically route through bank transfers back to your verified account. Processing times vary from same-day domestic transfers to several business days for international movements.

On-chain transfers let you move cryptocurrencies to external wallets. Always double-check wallet addresses before confirming transfers. Crypto transactions are permanent, and sending funds to the wrong address means they’re gone forever.

Tax logs become your best friend at filing time. Most crypto exchange platforms provide detailed transaction histories you can export for tax reporting.

Staying Safe: Risks, Compliance & Storage

The world of cryptocurrency trading offers exciting opportunities, but it also comes with unique challenges that can catch newcomers off guard.

Exchange hacks still make headlines, though thankfully less often than in crypto’s early days. While major platforms have invested heavily in security, smaller or newer exchanges might not have the same level of protection. This is why sticking with well-established crypto exchange platforms makes sense.

Phishing attacks are surprisingly common and getting more sophisticated. Scammers create fake websites that look identical to real exchanges, then steal your login credentials. Always double-check the URL in your browser, and consider bookmarking your exchange’s real login page.

Regulatory shifts can happen quickly in the crypto world. A government might suddenly ban certain cryptocurrencies or impose new restrictions on trading. While you can’t predict these changes, staying informed helps you adapt your strategy.

For deeper insights into how the underlying technology works, check out More info about blockchain’s role in digital currencies.

Compliance & Transparency

Modern crypto exchange platforms operate in an increasingly regulated environment, and that’s actually good news for users. These rules help protect you from fraud and ensure exchanges maintain proper standards.

KYC tiers (Know Your Customer) have become the norm across most legitimate platforms. Basic verification might let you deposit and trade small amounts, while higher tiers open up larger limits and additional features.

AML checks (Anti-Money Laundering) work behind the scenes to monitor transaction patterns. If you suddenly start moving unusually large amounts, the system might flag your account for manual review.

The travel rule requires exchanges to collect information about cryptocurrency transfers above certain thresholds, typically $1,000 to $3,000 depending on your location.

Proof-of-reserves is an exciting development where exchanges publicly prove they actually hold the cryptocurrencies they claim to have. It’s like a transparent audit that anyone can verify.

Hot vs. Cold Storage Best Practices

Understanding how your chosen crypto exchange stores funds helps you make smarter decisions about where to keep your digital assets.

Hot wallets stay connected to the internet, making them perfect for daily trading operations. When you place an order, the exchange can quickly access these funds to complete your transaction. The downside? Internet connectivity means potential vulnerability.

Cold storage keeps the majority of funds completely offline in air-gapped devices that never touch the internet. Think of it as a digital vault buried deep underground.

Multisig vaults require multiple digital signatures to authorize any transaction. Even if a hacker gets one key, they’d need several others to actually steal anything.

Insurance coverage varies dramatically between platforms. Some exchanges maintain their own insurance funds, while others purchase traditional insurance policies.

The smartest approach combines the best of both worlds. Keep funds you’re actively trading on the exchange for convenience, but consider moving longer-term holdings to your own hardware wallets for maximum security.

Frequently Asked Questions about Crypto Exchanges

What is a crypto exchange and how does it work?

Think of a crypto exchange as the digital equivalent of a stock market, but instead of trading company shares, you’re buying and selling cryptocurrencies like Bitcoin and Ethereum. These platforms create a space where millions of people can trade digital assets safely and efficiently.

The magic happens through sophisticated matching systems. When you want to buy Bitcoin at $50,000, the exchange finds someone willing to sell at that price and connects you instantly. Most platforms use order books that display all the buy and sell orders at different price levels.

Decentralized exchanges work differently – they use smart contracts and liquidity pools instead of traditional order books. You’re essentially trading against a pool of cryptocurrencies rather than directly with another person.

The whole process is remarkably fast. Modern exchanges can process your trade in milliseconds, transferring the assets between accounts almost instantly.

How much will I pay in trading fees and other costs?

Trading costs can make or break your crypto investment returns. Most crypto exchange platforms charge between 0.1% to 0.25% per trade, though the actual amount depends on your trading volume and the specific platform.

The maker-taker model is standard across the industry. When you place a limit order that adds liquidity to the market, you’re a “maker” and typically pay lower fees. Market orders that immediately execute make you a “taker” with slightly higher fees.

Volume matters significantly for active traders. Many exchanges offer tiered fee structures where your rate decreases as your monthly trading volume increases. Heavy traders might pay as little as 0.02% while newcomers start at higher rates.

Hidden costs can sneak up on you. Deposit fees are often waived for bank transfers but can be substantial for credit card funding. Withdrawal fees vary by cryptocurrency – Bitcoin withdrawals might cost $10-25 while some altcoins have minimal fees.

Which security measures should every user enable?

Security should be your top priority when using any crypto exchange. The good news is that protecting yourself is straightforward if you follow proven strategies.

Two-factor authentication (2FA) is absolutely non-negotiable. This adds a second layer of protection beyond your password, typically through an app on your phone. Use authenticator apps like Google Authenticator rather than SMS verification.

Your password strategy can make or break your security. Create strong, unique passwords for each exchange account using a password manager. Never reuse passwords across multiple platforms.

Email notifications act as your early warning system. Enable alerts for all account activities including logins, trades, withdrawals, and settings changes.

Withdrawal whitelisting allows you to pre-approve specific wallet addresses for withdrawals. Even if someone gains access to your account, they can’t send your crypto to their own wallets without additional verification.

Consider using hardware wallets for long-term storage rather than keeping large amounts on exchanges. The safest crypto is the crypto you control directly.

Conclusion

The crypto exchange world is moving fast, and it’s exciting to watch. What started as a niche corner of the internet has grown into a massive financial ecosystem that’s changing how we think about money itself.

We’re still in the early days. Decentralized exchanges are getting easier to use every month. Regulatory frameworks are becoming clearer. And security measures keep getting stronger, making it safer than ever to dip your toes into crypto waters.

But here’s what hasn’t changed: education is still your best investment. The traders who take time to understand how exchanges work, what fees they’re paying, and how to keep their assets secure are the ones who succeed long-term.

At Finances 4You, we’ve seen how understanding crypto exchanges has become as important as knowing your way around traditional investment platforms. The good news? You don’t need to learn everything at once. Start with a reputable exchange, make small trades, and build your confidence gradually.

The best part about today’s crypto landscape is that you have options. Whether you prefer the simplicity of centralized platforms or the control that comes with decentralized trading, there’s a solution that fits your comfort level and goals.

For those ready to take their crypto knowledge to the next level, our comprehensive guide covers everything from basic concepts to advanced strategies: More info about crypto investing 101.

The best crypto exchange isn’t necessarily the one with the flashiest features or the lowest fees. It’s the one that matches your needs, trading style, and risk tolerance. Take your time choosing, start small, and never compromise on security for convenience.

The crypto revolution isn’t slowing down anytime soon. By choosing the right exchange and approaching trading with the right mindset, you’re positioning yourself to be part of something truly transformative.