Why Oklo Stock Has Become One of the Most Volatile Clean Energy Plays

Oklo stock has returned a staggering 417% over the past year, turning this Santa Clara–based nuclear startup into one of the market’s most talked-about clean-energy plays. Backed by OpenAI co-founder Sam Altman, Oklo is developing small modular reactors that promise always-on, carbon-free power.

Quick Facts About Oklo Stock (OKLO):

- Trading Range (52-week): $5.35 – $73.55

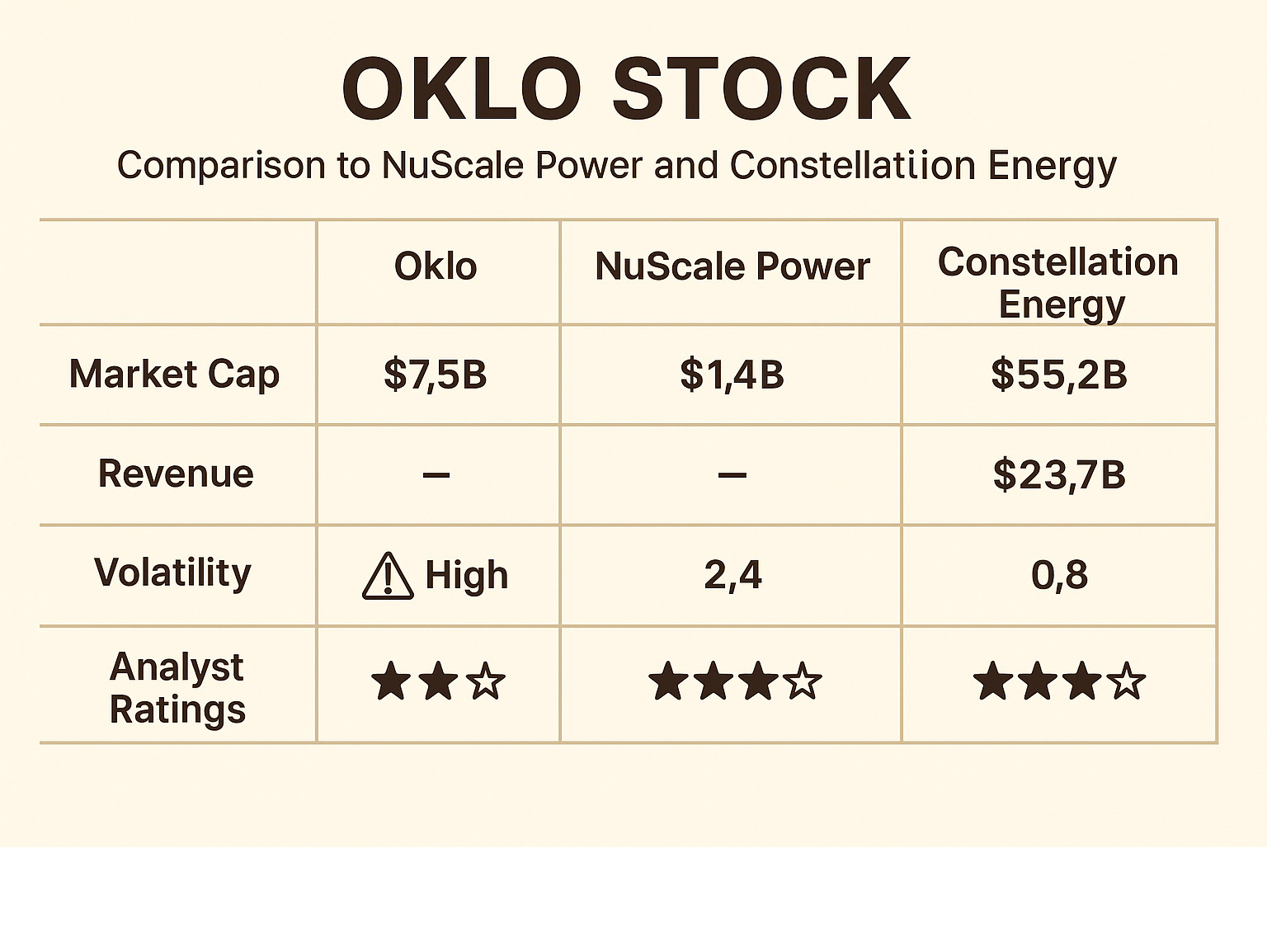

- Market Cap: ~$7.5 billion

- YTD Return: +159%

- Technology: Fast fission & nuclear-fuel recycling

- Key Partners: U.S. Air Force, DOE, National Labs

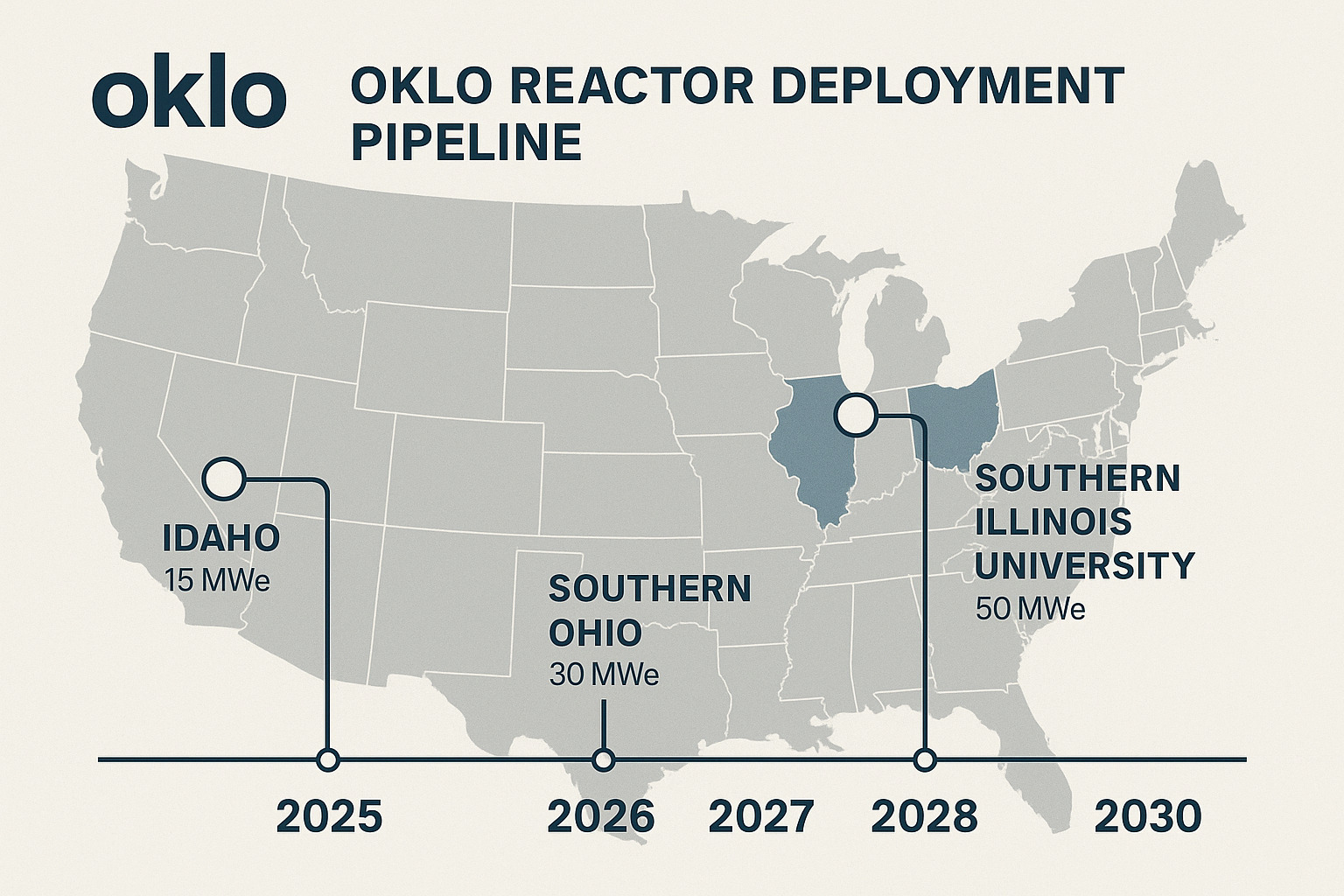

- Revenue: Pre-revenue; first commercial unit targeted mid-to-late 2020s

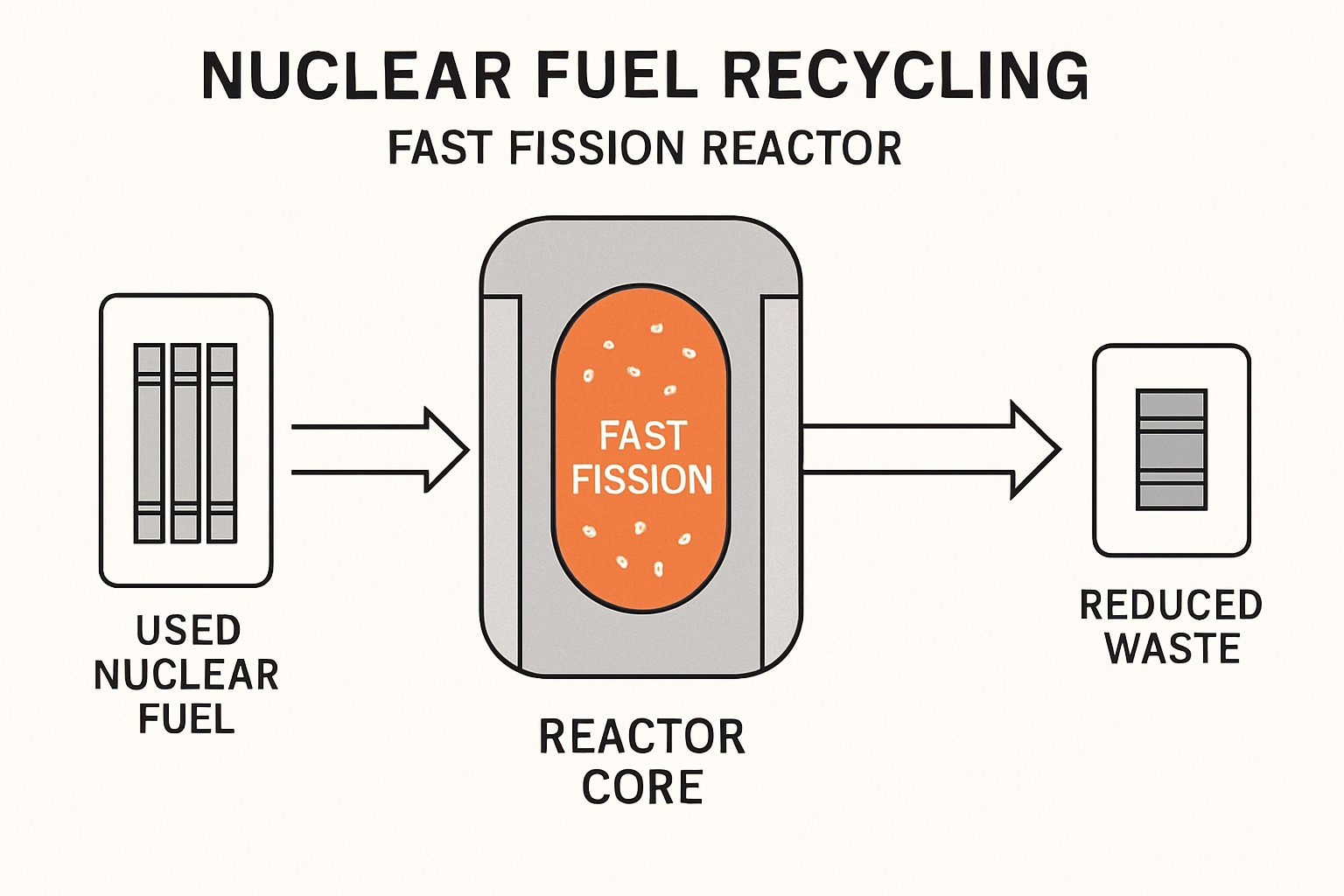

Oklo’s 15-50 MW Aurora design can even recycle spent nuclear fuel—turning waste into power. That huge upside, however, comes with execution and regulatory risk, which is why oklo stock trades with a beta above 2 and daily price swings that can rattle even seasoned investors.

Recent catalysts such as Google’s fusion announcement and Oklo’s Air Force contract have amplified the volatility, leaving investors to decide whether this is the next clean-energy breakthrough or just high-octane speculation.

Important oklo stock terms:

What Does Oklo Inc. Do and Why It Matters

Picture this: a nuclear reactor that’s small enough to fit in your neighborhood, smart enough to run itself, and clever enough to turn nuclear waste into clean electricity. That’s exactly what Oklo Inc. is building, and it’s why oklo stock has captured the attention of everyone from Silicon Valley investors to Pentagon officials.

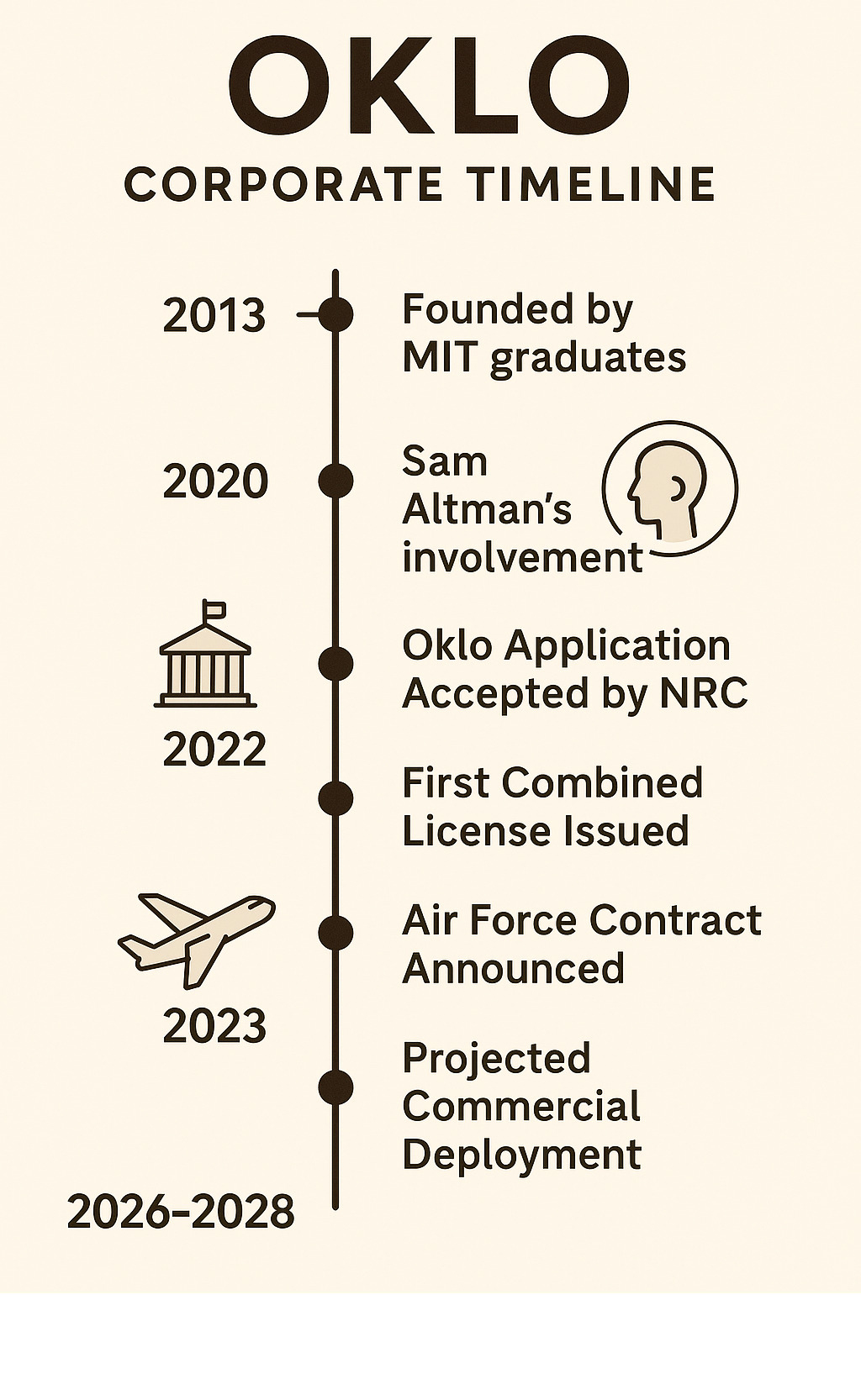

Founded back in 2013 by two brilliant MIT graduates, Jacob DeWitte and Caroline Cochran, Oklo takes its name from a fascinating piece of natural history. About 1.7 billion years ago in Gabon, Africa, natural nuclear reactors operated all by themselves underground. It’s a perfect metaphor for what Oklo is trying to achieve – fast fission reactors that can run safely and efficiently with minimal human intervention.

Here’s where things get really interesting. Oklo’s Aurora design isn’t just another nuclear reactor. It’s a game-changer that tackles two massive problems at once: our desperate need for clean energy that works 24/7, and the growing mountain of nuclear waste that nobody knows what to do with.

The Aurora reactor produces between 15-50 MW of electrical power using something called a fast neutron core, cooled by liquid sodium instead of water. But here’s the kicker – it can actually eat used nuclear fuel from other reactors, extracting way more energy while dramatically reducing long-term waste.

Think about it this way: while solar panels sit useless on cloudy days and wind turbines stop spinning when the air is still, Oklo’s reactors keep humming along, providing reliable baseload power regardless of weather. That’s exactly what our increasingly digital world needs.

The U.S. Air Force has already figured this out, signing a contract with Oklo to power defense facilities. Meanwhile, those massive data centers that keep our smartphones and streaming services running are desperately hunting for carbon-free electricity that never takes a break. DOE collaboration and partnerships with National Laboratories have helped validate Oklo’s technology and steer the complex regulatory landscape.

Oklo’s Business Model in a Nutshell

Here’s where Oklo gets really smart about making money. Instead of building reactors and selling them like most nuclear companies, they’re keeping ownership and selling electricity through power-purchase agreements (PPAs). It’s like the Netflix of nuclear power – customers pay for what they use without the massive upfront investment.

This approach is brilliant for several reasons. Oklo maintains complete control over safety and operations, which is crucial when you’re dealing with nuclear technology. They also create a steady revenue stream instead of relying on one-time equipment sales that can be feast or famine.

The company is targeting three main markets that all share a common problem: they need reliable, clean electricity that works around the clock. Microgrid markets serve remote industrial sites that can’t depend on the main power grid. Military installations need energy security that can’t be compromised. And those hyperscale data centers powering our digital lives need massive amounts of consistent electricity.

But wait, there’s more. Oklo’s reactors don’t just make electricity – they can also provide industrial heat supply for manufacturing and chemical processing. The modular design means you can start with one reactor and add more as your needs grow, creating custom solutions for different customers.

Key Customers and Partnerships

The list of organizations working with Oklo reads like a directory of America’s most important energy and defense players. That U.S. Air Force contract isn’t just about revenue – it’s a stamp of approval from one of the world’s pickiest customers when it comes to reliable, secure power.

Working closely with the Department of Energy and National Laboratories, especially Idaho National Lab, gives Oklo access to world-class research facilities and regulatory expertise. These partnerships are absolutely crucial for navigating the incredibly complex process of getting advanced nuclear technology approved.

Sam Altman’s role adds another fascinating dimension to the story. As OpenAI’s co-founder, Altman brings Silicon Valley connections and a deep understanding of how breakthrough technologies scale up. His recent decision to step down from Oklo’s board to avoid conflicts actually shows how seriously both companies take their energy strategies.

The hyperscale data centers represent the biggest long-term opportunity. Major tech companies have made bold commitments to carbon-neutral operations while simultaneously building more and more computing infrastructure. Traditional renewable sources simply can’t provide the consistent, high-density power these digital giants need – creating a perfect match for Oklo’s always-on nuclear technology.

Oklo Stock Performance and Recent Volatility

Looking for a wild ride? Oklo stock delivers. Prices have swung between $5.35 and $73.55 in just 12 months—a 417% one-year gain that puts most momentum trades to shame.

With a beta of 2.39 and 13.9% short interest, daily 10% moves are common. Positive headlines can spark violent rallies as short sellers scramble to cover, while any hint of bad news cuts just as sharply.

Even analysts can’t agree on fair value. B. Riley recently lifted its target to $58, yet published forecasts still range from $30 to $77.

Why Is Oklo So Volatile?

- Cutting-edge tech: Fast reactors and fuel recycling are unproven at scale, so sentiment shifts with every technical update.

- Sector headlines: Google’s fusion deal and other nuclear news ripple straight into oklo stock.

- Options activity: Moderate volumes mean “option whales” can move the underlying shares as market makers hedge.

- Short-squeeze potential: Nearly 14% of the float is sold short, creating explosive upside when good news drops.

Buy, Sell, or Hold?

Most research shops call it a Hold. Alternative-data services score brand buzz high but fundamentals low—no surprise for a pre-revenue company. At Finances 4You we label Oklo stock a speculative satellite holding: use position sizing and expect turbulence.

Technology Edge: Fast Fission, Recycling, and Competitive Landscape

When you dig into what makes Oklo stock compelling from a technology standpoint, it’s really about solving two huge problems at once. Traditional nuclear plants are massive, expensive, and frankly, kind of wasteful. Oklo’s Aurora reactor flips this script entirely.

The heart of Oklo’s innovation lies in its metal-fuel core cooled by liquid sodium. This might sound technical, but here’s why it matters: this setup runs much hotter than traditional water-cooled reactors, which means better efficiency and more power from a smaller package. Think of it like the difference between a gas-guzzling truck and a high-performance sports car – both get you there, but one does it with style and efficiency.

What really sets Oklo apart is the fuel recycling capability. Here’s a mind-blowing fact: traditional nuclear plants only use about 5% of the energy in their fuel before tossing it aside as “waste.” That’s like eating one bite of a sandwich and throwing the rest away. Oklo’s fast neutron technology can actually feast on this so-called waste, extracting dramatically more energy while shrinking the waste problem.

The 15-50 MW output range makes these reactors perfect for applications where massive nuclear plants are overkill. We’re talking about powering data centers, military bases, or industrial facilities without needing to build a small city around the reactor.

The licensing pathway represents both the biggest opportunity and the biggest headache for Oklo stock investors. The Nuclear Regulatory Commission has frameworks for advanced reactors, but Oklo’s specific technology requires extensive review. The company has been working with regulators for years, building relationships and establishing safety protocols. Still, final approval remains years away – and that’s assuming everything goes smoothly.

Here’s where things get interesting from a cost perspective. The modular design means these reactors can be built in factories rather than constructed piece by piece on-site. This factory approach could slash both costs and construction timelines compared to traditional nuclear projects that often spiral into decade-long budget disasters.

How Oklo Differs from Other Nuclear and Clean Energy Plays

The nuclear energy landscape includes several interesting players, but Oklo occupies a unique sweet spot. While some companies focus on utility-scale reactors and others pursue tiny micro-reactors for remote locations, Oklo targets that middle ground where you need serious power but don’t want to build a massive facility.

The 24/7 baseload power advantage becomes crucial when you compare Oklo to renewable alternatives. Solar panels don’t work at night, and wind turbines sit idle when the air is still. Data centers and military facilities can’t afford to shut down when the weather doesn’t cooperate. Oklo’s reactors just keep humming along regardless of what’s happening outside.

The micro-footprint story is compelling for investors in Oklo stock. Traditional nuclear plants sprawl across hundreds of acres and need massive cooling systems. Oklo’s reactors can fit on sites measured in acres, not square miles. This opens up deployment opportunities that simply don’t exist for conventional nuclear technology.

Perhaps most importantly, Oklo promises faster deployment timelines. While traditional nuclear projects often take a decade or more from conception to operation, Oklo targets timelines measured in years. When customers increasingly demand rapid solutions to their clean energy needs, speed could prove more valuable than perfection.

The lower waste profile addresses one of nuclear power’s biggest public relations problems. By actually consuming nuclear waste as fuel, Oklo turns a liability into an asset. This could prove crucial for public acceptance and regulatory approval as communities become more comfortable with nuclear technology that solves problems rather than creating them.

Risks, Financial Health, and Outlook Through 2026

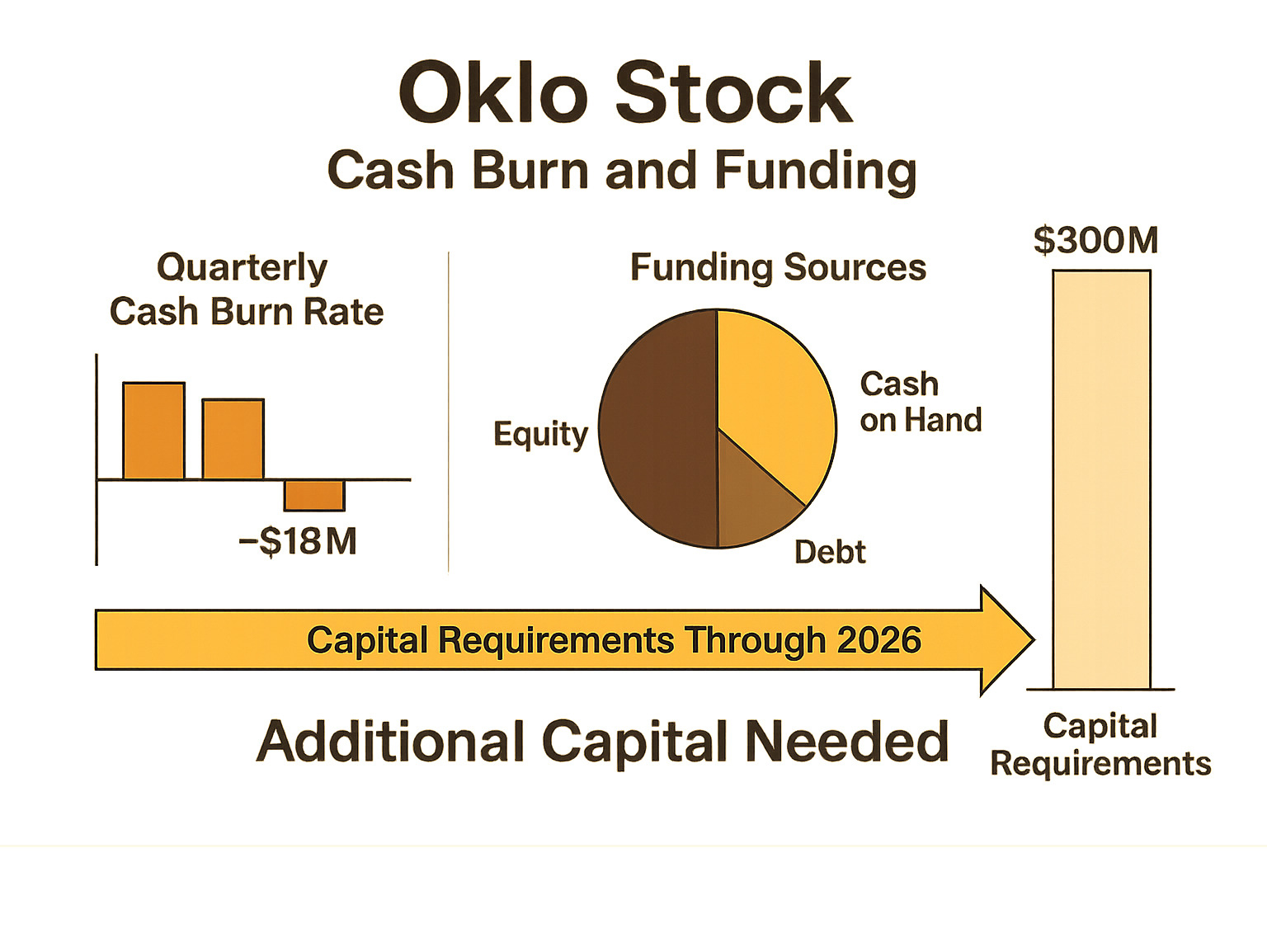

Let’s be honest about Oklo stock – we’re dealing with a company that’s burning through cash faster than a teenager with their first credit card. The financial picture shows exactly what you’d expect from a pre-revenue nuclear startup: negative earnings per share of -$0.12 and quarterly losses that would make any traditional investor wince.

The company reported a net loss of $9.81 million in their most recent quarter. Now, before you panic, this is actually pretty normal for a company trying to build the nuclear reactors of the future. Think of it like paying for an expensive education – the bills come first, the payoff comes later.

With roughly $235 million in the bank, Oklo has enough runway to keep the lights on for several years at their current spending pace. But here’s the catch – scaling up to actually build and deploy these reactors will require a lot more money. We’re talking about the kind of capital requirements that make even Silicon Valley investors take a deep breath.

The regulatory licensing maze represents the biggest near-term headache for Oklo. The Nuclear Regulatory Commission doesn’t exactly hand out approvals like Halloween candy. Every safety protocol, operational procedure, and technical specification gets scrutinized with the intensity of a tax audit. While Oklo has been working with regulators for years, there’s always the possibility of delays or additional requirements that could push commercial deployment further into the future.

Supply chain vulnerabilities add another layer of complexity. Building fast reactors isn’t like assembling smartphones – you can’t just order specialized nuclear components from Amazon Prime. The limited number of suppliers for critical materials and components could create serious bottlenecks as Oklo tries to scale production.

Then there’s the fusion technology development creating uncertainty in the nuclear space. Recent breakthroughs in fusion technology have some investors wondering if fission-based approaches like Oklo’s might face increased competition from alternative nuclear technologies. It’s like betting on the best horse in a race where someone might invent teleportation halfway through.

Dilution risk looms large for current shareholders. As Oklo moves toward commercial deployment, they’ll almost certainly need to raise additional capital. More shares outstanding typically means your slice of the pie gets smaller, even if the overall pie grows.

Scenario Forecasts for Oklo Stock in 2025-2026

Looking ahead to 2025-2026, we see three realistic paths for Oklo stock – think of them as the good, the okay, and the “ouch” scenarios.

Our bull case targets $75 per share, assuming everything goes right. This scenario requires regulatory approval to come through on schedule, major customers to sign on the dotted line, and Oklo to successfully demonstrate their fuel recycling technology works as advertised. It’s the kind of outcome that would make early investors very happy and probably spark a few “I told you so” conversations at cocktail parties.

The base case points toward $45 per share, which reflects steady progress with the usual bumps and delays that come with pioneering technology. Think regulatory approval by 2026, first commercial reactors coming online in 2027, and modest but growing market adoption. This scenario assumes Oklo executes reasonably well but faces normal development challenges along the way.

Our bear case could see the stock drop to $25 or lower, triggered by regulatory setbacks, technical problems, or competitive threats that make investors lose confidence. Major customer cancellations, safety concerns, or breakthrough announcements from alternative nuclear technologies could all push the stock into this territory.

The reality is that each scenario carries meaningful probability given the uncertainties involved in advanced nuclear technology. Oklo stock will likely continue experiencing the kind of volatility that makes roller coasters look tame. For investors considering a position, think carefully about how much uncertainty you can stomach – and remember that in emerging technology, even the best-laid plans can change quickly.

Frequently Asked Questions about Oklo Stock

What is the current OKLO price and 52-week range?

Oklo stock has been on quite the wild ride lately, currently trading in the $51-55 range. But here’s where it gets interesting – the 52-week range tells a story that would make even the most seasoned investors do a double-take. We’re talking about a spread from $5.35 all the way up to $73.55.

Think about that for a moment. If you bought at the bottom in September 2024 and sold at the peak in June 2025, you would have made over 1,200% returns. Of course, timing the market perfectly is about as likely as winning the lottery twice, but it shows just how dramatically this stock can move.

The daily trading action is equally impressive, with volumes regularly exceeding 20 million shares. That’s a lot of people making bets on whether this nuclear startup will change the world or flame out spectacularly. The high volume suggests serious institutional interest, not just retail investors gambling on the next big thing.

Does Oklo generate any revenue yet?

Here’s the straightforward answer: Oklo stock represents a company that hasn’t made its first dollar in revenue yet. Their most recent quarterly report shows a big fat zero in the revenue column, which is exactly what analysts expected.

This isn’t necessarily a red flag – it’s just the reality of investing in cutting-edge technology companies. Oklo is still in the development phase, working through regulatory approvals and building their first commercial reactors. It’s like investing in a restaurant before they’ve opened their doors or hired their first chef.

The company funds its operations through equity raises and strategic partnerships rather than customer payments. Revenue generation won’t begin until they actually start delivering power to customers, which management targets for the mid-to-late 2020s. Until then, investors are essentially betting on the company’s potential rather than its current performance.

How big could the market for Oklo reactors become?

Now this is where things get exciting from an investment perspective. The addressable market for small modular reactors could reach into the hundreds of billions globally over the next two decades. We’re not talking about a niche market here – this could be massive.

The demand drivers are compelling and growing stronger each year. Data centers are absolutely desperate for reliable, clean power that works 24/7. Every time you stream a video or ask ChatGPT a question, you’re using energy that these facilities need to provide consistently.

Industrial facilities represent another huge opportunity, especially those requiring high-temperature process heat that traditional renewables can’t provide. Then you have remote communities that lack reliable grid access and military installations that need energy security above all else.

The International Energy Agency projects significant growth in nuclear capacity to meet global climate goals, with small modular reactors playing an increasingly important role. But here’s the catch – market development depends entirely on successful technology demonstration, achieving cost competitiveness, and navigating regulatory frameworks.

The potential is enormous, but so are the problems. That’s exactly why Oklo stock trades with such extreme volatility. Investors are weighing massive market opportunity against significant execution risk, creating the perfect storm for dramatic price swings.

Conclusion

The story of Oklo stock reads like a fascinating chapter in the clean energy revolution – one filled with breakthrough technology, Silicon Valley ambition, and the kind of volatility that keeps investors on the edge of their seats. After diving deep into this company’s prospects, we’re left with a compelling but complex investment picture.

On one hand, Oklo’s approach to nuclear power genuinely addresses some of our biggest energy challenges. Their small modular reactors that can actually recycle nuclear waste? That’s the kind of innovation we desperately need as data centers gobble up more electricity and climate goals demand reliable clean power around the clock.

The backing from Sam Altman adds serious Silicon Valley credibility, while partnerships with the U.S. Air Force and Department of Energy provide real validation. These aren’t just feel-good announcements – they represent potential pathways to actual revenue in a sector where many companies never make it past the drawing board.

But let’s be honest about the risks here. Oklo stock moves like a caffeinated cryptocurrency, with daily swings that can make or break portfolios. The company is still years away from generating its first dollar of revenue, and regulatory approval remains a big question mark. When your beta is 2.39, you’re signing up for a wild ride that’s definitely not for everyone.

Here at Finances 4You, we believe in matching investments to your life stage and risk tolerance. If you’re young with decades to invest and can stomach significant volatility, Oklo stock might deserve a small corner of your portfolio. But if you’re approaching retirement or need steady returns, this probably isn’t your play.

The clean energy transition is creating incredible opportunities, but it’s also littered with companies that promised the moon and delivered disappointment. Oklo has better credentials than most, but success is far from guaranteed in the complex world of advanced nuclear technology.

For those intrigued by the clean energy story but seeking less roller-coaster investing, consider exploring our comprehensive guides on Investment Strategies and Best Ways to Invest Money. These resources can help you build a balanced approach that captures growth opportunities without betting your financial future on any single breakthrough technology.

The bottom line? Oklo stock represents one of the more interesting speculative plays in clean energy today. Just make sure you’re investing with money you can afford to lose – and maybe keep some antacids handy for those inevitable 20% daily swings.