Why Investing for Millennials Is Your Path to Financial Freedom

Investing for millennials starts with understanding that you have the most powerful wealth-building tool on your side: time. Born between 1981 and 1996, millennials face unique financial challenges but also have decades to harness compound interest.

Quick Start Guide for Millennial Investors:

- Start with employer 401(k) match – it’s free money with 100% instant return

- Open a Roth IRA – tax-free growth perfect for your current tax bracket

- Begin with $100/month – micro-investing apps make it simple

- Choose low-cost index funds – broad market exposure without high fees

- Automate everything – set it and forget it approach builds discipline

The numbers tell the story. A 28-year-old who contributes $6,000 per year to a Roth IRA could have $910,000 by retirement at a 7% return. Wait until 35? You’ll only have $565,000.

Yet only 31% of young millennials actively save for retirement. The Great Recession left scars, student loans average $38,877, and many lack employer-sponsored plans. But here’s the reality: not investing carries its own risk as inflation erodes your cash savings.

This guide cuts through the noise. You’ll learn how to start investing with limited funds, balance debt payments with wealth building, and use technology to your advantage.

The best time to start was yesterday. The second best time is right now.

Investing for millennials vocab to learn:

- best investment books for millennials

- real estate investment strategies for millennials

- best etfs for millennials

Who Are Millennials & Their Money Reality

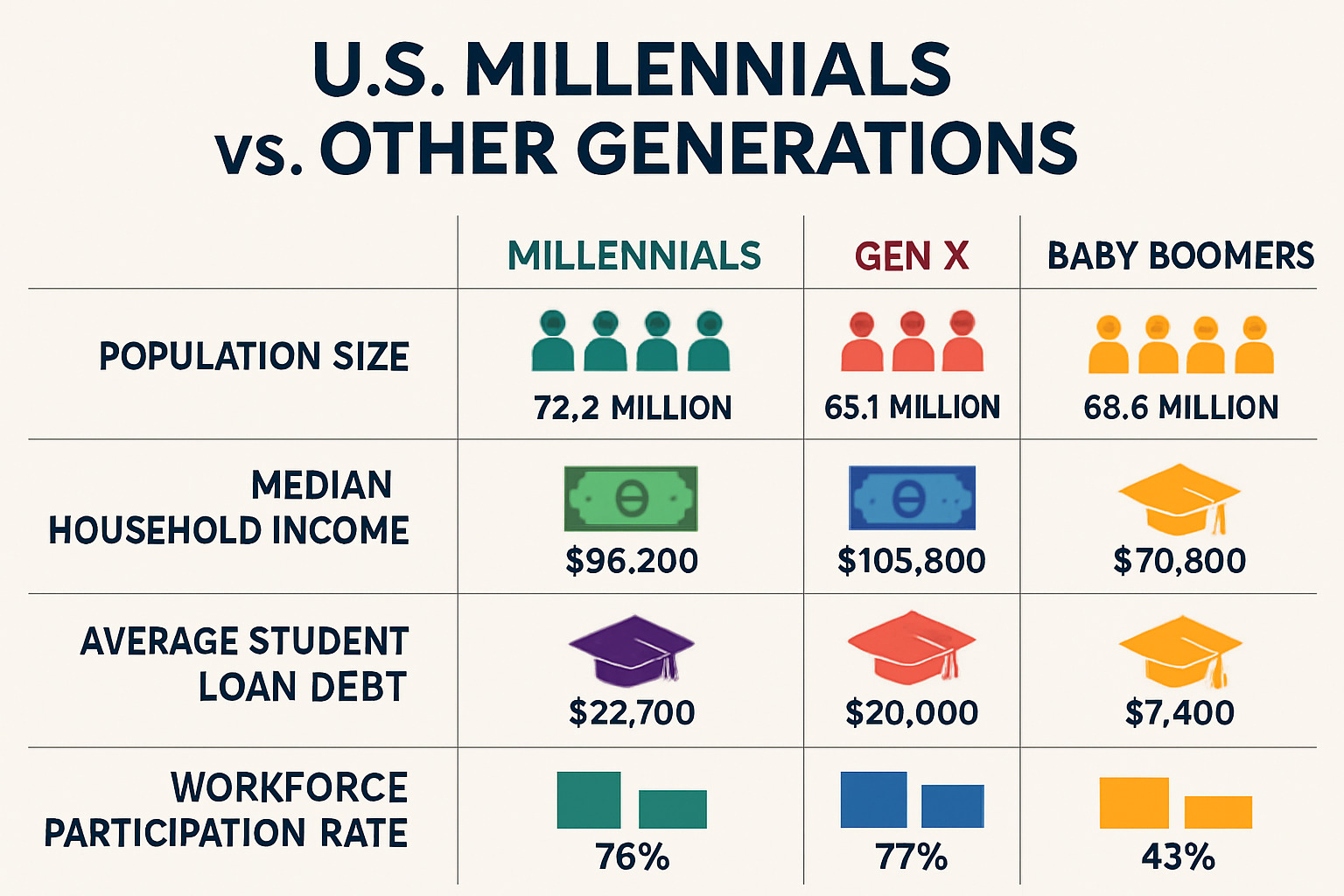

Meet the 72 million Americans born between 1981 and 1996 – the largest living generation and most ethnically diverse in U.S. history. By 2025, millennials will make up 75% of the workforce, yet your financial reality is unlike any generation before.

The median millennial household earns $71,566 annually, but carries $38,877 in student loan debt – a burden previous generations didn’t face at this scale.

The Great Recession left deep scars. Many entered the job market when unemployment hit 15% for early-20s workers, creating lasting impacts on earning trajectories.

But here’s what’s encouraging: Nearly three-quarters of millennials say they’re actively saving for the future – a 10% jump from just two years ago. About 21% don’t have employer-sponsored retirement plans, which means flying solo on investment decisions.

You’re also rewriting work rules. The gig economy, remote flexibility, and entrepreneurial spirit create opportunities. When 74% of millennials chose not to return to full-time office work post-pandemic, you proved flexibility matters more than corner offices.

The bottom line? Your generation faces unique problems, but you also have something powerful: time.

Ready to turn obstacles into opportunities? Check out our Investment Tips specifically crafted for your generation.

Why Investing Early Matters for Millennials

Time is your secret weapon as a millennial investor. Investing for millennials early open ups compound interest – where your money grows on its growth.

If you start investing $14 per day at age 23, you could have $1 million by age 67. Wait seven years? You’ll need 50% more to reach that same goal.

Start investing $5,000 annually at age 19: roughly $1.5 million by 65. Begin at 25? About $998,000. Wait until 30? Approximately $691,000. That’s over half a million dollars difference between starting at 19 versus 25.

Inflation is another threat. While savings accounts earn 2.81% annually, the S&P 500 has returned roughly 8.12% over 20 years. That gap compounds into serious money.

53% of millennials expect to become millionaires. With smart investing habits, this isn’t wishful thinking – it’s achievable.

Psychological Barriers & How to Overcome Them

Many millennials feel gun-shy about investing after watching parents’ retirement accounts tank in 2008. But generational trauma can cost serious money. The S&P 500 dropped 37% in 2008, then bounced back 27% in 2009.

For 30-40 year periods, diversified stock investments consistently beat cash and bonds. Start small to build confidence. Automation helps – when investing happens automatically, you’re less tempted to panic.

Investing for Millennials with Limited Funds

Fractional shares mean owning expensive stocks for just $1. Micro-investing apps round up purchases and invest spare change. Dollar-cost averaging turns volatility into your friend.

Dedicate side hustle income to investing. Just $175 monthly can grow into substantial wealth over decades.

For guidance on starting small, check our Beginner Investing resources.

Balancing Debt Repayment and Investing Goals

If student loans carry rates below 6-7%, consider minimum payments while investing for retirement. Stock investments historically return 10% annually.

Credit card debt is different – prioritize paying off high-interest debt first. Always grab your employer 401(k) match regardless.

Build a small emergency fund simultaneously. Even $1,000 prevents expenses from derailing investment progress.

For avoiding common pitfalls, review our Top 5 Common Investing Mistakes guide.

Best Investing Accounts for Millennials

The right investment accounts save thousands in taxes over your lifetime. Smart investing for millennials means using several account types strategically.

Your employer’s 401(k) should be first priority if they offer matching – that’s instant 100% returns up to the match limit.

Roth IRAs are perfect for millennials. You contribute after-tax money, but everything grows tax-free forever. Since you’re likely in a lower tax bracket now than during peak earning years, paying taxes upfront makes sense. For 2024, contribute up to $6,500 annually.

Traditional IRAs offer tax deductions now but you pay taxes on withdrawals later. Better for high earners wanting immediate tax relief.

Taxable brokerage accounts provide complete flexibility once tax-advantaged options are maxed. No contribution limits or early withdrawal penalties.

Health Savings Accounts (HSAs) offer triple tax advantages with high-deductible health plans – contributions are deductible, growth is tax-free, and medical withdrawals are tax-free.

| Account Type | Tax Treatment | Contribution Limit (2024) | Best For |

|---|---|---|---|

| 401(k) | Pre-tax contributions, taxed on withdrawal | $23,000 | Employer match, high earners |

| Roth IRA | After-tax contributions, tax-free growth | $6,500 | Young investors, lower tax brackets |

| Traditional IRA | Pre-tax contributions, taxed on withdrawal | $6,500 | Tax deduction needed now |

| Taxable Brokerage | After-tax contributions, pay taxes on gains | None | Flexibility |

| HSA | Triple tax advantage | $4,150 individual | High-deductible health plan holders |

For investment fundamentals, check our Investing 101 guide.

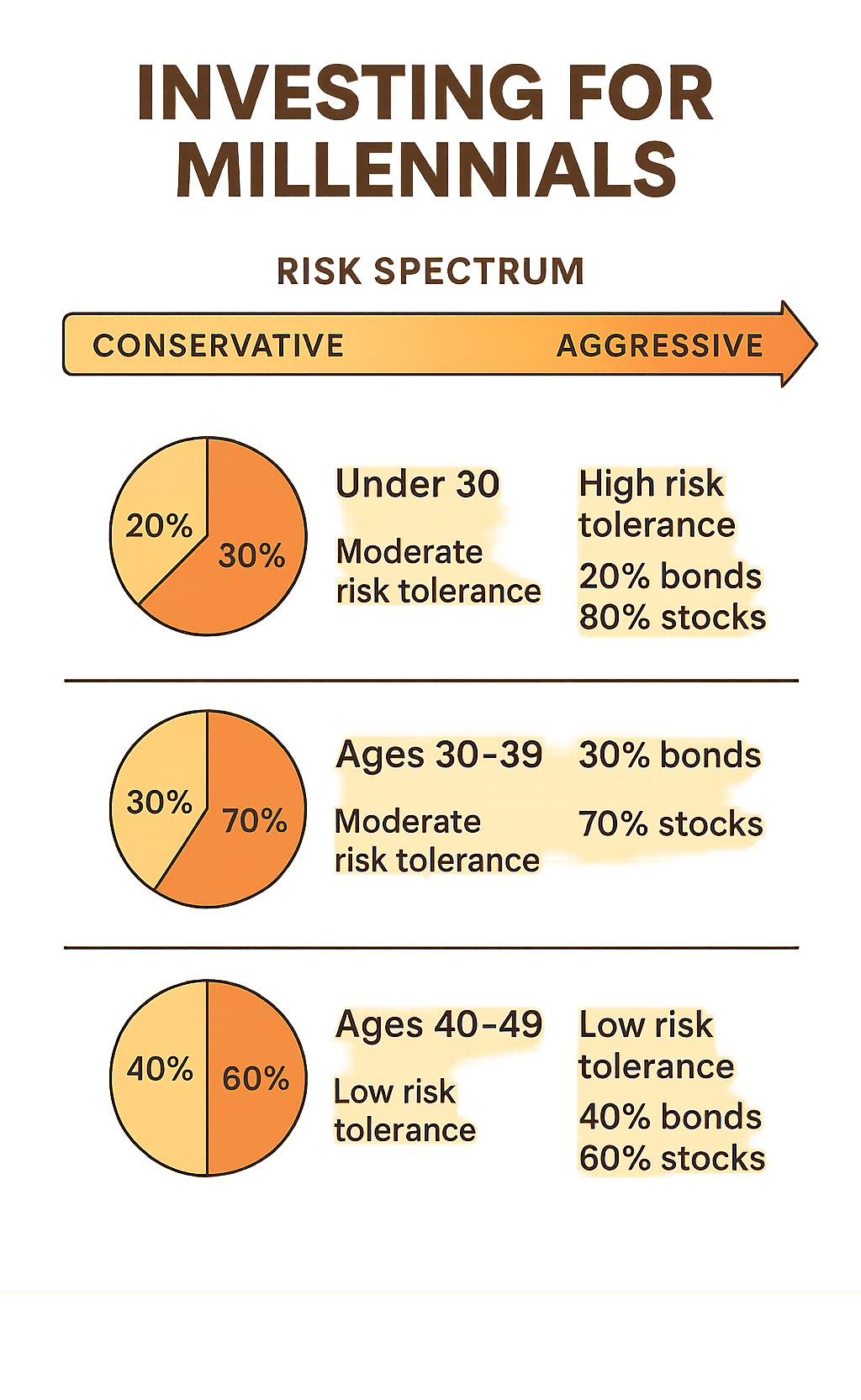

Determining Risk Tolerance When Investing for Millennials

With 30-40 years until retirement, you have time to ride out market volatility. Historically, every 20-year stock market period has been profitable.

Target-date funds automatically adjust risk as you age. Many experts suggest millennials should be more aggressive than traditional formulas recommend due to longer lifespans and potential Social Security reductions.

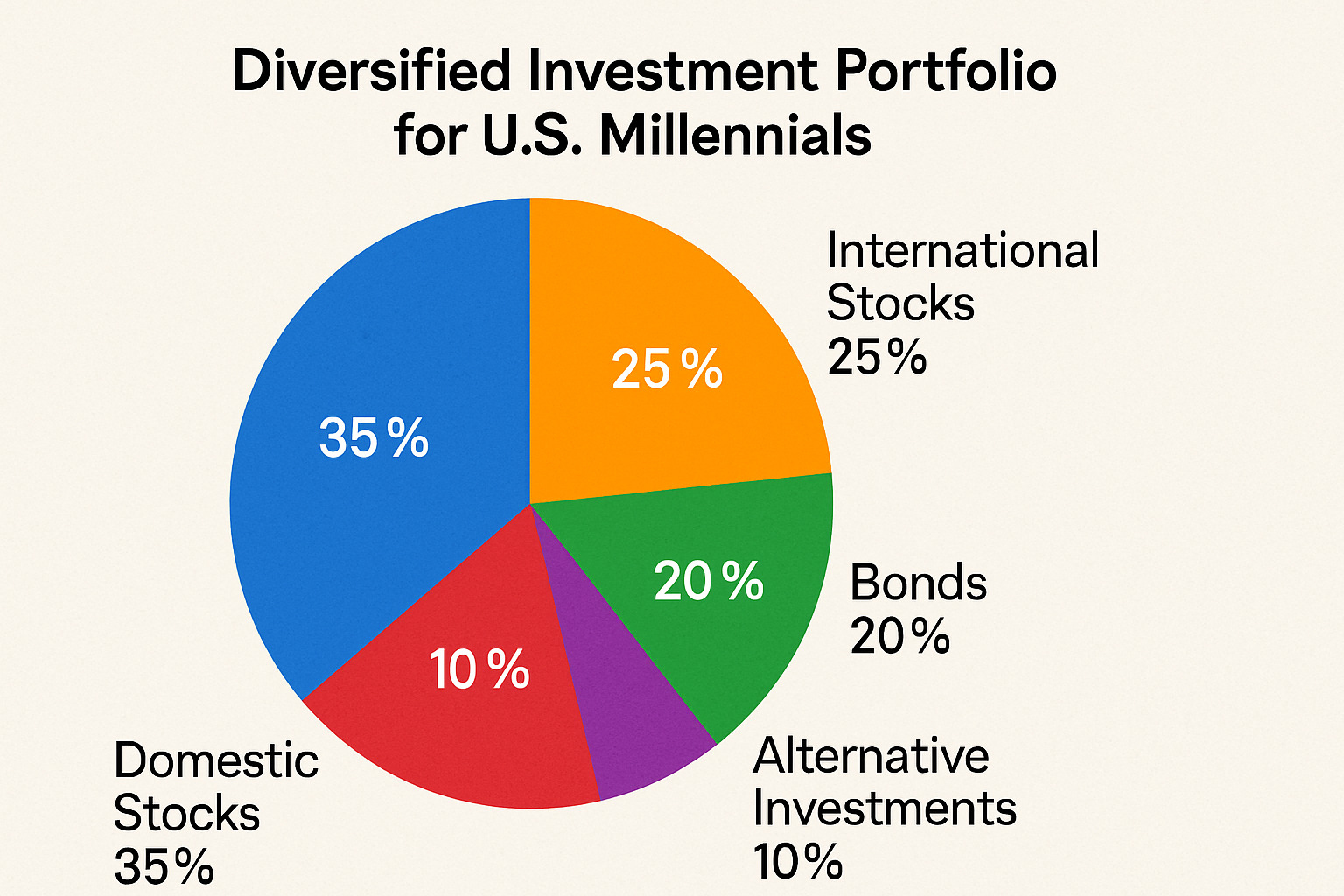

Diversification through broad market index funds spreads risk across thousands of companies. International diversification provides additional protection when U.S. markets struggle.

Building a Future-Proof Portfolio & Strategy

Successful investing for millennials means building a solid foundation with low-cost, diversified investments and letting time work its magic.

Index funds and ETFs should be your portfolio backbone. These track broad market indices, giving you ownership in hundreds of companies with expense ratios often below 0.1%.

A simple 80/20 portfolio allocation works for young investors – 80% stocks for growth, 20% bonds for stability. Build this with just two funds: total stock market index and total bond market index.

ESG investing lets you align investments with values while maintaining competitive performance. REITs add real estate exposure for inflation protection.

Treat cryptocurrency like Vegas money – limit to 5% or less due to volatility and regulatory uncertainty.

Rebalance annually to maintain target allocations, forcing you to “buy low, sell high.”

For specific recommendations, check our Best ETFs for Millennials guide.

Passive vs Active Approaches

Passive investing consistently beats active investing over long periods. Index funds match market returns at minimal cost, while actively managed funds rarely succeed after accounting for higher fees.

Tax efficiency favors passive approaches – index funds generate fewer taxable events. The average investor significantly underperforms due to poor timing decisions driven by fear and greed.

For comprehensive strategies, explore our Investment Options for Millennials page.

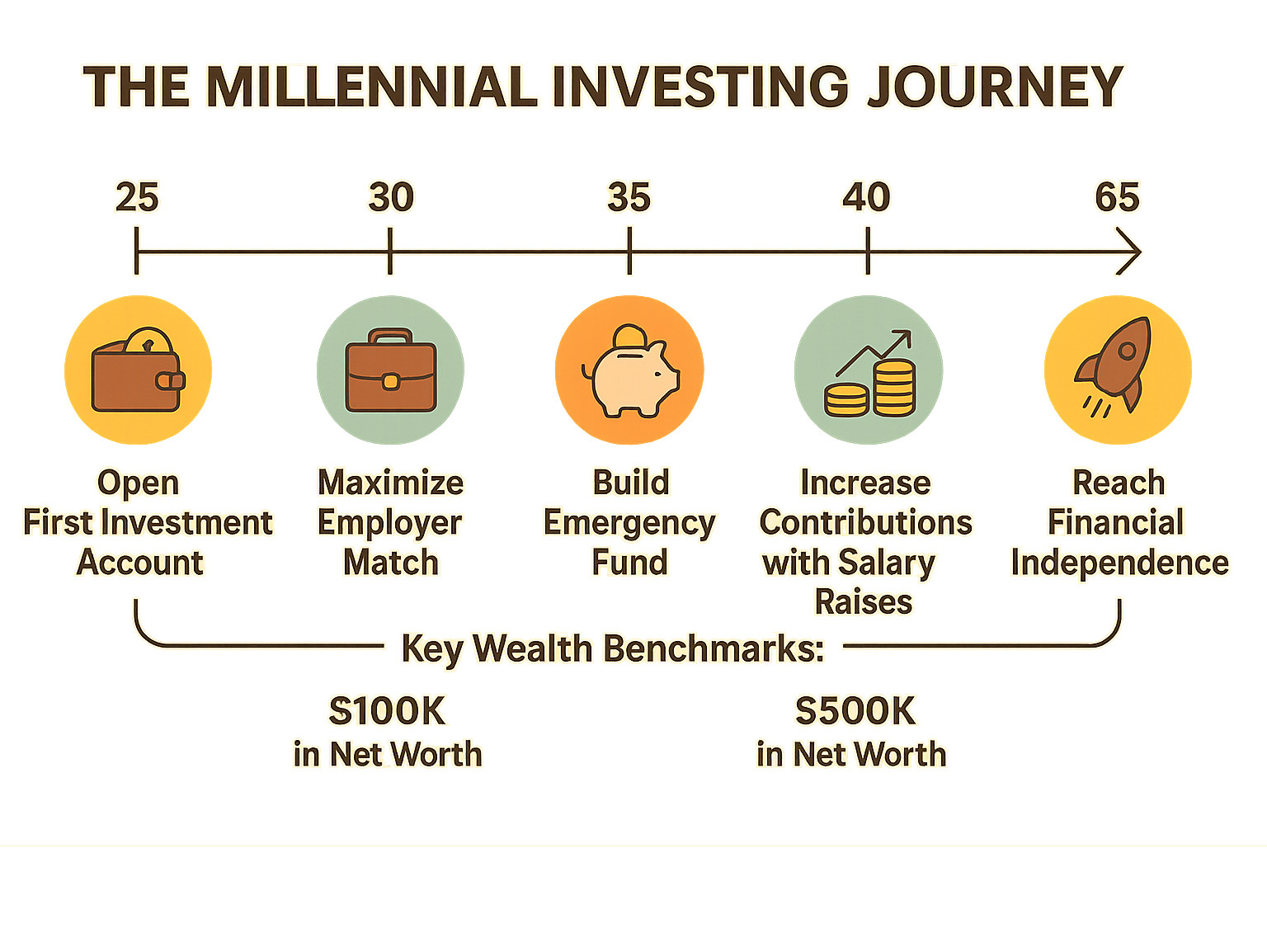

Wealth-Building Playbook Over Time

Start with whatever you can afford – even $50 monthly beats zero. When you get raises, immediately increase investment contributions by half the raise amount.

Roth conversions during lower-income years eliminate future tax obligations. Tax-loss harvesting in taxable accounts reduces annual tax burden.

Side income streams dramatically accelerate wealth building. Additional money dedicated to investments compounds over decades.

For additional strategies, the Bankrate millennial guide offers valuable perspectives.

Tech Tools, Resources & Common Mistakes

The digital revolution has transformed investing for millennials. What once required hefty minimums and expensive fees is now accessible from your smartphone.

Robo-advisors like Betterment and Wealthfront handle portfolio management for under 0.50% fees. They automatically rebalance, optimize taxes, and adjust allocations. 61% of millennials approve of robo-advisors for investment management.

Be wary of gamification features that encourage frequent trading. The best investors are boring – they automate contributions and ignore daily noise.

Be skeptical of social media financial advice. While 42% of young adults rely on TikTok and Instagram for guidance, much comes from unqualified sources.

Curated Resources to Level Up

Podcasts make learning painless. “The Investors Podcast” and “Motley Fool Money” provide quality insights without hype.

Classic books remain relevant. “A Random Walk Down Wall Street” explains index investing, while “The Bogleheads’ Guide” offers practical strategies.

Online tools transform concepts into concrete numbers. Compound interest calculators show what monthly contributions become over time.

The Bogleheads community forum provides free advice from experienced investors – like having thousands of financial mentors available 24/7.

For book recommendations, explore our Best Investment Books for Millennials collection.

Pitfalls Millennials Should Avoid

Overtrading destroys wealth through fees and taxes while rarely improving returns. Investors who check accounts least frequently often perform best.

High fees compound negatively. A 1% annual fee difference can cost hundreds of thousands over 40 years.

Lack of diversification increases risk without improving returns. Cryptocurrency FOMO has burned investors treating digital assets like lottery tickets.

Early withdrawals from retirement accounts cost 10% penalties plus decades of lost compound growth. Lifestyle inflation sabotages wealth building as incomes grow.

For diversification strategies, read our How to Diversify Your Investment Portfolio guide.

Frequently Asked Questions about Investing for Millennials

How can millennials invest with just $100?

Investing for millennials has never been more accessible. Fractional shares let you own pieces of expensive stocks with just $10. ETFs provide instant diversification across hundreds of companies.

Automate $100 monthly transfers for dollar-cost averaging. Apps that round up purchases and invest spare change make it painless.

Investing $100 monthly for 30 years at 7% return gives you approximately $122,000.

For step-by-step guidance, check our Beginner Investing resources.

Should I pay off student loans before investing?

If loans charge less than 6% interest, you’re probably better off making minimum payments while investing. The stock market has historically returned around 10% annually.

Always capture your employer 401(k) match regardless – that’s an immediate 100% return no loan rate can match.

Consider refinancing high-rate loans and splitting extra money between additional payments and investing.

What’s the safest way to start investing for millennials?

Start with an emergency fund of 3-6 months expenses in high-yield savings. For investments, broad market index funds are safest for long-term wealth building.

Target-date funds automatically adjust from aggressive to conservative as retirement approaches. Keep it simple with total stock market and international funds.

For millennials with 30-40 years until retirement, not taking appropriate investment risk is actually the riskiest strategy due to inflation.

Conclusion

Investing for millennials isn’t just about building wealth – it’s about rewriting the financial story for your generation. You’ve weathered storms that would have broken previous generations: the Great Recession during your career-launching years, a global pandemic, student loan debt that averages nearly $40,000, and an economy that seems to change the rules every few years.

But here’s what makes you different – you’re not just surviving these challenges, you’re learning from them. Nearly 75% of millennials are now actively saving for the future, a 10% jump from just two years ago. You’re the generation that’s figured out how to turn financial trauma into financial wisdom.

The roadmap is simpler than the financial industry wants you to believe. Start now with whatever you have – even $100 makes a difference when you have decades ahead of you. Grab that employer 401(k) match because turning down free money never made anyone wealthy. Open a Roth IRA and let your money grow tax-free for the next 40 years.

Choose low-cost index funds that give you a piece of the entire market without the drama of picking individual stocks. Automate everything so your money moves before you can second-guess yourself. And most importantly, stay consistent when the market throws its inevitable tantrums.

The math is compelling, but it’s also personal. That 28-year-old who commits $6,000 annually to a Roth IRA? They’re not just building a $910,000 nest egg – they’re buying freedom. Freedom from financial stress, freedom to make career choices based on passion rather than desperation, freedom to retire with dignity.

At Finances 4You, we understand that your generation faces unique challenges, but you also have unique advantages. You’re tech-savvy, value-driven, and you’ve learned that traditional financial advice doesn’t always fit modern realities. Our mission is helping you align your net worth with your age group through strategies that actually work in today’s world.

Your financial journey doesn’t require perfection – it requires persistence. Every automated contribution, every employer match you capture, every year you stay invested despite market noise, you’re building something powerful. You’re proving that a generation written off as financially irresponsible is actually financially revolutionary.

The conversation around investing for millennials has shifted from “Can they do it?” to “How fast can they build wealth?” The answer depends on when you start. Today is always better than tomorrow, and tomorrow is always better than never.

For comprehensive strategies custom to your generation’s specific opportunities and challenges, explore our detailed Investment Options for Millennials guide. Your future self is counting on the decisions you make today. Make them count.