Why Cryptocurrency Trading for Beginners is Taking Off in 2025

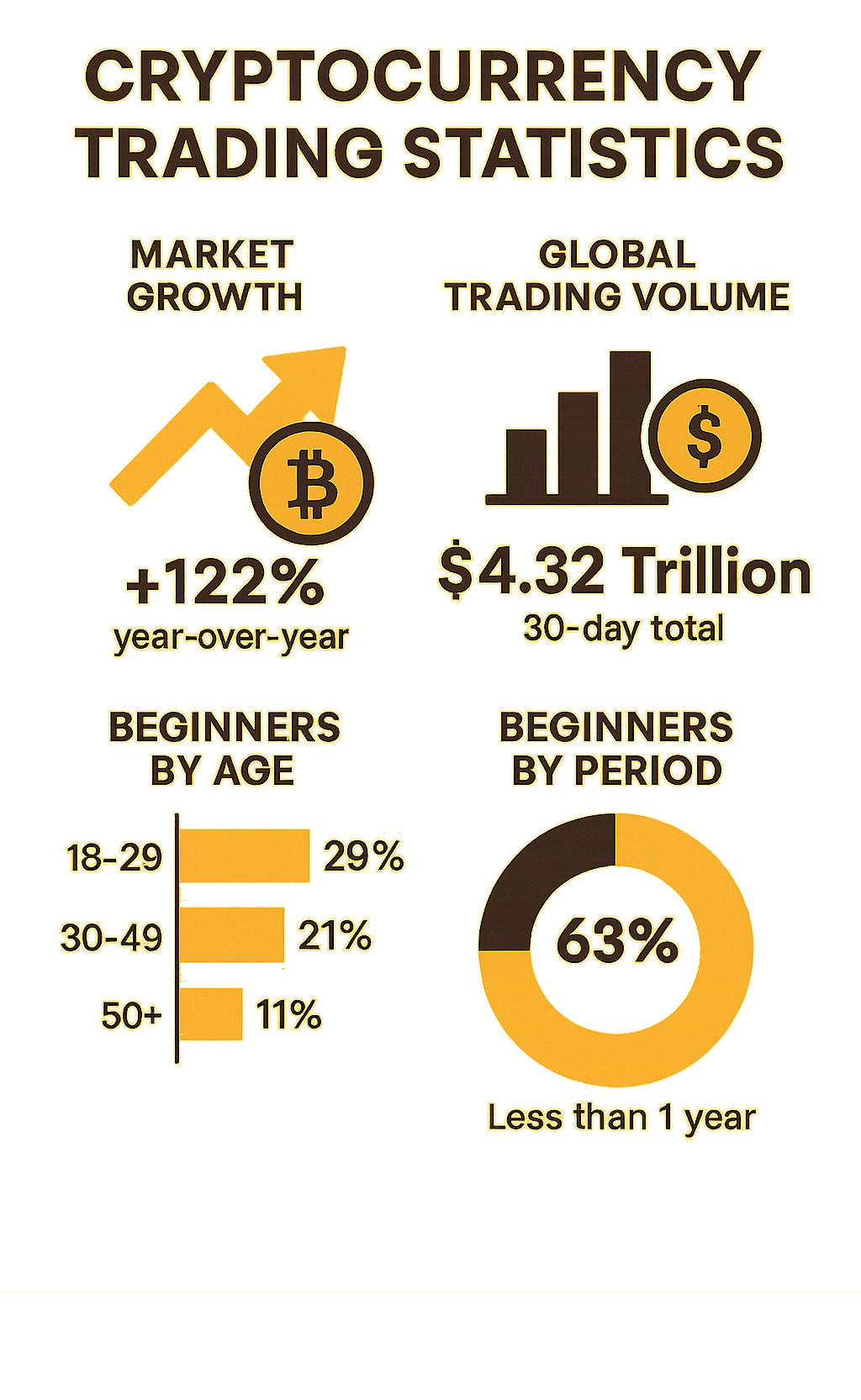

Cryptocurrency trading for beginners has exploded in popularity, with crypto trading seeing 122% growth year-over-year according to Forbes. Unlike traditional markets that close after hours, crypto operates 24/7, giving you the flexibility to trade around your work schedule.

Quick Start Guide for Beginners:

- Choose a regulated exchange (look for CSA-registered platforms in Canada)

- Set up a secure wallet for storing your digital assets

- Start small – you can begin with as little as $100

- Learn the basics – understand trading pairs, order types, and market analysis

- Practice risk management – never invest more than you can afford to lose

The appeal is clear: some cryptocurrencies have shown exponential growth that far exceeds traditional investments. Bitcoin has outperformed nearly all asset classes over the past several years, with thousands of cryptocurrencies available.

But here’s the reality – cryptocurrency is generally considered more risky than traditional investments like real estate or stocks. The markets are highly volatile, and 63% of retail investor accounts lose money when trading CFDs according to industry data.

The key is understanding that crypto trading requires education, discipline, and proper risk management. This guide will walk you through everything you need to know to start trading safely and build wealth effectively.

Cryptocurrency trading for beginners definitions:

– crypto market

– crypto calculator

– cold wallet crypto

Cryptocurrency Trading for Beginners: Core Concepts

Think of cryptocurrency as digital money that lives on the internet. Unlike the dollars in your bank account, crypto operates on blockchain technology – a tamper-proof ledger copied across thousands of computers worldwide. Every transaction gets recorded permanently, and no single person or government controls it.

What is cryptocurrency trading?

Cryptocurrency trading for beginners starts with understanding what you’re actually doing when you buy and sell these digital assets. Simply put, you’re trying to profit from price movements – buying low and selling high.

The key difference? Cryptocurrencies are decentralized, operating on peer-to-peer networks without banks or governments calling the shots. When you trade crypto, you’re speculating on whether Bitcoin, Ethereum, or other digital currencies will go up or down in value.

You have two main options. Spot trading means you actually own the cryptocurrency and can move it to your personal wallet. CFD trading lets you speculate on price movements without owning the underlying asset.

Most beginners should stick with spot trading because it’s straightforward and you actually own your digital assets.

Difference between trading and investing in crypto

Trading means you’re actively buying and selling over short periods – days, weeks, or months. Investing (often called “HODLing”) means buying and holding for years, believing your chosen cryptocurrencies will grow substantially over time.

| Trading | Investing |

|---|---|

| Short-term focus (days to months) | Long-term vision (years to decades) |

| Active buying and selling | Buy and hold strategy |

| Higher risk, potentially higher returns | Steadier approach with less stress |

| Requires significant time commitment | More passive, set-and-forget style |

Main types of crypto markets

Spot markets are where most beginners should start. When you buy Bitcoin on a spot exchange, you’re purchasing actual Bitcoin at current market prices.

Futures markets involve contracts to buy or sell crypto at predetermined prices on future dates. These use leverage and are not suitable for cryptocurrency trading for beginners.

Options markets give you the right to buy or sell at specific prices. Like futures, these are advanced instruments requiring significant experience.

Focus exclusively on spot trading until you’ve mastered the basics.

Step-by-Step Guide: How to Start Trading Cryptocurrency as a Beginner

Now let’s walk through the practical steps to start your crypto trading journey. We’ll break this down into manageable phases that build upon each other.

1. Choose a reputable exchange or platform

Think of choosing a crypto exchange like picking a bank – you want one that’s trustworthy, secure, and won’t disappear with your money. For cryptocurrency trading for beginners, this decision sets the foundation for your entire trading journey.

Security should be your top priority. Look for exchanges registered with the Canadian Securities Administrators (CSA) if you’re trading in Canada. These platforms follow strict regulatory standards under Canada’s securities and futures laws.

Fees can eat into your profits quickly. Some exchanges charge as little as 0.1% per trade, while others hit you with 1-3% fees. Don’t just look at trading fees – check deposit and withdrawal costs too.

Liquidity matters more than beginners realize. High liquidity means lots of buyers and sellers, so you can trade quickly without moving prices against yourself. Look for exchanges with high daily trading volumes.

The user interface can make or break your experience. You want a platform that doesn’t require a computer science degree to steer. Many exchanges offer both simple and advanced views – start with the basic interface.

Make sure they have the coins you want. While every major exchange supports Bitcoin and Ethereum, altcoin selection varies dramatically.

The cheapest option isn’t always the best. A slightly higher fee is worth paying for better security and peace of mind.

2. Set up and secure your wallet

Think of your crypto wallet as your digital bank account, but with one crucial difference – you’re completely responsible for keeping it safe. Unlike traditional banks, there’s no customer service to call if you lose access.

Cryptocurrency trading for beginners requires understanding two main wallet types.

Hot wallets stay connected to the internet, making them perfect for active trading. They’re convenient for daily use, but you wouldn’t store large amounts there. Most exchanges provide hot wallets automatically.

Cold wallets are your crypto’s safe deposit box. These hardware devices stay completely offline, making them nearly impossible to hack. For significant amounts, cold storage is essential.

Here’s the reality: lose your private keys, lose your crypto forever. Your seed phrase (usually 12-24 words) is the master key to everything you own.

For detailed security guidance, check our Cold Wallet Crypto guide.

Your security checklist: Enable two-factor authentication, back up your seed phrase offline (never digitally), use unique passwords, and keep wallet software updated.

Most beginners keep everything on exchanges. That’s fine for small amounts, but as your portfolio grows, moving the majority to cold storage becomes essential.

3. Fund your account & place your first trade

Now comes the exciting part – funding your account and making your first cryptocurrency purchase!

Getting money into your exchange is straightforward. Bank transfers are usually cheapest but take 1-3 business days. Credit or debit cards offer instant deposits but cost more (2-4% extra). Many Canadian exchanges accept e-transfers, balancing speed and cost.

Cryptocurrency trading for beginners gets interesting with trading pairs. Everything trades in pairs, like BTC/CAD (Bitcoin priced in Canadian dollars). The first currency is what you’re buying/selling, the second is what you’re paying with.

Your first trade should be simple – stick with Bitcoin or Ethereum paired with Canadian dollars. These have the highest liquidity and tightest spreads.

Order types serve different purposes. Market orders execute immediately at current prices. Limit orders let you set exact prices but may not fill. Stop-loss orders automatically sell if prices drop to specified levels – essential safety nets.

Consider Dollar-Cost Averaging (DCA) – buying smaller amounts regularly instead of investing everything at once. This smooths out price swings and removes timing pressure.

For deeper insights, check our Crypto Investing 101 guide.

4. Record keeping & taxes for crypto traders

Cryptocurrency trading for beginners often overlook this: every crypto transaction has potential tax implications, including trading Bitcoin for Ethereum.

The Canada Revenue Agency considers crypto transactions taxable events. According to the CRA, tax treatment depends on your trading activity.

Capital gains treatment applies when buying and holding as investments. Only 50% of gains are taxable – the same as stocks.

Business income treatment applies to active trading. Here, 100% of gains become taxable as regular income. The CRA considers trading frequency, market knowledge, and whether it supplements regular income.

Record-keeping must be bulletproof. Every transaction needs documentation: date, transaction type, amounts, Canadian dollar value, purpose, and exchange information.

Trading one cryptocurrency for another counts as a taxable event. If you bought Bitcoin at $50,000 CAD and traded it for Ethereum when Bitcoin was $60,000 CAD, you’ve realized a $10,000 capital gain.

Many traders use specialized tax software connecting to exchanges for automatic calculations. Start tracking from day one – reconstructing months of activity during tax season is nobody’s idea of fun.

Essential Strategies & Market Analysis for Cryptocurrency Trading for Beginners

Cryptocurrency trading for beginners can start with simple strategies that actually work. Think of market analysis like learning to drive – start with basics before tackling complex maneuvers.

Technical analysis basics for beginners

Technical analysis is reading the story that price charts tell you. Every candlestick represents real people buying and selling.

Support and resistance levels are your best friends. Support acts like a floor catching falling prices, while resistance is a ceiling stopping rises. When Bitcoin repeatedly bounces off $40,000, that’s support.

Trend lines help you see the bigger picture. Draw lines connecting higher lows in uptrends or lower highs in downtrends.

Volume tells you how many people participate in price movements. High volume during increases suggests strong conviction.

RSI (Relative Strength Index) acts like a fever thermometer. Above 70 might indicate “overbought” conditions, below 30 suggests “oversold.”

Moving averages smooth out noise and show underlying trends.

Fundamental & on-chain metrics

While charts show price action, fundamental analysis reveals why it’s happening.

Read the whitepaper – the project’s business plan. Does it solve real problems? Look at the team – would you trust them in traditional business?

Tokenomics – how the cryptocurrency’s economics work – can make or break investments. Some coins have unlimited supply (potentially inflationary), others have fixed caps (potentially deflationary).

On-chain metrics give insights traditional markets can’t offer. You can see network usage, value transfers, and adoption trends.

Popular strategies for cryptocurrency trading for beginners

Dollar-Cost Averaging (DCA) removes timing stress. Buy fixed amounts regularly instead of agonizing over perfect prices.

Range trading works when markets move sideways. Buy near range bottoms, sell near tops.

Trend following accepts “the trend is your friend.” Ride strong trends until clear reversal signs appear.

HODL strategy sometimes means the best action is no action, especially for quality long-term projects.

For market insights, check our Cryptocurrency Trends analysis.

No strategy works 100% of the time. Find approaches matching your personality, schedule, and risk tolerance.

Risk Management & Security Best Practices

Cryptocurrency trading for beginners can be rewarding, but many lose money. The difference between success and disaster often comes down to risk management and asset protection.

Managing risk when trading cryptocurrency for beginners

The golden rule: never risk more than you can afford to lose completely.

Position sizing is your first defense. Professional traders follow the 1% rule, risking only 1-2% of total capital per trade. With $10,000 to invest, risk just $100-200 per position.

Stop-loss orders are emotional safety nets. Set them before entering trades, not after losing money. If buying Bitcoin at $40,000, consider a stop-loss at $36,000.

Portfolio allocation requires discipline. Crypto should represent only 5-10% of your total investment portfolio.

The biggest enemy isn’t market volatility – it’s emotional control. Fear makes you sell at bottoms, greed makes you buy at tops.

Storing and protecting your digital assets

Your seed phrase is literally worth its weight in gold. These 12-24 words are master keys to your crypto fortune. Write them on paper (never store digitally) and keep in secure locations like fireproof safes.

Multi-signature wallets require multiple signatures for transactions. More complex but invaluable for larger holdings.

Backup strategies should be redundant and geographically distributed. Create multiple copies stored in different secure locations.

Common mistakes beginners make

Over-leveraging turns small losses into catastrophic ones. Using borrowed money amplifies both gains and losses.

Ignoring fees creates death by a thousand cuts. Trading, withdrawal, and network fees add up quickly.

FOMO (Fear of Missing Out) turns rational people into emotional buyers. Chasing rising prices often means buying at peaks.

Neglecting security until too late is tragically common. Learn about crypto investment scams before becoming a victim.

In crypto trading, your first job isn’t making money – it’s not losing money. Master risk management first, profits follow naturally.

Frequently Asked Questions about Cryptocurrency Trading for Beginners

What factors move crypto prices?

Supply and demand forms the foundation. Bitcoin’s 21 million coin cap creates scarcity. When more people want to buy than sell, prices rise. Crypto markets are smaller than traditional ones, so modest demand changes create dramatic swings.

Market sentiment acts like crypto’s emotional heartbeat. A single tweet or news about country adoption can send prices soaring or crashing within hours.

Regulatory announcements shake entire markets overnight. Crypto-friendly policies typically surge prices as confidence grows. Ban discussions trigger massive selloffs.

Institutional adoption brings legitimacy and massive buying power. When companies like Tesla add Bitcoin to balance sheets, it signals mainstream acceptance.

Technical developments within networks significantly impact prices. Major upgrades drive prices higher, while security breaches cause sharp declines.

How much money do I need to start trading?

You can begin cryptocurrency trading for beginners with as little as $100 for learning, but let’s discuss practical amounts.

Starting with $100-500 is fine for education. You’ll gain hands-on experience without risking significant money.

The $1,000-5,000 range provides more flexibility. You can diversify across cryptocurrencies and trading fees become less burdensome. When paying $5 fees on $100 trades, that’s 5% gone before starting. The same fee on $1,000 trades is just 0.5%.

Remember: only invest money you can afford to lose completely. Your crypto investment should never be money needed for rent, groceries, or emergencies.

Is cryptocurrency trading legal and taxable?

Yes, cryptocurrency trading for beginners is completely legal in Canada, but tax implications are complex.

Legal landscape in Canada is crypto-friendly. You can buy, sell, and trade without legal concerns. Exchanges must register with provincial securities regulators, protecting traders through compliance standards.

Tax treatment is where complexity arises. The CRA views crypto as property, making every sale, trade, or purchase potentially taxable.

The CRA determines if you’re investing or running a business. Long-term holding typically qualifies for capital gains tax on 50% of profits. Active trading might be considered business income, making 100% taxable.

Record keeping isn’t optional. Track every transaction: date, amount, Canadian dollar value, and purpose. This includes trades between cryptocurrencies.

The CRA website provides detailed crypto taxation guidance.

Conclusion

Cryptocurrency trading for beginners offers exciting opportunities but requires education, discipline, and proper risk management. The 122% year-over-year growth shows this market’s potential, but 63% of retail accounts lose money.

Key takeaways for your crypto trading journey:

- Start small and learn continuously – Begin with amounts you can afford to lose

- Prioritize security – Use reputable exchanges, secure wallets, and strong authentication

- Develop a trading plan – Define goals, risk tolerance, and strategies before trading

- Manage risk religiously – Use stop-losses, position sizing, and portfolio allocation

- Stay informed – Follow market trends and regulatory changes

At Finances 4You, we believe in aligning investment strategies with your age group and financial goals. Cryptocurrency can be part of a diversified portfolio, but shouldn’t dominate your wealth-building strategy, especially as a beginner.

The crypto market operates 24/7, offering flexibility traditional markets can’t match. However, this means constant volatility and the need for disciplined risk management. Start with our recommended approach: choose a regulated exchange, secure your assets properly, and begin with small positions while learning.

Every successful trader was once a beginner. Focus on building knowledge, developing good habits, and protecting your capital. The opportunities in cryptocurrency are significant, but they reward prepared and disciplined traders.

For comprehensive guidance on digital asset investing, check our detailed guide on How to Safely Invest in Digital Currencies. You can also explore our Crypto Investing 101 for foundational investment principles.

The cryptocurrency revolution is just beginning, and with proper education and risk management, you can participate safely and potentially profitably. Start small, learn continuously, and remember that building wealth is a marathon, not a sprint.