Why Charles Coristine’s Wall Street to Snack Food Journey Matters

LesserEvil CEO Charles Coristine transformed a failing snack company into a $100+ million business after leaving his Wall Street career at Morgan Stanley. Here’s what you need to know about his remarkable turnaround story:

Key Facts About Charles Coristine:

- Background: Former bond trader at Morgan Stanley with Cornell MBA

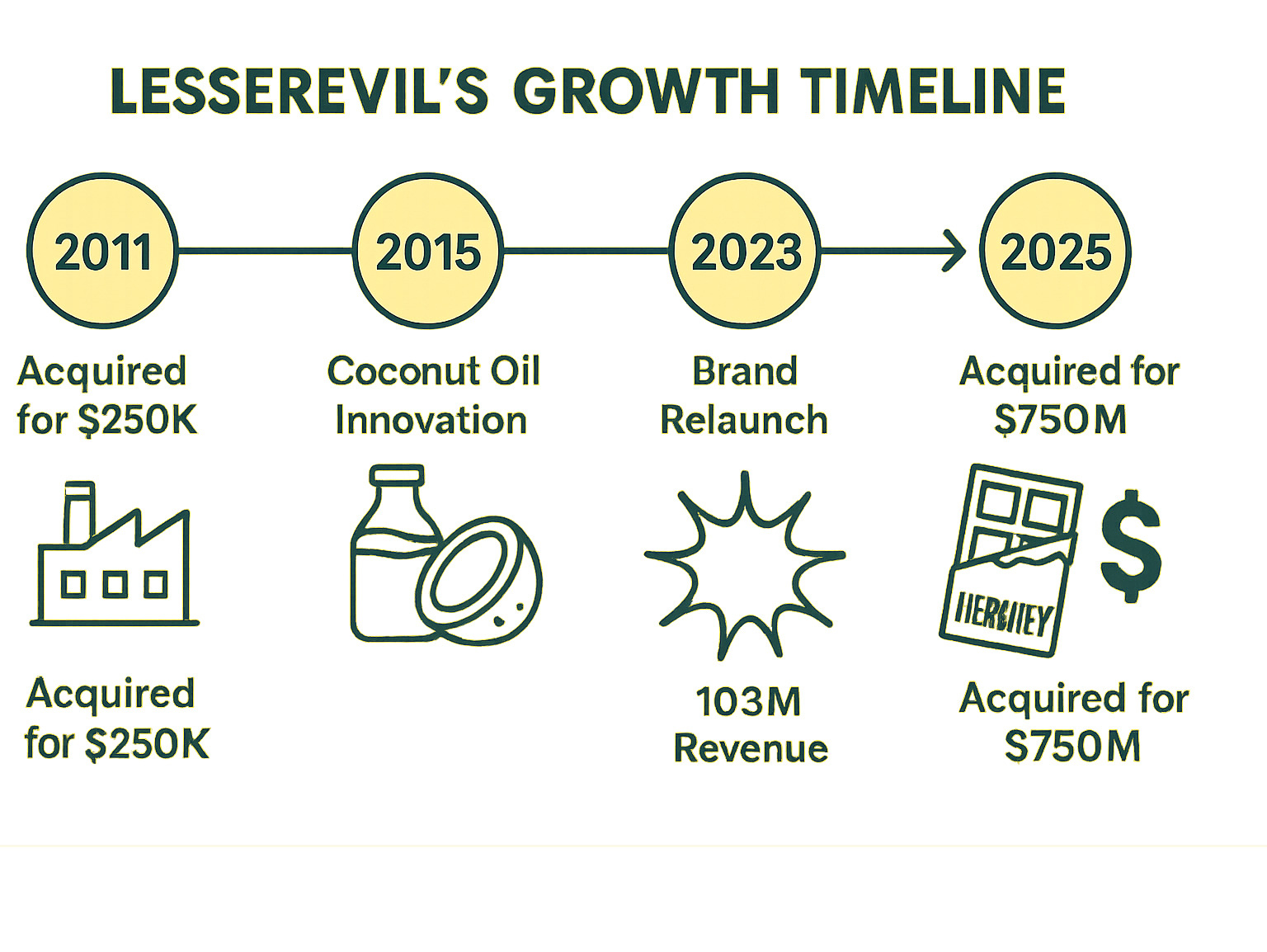

- Acquisition: Bought LesserEvil in 2011 for $250,000 (plus $100,000 earn-out)

- Growth: Scaled revenue from under $1 million to $103.3 million by 2023

- Exit: Hershey announced plans to acquire LesserEvil for $750 million in 2025

- Innovation: Pioneered coconut oil popcorn and built vertically integrated organic snack factories

Coristine’s story resonates with high-earning professionals because it shows how financial discipline from Wall Street can create massive value when applied to mission-driven businesses. His journey from trading bonds at 3 AM to building a mindful snacking empire demonstrates that career pivots can lead to both financial success and personal fulfillment.

What makes this case study compelling is how Coristine used his analytical skills to identify undervalued opportunities, then applied lean startup principles to scale methodically. He didn’t just buy a business – he rebuilt it from the ground up with in-house manufacturing, clean ingredients, and strategic branding.

For young professionals struggling with lifestyle inflation, Coristine’s approach offers a blueprint: leverage your existing skills, make calculated risks, and focus on building sustainable value rather than chasing quick returns.

* lesserevil ceo charles coristine* basics:

- investing for millennials

- investment tips for millennials

- real estate investment strategies for millennials

From Wall Street to the Snack Aisle: Who Is Charles Coristine?

LesserEvil CEO Charles Coristine didn’t wake up one morning and decide to trade his Morgan Stanley business cards for popcorn kernels. His journey from Wall Street bond trader to mindful snack entrepreneur unfolded over years of soul-searching and gradual realization that success and fulfillment aren’t always the same thing.

Picture this: It’s 3 AM, and while most people are sleeping, Coristine is wide awake analyzing bond markets and executing trades worth millions. The adrenaline rush was real, and honestly, he was good at it. His Cornell MBA gave him the analytical chops to thrive in high-stakes finance, but something was missing.

The burnout crept in slowly. You know that feeling when your paycheck keeps growing but your enthusiasm keeps shrinking? That’s exactly what happened to Coristine. The long hours and relentless pressure of Wall Street started taking their toll, and he found himself questioning whether chasing quarterly bonuses was really how he wanted to spend his life.

The turning point wasn’t dramatic – it was more like a gradual shift toward wanting work that actually mattered. While his colleagues were still obsessing over basis points, Coristine was getting interested in wellness and mindful living. He started thinking about businesses that could create positive impact rather than just profitable transactions.

This wasn’t just about escaping corporate life (though let’s be honest, that was part of it). It was about aligning his career with his values. Understanding Business Financial Planning gave him a huge advantage when he started looking at acquisition opportunities. He could spot cash flow problems, identify operational inefficiencies, and structure deals that protected his downside while maximizing potential upside.

Early Career & Skill-Set Transfer

Here’s what’s fascinating: the skills that made Coristine successful on Wall Street translated perfectly to entrepreneurship. Think about what bond trading actually requires – you’re analyzing complex data under pressure, making split-second decisions, and managing risk across multiple positions simultaneously.

Running a snack food company? Same skills, different arena. When lesserevil ceo charles coristine needed to evaluate suppliers, negotiate with major retailers, or optimize production schedules, he drew on that same analytical discipline he’d honed in financial markets.

His data-driven mindset became his secret weapon. Instead of just guessing what consumers wanted, he applied the same rigorous analysis he’d used in trading to understand market preferences, pricing strategies, and distribution economics. Wall Street taught him to let the numbers tell the story, and that approach would prove invaluable in building LesserEvil.

Motivation to Enter Food Industry

So why food? The answer reveals a lot about Coristine’s character. He recognized that Americans were becoming more health-conscious but still wanted convenient, tasty snacks. This wasn’t just a market opportunity – it was a mission that aligned with his personal wellness journey.

Family conversations played a bigger role than you might expect. His discussions with a personal nutritionist actually led directly to developing LesserEvil’s signature coconut oil popcorn. That willingness to listen to different perspectives and incorporate outside insights became a hallmark of his leadership style.

The timing was perfect. Latest research on career change satisfaction shows that professionals who make values-driven career transitions report higher long-term satisfaction, even when they initially earn less money.

Coristine’s experience backs this up completely. He frequently describes his work at LesserEvil as “joyous” and says “it doesn’t feel like work.” That’s the kind of career satisfaction that money alone can’t buy – though as we’ll see, the financial rewards eventually followed too.

The 2011 Acquisition: Buying LesserEvil for $250K

Sometimes the best business deals happen in the most unexpected places. For lesserevil ceo charles coristine, that place was a casual backyard barbecue where he first heard about a struggling snack company with huge potential.

The original owner painted a picture of a brand that had everything going for it – except success. LesserEvil had a catchy name, a mission people could get behind, and products that should have been flying off shelves. Instead, it was barely hanging on with less than $1 million in annual revenue and a reputation that screamed “failed startup.”

Coristine saw something others missed. His Wall Street training had taught him to spot undervalued assets, and this felt like finding a diamond in the rough. The $250,000 purchase price plus a $100,000 earn-out reflected both the opportunity and the massive risks involved.

What he was really buying wasn’t a thriving business – it was a chance to rebuild from the ground up. The low price tag made sense when you looked under the hood. This was essentially a bankrupt brand with a pulse, held together by hope and very little else.

Immediate Challenges

Walking into LesserEvil felt like inheriting someone else’s messy divorce. The out-of-date recipes hadn’t been touched in years, which meant the products didn’t match what health-conscious consumers actually wanted. Imagine trying to sell flip phones in the smartphone era – that’s how relevant some of these formulations felt.

The co-packer dependence created its own nightmare. When you don’t control your own production, you’re at the mercy of someone else’s priorities and quality standards. Coristine quickly learned that inconsistent production schedules and quality control issues were killing any chance of building retailer trust.

Perhaps most frustrating was the limited retail doors. Without strong relationships with distributors and buyers, even amazing products sit in warehouses. It’s like having the world’s best-kept secret – except secrets don’t pay the bills.

Every challenge connected to the next in a downward spiral. Poor availability led to weak sales, which made retailers even less interested in carrying the products. Breaking this cycle would require both patience and some serious financial firepower.

Funding the Turnaround

Coristine’s funding strategy showed the discipline he’d learned managing risk on Wall Street. Instead of swinging for the fences with massive venture capital rounds, he started small and smart with friends-and-family loans and local bank lines of credit.

This conservative approach made perfect sense. Why give away huge chunks of equity before proving the concept could work? By keeping initial funding modest, Coristine maintained control while testing his turnaround theories in real market conditions.

The strategy paid off when InvestEco provided a significant infusion in 2018 – by then, the company had momentum and could negotiate from a position of strength rather than desperation. This staged approach to funding became a template that many entrepreneurs could learn from, especially those concerned about business financial planning and maintaining ownership control.

Every dollar had to work overtime during those early years. There was no room for vanity spending or “nice-to-have” expenses. This financial discipline would become a cornerstone of LesserEvil’s culture as it grew into the powerhouse that eventually caught Hershey’s attention.

lesserevil ceo charles coristine: Strategies That Sparked a $100 M Turnaround

The change of LesserEvil under Charles Coristine’s leadership demonstrates how strategic thinking and operational excellence can create extraordinary value. His approach combined several key elements: vertical integration through in-house manufacturing, product innovation centered on clean ingredients, and brand repositioning around mindful consumption.

The decision to build dedicated manufacturing facilities represented a major strategic bet. Rather than continuing to rely on co-packers, Coristine invested in organic-certified factories in Danbury and later New Milford. This vertical integration provided quality control, cost advantages, and the flexibility to innovate rapidly.

The coconut oil Buddha Bowl popcorn became the company’s breakthrough product, but its development required meticulous testing. Coristine famously validated coconut oil’s shelf stability by leaving it on a hot refrigerator for three months – a scrappy approach that epitomized his hands-on leadership style.

The 2019 brand relaunch introduced guru mascots and positioned LesserEvil around “mindful snacking” rather than just health benefits. This subtle shift broadened the brand’s appeal while maintaining its wellness credentials. The new packaging and messaging helped products stand out on crowded retail shelves.

Understanding How to Create a Scalable Business Model principles guided Coristine’s approach to expansion. Rather than pursuing growth at any cost, he focused on building sustainable systems that could support long-term scaling.

| Metric | 2011 (Acquisition) | 2023 (Pre-Hershey) | Growth Factor |

|---|---|---|---|

| Annual Revenue | <$1M | $103.3M | >100x |

| Net Sales | N/A | $82.9M | – |

| EBITDA | Negative | $14.4M | – |

| Employees | <10 | 350 | 35x+ |

| Production Capacity | Limited | 5,000 lbs/hour | – |

Innovation in Ingredients & Manufacturing

Coristine’s background in analytical thinking proved crucial when evaluating ingredient alternatives. The switch to organic coconut and avocado oils wasn’t just about health benefits – these premium ingredients commanded higher margins and differentiated LesserEvil from conventional snack brands.

The company’s manufacturing capabilities became a competitive advantage. With the ability to produce 5,000 pounds of popcorn per hour across both facilities, LesserEvil could respond quickly to demand fluctuations and test new products without external dependencies.

When Consumer Reports identified lead contamination in some products, Coristine’s response demonstrated both crisis management skills and commitment to transparency. The company immediately reformulated affected products, switching from cassava to sorghum, and implemented additional testing protocols.

Building a Mindful Brand

The change of LesserEvil’s brand identity reflected Coristine’s understanding that successful products need emotional connection, not just functional benefits. The guru mascots and playful packaging created personality while maintaining the brand’s wellness positioning.

His unconventional hiring decisions, including recruiting a wakeboard instructor as head of marketing, brought fresh perspectives that traditional food industry executives might have missed. This willingness to look beyond conventional credentials became a defining characteristic of the company culture.

Social media strategy emphasized humor and authenticity over corporate messaging. This approach resonated with younger consumers who valued brands that didn’t take themselves too seriously while still delivering quality products.

Scaling Revenue & Funding Milestones

The financial trajectory of LesserEvil under Coristine’s leadership validates his strategic approach. Gross sales reached $103.3 million in 2023, with net sales of $82.9 million and EBITDA of $14.4 million. The company achieved profitability in 2021, demonstrating sustainable unit economics.

The 2024 Series B funding round raised $19 million to fuel further expansion and buy out earlier investors. This capital provided resources for the New Milford facility expansion and new product development initiatives.

The ultimate validation came with Hershey’s announced acquisition for $750 million plus potential performance-based payments. This represented a 2,100x return on Coristine’s initial $250,000 investment – an extraordinary outcome by any measure.

Employment growth from fewer than 10 people to 350 employees reflects the company’s expansion while maintaining its commitment to providing “good jobs for great people.” This focus on employee welfare became central to the company’s culture and contributed to low turnover rates in an industry known for workforce challenges.

For more insights on sustainable business growth, explore our coverage of sustainable snacks.

Leadership, Culture, and Setbacks Under lesserevil ceo charles coristine

lesserevil ceo charles coristine brings a fascinating leadership style that would probably surprise his old Wall Street colleagues. Picture a CEO who meditates before big decisions and treats every business challenge like a learning experiment rather than a crisis to survive.

His approach blends the analytical thinking he learned trading bonds with mindfulness practices that actually influence how the company operates. When LesserEvil faces tough decisions, teams take time to reflect and question their assumptions instead of just rushing to execute. It sounds touchy-feely, but this method has sparked some of their biggest innovations.

The lean startup mindset runs deep at LesserEvil. Every new product launch gets treated like a science experiment – if something doesn’t work, the team focuses on what they learned rather than who to blame. This philosophy became absolutely crucial when the company hit its biggest challenge yet.

Understanding Achieving Financial Objectives often means navigating setbacks with the same discipline you apply to growth – something Coristine mastered during his finance career and applied throughout LesserEvil’s journey.

Facing Controversy & Crisis Response

In 2024, Consumer Reports dropped some unwelcome news about lead levels in certain LesserEvil cassava-based puffs. For any food company CEO, this represents a nightmare scenario that could destroy years of brand building overnight.

Coristine’s response revealed the leadership principles he’d developed over years of high-pressure situations. Instead of hiring lawyers to minimize the issue or pointing fingers at suppliers, he immediately issued a public apology and began reformulating the affected products. The company switched from cassava to sorghum and implemented much stricter testing protocols.

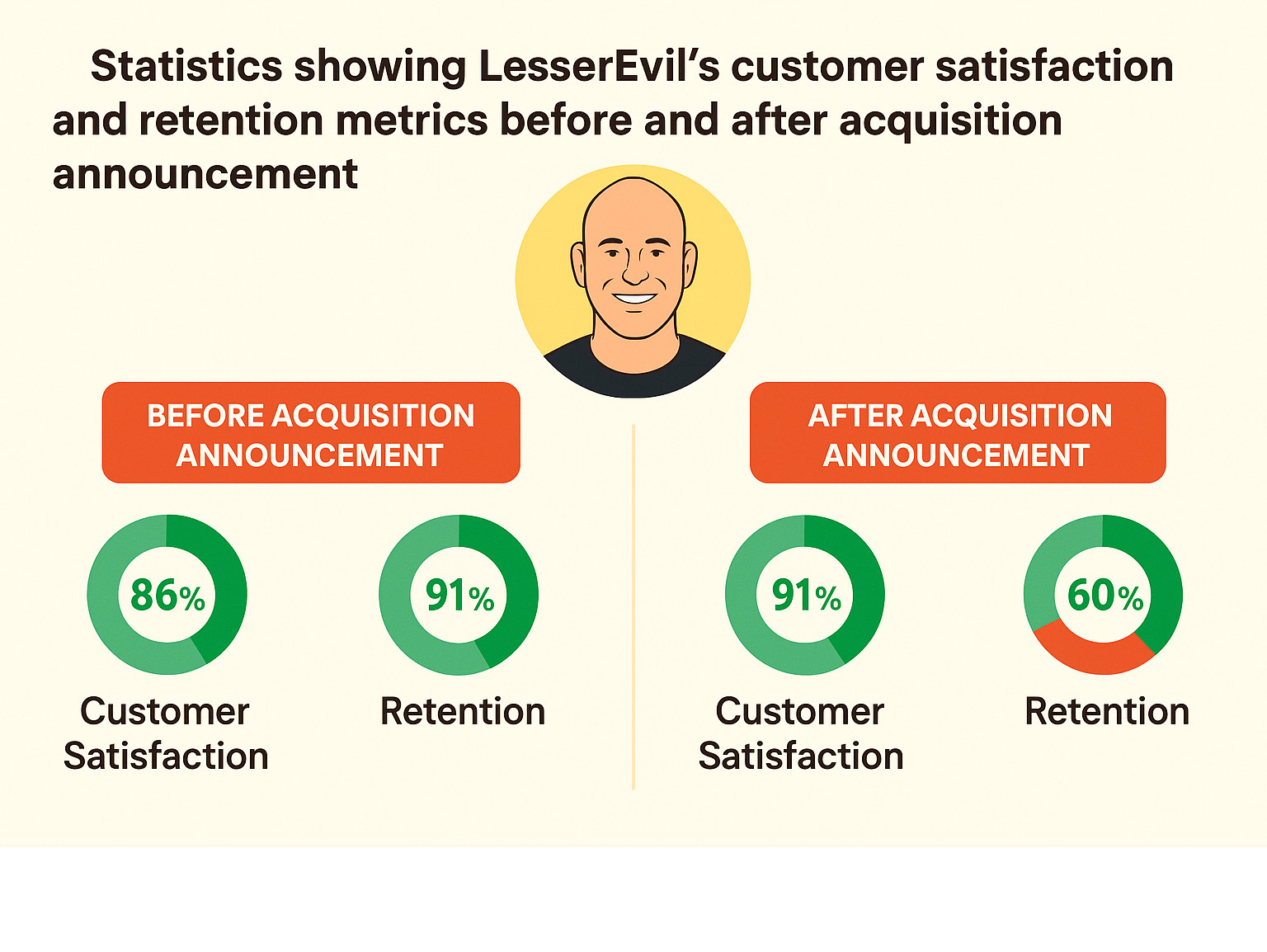

The transparency pledge that followed included commitments to improved quality control, regular third-party testing, and clearer communication about where ingredients come from. While sales took a temporary hit and some customers questioned the brand, the decisive response helped maintain trust with most loyal customers.

This crisis highlighted something important about scaling food businesses – as production volumes increase and product lines expand, maintaining quality control becomes exponentially more complex. The experience led to significant investments in testing infrastructure that probably should have happened earlier.

The scientific research on food safety that triggered this crisis ultimately made LesserEvil a safer, more responsible company, even though it was painful at the time.

Company Culture Under lesserevil ceo charles coristine

Walk into a LesserEvil facility and you’ll quickly notice this isn’t your typical corporate environment. Coristine regularly appears on the factory floor, chatting with production workers and actually listening to their suggestions about improving processes.

His open-door policy isn’t just corporate speak – employees genuinely feel comfortable approaching him directly with ideas or concerns. For a company with 350 employees, this level of accessibility is pretty remarkable and creates a culture where good ideas can come from anywhere.

The decision to hire that wakeboard instructor as head of marketing wasn’t just quirky – it reflects a deeper commitment to valuing diverse perspectives over traditional credentials. This approach has brought fresh thinking to everything from product development to social media strategy.

Employee wellness goes beyond the usual corporate benefits package. The company offers mindfulness training, unlimited access to their own healthy snacks (obviously), and flexible work arrangements that actually respect people’s lives outside work. These initiatives align perfectly with the brand values while helping retain talented people in a competitive job market.

Perhaps most importantly, the culture treats failures as learning opportunities rather than career-ending mistakes. When product launches don’t meet expectations or operational challenges arise, the post-mortem focuses on extracting lessons and improving processes. This psychological safety encourages the kind of calculated risk-taking that drives innovation.

What’s Next: Hershey Acquisition and Coristine’s Long-Term Vision

The April 2025 announcement that Hershey plans to acquire LesserEvil for $750 million plus performance-based earn-outs marks an incredible milestone in lesserevil ceo charles coristine’s journey from Wall Street to snack food success. This deal represents more than just a financial win – it’s validation of his vision that healthy snacking could become a massive market opportunity.

What makes this acquisition particularly interesting is the deal structure itself. Rather than a simple cash buyout, the performance-based earn-outs mean Coristine and his team could earn significantly more if they continue hitting growth targets. This arrangement shows Hershey’s confidence in LesserEvil’s trajectory while keeping the original team motivated to push for even bigger results.

Coristine will remain as CEO after the acquisition, which tells us a lot about what Hershey values. They’re not just buying products or market share – they’re buying the leadership and culture that created this remarkable turnaround. For someone who left Wall Street seeking more meaningful work, staying on as CEO allows Coristine to continue the mission-driven approach that made LesserEvil successful.

The global distribution opportunities through Hershey’s network represent perhaps the biggest game-changer. LesserEvil’s organic, mindful snacking products can now reach international markets that would have taken years to penetrate independently. This expansion potential likely factored heavily into the acquisition’s valuation.

New category expansion becomes much more realistic with Hershey’s resources backing future innovation. While LesserEvil will maintain focus on their core popcorn and puff products that built the brand, the acquisition opens doors to explore adjacent categories like bars, crackers, and other better-for-you snacks.

For Coristine personally, this represents the rare entrepreneurial outcome where financial success aligns with personal fulfillment. His frequent comments about work feeling “joyous” suggest that joining Hershey won’t diminish his enthusiasm for building something meaningful. The transition preserves the mission-driven culture while providing resources for much larger impact.

Understanding Finance Management Guide principles helps appreciate how smartly Coristine structured this exit. Rather than maximizing immediate cash, the earn-out structure positions him to benefit from continued growth while maintaining operational control. For entrepreneurs considering their own exit strategies, this deal offers a compelling blueprint for How to Structure Your Business for Long-Term Financial Success.

Frequently Asked Questions about Charles Coristine & LesserEvil

How did Coristine validate coconut oil’s shelf life?

LesserEvil CEO Charles Coristine took a refreshingly simple approach to testing coconut oil’s durability. Instead of spending months on expensive laboratory studies, he placed a container of coconut oil on top of his hot refrigerator and waited three months.

This unconventional testing method perfectly captures Coristine’s scrappy, entrepreneurial mindset. The refrigerator’s heat created conditions even harsher than most retail environments, so when the oil remained fresh and stable throughout the entire period, he knew he had a winner.

The approach saved both time and money while providing real-world validation that formal testing might have missed. It’s the kind of creative problem-solving that Wall Street traders learn – find the most direct path to the answer you need.

This simple test gave Coristine the confidence to build LesserEvil’s signature coconut oil popcorn around this ingredient, which became central to the company’s growth strategy.

Why keep manufacturing in-house instead of using co-packers?

When Coristine took over LesserEvil, the company’s co-packer relationships were already strained and unreliable. But his decision to invest in dedicated manufacturing facilities went far beyond fixing immediate problems.

Quality control became the biggest advantage of vertical integration. When you control every step of production, there’s no finger-pointing when something goes wrong. LesserEvil could ensure consistent ingredient sourcing, processing methods, and packaging standards across all products.

Innovation speed transformed completely with in-house manufacturing. New flavors that might have taken months to test with external co-packers could be refined within weeks. This agility proved crucial as consumer preferences shifted and competition intensified.

The economic benefits grew substantial as volumes increased. While the initial capital investments were significant, the long-term cost advantages improved margins and provided pricing flexibility that co-packer relationships couldn’t match.

Perhaps most importantly, LesserEvil’s organic-certified facilities created differentiation that many co-packers couldn’t provide. The stringent requirements for organic processing limited product development options when relying on external manufacturers.

Today, with facilities capable of producing 5,000 pounds of popcorn per hour, this vertical integration strategy has become a major competitive advantage.

What will change for customers after the Hershey deal?

For LesserEvil customers, the Hershey acquisition should bring mostly positive changes, starting with dramatically improved availability. Hershey’s distribution network will make LesserEvil products accessible in more stores and geographic markets than ever before.

Product quality and ingredients are expected to remain unchanged – these clean ingredient lists and mindful snacking positioning are exactly what attracted Hershey to the deal in the first place. The wellness focus that defines LesserEvil will continue under new ownership.

Innovation may actually accelerate with access to Hershey’s research and development resources. New products and flavors could reach market faster while maintaining the brand’s commitment to better-for-you snacking.

Pricing could become more competitive due to economies of scale and Hershey’s purchasing power with retailers. This means customers might actually pay less for their favorite LesserEvil products.

The main concern involves potential changes to the company’s entrepreneurial culture and decision-making speed as it integrates into a much larger organization. However, with lesserevil ceo charles coristine remaining in his leadership role, the customer-focused approach and innovative spirit that built the brand should continue.

Conclusion

Charles Coristine’s journey from Wall Street bond trader to LesserEvil CEO shows us something pretty remarkable: you don’t have to choose between making money and making a difference. His story proves that the skills you develop in one career can become superpowers in another – if you’re willing to take the leap.

What strikes us most at Finances 4You is how Coristine applied his financial training to build something meaningful. He didn’t abandon everything he learned about risk management and data analysis when he left Morgan Stanley. Instead, he used those tools to turn a failing snack company into a $750 million success story.

The math is pretty incredible when you think about it. A $250,000 investment that grew into a $750 million exit represents the kind of returns that most people only dream about. But here’s the thing – it wasn’t luck or timing alone. It was disciplined thinking, strategic patience, and the willingness to get his hands dirty building something from scratch.

For anyone feeling stuck in a high-paying job that doesn’t fulfill them, Coristine’s experience offers a different path forward. You don’t have to sacrifice financial security to find meaningful work. You just need to be smart about how you make the transition.

The LesserEvil turnaround also teaches us about the power of vertical integration and brand building. Coristine didn’t just buy a company – he rebuilt it completely, from manufacturing to marketing. This comprehensive approach created multiple competitive advantages that made the business incredibly valuable to acquirers like Hershey.

What we find most inspiring is how lesserevil ceo charles coristine stayed true to his values while building serious wealth. The mindful snacking mission wasn’t just marketing speak – it guided real business decisions about ingredients, manufacturing, and company culture. This authenticity resonated with customers and ultimately drove financial success.

The Hershey acquisition validates something we believe strongly: values-driven businesses can deliver exceptional returns when they solve real problems for customers. As more people prioritize health and transparency in their purchasing decisions, entrepreneurs who can serve these needs authentically will find tremendous opportunities.

Understanding How to Structure Your Business for Long-Term Financial Success becomes crucial for anyone inspired by this story. The principles that worked for LesserEvil – focus on quality, build sustainable systems, and stay close to your customers – apply across industries and business models.

Charles Coristine’s change of LesserEvil reminds us that the best financial strategies often involve creating value for others while staying true to your own principles. Sometimes the biggest risk is not taking any risk at all.