Why Crypto Mining Sites Are Revolutionizing Passive Income

Crypto mining sites have transformed how everyday investors can earn cryptocurrency without buying expensive hardware or managing complex technical setups. These platforms let you rent mining power from professional data centers and earn daily Bitcoin rewards directly to your wallet.

Top crypto mining sites for 2025:

- NiceHash – World’s leading hashrate marketplace with complete mining ecosystem

- GoMining – Digital miners as NFTs with 229,543 miners sold and 3,984 BTC earned

- Cudo Miner – Over 100,000 users earning with AI-powered auto-switching

- HashBeat – 500,000+ users across 60+ countries with unlimited earnings

- GlobePool – Premier provider offering $8,100 daily rewards on $100,000 investment

- Compass Mining – 5.9 EH/s hashrate management with verified hosting facilities

The cloud mining industry has exploded because it removes the biggest barriers to crypto mining: expensive ASIC hardware, high electricity costs, and technical complexity. Instead of spending thousands on mining rigs, you can start earning Bitcoin for as little as $10-100.

Modern platforms use AI algorithms to automatically switch between the most profitable coins. Some offer welcome bonuses up to $100-150 and daily returns ranging from 6% to 15%. With features like mobile apps, referral programs, and zero withdrawal fees, these sites make cryptocurrency mining accessible to anyone.

But with great opportunity comes great risk. The space is filled with legitimate platforms alongside potential scams promising unrealistic returns. Understanding how to evaluate these sites is crucial for protecting your investment.

Crypto mining sites vocabulary:

– crypto market

– crypto exchange

– cold wallet crypto

How Does Crypto Mining Work in 2025?

Think of crypto mining like a global lottery where millions of computers compete to solve the same puzzle. The winner gets to add new transactions to the blockchain and earns cryptocurrency as a reward. It’s the same proof-of-work system that’s kept Bitcoin secure since 2009, but today’s mining world looks completely different.

Here’s what happens behind the scenes: your computer (or the crypto mining sites you’re using) races against others to crack complex math problems. The first miner to solve the puzzle wins the block reward – currently 6.25 Bitcoin for each block. But here’s the catch: this reward gets cut in half every four years during events called halving events. The next one will drop rewards to just 3.125 BTC.

The network is smart enough to keep things fair. Every two weeks, Bitcoin automatically adjusts the network difficulty to maintain 10-minute block times. More miners join? The puzzles get harder. Miners leave? Things get easier. It’s like a self-balancing scale that never tips too far in either direction.

Your biggest enemy as a miner isn’t the competition – it’s your electricity costs. Professional mining farms hunt for power rates under 5 cents per kilowatt-hour, while most home miners pay 10-20 cents. That difference can make or break your profitability, especially when Bitcoin prices drop.

The environmental impact has become impossible to ignore. Bitcoin mining consumes roughly 120-150 terawatt-hours annually – that’s more than some entire countries. The good news? The industry is going green fast, with over half of mining operations now using renewable energy sources like solar and wind power.

The carbon footprint concerns are driving innovation in sustainable mining. Many crypto mining sites now advertise their green credentials, using everything from hydroelectric power to capturing methane from landfills. It’s not just good PR – it’s often cheaper too.

Latest research on mining profitability reveals the harsh reality: only operations with dirt-cheap electricity (under 6 cents per kWh) and cutting-edge hardware stay profitable when markets turn sour. That’s exactly why cloud mining platforms have become so popular – they handle the technical headaches while you focus on the returns.

From ASICs to Cloud: Mining Methods Explained

The world of crypto mining has come a long way from the early days when people mined Bitcoin on their laptops. Today’s mining landscape offers several paths to earning cryptocurrency, each designed for different budgets and comfort levels.

Hardware mining still represents the traditional gold standard for serious miners. When you buy your own ASIC miners like the Antminer S21, you’re making a substantial commitment – these powerful machines cost anywhere from $3,000 to $8,000 each and gulp down 3,000 to 5,000 watts of electricity. It’s like having a small industrial appliance running 24/7 in your garage.

The appeal of owning your hardware is clear: you control everything. No monthly fees, no contract limitations, and all the mining rewards flow directly to your wallet. But let’s be honest – it’s not for everyone. You need cheap electricity (ideally under $0.06 per kWh), adequate cooling, and the technical know-how to troubleshoot when things go wrong.

Cloud mining has completely changed the game by removing these barriers. Crypto mining sites let you rent mining power from professional data centers without ever touching a piece of hardware. Think of it like renting an apartment instead of buying a house – you get all the benefits without the massive upfront costs or maintenance headaches.

Modern mining software has become incredibly sophisticated, incorporating AI automation that would make your smartphone jealous. These algorithms constantly analyze which cryptocurrencies are most profitable to mine and automatically switch your mining power accordingly. Some platforms report earnings boosts of up to 30% compared to mining just one coin.

The convenience factor has exploded with mobile apps that put mining management right in your pocket. You can check your daily earnings while waiting for coffee, adjust your mining strategy during lunch, and withdraw funds before dinner. Some platforms even offer “idle mining” features that work quietly in the background when you’re not using your device.

Renewable energy integration has become a major selling point as the industry addresses environmental concerns. Forward-thinking platforms now source power from solar farms, wind installations, and hydroelectric facilities. This isn’t just good for the planet – renewable energy often costs less than traditional power sources, potentially boosting your returns.

The shift toward cloud-based mining reflects how technology evolves. Just like we moved from buying DVDs to streaming Netflix, crypto mining is transitioning from hardware ownership to service-based models that prioritize accessibility and convenience over technical complexity.

Best Crypto Mining Sites & Platforms in 2025

Finding the right crypto mining sites in 2025 means looking beyond flashy promises to find platforms with real track records and transparent operations. After analyzing dozens of platforms, we’ve identified the ones that consistently deliver results for their users.

The best platforms share common traits: they have large user bases, clear fee structures, and proven withdrawal processes. They also provide detailed information about their mining operations rather than hiding behind vague marketing language.

| Platform | Users | Hashrate | Sign-up Bonus | Daily Returns | Key Feature |

|---|---|---|---|---|---|

| NiceHash | 4M+ | World’s largest | Varies | Market-based | Hashrate marketplace |

| GoMining | 229K miners | 6.9 EH/s | None | 38-40% annual | NFT-based miners |

| Cudo Miner | 100K+ | Variable | None | Up to 30% boost | AI optimization |

| HashBeat | 500K+ | Global network | Free trial | 6-15% daily | 60+ countries |

| GlobePool | Unknown | 500 TH/s plans | $15 | $8,100/day* | High-volume focus |

| Compass | 10K+ | 5.9 EH/s | None | Hardware-based | Verified hosting |

*Based on $100,000 investment examples from platform marketing materials

What makes these platforms stand out is their ability to make mining accessible while maintaining professional-grade operations. They’ve removed the technical barriers that once made mining only available to tech experts.

Top Cloud Crypto Mining Sites

NiceHash has earned its reputation as the world’s leading hashrate marketplace by doing things differently. Instead of locking you into fixed contracts, they operate like a stock exchange for mining power. You can buy exactly the amount of hashrate you want, when you want it.

This flexibility is game-changing. When Bitcoin prices surge, you can increase your mining power instantly. When profitability drops, you can scale back just as quickly. The platform’s transparency lets you see real-time pricing for different mining algorithms, so you always know what you’re paying.

What’s really clever about NiceHash is that it works both ways. If you have your own mining hardware sitting idle, you can sell your hashrate to other users and earn Bitcoin that way too.

GoMining takes a completely different approach by turning mining power into digital collectibles. Each “digital miner” is actually an NFT that represents real mining equipment in verified data centers. It sounds gimmicky, but it’s surprisingly practical.

The platform has sold over 229,000 digital miners, and users have earned nearly 4,000 BTC in total rewards. The mobile app makes everything simple – your daily rewards arrive automatically with zero withdrawal fees. If you decide you want out, you can sell your digital miners on their marketplace.

The annual returns of 38-40% in BTC look attractive, though remember that Bitcoin’s price volatility means your dollar returns will fluctuate significantly.

GlobePool targets serious investors with substantial capital. Their marketing materials show impressive numbers – like earning $8,100 daily on a $100,000 investment. While these returns grab attention, approach such high promises with healthy skepticism.

High daily return promises should always raise red flags. Start small with any platform to test their legitimacy before committing significant money.

Most Secure Crypto Mining Sites

Security separates legitimate crypto mining sites from potential scams. The platforms we trust implement multiple protection layers to keep your funds safe.

Compass Mining operates with institutional-level security by partnering only with verified hosting facilities. They manage an impressive 5.9 EH/s of hashrate across 20 professional data centers and have successfully sold over 100,000 mining machines.

Their transparency sets them apart. You can see exactly which data center hosts your equipment and monitor its performance in real-time. While they focus more on hardware hosting than pure cloud mining, this verified facility network provides extra security for users who want professional equipment management.

Compass requires full KYC verification and provides detailed reporting on all mining operations. This might feel like extra hassle, but it’s actually a good sign – legitimate platforms follow proper compliance procedures.

Cudo Miner has built strong security foundations with over 100,000 users trusting their platform. They implement multi-factor authentication through apps like Google Authenticator and undergo regular third-party security audits.

Their software approach to security is particularly smart. The desktop application includes built-in protections against hardware damage from overheating. Remote management capabilities let you monitor operations from anywhere while keeping your systems safe.

The platform’s code-signing by DigiCert provides additional verification that you’re downloading legitimate software, not malware disguised as mining applications.

Share on LinkedIn our analysis of secure cloud mining platforms to help others make informed decisions.

Emerging Green Crypto Mining Sites

Environmental sustainability has become a major factor in choosing crypto mining sites. Smart platforms are investing heavily in renewable energy to reduce costs and appeal to environmentally conscious investors.

Bitdeer operates mining facilities powered by renewable energy sources and provides transparent environmental impact reporting. Their global data center locations let you choose facilities based on your environmental preferences, not just profitability.

The company’s commitment to sustainability goes beyond marketing – they publish detailed reports on their energy sources and carbon footprint. This transparency helps you make informed decisions about the environmental impact of your mining activities.

PowerMine365 markets itself as a 100% green-energy Bitcoin mining platform. They exclusively source power from solar, wind, and hydroelectric facilities, targeting investors who want crypto earnings without the environmental guilt.

These green mining platforms often achieve lower operating costs due to cheaper renewable energy. Solar and wind power can be significantly less expensive than traditional grid electricity, potentially leading to better returns for users.

However, always verify environmental claims through third-party certifications rather than trusting marketing materials alone. Real sustainability requires proof, not just promises.

Profitability, Fees & Environmental Impact

Let’s be honest about something most crypto mining sites don’t want to discuss upfront: the real costs that can eat into your profits faster than you might expect.

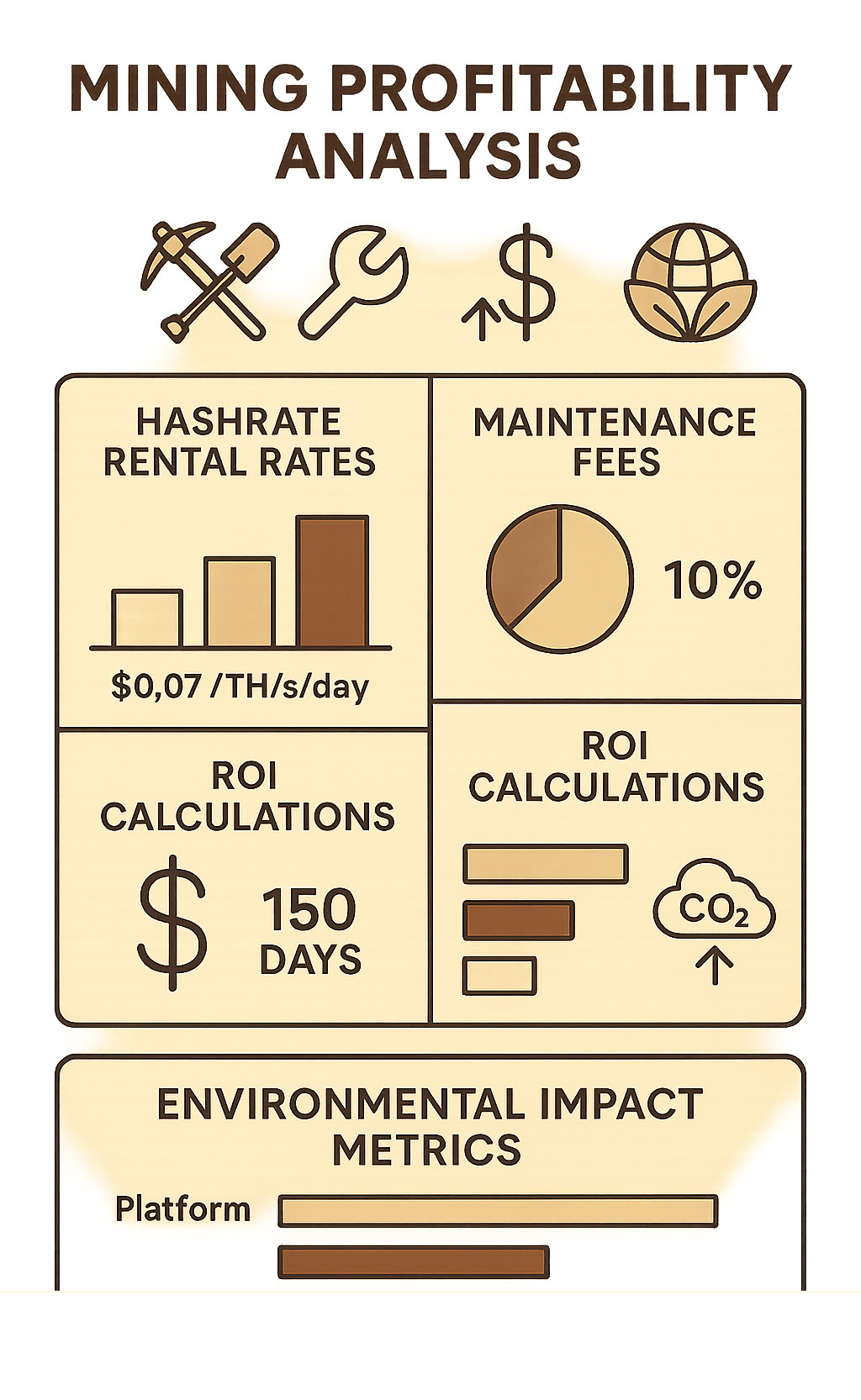

Hashrate rental rates change constantly based on supply and demand, just like any marketplace. On platforms like NiceHash, you’ll see prices swing from $0.05 to $0.15 per TH/day depending on how many people want to mine at that moment. When Bitcoin’s price jumps, everyone rushes to rent mining power, driving rates higher.

The sneaky profit-killer is maintenance fees. These daily or monthly charges cover electricity, cooling, and keeping those mining rigs humming in data centers. Most platforms charge between 5-15% of your gross mining rewards, and here’s the kicker – they keep charging even when mining isn’t profitable. It’s like paying rent on an apartment whether you’re living there or not.

Those shiny ROI calculators on mining websites? Take them with a grain of salt. They typically assume Bitcoin’s price stays the same and network difficulty never changes. In reality, both fluctuate constantly. Bitcoin could drop 30% next week, or network difficulty could spike when new miners join, slashing your returns overnight.

Market volatility is where many cloud mining dreams go to die. When Bitcoin crashes from $60,000 to $30,000, your mining rewards in dollar terms get cut in half too. But your maintenance fees? Still the same. Your contract duration? Still ticking down. This is why understanding your break-even point matters more than chasing high daily return percentages.

The bright spot is green energy sourcing, which benefits both your conscience and your wallet. Mining operations powered by solar, wind, or hydroelectric power often achieve lower electricity costs than coal-powered facilities. Some platforms now purchase carbon credits to offset their environmental impact, though this typically adds to operational costs.

Don’t forget about regulatory taxes – the IRS treats mining rewards as taxable income at fair market value when you receive them. Keep detailed records of every payout and fee, because tax season will come whether your mining venture was profitable or not.

The key to success with crypto mining sites isn’t finding the highest advertised returns – it’s understanding all the costs, fees, and risks before you invest your first dollar.

How to Choose and Start With Crypto Mining Sites

Choosing the right crypto mining sites feels overwhelming when you’re staring at dozens of platforms promising easy profits. The truth is, most people jump in too quickly and learn expensive lessons. Let’s walk through a smarter approach that protects your money while giving you the best shot at real returns.

Start with the fundamentals of due diligence. Before you invest a single dollar, verify that the company actually exists as a legitimate business. Check their company registration in places like Delaware, Singapore, or other business-friendly jurisdictions. Look for a real management team with LinkedIn profiles and industry experience you can verify.

The best platforms are transparent about their mining facilities. They’ll show you photos of their data centers, provide facility addresses, and sometimes even offer virtual tours. If a platform won’t tell you where their mining equipment is located, that’s a massive red flag.

KYC verification might seem annoying, but it’s actually your friend. Legitimate platforms follow anti-money laundering laws, which means they’ll ask for your ID and proof of address. Scam platforms often skip this step because they’re not planning to be around long enough for regulators to catch them.

Testing customer support before you invest tells you everything about how they’ll treat you later. Send them a question about fees or withdrawal processes. Do they respond within 24 hours with helpful information? Or do you get generic copy-paste responses that don’t answer your question?

Free trials are perfect for getting a feel for how platforms work. GoMining and HashBeat both offer trial periods where you can see their dashboard, understand their payout process, and test withdrawals with small amounts. Think of it as a test drive before buying the car.

Here’s where most people mess up: they invest large amounts immediately. Smart investors start with the minimum deposit, usually $10-50, and test the complete cycle. Make a small deposit, let it mine for a few days, then withdraw your earnings. Time how long withdrawals take and whether you receive exactly what was promised.

Pay attention to withdrawal limits and processing times. Legitimate platforms process withdrawals within 24-48 hours and clearly state minimum withdrawal amounts upfront. If a platform requires you to earn $100 before your first withdrawal, or takes a week to process payments, those are warning signs.

The biggest scam red flags are promises that sound too good to be true. No legitimate investment consistently pays 10-15% daily returns. If someone could really generate those returns safely, they wouldn’t need your money. Referral programs offering 20-50% bonuses are another red flag – sustainable businesses don’t give away half their profits in referral fees.

Watch out for pressure tactics too. Legitimate platforms let you take your time deciding. Scam platforms create fake urgency with “limited time offers” or countdown timers pushing you to invest immediately.

More info about digital-currency guides can help you understand the broader context of cryptocurrency investing and avoid common beginner mistakes that cost people thousands of dollars.

The goal isn’t to get rich quick – it’s to build a sustainable income stream that grows your wealth over time. Take your time, do your research, and start small. Your future self will thank you for being cautious now rather than sorry later.

Frequently Asked Questions about Crypto Mining Sites

Are crypto mining sites profitable in 2025?

Crypto mining sites can definitely be profitable, but let’s be honest about what that really means. The returns aren’t guaranteed, and they swing wildly based on Bitcoin’s mood swings, how hard the network is to mine, and what fees platforms charge.

From our research, legitimate platforms typically deliver annual returns between 10-40%. That sounds great until you realize this includes those painful months when Bitcoin crashes and your mining rewards feel like pocket change. We’ve seen platforms that were printing money in bull markets suddenly become unprofitable when Bitcoin dropped 50%.

The secret sauce to actual profitability? Don’t put all your eggs in one basket. Start small with multiple platforms, test their withdrawal processes, and only reinvest your profits – never your rent money. Think of it like dating: you wouldn’t marry someone after the first date, so don’t dump your life savings into a mining platform after reading their flashy marketing.

If someone promises you guaranteed daily returns above 2-3%, that’s your cue to run. Real mining profits fluctuate with market conditions, and anyone claiming otherwise is probably selling you a bridge in Brooklyn.

How do I spot a legitimate crypto mining site?

Spotting legitimate crypto mining sites is like being a detective – you need to look for clues that separate the real deal from elaborate scams.

The good guys always show their work. They’ll tell you exactly where their mining facilities are located, what equipment they’re using, and who’s running the show. You should be able to find their management team on LinkedIn, see their company registration, and read detailed terms of service that don’t require a law degree to understand.

Professional platforms also act professionally. They have responsive customer support, active social media presence, and don’t pressure you to recruit your grandmother for bonus points. Their daily returns stay in the field of reality – usually under 1-2% daily – because they understand basic math.

The red flags are usually pretty obvious once you know what to look for. Anonymous teams using stock photos, promises of guaranteed 10% daily returns, and withdrawal processes that require you to jump through flaming hoops are all giant warning signs. If their marketing sounds like a get-rich-quick infomercial, trust your gut and walk away.

Here’s a pro tip: legitimate platforms want you to succeed long-term because happy customers stick around. Scammers want your money fast and don’t care if you ever come back.

What’s the easiest way to withdraw my mining rewards?

Getting your money out should be the easiest part of using crypto mining sites, not an obstacle course designed to keep your funds hostage.

Automatic withdrawals are your best friend here. Platforms like GoMining set these up so your rewards automatically hit your wallet once you reach the minimum threshold. No fees, no hassle, no remembering to log in and click buttons. It’s like having your paycheck direct deposited – simple and reliable.

If you prefer more control, manual withdrawals let you decide when and how much to withdraw. Most legitimate platforms process these within 24-48 hours, though some charge small fees that typically range from 0.5-2% of your withdrawal amount.

Minimum withdrawal amounts vary quite a bit. For Bitcoin, you’re usually looking at 0.005-0.01 BTC, while Ethereum might require 0.1 ETH. Smaller amounts like USDT often have $10-50 minimums, which makes them more accessible for beginners.

The golden rule? Always withdraw to a wallet you control. Leaving funds on mining platforms is like leaving your car running in a bad neighborhood – it might be fine, but why take the risk? Test small withdrawals first to make sure everything works smoothly, and keep detailed records because the tax man will want his cut eventually.

If a platform makes withdrawing your own money feel like solving a Rubik’s cube blindfolded, that’s a huge red flag. Your money should be available when you want it, not when they feel like giving it back.

Conclusion

The journey through crypto mining sites reveals a landscape filled with both genuine opportunities and potential pitfalls. After analyzing platforms like NiceHash, GoMining, and Cudo Miner, it’s clear that legitimate cloud mining can offer a pathway to cryptocurrency earnings without the headaches of managing hardware.

The most successful approach we’ve seen involves starting small and building gradually. Rather than diving in with large investments based on flashy marketing promises, smart investors test platforms with minimal amounts first. This lets you experience the withdrawal process, understand fee structures, and gauge actual returns before committing serious money.

Diversification remains your best friend in this space. Spreading investments across multiple proven platforms reduces your risk if any single platform encounters problems. Think of it like not putting all your eggs in one basket – except these baskets are generating cryptocurrency while you sleep.

At Finances 4You, we see cryptocurrency mining as one piece of a larger financial puzzle. It can complement traditional wealth-building strategies, especially for those looking to explore alternative income streams. However, it should never replace core investment principles like emergency funds, retirement savings, and diversified portfolios.

The platforms we’ve explored offer different approaches to suit various comfort levels. NiceHash’s marketplace model appeals to those who want flexibility and transparency. GoMining’s NFT-based miners attract users who appreciate the mobile-first experience and zero withdrawal fees. Cudo Miner’s AI optimization suits those who want technology working to maximize their returns automatically.

Cryptocurrency mining inherently involves significant risks. Bitcoin’s price volatility, changing network difficulty, and regulatory uncertainties all impact profitability. What looks profitable today might not be tomorrow – that’s simply the nature of this emerging industry.

The key is maintaining realistic expectations while staying informed about market developments. Never invest money you can’t afford to lose, and always prioritize understanding over potential returns. The most successful miners we’ve encountered treat it as a learning experience first and an investment second.

More info about our advisory tools can help you integrate cryptocurrency mining into your broader financial planning strategy while maintaining appropriate risk management.