Why Starting Your Retirement Savings Journey Today Changes Everything

Learning how to save for retirement might feel overwhelming, but the core strategy is surprisingly straightforward. Here’s what you need to know:

Quick Answer: How to Save for Retirement

1. Save 15% of your income annually (including employer match)

2. Start with your employer’s 401(k) to get the full company match

3. Open an IRA (Traditional or Roth) for additional savings

4. Automate your contributions so you save consistently

5. Increase savings by 1% each year to build momentum

6. Use catch-up contributions if you’re 50 or older

Nearly half of retirees fear running out of money—and for good reason. Research shows that most people need to replace 70-90% of their pre-retirement income to maintain their lifestyle, but Social Security only covers about 40% of that need.

The gap? That’s where your personal savings come in.

Here’s the encouraging truth: time is your biggest advantage. A 25-year-old saving just $75 monthly can potentially accumulate over $260,000 by retirement, thanks to compound growth. Wait until 35 to start with $100 monthly? You might only reach $150,000.

The math is clear—but so is the opportunity. Whether you’re just starting your career or realizing you need to catch up, the best time to boost your retirement savings is right now.

How to Save for Retirement: Setting Your Annual Savings Target

Think of your retirement savings like planting a tree—the earlier you start, the more time it has to grow into something magnificent. But here’s the question everyone asks: how much should you actually save for retirement each year?

The answer isn’t as scary as you might think. Financial experts have crunched the numbers, and they’ve landed on a sweet spot that works for most people: the 15% rule.

How Much Should I Save Each Year?

Here’s the magic number that has helped millions of Americans build solid retirement nest eggs: 15% of your pre-tax income annually. Before you start hyperventilating, remember this includes any employer match you receive—so it’s more doable than it sounds.

Let’s break this down with real numbers. If you’re earning $60,000 a year, you’d aim to save $9,000 annually. That works out to about $750 per month. Now, if your employer offers a typical 5% match, you’d only need to contribute 10% from your own pocket while your company kicks in the other 5%.

This 15% target is designed with a specific goal in mind: replacing roughly 45% of your pre-retirement income through your personal savings. Combined with Social Security benefits, this should give you enough to maintain your lifestyle in retirement.

For 2024, the contribution limits give you plenty of room to work with. You can stash away up to $23,000 in a 401(k) (plus an extra $7,500 if you’re 50 or older), and $7,000 in an IRA (with a $1,000 bonus for the 50-plus crowd).

Don’t feel like you need to hit 15% on day one. Many successful savers start small—maybe just enough to grab their full employer match—then bump up their contributions by 1% each year. Before they know it, they’ve reached that 15% target without feeling the pinch.

How to Save for Retirement if You’re Behind

If you’re reading this and thinking “I should have started years ago,” take a deep breath. You’re not alone, and more importantly, you’re not out of options. Late starters can still build impressive retirement savings with the right strategy.

If you’re under 40, you’ve got time on your side. Consider increasing your savings rate to 20% or higher if your budget allows. Focus on growth investments to make the most of your remaining years before retirement. This might also be the perfect time to explore side income opportunities that can boost your savings capacity.

If you’re over 40, don’t despair—you’ve got some powerful tools at your disposal. Once you hit 50, those catch-up contributions become your best friend. You might also want to think about delaying retirement by just 2-3 years, which can dramatically improve your financial position. Every year you wait means more time for your money to grow and less time you’ll need it to last.

Another strategy that works wonders is trimming discretionary expenses and funneling that money straight into retirement savings. That daily coffee shop visit or streaming service you forgot about? Those dollars can work much harder in your retirement account.

Here’s an encouraging fact: delaying retirement from age 65 to 67 can reduce your required savings target from 12 times your final salary to just 10 times. The math really does work in your favor when you give yourself more time.

For a deeper dive into creating a comprehensive strategy, our guide on how to plan for retirement covers all the bases you’ll need to consider.

Choosing the Right Retirement Accounts

Think of retirement accounts as different tools in your financial toolbox. Each one serves a specific purpose, and knowing how to save for retirement means understanding which tool works best for your situation.

The key difference between account types comes down to taxes—specifically, when you pay them. Traditional accounts give you a tax break today but require you to pay taxes when you withdraw money in retirement. Roth accounts work the opposite way: you pay taxes now but enjoy tax-free withdrawals later.

Beyond the basic 401(k) and IRA options, you might also consider Health Savings Accounts (HSAs) if you have a high-deductible health plan. These offer a triple tax advantage: deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. After age 65, you can withdraw HSA funds for any purpose (paying regular income tax, just like a traditional IRA).

Traditional vs. Roth Comparison:

| Feature | Traditional 401(k)/IRA | Roth 401(k)/IRA |

|---|---|---|

| Tax Treatment | Deductible now, taxed later | Taxed now, tax-free later |

| Best For | Higher current tax bracket | Lower current tax bracket |

| Required Distributions | Yes, starting at 73 | No (Roth IRA only) |

| Early Withdrawal | Penalties apply | Contributions accessible anytime |

The choice between traditional and Roth often depends on whether you expect to be in a higher or lower tax bracket in retirement. If you’re early in your career with room for income growth, Roth accounts often make sense. If you’re at peak earning years, traditional accounts might save you more money.

How to Save for Retirement With Employer Plans

Your workplace retirement plan deserves first priority when you’re figuring out how to save for retirement. Why? Because your employer is essentially offering you free money through matching contributions.

Getting your full employer match is like receiving an immediate 100% return on your investment. If your company matches 50% of your contributions up to 6% of your salary, you’re looking at guaranteed free money. On a $60,000 salary, that’s potentially $1,800 annually that you’d be leaving on the table by not participating.

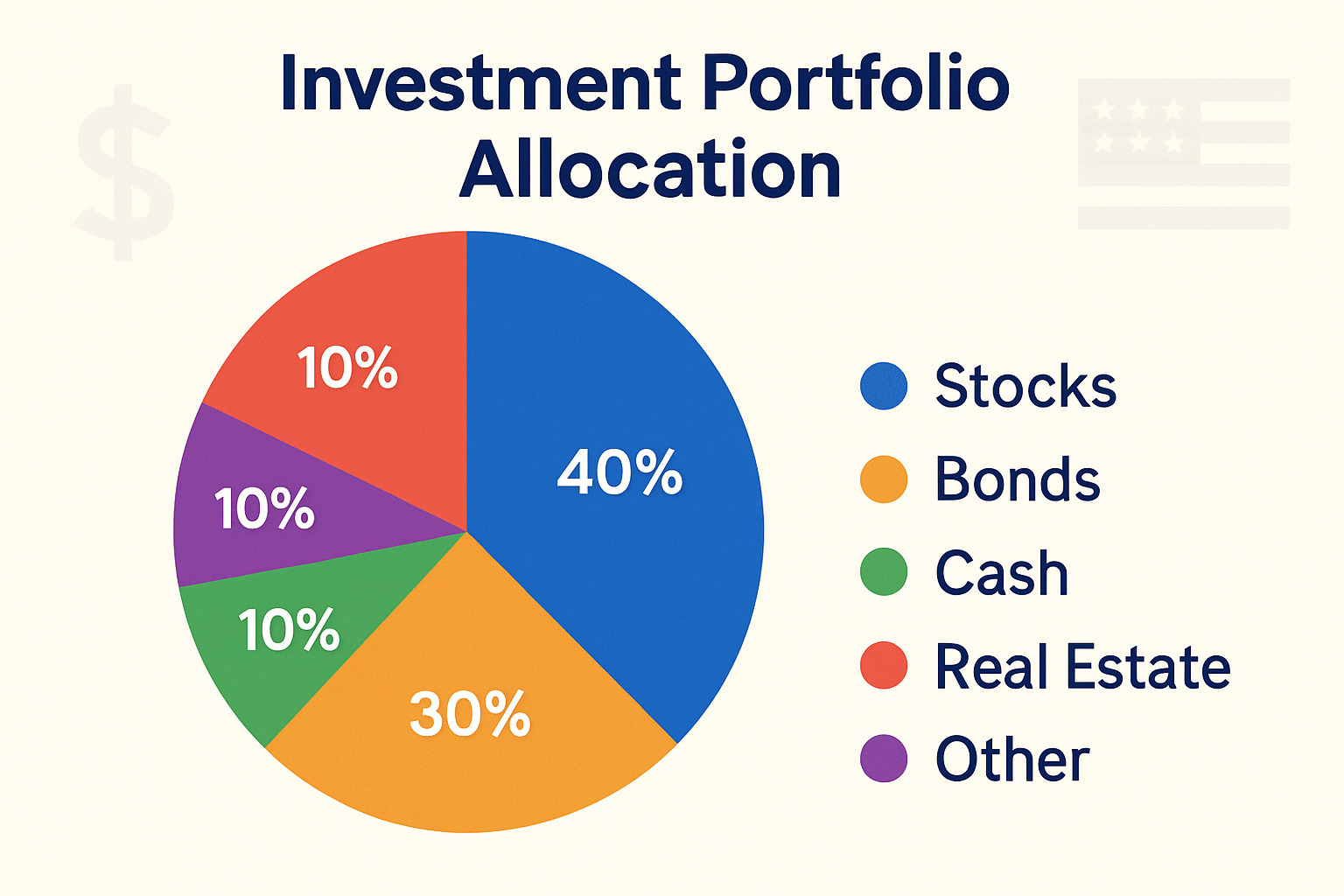

Most employer plans offer target-date funds, which automatically adjust your investment mix as you get closer to retirement. These funds start with a higher percentage of stocks when you’re young (for growth potential) and gradually shift toward bonds and cash as retirement approaches (for stability). They’re perfect if you want a “set it and forget it” approach to investing.

Vesting schedules determine when employer contributions truly belong to you. Some companies offer immediate vesting, meaning you own 100% of employer contributions right away. Others use graduated schedules where you earn ownership over several years. Understanding your vesting schedule is crucial if you’re considering a job change.

For comprehensive strategies on maximizing these benefits, check out our guide on the best way to save for retirement.

How to Save for Retirement When You’re Self-Employed

Being self-employed actually gives you some of the best retirement savings opportunities available. The contribution limits are much higher than what employees get, and you have more control over your investment choices.

Solo 401(k) plans are the powerhouse option for self-employed individuals. You can contribute as both the employee and the employer, potentially saving up to $69,000 annually (plus a $7,500 catch-up contribution if you’re 50 or older). You can even split your contributions between traditional and Roth options within the same plan.

SEP-IRA plans offer simplicity with high contribution limits—up to 25% of your compensation or $69,000, whichever is less. They’re easier to set up and maintain than Solo 401(k)s, making them popular among freelancers and consultants. The downside? If you have employees, you must contribute equally for everyone.

SIMPLE IRA plans work well for small business owners with a few employees. The contribution limits are lower—$16,000 for 2024 with a $3,500 catch-up—but they’re easier to administer than traditional 401(k)s. Employers can match up to 3% of compensation or make non-elective contributions for all eligible workers.

Our detailed guide to 401k plans for self-employed individuals covers all the specifics you need to make the right choice for your situation.

Understanding Social Security’s Role

Social Security provides a crucial foundation for retirement income, but it was never designed to cover all your expenses. Think of it as one leg of a three-legged stool, alongside employer benefits and personal savings.

The timing of when you claim Social Security benefits makes an enormous difference in your lifetime income. Claiming at age 62 gives you about 75% of your full benefit, while waiting until age 70 increases your benefit to 132% of the full amount. That 8% annual increase for delaying benefits past full retirement age is a guaranteed return you simply can’t get from any investment.

Most people need Social Security to replace about 40% of their pre-retirement income, which means your personal savings need to bridge a significant gap. Understanding your projected benefits helps you set realistic savings targets for the income you’ll need from other sources.

The Social Security Administration’s retirement estimator at SSA.gov provides personalized projections based on your actual earnings history. This tool helps you see exactly how much additional income you’ll need to generate from your retirement accounts and other savings.

Catch-Up and Optimization Strategies

Once you’ve mastered the basics of how to save for retirement, it’s time to shift into high gear. Think of this phase as fine-tuning a well-oiled machine—small adjustments can create surprisingly powerful results.

The beauty of optimization strategies is that they build on habits you’ve already formed. You’re not starting from scratch; you’re simply making your existing efforts work harder for you.

The 1% Challenge is one of the most effective strategies we’ve seen. Here’s how it works: commit to increasing your retirement contributions by just 1% each year. It sounds almost too simple, but research shows this gradual approach can boost your retirement income by approximately 3% for every 1% increase in savings rate.

The psychological genius of this approach is that a 1% increase feels manageable. If you’re earning $50,000 and saving 10%, bumping it to 11% means just $41 more per month. Most people won’t even notice that difference in their take-home pay.

Automation becomes your secret weapon once you’re ready to optimize. Set up automatic increases tied to your annual review or salary raises. Many 401(k) plans offer automatic escalation features that handle this seamlessly. When you don’t see the money in your paycheck, you genuinely won’t miss it.

Catch-up contributions after age 50 are like getting a second chance to boost your savings. For 2024, you can contribute an additional $7,500 to your 401(k) and $1,000 to your IRA beyond the standard limits. That’s potentially $8,500 more per year in tax-advantaged savings.

Here’s where windfalls become game-changers. Direct bonuses, tax refunds, and inheritance money straight into retirement accounts. These “found money” opportunities can accelerate your progress without impacting your regular budget or lifestyle.

HSAs offer a triple tax advantage that makes them incredibly powerful for retirement planning. You get tax-deductible contributions, tax-free growth, and tax-free withdrawals for medical expenses—or any purpose after age 65. It’s essentially a stealth retirement account disguised as health insurance.

Don’t forget about rebalancing your portfolio annually. As some investments grow faster than others, your asset allocation can drift from your target. Rebalancing forces you to sell high and buy low, which is exactly what successful investors do.

Paying off high-interest debt before retirement should be part of your optimization strategy too. Credit card debt at 18% interest is essentially a guaranteed negative return on your money. Eliminating it creates more room in your budget for retirement savings.

For comprehensive investment strategies as you approach retirement, check out our guide on the best way to invest for retirement.

Maximizing Employer & Tax Advantages

Your employer and the tax code offer hidden gems that many people overlook. Learning how to save for retirement means understanding these opportunities and using them strategically.

After-tax 401(k) contributions represent one of the most powerful strategies for high earners. Some plans allow after-tax contributions beyond the normal limits, which can then be converted to Roth accounts. This “mega backdoor Roth” strategy lets you potentially save much more in tax-free accounts than traditional limits allow.

The process works like this: you make after-tax contributions to your 401(k), then immediately convert them to Roth. Since you’ve already paid taxes on the money, the conversion creates no additional tax liability. The growth from that point forward is completely tax-free.

The Saver’s Credit provides up to $1,000 for individuals or $2,000 for couples who contribute to retirement accounts and meet income requirements. It’s literally free money from the government, yet millions of eligible people never claim it. The credit phases out at higher income levels, but for those who qualify, it’s an immediate return on your retirement contributions.

Strategic rollovers when changing jobs can save you thousands in fees and keep your retirement planning organized. Leaving old 401(k) accounts scattered across former employers makes tracking difficult and often subjects you to higher fees. Rolling them into your new employer’s plan or an IRA maintains tax advantages while giving you better control.

Understanding contribution limits and deadlines helps you maximize your tax benefits. You have until April 15th to make IRA contributions for the previous tax year, giving you extra time to optimize your tax situation. Some people strategically wait until they file their taxes to see if they need additional deductions.

Advanced Moves for Late Starters

Starting your retirement savings journey later in life requires more aggressive strategies, but don’t let that discourage you. Research shows that even late starters can build substantial retirement security by taking decisive action.

Annuities deserve consideration despite their mixed reputation. While they’re not right for everyone, immediate or deferred annuities can provide guaranteed income streams that complement your other retirement savings. They’re particularly valuable for covering basic expenses like housing and healthcare, giving you peace of mind about your essential needs.

The key with annuities is understanding what you’re buying and ensuring the fees are reasonable. They work best as part of a diversified retirement income strategy, not as your only solution.

Sequence-of-returns risk becomes critical when you’re close to or in retirement. Market downturns early in retirement can devastate your savings because you’re withdrawing money while values are depressed. Consider keeping 2-3 years of expenses in cash or short-term bonds to avoid selling investments during market lows.

This strategy, often called the “bucket approach,” lets market volatility work itself out while you live off safer investments. When markets recover, you can replenish your cash bucket from your growth investments.

Phased retirement offers a middle ground between full-time work and complete retirement. Rather than stopping work entirely, consider reducing hours or consulting in your field. This extends your earning years while allowing you to start enjoying more leisure time. Many people find this transition more satisfying than an abrupt stop to their careers.

Downsizing your lifestyle strategically can free up significant money for retirement savings. Moving to a smaller home or less expensive area can reduce both your current expenses and your required retirement income. The equity from selling a larger home can provide a substantial boost to your retirement accounts.

The research from the Social Security Administration shows that even small delays in retirement can significantly improve your financial security. Each additional year of work typically reduces your required savings by 6-8%, making catch-up strategies highly effective for late starters.

Adjusting Your Investments as Retirement Nears

Your investment strategy should evolve as you approach and enter retirement. The focus shifts from growth to preservation and income generation.

Asset Allocation Guidelines

A common rule of thumb is to subtract your age from 100 to determine your stock allocation. A 40-year-old might hold 60% stocks, while a 70-year-old might prefer 30% stocks. However, with longer life expectancies, many experts now suggest subtracting your age from 110 or 120.

The Glide Path Approach

Target-date funds automatically implement a glide path, gradually shifting from aggressive growth investments to more conservative options as your target retirement date approaches. This removes the guesswork and emotional decision-making that can derail retirement plans.

Rebalancing Discipline

Review and rebalance your portfolio at least annually. This forces you to sell high-performing assets and buy underperforming ones, maintaining your desired risk level while potentially improving returns.

For comprehensive retirement planning strategies, explore our comprehensive retirement planning resource.

Protecting Your Nest Egg

As you near retirement, protecting what you’ve built becomes as important as continued growth:

The 4% Safe Withdrawal Rule

Research suggests withdrawing no more than 4% of your retirement savings annually to make your money last 30 years. This means you need 25 times your annual expenses saved to retire comfortably.

Bucket Strategy

Divide your retirement savings into three buckets:

– Short-term (1-3 years): Cash and short-term bonds for immediate expenses

– Medium-term (4-10 years): Balanced funds for upcoming needs

– Long-term (10+ years): Growth investments for later retirement years

Guaranteed Income Foundation

Consider allocating 10-20% of your retirement savings to guaranteed income products to cover basic expenses. This provides peace of mind and allows you to be more aggressive with remaining investments.

Tracking Progress & Avoiding Common Mistakes

Building a secure retirement requires more than just setting up automatic contributions and hoping for the best. You need to regularly check your progress and steer clear of the financial landmines that can derail even the best-laid retirement plans.

Think of these age-based milestones as your retirement savings GPS. By age 30, aim to have one times your annual salary saved. If you’re earning $50,000, that means $50,000 in retirement accounts. By age 40, you’ll want three times your salary, and the targets continue climbing: six times by 50, eight times by 60, and ten times by your full retirement age of 67.

These benchmarks aren’t meant to stress you out if you’re behind. Instead, they’re your early warning system. If you’re significantly off track, you still have time to adjust your strategy and boost your savings rate.

Online retirement calculators can help you project whether your current savings rate will meet your goals. Most 401(k) providers offer these tools, and they’re surprisingly accurate when you input realistic assumptions about returns and inflation.

Your net worth should grow steadily as you progress through these milestones. This includes not just retirement accounts, but your home equity and other investments. The key is seeing consistent upward momentum over time, even if you hit temporary setbacks during market downturns.

The biggest retirement planning mistakes often stem from emotional decisions or lack of planning. Early withdrawals from retirement accounts are particularly devastating because you’ll pay a 10% penalty plus income taxes, and you’ll lose decades of potential compound growth on that money.

Taking loans from your 401(k) might seem harmless since you’re borrowing from yourself, but it reduces your account balance and stops that money from growing. Worse yet, if you change jobs, the entire loan typically becomes due immediately or gets treated as a taxable distribution.

High investment fees can silently drain your retirement savings over decades. A difference of just 1% in annual fees can cost you hundreds of thousands of dollars over a 30-year career. Review your investment options annually and choose low-cost index funds when possible.

Many people also fall into the trap of panic selling during market downturns. When learning how to save for retirement, market volatility is normal. Selling when markets are down locks in your losses and prevents you from participating in the recovery.

Before you get too aggressive with retirement savings, make sure you have three to six months of expenses in an emergency fund. This cash cushion prevents you from raiding your retirement accounts when life throws you a curveball like job loss or medical bills.

Behavioral biases can also derail your retirement plans. Some people contribute heavily when markets are doing well but reduce contributions during downturns—exactly the opposite of what they should do. Others constantly chase last year’s best-performing investments, missing out on long-term growth.

The solution is creating systems that remove emotion from your retirement saving decisions. Automatic contributions, annual increases, and target-date funds all help you stay on track without constantly second-guessing yourself.

For a deeper dive into protecting your retirement future, check out our guide on how to avoid these common retirement planning mistakes.

Frequently Asked Questions About How to Save for Retirement

Let’s tackle the most common questions we hear about retirement savings. These answers will help you understand whether you’re on track and what adjustments you might need to make.

How much should I have saved by age 30, 40, 50, 60, 67?

Here’s the reality check most people need: by age 30, you should have saved about one times your annual salary. If you’re earning $50,000, that means $50,000 in retirement accounts.

The benchmarks continue climbing from there. By age 40, aim for three times your salary saved up. That same $50,000 earner should have $150,000 tucked away. Age 50 calls for six times your salary, while age 60 should see eight times your annual income in retirement accounts.

The ultimate goal? Ten times your salary saved by age 67. This might sound intimidating, but remember—these targets assume you’re consistently saving 15% of your income and letting compound growth work its magic.

Don’t panic if you’re behind these milestones. Life happens, and plenty of successful retirees started later than ideal. The key is recognizing where you stand and taking action. Even increasing your savings rate by just 2-3% can dramatically improve your trajectory.

What percentage of my income should go toward retirement savings?

The magic number financial experts consistently recommend is 15% of your pre-tax income—and yes, that includes any employer match you receive. This percentage isn’t arbitrary; it’s based on solid research showing most people need to replace about 70-90% of their pre-retirement income to maintain their lifestyle.

Here’s how the math works: Social Security typically replaces about 40% of your pre-retirement income. Your personal savings need to bridge the remaining gap, which is where that 15% savings rate comes in.

If 15% feels overwhelming right now, start smaller. Many people begin with just enough to capture their full employer match—often around 3-6% of their salary. Then they bump up their contribution by 1% each year until they hit that 15% target.

The beautiful thing about this gradual approach? You barely notice the difference in your paycheck, but your future self will definitely notice the difference in your retirement account.

What is the 4% rule and how does it set my goal?

The 4% rule is your roadmap for figuring out exactly how much you need to save for retirement. It suggests you can safely withdraw 4% of your total retirement savings each year without running out of money during a typical 30-year retirement.

Here’s how to use it: Take the annual income you’ll need from your savings in retirement and multiply by 25. Need $40,000 per year? You’ll want $1 million saved. Need $60,000? That’s $1.5 million.

Let’s say you currently earn $75,000 and expect Social Security to provide $30,000 annually. You’d need another $45,000 from your savings to replace about 75% of your income. Using the 4% rule: $45,000 × 25 = $1,125,000.

This rule isn’t perfect—market conditions and your specific situation matter—but it gives you a concrete target to work toward. It transforms the vague goal of “saving for retirement” into a specific, achievable number. And honestly, having that target makes the whole process feel much more manageable.

Conclusion

Learning how to save for retirement is one of the most important financial skills you’ll ever develop—and honestly, it’s not as scary as it might seem at first glance. The strategies we’ve covered, from that foundational 15% savings rule to the more advanced catch-up moves, give you a clear path forward no matter where you’re starting from.

Here at Finances 4You, we’ve seen countless people transform their financial futures by taking these principles to heart. Our approach centers on helping you align your net worth with your age group, creating that solid foundation for long-term success. Whether you’re 25 and just landed your first real job, or 45 and suddenly realizing retirement isn’t as far off as you thought, the most important step is always the same: start where you are, with what you have, today.

The beauty of retirement savings lies in its predictability. Unlike trying to time the stock market or chase the latest investment trends, consistent saving and smart account choices create wealth through the simple magic of compound growth. That 25-year-old saving $75 monthly we talked about earlier? They’re not doing anything fancy—just showing up month after month, year after year.

Your financial future starts with these five moves: First, figure out your current savings rate and see how it stacks up against that 15% target. Second, grab every penny of available employer match—it’s literally free money sitting on the table. Third, automate everything so you’re not relying on willpower every month. Fourth, commit to reviewing your progress each year and bumping up contributions when you get raises. Finally, adjust your investment mix as retirement gets closer, shifting from growth mode to protection mode.

This is a marathon, not a sprint. You don’t need to become a financial expert overnight or save massive amounts immediately. Small, steady actions compound into life-changing results over time. The person who saves consistently for 30 years will always beat the person who tries to catch up with huge contributions in the final decade.

Ready to take your retirement planning to the next level? Our retirement planning resource center is packed with detailed guides and strategies to help you maximize every dollar you save. From investment allocation to tax optimization, we’ve got the insights you need to build the retirement you actually want.

Your future self is counting on the decisions you make today. The good news? You now have the roadmap to make those decisions with confidence. Time to put it into action.