Why Retirement Planning Is Your Path to Financial Freedom

A retirement planning guide helps you build a roadmap for turning your current income into lifelong financial security. For young professionals earning good salaries, retirement might feel decades away – but starting now gives you the biggest advantage possible.

Quick retirement planning essentials:

– Start early – compound growth works best with time

– Save 10-15% of income across RRSP, TFSA, and employer plans

– Target 70% of pre-retirement income for comfortable lifestyle

– Review annually and adjust for life changes

– Diversify income sources – government benefits, pensions, personal savings

The math is compelling. If you start saving $243 per month at age 30, you’ll reach $100,000 by age 50 at 5% returns. Wait until age 40? You’ll need $643 monthly to hit the same goal.

The real challenge for high earners isn’t income – it’s lifestyle inflation. As your salary grows, expenses often grow faster. Without a written plan, 81% of Canadians with comprehensive financial plans report being on track, compared to just 44% without one.

Retirement planning isn’t just about money. It’s about maintaining your lifestyle when paycheques stop. With Canadians living longer and government benefits covering less, your personal savings become the foundation of retirement security.

Easy retirement planning guide glossary:

– best investments for retirement

– how much should you save for retirement

– thrift savings plan guide

What Is Retirement Planning & Why It Matters

Think of retirement planning as creating your personal roadmap to financial freedom. It’s the process of figuring out how much money you’ll need when you stop working and building a strategy to get there. Today’s retirement looks nothing like your parents’ golden years.

Gone are the days when companies handed out gold watches and guaranteed pensions at 65. Today, you’re the CEO of your own retirement, responsible for funding those golden years through personal savings, government benefits, and whatever employer perks you can snag along the way.

The reality check? Canadian retirees currently live on about 62% of their pre-retirement income, though financial experts recommend targeting closer to 71% for genuine comfort. Without a solid retirement planning guide, you might face a lifestyle downgrade just when you want to start enjoying life.

Here’s where compound growth becomes your best friend. That $1,000 you invest at 25 grows to $7,040 by age 65 at 5% returns. Wait until 35, and the same money only reaches $4,322. Time literally equals money when it comes to retirement planning.

Don’t count on government benefits to cover everything either. While Canada Pension Plan (CPP) and Old Age Security (OAS) provide a foundation, they’re designed to replace only about 40% of average earnings. If you’re earning above average, that percentage drops even further.

When Should You Start?

Right now. Whether you’re 25 or 55, today is always the best day to start planning for retirement.

The math tells a compelling story. Starting early is like having a financial superpower. If you need $100,000 and start saving 20 years before retirement, you only need to save $243 monthly at 5% interest. Wait until you have just 10 years left? You’ll need $643 monthly for the same goal.

But what if you’re getting a late start? Don’t panic. Many retirement accounts offer catch-up contributions for people over 50. It’s like getting a second chance to boost your savings when you might have more income and fewer expenses.

Here’s some free money advice: never ignore employer matching contributions. If your company matches your retirement contributions, that’s an immediate 100% return on investment. Missing out on employer matching is like walking past $20 bills on the sidewalk.

Why a Written Plan Beats Guesswork

Here’s a statistic that might surprise you: 81% of Canadians with comprehensive financial plans feel on track with their finances, compared to only 44% of those winging it without a plan. The difference? Having a written roadmap removes the guesswork.

A written plan gives you measurable milestones to celebrate. Instead of wondering “Am I saving enough?” you’ll know exactly where you stand and what needs adjusting. When life throws you curveballs – like job changes, house purchases, or family additions – your plan provides context for making smart financial decisions.

More info about budgeting tools

Calculating Your Retirement Number

Think of your “retirement number” as your financial finish line – the total amount you need saved to live comfortably when paycheques stop. There’s no magic number that works for everyone. Your retirement number depends entirely on the lifestyle you want and the expenses you’ll face.

The traditional advice suggests replacing 70-90% of your pre-retirement income. While this gives you a starting point, your actual needs might be quite different. Some retirees thrive on 50% replacement if they’ve paid off their mortgage and prefer simple pleasures. Others need 90% or more to maintain their current lifestyle.

| Income Replacement | Lifestyle | Monthly Income Needed (if earning $80,000) |

|---|---|---|

| 50% | Basic comfort, paid-off home | $3,333 |

| 70% | Current standard with adjustments | $4,667 |

| 90% | Full lifestyle maintained | $6,000 |

Retirement expenses aren’t just smaller versions of working expenses – they’re completely different. You’ll stop contributing to your retirement planning guide savings, and you won’t need work clothes or daily commuting costs. Your mortgage might be paid off, and your tax situation will likely change.

But don’t get too excited about lower expenses. Healthcare costs typically increase, and many retirees spend more on travel, dining out, and spoiling grandchildren than they ever did while working.

Estimating Expenses & Creating a Retirement Budget

Creating a realistic retirement budget starts with honest conversations about your future self. Will you be the retiree who’s perfectly happy gardening and reading, or will you be booking cruise ships and taking cooking classes in Italy?

Housing costs will likely be your biggest expense, just like now. The key question: will your mortgage be paid off? If yes, you’re already ahead of the game. But don’t forget about property taxes, maintenance, and utilities.

Healthcare expenses deserve special attention. While Canada’s healthcare system covers many basics, you’ll face costs for prescription medications, dental care, vision care, and physiotherapy. The average lifetime out-of-pocket healthcare costs for a 65-year-old couple is $285,000.

Travel and leisure often increase in retirement. After decades of limited vacation time, many retirees accept their freedom with enthusiasm. Budget for annual vacations, new hobbies, dining out, and those special gifts for family members.

More info about cash-flow planning

How Inflation Affects the Bottom Line

Inflation is the sneaky villain of retirement planning. It doesn’t announce itself with dramatic market crashes – it just quietly erodes your purchasing power year after year.

Here’s the math that matters: at 2.5% annual inflation, your $50,000 annual expenses today will cost $81,900 in 20 years. That morning coffee that costs $4 today? It’ll be $6.55 when you retire.

Healthcare inflation hits even harder. Medical costs typically rise at 6-8% annually, far outpacing general inflation. This means the healthcare portion of your retirement budget needs extra attention and higher growth assumptions.

The good news? Canada Pension Plan (CPP) and Old Age Security (OAS) benefits are indexed to inflation, providing some protection. Your investment portfolio can also fight inflation through growth investments like stocks, which historically outpace inflation over long periods.

Scientific research on inflation

Building Your Retirement Planning Guide Roadmap

Creating a solid retirement planning guide is like building a house – you need a strong foundation and multiple support beams. The most successful retirees don’t rely on just one income source. Instead, they build what financial experts call the “three-legged stool” of retirement: government benefits, employer pensions, and personal savings.

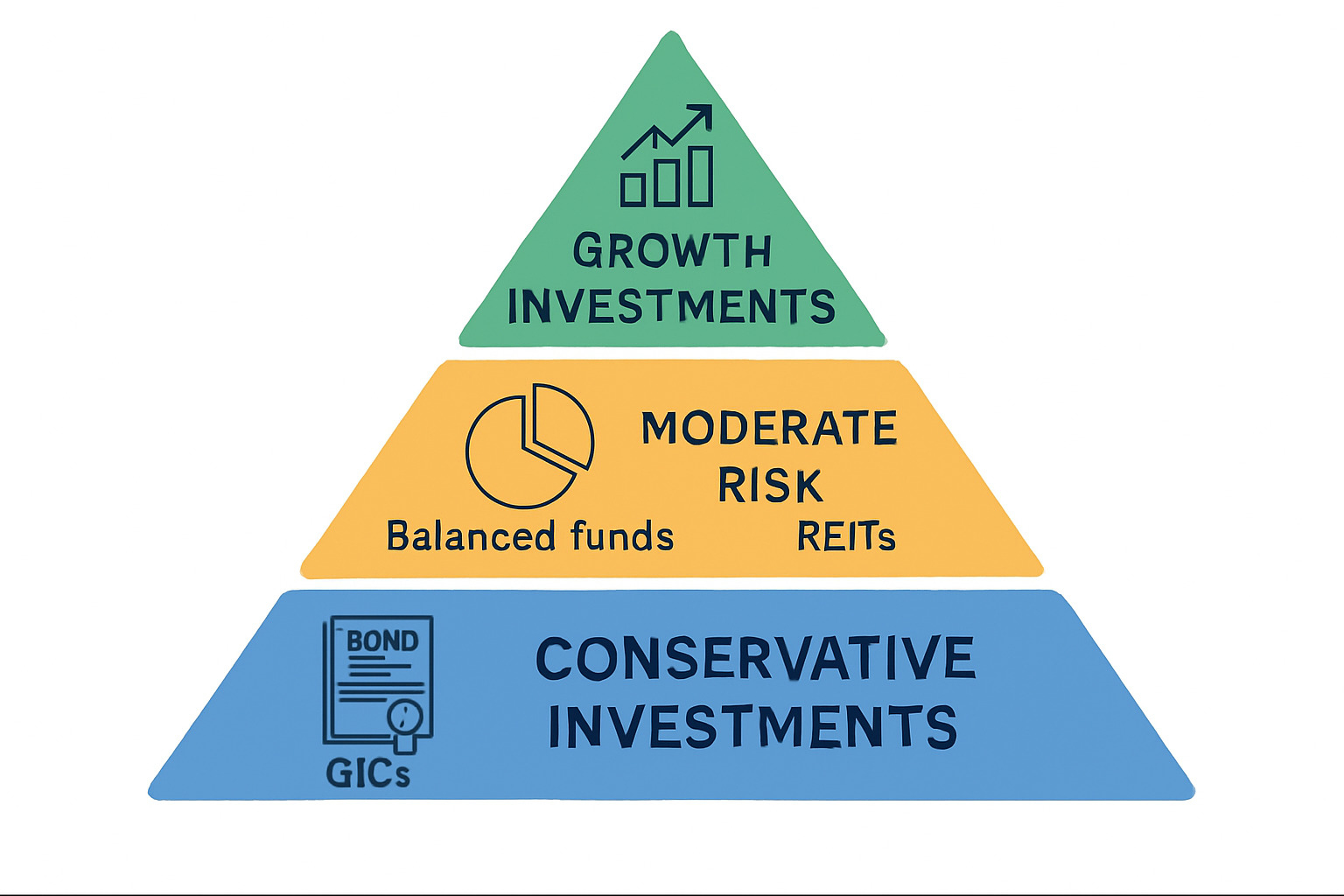

Think of your asset allocation like building a pyramid. The foundation should be rock-solid with conservative investments like bonds and GICs. The middle layer holds moderate-risk options such as balanced funds and REITs. At the top, you’ll find growth investments like stocks and equity funds.

Your investment mix should evolve with your age. In your twenties and thirties, you can handle 80-90% stocks and 10-20% bonds. As you move through your forties, shift to 70-80% stocks and 20-30% bonds. By your fifties, aim for 60-70% stocks and 30-40% bonds.

Step-by-Step Retirement Planning Guide Checklist

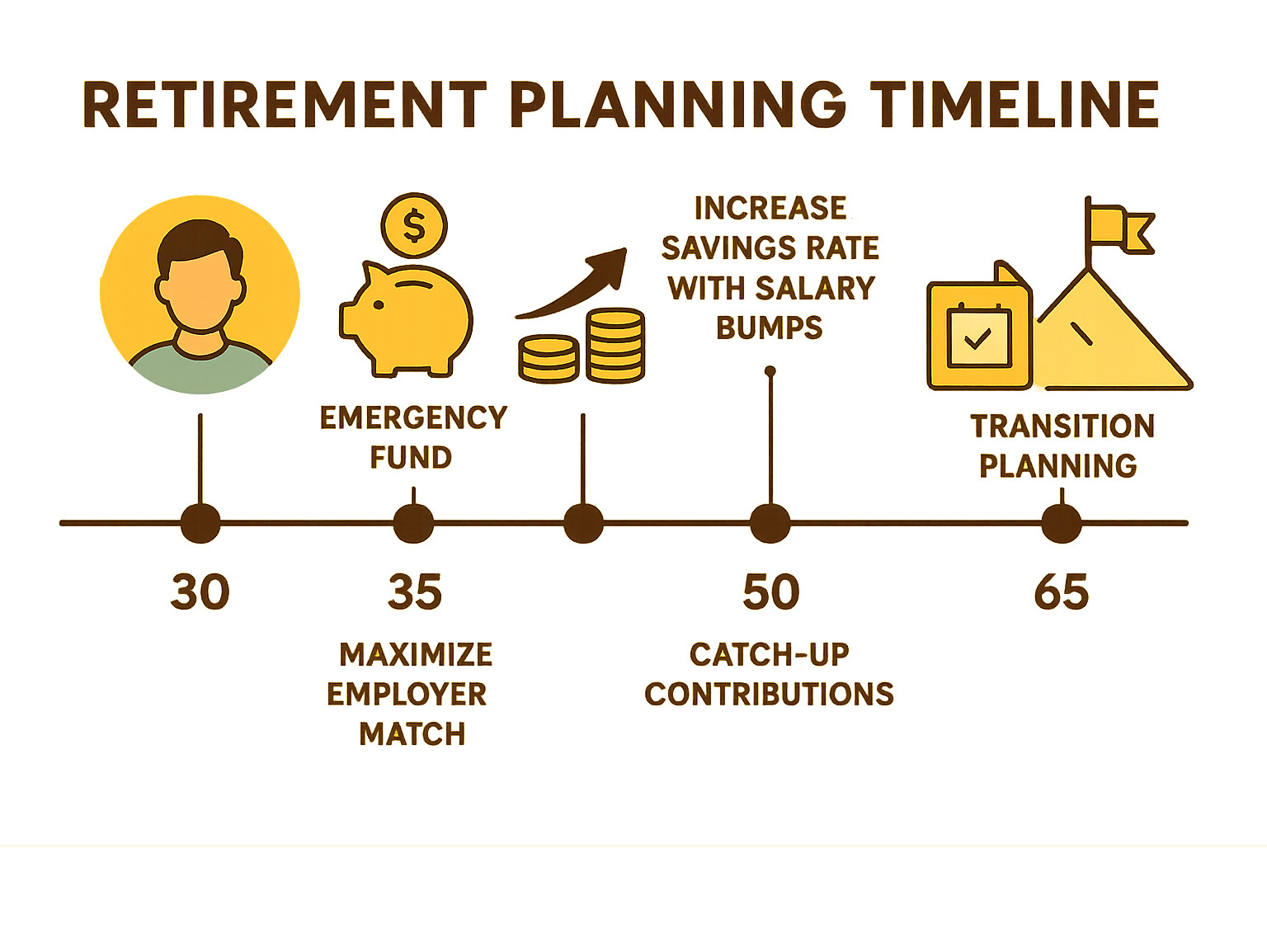

Building your retirement planning guide happens in phases, each with specific priorities and goals.

Your Foundation Years (Ages 20-35) are all about getting the basics right. Start with an emergency fund covering three to six months of expenses. Maximize any employer matching contributions because it’s literally free money. Open both RRSP and TFSA accounts and set up automatic contributions.

The Acceleration Phase (Ages 35-50) is when your earning power really kicks in. Every time you get a raise, increase your savings rate rather than just inflating your lifestyle. This is the perfect time to diversify your investments and get serious about annual portfolio reviews.

Optimization Time (Ages 50-65) brings catch-up opportunities and fine-tuning. Take advantage of catch-up contributions if you’re eligible. Gradually shift toward more conservative investments as retirement approaches. Start planning your Social Security and CPP timing strategy.

Choosing the Right Accounts & Plans

Understanding different account types is like knowing which tool to use for each job. The wrong choice can cost you thousands in unnecessary taxes.

Tax-deferred accounts like RRSPs and 401(k)s work by reducing your current taxable income when you contribute. Your investments grow tax-free until you withdraw them, at which point they’re taxed as regular income.

Tax-free accounts like TFSAs and Roth IRAs flip the script. You contribute after-tax dollars, but then your investments grow tax-free forever and withdrawals are completely tax-free.

For 2024, you can contribute up to 18% of your previous year’s income to an RRSP, with a maximum of $31,560. TFSA contributions are limited to $7,000 annually. The good news? Unused contribution room carries forward.

More info about registered plans

Mapping Multiple Income Streams

The most secure retirements combine multiple income sources, creating a financial safety net that doesn’t depend on any single source.

Guaranteed income sources provide the bedrock of retirement security. Government pensions like CPP can provide up to $1,364 monthly in 2024, while OAS adds up to $713 monthly. Employer-defined benefit plans offer guaranteed monthly income for life.

Variable income sources offer growth potential but come with some uncertainty. Your investment portfolios in RRSPs, TFSAs, and non-registered accounts can provide substantial income if managed well. Real estate investments through rental properties or REITs offer both income and inflation protection.

Navigating Retirement Risks & Income Strategies

Retirement planning isn’t just about piling up money – it’s about protecting what you’ve built and turning those savings into reliable income. The biggest retirement risks aren’t always obvious. Market volatility can wreck your plans if stocks crash right when you retire. Longevity risk sounds like a nice problem to have, but living to 95 instead of 85 means your money needs to stretch an extra decade.

Inflation quietly steals your purchasing power over time. At just 3% annual inflation, your dollar loses half its buying power in 23 years. Sequence of returns risk – getting poor investment returns early in retirement – can permanently damage your financial security even if markets bounce back later.

From Saving to Spending: Turning Assets into Paycheques

Switching from saving money to spending it requires a complete mindset shift. For decades, you’ve been trained to save and invest. Now you need to create a sustainable income stream from your nest egg without running out of money.

The 4% rule provides a starting point for many retirees. Withdraw 4% of your total portfolio in year one, then adjust that dollar amount for inflation each year. This approach historically allows portfolios to survive 30+ years.

A bucket strategy offers more security by dividing your money into three time-based buckets. Keep 1-2 years of expenses in cash and short-term bonds for immediate needs. Put 3-10 years of expenses in moderate-risk investments. Keep everything else in growth investments for the long haul.

Required minimum distributions kick in at age 73 for tax-deferred accounts like RRSPs and 401(k)s. The government wants its tax money, so you must start withdrawing specific amounts whether you need the money or not.

Protecting Your Nest Egg

Your retirement savings face threats beyond market volatility. Protecting your nest egg requires multiple layers of defense.

Insurance becomes more important in retirement. Health insurance ensures continuous coverage when employer benefits end. Long-term care insurance protects against catastrophic care costs that can quickly drain retirement accounts.

An emergency fund remains crucial in retirement – arguably more so than during your working years. Keep 6-12 months of expenses in easily accessible accounts. This prevents you from selling investments at terrible times to cover unexpected expenses.

Fraud prevention deserves serious attention because older adults are prime targets for financial scams. Never share personal information over the phone. Be skeptical of “guaranteed” high-return investments – if it sounds too good to be true, it probably is.

Scientific research on elder fraud

Keeping Your Plan On Track

A retirement planning guide isn’t something you create once and tuck away in a drawer. Life changes, markets fluctuate, and your goals evolve. The difference between retirement success and struggle often comes down to staying engaged with your plan.

Your Annual Financial Physical

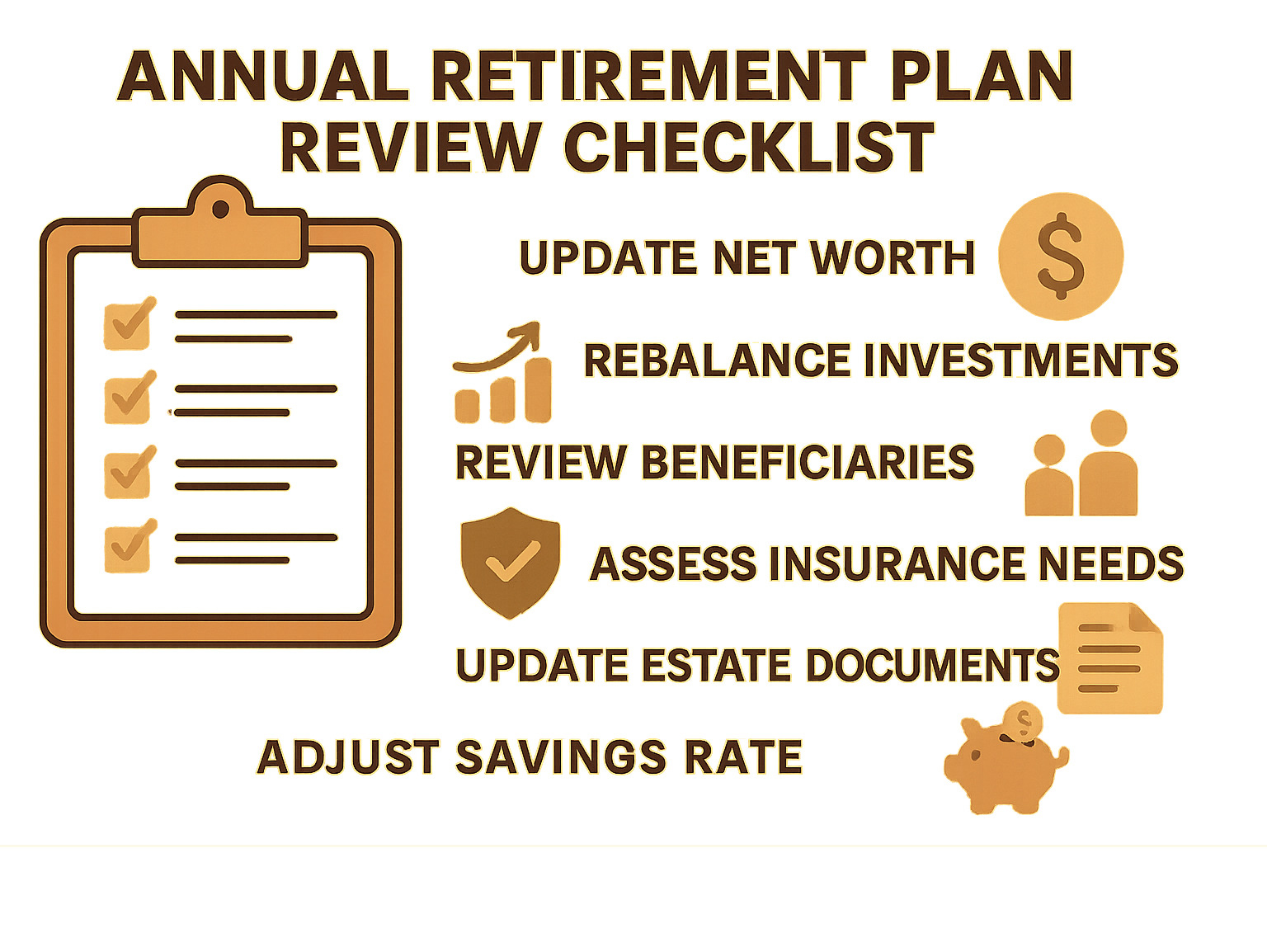

Just like you visit your doctor for a check-up, your retirement plan needs an annual review. Pick a date that’s meaningful to you – maybe your birthday or the start of a new year – and make it a tradition.

During this yearly review, calculate your current net worth by adding up all your assets and subtracting your debts. This single number tells you more about your financial health than any other metric.

Next, review your investment performance and see if your portfolio has drifted from your target allocation. If you planned for 70% stocks and 30% bonds, but strong stock performance has pushed you to 80% stocks, it’s time to rebalance.

The Art of Rebalancing

Your investments won’t stay in perfect balance on their own. Success in one area throws off your carefully planned allocation. Rebalancing means selling investments that have grown beyond your target and buying those that have fallen below. It feels counterintuitive, but it forces you to buy low and sell high.

When Life Throws You Curveballs

Some events require immediate attention to your retirement plan. Marriage changes everything – you’re now planning for two people with potentially different risk tolerances. Job changes might mean new employer benefits or salary changes that affect your savings rate.

Monitoring & Adjusting Your Retirement Planning Guide

Technology has made tracking your retirement planning guide progress easier than ever. The key is finding tools you’ll actually use consistently.

Online calculators let you model different scenarios quickly. What happens if you retire two years earlier? How much difference does an extra $100 monthly contribution make?

Net worth tracking provides the clearest picture of your progress. Whether you use a simple spreadsheet or sophisticated software, tracking this number quarterly shows whether you’re moving toward your goals.

Professional support becomes more valuable as your situation grows complex or as you approach retirement. A fee-only financial planner can provide objective advice without sales pressure.

More info about advisory services

Frequently Asked Questions about Retirement Planning

How much money will I need to retire comfortably?

This is the million-dollar question – sometimes literally! The truth is, your retirement number depends entirely on the lifestyle you want to maintain. Most financial experts suggest replacing 70-80% of your pre-retirement income, but let’s break this down practically.

Start by thinking about your future self. Will your mortgage be paid off? Do you plan to travel extensively or live simply? These lifestyle choices dramatically impact your retirement needs.

Here’s a straightforward calculation. First, estimate your annual retirement expenses by looking at your current spending and adjusting for changes. Next, multiply that annual expense number by 25. This follows the 4% withdrawal rule – the idea that you can safely withdraw 4% of your savings each year without running out of money.

So if you need $60,000 annually, you’d need $1.5 million saved. But don’t panic! Remember to subtract expected income from government benefits like CPP and OAS. If you expect $20,000 annually from these sources, you only need to cover $40,000 from personal savings – bringing your target down to $1 million.

What types of retirement accounts should I prioritize first?

Think of building your retirement savings like constructing a house – you need a solid foundation before adding the fancy features.

Start with employer matching – this is literally free money. If your employer matches your retirement contributions, contribute at least enough to get the full match. It’s an immediate 100% return on your investment.

Before investing, make sure you have your financial foundation solid. Pay off high-interest debt like credit cards – there’s no point earning 7% in investments while paying 19% on credit card debt. Build an emergency fund covering 3-6 months of expenses.

Once your foundation is solid, maximize your tax-advantaged accounts. Both RRSPs and TFSAs offer significant tax benefits, but they work differently. The choice depends on your current versus expected future tax rate.

How often should I revisit my retirement plan?

Your retirement planning guide isn’t a dusty document you create once and forget about. Think of it more like a GPS that needs regular updates as your life changes direction.

Schedule an annual financial check-up every January or on your birthday. This yearly review keeps you on track and catches problems before they become serious. Calculate your net worth, review how your investments performed, and check whether you’re still on pace to meet your retirement goals.

Life doesn’t wait for your annual review, though. Major life events trigger immediate plan updates. Getting married or divorced changes everything about your financial picture. Job changes, especially significant salary increases, create opportunities to boost your retirement savings.

Conclusion

Building a comprehensive retirement planning guide isn’t just about crunching numbers – it’s about creating peace of mind for your future. At Finances 4You, we’re passionate about helping you align your net worth with your age group and build the retirement you actually want.

Think about it this way: every dollar you save today is like hiring a little worker who never takes a day off. That worker keeps growing your money, even while you sleep. The earlier you start, the more workers you can hire.

The most important lessons from this retirement planning guide are surprisingly simple. Start now – even if it’s just $50 a month, because time truly is your greatest ally. Save consistently by aiming for that sweet spot of 10-15% of your income across all your retirement accounts. Diversify wisely so you’re not putting all your eggs in one basket, and remember to plan for inflation.

Here’s what we’ve learned from helping thousands of people plan their retirements: the people who succeed aren’t necessarily the ones who earn the most money. They’re the ones who start early, stay consistent, and review their plans regularly.

Whether you’re a 25-year-old just starting your first job or a 55-year-old wondering if you’ve started too late, the strategies in this guide can work for you. The key is taking that first step – maybe it’s calculating your retirement number, maybe it’s finally signing up for your employer’s matching program, or maybe it’s just setting up an automatic transfer to your TFSA.

Your future self is counting on the decisions you make today. And honestly? Future you is going to be pretty grateful for every dollar you save and every smart financial choice you make right now.

At Finances 4You, we’re here to support you on this journey with practical advice that actually makes sense for real people living real lives. Because retirement planning shouldn’t feel like rocket science – it should feel like taking care of yourself.