What’s the Real Difference? Emergency Fund vs Savings Explained

Looking for a quick answer about emergency fund vs savings? Here’s what you need to know:

| Feature | Emergency Fund | Regular Savings |

|---|---|---|

| Purpose | Unexpected emergencies only (job loss, medical bills, urgent repairs) | Planned purchases and financial goals |

| Typical Amount | 3-6 months of essential expenses ($500-$1,000 to start) | Varies based on your specific goals |

| Access Needed | Immediate, penalty-free access | Can be less liquid depending on timeline |

| Best Account Type | High-yield savings account, separate from checking | Various options based on goal timeline |

| When to Use | Only for true financial emergencies | When you reach your planned savings goal |

We’ve all been there – the car breaks down, the refrigerator stops working, or worse, a sudden job loss threatens your financial stability. These moments highlight why understanding the emergency fund vs savings difference matters for your financial health.

An emergency fund is your financial safety net – money set aside specifically for unexpected expenses that could otherwise derail your finances. A savings account, on the other hand, is where you build funds for planned future goals like vacations, a down payment on a house, or a new car.

Less than half (43%) of Americans have enough money saved to cover a surprise $1,000 expense. Without a proper emergency fund, many people turn to credit cards or loans, creating a cycle of debt that’s hard to escape.

Think of your emergency fund as insurance for your financial life – you hope you won’t need it, but you’ll be incredibly grateful it exists when an unexpected expense arrives. Your regular savings, meanwhile, represents your dreams and aspirations – the positive financial milestones you’re working toward.

The key difference? Emergency funds are for the unexpected things you hope won’t happen. Savings accounts are for the expected things you’re actively planning for.

Important Emergency fund vs savings terms:

– Building emergency savings

– Emergency savings challenge

Emergency fund vs savings: The Quick Breakdown

When it comes to emergency fund vs savings, think of them as two essential tools in your financial toolkit – each designed for a specific purpose in your money journey.

Your emergency fund works like a financial umbrella – it’s there to protect you when life unexpectedly pours down expenses. This money is reserved strictly for genuine emergencies: situations that catch you off guard, demand immediate attention, and simply can’t wait.

Regular savings, on the other hand, functions more like a roadmap guiding you toward your financial dreams – whether that’s lounging on a tropical beach, driving away in a new car, putting a down payment on a home, or enjoying a comfortable retirement. These are the planned expenses you’re actively and excitedly working toward.

“An Emergency Fund is a buffer between you and financial disaster when the unexpected happens,” explains financial expert Claire Hunsaker. “It’s money you hope you’ll never need to use, but will be grateful to have if disaster strikes.”

The differences between these two types of funds go deeper than just their purpose:

Accessibility matters tremendously with emergency funds – they must be easily available, typically sitting in a high-yield savings account that allows immediate withdrawals without penalties. Your goal-based savings can live in less liquid accounts depending on your timeline.

Growth potential varies too. Since emergency funds need to be accessible, they typically earn modest returns compared to longer-term savings that can be invested more aggressively.

Usage rules differ significantly. Emergency funds come with strict criteria (we’ll cover what qualifies as a true emergency shortly), while savings accounts are joyfully emptied when you reach your target goal.

Why “Emergency fund vs savings” isn’t either/or

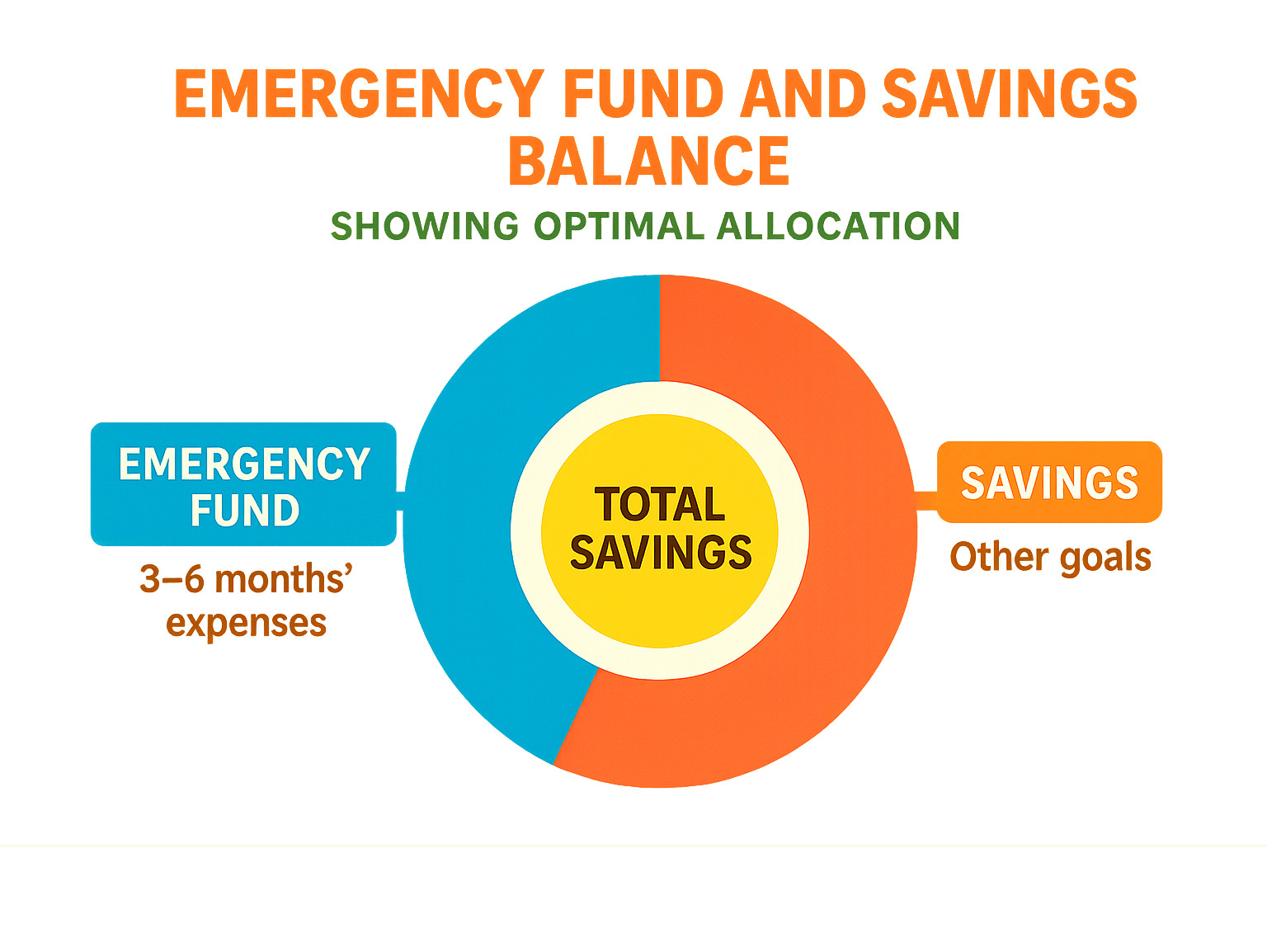

Here’s a critical point many people miss: the emergency fund vs savings question isn’t about choosing one over the other. You genuinely need both.

Think of your emergency fund as your financial foundation. It provides stability and security, letting you weather unexpected financial storms without derailing your other financial goals. Without this foundation, any financial shock could force you to raid the money you’ve been saving for important life milestones.

As one of our financial advisors puts it: “Without an emergency fund, your savings account becomes your emergency fund by default.”

Having separate funds for emergencies and planned expenses creates a dual-strategy approach that protects both your present security and your future dreams. With a solid emergency fund in place, you can confidently funnel money toward your savings goals knowing that an unexpected expense won’t force you to backtrack on your progress.

For more guidance on building your emergency savings, check out our helpful guide on Building Emergency Savings.

When to tap Emergency fund vs savings on a rough day

Knowing exactly when to use each fund is crucial for maintaining your financial health. At Finances 4You, we recommend using a simple “consequences-urgency test” to determine whether that expense warrants dipping into your emergency fund:

- Is it urgent? Does this expense need to be addressed immediately?

- What are the consequences? Would failing to pay this expense cause severe hardship or additional expenses down the road?

If you answer “yes” to both questions, it’s likely appropriate to use your emergency fund.

Let’s look at some real-world examples:

Car repair situations can be tricky. If your car is your only transportation to work and it breaks down, the repair is both urgent and carries severe consequences if not addressed – making it an emergency fund situation. But if you’re just upgrading your sound system? That’s a planned savings expense.

Medical bills from an unexpected hospital visit or essential medication are urgent and necessary for your health – definitely emergency fund appropriate.

Home repairs vary in urgency. A leaking roof that could cause extensive water damage? Reach for that emergency fund. Remodeling your kitchen because you’re tired of the old cabinets? That’s what your planned savings are for.

Vacation opportunities might feel urgent when a great last-minute travel deal pops up, but this is a want, not a need. Use your dedicated savings account, not your emergency fund.

Remember: Every time you dip into your emergency fund for non-emergencies, you’re leaving yourself vulnerable when actual emergencies strike. Keeping these funds separate isn’t just about organization – it’s about financial security and peace of mind.

What Counts as a True Emergency?

We’ve all experienced that heart-dropping moment—the blinking warning light on your car’s dashboard, the landlord’s urgent call about a broken water heater, or worse, that dreaded layoff notice arriving unexpectedly. These are precisely the moments when having an emergency fund vs savings becomes crystal clear.

A genuine financial emergency isn’t just any unexpected expense. It typically has three key characteristics that set it apart:

First, it catches you by surprise—you simply didn’t see it coming. Second, it demands immediate attention—waiting isn’t an option. Third, it’s absolutely necessary—ignoring it would create significant hardship or even more expensive problems down the road.

“Think of your emergency fund as financial first aid,” says money coach Sarah Thompson. “You don’t use bandages for paper cuts, and you shouldn’t tap emergency funds for minor inconveniences.”

Job loss or sudden income reduction represents one of the most common financial emergencies. This reality is particularly sobering when you consider that one-in-five Americans have absolutely no emergency savings whatsoever, while another 13.8% could barely cover a single month of expenses without their regular paycheck. Your emergency fund provides that crucial breathing room while you search for new employment.

Medical emergencies often strike without warning, and even with decent insurance, out-of-pocket costs can be staggering. A 2019 study revealed that medical issues contributed to a whopping 67% of all bankruptcies in the United States—a statistic that underscores why having medical emergency funds matters.

Major home repairs like a leaking roof, broken furnace in winter, or serious plumbing problems qualify as legitimate emergencies. These issues require immediate attention to prevent further damage and potentially much higher repair costs.

When your car is essential for getting to work, urgent repairs become a true emergency. Without transportation, your income source could be threatened, creating a cascade of financial problems.

Even emergency pet care often qualifies as a legitimate use of emergency funds. When your beloved companion is suffering, most pet owners consider those unexpected veterinary bills a necessary expense.

Financial expert Ariel Finegold makes a helpful distinction between “spending shocks” (smaller, more frequent surprises) and “income shocks” (rare but major disruptions like job loss). Your emergency fund needs to be prepared for both types of financial curveballs.

“Start by saving half a month’s expenses or $2,000—whichever is greater—to handle common spending shocks,” Finegold recommends. “Then work toward building 3-6 months of expenses for those larger income shocks that could derail your finances completely.”

According to Bankrate’s research, less than half (43%) of all Americans could cover an unexpected $1,000 expense from savings. This sobering statistic highlights why building an emergency fund should be a top financial priority.

Expenses that do NOT qualify

Just because something feels urgent doesn’t mean it’s a true emergency. Knowing when to resist the temptation to dip into your emergency fund is crucial for financial discipline.

Predictable expenses should never come from your emergency fund. Annual insurance premiums, property taxes, or regular car maintenance aren’t emergencies—they’re predictable costs you should budget for separately. As my grandmother used to say, “Christmas isn’t a surprise—it comes every December 25th!” Holiday gifts and seasonal shopping aren’t emergencies either.

That amazing “once-in-a-lifetime” sale on a new TV? Not an emergency. Limited-time deals may create a false sense of urgency, but they don’t constitute a true financial emergency.

Vacation costs should always come from dedicated vacation savings, not your emergency fund—even if it’s a spontaneous weekend getaway that “feels” urgent.

Those non-essential home upgrades you’ve been dreaming about—like new kitchen countertops or a bathroom renovation—aren’t emergencies, no matter how dated your current ones look.

Many financial experts make a helpful distinction between “rainy day funds” for smaller unexpected expenses (like minor repairs) and true emergency funds for major life disruptions. At Finances 4You, we often recommend having both types of funds to create a comprehensive financial safety net.

For better budgeting discipline, including planning for those predictable irregular expenses that often masquerade as emergencies, check out our Comprehensive Budget Worksheet. This tool helps you identify and prepare for expenses that might otherwise tempt you to raid your emergency fund inappropriately.

Setting Targets: How Much to Keep in Each Fund

When it comes to emergency fund vs savings, there’s no one-size-fits-all magic number. Your financial life is as unique as your fingerprint, and your safety nets should reflect that reality.

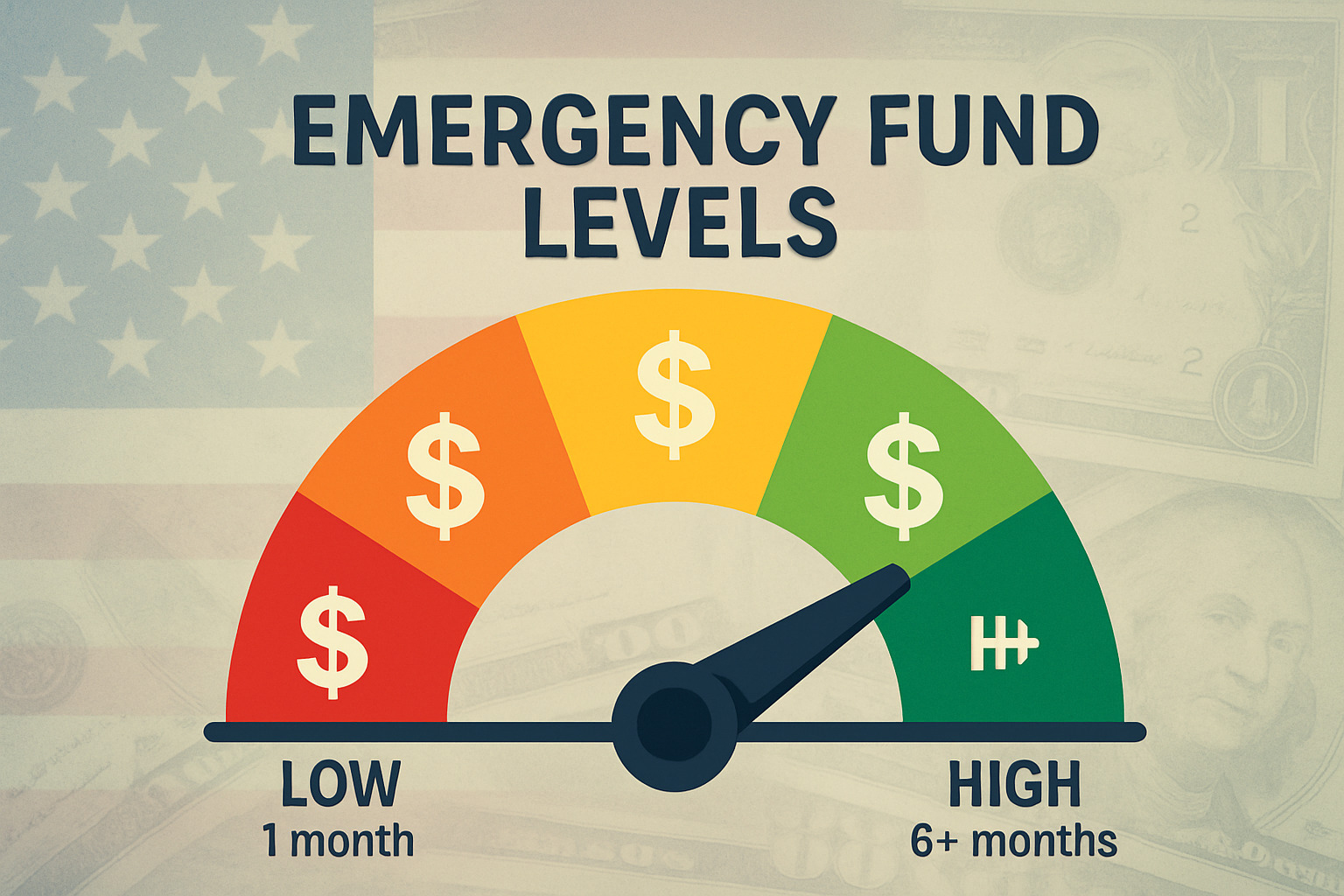

For emergency funds, you’ve probably heard the standard advice of saving 3-6 months of expenses. But let’s be real – your situation might call for something different. Think of it as custom-tailoring your financial safety net to fit your life perfectly.

“Many factors can affect savings needs,” explains financial expert Nicole Townsend. “Consider your personal situation when determining your target.”

Your ideal emergency cushion depends on several personal factors that only you can weigh:

Do you have dependents counting on your income? More mouths to feed means you’ll want a bigger buffer. Is your job stability rock-solid, or do you work in a volatile industry? Government employees might aim for the lower end (3 months), while freelancers or seasonal workers should shoot higher (6+ months). Does your income bounce around from month to month? Inconsistent paychecks call for more backup cash.

Your health coverage matters too. Great insurance might let you get by with slightly less emergency savings, while high-deductible plans suggest padding your fund a bit more. These aren’t just theoretical concerns – they’re the real-life factors that determine whether your safety net will actually catch you when you need it.

For your regular savings goals, the target is much more straightforward – it’s simply whatever your specific dreams cost. Whether you’re dreaming of a beach vacation, saving for a wedding that makes Pinterest jealous, or gathering a down payment for your first home, your savings target is directly tied to what you’re planning for.

Calculating your emergency-fund number

Let’s make this concrete. To figure out your personal emergency fund target:

First, add up what it costs to keep your life running for a month – just the essentials. We’re talking housing, utilities, groceries (not takeout), minimum debt payments, transportation, and insurance premiums. This is your monthly baseline.

Next, multiply that number by your personal risk factor (typically 3-6 months). If you’re the sole provider for your family with a variable income in an unpredictable industry, lean toward six months or even more. If you’re in a dual-income household with stable jobs and great benefits, three months might be sufficient.

Don’t let the final number overwhelm you! Many financial experts suggest starting with a mini emergency fund of $2,000 (or half a month’s expenses, whichever is greater) to handle common “spending shocks” like car repairs. Then gradually build toward your full target.

For example, if your essential monthly expenses total $3,000:

– Your starter emergency fund might be $2,000

– Your intermediate goal could be $9,000 (3 months)

– Your ultimate target might be $18,000 (6 months)

Ready to kick-start your emergency savings? Join our Emergency Savings Challenge for structure and motivation to reach your goals faster.

Mapping out savings goals & timelines

For your regular savings goals, clarity is your best friend. Instead of a vague “vacation fund,” get specific: “$3,000 for a trip to Italy next summer.” This specificity transforms abstract wishes into achievable targets.

The timeline makes all the difference here. A house down payment in five years requires a different monthly contribution than a wedding next fall. Simply divide your target amount by the number of months until you need the money.

For that $10,000 down payment two years from now? That’s $417 per month you’ll need to set aside ($10,000 ÷ 24 months). For a $3,000 vacation in eight months? That’s $375 monthly.

Many financial experts swear by “sinking funds” for these planned expenses – dedicated savings pots for specific goals. This approach keeps your money organized and prevents the temptation to dip into your emergency fund for non-emergencies.

By setting SMART goals (Specific, Measurable, Achievable, Relevant, Time-bound) for your savings, you transform vague financial wishes into concrete plans with clear action steps. This clarity not only makes your goals more achievable but also provides the satisfaction of watching your progress toward something meaningful.

Where to Park Your Cash for Safety + Growth

Finding the right home for your money is crucial when thinking about emergency fund vs savings. Where you keep each type of fund can make a big difference in both safety and growth potential.

Think of your accounts like different types of containers – some need to be easily opened at a moment’s notice (emergency funds), while others can be sealed up tight to earn more interest (planned savings). The good news? Both types should be protected by FDIC or NCUA insurance, which covers up to $250,000 per depositor per bank if something goes wrong.

The interest rate landscape in 2024 offers some nice opportunities. High-yield savings accounts are currently paying around 4.5% APY – that’s over ten times the national average of 0.42% for regular savings accounts! This difference might seem small at first glance, but it adds up significantly over time, especially when you’re trying to keep pace with inflation.

Best spots for your emergency fund

Your emergency fund has a specific job: being there when you need it most. This means it needs three key qualities:

First, it must be easily accessible – you don’t want to wait days or jump through hoops when facing a genuine emergency. Second, it needs to be completely safe from market ups and downs. And third, it should be separate from your everyday checking account to avoid the temptation of dipping into it for non-emergencies.

High-yield savings accounts make an excellent home for emergency funds. These online accounts offer that much higher interest rate we mentioned while still giving you quick access to your money. Most don’t require minimum balances or charge monthly fees, making them perfect for starting small.

Money market accounts offer another solid option. They typically pay competitive interest rates and come with check-writing privileges or debit cards for direct access when needed. Just watch out for minimum balance requirements, which tend to be higher than regular savings accounts.

Cash management accounts from brokerage firms blend checking and savings features with attractive interest rates. They’re becoming increasingly popular as one-stop solutions.

Financial expert Ariel Finegold puts it nicely: “Ease of account use and yield or return are the two main factors to consider. You want your emergency fund to be accessible within 1-2 business days at most.”

Many financial advisors, including our team at Finances 4You, recommend keeping your emergency fund at a completely different bank than your checking account. This creates a healthy psychological barrier – you’ll think twice before transferring money for something that isn’t truly an emergency.

For more strategies on managing your money effectively, our guide on Personal Budgeting offers practical tips and tools.

Best spots for planned savings

When it comes to your regular savings goals, your timeline should determine where you park your cash:

For short-term goals (under 1 year) like a vacation or holiday shopping fund, high-yield savings accounts or money market accounts still make the most sense. You’ll earn decent interest while maintaining easy access to your funds when the time comes.

For medium-term goals (1-3 years) like saving for a car or wedding, Certificates of Deposit (CDs) can offer higher interest rates. Since you know approximately when you’ll need the money, you can lock it away until then. A CD ladder – buying several CDs with different maturity dates – gives you periodic access while earning better rates.

For longer-term goals (3+ years) like a home down payment, you might consider Treasury bills, I-bonds, or even conservative investment accounts. These options typically offer better returns than savings accounts, though they come with slightly more risk or complexity.

The longer your timeline, the more options you have for potentially higher returns. But never put money you’ll need soon into volatile investments – the risk of losing your principal just isn’t worth the potential extra gains.

The beauty of having separate accounts for emergencies and planned expenses is that you can optimize each one for its specific purpose – safety and accessibility for emergencies, growth potential for longer-term goals.

For more detailed guidance on savings tools and strategies, check out the Consumer Financial Protection Bureau’s savings planning tool, which offers excellent worksheets for mapping out your savings journey.

Step-by-Step: Building Both Funds From Scratch

Let’s face it – starting from zero can feel overwhelming. Whether you’re fresh out of college or recovering from a financial setback, building both an emergency fund vs savings simultaneously might seem impossible. But I promise you, it’s not!

Think of building your financial safety nets like training for a marathon – you don’t start by running 26 miles. You begin with small, consistent steps that compound over time.

Your first priority should be establishing at least a small emergency cushion. Even $500-$1,000 can prevent a minor car repair from becoming a major financial crisis. Once you have this starter emergency fund, you can begin building both funds in parallel, with slightly more emphasis on completing your full emergency fund.

“The secret to building any savings isn’t finding huge chunks of money to set aside,” says financial advisor Claire Bennett. “It’s creating a system where saving happens automatically, consistently, and painlessly.”

The most powerful tool in your savings arsenal is automation. Set up direct deposits that immediately divert a portion of your paycheck to separate savings accounts before you ever see the money. When savings happens automatically, you adapt your lifestyle to what remains rather than trying to save what’s left at the end of the month (which, let’s be honest, is often nothing).

Windfalls present golden opportunities to accelerate your progress. That tax refund, work bonus, or birthday check from grandma? Resist the urge to treat yourself and instead treat your future self by boosting your emergency fund or savings goals.

Many successful savers swear by the “pay yourself first” principle. Before paying bills or discretionary expenses, allocate money to your financial goals. This simple mindset shift – treating savings as a non-negotiable expense rather than an afterthought – can transform your financial life.

Don’t forget to celebrate your milestones! Reached $500 in your emergency fund? Take a moment to acknowledge your progress. Building financial security isn’t just about the destination; it’s about recognizing the journey.

For more helpful tools to manage your savings journey, check out our Top 10 Free Financial Tools to Manage Your Money.

Starting when you have zero saved

Starting with nothing requires both mental fortitude and practical tactics. Begin by setting a micro-goal that feels achievable – perhaps just $100. This creates momentum and proves to yourself that you can save.

The envelope method works wonderfully for visual people. Physically setting aside small amounts – even just $5 or $10 at a time – provides tangible evidence of your progress. Once you’ve collected enough, deposit it into a proper savings account.

Find your “why.” Saving for some vague future emergency lacks emotional power. Instead, consider what specific peace of mind that emergency fund will provide – perhaps it means your children won’t go hungry if you lose your job, or you won’t be forced to move if your car breaks down. This emotional connection makes saving more meaningful.

Consider joining a social savings challenge to make the process more engaging. The popular 52-week challenge starts with saving just $1 the first week, then $2 the second week, gradually increasing until you’re saving $52 in the final week – resulting in $1,378 saved in a year. Having an accountability partner can significantly boost your chances of success, as you can encourage each other through the inevitable tough weeks.

“I tell my clients to start with just $25 a week,” shares financial coach Miguel Rodriguez. “That’s one takeout meal or a few coffees. Almost everyone can find that much with a little intention, and it adds up to your first $1,000 in less than a year.”

Strategies to keep contributions consistent

Consistency trumps amount when it comes to building savings. The most successful savers aren’t necessarily those who make the largest deposits – they’re the ones who never miss a contribution.

Treat savings like a bill you absolutely must pay. Budget for your emergency fund and savings contributions with the same non-negotiable attitude you have toward your rent or mortgage. These aren’t optional expenses; they’re investments in your financial security.

Life gets busy, and it’s easy to forget manual transfers. Set calendar reminders if you can’t automate, or better yet, schedule recurring transfers to coincide with your payday so the money moves before you can spend it.

When good fortune comes your way through a raise or promotion, immediately increase your savings rate. If you’ve been living comfortably on your current income, directing at least half of any raise toward savings allows you to build wealth while still enjoying some lifestyle improvement.

Regular reviews keep you on track. Schedule quarterly “money dates” with yourself (or your partner) to assess your progress and adjust your strategy. These check-ins help you celebrate wins, identify obstacles, and ensure inflation isn’t eroding your targets.

For those with irregular income – freelancers, commission-based workers, or seasonal employees – percentage-based saving works better than fixed amounts. During flush periods, commit to saving a higher percentage to offset leaner times.

Building both an emergency fund vs savings isn’t a sprint – it’s a marathon. Small, consistent steps will eventually get you to both the security of a fully-funded emergency fund and the excitement of reaching your savings goals. With each deposit, you’re buying yourself something priceless: peace of mind and future possibilities.

Keeping the Buckets Separate & Rebuilding After a Dip

Let’s face it – keeping your emergency fund vs savings actually separate is harder than it sounds. It’s like having cookies and vegetables in the same cabinet; you’ll inevitably reach for the cookies when you’re just a little hungry, not starving.

When these financial buckets blend together, you’re setting yourself up for trouble. You might find yourself without adequate funds when a genuine crisis hits, or watch your dream vacation fund slowly disappear into the “I needed new tires” category. The mental accounting that helps maintain financial discipline gets fuzzy, and suddenly everything feels like an emergency.

“I see clients mix these funds all the time,” says financial advisor Maria Chen. “Before they know it, they’ve redecorated their kitchen with their emergency money, then panic when the furnace breaks in January.”

Creating psychological barriers between these accounts is surprisingly effective. Consider keeping your emergency fund at an entirely different bank than your regular accounts – this small hurdle can make you think twice before making withdrawals. Give your accounts specific, purpose-driven names like “Job Loss Safety Net” or “Hawaii 2025 Trip” rather than generic “Savings” labels.

For many of my clients, removing easy access tools works wonders – don’t get a debit card for your emergency fund, and set up your online banking so transfers take 1-2 business days rather than happening instantly. That cooling-off period can save you from impulsive decisions.

Replenishment game plan after an emergency hit

When life throws you that inevitable curveball and you do need to dip into your emergency fund, don’t panic – but do act quickly. Your emergency fund worked exactly as intended! Now it’s time to rebuild.

Make replenishing your emergency fund your absolute top financial priority. This might mean temporarily pressing pause on your vacation savings or extending your timeline for buying that new car. Think of it like repairing a hole in your roof – other home improvements can wait until the basic protection is back in place.

Set an aggressive but realistic timeline for rebuilding. I typically recommend aiming to replace the withdrawn amount within 3-6 months. This creates urgency without feeling impossible.

Look for quick-win opportunities in your budget. That streaming service you barely watch? Pause it. The takeout lunch habit? Brown bag it for a few months. These temporary sacrifices won’t last forever, and they’ll help you rebuild your financial security faster.

Windfalls are your secret weapon for emergency fund recovery. Tax refunds, work bonuses, birthday cash, side gig income – direct all unexpected money straight to your emergency fund until it’s whole again. You’ll be surprised how quickly these can add up.

Some lenders offer “skip-a-payment” options during hardship. While interest typically still accrues, this strategy can temporarily free up cash to rebuild your emergency cushion faster. Just be sure you understand the terms before using this option.

Guardrails to avoid accidental mixing of funds

Beyond simply having separate accounts, you need robust guardrails to maintain boundaries between your funds. Monthly account audits may sound boring, but they’re incredibly effective at catching “fund drift” before it becomes a problem. Schedule 15 minutes on your calendar each month to review all accounts and ensure you’re staying true to each account’s purpose.

Automatic transfers are your best friend in maintaining separation. When money moves to the right places without requiring manual decisions, you remove the temptation to redirect funds impulsively. Set these up to happen immediately after payday – what you don’t see, you won’t miss.

Create “spending speed bumps” by implementing a personal 24-hour waiting period before any withdrawal from your emergency fund. During that cooling-off period, ask yourself: “Is this truly urgent? What would happen if I waited a month to address this? Is there another way to handle this expense?”

Keep a physical or digital log of emergency fund withdrawals. Note the date, amount, and specific reason for each withdrawal. This simple accountability tool helps identify patterns (like consistently underbudgeting for car maintenance) and prevents the “just this once” mentality from becoming a habit.

Consider recruiting an accountability partner – someone you trust to help you stick to your financial goals. Before making a significant emergency fund withdrawal, commit to texting or calling this person to explain why you need the money. Sometimes just articulating the reason out loud helps clarify whether it’s truly an emergency.

For more structured guidance on maintaining financial boundaries and building a solid foundation for your future, check out our comprehensive guide on Building a Strong Financial Foundation.

Frequently Asked Questions about Emergency fund vs savings

How do personal factors change how much I need in each fund?

When it comes to emergency fund vs savings, there’s no one-size-fits-all approach. Your personal situation dramatically impacts how much you should set aside in each bucket.

For your emergency fund, consider these key factors that might require adjusting your target:

Job stability makes a huge difference. If you’re a tenured professor or government employee with virtually guaranteed employment, you might comfortably stick with just 3 months of expenses. On the flip side, if you’re a freelancer riding the feast-or-famine rollercoaster or working in a volatile industry (I’m looking at you, tech startups!), you’ll sleep better with 6-12 months tucked away.

Family size matters too. More people depending on your income means more potential emergencies and higher costs when they occur. A single person might need a smaller cushion than someone supporting a family of five with all the surprise sports injuries and appliance breakdowns that entails.

If you or your loved ones have ongoing health issues, you’ll want to beef up that emergency fund. A good rule of thumb? Save at least twice your health insurance out-of-pocket maximum. Those medical bills can stack up faster than pancakes at a breakfast buffet!

Homeowners need larger emergency funds than renters – it’s just a fact of life. When you own your home, you’re the one on the hook when the water heater dies or the roof starts leaking. And if your house was built when disco was still popular, you might want to add even more to that emergency cushion.

Living in hurricane alley or wildfire country? Your emergency fund should reflect these geographic risks, including potential evacuation costs or temporary housing if disaster strikes.

Finally, your debt obligations play a huge role. Higher monthly debt payments mean you need a larger safety net to keep those obligations current during any income disruptions.

For your savings goals, personal factors like your timeline, risk tolerance, and specific objectives will guide both how much to save and where to keep those funds.

Can I combine both funds in one high-yield account with sub-labels?

Yes, you absolutely can use one account with sub-labels for both your emergency fund and savings goals – but like eating gas station sushi, proceed with caution.

This approach offers some clear benefits: You’ll simplify your financial life with fewer accounts to track, potentially qualify for higher interest rates or lower fees with a larger combined balance, and get a satisfying view of your overall savings progress in one place.

However, there are real psychological risks to this approach. Even with clear labels, you might face increased temptation to “temporarily borrow” from your emergency fund to reach a savings goal faster. (“I’ll pay myself back next month!” – Narrator: They didn’t.) You might also accidentally confuse your totals, thinking you have more emergency money available than you actually do.

If you decide to go the combined route, look for an account that offers robust “bucket” or “envelope” features with clear visual separation between funds. Many online banks now offer these tools, making it easier to maintain mental boundaries while enjoying the convenience of a single account.

Be honest with yourself about your financial discipline. If you’ve ever dipped into savings for a non-emergency, separate accounts with different login credentials might be a better choice for you.

What if my emergency fund grows too large—should I invest the excess?

First of all, congratulations on such a wonderful “problem” to have! Once your emergency fund exceeds 6 months of expenses (or whatever target makes sense for your personal risk factors), you might indeed be holding too much cash that could be working harder elsewhere.

Many financial experts recommend creating a tiered approach to your emergency fund:

For immediate emergencies, keep 1-2 months’ worth of expenses in a high-yield savings account where you can access it instantly. This is your “the car broke down and I need it fixed tomorrow” money.

Then, place another 2-4 months’ worth in slightly less liquid but higher-yielding options like CDs or money market funds. You might wait a day or two for access, but the higher returns make this worthwhile for funds you hopefully won’t need right away.

Any additional emergency savings beyond that could potentially go into a very conservative investment account. This isn’t for market speculation – think treasury bonds or a conservative balanced fund that prioritizes capital preservation.

Another smart approach: once your emergency fund hits your target, simply redirect those automatic contributions to retirement accounts, college savings, or other long-term goals. Your future self will thank you!

Some people also create a separate “life happens” fund for those annoying but not catastrophic expenses – the washing machine repair or unexpected dental work that doesn’t quite qualify as a true emergency but isn’t exactly planned either.

Keeping too much cash earning minimal interest has a real opportunity cost over time. Inflation quietly eats away at your purchasing power, and those dollars could be building wealth elsewhere. That said, the peace of mind from a robust emergency fund is priceless, especially during uncertain economic times.

Conclusion

Understanding the difference between an emergency fund vs savings isn’t just financial theory—it’s a practical approach that can truly transform your financial well-being and bring much-needed peace to your money worries.

Think of your emergency fund as the sturdy foundation of your financial house. It’s there to protect you when unexpected storms blow through your life, preventing you from racking up debt when your car suddenly needs repairs or your job disappears without warning. Your savings accounts, on the other hand, represent your hopes and dreams—they’re the vehicles that carry you toward your most important life milestones without the burden of financial stress.

These two elements aren’t competing for your attention or your dollars. They’re teammates working together in your financial journey:

Start small with your emergency fund—just $500-$1,000 creates that initial safety net that helps you sleep better at night. Then gradually build this cushion until you’ve got 3-6 months of expenses safely tucked away, adjusting based on your personal situation and risk factors.

While you’re building that emergency foundation, don’t put your dreams on hold. Work simultaneously toward those specific savings goals—whether it’s a dream vacation, a down payment, or your child’s education. Give each goal a clear timeline and target amount.

The magic happens when you keep these funds completely separate. This clarity helps you respect the purpose of each dollar and prevents the all-too-common mistake of “borrowing” from your emergency fund for non-emergencies. Make your progress effortless by automating contributions to both funds—what you don’t see in your checking account, you won’t be tempted to spend.

Financial security evolves as your life does. The emergency fund that worked for you as a single renter might need adjusting when you become a homeowner with a family. Stay flexible and revisit your strategy as your circumstances change.

True financial wellbeing isn’t just about watching numbers grow in your accounts. It’s about the deep sense of calm that comes from knowing you’re prepared—both for life’s unexpected challenges and its exciting opportunities.

At Finances 4You, we believe that balancing emergency funds and savings is essential to aligning your net worth with your age group and building lasting financial security. If you’re ready for more comprehensive guidance on creating a complete financial plan, our Ultimate Budgeting Resource Guide offers exactly what you need.

Your journey to financial confidence begins with these two fundamental pillars—an emergency fund that catches you when life knocks you down, and savings accounts that lift you toward your dreams. By implementing the emergency fund vs savings strategy we’ve outlined, you’re taking a crucial step toward both stability today and prosperity tomorrow.