Why Staying Current with Crypto News Matters

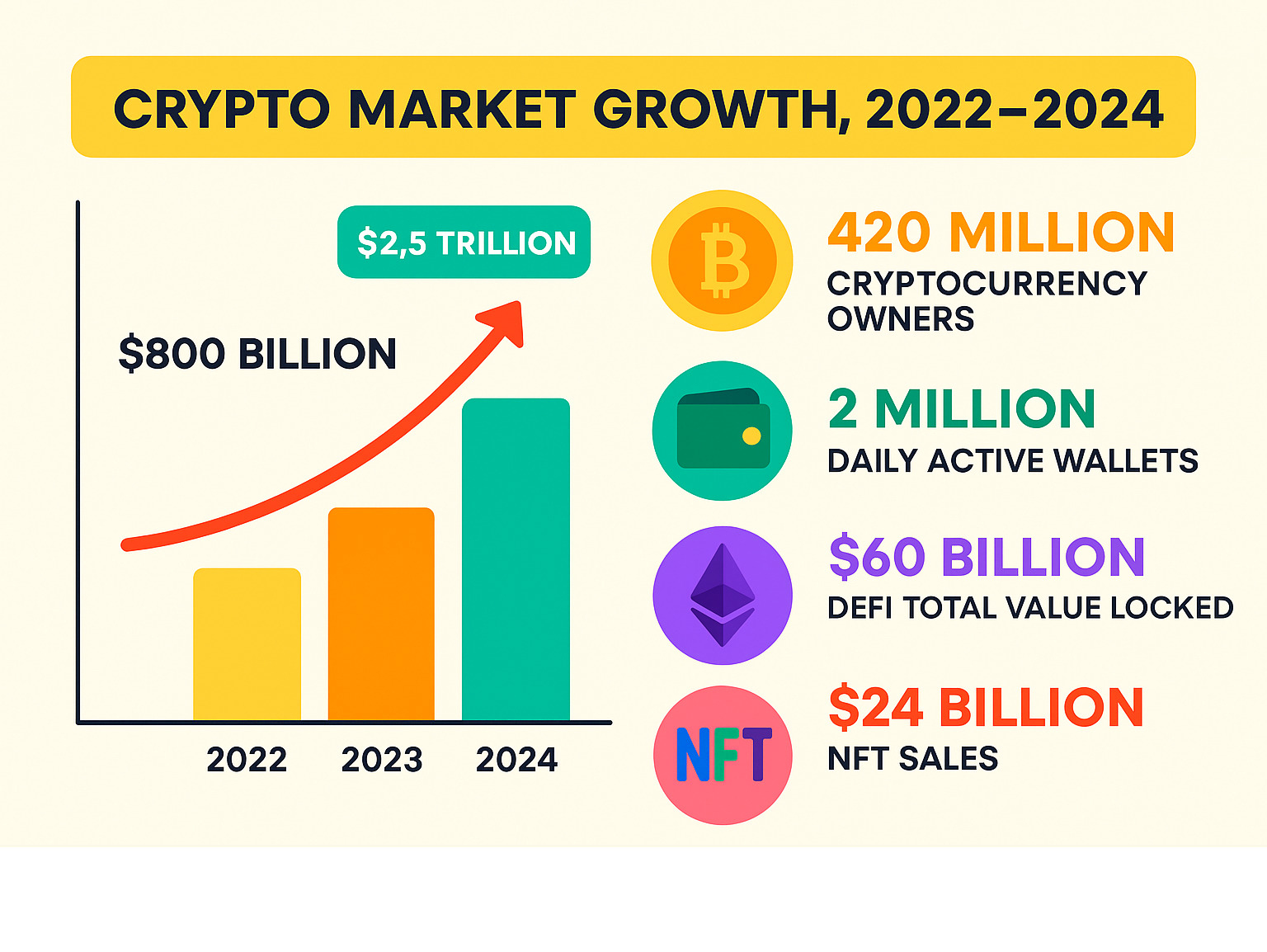

Crypto news moves at lightning speed, and missing key developments can cost you money or opportunities. With over 420 million people worldwide owning cryptocurrency and the global crypto market cap surpassing $2.5 trillion in 2024, staying informed isn’t just smart—it’s essential.

Key crypto news categories to watch:

- Market movements – Bitcoin, Ethereum, and altcoin price changes

- Regulatory updates – SEC settlements, new laws, compliance changes

- Technology developments – New protocols, security updates, DeFi innovations

- Corporate adoption – Companies adding crypto to their balance sheets

- Security incidents – Hacks, scams, and wallet safety alerts

The crypto landscape changes daily. Major stories like Ripple’s SEC settlement proposal, GameStop’s $1.3 billion Bitcoin investment plan, and Vietnam’s new digital asset framework can impact your portfolio overnight.

Whether you’re holding Bitcoin, exploring DeFi platforms, or considering your first crypto investment, understanding these developments helps you make smarter financial decisions. The difference between profit and loss often comes down to timing and information.

Crypto news terms at a glance:

– crypto market

– crypto exchange

– cryptocurrency trading for beginners

Crypto News Roundup

The crypto news cycle has been absolutely wild lately, and if you’ve been trying to keep up, you’re probably feeling a bit dizzy. From massive corporate Bitcoin bets to long-awaited legal settlements, the past few weeks have delivered some game-changing developments that could reshape how we think about digital assets.

Let’s start with the elephant in the room: GameStop’s shocking Bitcoin strategy. The gaming retailer just announced plans to raise $1.3 billion through convertible bonds with one clear goal—buying Bitcoin. Yes, the same GameStop that became a meme stock sensation is now making one of the boldest corporate crypto treasury moves we’ve ever seen. The market wasn’t exactly thrilled, with the stock tumbling 25% after the news broke. But love it or hate it, this move signals that even traditional retailers are taking crypto seriously.

Meanwhile, BlackRock quietly launched its Bitcoin exchange-traded product in Europe. While the initial inflows were modest, this represents another huge step toward mainstream institutional adoption. When the world’s largest asset manager makes a move like this, other financial giants usually follow.

The Ripple-SEC saga might finally be coming to an end after what feels like an eternity. Both sides have proposed a $125 million settlement, with $50 million going to the SEC and $75 million returning to Ripple. If approved, this could close the book on one of crypto’s longest and most watched legal battles.

In the DeFi world, Hyperliquid has been absolutely crushing it. The protocol rocketed to become the 11th largest blockchain by total value locked, hitting $2.01 billion. Its native HYPE token has been on a tear too, jumping 330% from its April lows. Sometimes the crypto market rewards innovation in spectacular fashion.

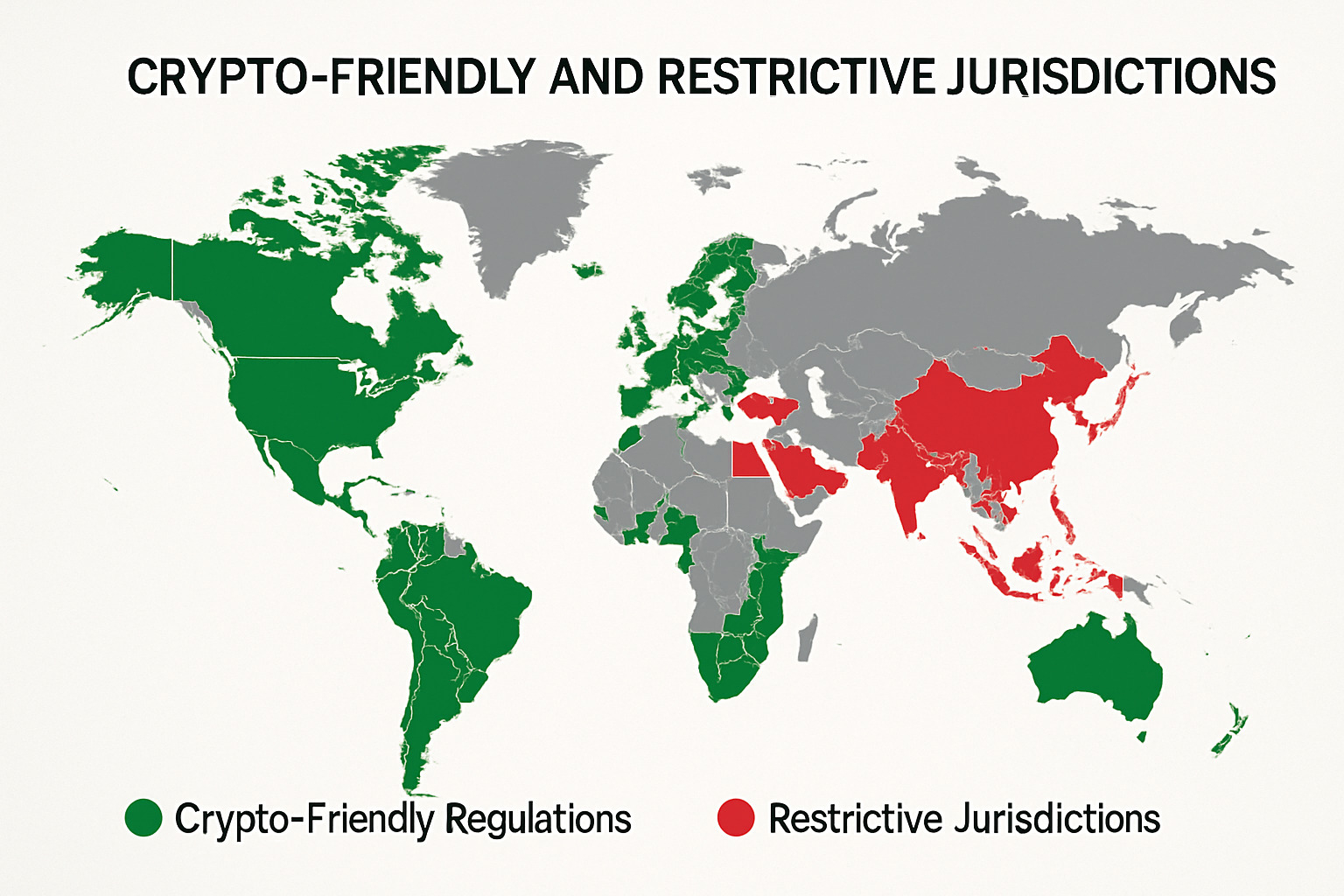

On the regulatory front, we’re seeing a fascinating split. Vietnam just passed comprehensive digital asset legislation that takes effect in January 2026, creating a clear framework for crypto innovation with built-in incentives. Meanwhile, Connecticut went the opposite direction, becoming the first U.S. state to explicitly ban government cryptocurrency reserves. Talk about mixed signals from lawmakers.

The memecoin mania continues with Pepe Unchained and similar projects capturing retail investor attention, while institutional players are quietly accumulating established tokens. Whale activity has been particularly interesting lately, with large holders making strategic moves that often predict broader market trends.

These stories perfectly capture the cryptocurrency trends we’re tracking at Finances 4You. Each headline represents a different piece of crypto’s complex puzzle—from corporate adoption to regulatory clarity to pure speculation.

Crypto News Flash: Market Moves

Bitcoin dominance remains strong, holding around 50% of the total crypto market cap, though altcoins have been making some interesting moves lately. The king of crypto is still trading below its all-time high of $109,135 from earlier this year, but institutional interest keeps flowing in.

HYPE token’s 330% rally has been the standout performer, climbing from $9.29 in April to around $40 recently. This explosive growth came alongside Hyperliquid’s meteoric rise in total value locked, proving that solid fundamentals can still drive spectacular returns in crypto.

Stablecoin flows tell an interesting story too. USDT on TRON just surpassed $80 billion, which strengthens TRON’s position as a leading stablecoin network and shows where the smart money is moving.

Crypto News Flash: Altcoins & Trends

The altcoin space has been buzzing with some fascinating developments that show just how creative (and sometimes crazy) this market can get.

FET token got a major boost when Interactive Strength announced a $500 million investment plan, though only $55.56 million is guaranteed upfront. Seeing a fitness equipment manufacturer dive into AI tokens shows how crypto is spreading into unexpected corners of the business world.

SEI has been building impressive Layer 2 trading infrastructure, and the technical momentum is starting to show in the price action. The token recently broke above key resistance levels, which has traders paying attention.

Memecoins are surging again, with Dogecoin gaining 15.5% and Shiba Inu jumping 14% in recent sessions. Even newer projects like Little Pepe are trying to combine meme culture with actual Layer 2 functionality—because why not add some utility to the fun?

The key takeaway? This market rewards both serious innovation and pure speculation, sometimes in equal measure. The trick is knowing which trends have staying power and which ones are just riding the hype wave.

Market Movers & Price Action

The crypto news cycle has been dominated by some wild price swings lately, and understanding what’s driving these movements can help you make smarter investment decisions. Let’s break down the key players and what their performance tells us about the broader market.

Bitcoin’s rollercoaster ride continues to capture headlines. After touching that jaw-dropping all-time high of $109,135 earlier this year, BTC has pulled back and is currently trading below $90,000. The year-to-date numbers show Bitcoin down 5.7% as of March 2025, which might seem disappointing until you consider the bigger picture.

Here’s where it gets interesting: Bitcoin whales have been on a shopping spree, purchasing a staggering $11 billion worth of BTC in just two weeks, according to Glassnode data. When the big players are buying the dip, it often signals confidence in Bitcoin’s long-term prospects.

Ethereum is quietly building momentum behind the scenes. While the price action might not be grabbing as many headlines as Bitcoin, the network continues expanding its DeFi ecosystem. Growing institutional interest in spot Ethereum ETFs suggests that traditional finance is warming up to the world’s second-largest cryptocurrency.

The real star of recent crypto news has been HYPE token’s incredible surge. This Hyperliquid native token jumped from $9.29 to over $40, representing a mind-blowing 330% gain. The token now boasts a market cap of $13 billion with a fully diluted valuation of $40.75 billion. What’s driving this meteoric rise? The protocol’s total value locked (TVL) grew 70% in just 30 days, reaching $2.01 billion.

FET token tells a different story of volatility and corporate intrigue. Down 78% from its March 2024 peak of $3.47, FET is currently trading between $0.70-$0.80. Interactive Strength’s announced $500 million investment (though only $55.56 million is guaranteed upfront) has added another layer of uncertainty to the token’s price action.

The memecoin sector remains as unpredictable as ever. PEPE crashed over 43% from its March peak but is showing signs of recovery. These tokens continue attracting significant trading volume despite their volatile nature, proving that speculation and community-driven projects still have their place in the crypto ecosystem.

One of the most encouraging developments has been the staking market explosion. Total staking market cap reached $17.1 billion, up 16% in just seven days. This growth indicates that investors are thinking long-term and have confidence in proof-of-stake networks.

| Metric | Bitcoin (BTC) | Ethereum (ETH) |

|---|---|---|

| YTD Performance | -5.7% | Growing institutional interest |

| All-time High | $109,135 | Continued network expansion |

| Current Trend | Whale accumulation | DeFi ecosystem growth |

| Market Sentiment | Cautiously optimistic | Building momentum |

These price movements reflect the market’s ongoing maturation. We’re seeing a mix of institutional adoption, technological advancement, and good old-fashioned speculation. The key is understanding which trends have staying power versus those driven by short-term hype.

For a deeper dive into these market dynamics and how they might affect your investment strategy, explore our comprehensive crypto market analysis.

Regulation & Policy Watch

The regulatory landscape is shifting beneath our feet, and these changes could make or break your crypto investments. While technical charts grab headlines, it’s often the quiet policy meetings in Washington D.C. and state capitals that really move markets.

The SEC’s approach is changing under Chair Paul Atkins, who’s steering the agency away from aggressive enforcement toward actual rulemaking. The Ripple settlement proposal perfectly captures this shift – after years of costly legal battles, both sides agreed to a $125 million settlement that splits the difference. This collaborative approach could signal smoother waters ahead for the entire crypto industry.

Stablecoin clarity is finally coming. The House released new bill language that could provide the regulatory framework stablecoin issuers desperately need. Key senators are pushing for completion by September 30, which would remove a major cloud of uncertainty hanging over the $200+ billion stablecoin market.

Meanwhile, Vietnam is rolling out the red carpet for crypto innovation. Their Digital Technology Industry Law, taking effect January 1, 2026, creates clear definitions between virtual assets and crypto assets while offering tax incentives for blockchain companies. It’s a smart move that could help Vietnam exit the FATF grey list while attracting crypto businesses.

Connecticut took the opposite approach, becoming the first U.S. state to explicitly ban government cryptocurrency reserves. This creates an interesting divide – while states like New Hampshire, Texas, and Arizona are building Bitcoin reserves, Connecticut is saying “not for us.” These state-by-state differences highlight how fragmented U.S. crypto policy remains.

The Federal Reserve continues debating a potential U.S. Bitcoin strategic reserve, though concrete proposals remain scarce. Still, even the discussion influences market sentiment and keeps institutional investors paying attention.

FATF compliance requirements are also tightening globally, pushing exchanges and service providers to upgrade their anti-money laundering systems. While this adds costs, it also legitimizes the industry in the eyes of traditional finance.

Understanding these regulatory trends isn’t just academic – it directly impacts your portfolio. Crypto news often breaks first in regulatory filings and policy announcements, giving savvy investors an edge over those focused only on price charts.

For deeper insights into how regulation shapes the future of digital money, explore our analysis of The Rise of Cryptocurrency: Is It the Future of Money?

Technology & Security Spotlight

The crypto world thrives on innovation, but recent developments show us both the incredible potential and serious risks that come with cutting-edge technology. Let’s explore what’s actually happening behind the scenes of your favorite platforms.

Bybit’s ambitious new project is making waves in the DeFi space. Their upcoming decentralized exchange, launching by the end of June 2025, promises something we haven’t seen before – a true hybrid that combines the best of both worlds. You’ll get the deep liquidity of centralized exchanges with the transparency and control of DeFi protocols. They’re using sophisticated RFQ (Request for Quote) and CLMM (Concentrated Liquidity Market Maker) mechanisms to make trading smoother and more efficient.

Solana is everywhere these days, and for good reason. The network keeps expanding its reach, with Interactive Brokers recently adding SOL alongside XRP, ADA, and DOGE to their trading platform. This isn’t just another listing – it’s a signal that traditional financial institutions are finally taking altcoins seriously. When major brokers start offering these assets, it usually means broader adoption is right around the corner.

AI agents are getting real thanks to Fetch.ai’s latest developments. We’re not talking about abstract AI tokens anymore – these agents can actually find you a parking spot, book appointments, and handle real-world tasks. It’s exactly the kind of practical utility that separates legitimate projects from pure speculation.

DeFi liquidity problems are getting solved through clever new protocols that concentrate capital where it’s needed most. Instead of spreading liquidity thin across multiple pools, these innovations direct funds to where trading activity is highest, making everything more efficient for users.

But here’s where things get concerning. The crypto industry just experienced its worst quarter ever for security breaches in Q1 2025, with a staggering $1.64 billion lost to various hacks and exploits. The most shocking incident involved $1.4 billion stolen from a major exchange, with investigators unable to trace at least half of those funds. These numbers should make everyone pause and think about their security practices.

Corporate treasuries are making bold moves too. GameStop’s decision to close stores and invest in Bitcoin represents one of the most dramatic corporate strategy shifts we’ve seen. They’re planning to raise $1.3 billion through convertible bonds specifically to buy Bitcoin – a move that’s much riskier relative to their company size compared to other corporate Bitcoin adopters.

Your security matters more than ever in this environment. Using hardware wallets for significant holdings isn’t optional anymore – it’s essential. Enable two-factor authentication on every single account, double-check website URLs before entering any credentials, and keep all your software updated. Most importantly, never share your private keys or seed phrases with anyone, ever.

The technology driving crypto news continues advancing at breakneck speed, solving real problems around scalability, security, and user experience. But those security incidents remind us that this space still carries significant risks that require constant vigilance.

For deeper insights into how blockchain technology shapes the future of digital assets, check out our comprehensive guide on The Role of Blockchain in Digital Currencies.

Conclusion

The crypto news landscape has never been more dynamic, and frankly, it’s both exciting and exhausting to keep up with. From GameStop’s eyebrow-raising $1.3 billion Bitcoin gamble to Vietnam rolling out the red carpet for digital assets, we’re watching cryptocurrency shed its “fringe investment” label faster than a Bitcoin transaction on a busy day.

What This All Means for Your Money

Here’s the thing—whether you’re just starting to build wealth or you’re well on your way to financial independence, these developments matter more than you might think. Institutional adoption is no longer a “maybe someday” story. When BlackRock launches Bitcoin products in Europe and fitness equipment companies start buying AI tokens, we’ve officially entered mainstream territory.

Regulatory clarity is finally emerging, and that’s huge news for anyone who’s been sitting on the sidelines waiting for clearer rules. The Ripple-SEC settlement proposal and Vietnam’s comprehensive framework show us that governments are figuring out how to work with crypto rather than against it. Connecticut’s crypto ban reminds us that not everyone’s on board yet, but the trend is clear.

Technology keeps pushing boundaries in ways that actually solve real problems. New DEX models, AI integration, and Layer 2 solutions aren’t just fancy tech talk—they’re making crypto more useful for everyday people. But let’s be honest: security remains a massive headache. With $1.64 billion lost to hacks in just one quarter, protecting your digital assets is more critical than ever.

Market volatility isn’t going anywhere soon. HYPE token’s 330% rally and PEPE’s 43% crash remind us that crypto can still feel like riding a roller coaster blindfolded.

Looking Ahead

The next six months will likely bring more corporate Bitcoin adoption, clearer regulations, and technological breakthroughs that make crypto easier to use. Companies taking massive positions alongside traditional institutions creates opportunities, but also complexity that requires careful navigation.

At Finances 4You, we believe staying informed about crypto news helps you make smarter decisions about whether digital assets fit your financial goals. Whether crypto represents a small hedge or a significant portion of your portfolio, understanding these developments helps you align your investment strategy with your age and risk tolerance.

The crypto revolution isn’t slowing down—it’s just getting more sophisticated. Those who stay informed, practice proper security, and maintain realistic expectations will be best positioned for whatever comes next.

For ongoing coverage of digital asset developments, explore our comprehensive digital currencies section. The story is far from over, and honestly, we’re just getting to the good part.