Why Every Investor Needs a Comprehensive Resource Guide

A resource guide for investors is your roadmap to navigating the complex world of financial markets, regulatory requirements, and investment opportunities. Whether you’re opening your first brokerage account or exploring alternative investments, having the right resources at your fingertips can mean the difference between smart wealth building and costly mistakes.

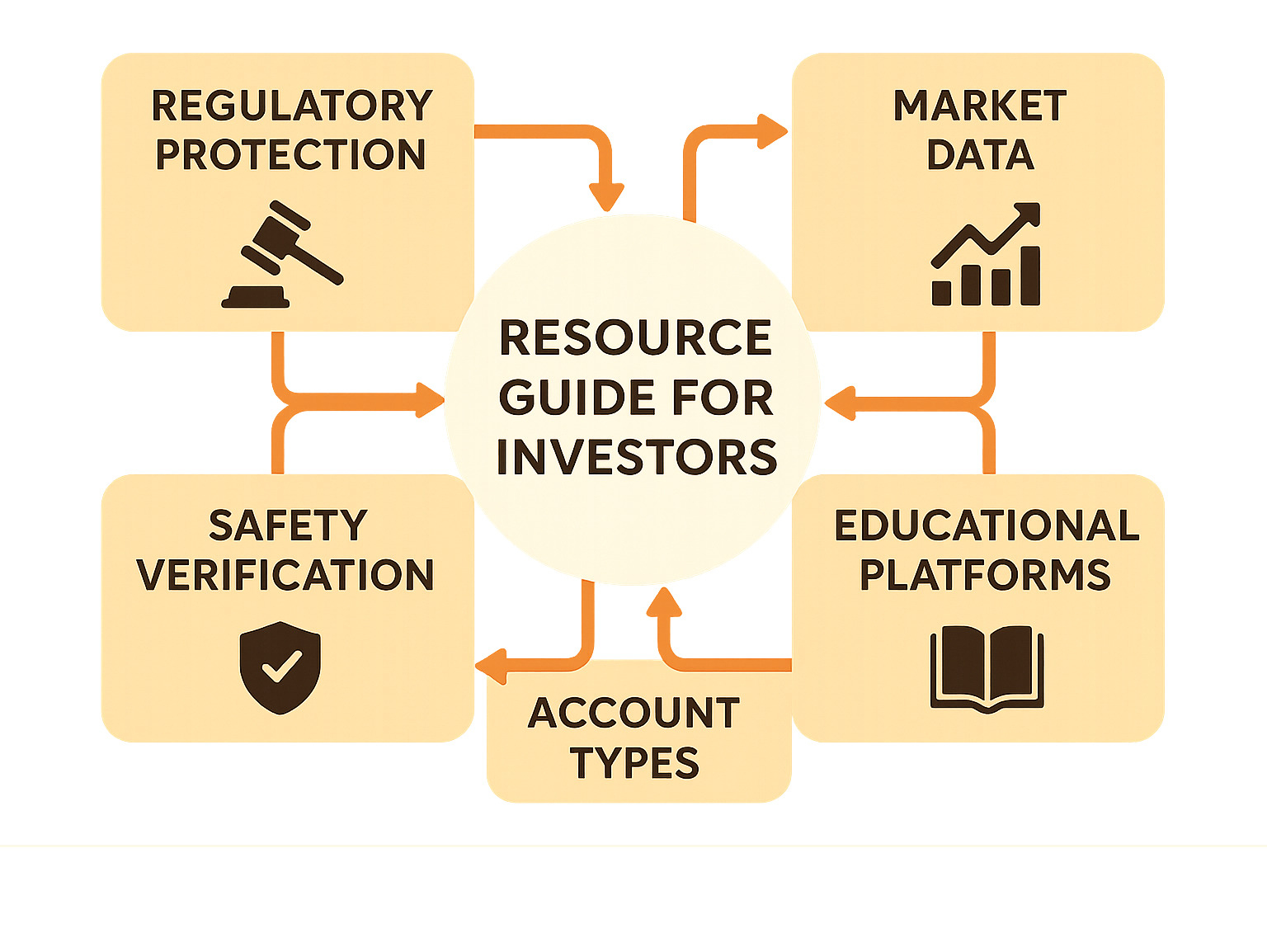

Quick Answer: Essential Investment Resources

– Regulatory Sites: SEC.gov, FINRA.org, Investor.gov for education and fraud protection

– Market Data: Yahoo Finance, Morningstar, FINRA Market Data Center for research

– Account Platforms: Robinhood, Webull, Charles Schwab for trading and management

– Educational Tools: Investopedia, SEC Beginner’s Guide, stock market simulators

– Safety Checks: FINRA BrokerCheck, EDGAR database for professional verification

The investment landscape has exploded in complexity. As of October 2024, there are nearly 15,000 cryptocurrencies available for trading, while the U.S. capital markets represent approximately 55% of all global public equity markets. For young professionals earning high salaries but struggling with lifestyle inflation, this abundance of choice can feel overwhelming.

That’s where a well-organized resource guide becomes invaluable. You don’t need to become an expert overnight – you just need to know where to find reliable information when you need it.

The good news? Many of the best investment resources are completely free. Investor.gov received over 12 million visits in 2023, while FINRA’s BrokerCheck tool has been used over 200 million times to verify investment professionals. These aren’t just statistics – they represent millions of people taking control of their financial futures.

Essential resource guide for investors terms:

– Analyzing financial statements

– Comprehensive budget worksheet

– Retirement income options

Mapping the Modern Investment Universe

Think of today’s investment landscape like a massive buffet – there are so many options that it’s easy to get overwhelmed. But here’s the thing: you don’t need to try everything. A solid resource guide for investors helps you understand what’s available so you can make smart choices that fit your goals.

Traditional investments still form the backbone of most successful portfolios. Stocks give you a piece of ownership in companies, potentially growing in value while some pay dividends along the way. Bonds work differently – you’re essentially lending money to governments or corporations in exchange for regular interest payments. They’re generally safer than stocks but offer lower returns.

ETFs and mutual funds are like investment shortcuts. Instead of picking individual stocks, you buy into a fund that owns hundreds or thousands of different investments. It’s instant diversification without needing a fortune to get started. The main difference? ETFs trade like stocks throughout the day, while mutual funds price once daily after markets close.

Real estate investing has gotten much more accessible. You don’t need to become a landlord anymore. REITs (Real Estate Investment Trusts) let you invest in commercial properties through the stock market. Platforms like Fundrise have opened real estate investing to people with just a few thousand dollars to start.

The cryptocurrency revolution has shaken up everything we thought we knew about money and investing. With the total crypto market cap at $2.367 trillion as of October 2024, digital assets have moved from internet curiosity to legitimate investment option. Bitcoin often moves independently of traditional stocks, which can help balance your portfolio during market turbulence.

Angel investing used to be reserved for the ultra-wealthy, but platforms now allow smaller investors to fund startups. Fair warning though – you typically need accredited investor status (earning $200,000+ annually or having $1 million net worth) and these investments are risky. Most startups fail, but the winners can be spectacular.

Core & Satellite Approaches

Here’s a strategy that makes sense for most investors: think core and satellite. Your core holdings should make up 60-80% of your portfolio. These are your steady, reliable investments – think broad market ETFs with low fees that track the overall market performance.

Your satellite investments get the remaining 20-40%. This is where you can get creative with sector-specific ETFs, individual stocks you’ve researched, or alternative investments like REITs or commodities. The core keeps you grounded while the satellites give you a chance to potentially beat the market.

Asset allocation isn’t one-size-fits-all. The old rule suggested holding your age in bonds (so a 30-year-old holds 30% bonds, 70% stocks). But with people living longer and interest rates historically low, many advisors now recommend more aggressive allocations for younger investors. Your risk tolerance and time horizon matter more than any formula.

Alternative Niches & Longevity Plays

The investment world keeps expanding into fascinating new territories. Private equity used to be exclusive to big institutions, but now it’s becoming accessible through interval funds and private REITs. These investments can offer higher returns but come with a catch – your money is tied up longer and fees are typically higher.

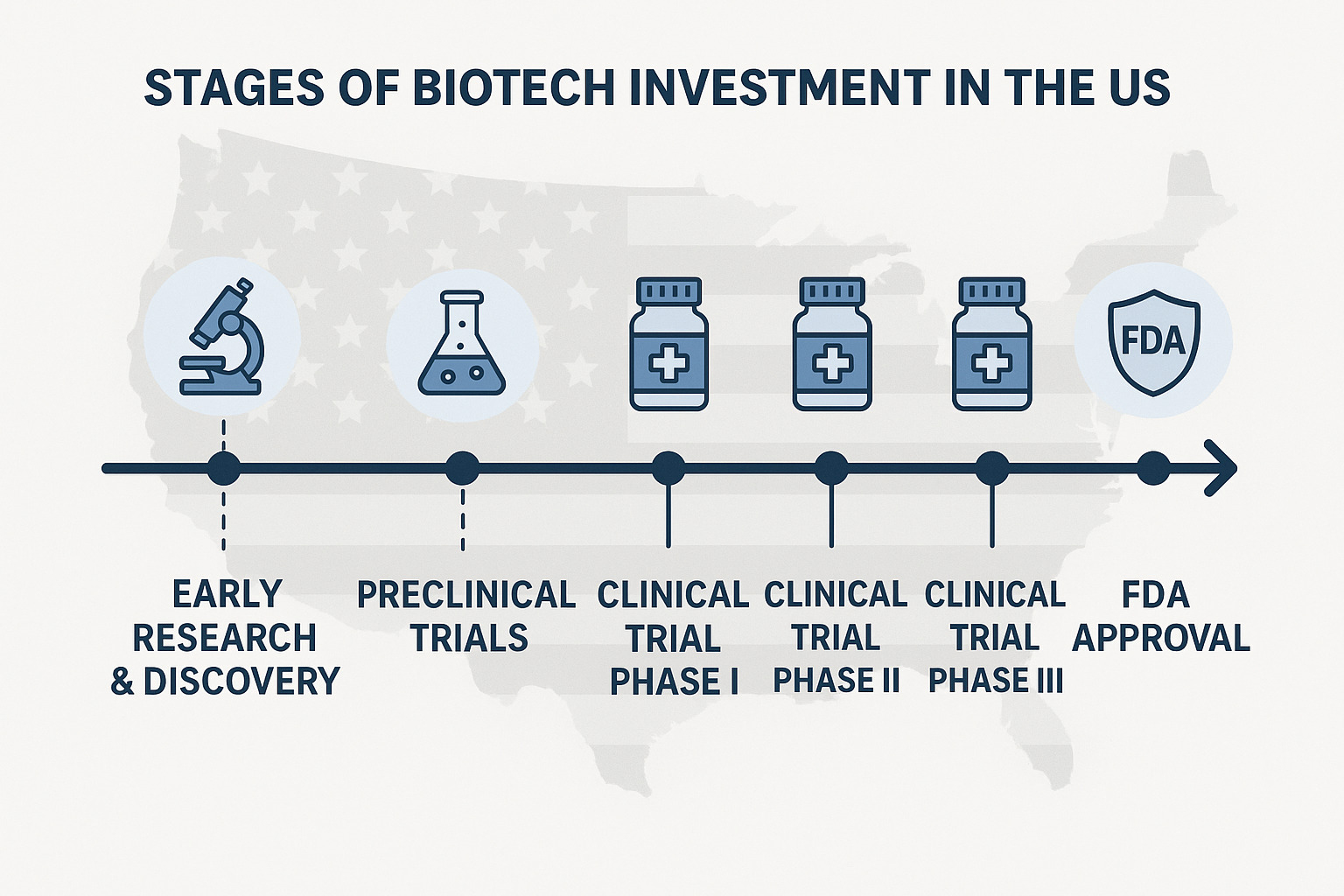

Longevity biotech represents one of the most intriguing emerging sectors. Companies are developing treatments for age-related diseases with the goal of extending healthy human lifespan. Some investors see this as the next major investment theme, combining potential for massive returns with meaningful social impact.

NFTs and digital collectibles created quite the frenzy, but the excitement has cooled considerably. The underlying blockchain technology continues evolving though. Smart investors focus on utility rather than speculation – looking for projects that solve real problems rather than chasing the latest trend.

Diversification remains your best friend. Spreading your investments across different asset types, geographic regions, and sectors helps protect you when one area struggles. No single investment should make or break your financial future.

Getting Started: Accounts, Goals & Strategy

Taking your first steps into investing feels a bit like learning to drive – exciting, slightly nerve-wracking, and definitely easier once you know the basics. The good news? Opening a brokerage account today is simpler than ordering pizza online, and you don’t need thousands of dollars to get started.

Your choice of platform depends on how hands-on you want to be. Self-directed platforms like Robinhood and Webull put you in the driver’s seat with commission-free trading and interfaces that actually make sense. Robinhood pioneered the whole commission-free revolution (remember when trades cost $10 each?), while Webull offers more sophisticated charting tools once you’re ready to geek out over technical analysis.

If you’d rather have someone else handle the heavy lifting, robo-advisors like SoFi Invest are your new best friend. You answer a few questions about your goals and risk tolerance, then algorithms build and manage a diversified portfolio for you. It’s like having a financial advisor who never sleeps and charges way less than traditional advisors.

Full-service platforms like Charles Schwab and Fidelity give you the best of both worlds – you can trade on your own while having access to professional research, retirement planning tools, and actual human advisors when you need them. Think of them as the Swiss Army knife of investing platforms.

Before you open any account, though, let’s talk about your financial foundation. You need an emergency fund with 3-6 months of expenses sitting in a high-yield savings account. This isn’t being overly cautious – it’s being smart. When life throws curveballs (and it will), you don’t want to sell your investments at the worst possible time.

Your investment timeline matters too. Money you’ll need within five years shouldn’t be riding the stock market roller coaster. Stocks can be volatile in the short term, even if they tend to go up over longer periods.

Opening Your First Account Step-by-Step

The actual account opening process follows standard Know Your Customer (KYC) requirements – basically, they need to verify you’re a real person with real money. You’ll need your Social Security number, employment information, and bank account details for funding. Most platforms walk you through this online and approve accounts within minutes.

Here’s where it gets interesting: you need to choose between taxable brokerage accounts and tax-advantaged retirement accounts like 401(k)s, IRAs, and Roth IRAs. If your employer offers 401(k) matching, contribute enough to get the full match before investing anywhere else. Seriously, this is free money – don’t leave it on the table.

Funding your account is straightforward. Most people use bank transfers (free but takes 3-5 business days), though you can also deposit checks or wire money if you’re in a hurry. Just remember that your money needs to “settle” before you can invest it – another reason not to rush this process.

Building Your Own Resource Guide for Investors

Creating your personal resource guide for investors starts with brutal honesty about your finances. Use our comprehensive budget worksheet to figure out exactly where your money goes each month. You might be surprised by what you find.

Once you know how much you can consistently invest, consider dollar-cost averaging – investing the same amount regularly regardless of what the market is doing. Instead of trying to time the market (spoiler alert: even professionals struggle with this), you automatically buy more shares when prices are low and fewer when prices are high.

| Platform Type | Best For | Typical Fees | Key Features |

|---|---|---|---|

| Commission-Free | Beginners, Active Traders | $0 stock trades | Simple interface, mobile-first |

| Robo-Advisor | Hands-off Investors | 0.25-0.50% annually | Automatic rebalancing, tax-loss harvesting |

| Full-Service | Comprehensive Needs | $0-$4.95 per trade | Research, planning tools, human advisors |

The beauty of building your own resource guide is that it grows with you. Start simple, learn as you go, and don’t be afraid to ask questions. Every successful investor started exactly where you are now.

Data, Tools & Calculators Every Investor Should Bookmark

The difference between successful investors and everyone else often comes down to having the right information at the right time. Think of investment tools like a carpenter’s toolbox – you don’t need every fancy gadget, but having quality basics makes all the difference. Your resource guide for investors should include these essential data sources and calculators.

Yahoo Finance has been the go-to resource for millions of investors since the early days of the internet. What makes it special isn’t just the historical stock prices dating back to the 1970s – it’s how everything connects. You can screen for dividend-paying stocks, check their price history, read the latest news, and see what analysts are saying, all in one place. The stock screener alone can save you hours of research by filtering thousands of companies based on your specific criteria.

Morningstar takes a different approach, focusing on quality over quantity. Their star rating system gives you a quick snapshot of whether a stock or fund is worth investigating further. But here’s the real gem: their Investing Classroom offers over 100 free courses that can turn you from a complete beginner into someone who actually understands what they’re buying. It’s like getting a financial education without the student loans.

When you’re ready to dig into bonds, FINRA’s Market Data Center becomes invaluable. Bond pricing can be murky – unlike stocks where you see the price instantly, bonds often trade over-the-counter with less transparency. FINRA’s data comes straight from the regulatory source, giving you confidence in what you’re seeing.

Finviz might sound like a made-up name, but it’s become essential for visual learners. Their heat maps show you the entire market’s performance in colorful blocks – green for gains, red for losses. You can spot trends and opportunities at a glance, something that would take hours scrolling through individual stock listings.

Must-Have Free Tools

Getting comfortable with investing doesn’t require risking your hard-earned money right away. Stock market simulators let you practice with virtual money while using real market data. It’s like learning to drive in an empty parking lot before hitting the highway. You’ll make mistakes – everyone does – but they won’t cost you anything except pride.

Portfolio trackers solve one of modern investing’s biggest headaches: keeping track of everything. Many people have investments scattered across employer 401k plans, personal IRAs, and taxable accounts. These tools pull everything together, showing your true net worth and whether your asset allocation matches your goals.

Retirement calculators can be eye-opening, sometimes in uncomfortable ways. They’ll tell you honestly whether your current savings rate will support your retirement dreams or if you need to adjust expectations. The good news? Starting early gives you tremendous power, even if you can’t save huge amounts initially.

With nearly 15,000 cryptocurrencies floating around, cryptocurrency aggregators like CoinMarketCap and CoinGecko have become essential for anyone exploring digital assets. They help separate legitimate projects from the thousands of questionable tokens that pop up daily. Think of them as your first line of defense against crypto chaos.

Paid Research Worth Considering

Free tools handle 90% of what most investors need, but sometimes paid resources make sense. Professional analyst reports dive deep into companies with financial modeling and industry analysis that would take you weeks to compile yourself. Just remember – even highly paid analysts get things wrong regularly. Use their research as one piece of the puzzle, not the final answer.

Premium news feeds promise faster access to market-moving information, but unless you’re making split-second trading decisions, the speed advantage rarely matters for long-term wealth building. Your money is usually better spent on a good book about investing fundamentals.

Investment newsletters from reputable sources can provide valuable education and insights. The key word is reputable – avoid anything promising guaranteed returns or secret strategies that Wall Street doesn’t want you to know. If it sounds too good to be true, it probably is.

Regulation, Education & Safety Net – Your Ultimate Resource Guide for Investors

Think of financial regulators as your investing safety net. They’re not there to make your life difficult – they’re actually providing some of the best free resources available to help you invest smarter and avoid costly mistakes.

The Securities and Exchange Commission (SEC) might sound intimidating, but they’re actually on your side. Their Investor.gov website is like having a patient financial mentor available 24/7. Over 12 million people visited this site in 2023, and for good reason – it breaks down complex investing concepts into plain English that actually makes sense.

Whether you’re trying to understand what a mutual fund actually does or figuring out how to read a company’s financial statements, Investor.gov has you covered. The best part? Everything is completely unbiased. They’re not trying to sell you anything, just educate you.

FINRA resources complement the SEC’s offerings perfectly. FINRA regulates the people who sell investments, so they know exactly what tricks and traps to watch out for. Their educational materials feel like they were written by someone who actually understands what it’s like to be confused by financial jargon.

Their Fund Analyzer tool is particularly helpful when you’re comparing mutual funds or ETFs. Instead of getting lost in marketing materials, you can see side-by-side comparisons of fees, performance, and risk levels.

The Consumer Financial Protection Bureau (CFPB) handles the broader financial picture. While they don’t focus exclusively on investments, they’re invaluable when dealing with banks, credit cards, or any financial service provider that’s giving you trouble.

For bond investors, MSRB’s EMMA database provides access to information on over 1 million municipal securities. Municipal bonds can be tricky to research, but EMMA gives you the same pricing and disclosure information that professional investors use.

Why This Resource Guide for Investors Matters

Here’s where things get really practical. Anyone can create a professional-looking website and make impressive claims about investment returns. But the SEC’s EDGAR database contains the real story – over 20 million company filings that companies are legally required to submit.

Learning to steer EDGAR might feel intimidating at first, but it’s like learning to see through marketing spin. When a company says they’re “positioned for explosive growth,” their actual filings might reveal mounting debt and declining sales.

Annual reports (10-K) and quarterly reports (10-Q) contain the details that really matter for long-term investment success. You’ll find information about executive compensation, legal problems, competitive challenges, and the financial health that determines whether your investment will grow or shrink.

Proxy statements reveal how companies treat their shareholders. If management is paying themselves millions while the company struggles, you’ll find that information clearly laid out in the proxy filing. It’s like getting insider information, except it’s completely legal and free.

Evaluating Professionals & Avoiding Fraud

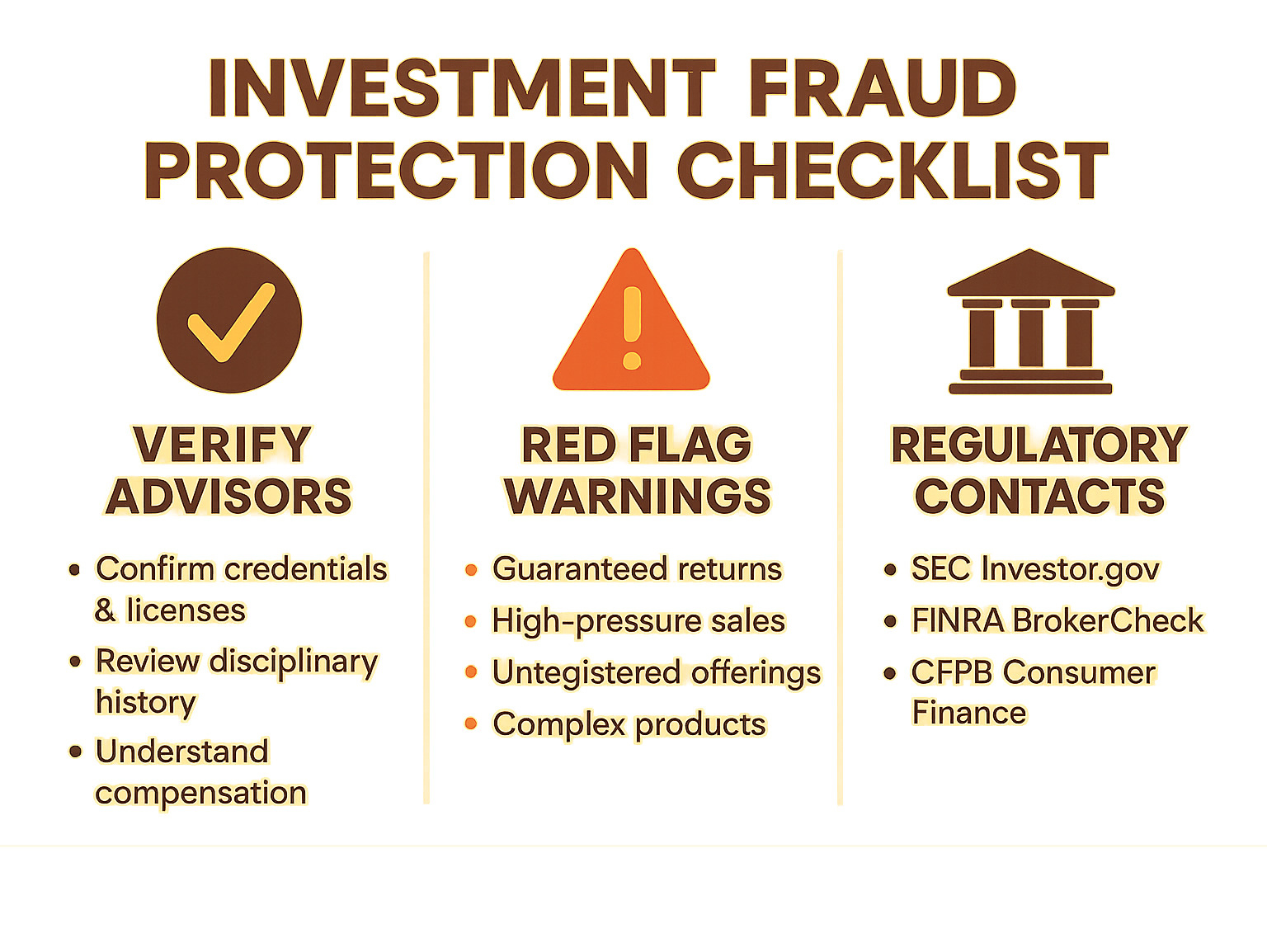

Before trusting anyone with your money, do your homework. FINRA’s BrokerCheck tool has been used over 200 million times to verify investment professionals’ backgrounds. That’s a lot of people taking the smart step of checking credentials before writing checks.

The search takes about 30 seconds and reveals customer complaints, regulatory actions, and any criminal history. If someone claims to be a financial expert but has a history of customer complaints or regulatory violations, you’ll know before it becomes your problem.

Form CRS (Customer Relationship Summary) explains how investment professionals get paid and what services they actually provide. This standardized form helps you understand potential conflicts of interest. If your advisor gets paid more for selling certain products, that’s information you need to know.

For cryptocurrency investments, the Wild West nature of the market requires extra caution. Token audit sites like Token Sniffer help verify smart contracts and detect potential scams. With thousands of new tokens launching regularly, these tools help separate legitimate projects from “rug pulls” designed to steal investor money.

Watch out for these major red flags: guaranteed returns with no risk, pressure to “act now” before you miss out, unlicensed sellers or unregistered investments, overly complex strategies that no one can explain clearly, and testimonials that sound too good to be true. If something feels off, trust your instincts.

The SEC regularly issues investor alerts about the latest scams. Staying informed about current fraud schemes helps you recognize and avoid them before they cost you money.

A comprehensive resource guide for investors isn’t just about finding good investments – it’s equally important to avoid bad ones. These regulatory resources give you the tools to protect yourself while building wealth for the long term.

Conclusion

Your journey to building lasting wealth doesn’t end with picking a few good stocks or setting up a brokerage account. It starts with having a solid resource guide for investors that grows with you over time. Think of it as your financial GPS – always there to guide you when markets get confusing or new opportunities emerge.

At Finances 4You, we’ve seen countless investors succeed by taking a methodical approach to building their knowledge base. The resources we’ve shared aren’t just bookmarks to collect digital dust. They’re your toolkit for making confident decisions whether you’re 25 and just starting out or 45 and looking to diversify into alternative investments.

Start simple, then expand. Open that first brokerage account and begin with broad market ETFs. There’s no shame in keeping things basic while you learn the ropes. Use the free educational resources from FINRA and the SEC to build your foundation – these aren’t boring government websites, they’re treasure troves of practical knowledge that can save you thousands in mistakes.

Always verify before you trust. With investment scams becoming more sophisticated, checking credentials through FINRA’s BrokerCheck isn’t optional anymore. It’s like checking reviews before trying a new restaurant, except the stakes are much higher.

The investment landscape will keep changing. New technologies, regulations, and market conditions will create opportunities we can’t even imagine today. But here’s the thing – having a comprehensive resource guide for investors means you’ll be ready to adapt instead of scrambling to catch up.

Your financial education is the one investment that pays dividends forever. Markets may crash, cryptocurrencies may disappear, but the knowledge you gain from understanding financial statements, recognizing fraud, and making informed decisions will serve you for life.

Ready to see where you stand? Check out our net worth benchmarks by age to gauge your progress against your peers. Use those insights to fine-tune your investment strategy and stay motivated on your wealth-building journey.

The resources are all here waiting for you. The only question left is: when will you start using them?