Why Understanding IRA vs 401k Matters for Your Financial Future

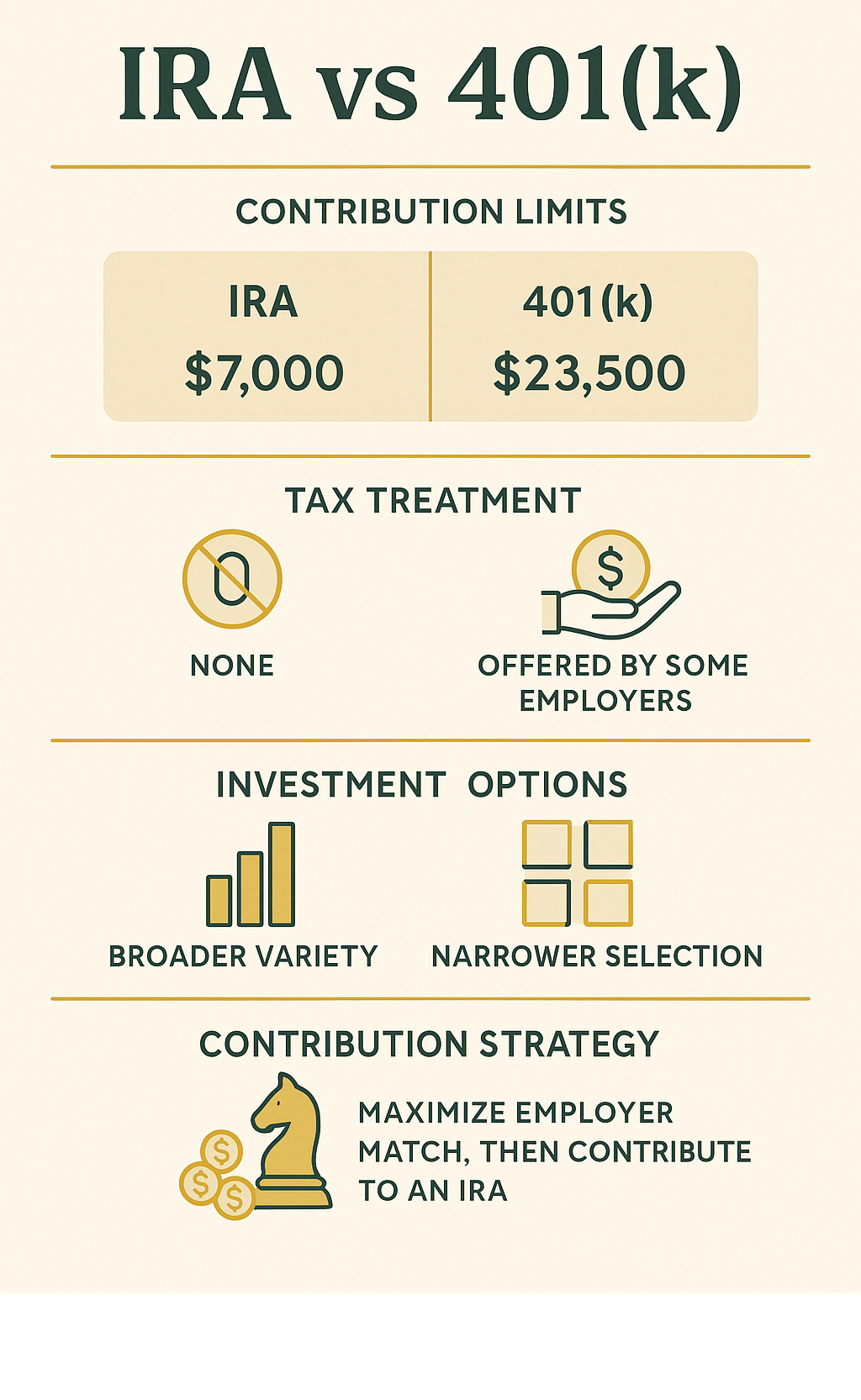

When comparing ira vs 401k options, the key differences come down to contribution limits, employer involvement, and investment flexibility. Here’s what you need to know:

Quick Answer:

– 401(k): Employer-sponsored, $23,500 limit (2025), potential employer match, limited investment options

– IRA: Individual account, $7,000 limit (2025), no employer match, broader investment choices

– Best Strategy: Capture employer match first, then maximize IRA contributions, return to 401(k) if funds remain

Most Americans are falling behind on retirement savings, with many relying solely on Social Security. Yet both IRAs and 401(k)s offer powerful tax advantages that can turn modest contributions into substantial nest eggs through compound growth.

The average employer match sits at 4.6% of income – essentially free money that too many workers leave on the table. The 2025 contribution limits have increased to $23,500 for 401(k)s and remain at $7,000 for IRAs, with additional catch-up contributions available for those over 50.

Understanding these accounts isn’t just about picking one over the other. Smart savers often use both to maximize their tax-advantaged savings space and create flexibility in retirement.

Ira vs 401k terms to remember:

– ira and roth ira

– retirement savings plans

– ira tax savings retirement planning

IRA vs 401k: Quick Comparison Snapshot

When you’re trying to decide between ira vs 401k options, it helps to see the key differences laid out clearly. The most striking difference? 401(k) plans let you save way more money each year. For 2025, you can contribute up to $23,500 to your 401(k), compared to just $7,000 for an IRA.

But here’s the trade-off: 401(k) plans come with strings attached. Your employer chooses your investment options, while with an IRA, you can invest in almost anything.

| Feature | 401(k) | IRA |

|---|---|---|

| 2025 Contribution Limit | $23,500 | $7,000 |

| Catch-up (Age 50+) | $7,500 (ages 50-59, 64+) | $1,000 |

| Special Catch-up (60-63) | $11,250 | Not available |

| Employer Match | Yes (average 4.6%) | No |

| Income Limits | None | Yes (varies by type) |

| Investment Options | Limited by employer | Virtually unlimited |

| Early Access | Loans possible | Penalty exceptions |

| Required at Age 73 | RMDs (Traditional) | RMDs (Traditional) |

The employer match is where 401(k) plans really shine. It’s literally free money – the average employer kicks in 4.6% of your salary if you contribute enough to qualify.

Contribution Limits & Catch-Ups (ira vs 401k)

The 401(k) limits for 2025 show a clear bias toward workplace plans. That $23,500 limit gives you serious saving power, especially compared to the $7,000 IRA cap.

The SECURE 2.0 Act created a special “super catch-up” for people aged 60 to 63. If you’re in that age range, you can contribute an extra $11,250 to your 401(k) on top of the regular $7,500 catch-up. That brings your total 401(k) contribution to $34,750 per year.

Tax Timing: Traditional vs Roth (ira vs 401k)

Here’s where the ira vs 401k decision gets really personal, because both account types offer Traditional and Roth options. You’re essentially making a bet on your future tax situation.

Traditional accounts give you an immediate tax break. Every dollar you contribute reduces this year’s taxable income. Roth accounts flip the script completely. You pay taxes on your contributions today, but qualified withdrawals in retirement are totally tax-free.

That’s why many smart savers hedge their bets with both Traditional and Roth accounts. Tax diversification gives you flexibility in retirement – you can choose which account to tap based on your tax situation each year.

For deeper strategies on maximizing these tax benefits, our guide on IRA tax savings retirement planning breaks down the details you need to know.

Deep Dive: Eligibility, Income Caps & Employer Money

The rules around who can contribute to retirement accounts can feel complex, but understanding these eligibility requirements is crucial for making smart decisions in the ira vs 401k debate.

Who Can Contribute and How Much?

401(k) eligibility keeps things simple – if your employer offers a plan and you’re eligible to participate, you’re good to go. The best part? There are no income limits for 401(k) contributions, making these accounts incredibly valuable for high earners.

IRA eligibility starts with the earned income test – you need to have earned income from work. But income limits can restrict your IRA options.

For Roth IRA contributions, the phase-out starts at $146,000 for single filers and $230,000 for married couples filing jointly. Traditional IRA deductions face their own income limits if you have access to a workplace retirement plan. The phase-out begins at $77,000 for singles and $123,000 for married couples.

The spousal IRA rule offers a silver lining for single-income households. Even if one spouse doesn’t work, they can still contribute to an IRA based on their partner’s earned income.

How Employer Contributions & Vesting Work

Here’s where 401(k)s really flex their muscles – employer matching is free money, and the average match of 4.6% of income can boost your retirement savings significantly.

But there’s a catch called vesting. This determines when those employer contributions actually become yours to keep. Some employers offer immediate vesting, while others use graduated schedules where you earn ownership over time.

Cliff vesting is the all-or-nothing approach – you might get 100% ownership after three years of service, but nothing if you leave before then. Understanding your vesting schedule becomes critical if you’re considering a job change.

Investment Menus & Fees

The investment landscape represents one of the most practical differences in the ira vs 401k comparison.

401(k) plans typically offer a curated menu of 20 or fewer investment options, usually mutual funds that your employer has pre-selected. IRAs throw open the investment universe. You can buy individual stocks, bonds, ETFs, mutual funds, and even alternative investments.

The fee picture tells a complex story. Many small-business 401(k) plans can result in participants paying 0.5% to 2% annually in hidden fees. Meanwhile, IRAs at discount brokerages often provide commission-free trading and access to rock-bottom-cost index funds.

For comprehensive strategies on optimizing your investment approach across different account types, our guide to retirement savings plans can help you steer these decisions.

Maximizing Savings: Strategy Roadmap

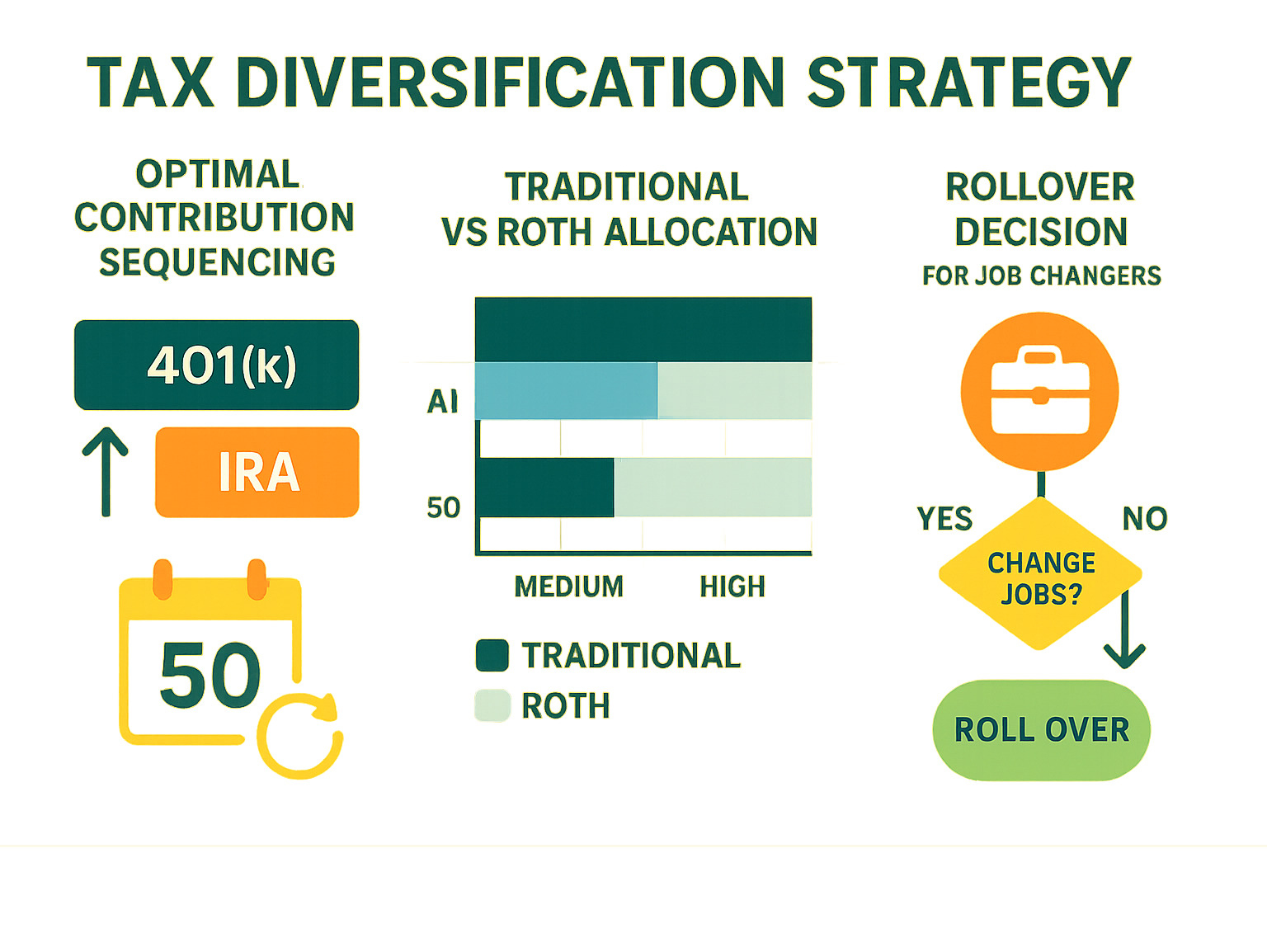

The optimal ira vs 401k approach isn’t either/or – it’s about sequencing your contributions for maximum benefit.

Start by capturing your full employer match in your 401(k). This is literally free money with an instant 100% return. Once you’ve secured that match, shift focus to maxing out your IRA contribution. IRAs typically offer better investment options and lower fees than most 401(k) plans.

After maxing your IRA, return to your 401(k) to take advantage of those higher contribution limits. This is where high earners can really accelerate their savings.

Using Both Accounts for Tax Diversification

Smart retirement planning means creating tax diversification – having both traditional (pre-tax) and Roth (after-tax) money available in retirement. This creates flexibility for tax planning.

Dual-funding strategies work best when you think about your contribution calendar. Your 401(k) contributions happen automatically through payroll deduction, while you can make lump-sum IRA contributions anytime before the tax deadline.

Rollover & Portability Rules

Job changes don’t have to derail your retirement plans. When you leave an employer, your 401(k) doesn’t have to stay put.

Direct rollovers are your best friend here. They move your money from one account to another without you ever touching it, avoiding the automatic 20% withholding that happens with indirect rollovers.

Rolling your old 401(k) to an IRA usually makes sense because of the investment flexibility and lower fees. But there’s one important exception: if you’re planning to retire early, keeping some money in a 401(k) might be smart. The Rule of 55 allows penalty-free withdrawals from a 401(k) if you leave your job at 55 or later.

Early Withdrawal Penalties & Exceptions

Both ira vs 401k accounts generally impose a 10% penalty on early withdrawals, but there are important escape hatches to know about.

IRA exceptions are more generous, especially for life’s big expenses. You can withdraw up to $10,000 penalty-free for a first-time home purchase, pay for college expenses, or cover large medical bills.

401(k) early access is trickier but has one major advantage: the Rule of 55. If you leave your job at 55 or later, you can tap that employer’s 401(k) without penalty.

Roth accounts offer the most flexibility of all. Since you already paid taxes on your contributions, you can withdraw them anytime without taxes or penalties.

The IRS penalty exceptions list provides the complete rundown, but remember – these exceptions help you avoid penalties, not taxes.

Common Pitfalls & Pro Tips

Even with the best intentions, retirement savers often make costly mistakes that can derail their financial future. Understanding these common pitfalls can save you thousands of dollars when comparing ira vs 401k strategies.

High plan fees represent perhaps the most insidious threat to your retirement wealth. That seemingly innocent 1% annual fee actually steals about 20% of your potential retirement wealth over 30 years thanks to compound interest working against you.

Forgetting Required Minimum Distributions after age 73 triggers one of the IRS’s harshest penalties – a whopping 25% tax on the amount you should have withdrawn. The smart move is setting up automatic calendar reminders or working with a financial advisor.

Missing catch-up contributions after age 50 means leaving valuable tax-advantaged savings space unused. This becomes even more critical with the new super catch-up provision allowing workers aged 60-63 to contribute an additional $11,250 to their 401(k).

401(k) loan defaults create a nightmare scenario. When you leave your job with an outstanding 401(k) loan, the remaining balance typically becomes a taxable distribution plus a 10% penalty if you’re under 59½.

Ignoring vesting schedules can literally cost you thousands of dollars in employer contributions. Some people change jobs just months before becoming fully vested in their employer match.

Automation becomes your best friend for avoiding these pitfalls. Set up automatic contributions to both your 401(k) and IRA. Use target-date funds if you’re prone to tinkering with investments during volatile markets.

Case Studies: High Earner, Small-Biz Owner, New Grad

Sarah, the high earner making $200,000 annually, faces income limits that prevent direct Roth IRA contributions. She maxes out her 401(k) at $23,500, capturing her full employer match. Then she executes a backdoor Roth IRA strategy – contributing $7,000 to a non-deductible Traditional IRA and immediately converting it to a Roth IRA.

Mike, the small business owner, compares a SEP IRA, which allows contributions up to 25% of his compensation or $70,000 for 2025, against a Solo 401(k) that lets him contribute $23,500 as an employee plus up to 25% of compensation as the employer.

Jessica, the new graduate earning $45,000, is likely in a lower tax bracket now than she’ll be during her peak earning years, making Roth contributions particularly attractive. She contributes enough to her 401(k) to capture any employer match, then focuses on maxing out her $7,000 Roth IRA contribution.

Frequently Asked Questions about ira vs 401k

Let’s tackle the most common questions we hear about navigating the ira vs 401k landscape. These answers will help clear up the confusion and give you confidence in your retirement planning decisions.

1. Can I contribute to both in the same year?

Yes, you absolutely can contribute to both a 401(k) and an IRA in the same tax year! This is actually one of the smartest moves you can make to maximize your retirement savings. Think of it as using every tool in your toolbox.

Each account has its own separate contribution limits, so you could potentially save $30,500 annually ($23,500 in your 401k plus $7,000 in an IRA) for 2025. If you’re over 50, those catch-up contributions bump your total even higher.

Here’s the catch though – having access to a workplace retirement plan like a 401(k) might limit your ability to deduct Traditional IRA contributions if your income gets too high. The IRS starts phasing out the deduction at $77,000 for single filers who have workplace plans. But don’t worry – you can still contribute to a Roth IRA (income permitting) or make non-deductible Traditional IRA contributions.

The beauty of using both accounts is that you get the best of both worlds: employer matching from your 401(k) and broader investment choices from your IRA.

2. What happens to my 401(k) when I switch jobs?

Job changes don’t have to derail your retirement savings. You’ve got four main options when you leave an employer, and choosing the right one can save you thousands in fees and taxes.

Leaving it with your former employer works if your balance exceeds $5,000 and you’re happy with the plan’s investment options and fees. Some people juggle multiple old 401(k) accounts this way, though it can get complicated to manage.

Rolling to your new employer’s plan makes sense if the new plan has great investment options and low fees. It keeps everything consolidated and maintains your ability to take 401(k) loans if needed.

Rolling to an IRA is often the most popular choice because it typically gives you access to thousands more investment options and potentially lower fees. You’ll have complete control over your investment strategy and can often find rock-bottom expense ratios on index funds.

Cashing out is almost always a terrible idea. You’ll pay income taxes plus a 10% penalty if you’re under 59½. A $50,000 balance could shrink to $35,000 or less after taxes and penalties – ouch!

The key is doing a direct rollover where the money moves directly between accounts. This avoids the 20% withholding that happens with indirect rollovers and eliminates any risk of missing the 60-day deadline.

3. How do SIMPLE and SEP IRAs compare to a standard 401(k)?

Small business owners often face a different set of choices when it comes to ira vs 401k decisions. SIMPLE and SEP IRAs are designed specifically for smaller companies that want to offer retirement benefits without the complexity of a full 401(k) plan.

SIMPLE IRAs allow employees to contribute up to $16,500 for 2025 (plus $3,500 catch-up if over 50). Employers must either match contributions dollar-for-dollar up to 3% of compensation or make a 2% non-elective contribution for all eligible employees. The setup is straightforward, and administrative costs are minimal.

SEP IRAs are even simpler – only employers contribute, up to 25% of each employee’s compensation or $70,000 for 2025. There’s no employee contribution option, but the employer contributions are typically higher than what you’d see with SIMPLE plans. They’re perfect for business owners who want to make large contributions for themselves and don’t mind contributing equally for employees.

Traditional 401(k) plans offer higher employee contribution limits at $23,500, plus the potential for employer matching and profit-sharing contributions. They also allow loans and have more flexible withdrawal options. However, they require more administrative work and higher costs to maintain.

For solo entrepreneurs or business owners with just a spouse as an employee, a Solo 401(k) often beats both SIMPLE and SEP IRAs by allowing both employee and employer contributions from the same person.

The choice often comes down to how much administrative complexity you’re willing to handle versus how much you want to contribute. Smaller businesses usually start with SIMPLE or SEP IRAs for their simplicity, then graduate to 401(k) plans as they grow and want more features.

Conclusion & Next Steps

The ira vs 401k journey doesn’t end with choosing one account over the other. The smartest retirement savers treat these accounts like dance partners – each has their strengths, and together they create something beautiful.

Always start with that employer match – it’s literally free money sitting on the table. Then let your IRA flex its muscles with better investment choices and lower fees. This one-two punch gives you the best of both worlds.

At Finances 4You, we’ve seen too many people get stuck in analysis paralysis, researching the perfect strategy while their money sits in checking accounts earning nothing. Here’s the truth: starting imperfectly beats perfect planning that never begins.

Your future self is counting on the decisions you make today. That 25-year-old who starts contributing $200 monthly will likely retire with more wealth than the 35-year-old who waits for the “perfect” moment to contribute $500 monthly.

Tax diversification through both Traditional and Roth accounts gives you options in retirement. Having both creates flexibility that single-account strategies can’t match.

Don’t forget those catch-up contributions after age 50. The new super catch-up provisions for ages 60-63 recognize that many people hit their savings stride later in their careers.

Here’s your action plan: Review your current 401(k)’s fees and investment lineup. Calculate whether you’re capturing every dollar of employer match. Determine if opening an IRA makes sense for your income level and goals. Set up automatic contributions so you pay yourself first.

Most importantly, review your strategy annually. Your income will change, tax laws will evolve, and your retirement timeline will get clearer.

For deeper guidance on building a complete retirement strategy that aligns your net worth with your age and goals, check out our comprehensive resource on comprehensive retirement planning.

The best ira vs 401k strategy is the one you actually follow. Start where you are, use what you have, and adjust as you learn. Your retirement dreams are waiting – and every dollar you save today is a vote of confidence in your future self.