Why Real-Time Crypto Price Tracking Matters More Than Ever

Crypto price movements can make or break your investment portfolio in minutes, not days. With Bitcoin trading between $106,759 and $107,971 in just 24 hours and the global cryptocurrency market cap hitting $3.31 trillion, staying on top of price changes isn’t optional anymore.

Current Top Cryptocurrency Prices:

- Bitcoin (BTC): $107,899 (+1.39% 24h) – Market cap: $2.14T

- Ethereum (ETH): $2,463 (+1.46% 24h) – Market cap: $297B

- XRP: $2.22 (+2% 24h) – Trading volume: $4.05B

- Total Market Cap: $3.31T (+1.14% daily increase)

- Fear & Greed Index: 50 (Neutral sentiment)

The crypto market never sleeps. While you’re focused on your career and managing lifestyle inflation, digital assets are moving 24/7 across global exchanges. Trading volume jumped 13.08% to $99.85 billion in the last day alone.

Professional investors know this secret: The difference between checking prices once a day versus real-time tracking can mean thousands in missed opportunities or avoided losses.

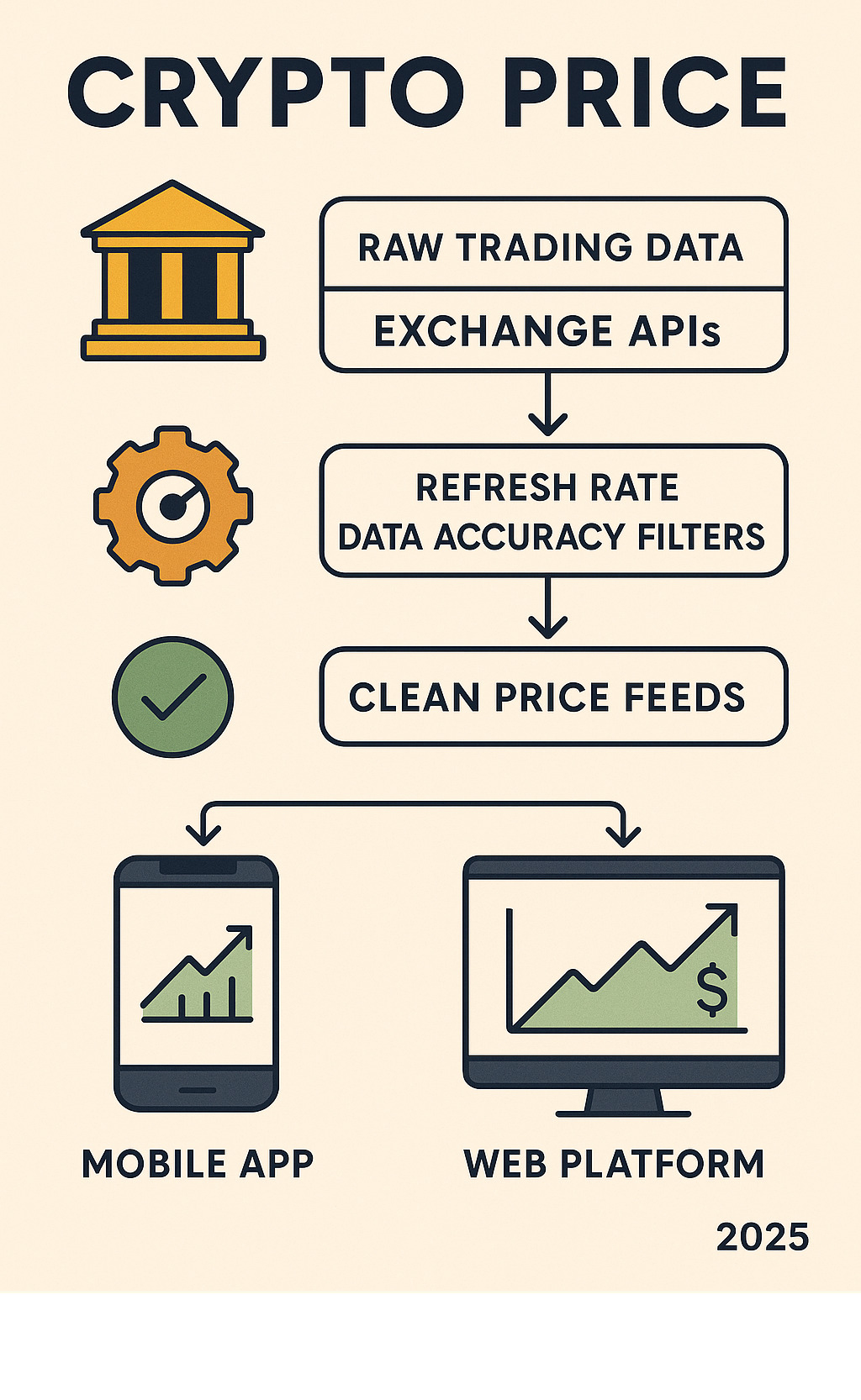

Whether you’re building wealth in your 30s or trying to understand how crypto fits into your net worth goals, having the right crypto price tools at your fingertips is essential. The best tracking platforms aggregate data from multiple exchanges, filter out anomalies, and deliver accurate prices faster than you can refresh a basic website.

Similar topics to crypto price:

Why Real-Time Tracking Beats Daily Summaries

Think about it this way: checking crypto price once a day is like watching a movie by looking at one frame every hour. You’ll miss all the action that actually matters.

The numbers tell the story. When Bitcoin’s supply in profit jumped from 87% to 98% in just one week, smart investors who were watching real-time data rode that wave up. Meanwhile, folks checking prices over their morning coffee found out about the move when it was already over.

Price volatility in crypto makes traditional stock market swings look tame. Bitcoin regularly moves $1,000 or more in a few hours. Ethereum can shift 2-5% while you’re sleeping. And don’t get us started on altcoins – they think nothing of swinging 10-20% in a single day, especially on weekends when you’re probably not paying attention.

Right now, the Fear & Greed Index sits at 50, which means the market is feeling pretty neutral. But here’s the thing – that number can flip faster than your mood on a Monday morning. One tweet, one regulatory announcement, or one major company buying Bitcoin can send prices flying in either direction.

Institutional money moves fast and hits hard. When BlackRock’s Bitcoin ETF crossed $72 billion in assets, crypto prices didn’t wait for the evening news to react. They moved within minutes. These big players don’t check prices once a day – they have teams watching every tick.

Here’s what really matters for your wealth building: with 96.7% of all Bitcoin currently sitting in profit, we’re in a unique moment. This could mean explosive growth ahead, or it could signal that profit-taking is coming. Either way, you want to know about it as it happens, not after the fact.

If you’re in your peak earning years and building serious wealth, missing a 20% move because you were too busy to check prices can seriously dent your net worth goals. The Crypto Market gives you the real-time insights you need to stay ahead of these moves instead of chasing them.

The bottom line? In crypto, yesterday’s prices are ancient history. Real-time tracking isn’t just nice to have – it’s essential for anyone serious about building wealth in the digital age.

Best Free Dashboards to Monitor Crypto Price

Finding the right crypto price dashboard feels like searching for a needle in a haystack – there are hundreds of options, but most either overwhelm you with unnecessary features or miss the data that actually matters for building wealth.

After testing dozens of platforms, we’ve finded that the best aggregator sites share three key traits: they pull data from multiple exchanges to avoid single-point failures, they calculate weighted averages that reflect real market conditions, and they filter out those suspicious trades that could throw off your investment decisions.

Real-time price feeds from 10+ major exchanges form the backbone of reliable tracking, while market cap rankings updated every 30 seconds keep you informed about shifting market dynamics. The platforms worth your time also provide 24-hour volume data with percentage changes and heat maps showing sector performance – all wrapped in a mobile-responsive design that works whether you’re checking prices during your commute or reviewing your portfolio over weekend coffee.

The current market cap leaders tell an interesting story about where institutional money is flowing. Bitcoin’s $2.14 trillion market cap represents roughly 64% market dominance – a level that suggests both stability and room for other assets to grow. Ethereum’s $297 billion maintains its position as the smart contract leader, while Tether’s $157.88 billion provides the stablecoin foundation that keeps trading liquid during volatile periods.

XRP’s $129.25 billion market cap reflects renewed optimism around payment solutions, and BNB’s $92.75 billion shows how exchange utility tokens can maintain value even during broader market uncertainty. Understanding these market cap relationships helps you gauge which assets offer stability versus growth potential – crucial insight when you’re building wealth systematically over time.

The Crypto Market Cap section dives deeper into how market capitalization fits into your overall investment strategy and wealth-building timeline.

Volume heat maps reveal the liquidity story behind the headlines. Bitcoin’s $47.4 billion daily volume versus Dogecoin’s $634 million shows you which assets you can actually trade without moving the market against yourself. For anyone building serious wealth, this liquidity difference matters when you need to enter or exit positions as part of your broader financial strategy.

Finances 4You Crypto Dashboard: Fast, Reliable Crypto Price Updates

We built our crypto tracking tools with one simple goal: give you the information you need to make smart wealth-building decisions without drowning you in data that doesn’t matter. Instead of flashy charts designed to encourage day trading, we focus on actionable metrics that help align your crypto investments with age-appropriate net worth goals.

Our dashboard refreshes price updates every 15 seconds across 500+ coins, with market cap data updating every 30 seconds for the top 100 assets. Volume analysis refreshes every minute for major trading pairs, while real-time news integration delivers curated sources with impact alerts that actually affect prices.

The magic happens in our API speed advantage. We pull data directly from exchange APIs and apply filters that remove wash trading and those suspicious prints that could mislead your investment decisions. This means the crypto price you see reflects genuine market activity, not manipulated data designed to create false signals.

Altcoin coverage matters more than most people realize. While Bitcoin and Ethereum dominate the headlines, our research shows that portfolios including 5-10 carefully selected altcoins often outperform Bitcoin-only strategies over 3+ year periods. That’s why we track 500+ altcoins – because diversification remains a cornerstone of long-term wealth building, even in crypto.

The platform integrates seamlessly with our wealth management tools, so you can see exactly how your crypto holdings fit into your overall net worth picture. This holistic view helps prevent the over-allocation to speculative assets that derails so many investment plans.

Advanced Charting & Alerts: Pro-Level Crypto Price Monitoring

Professional traders spend years learning to read complex charts, but you don’t need a finance degree to benefit from advanced monitoring tools. We’ve simplified the most useful technical indicators into insights you can actually use.

RSI (Relative Strength Index) shows when an asset might be overbought or oversold – think of it as a “too hot, too cold, just right” indicator for timing purchases. Moving averages reveal trend direction and momentum without requiring you to stare at squiggly lines all day. Bollinger Bands indicate volatility and potential breakout zones, while volume profiles confirm whether price moves have genuine support or are just noise.

Our custom alerts handle the scenarios that matter most for wealth building. Get notified when Bitcoin drops below $100,000 (a major support level worth watching), when Ethereum breaks above $2,550 (potential resistance breakthrough), or when any top-10 coin moves 15%+ in 4 hours (momentum that deserves attention). We also track when the Fear & Greed Index shifts from neutral to extreme – sentiment changes that often precede major market moves.

The multi-asset view eliminates the need to jump between tabs and windows. When Bitcoin rallies, you can immediately see which altcoins are following the trend versus lagging behind – crucial information for rebalancing decisions that keep your portfolio aligned with your goals.

Because these alerts integrate with our wealth management platform, they consider your overall financial picture. If you’re already overweight in growth assets, we might tone down aggressive crypto alerts to help maintain your target allocation strategy.

Integrated Portfolio & Top Movers: All-in-One Crypto Price Tracking

Managing crypto alongside traditional investments shouldn’t feel like juggling two completely separate financial lives. Our portfolio tools treat digital assets as part of your broader wealth strategy, not isolated speculation that exists in its own bubble.

We help you organize watchlists that make sense for long-term wealth building. Core holdings like Bitcoin and Ethereum provide the stability foundation, while growth plays among the top 20 altcoins offer upside potential with strong fundamentals. Small-cap moonshot tokens get their own category for the 10x+ potential that comes with higher risk, and stablecoins like USDC and Tether serve as cash-like positions for opportunistic purchases.

Current top movers show where momentum is building right now. Cardano’s +3.05% move reflects growing smart contract adoption, Dogecoin’s +2.33% rally demonstrates community-driven momentum, and XRP’s +2% gain suggests improving regulatory clarity is finally translating to price action.

Your watchlists, alerts, and portfolio data sync across all devices seamlessly. Check crypto prices on your phone during lunch, set alerts on your laptop at home, and review performance on your tablet over the weekend – everything stays connected and current.

This unified approach helps maintain the discipline that separates successful wealth building from emotional speculation. When crypto prices are surging and FOMO starts creeping in, our integrated view reminds you of your target allocations and overall wealth goals. Sometimes the best investment decision is doing nothing at all.

Mobile Apps & Alerts: Keep Crypto Price In Your Pocket

Your phone already buzzes with notifications all day – but the right crypto price alerts can actually save you money instead of just stealing your attention. The trick is setting up smart notifications that tell you what matters while filtering out the noise.

Think about it: Bitcoin moved over $1,200 in a single day recently. If you had alerts set up properly, you’d know about significant moves without obsessively checking prices every few minutes. That’s the difference between staying informed and becoming a stressed-out chart watcher.

Push notifications work best when they’re selective. Set alerts for moves bigger than 10% in your major holdings, technical breakouts in coins you’re watching, or when your portfolio value hits important levels. Skip the alerts for every 2% wiggle – those will just train you to ignore all notifications.

Here’s a psychological tip: Don’t set alerts at round numbers like $100,000 for Bitcoin. Everyone else does that too, which creates artificial trading activity that triggers false signals. Instead, focus on meaningful technical levels that actually indicate trend changes.

Portfolio snapshot widgets on your home screen show your total value without opening any apps. This passive approach helps you stay aware of your investments without falling into the rabbit hole of constant checking. It’s like glancing at your watch versus staring at a clock.

Finances 4You Mobile: Crypto Price on the Move

Our mobile app focuses on what you actually need to know, not flashy charts that look impressive but don’t help your decision-making. Clean interface, fast loading, and smart alerts – that’s it.

The exchange sync feature connects to your actual holdings using read-only API keys. This means you’re tracking real performance, not just wishful thinking about coins you’re considering. It’s surprisingly motivating to see your actual numbers instead of theoretical portfolios.

Alert timing matters more than you might think. Our app lets you set immediate alerts for major moves (like 5% in an hour), daily summaries for broader trends, and weekly digests for the big picture. You can even customize thresholds based on how much you have invested in each coin.

Sleep mode intelligence silences most alerts during your specified sleep hours, but lets truly emergency notifications (like 20% portfolio swings) break through. Because let’s be honest – you don’t need to know about a 3% Ethereum move at 2 AM, but you might want to know if your portfolio just dropped 20%.

The app integrates with our wealth management tools, so crypto price tracking feels natural alongside your other financial planning. No need to juggle multiple apps or lose sight of how crypto fits into your bigger financial picture.

Setting Up SMS & Email Triggers for Any Crypto Price Level

Sometimes your phone dies, or you’re in a meeting, or you just want backup communication. SMS and email triggers provide that extra layer of reliability when crypto markets are moving fast.

Webhook integration gets technical, but it’s worth understanding if you’re serious about tracking. You can connect alerts to Discord, Slack, or Telegram for team coordination. This works great for investment clubs or families managing crypto together.

The most valuable alerts often relate to risk, not opportunity. When your crypto allocation grows beyond your target percentage (because prices went up), rebalancing alerts help you maintain your intended asset mix. It’s easy to let a 5% crypto allocation become 15% when prices surge.

Quick Setup Guide: Get Your Crypto Price Pinged in Under 5 Minutes

Account creation takes 30 seconds – just email verification, no complex identity checks for basic price tracking. Watchlist setup takes 2 minutes – start with Bitcoin, Ethereum, and 3-5 altcoins you’ve actually researched.

Alert configuration is the important part – spend 2 minutes setting percentage-based alerts rather than fixed prices. As crypto prices change over time, percentage alerts adapt automatically. A $5,000 Bitcoin move means something different when Bitcoin is at $50,000 versus $100,000.

Security verification takes 30 seconds but saves you from potential headaches later. Enable two-factor authentication even for tracking accounts. Good security habits in crypto aren’t optional – they’re essential.

Remember the golden rules: Never share private keys with any tracking app, use read-only connections when linking exchanges, and regularly review which applications have access to your accounts. Even price tracking can become a security risk if you’re not careful about permissions.

Browser Extensions & Widgets for One-Click Crypto Price Checks

Gone are the days of constantly switching tabs to check crypto price movements. Browser extensions bring market data directly into your workflow, letting you stay informed while focusing on your career or other wealth-building activities.

The smartest extensions understand that you need market awareness without constant distraction. They deliver crypto price updates seamlessly, whether you’re researching investments, working on your side hustle, or planning your financial future.

Chrome plugins come in several flavors, each serving different needs. Ticker bars scroll prices across your toolbar, perfect for passive monitoring during work hours. New tab dashboards transform every blank tab into a market overview – genius for those of us who open dozens of tabs daily. Quick popup widgets appear with a simple hover or click, ideal when you need instant price checks without losing focus.

Dark mode options deserve special mention. If you’re like most professionals spending long hours researching investments or managing your portfolio after work, easy-on-the-eyes interfaces make a real difference during those late-night wealth-building sessions.

The key is finding extensions that improve your financial awareness without becoming productivity vampires. The best ones update crypto prices every 60 seconds – frequent enough to catch major moves, but not so aggressive that they drain your computer’s resources.

When configuring any extension, Stablecoins Explained: The Bridge Between Crypto and Fiat can help you understand why showing both volatile crypto prices and stable reference points creates better context for decision-making.

Lightweight Tickers: Minimalist Crypto Price Feeds

Sometimes less really is more. Lightweight tickers focus on delivering essential crypto price information without the visual noise that can derail your productivity.

These minimalist tools typically limit displays to 3-5 coins maximum – forcing you to focus on what truly matters for your wealth-building strategy. Green and red color coding provides instant sentiment feedback, while percentage changes across multiple timeframes help you distinguish between temporary blips and meaningful trends.

The beauty of lightweight tickers lies in their click-through functionality. When something catches your eye, a simple click opens detailed charts for deeper analysis. This two-tier approach keeps your main workspace clean while providing access to comprehensive data when needed.

Resource usage matters more than you might think. Quality tickers consume less than 50MB of RAM and barely register on CPU usage. They achieve this efficiency by caching data locally and batching API requests – smart design that respects both your computer’s performance and our server resources.

For professionals juggling multiple priorities, these streamlined tools provide market awareness without the constant mental interruption that comes with information overload.

New-Tab Dashboards: Full Market View in Every Blank Tab

Here’s a productivity hack that feels almost too good to be true: new-tab dashboards turn every blank browser tab into a comprehensive crypto price overview. Since most of us open dozens of tabs throughout the day, this creates effortless market exposure.

The productivity benefits extend beyond simple convenience. You develop passive market awareness during regular work, eliminating the need to remember price-checking tasks. When researching investments or reading financial news, relevant market data appears automatically as part of your browsing flow.

Customizable layouts adapt to different use cases. Morning coffee might call for a broad market overview, while evening portfolio reviews benefit from detailed performance metrics. The best dashboards remember your preferences and adjust accordingly.

Smart data refresh strategies make these tools practical for daily use. Instead of continuously updating in the background (hello, battery drain), quality dashboards refresh when tabs become active. This preserves your laptop’s battery life while ensuring current information exactly when you need it.

The psychological impact shouldn’t be underestimated either. Regular exposure to crypto price movements helps build intuitive market sense over time. You start recognizing patterns and developing better timing instincts – valuable skills for any serious wealth builder.

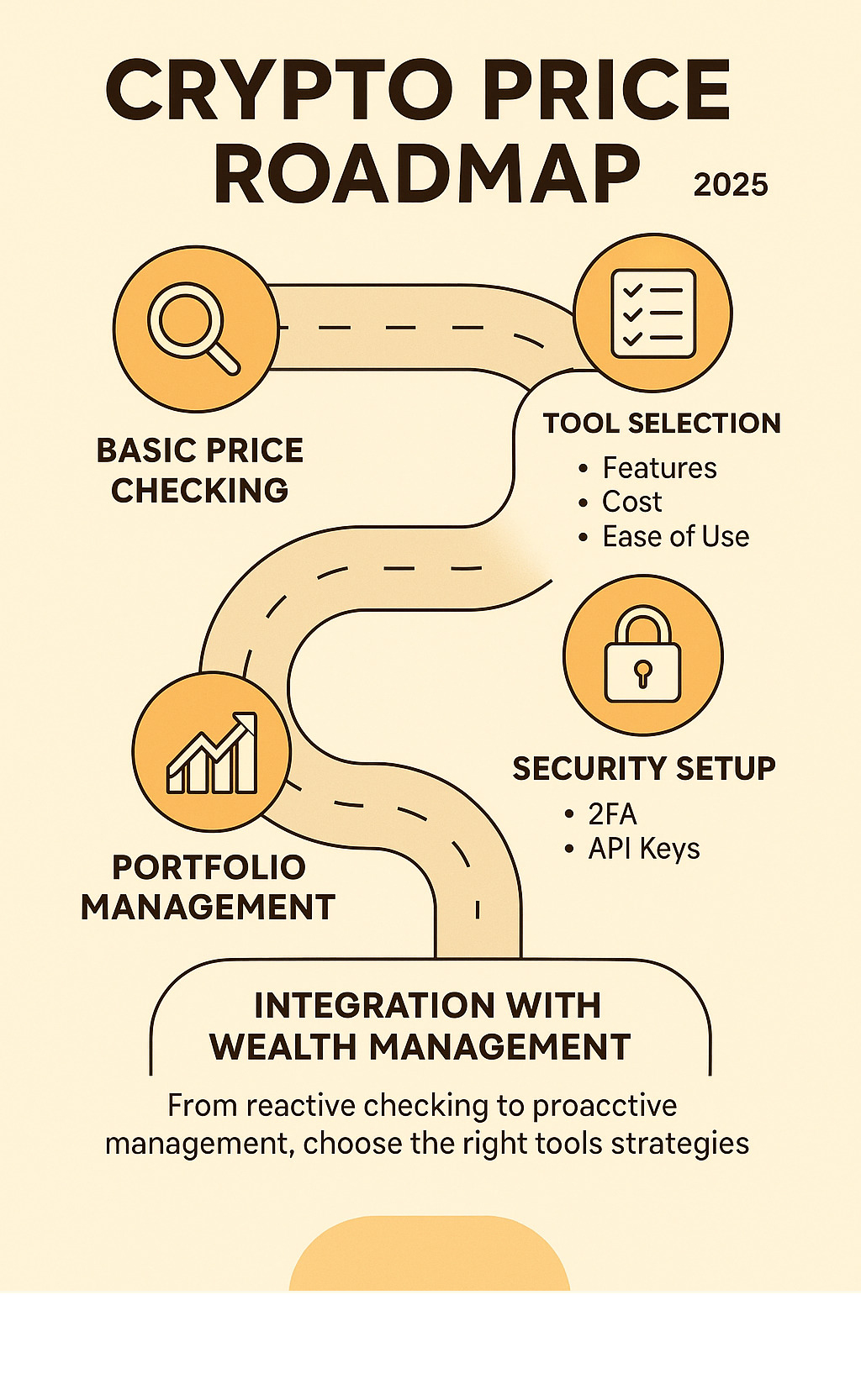

How to Choose the Right Crypto Price Tool

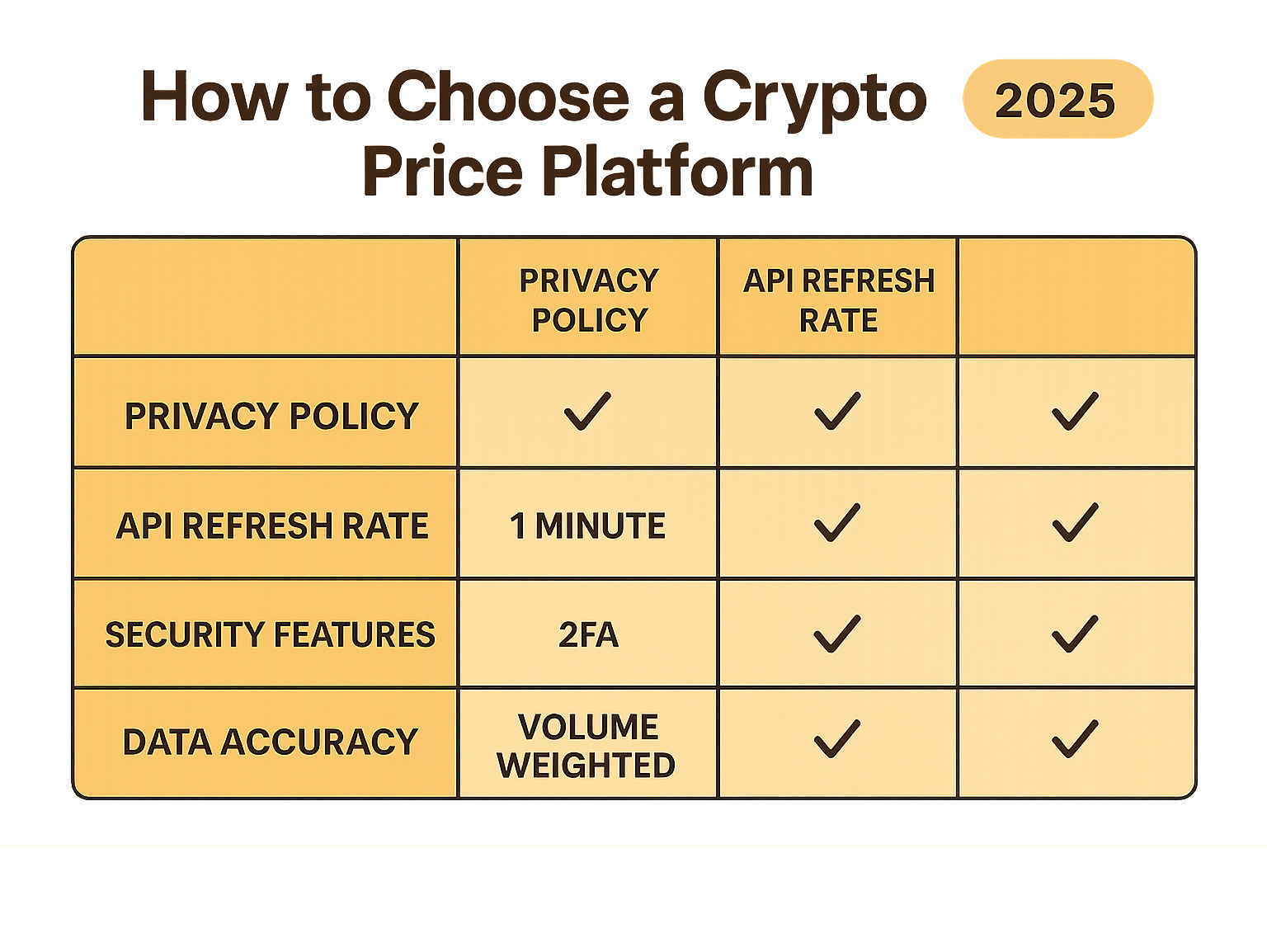

Finding the perfect crypto price tracking tool feels overwhelming when dozens of platforms promise “the best” data. After testing countless options, we’ve learned that the right choice depends on your specific needs and how crypto fits into your wealth-building journey.

Data accuracy should be your top priority. The best platforms pull information from multiple exchanges and use smart filters to remove fake trades and errors. When Bitcoin shows $107,899 on our dashboard, you can trust that price reflects real market activity, not manipulated data that could mislead your investment decisions.

Speed matters, but not always in the way you’d expect. Day traders need lightning-fast updates, while long-term wealth builders work perfectly fine with 30-second delays. If you’re checking prices once or twice daily as part of your broader financial planning, even 5-minute intervals provide sufficient accuracy.

Security layers become crucial when you’re tracking significant holdings. The platform you choose should offer read-only API connections, strong encryption, and clear privacy policies. Never compromise on security just to save a few dollars on subscription fees.

Supported coin coverage sounds impressive until you realize most platforms track thousands of obscure tokens you’ll never own. Focus on tools that accurately price Bitcoin, Ethereum, and the 20-50 established cryptocurrencies that align with serious wealth-building strategies.

Cost considerations often surprise newcomers. Free tiers typically provide excellent crypto price data with minor delays. Premium subscriptions add advanced alerts and portfolio analytics, but most wealth builders find free tools perfectly adequate for their needs.

The key is choosing tools that integrate smoothly with your existing financial planning routine. Crypto tracking should feel natural, not like a separate hobby that demands constant attention.

Must-Have Metrics Beyond Crypto Price: Market Cap, Volume & Sentiment

Crypto price tells only part of the story. Smart investors look deeper to understand what drives those numbers and whether movements represent genuine opportunities or temporary noise.

Market capitalization reveals the stability behind price movements. Bitcoin’s $2.14 trillion market cap means it takes massive money flows to move the price significantly. Compare that to smaller cryptocurrencies where a few million dollars can trigger 20% swings. Understanding this difference helps you position crypto appropriately within your age-appropriate wealth goals.

Trading volume acts like a truth detector for price movements. When Bitcoin rallies on its current $47.4 billion daily volume, that move carries more weight than a low-volume pump that could reverse quickly. Volume confirms whether institutional money is participating or if you’re seeing mostly retail speculation.

On-chain signals provide insider insights into what’s really happening. When large holders move coins to exchanges, selling pressure often follows. When coins flow off exchanges into private wallets, it suggests long-term holding confidence. These patterns help you time your own buying and selling decisions.

The Fear & Greed Index currently sits at 50 (neutral), combining volatility, momentum, social media chatter, and investor surveys. Extreme fear often creates buying opportunities for patient wealth builders, while extreme greed suggests taking some profits off the table.

Sentiment analysis matters because crypto markets are still heavily influenced by emotions and news cycles. Understanding whether current crypto price movements reflect fundamental changes or temporary reactions helps you avoid costly mistakes.

Our Crypto Investing 101 guide explains how these metrics work together to create a complete investment picture that aligns with your overall financial strategy.

Evaluating Data Sources: Centralized vs. Decentralized Feeds for Crypto Price

Where your crypto price data comes from matters more than most people realize. The source determines accuracy, speed, and reliability of the information driving your investment decisions.

Centralized exchanges provide the fastest, most liquid data. When you see Bitcoin at $107,899, that price likely comes from major exchanges like Coinbase, Binance, or Kraken. These platforms process billions in daily volume and offer institutional-grade infrastructure. The downside? Single points of failure and potential geographic restrictions during market stress.

Decentralized oracle networks offer censorship resistance and transparency but update more slowly and cost more to maintain. They’re excellent for DeFi applications but less practical for everyday crypto price tracking needs.

The best tracking platforms use weighted averages across multiple exchanges. This approach reduces the impact of any single exchange having technical issues while giving appropriate weight to venues with the highest genuine trading volume.

Anomaly detection becomes crucial during volatile periods. Quality platforms automatically filter out flash crashes from fat-finger trades, wash trading designed to inflate volume, and exchange-specific glitches that could mislead your analysis.

Smart crypto price tools also handle geographic discrepancies. When regulations or technical issues affect certain regions, prices can vary significantly between exchanges. Professional-grade platforms account for these differences to provide the most accurate global price picture.

Privacy & Security Checklist Before Linking Exchanges

Connecting your exchange accounts to crypto price tracking tools requires careful security planning. Even read-only access can expose sensitive portfolio information if not properly protected.

Read-only API keys should be your standard approach. Generate keys that allow viewing your balances and transaction history but never permit trading or withdrawals. Most quality tracking platforms only request read permissions anyway, but always verify before connecting.

Two-factor authentication isn’t optional in crypto. Enable 2FA on both your exchange accounts and any tracking platforms you use. Authenticator apps provide better security than SMS, which can be compromised through SIM swapping attacks that specifically target crypto investors.

Regular security audits of your connected applications help maintain protection over time. Review your linked services monthly, rotate API keys quarterly, and immediately revoke access for any tools you no longer use actively.

Encryption standards matter when choosing tracking platforms. Look for AES-256 encryption for stored data and TLS 1.3 for transmission. Platforms that undergo third-party security audits provide additional confidence in their protection measures.

The goal is staying informed about your crypto price movements without creating unnecessary security vulnerabilities. A few extra minutes spent on proper setup can prevent costly security breaches down the road.

Frequently Asked Questions about Tracking Crypto Price

Let’s tackle the most common questions we hear from people just starting their crypto price tracking journey. These answers come from real experience helping thousands of investors build wealth with digital assets.

How often should I refresh a crypto price dashboard?

Here’s the honest truth: most people check crypto prices way too often for their own good. If you’re building long-term wealth, obsessing over minute-by-minute movements will drive you crazy and hurt your returns.

The sweet spot for most investors? Check prices 2-3 times daily – maybe once in the morning with your coffee, once during lunch, and once before bed. This keeps you informed without turning into a price-watching zombie.

Your investment timeline should guide your checking habits. Long-term holders building retirement wealth can honestly get away with weekly check-ins. Active investors might need to peek 3-4 times daily during market hours. Day traders obviously need real-time feeds, but that’s a completely different game with much higher stress levels.

Here’s what research actually shows: People who constantly refresh their portfolios tend to make worse decisions. They panic sell during dips and FOMO buy during peaks. The investors who check monthly or quarterly often outperform the obsessive checkers.

Bottom line? Set specific times to check prices, then close the apps. Your mental health and your portfolio will thank you.

Does moving coins off exchanges affect crypto price readings?

Moving your cryptocurrencies to a personal wallet won’t change the crypto price you see on tracking apps, but it does create some interesting market dynamics worth understanding.

The direct answer is no – prices on dashboards reflect exchange trading activity, and your personal wallet moves don’t impact those calculations. Whether your Bitcoin sits on Coinbase or in your hardware wallet, the market price stays the same.

But here’s where it gets interesting: When lots of people move coins off exchanges simultaneously, it can actually influence future price movements. Think of it like removing inventory from stores – less available supply can lead to higher prices when demand spikes.

Current market example: Ethereum exchange supply recently dropped to 17.1 million ETH from much higher levels. This often signals that holders are planning to keep their coins long-term rather than trade them. Less selling pressure can support higher prices over time.

The tracking quirk you should know: Most crypto price tools only see exchange-based trading. They miss the massive over-the-counter (OTC) trades where institutions buy and sell directly. Sometimes this creates temporary disconnects between the prices you see and what big players are actually paying.

For your wealth building: Moving coins to cold storage is generally smart for security, just don’t expect it to change the prices on your dashboard immediately.

What is the safest way to share my portfolio with a crypto price app?

This question keeps us up at night because we’ve seen too many people compromise their security for tracking convenience. Never, ever share your private keys or seed phrases with any tracking app – that’s like giving someone the keys to your house.

The safest approach? Start with manual entry. Yes, it’s more work to type in your holdings, but you maintain complete control over your security. Update your portfolio when you make trades or monthly for long-term holders.

If manual entry feels too tedious, read-only API keys are your next best option. Major exchanges let you generate view-only access that shows your balances without allowing trades or withdrawals. Think of it like giving someone permission to look through your window but not open up your door.

Here’s how to do API keys safely: Generate keys with viewing permissions only, restrict them to specific IP addresses when possible, and set expiration dates for automatic rotation. Never create keys that allow trading or withdrawals for tracking purposes.

Red flags that should make you run: Any app asking for private keys, seed phrases, or trading permissions just for portfolio tracking. Apps without clear privacy policies or encrypted data storage. Services that seem too good to be true usually are.

Pro tip from our experience: Use separate, smaller accounts for testing new tracking tools before connecting your main holdings. Enable two-factor authentication on everything crypto-related. And keep backup records of your holdings somewhere completely separate from any tracking app.

Remember: Convenience is nice, but losing your crypto to a security breach will ruin your wealth-building plans permanently. When in doubt, choose the more secure option.

Conclusion

Mastering crypto price tracking isn’t about becoming glued to your screen – it’s about building smart systems that keep you informed while you focus on what matters most in life. With the cryptocurrency market now worth $3.31 trillion and trading around the clock, having the right monitoring approach can make the difference between catching opportunities and missing them entirely.

The beauty of modern crypto price tracking lies in its ability to work quietly in the background. Set up your alerts once, choose tools that sync across your devices, and let technology handle the heavy lifting while you build wealth through your career and other investments.

Your tracking setup should feel effortless, not overwhelming. Start with basic dashboard bookmarks and mobile alerts for your core holdings. As you get comfortable, add browser extensions and more sophisticated portfolio integration. The goal isn’t to track every coin under the sun – it’s to stay informed about the assets that actually impact your net worth.

Security remains non-negotiable in this space. Those few extra minutes setting up two-factor authentication and using read-only API keys protect years of careful wealth building. Think of security measures as insurance policies – small efforts that prevent major headaches down the road.

At Finances 4You, we’ve seen how proper crypto price monitoring transforms scattered checking into strategic wealth management. When your crypto tracking integrates seamlessly with your broader financial picture, you make better decisions about allocation, rebalancing, and long-term planning.

The most successful crypto investors we work with aren’t the ones checking prices every five minutes. They’re the ones who set up smart systems, stick to their allocation targets, and let compound growth work its magic over time. Your crypto investments should improve your wealth-building journey, not hijack it.

Whether you’re in your 30s building your first serious portfolio or optimizing your investment strategy later in life, the right tracking tools help ensure crypto plays its proper role in your financial future. Start simple, stay secure, and remember that the best investment strategy is the one you can stick with consistently.

Ready to dive deeper into crypto’s role in your wealth-building strategy? Our Digital Currency Investment guide shows how digital assets can complement traditional approaches to building lasting financial security.