Understanding Your Financial Health: Why Credit Scores Matter

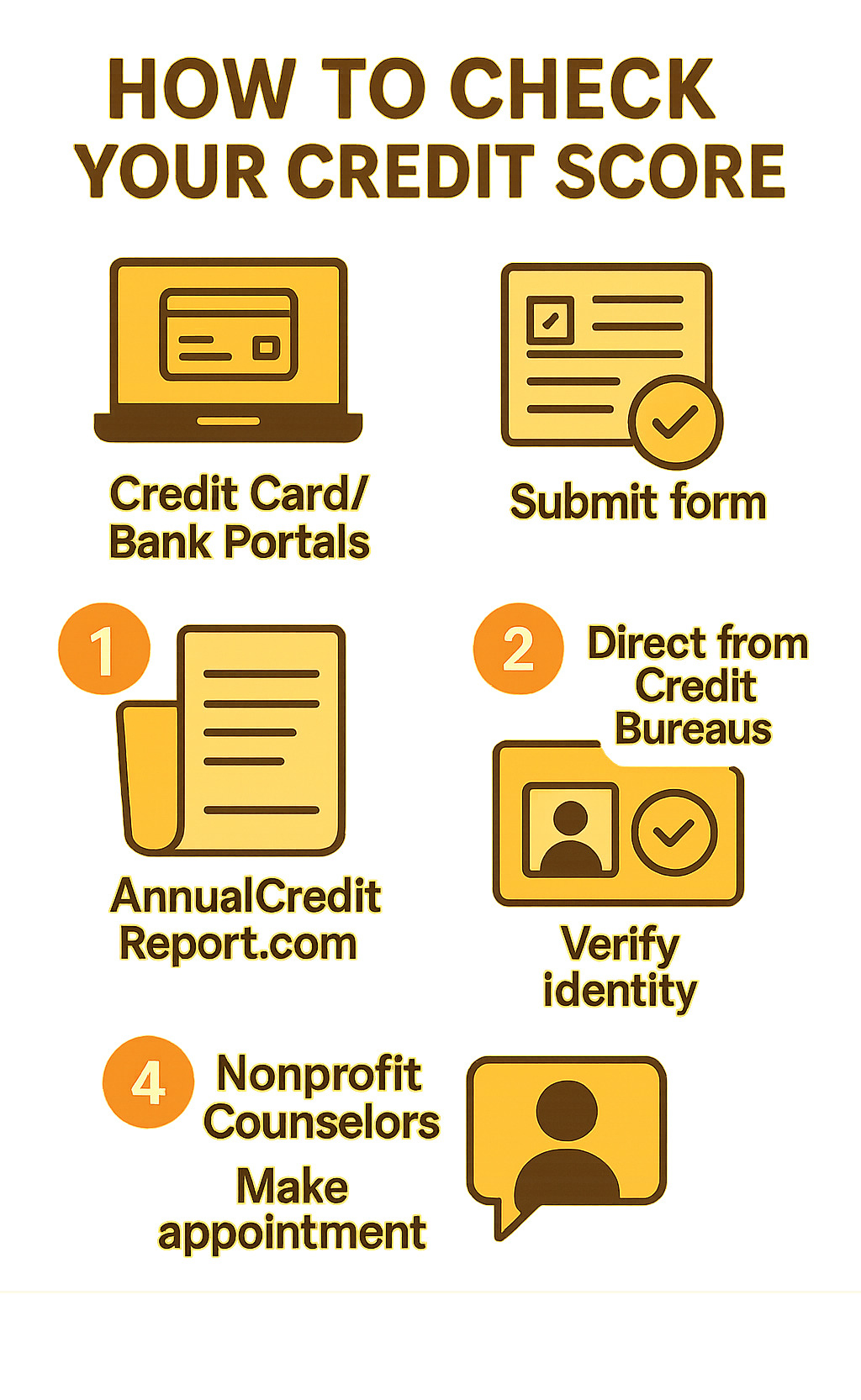

How to check your credit score is a straightforward process with several free and paid options available. Here’s a quick rundown:

| Method | Cost | Where to Access |

|---|---|---|

| Credit card/bank portals | Free | Log into your online account dashboard |

| AnnualCreditReport.com | Free | Official government-authorized website |

| Credit bureaus (Experian, Equifax, TransUnion) | Free/Paid options | Bureau websites |

| Nonprofit credit counselors | Free | HUD-approved counseling agencies |

Your credit score is a three-digit number that acts like your financial report card. It tells lenders how likely you are to repay borrowed money based on your past credit behavior. With 90% of top lenders using FICO® Scores to evaluate applications, knowing your score is essential before applying for loans, credit cards, or even apartments.

Many people don’t realize they have multiple credit scores. The three major credit bureaus (Equifax, Experian, and TransUnion) each maintain separate records of your credit history, and different scoring models (like FICO and VantageScore) interpret this data differently.

The good news? Checking your own credit score never hurts your credit – it’s considered a “soft inquiry.” You’re legally entitled to free credit reports from each bureau once a year through AnnualCreditReport.com, and many financial institutions now provide free credit scores to their customers.

The average FICO® Score in the United States is 710, with 67% of Americans having a good score or better. Whether you’re looking to improve your score, protect against identity theft, or simply stay informed about your financial health, regular monitoring is a smart habit.

Easy how to check your credit score word list:

Credit Score Essentials: Definitions, Reports vs Scores, Calculation Factors

Before diving into how to check your credit score, it’s important to understand what you’re actually looking at. Your credit profile has two main parts – think of your credit report as the detailed story of your financial life, while your credit score is simply the cliff notes version.

What’s a Credit Score and Why It Matters

A credit score is that magical three-digit number (usually between 300-850) that follows you throughout your financial life. It’s basically a financial report card that tells lenders how likely you are to pay back what you borrow.

Why should this number matter to you? Because it touches almost every part of your adult life:

Your score determines whether you’ll get approved for that dream house mortgage and what interest rate you’ll pay. (Trust me, even a 50-point difference can mean thousands of dollars over 30 years!)

It affects which credit cards you qualify for – the difference between settling for a basic card or getting one with juicy travel rewards and perks.

Many insurance companies peek at your credit when setting your premiums. Better score? Lower car insurance rates!

Looking for a new apartment? Landlords often run credit checks before handing over those keys.

As one of our Finances 4You clients shared, “I was shocked when I finally checked my score and realized I’d been overpaying on my car loan by 3% for years. That’s money I could’ve been saving for my kids’ college fund!”

Credit Report vs Credit Score

People often mix these up, but they’re quite different:

Your credit report is the complete biography of your financial life – accounts you’ve opened, payment histories, addresses, inquiries, and any public records like bankruptcies. It’s the raw data.

Your credit score is just the numerical grade calculated from all that information – like your financial GPA.

Here’s where people get confused: When you get your free annual credit reports from AnnualCreditReport.com, you typically won’t see your actual score. That’s why many folks scratch their heads wondering where the number is!

How Scores Are Calculated & Updated

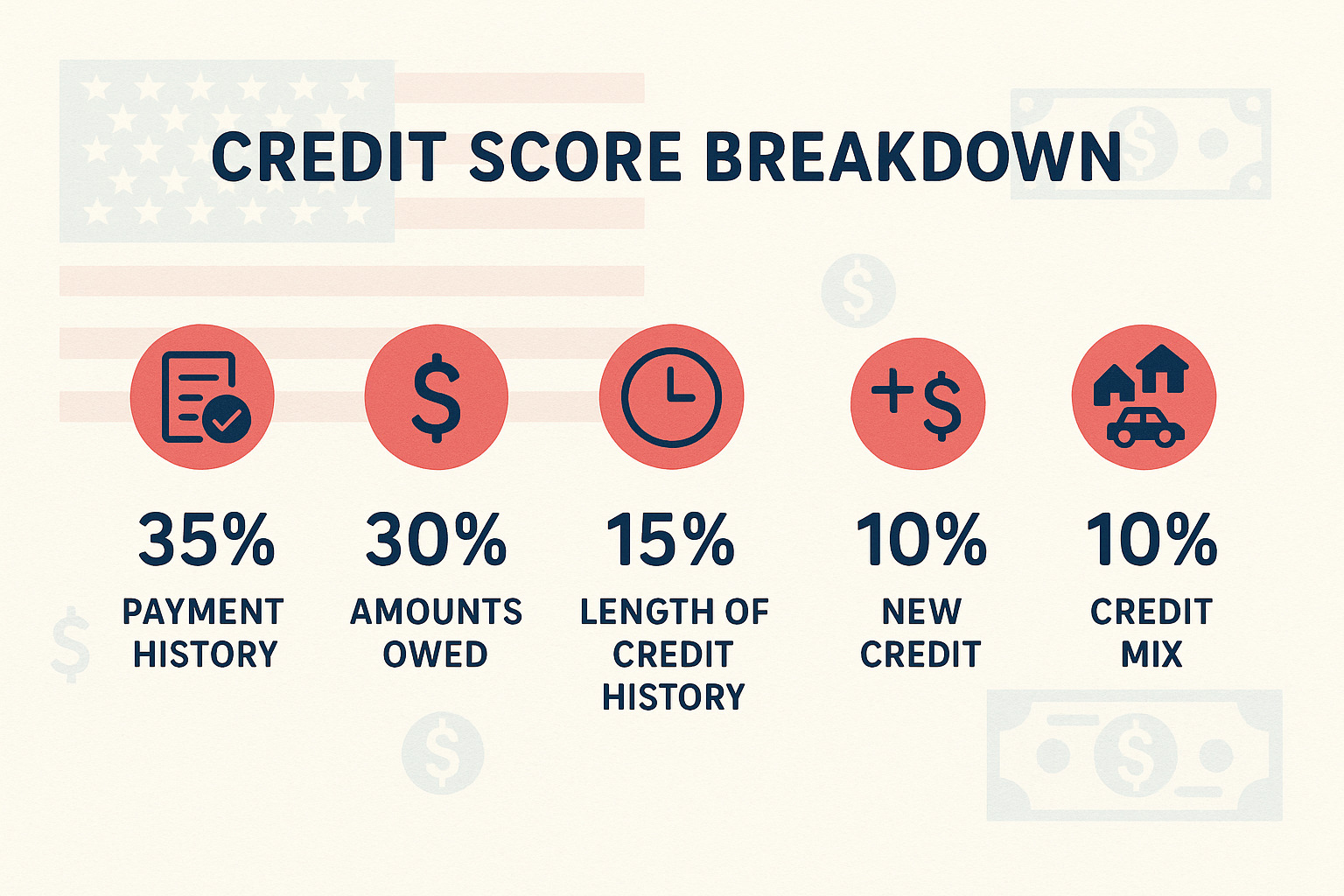

The credit score world has two major players: FICO and VantageScore. While they have their differences, both look at similar factors in your financial behavior:

FICO breaks it down like this:

- Your payment history weighs heaviest at 35% (do you pay on time?)

- Amounts owed comes in at 30% (how much of your available credit are you using?)

- Length of credit history accounts for 15% (longer is better!)

- New credit applications make up 10% (too many new accounts raise eyebrows)

- Credit mix rounds out the final 10% (having different types of credit shows versatility)

VantageScore considers the same factors but weights them differently, focusing heavily on payment history and credit age.

Your scores typically update when lenders report new information to the credit bureaus – usually monthly, though sometimes more frequently. Each bureau might receive updates at different times, which explains why your scores might vary depending on where you check.

Wondering what might tank your score overnight? Several culprits could be responsible:

- Missing a payment (even by just a few days)

- Maxing out your credit cards (especially if you’re using more than 30% of your limits)

- Closing old credit cards (which shortens your credit history)

- Applying for several new credit accounts in a short time

- Errors appearing on your report

- Someone stealing your identity (yikes!)

Want to really understand the ins and outs of credit reporting? Check out our complete guide to understanding credit scores and reports for an even deeper dive.

How to Check Your Credit Score

Now that you understand what a credit score is, let’s explore the various ways you can check yours. The good news is that how to check your credit score has become easier and more accessible than ever before.

Free Ways to Peek at Your Score

Your credit score is probably hiding in plain sight! Many financial institutions now offer this valuable information as a complimentary service. When I first found that my score was available through my bank app, it felt like finding money in an old coat pocket – a pleasant surprise that was there all along.

Most major banks and credit card companies display your score right on your dashboard after you log in. These scores typically update monthly and usually show either a FICO Score 8 or VantageScore 3.0. As Maria, one of our Finances 4You readers, shared: “I was pleasantly surprised to find my credit score right on my banking app dashboard. I didn’t even know it was there until I read about checking through my bank.”

The three major credit bureaus also offer direct free access options. Experian provides a free FICO® Score and credit report through their basic membership. Equifax offers a monthly free credit report and VantageScore® 3.0 when you sign up for their Core Credit™ program. TransUnion has monitoring services too, though most convert to paid subscriptions after trial periods.

Have you heard about score-boosting services? Experian Boost® lets you add utility, phone, and streaming service payments to your credit file – potentially giving your score a nice bump. According to Experian, 60% of users see their scores increase by an average of 12 points. Not bad for a free service!

While AnnualCreditReport.com doesn’t provide your actual score, you can get free weekly credit reports from all three bureaus through this site (this improved access has been extended through 2026). Reviewing these reports helps you catch any errors that might be dragging down your score.

For personalized guidance, HUD-approved nonprofit credit counselors can provide both a free credit report and score, plus explain what it all means. James, another reader, found this approach particularly helpful: “Working with a nonprofit counselor was eye-opening. Not only did I get my score for free, but I also got a detailed explanation of what was hurting it and a personalized plan to improve it.”

Buying Your Official Score

While free options are plentiful, sometimes you might want to purchase your official FICO scores, particularly before major financial decisions like applying for a mortgage. Think of it as buying the textbook instead of borrowing notes – you’re getting the exact information lenders will see.

The gold standard comes from myFICO.com, the official site of FICO, which offers one-time purchases or subscription plans providing access to scores from all three bureaus. These range from basic plans (around $20 monthly) to premier options (about $40 monthly). Each credit bureau also offers premium services with more frequent updates and identity theft protection beyond their free offerings.

A word of caution about paid services: watch out for free trials that quietly convert to paid subscriptions, understand which specific score model you’re receiving (there are dozens!), and check whether you’re getting scores from one bureau or all three. The differences can be significant.

Step-by-Step Checklist

Ready to check your score? Here’s your roadmap to success, regardless of which method you choose:

First, gather your identification information – you’ll need your Social Security Number, current and previous addresses, date of birth, and sometimes current loan account numbers. Next, choose your preferred access method, whether that’s your bank portal, a credit bureau website, or AnnualCreditReport.com.

Be prepared to answer some verification questions to confirm your identity. These often include details about past loans or accounts that only you would know – it’s like a financial pop quiz about your own history!

Once you’re in, review your score and accompanying information carefully. I recommend saving or printing a PDF copy for your records, which is especially important if you spot any errors. Finally, set a reminder to check again in the future – quarterly checks are a good practice for maintaining financial awareness.

For more comprehensive guidance on managing your finances, including credit monitoring as part of your overall strategy, visit our finance management guide.

Interpreting & Tracking Your Score

Once you know how to check your credit score, the next step is making sense of that three-digit number and keeping tabs on how it changes over time. Let’s explain what your score actually means for your financial life.

What Your Score Means

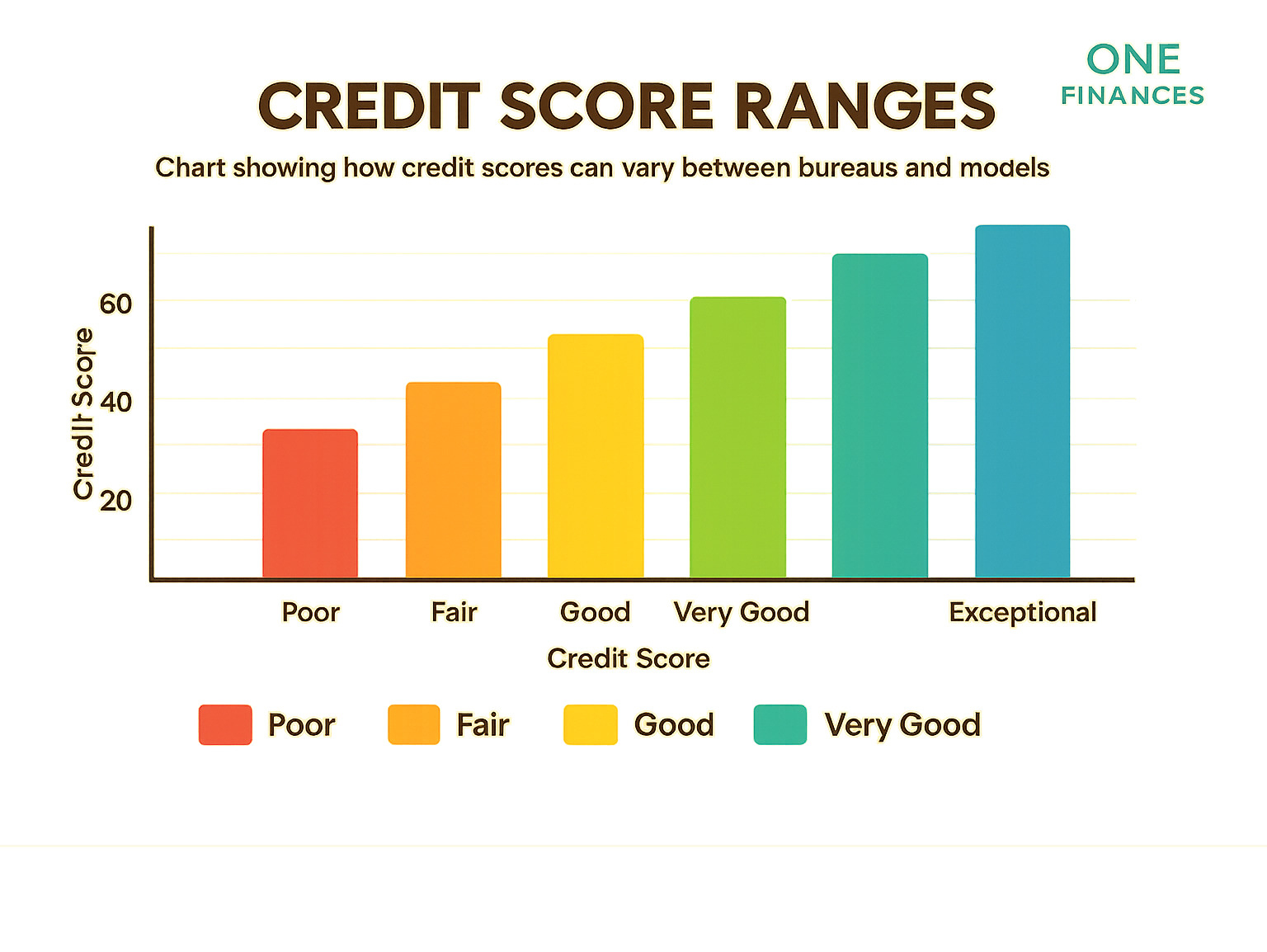

Think of the 300-850 credit score range as a financial thermometer. The higher your number, the “healthier” your credit profile appears to lenders. Here’s what different ranges typically signify:

Exceptional (800-850): You’re in the credit elite! Lenders will roll out the red carpet with their absolute best rates and terms. Only about 20% of Americans reach this credit mountain top.

Very Good (740-799): You’re still shining bright in lenders’ eyes. You’ll qualify for excellent offers, though perhaps a hair below the absolute premium rates.

Good (670-739): This is where the average American (710) sits. You’re seen as reliable and will qualify for most credit products, though not always with the sweetest deals.

Fair (580-669): You’re in the “we’ll lend to you, but it’ll cost you” territory. Expect approvals with higher interest rates attached.

Poor (300-579): The credit danger zone. Securing unsecured credit becomes challenging, and when available, comes with steep rates and restrictive terms.

The good news? About two-thirds of Americans (67%) have reached the “Good” score level or better. If you’re not there yet, don’t worry – scores can and do improve with consistent positive credit behaviors.

Why Scores Differ

“Wait – why is my score 720 on my bank app but 742 on my credit card portal?” This common confusion happens for several perfectly normal reasons:

Different bureaus see different pieces of your financial life. Your local credit union might report your excellent payment history to Experian but not to TransUnion. Your landlord might report rent payments to TransUnion but not Equifax. Each bureau has a slightly different picture of your credit history.

Scoring models vary widely. Even within FICO, there are numerous versions (FICO 8, FICO 9, etc.), each weighing factors slightly differently. VantageScore offers yet another approach. It’s like having your academic performance graded on different curves by different professors.

Timing creates temporary discrepancies. Your credit card company might report to Experian on the 15th of each month but to TransUnion on the 30th. If you check between those dates, you’ll see different information.

Educational vs. lender scores create confusion. Some free services provide “educational” scores – simplified versions that help you understand your general credit standing but aren’t the exact scores lenders use.

As one Finances 4You reader told us: “I finally stopped obsessing over the exact number and started focusing on the range instead. As long as all my scores stayed in the ‘Very Good’ category, I knew I was on the right track.”

How Often Should You Check

Checking your credit score is like taking your financial temperature – it’s a good habit, and unlike what some myths suggest, checking your own score is a “soft inquiry” that never hurts your credit. You can check as often as you’d like without penalty.

For most people, we recommend a quarterly check-up – frequent enough to catch issues but not so frequent that you’ll drive yourself crazy watching small fluctuations. However, certain situations call for more vigilant monitoring:

Before major financial moves, start checking 3-6 months ahead. Planning to buy a home or car? Begin monitoring your score well before applying for loans so you have time to address any issues.

After paying down significant debt, check to see the positive impact. Watching your score rise after hard work is incredibly motivating!

When you suspect fraud, check immediately. Unexpected score drops can be early warning signs of identity theft.

Here’s a pro tip: Through 2026, you can access your credit reports weekly (instead of the usual once per year) from all three bureaus at AnnualCreditReport.com. While these reports don’t include your actual score, they contain all the information that creates your score.

A smart approach is to stagger your checks by reviewing one bureau’s report every four months. This gives you year-round monitoring without information overload all at once.

For more insights on how your credit fits into your broader financial picture, check out our guide on personal budgeting.

Fix, Boost & Protect: Errors, Improvement Tactics, Fraud Defense + FAQs

Now that you know how to check your credit score, let’s talk about what to do with that information—whether you’ve spotted errors that need fixing, want to give your score a boost, or need to protect yourself from fraud.

Correcting Errors on Your Report

Would you believe that credit report errors are actually quite common? I’ve seen it happen to many of our readers, and these mistakes can really drag your score down unnecessarily.

If you spot something fishy, here’s your game plan:

First, gather your evidence—account statements, payment confirmations, or anything else that proves the error is actually an error. Then, file a dispute directly with the credit bureau through their website, by mail, or by phone:

- Equifax: equifax.com/personal/disputes

- Experian: experian.com/disputes

- TransUnion: transunion.com/disputes

Don’t stop there—also reach out to the company that provided the incorrect information to the bureau. Once you’ve submitted everything, the credit bureaus have to investigate within 30 days (sometimes 45 days) and let you know what they found.

One of our readers, Sarah, shared her win with us: “I found a collection account on my report that wasn’t even mine! After filing a dispute with proper documentation, the bureau removed it and my score jumped up 43 points almost immediately!”

Proven Ways to Raise a Low Score

If your score needs some TLC, focus on these tried-and-true strategies:

Pay every bill on time, every time. Your payment history weighs heaviest in your score calculation, so set up automatic payments or calendar reminders if you tend to forget due dates.

Shrink those credit card balances down to size. Try to keep your credit utilization (the percentage of available credit you’re using) below 30%—though aiming for under 10% will really make your score shine.

Hold onto those old credit cards, even if you don’t use them much. The length of your credit history matters, and closing old accounts can actually hurt your score.

Be selective with new credit applications since each one typically triggers a hard inquiry that temporarily dings your score.

Consider adding alternative data to your credit profile through services like Experian Boost, which can incorporate your on-time utility, phone, and streaming service payments.

If you’re really struggling to build credit, becoming an authorized user on a trusted person’s well-managed credit card or starting with a secured credit card can help establish positive history. Having a diverse mix of credit types (both revolving accounts like credit cards and installment loans like auto loans) can also give your score a nice lift.

For more detailed information about credit repair, you might want to check out the Federal Trade Commission’s credit repair guide, which provides official government advice on legitimate ways to improve your credit.

Guarding Against Fraud & Identity Theft

Your credit score is worth protecting, and these days, identity theft is unfortunately all too common. Here’s how to keep your credit on lockdown:

A security freeze is like putting your credit on ice—it prevents anyone (including you) from opening new accounts until you temporarily lift the freeze. You’ll need to contact each bureau individually to set this up.

Fraud alerts are a lighter touch—they don’t block new accounts but do require creditors to take extra verification steps before approving new credit in your name. The nice thing is that placing an alert with one bureau automatically extends to all three.

Regular credit monitoring helps you spot problems early. Watch for accounts or inquiries you don’t recognize, and consider setting up free alerts through your bank or credit card.

If you do suspect identity theft, report it immediately at ReportFraud.ftc.gov and follow their recovery steps.

Michael, who’s been reading our blog for years, told us: “After my health insurance company had a data breach, I placed freezes with all three bureaus right away. It was so reassuring knowing nobody could open accounts using my information.”

For more in-depth strategies on improving your credit, check out our guide on how to boost credit score.

Frequently Asked Questions about How to Check Your Credit Score

Q: Does checking my own credit score hurt my credit?

A: Not at all! When you check your own score, it’s considered a “soft inquiry” that has zero impact on your credit. You can check as often as you’d like without any penalty. Only “hard inquiries” (when you actually apply for credit) can temporarily lower your score.

Q: When will improvements to my credit show up in my score?

A: It depends on what you’re fixing. Paying down credit card balances often reflects within about 30 days. If you’ve successfully disputed errors, you’ll typically see changes 30-45 days after resolution. Late payment recovery happens gradually over time (though the late mark can stay on your report for up to 7 years). Adding positive information through services like Experian Boost can sometimes show up immediately.

Q: Which credit score do lenders actually use?

A: This one’s tricky because it varies! Most mortgage lenders use older FICO versions (FICO 2, 4, and 5), while auto lenders often prefer FICO Auto Scores. Credit card companies typically use FICO Score 8 or 9. When in doubt, just ask the lender which score they’ll be checking.

Q: Why can’t I see my credit score on my free credit report?

A: Great question that confuses many people! The law entitles you to free access to your credit reports, but not necessarily your credit scores. Scores are separate products that you can either purchase or access through various free services we discussed earlier.

Q: If I have no credit history, will I have a credit score?

A: Not right away. For a FICO score, you need at least one account open for six months or longer and at least one account reported to the bureau within the past six months. VantageScore can generate a score with less history, which is helpful for those just starting out.

Q: How can I tell if a credit score site is legitimate?

A: Watch for these signs of legitimate sites: they never ask for payment info for “free” scores, they have secure connections (https://), they don’t send unsolicited emails asking for personal information, and they’re associated with known financial institutions or the major credit bureaus. Be skeptical of sites promising “official” scores that aren’t connected to FICO or the major bureaus.

Conclusion

Let’s be real—knowing how to check your credit score is just the beginning of your financial journey. It’s like learning to read the dashboard of your car; now you can actually see how things are running under the hood!

Throughout this guide, we’ve walked through all the ways you can peek at your financial health score—from the free options sitting right in your bank app to the more comprehensive reports you can access through official channels.

Here’s what I hope you’ll take away from our conversation:

First, make checking your credit score a habit, not a one-time event. Think of it as your financial vital signs—worth monitoring quarterly at minimum, and definitely before big money moves like applying for a mortgage or car loan.

Second, don’t just glance at the number. Dig into those full credit reports (remember, they’re free weekly through 2026!). The stories they tell about your financial life can reveal errors costing you money or early warning signs of identity theft.

Third, don’t panic if your Capital One app shows one score while Experian shows another. Different scoring models and reporting timelines mean variation is completely normal.

Fourth, your score isn’t set in stone. With consistent on-time payments, strategic balance management, and patience, you can nudge that number upward over time.

Finally, protect what you’ve built! Your credit profile needs safeguarding through monitoring, security freezes, or fraud alerts when necessary.

At Finances 4You, we firmly believe that financial confidence comes from understanding your complete picture. Your credit score isn’t just some abstract number—it’s a reflection of your financial journey and a key that open ups opportunities, whether that’s your dream home, starting a business, or simply sleeping better at night knowing you’re on solid financial ground.

Ready to dive deeper into understanding your credit profile? Our complete guide to understanding credit scores and reports provides even more insights to help you steer your credit journey with confidence.

The road to financial well-being starts with awareness. What small step will you take today to check in on your credit health? Whatever your financial goals might be, we’re here cheering you on every step of the way.