Securing Your Financial Future: Understanding Retirement Income Options

Retirement income options are the various strategies you can use to generate cash flow after you stop working. If you’re exploring how to fund your retirement years, here’s a clear overview of the main options available:

| Income Source | Key Benefits | Considerations |

|---|---|---|

| Social Security | Guaranteed for life with COLA | Replaces only 33-40% of pre-retirement income |

| Employer pensions | Stable monthly payments | Becoming less common |

| Annuities | Guaranteed income for a specific period or life | Fees can be high; limited flexibility |

| 401(k)/IRA withdrawals | Flexibility and growth potential | Market risk; requires management |

| Dividend stocks | Potential growth and income | Market volatility |

| Bonds/bond funds | Relatively stable income | Lower long-term returns than stocks |

| Part-time work | Social engagement plus income | May affect Social Security benefits |

| Home equity | Access to wealth via downsizing or reverse mortgage | Impacts housing situation |

After years of saving for retirement, transitioning to spending mode requires careful planning. The average person who reaches age 65 today can expect to live to roughly 85, with about one in three living past 90. This longevity means your retirement income strategy needs to be sustainable for potentially 20–30 years.

Most financial experts suggest you’ll need 70–80% of your pre-retirement income to maintain your lifestyle. With inflation averaging around 2.6% annually, your purchasing power could be cut in half in less than 25 years if your income doesn’t keep pace.

Creating a reliable retirement income plan isn’t about picking just one option—it’s about building a diversified strategy that balances guaranteed income sources with growth potential to ensure your money lasts as long as you do.

Looking for practical tools to jump-start your planning? Download our Comprehensive Budget Worksheet, explore our guide to Comprehensive Retirement Planning, and review our insights on Life Insurance Planning for additional ways to strengthen your overall strategy.

How Much Income Will You Need in Retirement?

Let’s tackle the million-dollar question (sometimes literally): how much money will you actually need once you retire? Understanding this number is the foundation of exploring your retirement income options.

You’ve probably heard that magic “70-80% rule” – the idea that you’ll need about 70-80% of your pre-retirement income to maintain your lifestyle. While this provides a helpful starting point, your personal number might look quite different depending on your dreams and circumstances.

Creating a detailed retirement budget gives you a much clearer picture. Think about your expenses in three simple categories:

Essential expenses form your non-negotiable baseline – housing, utilities, groceries, healthcare, and insurance premiums. These will likely consume the largest portion of your retirement budget, especially as healthcare costs tend to increase as we age.

Discretionary spending is where life gets fun – travel trips, dining out, hobbies, and entertainment. Many retirees find they spend more in these categories during their active early retirement years.

Occasional large expenses are those big-ticket items that don’t happen regularly but pack a punch when they do – replacing your roof, buying a new car, or covering a major medical expense not fully covered by insurance.

Let’s put this in perspective: If you currently live on $100,000 annually but plan to enter retirement mortgage-free, you might reasonably need just $70,000-$80,000 per year. However, if extensive travel or new hobbies are on your horizon, you might need to adjust upward.

Don’t forget about inflation – that silent budget-eater that makes everything more expensive over time. At the average rate of 2.6%, prices essentially double every 25 years. This means the $70,000 lifestyle you start with at 65 could require $140,000 by age 90!

I always recommend building a cash reserve of 1-2 years’ worth of expenses in easily accessible accounts. This creates a safety buffer that protects you from having to sell investments during market downturns – a strategy that can significantly extend the life of your portfolio.

Want to dig deeper into creating a personalized retirement budget? Check out our detailed guide: More info about retirement budgets

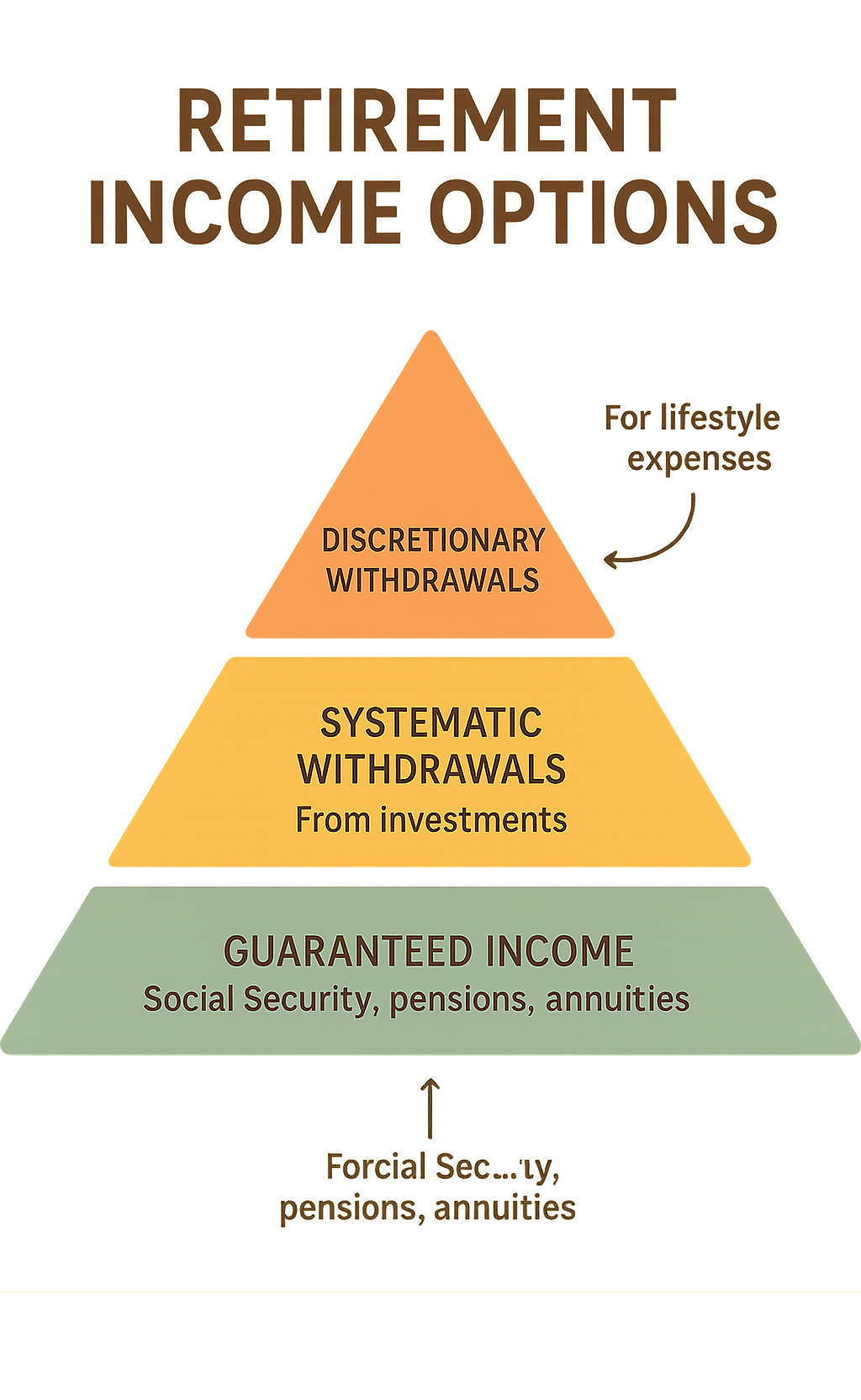

Guaranteed Retirement Income Options to Anchor Your Budget

Creating a retirement income strategy should start with establishing a solid foundation of guaranteed income to cover your essential expenses. These sources provide predictable, regular payments regardless of market conditions.

Social Security Basics

Social Security serves as the cornerstone of retirement income for most Americans. Despite what you might hear at neighborhood barbecues, this program isn’t vanishing into thin air—though benefits may evolve over time.

Think of Social Security as your retirement foundation. To qualify, you’ll need 40 credits, which typically means working about 10 years. Your benefit amount isn’t random—it’s calculated based on your highest 35 years of earnings, so those peak earning years really count!

Your Full Retirement Age (FRA) falls between 66-67 depending on when you were born. While you can claim benefits as early as 62, your monthly check will be smaller. Patient types who wait until 70 are rewarded with approximately 8% more for each year they delay beyond their FRA—that’s like getting a guaranteed investment return that’s hard to beat elsewhere!

Here’s the reality check: Social Security typically replaces only about 40% of pre-retirement income if you earn less than $100,000 annually, and even less (about 33%) if you earn more. This is why exploring additional retirement income options is so crucial.

Don’t forget about taxes—up to 85% of your Social Security benefits could be taxable depending on your other income sources. A little tax planning goes a long way here!

Defined Benefit vs Defined Contribution Plans

When it comes to employer retirement plans, there are two main flavors, and they couldn’t be more different:

| Feature | Defined Benefit (Pension) | Defined Contribution (401(k), 403(b)) |

|---|---|---|

| Who contributes | Primarily employer | Employee with possible employer match |

| Who bears investment risk | Employer | Employee |

| Benefit determination | Formula based on salary and years of service | Account balance based on contributions and investment returns |

| Guaranteed income | Yes | No (unless converted to annuity) |

| Portability | Limited | Yes, can be rolled over |

| PBGC insurance | Yes (in most cases) | No |

Traditional pensions are becoming something of a unicorn in the private sector—rare and magical if you find one! They remain more common in government jobs. With a pension, you can count on stable monthly income for life, often with cost-of-living adjustments to help fight inflation.

Most pensions offer payment choices that reflect your personal circumstances. The single life option gives you the highest monthly payment but stops when you pass away. The joint and survivor option provides a lower payment but continues for your spouse’s lifetime—peace of mind that many find worth the reduced monthly amount. The period certain option guarantees payments for a minimum period even if you die earlier.

For those worried about their company’s financial stability, there’s some good news: many private pensions are insured by the Pension Benefit Guaranty Corporation (PBGC), which acts like a safety net if your employer’s plan fails.

Helpful overview of pension protections

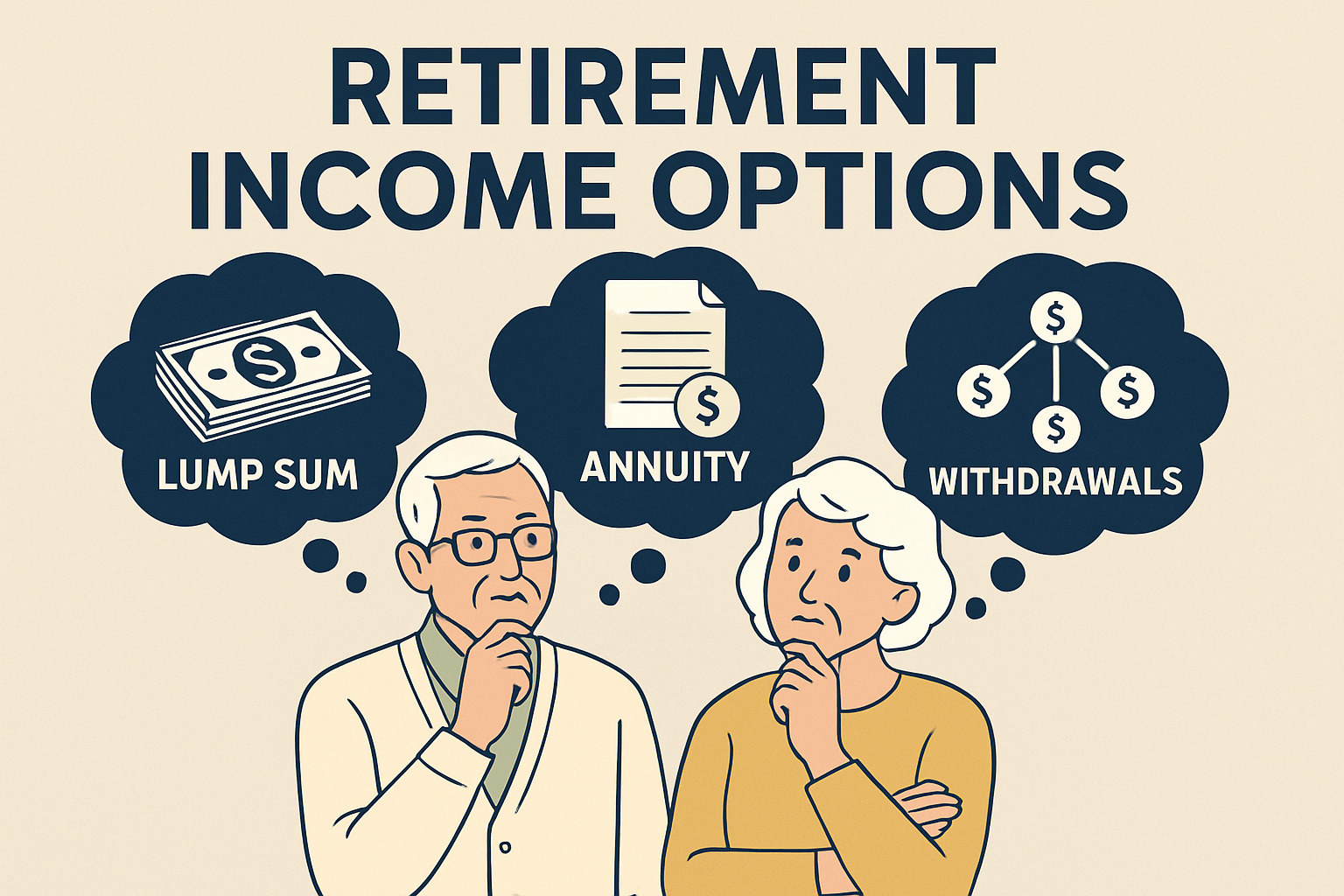

Annuities: Pros, Cons & Best Fits for Retirement income options

Annuities are essentially a way to create your own “personal pension” if you don’t have an employer-provided one. Think of them as an insurance product that converts your savings into a stream of income.

The most straightforward version is a Single Premium Immediate Annuity (SPIA). You hand over a lump sum, and the insurance company immediately begins sending you regular payments. For example, a 65-year-old man investing $100,000 might receive about $529 monthly for life, while a woman the same age might receive $501 (ladies, your longer life expectancy affects the math here).

Annuities offer some compelling benefits: guaranteed income for life or a specified period, protection against outliving your savings, potential inflation protection with the right riders, and the simplicity of regular deposits to your bank account. Some also offer tax advantages that might benefit your overall financial picture.

But they’re not without drawbacks. You’ll sacrifice liquidity for that chunk of money. There’s typically no inheritance for your heirs unless you choose options that reduce your payment. Many come with high fees and surrender charges. And they’re only as strong as the insurance company behind them—their credit risk becomes your concern.

Worried about inflation eating away at your purchasing power? Some annuities offer inflation protection riders, though these will reduce your initial payment. Another smart approach is “annuity laddering”—buying smaller annuities over time to potentially capture higher interest rates and increase your income as you age.

If you’re shopping for annuities, do your homework. Get quotes from at least three financially strong insurers, check their financial strength ratings, spread your purchases across multiple companies to stay within state guaranty limits, and read all the fine print about fees and terms.

Annuities work best when they’re part of a broader retirement strategy—typically to cover essential expenses alongside Social Security and any pension income you might have. They’re not a one-size-fits-all solution, but for many retirees, they provide valuable peace of mind knowing some bills will always be covered.

From Your Portfolio: Retirement income options for Growth & Flexibility

After securing your foundation with guaranteed income sources, it’s time to tap into your investment portfolio. This is where the magic happens – your investments can continue growing while also providing income, helping you stay ahead of inflation during what could be a 30+ year retirement journey.

Systematic Withdrawal Plans (SWP)

Remember the old saying about having your cake and eating it too? That’s essentially what a systematic withdrawal plan offers – regular income while maintaining growth potential.

The famous “4% rule” suggests withdrawing 4% of your nest egg in your first retirement year, then adjusting that amount annually for inflation. With a $1 million portfolio, that means about $40,000 in year one. But here’s the reality check: with today’s higher inflation and potentially lower future returns, many financial experts now recommend a more conservative 3-3.5% initial withdrawal rate.

What makes SWPs tricky is something called sequence-of-returns risk. If the market takes a nosedive right after you retire, you could deplete your savings faster than planned. That’s why having a cash bucket with 1-2 years of expenses is so smart – it prevents you from selling investments at rock-bottom prices during market downturns.

The beauty of this approach is flexibility. Had a great year in the market? Maybe splurge a little on that dream vacation. Market looking shaky? Perhaps tighten the belt temporarily. You remain in control, which is both empowering and a bit daunting.

How to Turn Your Retirement Savings into Reliable Income

Bonds & Bond Funds

Think of bonds as the steady, reliable friend in your investment mix – not as exciting as stocks perhaps, but dependable when you need them most.

Good news for retirees: bonds are looking more attractive lately. As of April 2024, a 5-year U.S. Treasury note yielded 4.68% – a significant jump from 1.26% at the end of 2021. That’s real money in your pocket!

When building your bond strategy, you’ll face some choices. Individual bonds give you predictable returns if held to maturity, while bond funds offer diversification and professional management. Many retirees benefit from creating a bond ladder – buying bonds with staggered maturity dates to provide regular income while managing interest rate risk.

Your bond portfolio might include a mix of government bonds for safety, municipal bonds for tax advantages (especially if you’re in a higher tax bracket), corporate bonds for higher yields, and perhaps some international bonds for diversification. The specific blend should match your income needs and comfort with risk.

Higher-rated bonds generally offer more security but lower yields, while longer-duration bonds typically pay more but come with greater interest rate risk. It’s all about finding your personal sweet spot.

Dividends & REITs

Want income that actually grows over time? That’s where dividend stocks and REITs shine in your retirement income options.

Dividend stocks – especially those with decades of consecutive dividend increases (affectionately called “Dividend Aristocrats”) – can be retirement gold. These companies have demonstrated their commitment to shareholders through good times and bad. Look for businesses with strong balance sheets, sustainable payout ratios (generally below 60%), and a history of dividend growth that outpaces inflation.

I like to think of dividend investing as planting a money tree that grows more fruit each year. Unlike bonds with fixed payments, quality dividend stocks often increase their payouts annually, helping you maintain purchasing power throughout retirement.

REITs (Real Estate Investment Trusts) let you become a landlord without the 3 a.m. plumbing emergencies. Because REITs must distribute at least 90% of their taxable income to shareholders, they typically offer higher yields than many other investments. As property values and rents rise with inflation, so too can your income – making REITs a potential inflation fighter in your portfolio.

Both dividend stocks and REITs involve market risk, so think of them as part of your diversified income strategy rather than your entire plan. When thoughtfully combined with other income sources, they can add growth potential and inflation protection to your retirement income mix.

Best Way to Invest for Retirement

Tax-Smart Withdrawal & RMD Strategies

One of the most overlooked aspects of retirement income options is tax efficiency. Strategic withdrawals can significantly extend your portfolio’s longevity and increase your spendable income. After all, it’s not just what you earn—it’s what you keep after taxes that matters.

Required Minimum Distributions: Rules & Tactics

Required Minimum Distributions (RMDs) are Uncle Sam’s way of finally collecting taxes on your tax-deferred retirement accounts. You’ve enjoyed years of tax-deferred growth, but eventually, the bill comes due.

If you have traditional IRAs, 401(k)s, or similar accounts, here’s what you need to know about RMDs:

- The starting age is now 73 for those born between 1951-1959 (and rises to 75 for those born in 1960 or later)

- Your first RMD must be taken by April 1 following the year you turn 73

- The IRS calculates how much you must withdraw based on your account balance and life expectancy

- Missing an RMD triggers a painful 50% penalty on the amount you should have withdrawn

Many retirees find RMDs frustrating because they force withdrawals (and create taxable income) whether you need the money or not. But with proper planning, you can make them work in your favor.

“I thought I could just ignore RMDs since I didn’t need the money,” says one of our clients. “Then I learned about the 50% penalty the hard way. Now I have them automatically calculated and distributed each December.”

Most financial institutions offer automatic RMD calculation services, which can take the guesswork out of compliance. Some even offer automatic distributions on a schedule you choose.

A particularly tax-smart move is using Qualified Charitable Distributions (QCDs). If you’re charitably inclined, you can direct up to $100,000 annually from your IRA directly to qualified charities. This satisfies your RMD requirement without increasing your taxable income—a true win-win.

Types of retirement plans detail

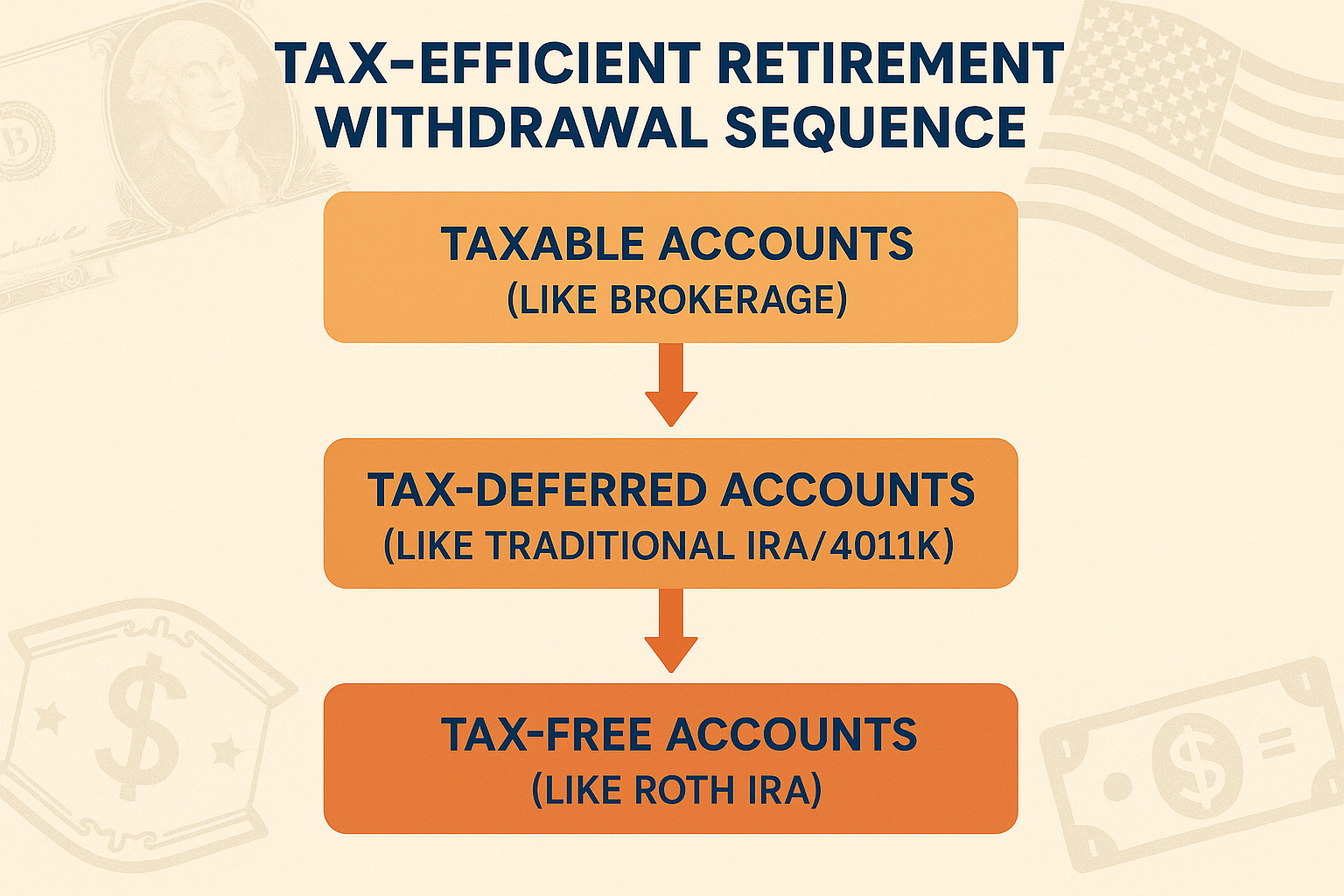

Sequencing Withdrawals for Efficiency

The order in which you tap your accounts can dramatically impact your tax bill over the course of retirement. Think of your retirement accounts as different buckets, each with unique tax properties.

A generally tax-efficient withdrawal sequence looks like this:

- Start with required minimum distributions (when applicable)—these are non-negotiable

- Move to taxable accounts, taking advantage of lower capital gains rates (currently 0%, 15%, or 20% depending on your income)

- Then tap tax-deferred accounts like traditional IRAs and 401(k)s

- Save tax-free Roth accounts for last, allowing them maximum time for tax-free growth

This approach lets your tax-advantaged accounts continue growing while you draw from accounts with less favorable tax treatment first. It’s like eating the vegetables on your plate before enjoying dessert!

Bracket management is another powerful strategy. By carefully controlling how much taxable income you generate each year, you can stay within lower tax brackets. For example, a married couple filing jointly in 2024 can have up to $89,450 in taxable income and remain in the 12% federal bracket.

Roth conversions can be particularly valuable in lower-income years, especially early in retirement before RMDs begin. Converting traditional IRA money to Roth means paying taxes now, but all future growth and withdrawals will be tax-free.

Don’t forget about Medicare IRMAA planning. Medicare premiums increase at certain income thresholds, based on your income from two years prior. Careful income planning can help you avoid these surcharges, which can add thousands to your annual healthcare costs.

“I saved nearly $4,000 in Medicare premiums last year by keeping my income just below an IRMAA threshold,” one retiree told us. “My financial advisor helped me time my withdrawals to stay under the limit.”

Tax laws change frequently, so regular reviews with a tax professional are essential to optimize your withdrawal strategy. What works perfectly today might need adjustment as both tax laws and your personal situation evolve.

Mitigating Risks & Supplementing Income

Even the best retirement plans can hit unexpected bumps in the road. Whether it’s living longer than expected, inflation eating away at your purchasing power, or market downturns affecting your investments, having backup strategies is just plain smart.

Supplemental Retirement income options if Savings Fall Short

If you find your primary retirement income options aren’t quite cutting it, don’t worry – you’ve got several ways to bridge the gap:

The beauty of part-time or gig work extends far beyond just the paycheck. Many of my clients find that working 10-20 hours weekly in a low-stress environment gives them the perfect balance. One client, a former accountant, now works at a garden center two days a week and tells me it’s the highlight of her retirement. Beyond the extra income (which reduces how much you need to withdraw from your portfolio), you’ll enjoy meaningful social connections and mental stimulation. Some positions even offer healthcare benefits, and many retirees find a chance to pursue interests they never had time for during their careers.

Your home is likely your largest asset, and home equity strategies can open up this wealth when needed. Downsizing to a smaller, more manageable home not only frees up equity but often reduces property taxes, maintenance costs, and utilities. I’ve seen many clients relocate to lower-cost areas where their retirement dollars stretch much further. For those wanting to stay put, home equity lines of credit can address temporary needs, while reverse mortgages provide ongoing income while allowing you to remain in your beloved home.

Don’t overlook other potential income sources that might be hiding in plain sight. Cash value from life insurance policies can be tapped through withdrawals or policy loans. Rental income from property investments provides ongoing cash flow. If you’re creative or inventive, royalties from intellectual property might be an option. Some retirees have even turned hobbies like collecting into income by selectively selling valuable items. And while not ideal for everyone, family support arrangements can sometimes bridge temporary gaps.

Avoid These Common Retirement Planning Mistakes

Building Flexibility Into Your Plan

The most resilient retirement income strategies bend rather than break when faced with challenges.

Regular reviews and adjustments are absolutely essential. At Finances 4You, we believe in annual comprehensive checkups for your retirement plan. These reviews should examine your portfolio performance and allocation, assess whether your withdrawal rate remains sustainable, identify tax efficiency opportunities, and account for any changes in your goals or life circumstances. Think of it like an annual physical for your financial health – preventative maintenance that catches small issues before they become big problems.

Rather than rigid withdrawal rules, dynamic spending strategies adapt to real-world conditions. During market downturns, you might reduce discretionary spending on travel or entertainment while maintaining essential expenses. When markets perform well, you might modestly increase withdrawals to enjoy special experiences or help family members. One client calls this her “accordion method” – expanding or contracting spending based on how her investments are performing.

Stress testing your plan is like weather-proofing your house before a storm. We help clients evaluate how their retirement strategy would hold up under various challenging scenarios: prolonged market downturns, higher-than-expected inflation, living to 95 or beyond, or facing major healthcare expenses. Knowing your plan can withstand these pressures brings tremendous peace of mind.

As you move through retirement, glide path adjustments to your investment mix may be appropriate. Conventional wisdom suggests becoming more conservative with age, but some research indicates that gradually increasing equity exposure during retirement may better combat inflation over a 25-30 year period. Your personal circumstances and risk tolerance should guide these decisions.

By building multiple layers of income sources and maintaining flexibility, you’ll create a retirement plan that can adapt to whatever life throws your way – expected or unexpected. The goal isn’t just financial security, but the freedom to enjoy this rewarding phase of life with confidence.

Frequently Asked Questions about Retirement income options

How much can I safely withdraw each year?

“How much can I take out without running out of money?” This might be the million-dollar question of retirement planning! While the classic 4% rule has been the go-to answer for decades, today’s economic landscape calls for a more thoughtful approach.

The 4% rule suggests withdrawing 4% of your portfolio in your first retirement year, then adjusting that amount for inflation annually. But this guideline was developed during different economic conditions than we face today.

For most new retirees, starting with a more conservative 3-3.5% withdrawal rate makes better sense, especially if you’re blessed with good health and family longevity. Think of it this way: being a bit more conservative early on gives you flexibility later.

Your safe withdrawal rate depends on several personal factors:

- How long you might live (family history can be a clue)

- Your investment mix between stocks, bonds, and other assets

- Current market conditions when you retire

- Your willingness to adjust spending when markets struggle

Your withdrawal strategy isn’t set in stone. At Finances 4You, we recommend reviewing your withdrawal rate annually, making adjustments based on your portfolio’s performance and your changing needs.

What is the best order to tap my accounts?

When it comes to which accounts to draw from first, the conventional wisdom actually makes good sense for most retirees. Think of it as a strategic dance with the tax code!

A smart withdrawal sequence typically looks like this:

First, take Required Minimum Distributions (RMDs) from traditional retirement accounts once you reach the required age. Uncle Sam insists on these withdrawals, so they’re non-negotiable.

Next, tap your taxable accounts (like your regular brokerage account). These often benefit from favorable capital gains tax rates, making them relatively tax-efficient to use early in retirement.

Then move to your tax-deferred accounts like traditional IRAs and 401(k)s. You’ll pay ordinary income tax on these withdrawals, but you’ve enjoyed tax-deferred growth for years.

Save your tax-free accounts like Roth IRAs for last. These continue growing tax-free, and withdrawals won’t increase your tax bracket or affect other income-based considerations like Medicare premiums.

This sequence isn’t one-size-fits-all, though. Your specific situation might call for adjustments based on your tax bracket, income needs, and whether you want to leave certain accounts to heirs. A good tax professional can help customize this approach to your unique circumstances.

Are annuities worth it for most retirees?

Ah, annuities – probably no financial product sparks more heated debates! The truth is, annuities can be valuable tools for some retirees while being completely wrong for others.

Think of annuities as creating your own personal pension. You hand over a chunk of money to an insurance company, and they promise regular payments for a specified period or the rest of your life. It’s peace of mind in exchange for giving up some control and potential growth.

Retirement income options like annuities make the most sense if you:

- Worry about outliving your money (they’re essentially longevity insurance)

- Want predictable income you can count on, regardless of market conditions

- Find managing investments increasingly challenging or stressful

- Don’t have enough guaranteed income from Social Security and pensions to cover your essential expenses

On the flip side, annuities probably aren’t your best bet if you:

- Need complete flexibility with your retirement funds

- Already have substantial guaranteed income from other sources

- Have health concerns that might limit your lifespan

- Prioritize leaving the maximum legacy possible to your heirs

If you do explore annuities, keep it simple! Focus on straightforward products like immediate annuities or deferred income annuities rather than complex variable or indexed annuities with high fees and confusing features.

Consider starting with just a portion of your retirement savings – perhaps enough to create guaranteed income that, combined with Social Security, covers your essential expenses. And always get quotes from several financially strong insurance companies.

The most successful retirement income strategies typically blend different approaches rather than putting all your eggs in one basket. A thoughtfully designed mix of Social Security, investments, and perhaps some annuity income gives you both security and flexibility for whatever life brings your way.

Conclusion

Let’s face it – retirement planning isn’t a “set it and forget it” affair. Creating an income strategy that supports you through decades of retirement requires thoughtful planning and regular adjustments. At Finances 4You, we’ve seen how combining multiple retirement income options custom to your unique situation makes all the difference between merely surviving retirement and truly thriving.

After guiding countless clients through this journey, we’ve identified six essential elements of a rock-solid retirement income plan:

First, start with an honest budget that distinguishes between your must-haves and nice-to-haves. Knowing exactly what you need helps avoid both overspending and unnecessary frugality.

Next, build that critical foundation of guaranteed income. Your Social Security benefits, any pension payments, and perhaps strategically chosen annuities should cover your essential expenses, giving you peace of mind regardless of market conditions.

Don’t overlook the power of tax planning! A thoughtfully designed withdrawal strategy can add years to your portfolio’s lifespan. It’s not just what you earn that matters – it’s what you keep after taxes.

While security is important, don’t abandon growth potential entirely. Maintaining appropriate exposure to stocks and other growth investments helps combat inflation’s silent threat to your purchasing power over a 20-30 year retirement.

Build flexibility into your plan from the start. The ability to adjust your spending, investment mix, and income sources in response to changing markets and personal circumstances is perhaps your most valuable retirement asset.

Finally, commit to regular reviews of your retirement strategy. Markets evolve, tax laws change, and your own needs shift. What works perfectly at 65 may need adjustments by 75 or 85.

Think of retirement planning as an ongoing conversation rather than a one-time decision. By embracing a comprehensive, diversified approach to your retirement income options, you’re setting yourself up to face your retirement years with genuine confidence and excitement about what lies ahead.