Why Crypto Wallets Are Essential for Digital Asset Security

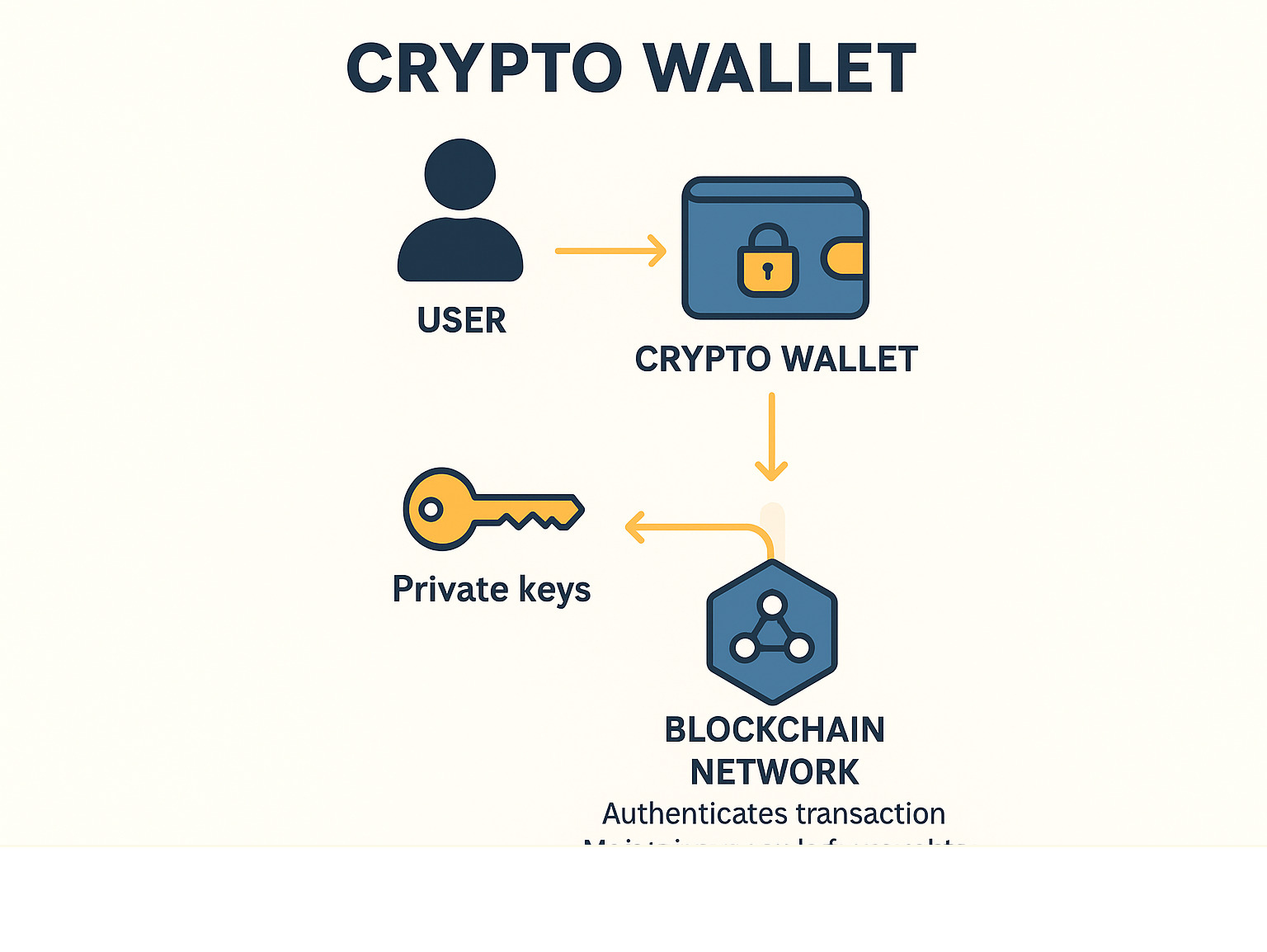

A crypto wallet is your digital vault that stores the private keys needed to access and manage your cryptocurrency holdings on the blockchain. Think of it as your personal bank account for digital assets – but instead of holding the coins themselves, it holds the cryptographic keys that prove you own them.

Quick Answer: What is a crypto wallet?

- Digital tool that stores your private keys and manages crypto transactions

- Self-custody option gives you full control over your funds (no bank needed)

- Security layer protects against hacks, theft, and unauthorized access

- Gateway to Web3 enables DeFi, NFTs, and decentralized app interactions

- Recovery system uses seed phrases to restore access if device is lost

The crypto landscape has exploded in recent years, with platforms like Trust Wallet now serving over 200 million users worldwide and MetaMask processing more than 5 billion transactions since 2021. But with this growth comes serious security risks.

The stakes are high. Unlike traditional bank accounts, crypto transactions are irreversible. Lose your private keys, and your digital assets are gone forever. Fall victim to a scam or hack, and there’s no customer service hotline to call for help.

This is where choosing the right wallet becomes critical. The wrong choice could leave your hard-earned crypto vulnerable to theft or permanently inaccessible. The right choice gives you secure, convenient access to the growing world of digital finance.

Important crypto wallet terms:

Crypto Wallet Basics: How They Keep Your Coins Safe

Think of a crypto wallet as your personal digital fortress. It doesn’t actually hold your cryptocurrency (that lives on the blockchain), but it guards the private keys that prove you own those digital assets.

Every wallet has two types of keys working together. Your public key is like your home address – safe to share with anyone who wants to send you crypto. Your private key is like the master key to your house. Anyone who gets hold of it can take everything.

The seed phrase is your wallet’s ultimate backup plan. This sequence of 12 or 24 random words can restore access to all your private keys if your device breaks or gets stolen. Write these words down on paper and treat them like gold.

Modern wallets wrap your private keys in AES encryption, the same military-grade protection used by banks and governments. Even if someone hacks your phone, they’d need your password to decrypt anything useful.

The big decision you’ll face is choosing between hot and cold storage. Hot wallets stay connected to the internet for convenience but face online threats. Cold wallets keep your keys completely offline, making them virtually hack-proof but less convenient for daily use.

Then there’s the custodial versus non-custodial choice. Custodial wallets manage your keys for you – convenient but you’re trusting someone else. Non-custodial wallets give you complete control, but with great power comes great responsibility.

More info about digital currencies

How a Crypto Wallet Works

Your crypto wallet is essentially a sophisticated key manager that talks to the blockchain. When you check your balance, your wallet queries the blockchain to see all transactions associated with your addresses.

When you want to send crypto, your wallet creates a transaction message with a digital signature created with your private key. This signature proves you have authority to spend those funds without revealing your private key. The blockchain verifies your signature and records the transaction permanently.

Setting Up Your First Crypto Wallet

Setting up your first crypto wallet is exciting but requires important security steps you can’t skip.

Download from official sources only – fake wallet apps are a favorite trick of scammers. When you first open your wallet, it will generate your seed phrase. Write down every word in the exact order shown, preferably on paper. Don’t screenshot it or store it digitally.

Most wallets will test you by asking you to verify your backup. This ensures you actually wrote them down correctly. Enable two-factor authentication immediately for wallets that offer it.

Start small when testing your new wallet. Send yourself a tiny amount first to make sure everything works correctly.

Types of Wallets & How to Pick the Right One

Choosing the right crypto wallet can feel overwhelming with so many options available. Think of it like picking a car – you wouldn’t choose a sports car for hauling furniture, just like you wouldn’t use a cold storage wallet for daily trading.

Hardware wallets are the Fort Knox of crypto storage. These physical devices keep your private keys completely offline and are perfect for storing larger amounts you don’t plan to touch frequently. Many hardware wallets now support staking for popular cryptocurrencies.

Mobile wallets are your crypto companion for everyday life. They’re incredibly convenient for daily transactions or jumping into DeFi opportunities while you’re on the go. Modern mobile wallets support over 100 blockchains and millions of digital assets.

Desktop wallets give you the full crypto experience on your computer. They’re ideal for serious traders who need detailed portfolio tracking and larger screens for managing complex transactions.

Browser extension wallets are your gateway to Web3. They seamlessly connect your browser to decentralized applications, making them essential for NFT collectors and DeFi enthusiasts.

The smart money often uses a hybrid approach. Keep small amounts in hot wallets for convenience while storing the bulk of your holdings in cold storage.

Hot vs. Cold Storage

The hot versus cold storage debate is about choosing between convenience and security.

Hot wallets are always connected to the internet, making them incredibly convenient but potentially vulnerable to online attacks. They’re perfect when you need quick access for trading or interacting with DeFi applications.

Cold wallets keep your private keys completely offline, making them virtually immune to hacking attempts. They’re your best friend for long-term storage of significant amounts.

Most savvy crypto users use a “hot-cold” strategy – keeping small amounts in hot wallets for daily activities while storing the majority in cold storage.

Custodial vs. Self-Custody

The custodial versus self-custody decision is fundamentally about control and responsibility.

Custodial wallets work like traditional bank accounts. A trusted third party manages your private keys and provides customer support when things go wrong. They offer professional security management and account recovery options.

Self-custody wallets put you in the driver’s seat. You control your private keys completely, which means no risk of a third party freezing your account. You get access to the full range of DeFi applications and true ownership of your digital assets. The downside? If you lose your seed phrase, there’s no customer service to call.

Choosing the Best Match

Finding your perfect crypto wallet match requires honest self-assessment. Consider your technical comfort level, investment goals, and how you plan to use crypto.

Asset diversity is crucial if you’re planning to explore beyond Bitcoin and Ethereum. Look for wallets supporting 50+ blockchain networks rather than single-currency solutions.

Staking goals should influence your choice significantly. If you want to earn rewards on your holdings, choose wallets with built-in staking for major proof-of-stake tokens.

NFT plans require specific wallet features. NFT collectors need gallery views, cross-chain support, and seamless integration with major marketplaces.

DeFi access demands wallets with dApp browsers, swap aggregators, and real-time gas fee estimation.

Top Wallet Features to Compare in 2025

The crypto wallet landscape has transformed dramatically. What started as simple tools for sending and receiving digital assets have evolved into sophisticated financial platforms.

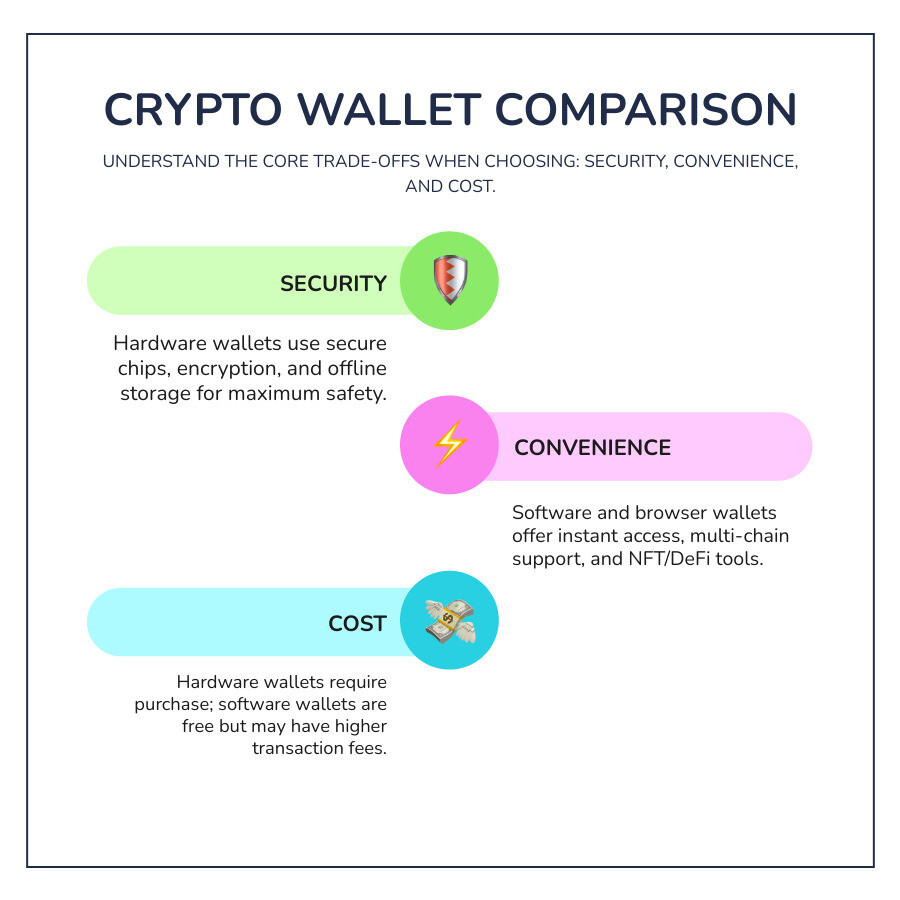

Security has taken center stage as the industry matures. Modern hardware wallets now come equipped with secure element chips – the same technology that protects your credit cards. These chips create an impenetrable fortress around your private keys.

Software wallets implement military-grade AES encryption alongside biometric authentication. Some even include real-time scam detection that analyzes transactions before you sign them.

The days of juggling multiple wallet apps are over thanks to comprehensive multi-chain support. Top-tier wallets now seamlessly handle 100+ different blockchains and millions of digital assets from a single interface.

Staking has become a wallet staple rather than an advanced feature. Users can now earn rewards on their holdings directly within their wallet interface, with many platforms offering auto-restaking to compound returns automatically.

For NFT enthusiasts, modern wallets provide gallery-style displays with rich metadata and direct marketplace integration.

DeFi integration has opened up entirely new possibilities. Built-in decentralized exchange aggregators find the best prices across multiple platforms, while integrated lending protocols let you earn yield or borrow against your holdings.

Security Deep Dive

When it comes to crypto wallet security, the stakes couldn’t be higher. Unlike traditional banking where mistakes can often be reversed, crypto transactions are permanent.

The foundation starts with encryption. AES-256 encryption protects your private keys when stored on devices. Hardware wallets take this further with secure element chips that create a tamper-resistant environment designed to self-destruct if someone tries to physically extract your keys.

Seed phrase protection represents one of the most critical security considerations. Innovative wallets now offer encrypted cloud backups that sync across your devices without ever exposing your actual seed phrase.

Phishing attacks have become increasingly sophisticated, prompting wallets to fight back with built-in intelligence systems. Advanced security scanners analyze every transaction before you approve it, checking addresses against known scam databases.

Convenience & Cost Considerations

Security means nothing if your crypto wallet is so difficult to use that you avoid it entirely. The challenge lies in balancing robust protection with everyday usability.

Understanding fee structures helps you make informed decisions. Software wallets typically cost nothing to download, though they may charge fees for premium features. Hardware wallets require upfront investment ranging from $49 to $500+.

Fiat on-ramps have revolutionized the user experience by enabling direct cryptocurrency purchases within wallet interfaces. The best platforms support multiple payment methods across 130+ countries.

User interface design significantly impacts daily usage satisfaction. Modern wallets prioritize intuitive navigation with customizable dashboards that adapt to your preferences.

Latest research on Bitcoin price swings

Best-Fit Wallet Recommendations by User Profile

Choosing the right crypto wallet isn’t one-size-fits-all. Your perfect wallet depends entirely on how you plan to use cryptocurrency. A day trader needs lightning-fast access to markets, while someone building long-term wealth prioritizes bulletproof security over convenience.

After helping thousands of people steer their crypto journey, we’ve identified distinct user profiles with specific needs. Understanding which category you fall into makes wallet selection much clearer.

Security-focused users treat their crypto like precious metals – locked away safely. Active users need their digital assets available instantly for trading and DeFi activities. Collectors and gamers require specialized features for managing NFTs and blockchain gaming assets.

Long-Term HODLers

If you’re building wealth by holding cryptocurrency for years, security trumps everything else. You’re essentially creating a digital treasure chest that needs to stay locked away from hackers and scammers.

Hardware wallets are your best friend here. These physical devices keep your private keys completely offline, making them virtually impossible to hack remotely. The secure element chip provides the same level of protection used in credit cards and passports.

Metal seed phrase backups might sound extreme, but they protect against house fires, floods, and other disasters that could destroy paper backups. Some HODLers even split their seed phrases across multiple secure locations for extra protection.

The key insight for long-term holders is treating your crypto wallet like a bank vault, not a checking account. You’ll sacrifice convenience for security, but that’s exactly what wealth preservation requires.

Active Traders & DeFi Users

Active traders and DeFi enthusiasts need instant access to markets, real-time price data, and seamless integration with decentralized applications. Every second counts when opportunities arise.

Mobile hot wallets excel here because they’re always connected and ready for action. The best ones support dozens of blockchain networks, letting you chase opportunities across different ecosystems.

Swap aggregators built into your wallet help you find the best prices across multiple exchanges instantly. Real-time gas fee estimation prevents you from overpaying during network congestion.

DeFi integration through built-in browsers lets you interact with lending protocols, yield farms, and liquidity pools directly from your wallet.

Most successful traders use a hybrid approach – keeping small amounts in hot wallets for daily activities while storing the majority of their wealth in cold storage.

NFT Collectors & Gamers

The world of digital collectibles and blockchain gaming demands specialized wallet features that traditional crypto users rarely need.

Gallery views with high-resolution displays let you actually enjoy your NFT collection instead of just seeing generic token symbols. The best wallets support audio and video NFTs too.

Cross-chain compatibility is crucial because NFTs exist across multiple blockchains. Scam detection protects you from malicious NFT contracts that could drain your wallet.

Marketplace integration lets you buy, sell, and trade NFTs directly from your wallet interface. Gaming-specific features like bulk transaction processing help when you’re making multiple in-game moves.

Many collectors start with mobile wallets for convenience but eventually move valuable NFTs to hardware wallets for long-term security.

Frequently Asked Questions about Crypto Wallets

What happens if I lose my seed phrase?

Losing your seed phrase is like losing the only key to a vault with no locksmith able to help you. Your crypto wallet becomes permanently inaccessible, and your digital assets are gone forever. There’s no “forgot password” button or customer service that can restore your access.

This is the reality of self-custody. Unlike traditional banks, blockchain technology is designed to be trustless and immutable. Your seed phrase is the only proof of ownership that exists.

Prevention is your only real protection. Write your seed phrase on paper immediately after wallet setup and store copies in multiple secure locations. Never store your seed phrase digitally – no screenshots, cloud storage, or password managers.

Can I use more than one wallet?

Absolutely! Using multiple wallets is actually a smart strategy that many experienced crypto users recommend. Think of it like having different bank accounts for different purposes.

Wallet diversification works similarly. You might use a mobile hot wallet for daily transactions and DeFi activities, while keeping the majority of your holdings in a hardware wallet for long-term storage.

Many users also maintain separate wallets for different activities. You might have one wallet for experimental DeFi protocols, another for established cryptocurrencies, and a third for NFT collecting.

Are crypto wallets free to use?

It depends on what type of crypto wallet you choose and how you use it. Many software wallets are completely free to download and use, while hardware wallets require an upfront investment ranging from around $50 to several hundred dollars.

Free software wallets include most mobile apps, desktop applications, and browser extensions. These wallets make money through optional services but the basic functionality costs nothing.

Hardware wallets require upfront cost for the physical device, but this one-time investment provides significantly improved security for your digital assets.

Beyond the wallet itself, you’ll encounter ongoing costs like network transaction fees that go to miners or validators, not to your wallet company. The most budget-friendly approach is starting with a free software wallet to learn the basics, then investing in a hardware wallet once your holdings reach a level where the security upgrade makes financial sense.

Conclusion

Choosing the right crypto wallet is one of the most important decisions you’ll make in your digital asset journey. It’s like picking the right safe for your valuables – except this safe also needs to be your gateway to an entirely new financial ecosystem.

The wallet you select will determine not only how secure your funds are, but also what opportunities you can access in the rapidly evolving world of decentralized finance. A hardware wallet might keep your Bitcoin perfectly safe, but it won’t help you participate in the latest DeFi protocols. A hot wallet gives you instant access to Web3 applications, but it also exposes you to online risks.

The beauty of crypto wallets lies in their flexibility. Unlike traditional banking, you’re not stuck with one institution’s limitations. You can use one crypto wallet for long-term savings, another for daily transactions, and a third for experimental DeFi activities.

At Finances 4You, we’ve seen how understanding crypto wallets has become crucial for young professionals building wealth in the digital age. With younger generations increasingly turning to cryptocurrency as an investment vehicle, proper wallet education becomes essential for financial success.

Your success depends on matching your wallet choice to your actual needs. Are you a long-term holder who checks prices once a month? A hardware wallet with proper backup procedures will serve you well. Are you actively trading and exploring DeFi opportunities? You’ll need a mobile wallet with advanced features and multi-chain support.

The most successful crypto users follow a simple pattern: they start small, learn thoroughly, and gradually expand their involvement. They understand that being your own bank means taking responsibility for security, but they also recognize the incredible opportunities this responsibility opens up.

The best crypto wallet is ultimately the one you understand completely and use correctly. Whether that’s a simple mobile app or a sophisticated hardware device depends entirely on your goals, technical comfort level, and risk tolerance. Take the time to make an informed choice – your future financial freedom may depend on it.