Why Long-Term Stock Investing is Your Best Path to Wealth

Long-term stock investing means buying shares and holding them for years or decades instead of trading frequently. This approach has consistently outperformed other strategies and is the foundation of lasting wealth.

Key Benefits of Long-Term Stock Investing:

- Higher Returns: The S&P 500 has averaged 9.80% annually from 1928-2023

- Lower Taxes: Long-term capital gains are taxed at 0%, 15%, or 20% vs up to 37% for short-term trades

- Compound Growth: A $1,000 investment in 1926 grew to over $15 million by 2024

- Reduced Stress: No need to watch daily price movements or time the market

- Lower Costs: Fewer transaction fees and trading expenses

The math is compelling. Missing just the five best trading days over 20 years would cut your returns by 58%. But here’s the reality for busy professionals: constantly checking stock prices and trying to time the market is a losing game.

As Warren Buffett puts it, his favorite holding period is “forever.” The most successful investors understand that time in the market beats timing the market.

Your biggest advantage isn’t picking hot stocks or predicting crashes. It’s having the patience to let compound interest work its magic while you focus on your career and life.

Long-term stock investing terms at a glance:

Why Time in the Market Beats Timing It

Want to know the most reassuring fact about long-term stock investing? From 1936 through 2024, the U.S. stock market never had negative returns on a rolling 20-year basis. Not once. Since 1972, the S&P 500 hasn’t produced negative returns on any rolling timeframe longer than 12 years.

This isn’t some lucky streak – it’s the mathematical power of staying invested through market cycles. While individual years can be brutal (we’re looking at you, 2008), time has a way of smoothing out the bumps and rewarding patient investors.

The data on market timing attempts is pretty devastating. Over the past 35 years, the U.S. stock market posted positive annual returns in nearly eight out of every 10 years. Yet countless investors miss these gains by jumping in and out based on fear, greed, or that “gut feeling” that rarely works out.

Here’s what really happens: since 1990, a huge chunk of the stock market’s gains and losses occur in just a few days of any given year. Between 1974 and 2023, the S&P 500 experienced annual losses in only 13 years. That means you had winning years about 75% of the time if you just stayed put.

Even more eye-opening? In the past 20 years, the S&P 500 had an average intra-year decline of nearly 15%, yet the index still had positive annual returns in over 75% of those years. This normal volatility scares many investors into selling at exactly the wrong time – right before the recovery.

Macro Trends – S&P 500 Historical Annual Returns shows this pattern clearly across decades of market history.

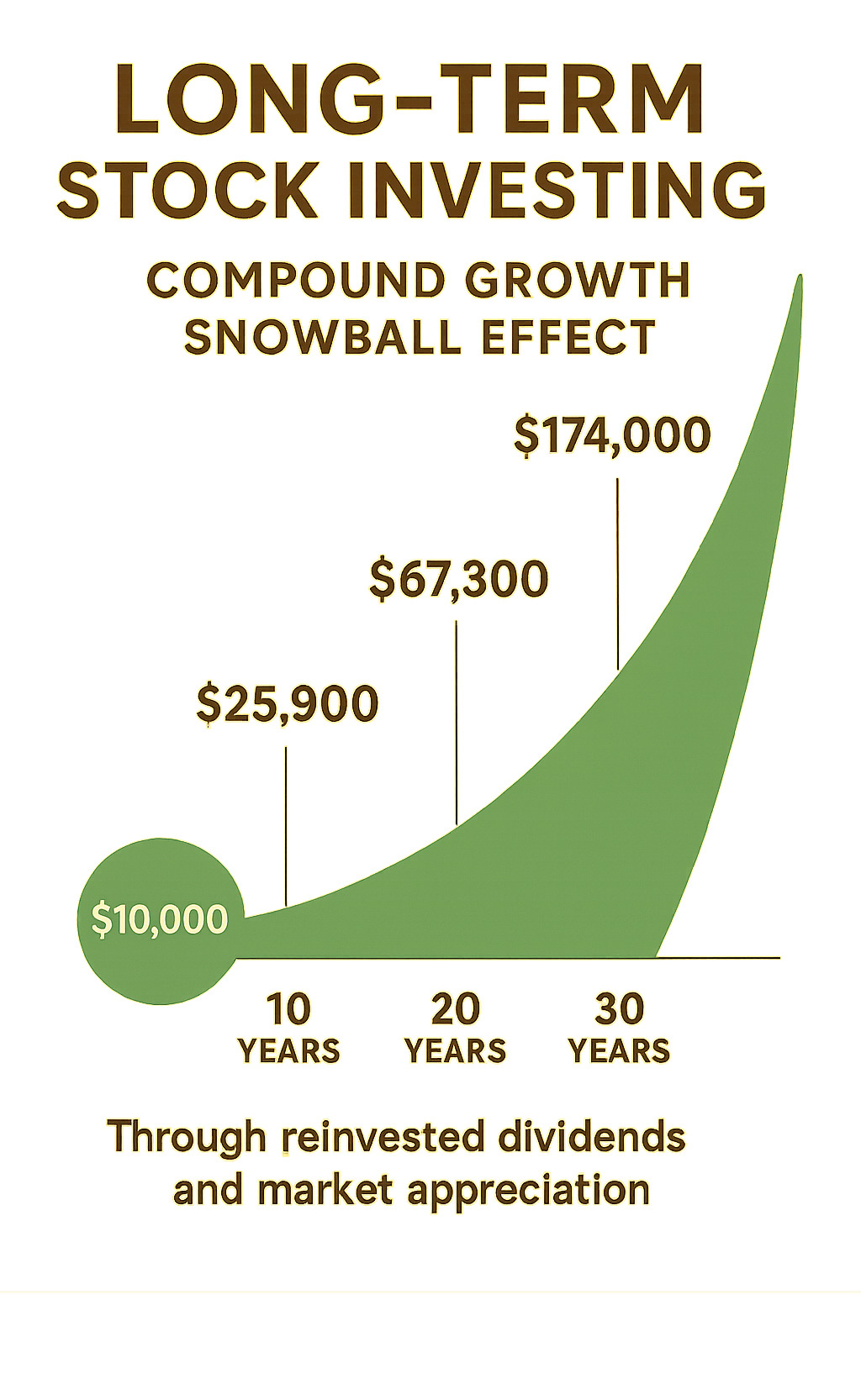

Compounding: Snowball Effect

Albert Einstein allegedly called compound interest the “eighth wonder of the world.” Whether he actually said it or not, the guy had a point. When you reinvest dividends and let your gains generate their own gains, your wealth grows exponentially rather than in a straight line.

Here’s where it gets exciting: a $100,000 investment in the S&P 500 more than doubled to $286,000 in ten years. After 30 years? It grew to more than $1,800,000. That’s using an inflation-adjusted annual average return of about 7%.

The magic happens because you’re not just earning returns on your original money – you’re earning returns on your returns. Dividend reinvestment often represents one-third to 40% of an equity investment’s total return over multiple business cycles. It’s like getting paid to get paid.

Starting early makes an enormous difference in your wealth-building journey. An investor who begins at age 25 investing $200 monthly at 7% annual returns could have around $300,000 by age 65. Wait until 35 to start, and you’ll only have about $245,000 – nearly $55,000 less despite only a 10-year delay. Time really is money.

Missing Best Days: Cost of Market Timing

Here’s the research that should make every market timer think twice: missing just the five best days in the S&P 500 over a 20-year period would have resulted in 58% lower returns compared to staying fully invested. That’s not a typo – 58% less money in your pocket.

This isn’t some theoretical exercise – it happens to real people who panic during downturns and miss the inevitable recovery. The cruel irony? The best days often come right after the worst days. When you’re licking your wounds on the sidelines, you miss the snapback that makes up for earlier losses.

The famous Dalbar study found that over 30 years ending in 2022, the average equity fund investor earned just 6.81% annually while the S&P 500 returned 9.65%. What caused this nearly 3% annual gap? Emotional trading that led to the classic mistake of buying high and selling low.

Your job as a long-term investor isn’t to be clever about timing – it’s to stay invested and let the market do what it does best: reward patience over panic. The market doesn’t care about your feelings, but it consistently rewards those who stick around for the long haul.

Long-Term Stock Investing Blueprint

Think of building your long-term stock investing strategy like constructing a house. You wouldn’t start hammering nails without a solid foundation, right? The same principle applies to your investment portfolio.

Your blueprint needs four key elements: clear goals that actually mean something to you, an honest assessment of how much risk makes you sleep well at night, smart asset allocation that matches your timeline, and tax-efficient accounts that keep more money in your pocket instead of Uncle Sam’s.

This foundation will be your anchor through decades of market ups and downs. When the financial news gets scary (and it will), you’ll have a plan to fall back on instead of making emotional decisions that hurt your wealth.

For comprehensive guidance on getting started, check out our Investing 101 guide.

Setting Goals & Asset Allocation for Long-Term Stock Investing

Here’s the truth: your age is the single most important factor in determining how much risk you should take. If you’re 25 and investing for retirement, you have 40 years to ride out market storms. Someone who’s 55? Not so much.

The old “age in bonds” rule suggested holding your age as a percentage in bonds. So at 30, you’d hold 30% bonds and 70% stocks. But with people living longer and bond yields staying low, many financial advisors now recommend staying more aggressive.

Your time horizon should drive your allocation. In your 20s and 30s, you can handle 80-90% stocks because you have decades to recover from any crashes. As you move through your 40s, dialing back to 70-80% stocks makes sense. By your 50s, a 60-70% stock allocation balances growth with stability.

The classic 60/40 portfolio (60% stocks, 40% bonds) remains a solid baseline for many investors. It’s not flashy, but it works. You get growth potential from stocks while bonds smooth out the bumpy ride.

As retirement approaches, you’ll want to gradually shift toward more conservative investments. This “glide path” approach means your portfolio automatically becomes less risky as you have less time to recover from losses. Target-date funds do this automatically, making them perfect for hands-off investors.

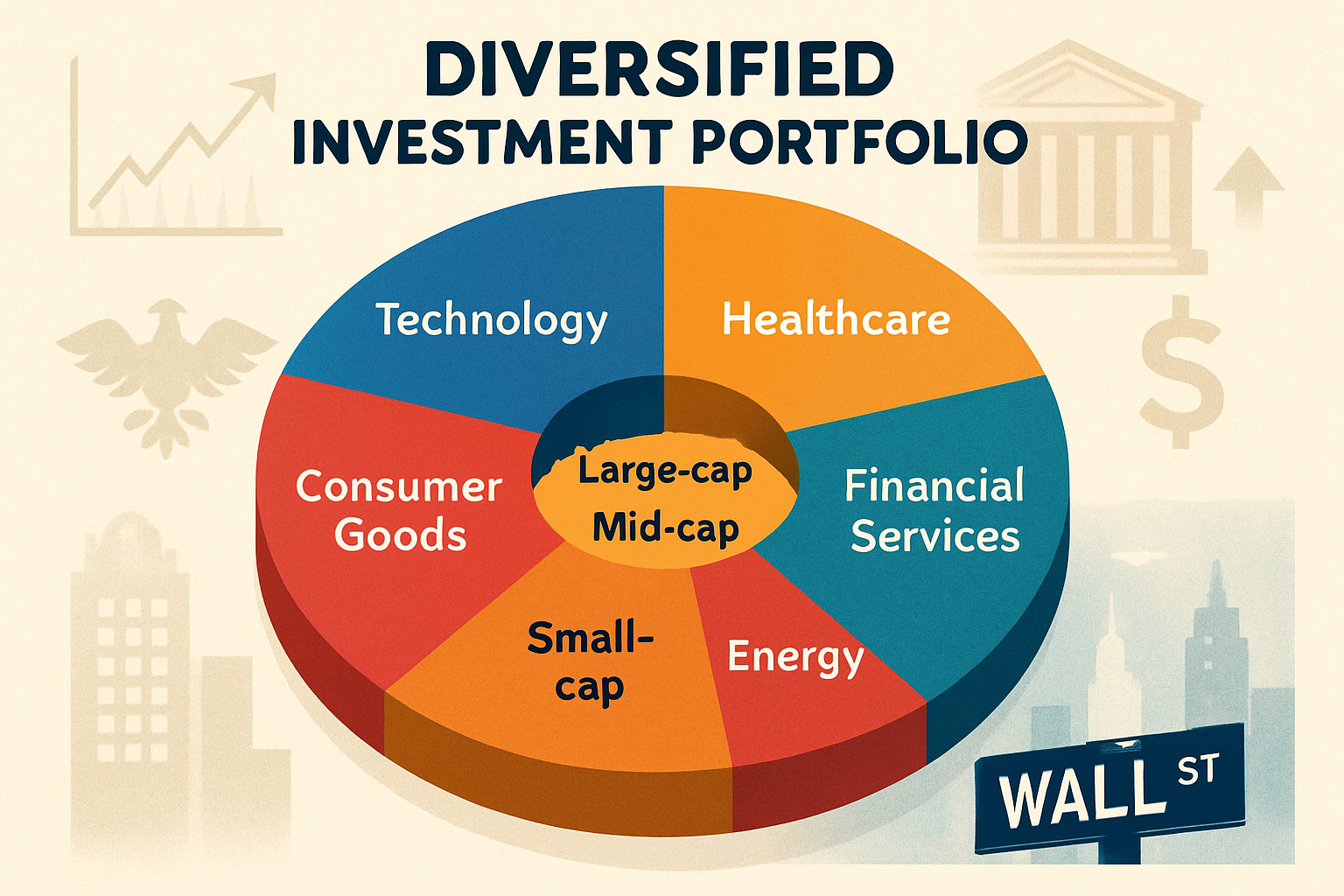

Diversification for Long-Term Stock Investing

Diversification isn’t about eliminating risk – it’s about eliminating stupid risk. You want to avoid the nightmare scenario where one company or sector tanks and takes your entire portfolio with it.

Spread your investments across different sectors like technology, healthcare, financial services, consumer goods, and energy. When tech stocks are struggling, healthcare might be thriving. Mix company sizes too – large-cap stability, mid-cap growth potential, and small-cap opportunities all play different roles.

Geography matters more than most people realize. The U.S. stock market is amazing, but it’s not the only game in town. International developed markets and emerging markets often move differently than U.S. stocks, giving you smoother overall returns.

Different asset classes like stocks, bonds, and real estate investment trusts (REITs) react differently to economic changes. When stocks are down, bonds might be up, and vice versa.

The easiest way to achieve all this diversification? Low-cost index funds and ETFs. A total stock market index fund gives you exposure to thousands of companies in one purchase. It’s like getting a perfectly balanced meal instead of trying to cook each ingredient separately.

For international exposure, consider putting 20-30% of your stock holdings in international funds. This gives you currency diversification and exposure to different economic cycles without getting too complicated.

For detailed strategies on building a diversified portfolio, see our guide on How to Diversify Your Investment Portfolio.

Strategies to Get Started & Stay the Course

The most brilliant long-term stock investing strategy in the world is worthless if you don’t actually follow it. We’ve seen too many investors create perfect plans on paper, then abandon them the moment markets get scary or life gets busy.

The secret isn’t finding the perfect strategy – it’s finding one that fits your life and personality so well that you’ll stick with it for decades. This means making your investing as automatic and simple as possible while keeping costs low and maintaining your target allocation over time.

Think of it like exercise. The best workout routine is the one you’ll actually do consistently, not the one that looks impressive in a fitness magazine. The same principle applies to investing.

Lump Sum vs. Dollar-Cost Averaging

Here’s a question that keeps many investors up at night: if you have a big chunk of money to invest, should you put it all in at once or spread it out over several months?

The math slightly favors lump sum investing because markets tend to go up more often than they go down. Getting your money working immediately means you capture more of those upward moves. But here’s the thing – math doesn’t account for the knots in your stomach when you invest $50,000 right before a market crash.

Dollar-cost averaging might give you slightly lower returns on paper, but it provides something valuable: peace of mind. When you invest the same amount each month regardless of market conditions, you automatically buy more shares when prices are low and fewer when they’re high.

For most people, we recommend a middle-ground approach. If you have a windfall like an inheritance or bonus, consider investing it in thirds over three to six months. This gives you some protection against terrible timing while still getting most of your money working relatively quickly.

If you’re investing from regular income, dollar-cost averaging happens naturally. Your monthly contributions to your 401(k) or IRA are automatically spread over time, smoothing out the bumps and building the discipline that makes long-term stock investing successful.

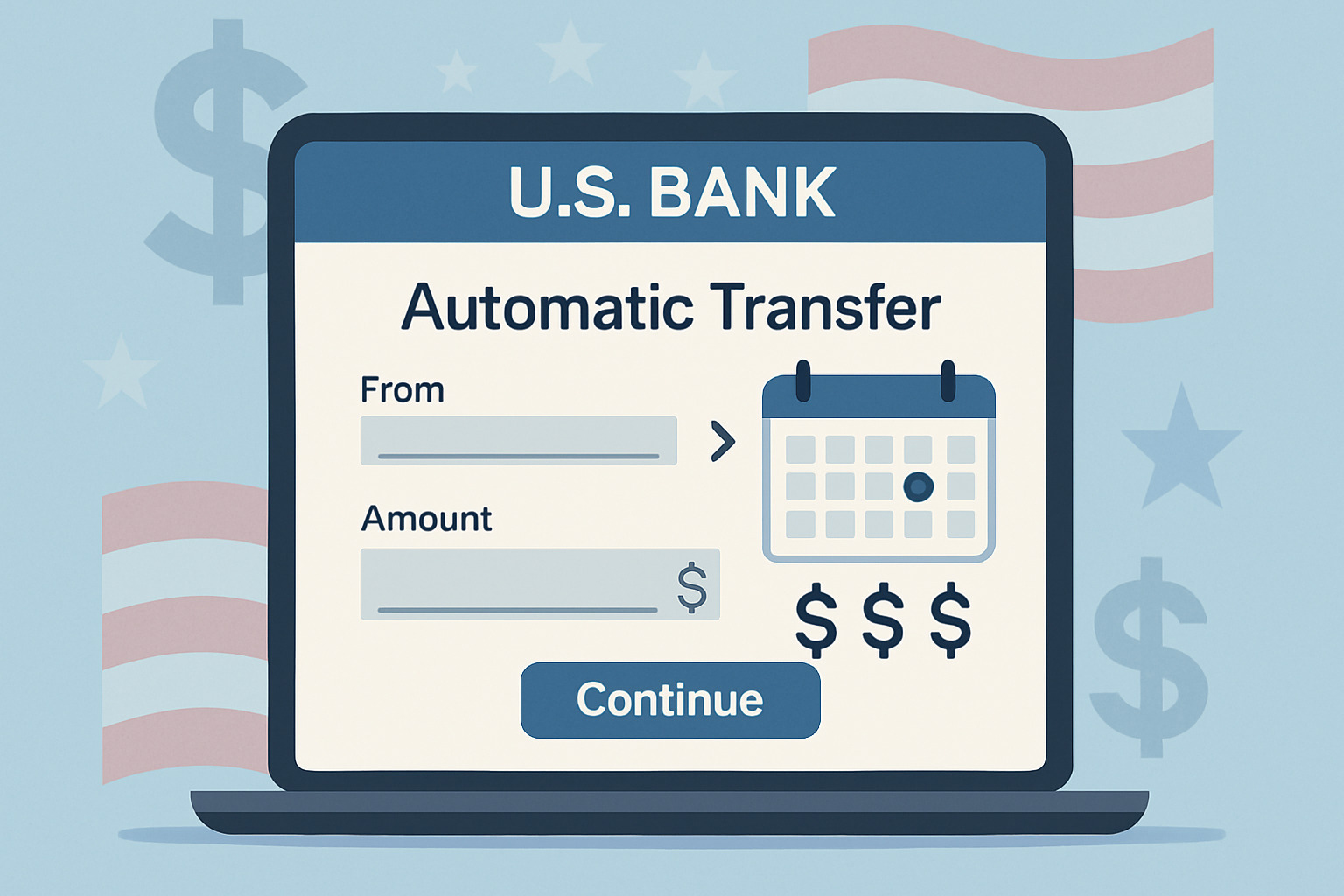

Automate, Rebalance, Minimize Fees

The three pillars that separate successful long-term investors from everyone else are automation, rebalancing, and fee control. Master these three, and you’re ahead of 90% of investors.

Automation is your best friend because it removes emotion from the equation. Set up automatic transfers from your checking account to your investment accounts. Most brokers offer this service for free, and it ensures you’re investing consistently whether markets are soaring or crashing. Your 401(k) contributions should be automated through payroll deduction – money you never see is money you won’t miss.

Rebalancing keeps your portfolio on track as markets move. Let’s say you want 70% stocks and 30% bonds. After a great year for stocks, you might find yourself with 80% stocks and 20% bonds. Time to rebalance by selling some stocks and buying bonds to get back to your target. Do this annually or whenever your allocation drifts more than 5% from your targets.

Fee control might be the most important factor in your long-term success. A 2% annual fee versus a 0.2% fee on a $100,000 investment will cost you about $225,000 over 25 years. That’s real money that could fund years of retirement. Choose low-cost index funds and ETFs with expense ratios under 0.20%, and avoid actively managed funds that charge premium fees for average performance.

The beauty of this approach is that once you set it up, it runs itself. You’re building wealth while you sleep, work, and live your life.

Managing Emotions During Volatility

The biggest challenge in long-term stock investing isn’t picking the right stocks or timing the market perfectly. It’s managing your emotions when everything feels like it’s falling apart.

Think about it: during the 2008 financial crisis, headlines screamed about the end of capitalism as we knew it. Many smart, successful people panicked and sold their investments near the bottom. They watched their portfolios recover from the sidelines, missing out on one of the strongest bull markets in history.

Meanwhile, investors who stayed the course didn’t just recover their losses – they went on to achieve new highs. The S&P 500 dropped 37% in 2008, but by 2012, patient investors were back in positive territory and climbing higher.

Your emotions will try to sabotage your wealth-building journey. Fear whispers “sell everything” during crashes, while greed shouts “buy more” during bubbles. Both can destroy decades of disciplined investing.

The good news? Once you understand these emotional patterns, you can prepare for them. It’s like knowing a storm is coming – you can’t stop it, but you can weather it much better.

For more insights on avoiding emotional mistakes, read our guide on More info about Top 5 Common Investing Mistakes and How to Avoid Them.

Behavioral Biases & Mind Tricks

Your brain plays tricks on you when money is involved. These aren’t character flaws – they’re hardwired survival instincts that worked great for our ancestors but can wreck your investment returns.

Loss aversion hits us all. Losing $1,000 feels twice as painful as gaining $1,000 feels good. This explains why investors often sell during market downturns and hold too much cash during recoveries. Your brain is literally wired to avoid losses, even when taking some losses is part of building long-term wealth.

Overconfidence strikes during good times. After a few successful years, you might start thinking you’re the next Warren Buffett. This leads to excessive trading, concentrated bets, and ignoring basic diversification principles. Remember: even professional fund managers struggle to beat simple index funds consistently.

Anchoring makes us fixate on recent prices or news. If your favorite stock was $100 last month and trades at $80 today, it feels like a bargain. But maybe it’s still overvalued at $80. Past prices don’t determine future value.

Here’s how to outsmart your own brain: Write down your investment plan when markets are calm. Include your goals, timeline, and how you’ll handle volatility. When emotions run high, refer back to this document instead of making impulsive decisions.

Avoid financial news during volatile periods. The media makes money from your attention, not your investment success. Constant negative headlines can trigger panic selling at exactly the wrong time.

Focus on your long-term goals, not daily fluctuations. If you’re investing for retirement in 20 years, today’s market moves are just noise. Volatility is simply the price you pay for higher long-term returns.

When and How to Review Your Portfolio

The secret to successful long-term stock investing is staying engaged without becoming obsessed. You need to check in regularly but not react to every market hiccup.

We recommend formal portfolio reviews once or twice per year. Think of it like an annual physical – you’re checking for problems before they become serious.

During your annual review, focus on the big picture. Check if your allocation still matches your targets. If stocks had a great year, you might find yourself with 80% stocks when you wanted 70%. Rebalance back to your target allocation.

Increase your contribution amounts if possible. Got a raise? Bump up your 401(k) contributions. This is one of the easiest ways to accelerate your wealth building.

Assess if your goals or timeline have changed. Maybe you want to retire earlier, or you’ve decided to help fund your kids’ college education. Adjust your strategy accordingly.

Consider tax-loss harvesting opportunities. If you have investments in taxable accounts, you might be able to offset gains with losses to reduce your tax bill.

Certain life events deserve extra attention. Major changes like marriage, divorce, or job transitions can significantly impact your financial situation. Inheritances or windfalls might require you to adjust your investment strategy.

Significant market events – like 20% moves up or down – might trigger rebalancing needs, but don’t let them trigger emotional decisions.

During reviews, ask yourself the questions that actually matter: Are you on track to meet your goals? Do you need to save more or adjust your timeline? These big-picture issues matter far more than whether tech stocks outperformed healthcare stocks last quarter.

The goal isn’t to achieve perfect performance. It’s to stay consistently invested so compound growth can work its magic over decades.

Frequently Asked Questions about Long-Term Portfolios

How long is “long-term” in stock investing?

When people ask about long-term stock investing, they’re often thinking about tax rules. The IRS considers anything held over 12 months as long-term, which gets you those sweet capital gains tax rates instead of ordinary income rates.

But here’s the thing – real long-term investing isn’t about hitting that 12-month mark. We’re talking about decades, not years. Think of it like planting an oak tree. You don’t expect shade next summer.

For stock investing, you want at least a 5-year horizon before you even think about touching that money. But the real magic happens when you stretch that to 10, 20, or even 30 years. That’s when compound growth really shows off.

Here’s a comforting fact: if you look at any 20-year period in stock market history, you’ve never lost money. Not once. The market has its tantrums, sure, but time has always been the great healer.

Do dividends really matter to long-term returns?

Oh, they absolutely do. This might surprise you, but dividend reinvestment often makes up one-third to 40% of your total returns over multiple market cycles. That’s not small change – that’s retirement-changing money.

Think of dividends as your investments paying you to own them. When you reinvest those payments, you’re buying more shares without reaching into your pocket. Those new shares generate their own dividends, creating a beautiful snowball effect.

Companies that consistently pay and grow their dividends tend to be the steady, reliable types. They’re like that friend who always pays you back – they usually have strong cash flows and solid management. During tough times, they’re often better positioned to weather the storm.

But here’s a word of caution: don’t chase high dividend yields blindly. An 8% dividend yield might look tempting, but it could signal a company in trouble. Focus on dividend growth and sustainability rather than just the current payout. A 3% yield that grows 5% annually beats a 6% yield that gets cut in half.

Should I adjust my stock allocation as I near retirement?

Yes, but don’t panic and dump all your stocks the day you turn 60. Retirement isn’t a cliff you fall off – it’s more like a long, winding path that can last 20 or 30 years.

The old “age in bonds” rule still has merit. If you’re 50, maybe hold 50% bonds and 50% stocks. But with people living longer and bond yields staying low, many financial advisors now recommend staying more aggressive longer.

Consider what’s called a “bond tent” approach. As you get within 5-10 years of retirement, gradually increase your bond allocation to protect against sequence-of-returns risk. This is the danger of a big market crash right before or after you retire, when you’re most vulnerable.

But here’s the twist – once you’re a few years into retirement, you might want to increase your stock allocation again. Why? Because you’ve still got decades ahead of you, and you need growth to maintain your purchasing power against inflation.

A healthy 65-year-old might still hold 50-60% stocks. Retirement isn’t the end of your investing journey – it’s just a new chapter. Your money still needs to work for you, just maybe not quite as aggressively as when you were 25.

Conclusion

Long-term stock investing isn’t about finding the next hot stock or timing the perfect entry point. It’s about using the most powerful force in investing: time and compound growth working together to build real wealth.

The evidence couldn’t be clearer. Investors who stay invested through market ups and downs, consistently reinvest their dividends, and maintain diversified portfolios leave the market timers in the dust. That impressive 9.80% annual return from the S&P 500 between 1928-2023 wasn’t earned by traders frantically buying and selling – it belonged to patient investors who understood that wealth is built slowly, then suddenly.

Think about it this way: every day you delay is another day you’re not earning returns on your returns. The math is unforgiving, but it’s also incredibly generous to those who start early and stay consistent.

Your path to financial independence rests on three pillars that we’ve covered throughout this guide. Starting early gives compound interest the maximum time to work its magic – even small amounts invested in your twenties can grow into substantial wealth by retirement. Staying invested through the inevitable market storms separates successful investors from those who panic and sell at the worst possible moments. Keeping costs low ensures that more of your money stays working for you instead of padding fund managers’ pockets.

At Finances 4You, we’ve seen countless individuals transform their financial futures through disciplined, long-term strategies. The path isn’t glamorous – there are no get-rich-quick schemes or secret formulas. It’s systematic, requires patience, and has been proven over decades of market history.

Here’s the truth that every successful investor learns: the best time to plant a tree was 20 years ago, but the second-best time is today. Your long-term stock investing journey starts with that first automated contribution, continues through market volatility, and rewards you with financial freedom.

The market will keep doing what it’s always done – going up and down, creating fear and greed, giving the media endless material for scary headlines. There will always be reasons to wait for a “better time” to invest. Economic uncertainty, political drama, global events – the list never ends.

But here’s what we know works: ignore the noise, stick to your plan, and trust in the power of time and compound growth. Your future self will thank you for every dollar you invest today and every month you stay the course.

For more resources on building wealth and achieving financial independence, explore our More info about resource guide for comprehensive tools and strategies that can help align your net worth with your age group and goals.

The choice is yours. You can spend your time trying to outsmart the market, or you can let the market work for you. We know which path leads to lasting wealth.