Why Understanding Financial Plan and Projections is Your First Step to Financial Success

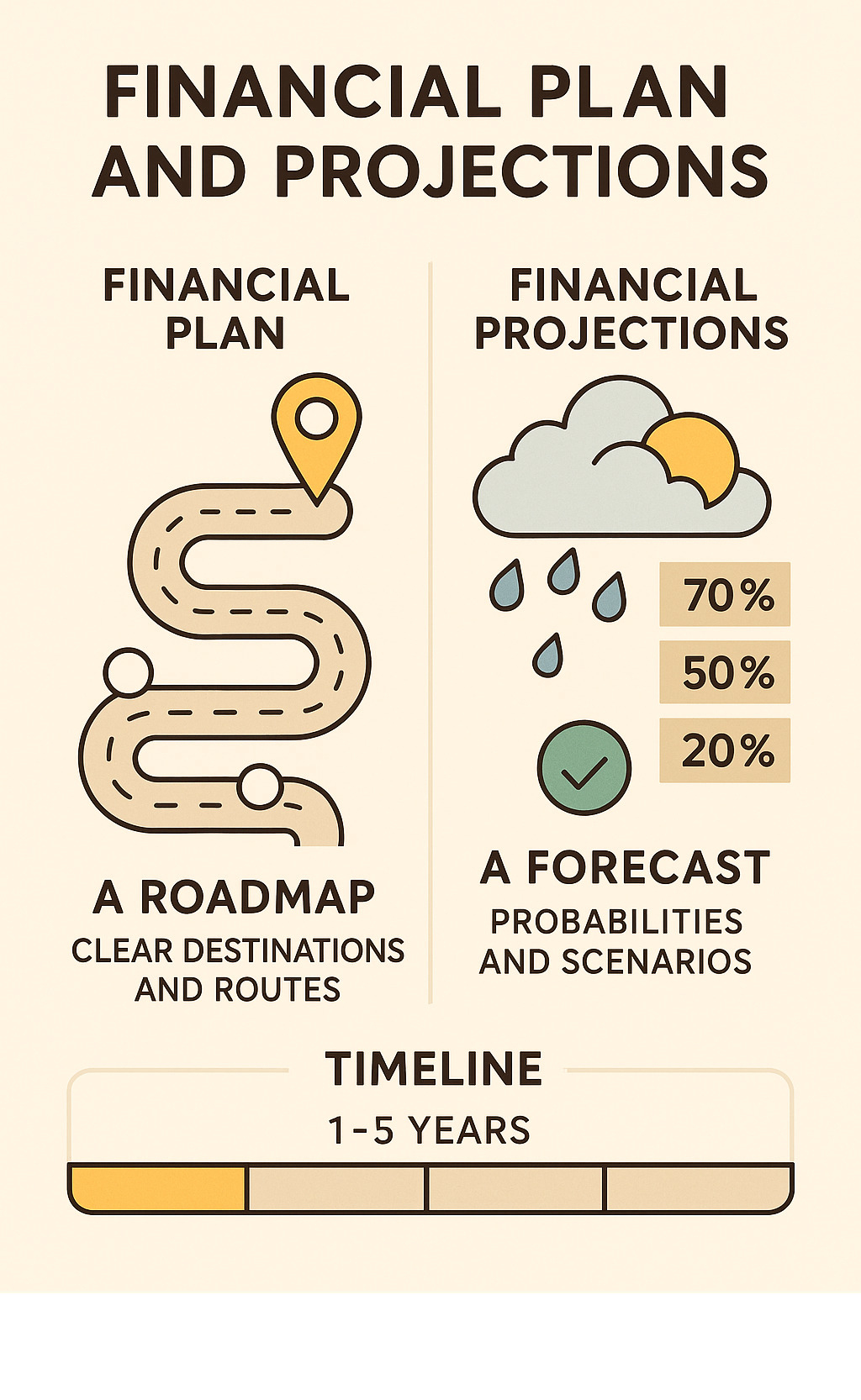

Financial plan and projections are the roadmap and weather forecast for your money journey. A financial plan lays out the necessary steps to generate future income and cover expenses, while projections estimate your likely future financial performance based on assumptions and data.

Quick Answer for Financial Plan and Projections:

- Financial Plan = Your roadmap (what you plan to do with money)

- Financial Projections = Your forecast (estimated future income and expenses)

- Timeline = Typically 1-5 years ahead

- Key Components = Income statements, balance sheets, cash flow statements

- Purpose = Goal setting, securing funding, tracking progress, identifying shortfalls

Whether you’re a high-earning professional trying to get ahead of lifestyle inflation or a business owner seeking investment, understanding these concepts is crucial. As financial experts note, “Financial forecasts are continually educated guesses” – but they’re educated guesses that can make the difference between financial success and struggle.

The research shows that creditors typically want financial projections for three to five years when evaluating funding requests. For individuals, these projections help determine if your current spending and saving habits will get you where you want to go.

Think of it this way: you wouldn’t take a cross-country road trip without a map and weather forecast. Your financial future deserves the same level of planning.

Find more about financial plan and projections:

The Core Concepts: Distinguishing Between a Plan and a Projection

Let’s clear up the confusion around financial plan and projections. Think of your financial journey as a road trip. Your financial plan is the route you plot with specific destinations. Your financial projection is the weather forecast, estimating conditions along the way.

A financial plan is your strategic roadmap, outlining actions to reach your financial goals. It covers investment strategies, tax planning, and retirement preparation. It’s your “how” document.

A financial projection estimates future financial performance based on data and assumptions. It focuses on metrics over time, answering “what if” questions like potential income growth or inflation’s impact. These data-driven forecasts show where you’re headed.

| Financial Plan (The ‘How’) | Financial Projection (The ‘What If’) |

|---|---|

| Strategic roadmap for achieving goals | Estimated future financial performance |

| Action-oriented steps | Data-driven forecasts |

| Covers all aspects of financial life | Focuses on specific metrics over time |

| Includes investment, tax, retirement planning | Shows revenue, expenses, cash flow |

| More stable, updated annually | Updated frequently based on performance |

These two work together. Your plan outlines the steps, and your projections show if those steps will lead to your destination.

Why are Financial Projections Essential?

Financial projections are powerful tools that can transform your financial future. Here’s why they matter.

Goal setting becomes more realistic with numbers laid out over time. Instead of a vague goal like “retire comfortably,” projections might show you need to save $2,000 more per month, leading to better decisions.

Securing funding is another critical area. Lenders and investors want concrete numbers to determine loan amounts, set interest rates, and make investment decisions. Without solid projections, you’re asking them to bet on your future without seeing the odds.

Resource allocation becomes clearer with projections. Should you use an extra $500 for debt or investments? Projections can show how each choice affects your financial future.

Performance tracking is vital. Comparing actual results to projections helps you spot problems early and course-correct. If revenue is 20% below projections, you know to act now, not when it’s a crisis.

Identifying shortfalls is a key benefit. Projections might reveal you’ll run out of emergency funds in eight months or aren’t saving enough for retirement. This knowledge allows you to make timely adjustments.

For more detailed strategies on achieving financial objectives, we dive deeper into how projections support your bigger financial picture.

Financial Plan vs. Financial Forecast: Is There a Difference?

The terms “financial projection” and “financial forecast” are often used interchangeably, even by professionals, which can be confusing.

In practice, they are similar: both are educated estimates about your financial future. Some experts argue forecasts are more formal, with extensive analysis, while projections are simpler. This distinction isn’t universally accepted.

The reality is that both are “educated guesses” about your financial future. The key is “educated”—they are careful estimates based on data, trends, and reasonable assumptions, not wild predictions.

What matters is that they are working documents to be reviewed and updated regularly. They are based on current information, not guarantees of the future.

For businesses looking to implement these concepts more systematically, our comprehensive guide on business financial planning provides practical strategies for creating and using both plans and projections effectively.

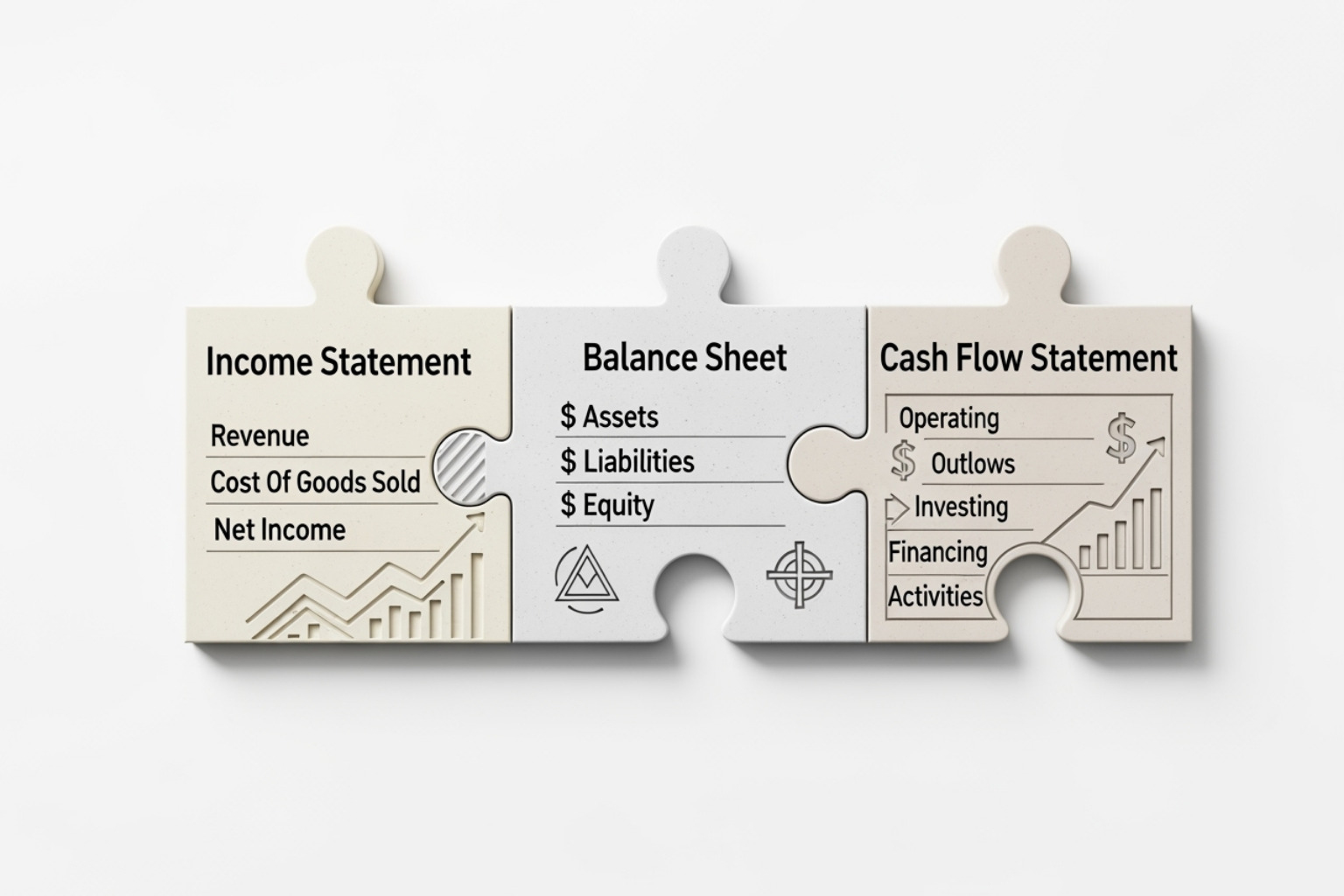

The Building Blocks: Key Components of Financial Projections

When you’re building financial plan and projections, you’re essentially creating a three-piece puzzle. Each piece represents a core financial statement that tells a different part of your money story. Remove any piece, and you’re missing crucial information that could derail your financial success.

Think of these statements as your financial dashboard – they work together to give you a complete picture of where your money comes from, where it goes, and what you’re building for the future.

The Income Statement (Profit & Loss)

Your income statement is like your financial report card – it shows whether you’re winning or losing the money game over a specific time period. This is where you’ll see if your financial dreams are realistic or if you need a reality check.

Revenue projection is your starting point. This covers all the money you expect to bring in, whether from your salary, business sales, investment returns, or that side hustle you’ve been working on. The key is being realistic about these numbers – wishful thinking won’t pay the bills.

Expense projection is where things get interesting (and sometimes scary). You’ll need to account for your Cost of Goods Sold if you’re running a business – these are the direct costs of making your product or delivering your service. Then come your operating expenses like rent, salaries, marketing, and insurance. Don’t forget those sneaky one-time expenses that always seem to pop up at the worst times.

Gross margin shows you what’s left after covering your direct costs. This number tells you if your business model actually works or if you’re just spinning your wheels.

Net income is the bottom line – literally. This is what you actually get to keep after everyone else gets paid. It’s the number that determines whether you’re building wealth or just treading water.

For personal finances, your income statement might track your salary and investment returns against expenses like housing, food, and that streaming service collection you forgot you had. Research shows that most people create monthly projections for the first year, then switch to annual projections for the long term.

If you’re new to reading these statements, our Beginner’s Guide to Understanding Financial Statements will help you decode the numbers without needing an accounting degree.

The Balance Sheet

Your balance sheet is like taking a financial selfie – it captures what you own, what you owe, and what you’re actually worth at one specific moment in time. The magic formula that makes everything balance is simple: Assets = Liabilities + Equity.

Assets are everything you own that has value. Your current assets include cash, inventory, and money people owe you. Your fixed assets are the big-ticket items like property, equipment, and investments that you plan to keep for the long haul.

Liabilities are what you owe to others. Current liabilities are the bills coming due soon – credit card debt, short-term loans, and that money you borrowed from your sister. Long-term liabilities include mortgages, business loans, and other debts you’ll be paying off for years.

Equity is what’s left over when you subtract what you owe from what you own. For individuals, this is your net worth. For businesses, it’s shareholder equity. This number tells you if you’re actually building wealth or just rearranging deck chairs on the Titanic.

The balance sheet projection helps you see how your financial position will evolve over time. Will you have more assets next year? Less debt? A stronger net worth? These projections help you make smart decisions about major purchases, investments, and debt payoff strategies.

The Cash Flow Statement

Here’s where things get real – you can look profitable on paper but still run out of cash if your timing is off. The cash flow statement tracks every dollar flowing in and out of your financial life, organized into three main categories.

Operating activities show cash from your main income sources minus your day-to-day expenses. This is the cash generated by your core business or personal income activities.

Investing activities track money spent on or received from investments, equipment purchases, or selling assets. This section shows how you’re positioning yourself for future growth.

Financing activities include cash from loans, investments, or debt payments. This reveals how you’re funding your operations and growth.

A solid cash flow projection ensures you’ll have money when you need it most. As financial experts remind us, cash flow is the lifeblood of any successful financial plan. You might be building wealth on paper, but if you can’t pay your bills on time, you’re in trouble.

These three statements work together to create a complete picture of your financial future. Master them, and you’ll have the foundation for financial plan and projections that actually work in the real world.

How to Create Your Financial Plan and Projections

Creating financial plan and projections doesn’t have to feel like solving a complex puzzle. Think of it as having a detailed conversation with your future self about money. The key is approaching it step by step, whether you’re planning for your business or personal life.

The beauty of financial projections lies in their flexibility. You’re not carving predictions in stone – you’re creating a flexible framework that helps you make smarter decisions today.

Creating a Financial Plan and Projections for Your Business

Starting a business projection begins with understanding your purpose and timeframe. Are you trying to secure funding from investors? Planning for expansion? Setting internal performance goals? Your reason for creating projections will shape everything else.

Most successful business projections cover three to five years. The first year gets broken down month by month because that’s where the rubber meets the road. Years two through five can be projected annually since you’re looking at broader trends rather than day-to-day operations.

Gathering your data comes next, and this is where many people get stuck. If you’re running an established business, your historical financial data becomes your best friend. Look for patterns in your revenue, seasonal fluctuations, and expense trends. New businesses need to dig into industry benchmarks and research similar companies in their space.

Sales and expense forecasting requires a delicate balance between optimism and realism. Start with revenue projections by studying your market carefully. Consider your pricing strategy, how much it costs to acquire customers, and any seasonal variations in your business. Then tackle expenses by separating fixed costs like rent and salaries from variable costs like materials and utilities.

Building your financial statements ties everything together. Your revenue and expense forecasts feed into your income statement, balance sheet, and cash flow statement. Many entrepreneurs find spreadsheet software works perfectly fine, though accounting software can automate calculations and reduce errors.

The final step involves analyzing and refining your projections. Create multiple scenarios – best case, worst case, and most likely. This approach helps you understand the range of possible outcomes and plan for different situations.

For practical help getting started, you can download a free financial projections template from SCORE or review the SBA’s guidance on writing a business plan.

Here’s a simple framework to follow:

- Define Purpose & Timeframe – Know why you’re creating projections

- Gather Data – Collect historical data and industry benchmarks

- Forecast Sales & Expenses – Project revenue and costs realistically

- Build Statements – Create your three core financial statements

- Analyze & Refine – Test different scenarios and adjust accordingly

Creating a Financial Plan and Projections for Your Personal Life

Personal financial projections follow similar principles but focus on life goals rather than business metrics. The process feels more personal because you’re planning for retirement goals, savings targets, and major life events rather than quarterly earnings.

Retirement planning forms the backbone of most personal projections. You’ll need to estimate your income needs in retirement, factor in inflation, and determine how much you need to save each month. At Finances 4You, we particularly focus on helping people align their net worth with their age group, which provides a useful benchmark for retirement readiness.

Major life events require their own projection approach. Planning for a home purchase involves different assumptions than saving for children’s education or preparing for a career change. Each goal needs its own timeline and savings strategy.

Investment returns should be projected conservatively. Base your estimates on your risk tolerance and investment mix, but don’t assume you’ll consistently beat the market. Historical averages provide a good starting point, but past performance doesn’t guarantee future results.

Debt reduction projections can be particularly motivating. You can model how different payment strategies affect your debt timeline and total interest paid. Sometimes seeing the numbers on paper provides the motivation needed to stick with an aggressive payoff plan.

The key to successful personal projections is being honest about your assumptions. If you’re projecting 20% annual investment returns or assuming you’ll never have an unexpected expense, you might want to reconsider.

For specialized situations, our guides on Retirement Planning and Financial Planning for Self-Employed individuals provide detailed strategies custom to specific circumstances.

Creating financial plan and projections is an iterative process. Your first attempt doesn’t need to be perfect – it just needs to be started. You’ll refine and improve your projections as you gain experience and as your circumstances change.

Navigating Uncertainty: Assumptions, Limitations, and Tools

Here’s the uncomfortable truth about financial plan and projections: they’re educated guesses dressed up in fancy spreadsheets. But that doesn’t make them useless – it just means you need to understand their limitations and work with them smartly.

Think of financial projections like weather forecasts. Meteorologists can tell you with decent accuracy if it’ll rain tomorrow, but predicting the weather three months from now? That’s much trickier. Your financial projections work the same way.

Critical Assumptions to Document

Every projection you create stands on a foundation of assumptions. The difference between useful projections and wishful thinking lies in making these assumptions explicit and reasonable.

Economic factors form the backbone of your projections. You’ll need to make assumptions about inflation rates (historically around 2-3% annually), interest rates, and overall economic growth. These might seem abstract, but they directly impact everything from your mortgage payments to investment returns.

Market conditions require careful consideration too. How big is your target market, and how fast is it growing? What’s your realistic market share? These assumptions matter whether you’re projecting business revenue or planning your career earnings.

For businesses, you’ll also need to estimate customer acquisition costs, customer lifetime value, and pricing strategies. Personal finance projections require assumptions about salary growth rates, investment returns, and the timing of major life events like buying a home or having children.

The key is writing these assumptions down. When your projections inevitably prove wrong (and they will), you’ll know exactly which assumptions to revisit and adjust.

Limitations and How to Address Them

Let’s address the elephant in the room: financial projections can’t predict black swan events. No projection foresaw the 2008 financial crisis or the COVID-19 pandemic. These unexpected events can throw even the most carefully crafted projections out the window.

Overoptimism bias is another major limitation. We naturally tend to be overly optimistic about our financial prospects. Counter this by creating multiple scenarios – conservative, realistic, and optimistic versions of your projections. This gives you a range of possibilities rather than a single point estimate.

Time makes projections less accurate. Your first-year projections will usually be much more accurate than your fifth-year estimates. Use longer-term projections for strategic direction and general planning, but don’t rely on them for precise decision-making.

The solution isn’t to abandon projections – it’s to treat them as living documents. Review them quarterly, compare actual results to your projections, and adjust as needed. As financial experts note, projections are commonly reviewed and revised annually as new information becomes available.

Tools and Resources to Help

You don’t need expensive software to create useful financial projections. Spreadsheet software like Excel or Google Sheets works perfectly for most people. They’re flexible, widely available, and most people already know how to use them.

Accounting software like QuickBooks or FreshBooks can automatically generate projections based on your historical data. This is particularly helpful for established businesses with consistent financial records.

For more sophisticated needs, financial modeling tools offer advanced features like scenario analysis and detailed visualizations. These tools can help you explore different “what if” scenarios more easily.

Sometimes it’s worth getting help from professional advisors, especially for complex situations or major financial decisions. A fresh perspective can catch assumptions you might have missed and provide industry insights you don’t have access to.

For additional resources to help with your financial planning, check out our comprehensive list of Top 10 Free Financial Tools to Manage Your Money.

The goal isn’t to predict the future perfectly – it’s to make better decisions today based on reasonable expectations about tomorrow.

Frequently Asked Questions about Financial Projections

Let’s tackle the most common questions people ask about financial plan and projections. These are the real-world concerns that keep coming up when folks start diving into their financial future.

How far into the future should financial projections go?

Here’s the sweet spot: three to five years is what most financial experts recommend. Think of it like planning a road trip – you want to see far enough ahead to make good decisions, but not so far that everything becomes a blur.

For your first year, break things down by month or quarter. This gives you the detailed view you need for day-to-day decisions. After that, annual projections work just fine for years two through five.

Why this timeframe? Well, creditors and investors typically want to see financial data and projections for three to five years when they’re evaluating funding requests. For your personal finances, this timeline perfectly matches medium-term goals like saving for a house down payment or building that emergency fund you keep meaning to start.

The research backs this up too – it’s long enough to show meaningful trends but short enough to maintain some accuracy. Beyond five years, you’re basically guessing, and everyone knows it.

What is the difference between top-down and bottom-up forecasting?

These are two different ways to build your projections, and understanding both can make your numbers much more reliable.

Top-down forecasting starts big and works down. You look at the total market size and estimate what slice you can realistically capture. For example, if the market for your consulting services is $10 billion and you think you can grab 0.01% of it, you’re projecting $1 million in revenue.

Bottom-up forecasting starts with your actual capacity and builds up. How many clients can you realistically serve each month? If you can handle 20 clients at $2,000 each, your monthly projection is $40,000.

The smart move? Use both methods and see if they align. If your top-down projection says $1 million but your bottom-up analysis shows you can only handle $500,000 worth of clients, you’ve got some thinking to do. Maybe you need to hire help, raise prices, or adjust your market share expectations.

This validation process helps catch overly optimistic assumptions before they become expensive mistakes.

How often should I update my financial projections?

Here’s the balance you’re looking for: review monthly or quarterly, but only update when it really matters.

Your financial plan and projections aren’t meant to be static documents gathering dust in a folder. Compare your actual results to your projections every month or quarter. This helps you spot trends early – both good and bad ones.

But don’t tweak your projections every time you have a great month or a rough patch. Look for sustained changes that suggest your underlying assumptions need updating. If your business revenue has been consistently 20% higher than projected for three months running, it’s time to revise those numbers.

For major updates, most companies and individuals do a thorough review at least annually. This aligns perfectly with tax planning and goal reassessment. As research shows, many companies revisit and amend these projections at least annually, treating it as part of their regular financial health checkup.

The key is staying responsive without becoming reactive. Your projections should evolve with your reality, but they shouldn’t swing wildly with every monthly fluctuation.

Conclusion

Think of financial plan and projections as your GPS for money decisions. You wouldn’t drive across the country without knowing your route and checking the weather forecast, right? The same logic applies to your financial journey.

Here’s what we’ve learned together: financial plans show you the road to take, while projections help you prepare for what might happen along the way. Neither needs to be perfect to be incredibly useful. They just need to be thoughtful and realistic.

The magic happens when you combine strategic decision-making with regular check-ins on your financial health. Whether you’re working to align your net worth with your age group (something we’re passionate about at Finances 4You) or planning your business expansion, these tools give you confidence instead of confusion.

Proactive management beats reactive scrambling every time. When you spot potential cash flow problems six months before they hit, you can adjust course smoothly. When you realize your retirement savings aren’t on track, you have time to fix it without panic.

The research backs this up completely. People and businesses who engage in systematic financial planning consistently outperform those who wing it. They sleep better at night, make smarter choices, and achieve their goals more often.

Start simple if you’re feeling overwhelmed. A basic projection beats no projection every time. You can always add complexity as you get more comfortable with the process.

Your future success depends on the decisions you make today. By mastering these concepts, you’re replacing financial guesswork with strategic thinking. You’re taking control of your money instead of letting it control you.

For more insights on building long-term wealth and making smart financial decisions, explore our resources on business financial strategy. Your financial future is too important to leave to chance, and with the right planning tools, you can steer toward your goals with genuine confidence.