Why IBIT Stock Has Become a Game-Changer for Bitcoin Investing

IBIT stock represents the iShares Bitcoin Trust, a groundbreaking exchange-traded fund that gives you direct exposure to Bitcoin without the hassle of managing digital wallets or cryptocurrency exchanges. Here’s what you need to know:

Quick IBIT Stock Facts:

- Current Price: $59.78 USD

- 52-Week Range: $28.23 – $63.70

- 1-Year Performance: +77.86%

- Assets Under Management: $74.2 billion

- Expense Ratio: 0.25%

- Ticker Symbol: IBIT (NASDAQ)

If you’re a high-earning professional looking to add Bitcoin exposure to your portfolio, IBIT offers a regulated, simple way to invest without the complexity of direct cryptocurrency ownership.

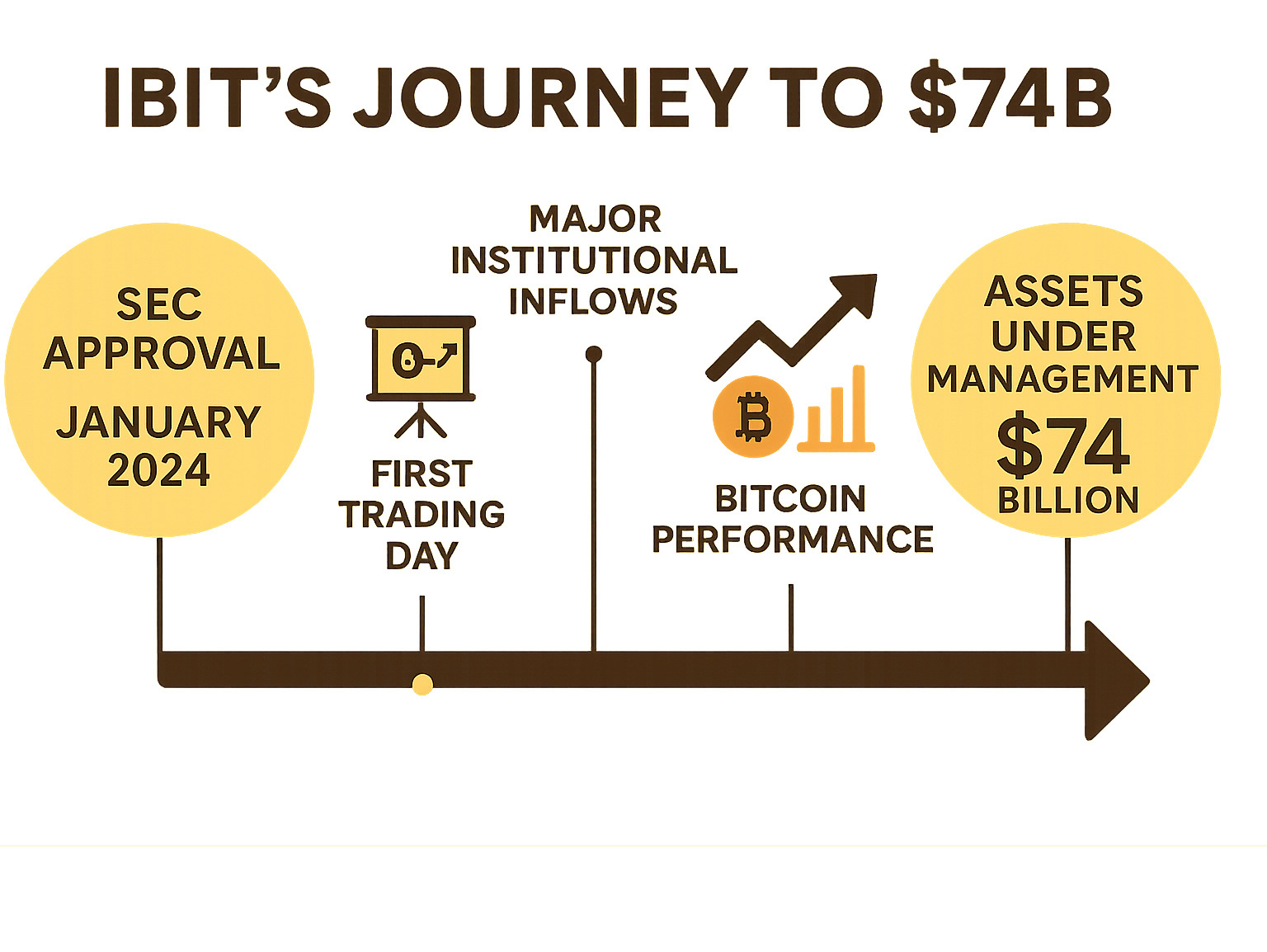

Launched in January 2024, this BlackRock-sponsored ETF holds actual Bitcoin in cold storage and tracks the CME CF Bitcoin Reference Rate. Unlike Bitcoin futures ETFs, IBIT provides direct exposure to Bitcoin’s spot price movements.

The fund has become one of the most successful ETF launches in history, reaching over $74 billion in assets within its first year. For investors dealing with lifestyle inflation and seeking diversification, IBIT provides a traditional brokerage account method to gain Bitcoin exposure alongside your existing stock and bond holdings.

The regulatory approval of spot Bitcoin ETFs like IBIT marked a major milestone for institutional Bitcoin adoption, making it easier than ever for retail investors to participate in the cryptocurrency market through familiar investment vehicles.

IBIT stock terms simplified:

What Is the iShares Bitcoin Trust (IBIT) and How It Works

Think of the iShares Bitcoin Trust (IBIT) as your gateway to Bitcoin investing without the headaches. This spot-backed Bitcoin ETF operates through a trust structure that’s refreshingly straightforward – it simply holds actual Bitcoin, not complicated derivatives or futures contracts.

Here’s what makes IBIT stock different: when you buy shares, you’re getting a piece of real Bitcoin that’s sitting securely in cold storage. The trust tracks the CME CF Bitcoin Reference Rate, which is basically the gold standard for Bitcoin pricing. BlackRock sponsors the fund and handles all the heavy lifting when it comes to custody and security.

The creation and redemption process might sound fancy, but it’s actually pretty simple. Authorized participants can swap Bitcoin for IBIT shares (and vice versa), which keeps the ETF’s price aligned with Bitcoin’s actual value. At just 0.25% in expenses, you’re getting professional Bitcoin management at a reasonable cost.

Every day, the fund calculates its Net Asset Value (NAV) based on the Bitcoin it holds, while the market price moves up and down during trading hours based on what people are willing to pay. This gives you the liquidity and transparency you’d expect from any quality ETF. More info about Crypto ETF

How IBIT Provides Exposure Without Owning Coins

Here’s where IBIT stock really shines – you get direct Bitcoin exposure without any of the cryptocurrency drama. No digital wallets to manage, no private keys to lose, and no sleepless nights worrying about exchange hacks.

The trust holds actual Bitcoin in institutional-grade cold storage, which means professional custodians handle all the security headaches for you. You can buy and sell IBIT shares through your regular brokerage account, just like you would with any other stock or ETF.

This setup eliminates the biggest pain points of Bitcoin ownership. You don’t need to research cryptocurrency exchanges, figure out complex security protocols, or worry about accidentally sending your Bitcoin to the wrong address (yes, that’s a real thing that happens to people).

The cold storage custody model uses multi-signature security and offline storage methods that are way more sophisticated than what most individual investors could set up on their own. It’s like having a team of Bitcoin security experts watching your investment 24/7.

How Closely Does IBIT Track Bitcoin’s Price?

IBIT stock does an impressive job of staying in sync with Bitcoin’s price movements. The fund maintains a correlation of approximately 0.99 with Bitcoin, which means it captures virtually every twist and turn in Bitcoin’s daily price action.

The tracking error is minimal – we’re talking about an average of just 0.04% difference between the fund’s performance and Bitcoin’s actual price. That’s remarkably tight tracking for any ETF, let alone one dealing with a volatile asset like Bitcoin.

During crazy market days when Bitcoin is swinging wildly, you might see slightly wider bid-ask spreads or brief moments where IBIT’s price drifts from its NAV. But these gaps typically close quickly thanks to the fund’s high liquidity and active market makers who jump on arbitrage opportunities.

The premium/discount to NAV stays consistently small, which means you’re not getting ripped off when you buy or sell. This tight tracking gives you confidence that your IBIT investment is genuinely reflecting Bitcoin’s performance, not some watered-down version of it.

Key Statistics & Recent Performance of IBIT Stock

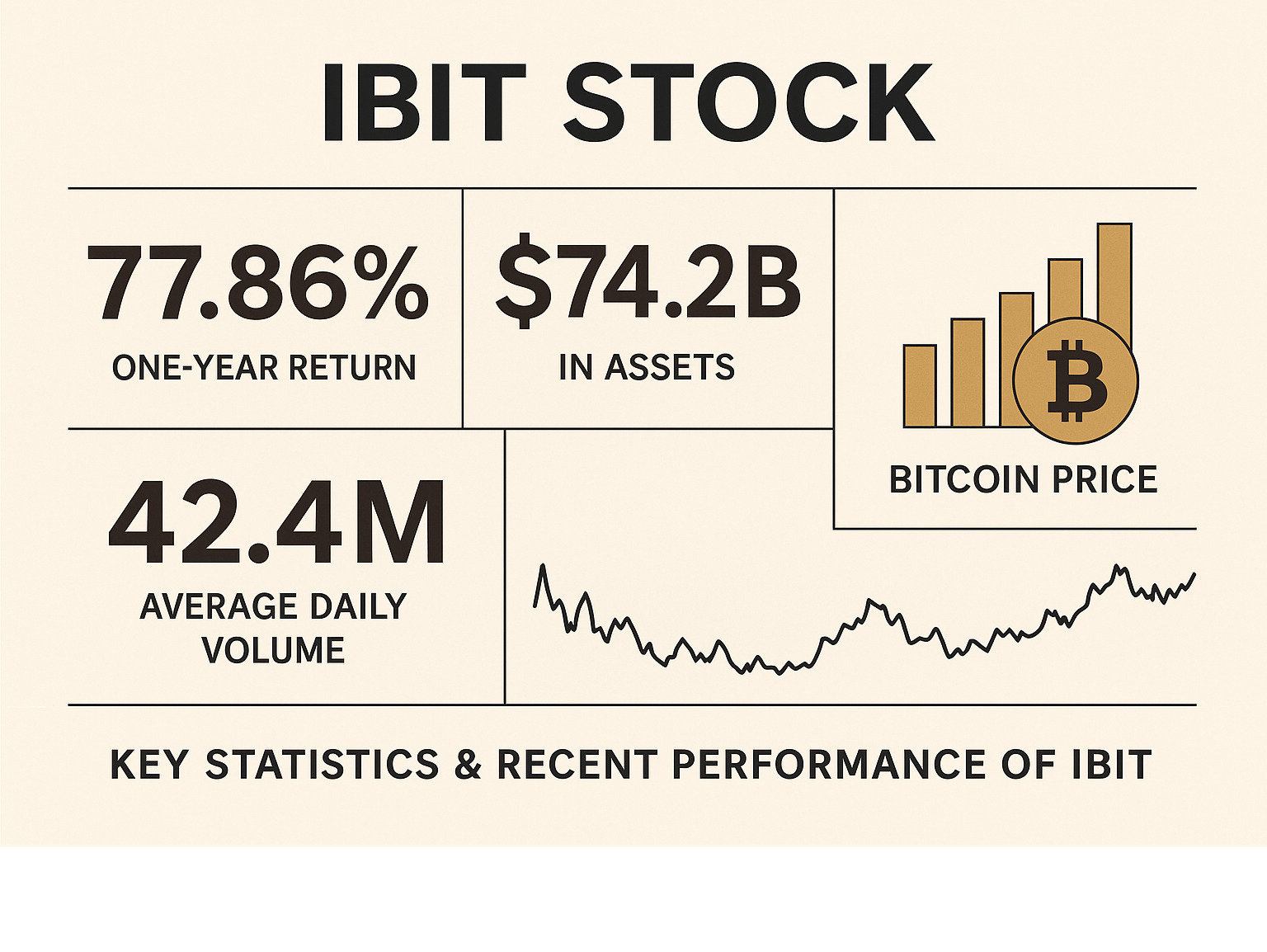

When you look at IBIT stock performance, the numbers tell a compelling story about Bitcoin’s mainstream adoption. Trading at $59.78 as of recent data, this BlackRock-managed fund has delivered an impressive 77.86% return over the past year – the kind of performance that makes traditional asset managers take notice.

The journey hasn’t been without its ups and downs, though. IBIT stock has traded in a 52-week range from $28.23 to $63.70, showcasing Bitcoin’s characteristic volatility while also demonstrating the substantial upside that’s attracted both retail and institutional investors.

What’s particularly striking is the fund’s massive scale and liquidity. With $74.2 billion in assets under management and over 1.01 billion shares outstanding, IBIT has become one of the largest ETFs launched in recent history. The daily trading volume of 42.4 million shares means you’re never stuck waiting to buy or sell – there’s always someone on the other side of your trade.

Year-to-date, IBIT stock is up 14.46%, showing continued momentum even as Bitcoin markets have matured. This performance reflects not just Bitcoin’s price movements, but also growing confidence in the ETF structure as a way to gain cryptocurrency exposure. Powered by Nasdaq Data Link real-time stats

Daily Market Metrics & Trading Characteristics

Trading IBIT stock feels remarkably similar to trading any blue-chip stock, which is exactly what BlackRock intended. The bid-ask spread typically runs just 0.02% – often as little as one cent – meaning you’re not getting nickel-and-dimed on transaction costs every time you trade.

The options market has developed quickly too, with active trading in both calls and puts across multiple strike prices and expiration dates. This gives sophisticated investors plenty of tools for hedging or income generation strategies, something you simply can’t do with direct Bitcoin ownership.

That daily volume of over 40 million shares isn’t just a number – it’s your assurance that you can move in and out of positions efficiently, even during those heart-stopping moments when Bitcoin decides to move 10% in a day. The fund’s liquidity profile makes it one of the most tradeable ways to get cryptocurrency exposure in your portfolio.

Premium/Discount History & Volatility

Here’s where IBIT stock really shines compared to some earlier Bitcoin investment vehicles. The fund typically trades within 0.04% of its net asset value, meaning you’re getting fair pricing that closely reflects the underlying Bitcoin holdings. No more worrying about paying huge premiums just to get Bitcoin exposure.

The volatility story is interesting too. While IBIT still carries a beta of 1.73 relative to the broader market – meaning it moves more dramatically than the S&P 500 – this has actually moderated since the fund’s early days. As Bitcoin markets have matured and institutional participation has grown, the wild swings have become somewhat more predictable.

During those inevitable Bitcoin volatility spikes, you might see IBIT stock briefly trade at wider premiums or discounts to its NAV. But these typically resolve within hours as market makers step in to capture arbitrage opportunities. It’s the ETF structure working exactly as designed, keeping your investment closely tied to Bitcoin’s actual price movements.

Factors Driving IBIT Stock: Correlation, Catalysts & Forecasts

Understanding what moves IBIT stock goes far beyond just watching Bitcoin’s price chart. While Bitcoin’s performance is the primary driver, several macro factors create the broader investment landscape that shapes IBIT’s trajectory.

The institutional adoption story continues to unfold in fascinating ways. Pension funds, university endowments, and corporate treasuries are increasingly viewing Bitcoin as a legitimate asset class rather than speculative digital currency. This shift represents a fundamental change in how traditional finance views cryptocurrency, and it’s creating steady demand for regulated vehicles like IBIT.

Bitcoin’s built-in scarcity mechanism through halving cycles creates compelling supply dynamics. Every four years, the reward for mining new Bitcoin gets cut in half, reducing the rate of new supply entering the market. The most recent halving occurred in 2024, historically setting up favorable conditions for price appreciation over the following years.

Regulatory clarity has been perhaps the biggest game-changer for IBIT stock. The SEC’s approval of spot Bitcoin ETFs removed a massive cloud of uncertainty that kept many institutional investors on the sidelines. As regulatory frameworks continue developing both in the U.S. and globally, this clarity tends to boost confidence in Bitcoin-related investments.

ETF inflows serve as a real-time barometer of institutional appetite. IBIT consistently ranks among the top recipients of new investment flows in the entire ETF universe, creating additional buying pressure for the underlying Bitcoin. These flows often become self-reinforcing as success attracts more success. More info about Crypto Market

Price Correlation to Bitcoin and Market Sentiment for IBIT stock

The relationship between IBIT stock and Bitcoin is remarkably tight, with the ETF typically capturing 95-99% of Bitcoin’s daily price movements. This means when Bitcoin has a good day, IBIT investors usually celebrate too.

Market sentiment plays a huge role in short-term price action. The Crypto Fear and Greed Index often provides early signals about where IBIT might head next. During periods of extreme fear, IBIT can experience additional selling pressure because ETF investors can exit their positions much more easily than people holding actual Bitcoin.

ETF flows offer fascinating insights into investor psychology. Large inflows typically signal institutional optimism about Bitcoin’s prospects, while sustained outflows suggest growing concern. These patterns often precede significant price movements by days or weeks.

Social media sentiment and retail investor enthusiasm also influence IBIT’s trading patterns, particularly during periods of high Bitcoin volatility. When Bitcoin makes headlines, IBIT often sees increased trading volume as investors pile in or head for the exits.

12-Month & Long-Term Forecasts for IBIT stock

The crystal ball gets pretty cloudy when predicting IBIT stock prices, but analyst consensus provides some interesting insights. The average 30-day price target sits at $63.05, suggesting about 5.36% upside from current levels around $59.78.

The range of analyst opinions tells its own story. The most optimistic target reaches $70.08, while conservative estimates hover around $56.01. This spread reflects the genuine uncertainty inherent in Bitcoin-related investments.

Long-term projections become even more speculative but potentially more rewarding. AI-driven forecasts suggest IBIT could reach $64.21 by 2026 and $79.58 by 2030, assuming continued Bitcoin adoption and favorable regulatory developments.

WalletInvestor’s analysis indicates potential for a 33% increase over five years, which would turn a $100 investment today into approximately $133 by 2030. These numbers sound attractive, but Bitcoin’s volatility means the actual path could be much bumpier than these smooth projections suggest.

Analyst Views: Buy, Sell or Hold?

The professional investment community maintains a cautiously optimistic stance on IBIT stock. Most analysts lean toward a “hold” recommendation, viewing the current price as fairly valued relative to near-term prospects.

The modest 5-6% upside to average price targets suggests that analysts don’t see IBIT as dramatically undervalued at current levels. This measured approach reflects both Bitcoin’s long-term potential and its short-term unpredictability.

Alternative data analysis incorporating social media sentiment, institutional flow patterns, and technical indicators supports a careful approach to IBIT investment. While long-term prospects remain positive, short-term volatility and ongoing regulatory uncertainty make position sizing crucial.

Most financial advisors recommend treating IBIT as part of a diversified portfolio rather than a standalone investment. Typical allocation suggestions range from 1-5% of total portfolio value, depending on your risk tolerance and investment timeline. This approach lets you participate in Bitcoin’s potential upside while protecting your overall financial stability.

Comparing IBIT to Other Bitcoin Investment Vehicles

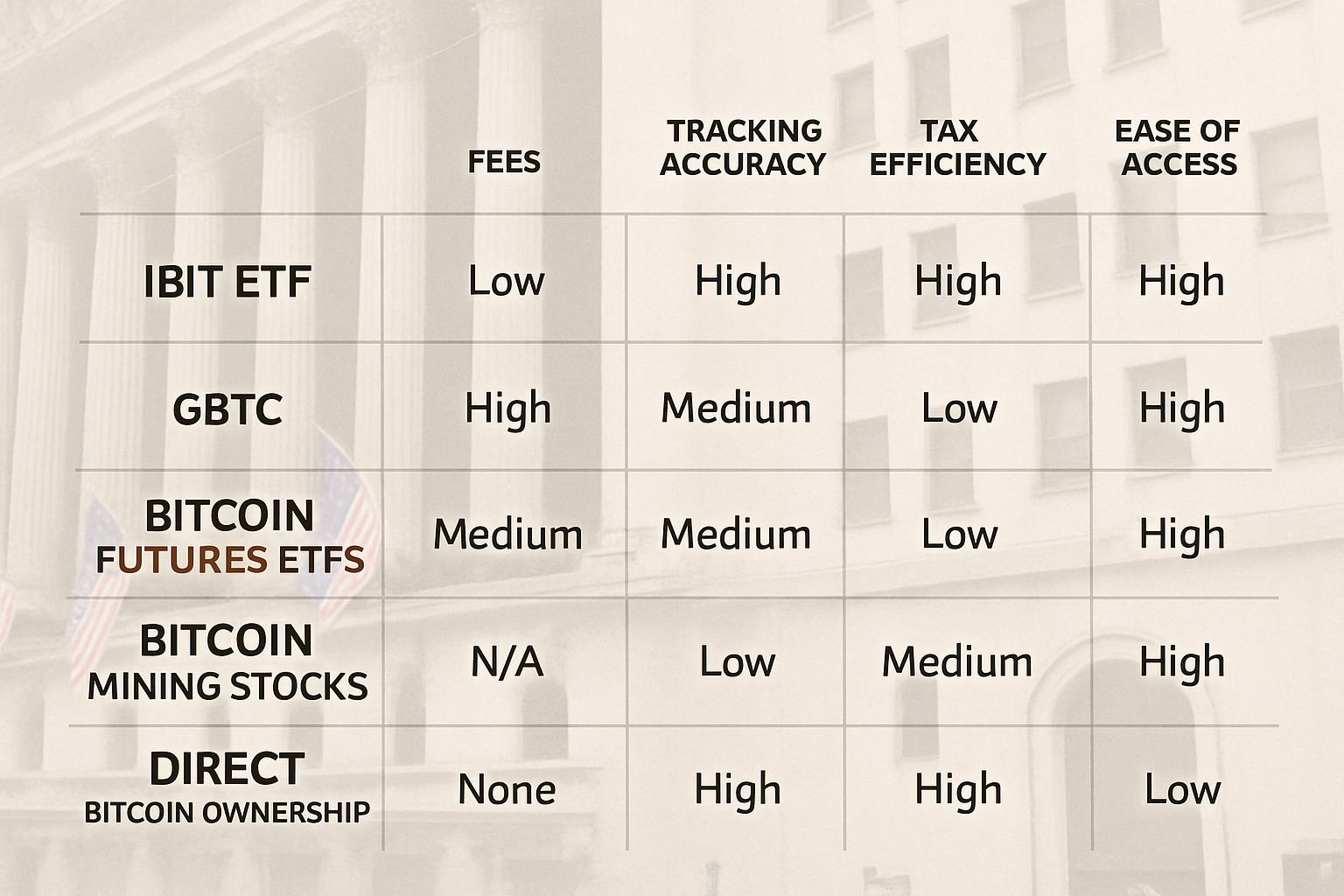

When you’re looking at ways to add Bitcoin to your portfolio, IBIT stock offers some compelling advantages over other options. Let’s walk through how it stacks up against the alternatives you might be considering.

The Grayscale Bitcoin Trust (GBTC) was the go-to option for years, but it came with a major headache – wild swings between trading above and below its actual Bitcoin value. Sometimes investors paid hefty premiums, other times they got discounts, but rarely did the price match what the Bitcoin was actually worth. IBIT stock solves this problem with its ETF structure that keeps the price tightly aligned with Bitcoin’s actual value.

Futures-based Bitcoin ETFs might seem similar, but they come with hidden costs that can eat into your returns. These funds don’t hold actual Bitcoin – instead, they buy contracts for future Bitcoin delivery. When these contracts roll over, you can lose money due to something called “contango” (when future prices are higher than current prices). IBIT stock sidesteps this entirely by holding real Bitcoin.

Bitcoin mining stocks give you a different kind of exposure – they often move more dramatically than Bitcoin itself, which can be exciting when prices rise but painful when they fall. Plus, you’re betting on the company’s ability to mine efficiently, manage costs, and steer regulatory changes. That’s a lot more complexity than the straightforward Bitcoin exposure you get with IBIT.

Direct Bitcoin ownership gives you complete control, but it also means you’re responsible for keeping your digital wallet secure, remembering complex passwords, and handling all the technical details. Studies show that millions of Bitcoin have been permanently lost due to forgotten passwords or technical mishaps – risks that simply don’t exist when you own IBIT stock.

Why Choose an ETF Wrapper?

The ETF structure makes investing in Bitcoin feel just like investing in any other part of your portfolio. When tax season rolls around, you’ll get a simple 1099 form instead of trying to figure out cryptocurrency tax reporting rules that seem to change every year.

Think about it – no more worrying about private key management or the horror stories of people losing access to millions in Bitcoin because they forgot a password. With IBIT, your Bitcoin exposure is as secure and accessible as your other investments.

The options trading possibilities open up strategies that aren’t available with direct Bitcoin ownership. Want to generate income by selling covered calls? Looking to protect your position with put options? These sophisticated strategies become possible when you hold IBIT stock instead of raw Bitcoin.

Tax reporting becomes refreshingly straightforward. Instead of tracking every Bitcoin transaction and calculating gains in dollars at the time of each trade, you simply report your IBIT transactions like any other stock or ETF sale.

Diversification Within a Crypto Allocation

If you’re building out a cryptocurrency portion of your portfolio, IBIT stock makes an excellent core holding. It gives you pure exposure to Bitcoin – the granddaddy of cryptocurrencies that still represents the largest chunk of the crypto market.

Most financial advisors suggest keeping your crypto allocation between 1-10% of your total portfolio, depending on your risk tolerance and how close you are to retirement. IBIT fits perfectly into this approach because it behaves like a traditional investment while giving you Bitcoin exposure.

The beauty of using IBIT as your Bitcoin exposure is that it correlates closely with Bitcoin’s price without the operational headaches. This means you can focus on the bigger picture of your portfolio allocation rather than getting bogged down in the technical details of cryptocurrency management.

More info about Crypto Investing 101 provides additional guidance on building diversified cryptocurrency allocations that complement traditional investment portfolios.

Risks, Taxes, and How to Buy IBIT

Let’s be honest – every investment comes with risks, and IBIT stock is no exception. While this ETF makes Bitcoin investing much simpler than managing your own crypto wallet, you still need to understand what you’re getting into.

The biggest risk on everyone’s mind? Regulatory changes. While the SEC has approved spot Bitcoin ETFs like IBIT, government attitudes toward cryptocurrency can shift. New regulations could impact how the fund operates or affect investor demand. The good news is that current trends favor more regulatory clarity, not less.

Then there’s the elephant in the room: Bitcoin’s famous volatility. When Bitcoin swings 10% in a day (which happens more often than you’d like), IBIT moves right along with it. With a beta of 1.73, IBIT typically moves about 73% more than the broader stock market. That means bigger potential gains, but also bigger potential losses.

Custody risks deserve mention too, even though BlackRock uses institutional-grade security. The underlying Bitcoin sits in cold storage with qualified custodians, but cyber threats to the Bitcoin network or custodial systems remain a theoretical concern. Still, this risk is much lower than trying to secure your own Bitcoin wallet.

Regulatory Environment & Impact on Bitcoin ETFs

The regulatory picture for Bitcoin ETFs has improved dramatically since IBIT’s approval. The SEC now oversees these funds just like traditional ETFs, which provides legitimacy that wasn’t there before.

Current custody rules require qualified custodians to hold the actual Bitcoin, ensuring institutional-grade security standards. This isn’t some fly-by-night operation – we’re talking about the same security protocols used for managing billions in traditional assets.

Global regulatory trends generally support Bitcoin ETFs like IBIT. As major economies develop clearer cryptocurrency frameworks, it creates a more stable environment for institutional adoption. While future regulatory changes could affect IBIT’s operations or fees, the current trajectory looks supportive rather than restrictive.

The key takeaway? Regulatory risk exists, but it’s trending in a positive direction for established, compliant products like IBIT.

Tax Considerations & Distribution Policy

Here’s where IBIT really shines compared to direct Bitcoin ownership – tax simplicity. You’ll get a standard 1099 form at tax time, just like with any other ETF. No complex cryptocurrency tax calculations or tracking every single transaction.

IBIT doesn’t pay dividends because Bitcoin doesn’t generate income. When you sell your shares, you’ll owe capital gains taxes on any profits. The wash sale rule applies, meaning you can’t claim a loss if you buy back IBIT shares within 30 days of selling.

Unlike some cryptocurrency investments that send you confusing K-1 forms, IBIT keeps things straightforward. This tax efficiency alone makes it worth considering over more complex Bitcoin investment structures.

The bottom line: IBIT treats taxes like a normal stock or ETF, which most investors find much easier to handle.

Step-by-Step Guide to Trading IBIT

Buying IBIT stock is refreshingly simple – it works exactly like purchasing any other ETF through your brokerage account. Most major online brokers offer access to NASDAQ-listed ETFs, so you’re probably already set up.

When you’re ready to buy, consider using limit orders instead of market orders, especially when Bitcoin is having one of its volatile days. This gives you more control over the price you pay.

Keep an eye on trading volume before making large purchases. With IBIT’s average daily volume of 42.4 million shares, liquidity usually isn’t an issue, but it’s worth checking during unusual market conditions.

Setting up price alerts can help you stay on top of IBIT’s movements without constantly checking your phone. Most brokers let you set notifications when IBIT hits certain price levels or moves by a specific percentage.

While IBIT doesn’t currently pay distributions, you might want to enable dividend reinvestment (DRIP) if your broker offers it, just in case that changes in the future. More info about Cryptocurrency Trading for Beginners

IBIT trades during regular market hours, unlike Bitcoin which trades 24/7. This can sometimes create interesting opportunities when Bitcoin moves significantly overnight or on weekends.

Frequently Asked Questions about IBIT

Let’s tackle the most common questions investors ask about IBIT stock. These answers will help you make informed decisions about whether this Bitcoin ETF fits your investment strategy.

What is the current expense ratio of IBIT?

IBIT charges an expense ratio of 0.25%, which means you’ll pay $2.50 annually for every $1,000 invested. This fee covers all the heavy lifting – fund management, institutional-grade custody services, and the operational expenses of securely storing Bitcoin.

When you compare this to other cryptocurrency investment options, 0.25% sits in the sweet spot of being reasonable without being cheap. The fee reflects the real costs of maintaining professional Bitcoin custody and regulatory compliance that individual investors would struggle to replicate on their own.

Think of it this way: you’re paying a quarter of a percent to avoid the headaches of managing private keys, researching crypto exchanges, and worrying about security breaches. For most investors, that’s a fair trade-off.

Does IBIT pay any dividends or distributions?

No, IBIT doesn’t pay dividends or distributions – and there’s a simple reason why. Bitcoin itself doesn’t generate income like dividend-paying stocks or interest-bearing bonds. It just sits there, hopefully appreciating in value over time.

Your returns from IBIT stock come entirely from Bitcoin’s price movements. When Bitcoin goes up, IBIT goes up. When you’re ready to cash out, you sell your shares and realize your gains (or losses, depending on timing).

This structure actually keeps things simple from a tax perspective. You won’t receive quarterly distribution statements or worry about reinvestment options. Your tax situation only changes when you actually sell your IBIT shares.

Is IBIT suitable for long-term investors?

IBIT can work well for long-term investors, but it requires the right mindset and portfolio allocation. If you believe Bitcoin will play a larger role in the global financial system over the coming decades, IBIT offers a regulated, hassle-free way to participate in that potential growth.

The key word here is allocation. Most financial advisors suggest keeping Bitcoin exposure between 1-5% of your total portfolio, treating it as a diversification tool rather than a core holding. This approach lets you benefit from Bitcoin’s potential upside while protecting your overall wealth from its notorious volatility.

Long-term success with IBIT stock typically requires patience during the inevitable downturns and the discipline not to panic-sell during Bitcoin’s periodic crashes. If you’re the type of investor who checks their portfolio daily and loses sleep over 20% swings, IBIT might not be the right fit for your temperament.

Bitcoin is still a relatively young asset class. While it has shown remarkable growth over its short history, past performance doesn’t guarantee future results – especially with an asset as unpredictable as Bitcoin.

Conclusion and Next Steps

IBIT stock has truly changed the game for Bitcoin investing, making it possible for everyday investors to get cryptocurrency exposure without the headaches of managing digital wallets or worrying about lost passwords. The fund’s remarkable journey to over $74 billion in assets shows just how hungry investors were for a simple, regulated way to invest in Bitcoin.

If you’re considering adding Bitcoin to your portfolio, IBIT checks a lot of boxes. You get direct price tracking that mirrors Bitcoin’s movements almost perfectly, regulatory oversight from the SEC that provides peace of mind, and tax simplicity with standard 1099 forms instead of complex crypto tax calculations. Plus, you never have to worry about hackers stealing your private keys or forgetting your wallet password.

But let’s be honest – Bitcoin is still Bitcoin. The price swings can be stomach-churning, and IBIT stock will ride those same roller coasters. That’s why most financial advisors suggest keeping your Bitcoin allocation small, maybe 1-5% of your total portfolio depending on how well you sleep at night during market turbulence.

The future looks promising for IBIT as more institutions warm up to Bitcoin and regulations become clearer. We’re seeing pension funds, university endowments, and even some corporations adding Bitcoin to their portfolios. IBIT makes it easy for them to do this through familiar investment channels.

At Finances 4You, we see IBIT as a valuable tool for investors who want to participate in the digital asset revolution without the technical complexity. The key is being smart about how much you allocate – enough to benefit if Bitcoin continues growing, but not so much that volatility keeps you up at night.

Consider dipping your toes in the water with a small IBIT position first. Watch how it behaves in your portfolio and how comfortable you feel with the price movements. You can always add more later as your comfort level grows.

The beauty of IBIT is that it brings Bitcoin investing into the mainstream financial world while maintaining all the potential upside of the underlying cryptocurrency. Whether Bitcoin reaches those optimistic long-term price targets or faces more bumps along the way, IBIT gives you a front-row seat with training wheels attached.

More info about Digital Currency Investment can help you develop a comprehensive approach to cryptocurrency investing that complements your existing investment strategy.