Why Retirement Savings Plans Are Your Key to Financial Freedom

Retirement savings plans are tax-advantaged accounts that help you build wealth for your future while reducing your current tax burden. Whether through employer-sponsored 401(k)s, individual IRAs, or self-employed options, these plans are essential for anyone serious about financial independence.

Best retirement savings plan options by situation:

• Employed with 401(k) match → Maximize employer match first, then consider IRA

• High earners → 401(k) + backdoor Roth IRA strategy

• Self-employed → SEP IRA or Solo 401(k) for higher contribution limits

• Government workers → Thrift Savings Plan (TSP) with excellent low fees

• Nonprofit employees → 403(b) plans with potential catch-up contributions

The numbers are compelling. More than 60 million Americans have a 401(k), making it the most popular retirement vehicle. But here’s what matters more: a 25-year-old investing just $75 monthly can accumulate $263,571 by age 65 at an 8% return, while someone starting at 35 needs $100 monthly to reach only $150,030.

Financial experts recommend replacing 70-80% of your pre-retirement income to maintain your lifestyle. Since Social Security typically covers only 40% of that need, retirement savings plans must bridge the gap.

The key is starting early and understanding your options. Each plan type offers different benefits, contribution limits, and tax advantages. Some allow immediate tax deductions, others provide tax-free withdrawals in retirement.

Retirement savings plans definitions:

– best way to invest for retirement

– best way to plan for retirement

– best way to save for retirement

What Is a Retirement Savings Plan and Why It Matters

Picture this: you’re 67, sitting on your porch with a cup of coffee, watching the sunrise without worrying about bills or running out of money. That peaceful scene? It’s powered by retirement savings plans – your ticket to financial freedom in your golden years.

A retirement savings plan is simply a tax-advantaged account where you stash money during your working years. Think of it as a special piggy bank that gets preferential treatment from Uncle Sam. Your money grows through compound interest and investment returns, building wealth while you sleep, work, and live your life.

Financial experts love talking about the “three-legged stool” of retirement security: pension benefits, Social Security, and personal savings. But here’s the reality check – that stool is looking pretty wobbly these days. Traditional pensions have nearly vanished from private companies (only 10% still offer them), which means your personal retirement savings plans have become the heavy lifter in your retirement strategy.

Why should you care about retirement planning right now? The reasons are more compelling than you might think.

Financial security isn’t just about having money – it’s about having choices. An average retired couple turning 65 in 2023 faces roughly $315,000 in healthcare expenses alone during retirement. Without adequate savings, you might find yourself choosing between medications and groceries, or moving in with family when you’d rather stay independent.

Longevity risk sounds fancy, but it’s really about a wonderful problem: we’re living longer than ever. Your retirement could easily stretch 20-30 years, which means your money needs staying power. The old “work until 65 and coast” approach requires serious planning to ensure your savings don’t disappear before you do.

Inflation is the silent wealth killer that makes everything more expensive over time. What costs $100 today might run you $180 in 20 years if inflation averages 3%. Retirement savings plans that invest in growth assets like stocks help your money fight back against this purchasing power erosion.

Social Security provides a foundation, but it typically replaces only about 40% of your pre-retirement income. Most financial planners recommend replacing 70-80% of your income to maintain your current lifestyle in retirement. That gap between 40% and 70-80%? That’s where your retirement savings step up to the plate.

Retirement Savings Plans Basics

Here’s where the magic happens: starting early transforms small amounts into life-changing wealth. Compound interest doesn’t just grow your money – it grows the growth on your money, creating a snowball effect that gets more powerful over time.

The stock market has historically delivered about 10% average annual returns over the long haul, though individual years can swing wildly. This average includes the Great Depression, multiple recessions, and various market crashes – yet patient investors who stayed the course have been rewarded.

Let’s put some real numbers on this. Save $50 every two weeks starting at age 25, earn that 10% average return, and you could be looking at serious wealth by retirement age. But wait just 10 years to start, and you’ll need to save significantly more to reach the same goal. Time is your greatest asset when building retirement wealth.

That $315,000 healthcare cost we mentioned earlier? It’s a sobering reminder that we can’t just wing retirement planning. This figure doesn’t even include housing, food, travel, or the fun stuff you want to do when you’re finally free from the 9-to-5 grind.

The bottom line is simple: retirement savings plans aren’t just nice to have – they’re essential for anyone who wants to retire with dignity and choices. The earlier you start, the less painful it becomes, and the more secure your future looks.

Main Types of Retirement Savings Plans

The world of retirement savings plans might seem overwhelming at first, but understanding your options is like having a roadmap to financial freedom. Think of it this way: you wouldn’t buy a car without knowing the difference between a sedan and an SUV, right? The same goes for retirement plans—each type serves different needs and life situations.

At the highest level, retirement plans fall into three main buckets. Defined benefit plans are the traditional pensions your grandparents might have enjoyed, where your employer promises a specific monthly paycheck in retirement based on your salary and years of service. These are becoming as rare as a unicorn in the private sector, though government employees still enjoy them.

Defined contribution plans flip the script entirely. Instead of a guaranteed monthly payment, you get an individual account where your retirement income depends on how much you and your employer contribute, plus how well your investments perform. This includes the popular 401(k), 403(b), and 457(b) plans that most of us deal with today.

Hybrid plans try to give you the best of both worlds. Cash balance plans, for example, combine the predictability of traditional pensions with some of the flexibility of individual accounts. Your employer still manages the investments, but you can see your account balance grow over time.

Here’s where it gets interesting—and practical. 401(k) plans dominate the private sector landscape. If you work for a regular company, this is probably what you have access to. 403(b) plans serve the do-gooders among us—teachers, hospital workers, church employees, and folks at nonprofits. 457(b) plans are the government workers’ special sauce, available to state and local employees.

Federal employees get their own special treatment with the Thrift Savings Plan (TSP), which many financial experts consider the gold standard because of its rock-bottom fees and solid investment choices.

On the individual side, you’ve got Traditional IRAs where you get a tax break now but pay taxes later, and Roth IRAs where you pay taxes upfront for tax-free retirement withdrawals. For the entrepreneurs and small business owners, there are SEP IRAs, SIMPLE IRAs, and Solo 401(k)s that often allow much higher contribution limits than regular IRAs.

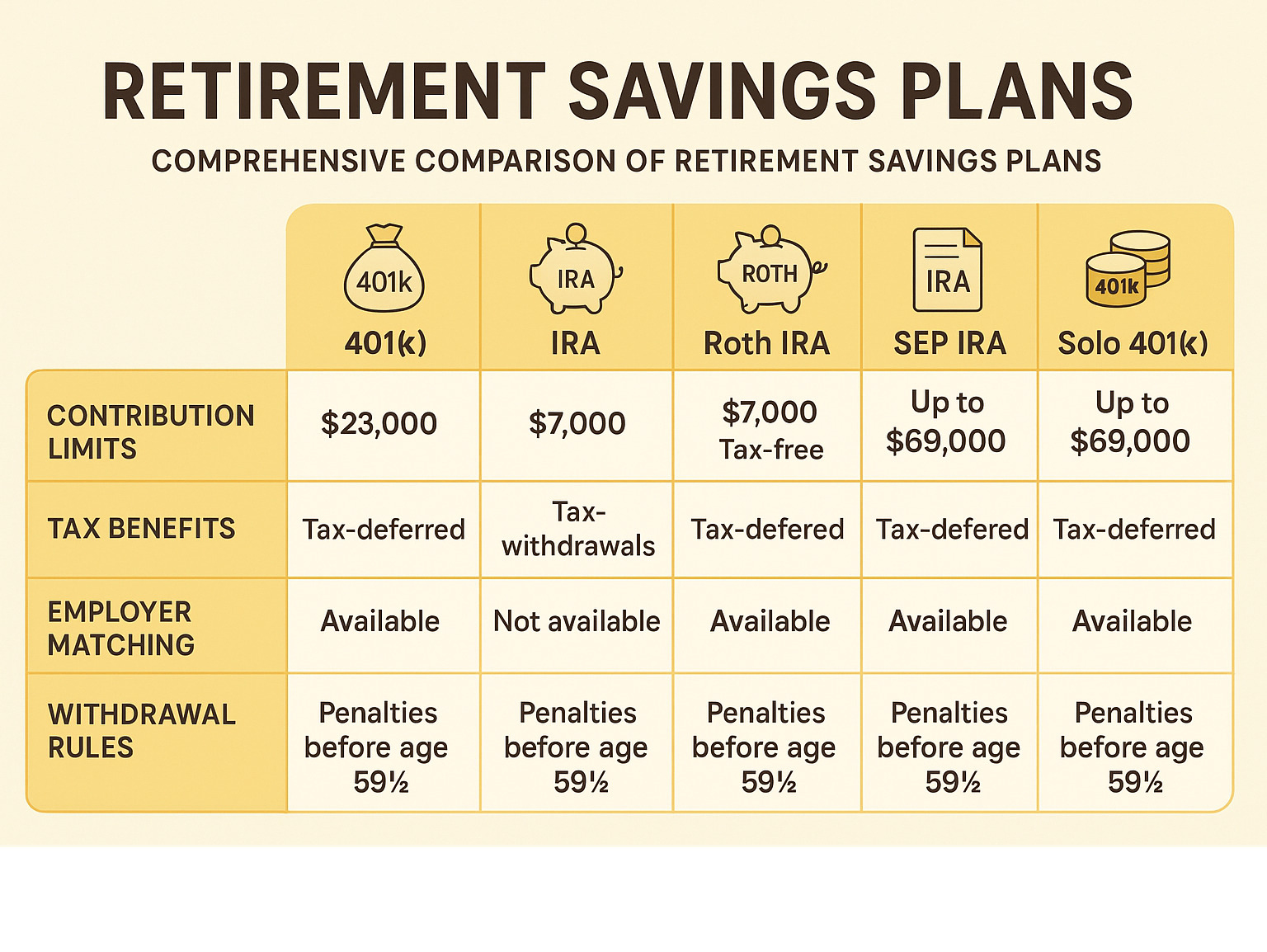

| Plan Type | Who Can Use It | 2024 Contribution Limit | Key Advantage |

|---|---|---|---|

| 401(k) | Private sector employees | $23,000 ($30,500 if 50+) | Employer matching |

| 403(b) | Nonprofit/education employees | $23,000 ($30,500 if 50+) | Extra catch-up for long-term employees |

| 457(b) | Government employees | $23,000 ($30,500 if 50+) | No early withdrawal penalty |

Employer-Sponsored Retirement Savings Plans

Let’s talk about the magic of employer matching—it’s literally free money sitting on the table. When your company offers to match your retirement savings plans contributions, they’re giving you an immediate 100% return on your investment up to their match limit. Miss out on this, and you’re essentially giving yourself a pay cut.

401(k) plans are the heavy hitters here. In 2024, you can stash away up to $23,000 of your own money, plus another $7,500 if you’re 50 or older and feeling the retirement crunch. Most employers sweeten the deal by matching a portion of what you contribute—commonly 50 cents for every dollar you put in, up to 5% of your salary.

But here’s something many people don’t realize: those employer contributions might not be yours immediately. Vesting schedules determine when you actually own that matching money. Some generous employers let you keep it right away, while others make you stick around for a few years to earn full ownership. It’s their way of encouraging loyalty.

The retirement plan world got a lot smarter with auto-enrollment. Instead of hoping employees will sign up, many companies now automatically enroll new hires at a modest contribution rate—usually 3% to 6% of their salary. Even better, auto-escalation gradually bumps up your contribution rate each year, so you’re saving more without feeling the pinch.

403(b) plans serve the noble professions—teachers, nurses, social workers, and others working for schools, hospitals, churches, and nonprofits. They offer the same basic contribution limits as 401(k)s, but with a special perk: if you’ve worked for the same employer for 15 years or more, you can contribute an extra $3,000 annually, up to a lifetime maximum of $15,000 in additional catch-up contributions.

457(b) plans for government workers have a unique superpower—no early withdrawal penalty if you leave your job, regardless of your age. Planning to retire early or switch careers? This feature makes 457(b) plans incredibly valuable for government employees with wanderlust.

The Thrift Savings Plan (TSP) is what federal employees get, and honestly, it’s pretty sweet. The fees are incredibly low, the investment options are solid, and federal employees under the Federal Employees Retirement System automatically receive 1% of their salary contributed to their TSP, plus matching up to 5% of their pay.

For a deeper dive into maximizing these employer benefits, check out our comprehensive guide on Top Retirement Saving Options: 401k, IRA, and More.

Individual Retirement Arrangements (IRAs)

IRAs are the democratic option in the retirement savings plans world—everyone can have one, whether your employer offers a retirement plan or not. Think of them as your personal retirement account that follows you from job to job. For 2024, you can contribute up to $7,000, with an extra $1,000 if you’re 50 or older and playing catch-up.

Traditional IRAs work like a tax deal with your future self. You get to deduct your contributions from this year’s taxes (subject to income limits if you have a workplace plan), your money grows tax-free while it’s invested, but you’ll pay regular income taxes when you withdraw the money in retirement. The government also forces you to start taking required minimum distributions at age 73—their way of finally collecting those taxes.

Roth IRAs flip this arrangement on its head. You pay taxes on the money before you contribute it, but then it grows completely tax-free, and you never pay taxes on withdrawals in retirement. Even better, there are no required minimum distributions during your lifetime, making Roth IRAs fantastic for estate planning. The catch? High earners face income limits that can shut them out of direct Roth contributions.

The Roth five-year rule trips up some people. To withdraw earnings tax-free, your account needs to be open for at least five years AND you need to be over 59½. This rule applies separately to each Roth conversion you do, so timing matters.

For 2024, the income limits for Roth IRA contributions start phasing out at $138,000 for single filers and $218,000 for married couples filing jointly, completely disappearing at $153,000 and $228,000 respectively.

Self-Employed & Small-Business Options

Being your own boss comes with unique challenges, but retirement savings plans for the self-employed often come with much higher contribution limits that can make employed folks a bit jealous.

SEP IRAs are beautifully simple. You can contribute up to 25% of your compensation or $69,000 for 2024, whichever is smaller. Setting one up takes about as much paperwork as opening a regular IRA, and the ongoing maintenance is minimal. The trade-off? If you have employees, you must contribute the same percentage for everyone—no playing favorites.

SIMPLE IRAs hit the sweet spot for small employers who want to offer retirement benefits without drowning in paperwork. Employees can contribute up to $16,000 in 2024 ($19,500 if they’re 50 or older), and you as the employer must either match up to 3% of each employee’s compensation or contribute 2% for everyone, whether they participate or not.

Solo 401(k)s are the superstars for business owners flying solo. Since you’re both the employer and the employee, you can contribute in both capacities, potentially reaching that $69,000 annual limit ($76,500 if you’re 50 or older). Some providers even offer loan features and Roth options, giving you maximum flexibility.

Profit-sharing plans let you be generous when business is good and conservative when it’s not. You can contribute up to 25% of total compensation for all participants, and you’re not locked into contributing every year. Many businesses combine these with 401(k) plans to create a retirement savings powerhouse.

Here’s a bonus: small businesses often qualify for tax credits when they establish retirement plans, making them more affordable. Thanks to the SECURE Act, you can get credits up to $5,000 annually for plan startup costs—essentially getting paid to help your employees save for retirement.

For detailed guidance on navigating these self-employed options, our article on 401k Plans for Self-Employed breaks down everything you need to know.

Contribution Limits, Catch-Ups & Tax Advantages of Retirement Savings Plans

Getting the most from your retirement savings plans means understanding the rules around how much you can contribute and the powerful tax benefits available. The good news? These limits are quite generous, and they increase almost every year to keep pace with inflation.

For 2024, you can contribute up to $23,000 to your 401(k), 403(b), or 457(b) plan. If you’re 50 or older, you get an extra boost with catch-up contributions, bringing your total to $30,500. Traditional and Roth IRAs allow $7,000 annually, or $8,000 if you’re in that magical 50-and-over club.

Self-employed folks often get the best deal. SEP IRAs let you sock away up to $69,000 or 25% of your compensation, whichever is less. SIMPLE IRAs have a $16,000 limit, rising to $19,500 with catch-up contributions.

Here’s where it gets really interesting: the Saver’s Credit. This often-overlooked benefit gives lower and moderate-income workers a direct tax credit for retirement contributions. We’re talking up to $1,000 for individuals or $2,000 for married couples. It’s not a deduction—it’s a dollar-for-dollar reduction in your tax bill.

The tax advantages work in two main ways. Pre-tax contributions to traditional accounts reduce your current taxable income immediately. Contribute $5,000 to your 401(k) while in the 22% tax bracket, and you’ll save $1,100 on this year’s taxes. Your money grows tax-deferred until retirement.

Roth contributions flip the script entirely. You pay taxes now but enjoy completely tax-free growth and withdrawals later. This is often the smarter choice for younger workers in lower tax brackets who expect their income (and tax rates) to rise over time.

The IRS publishes updated contribution limits each fall for the following year. For the most current information, you can reference the Latest research on contribution caps.

Retirement Savings Plans Contribution Limits

The IRS uses cost-of-living adjustments (COLA) to bump up contribution limits annually. This isn’t just bureaucratic housekeeping—it’s crucial for maintaining your savings power as everything gets more expensive.

Age-based strategy becomes your secret weapon as you get older. Those catch-up contributions for people 50 and older aren’t just nice-to-haves. They recognize a simple reality: you have fewer working years left to build your nest egg, so you need bigger annual contributions to catch up.

Smart savers use payroll deductions to their advantage through dollar-cost averaging. When you contribute the same amount each paycheck, you automatically buy more shares when prices are low and fewer when they’re high. It’s like having a built-in investment strategy that smooths out market bumps.

The key is starting with whatever you can afford and increasing gradually. Even bumping up your contribution by 1% each year can make a massive difference over time. For comprehensive strategies on maximizing your savings potential, check out our detailed guide on boosting your retirement savings.

How Employer Matches Work

Employer matching truly is the closest thing to free money you’ll find in the financial world. Most employers match a percentage of what you contribute, typically 50% of your first 5% of salary. On a $50,000 salary, contributing that full 5% ($2,500) would earn you a $1,250 employer match—that’s an immediate 50% return on your money.

Vesting schedules determine when those employer contributions actually become yours. Some generous employers offer immediate vesting, meaning you own the match right away. Others use cliff vesting, where you own nothing until you hit a certain milestone (usually 2-3 years), then suddenly own 100%. Graded vesting splits the difference, giving you increasing ownership over several years.

The math on increasing your contributions is eye-opening. Research shows that boosting your contribution rate from just 4% to 6% of a $50,000 salary could add more than $110,000 to your retirement nest egg over 30 years, assuming a 7.8% annual return. That extra 2% of salary—just $83 per month—compounds into serious money over time.

The bottom line? Always contribute enough to get the full employer match. It’s the first rule of retirement savings plans, and ignoring it is like leaving money on the table—literally.

Choosing, Managing & Rolling Over Your Plan

Making smart decisions about your retirement savings plans isn’t just about picking one and forgetting it. The choices you make today about fees, investments, and account management can add—or subtract—tens of thousands from your retirement nest egg.

Think of choosing a retirement plan like buying a car. You wouldn’t just look at the sticker price, right? You’d consider gas mileage, maintenance costs, and how well it fits your lifestyle. The same logic applies to retirement accounts.

Your risk tolerance should be your North Star when selecting investments within your plan. If you’re 25 and market drops make you want to check your balance more often, you can probably handle an aggressive stock-heavy portfolio. But if you’re 55 and those same drops keep you awake at night, it’s time to dial back the risk with more bonds and stable investments.

Asset allocation doesn’t have to be rocket science. Many plans offer target-date funds that automatically shift from aggressive to conservative as you age. These “set it and forget it” options work beautifully for busy people who don’t want to become investment experts.

Here’s where many people get tripped up: plan fees. A seemingly small 1% annual fee on a $100,000 account costs you $1,000 every single year. Over 20 years, that difference compounds dramatically. Always dig into expense ratios and administrative costs before committing.

Portability becomes crucial when you change jobs. IRAs offer complete freedom to move your money anywhere, while employer plans might lock you in with limited investment choices. The good news? Most retirement accounts allow rollovers when life takes you elsewhere.

ERISA laws provide important safety nets for employer-sponsored plans, requiring administrators to act in your best interest. For defined benefit pensions, the Pension Benefit Guaranty Corporation provides insurance against employer bankruptcy (though this doesn’t cover 401(k) accounts).

Key Factors When Selecting Retirement Savings Plans

Your salary level dramatically influences which strategies make sense. High earners often benefit from maxing out 401(k) contributions before considering IRAs, while moderate earners might prioritize capturing every dollar of employer matching first.

Job sector determines your available playground. Government workers get access to the excellent Thrift Savings Plan and 457(b) options. Nonprofit employees can use 403(b) plans with special catch-up provisions. Private sector workers typically steer 401(k) territory.

Self-employment status opens doors to some of the most powerful retirement tools available. SEP IRAs and Solo 401(k)s allow much higher contribution limits than traditional IRAs—sometimes letting you sock away $69,000 or more annually.

Your current tax bracket helps determine whether traditional (pre-tax) or Roth (after-tax) contributions make more sense. Generally, traditional contributions benefit people in higher tax brackets now, while Roth contributions favor those expecting higher brackets in retirement.

Plan fees deserve your detective skills. Low-cost index funds consistently outperform expensive actively managed funds over time, especially after accounting for fees. Don’t let fancy marketing convince you to pay premium prices for average performance.

For a deeper dive into retirement planning strategies, our comprehensive guide How to Plan for Retirement covers everything from goal setting to investment selection.

Rollover & Consolidation Options

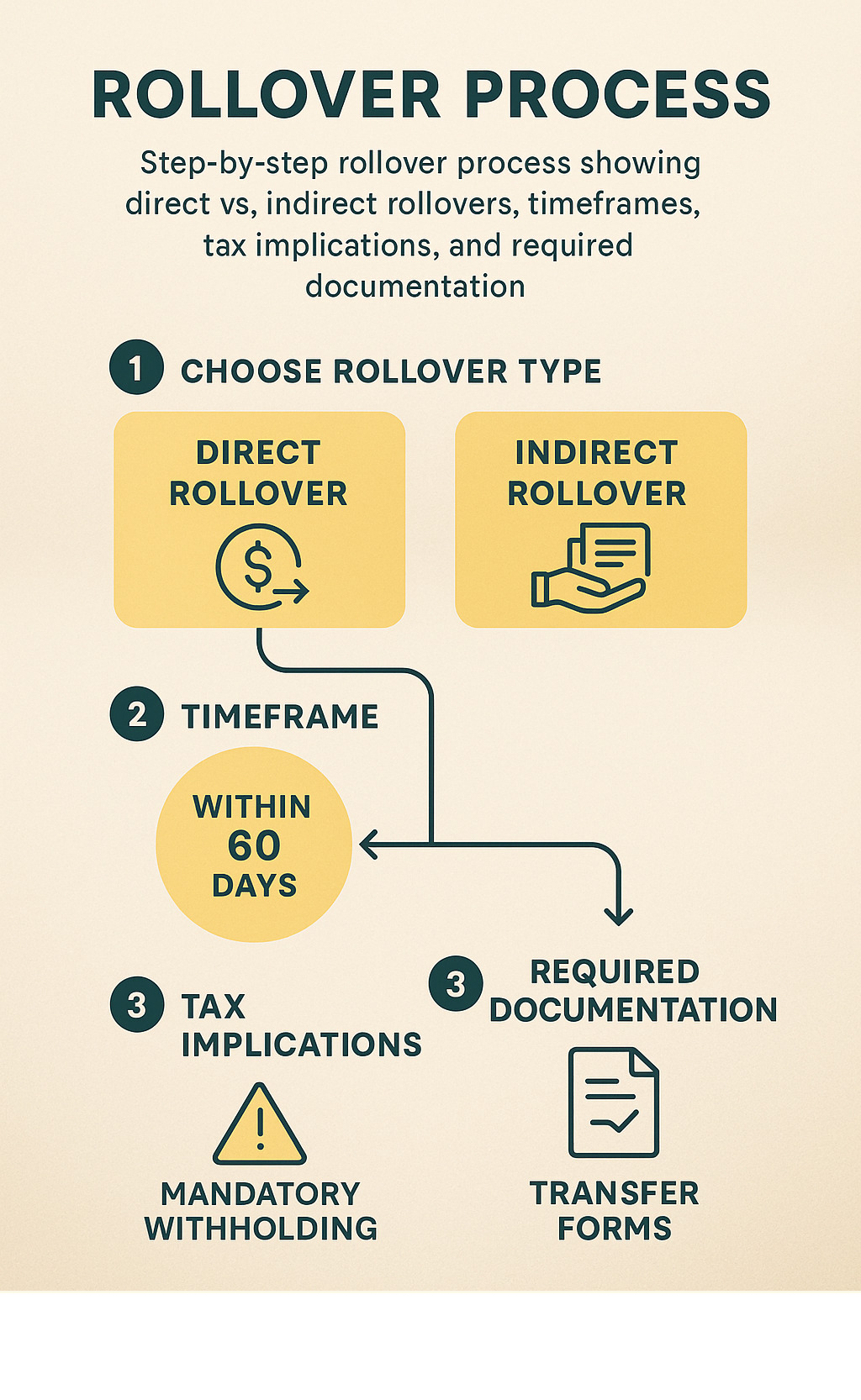

Changing jobs doesn’t mean abandoning your retirement savings plans. You’ve got several smart options for handling your old employer’s plan, and the choice you make can significantly impact your financial future.

Leaving money with your former employer works if they allow it and your balance exceeds $5,000. This might make sense if you love the investment options or fees are exceptionally low. Just remember you’ll lose the ability to contribute more.

Rolling to your new employer’s plan keeps things simple if they accept transfers. You’ll maintain the ability to borrow against your balance (if the plan allows) and keep everything under one roof.

Rolling to an IRA often provides the most flexibility. You’ll gain access to virtually unlimited investment options and potentially lower fees. This route works especially well if you want more control over your investment choices.

Cashing out sounds tempting but rarely makes financial sense. You’ll pay income taxes plus a 10% penalty if you’re under 59½. That “quick cash” could cost you hundreds of thousands in lost retirement wealth.

Direct rollovers are your safest bet—the money moves directly between custodians without you touching it. This avoids the 20% mandatory tax withholding that kicks in with indirect rollovers.

Indirect rollovers put you in the driver’s seat but with a strict 60-day deadline. Miss it, and the entire amount becomes taxable income plus penalties. The stress usually isn’t worth the temporary access to funds.

Roth conversions let you move traditional retirement money to Roth accounts by paying taxes now for tax-free growth later. This strategy shines during low-income years or when you expect tax rates to climb.

Strategies to Boost Savings at Every Life Stage

Building wealth for retirement isn’t a one-size-fits-all journey. Your retirement savings plans strategy needs to adapt as you move through different career stages, income levels, and life circumstances. The good news? There are proven tactics that work at every age.

Auto-escalation is like having a personal savings coach who never takes a day off. This feature automatically bumps up your contribution rate by 1% each year, usually around your work anniversary. You barely notice the change because it happens gradually, but the long-term impact is huge. Many people find they can handle these small increases much easier than making one big jump.

When life hands you extra money—whether it’s a raise, bonus, tax refund, or that birthday check from grandma—resist the urge to immediately upgrade your lifestyle. Instead, consider the “windfall strategy”: put at least half of any unexpected money directly into your retirement accounts. Since you weren’t counting on this money in your regular budget, you won’t miss it.

Smart budgeting can uncover surprising amounts of money for retirement savings. Start by negotiating your regular bills—call your insurance company, phone provider, or internet service to ask about discounts. You might save $50-100 monthly without changing your lifestyle at all.

Brown-bagging lunch just three days a week instead of buying it can save $1,500 annually. That money invested in a retirement savings plan with 7% returns becomes over $6,000 in 10 years. Sometimes the smallest changes create the biggest results.

Take a hard look at those subscription services piling up on your credit card. That streaming service you forgot about, the gym membership you use twice a year, the magazine subscription that seemed like a good idea—they add up fast. Cancel what you don’t actively use and redirect that money to your future self.

Once you hit 50, the IRS recognizes that time is getting shorter and allows catch-up contributions. You can add an extra $7,500 to your 401(k) and $1,000 to your IRA annually. This isn’t just about the extra money—it’s about making up for lost time if you started saving later than you wanted.

Delaying Social Security past your full retirement age is like getting a guaranteed 8% annual raise. For each year you wait until age 70, your monthly benefit increases by about 8%. If you’re healthy and have longevity in your family, this strategy can add hundreds of thousands to your lifetime income.

Don’t overlook Health Savings Accounts (HSAs) as retirement tools. Yes, they’re designed for medical expenses, but after age 65, you can withdraw money for any purpose (though you’ll pay taxes on non-medical withdrawals). The triple tax advantage—deductible contributions, tax-free growth, and tax-free medical withdrawals—makes HSAs incredibly powerful for retirement planning.

For detailed investment strategies within your retirement accounts, explore our guide on Best Way to Invest for Retirement.

The key is starting where you are and building momentum. Whether you’re 25 or 55, there are always strategies to boost your retirement savings. Small, consistent actions compound over time, just like your investments.

Frequently Asked Questions about Retirement Savings Plans

How much should I save each year?

The magic number financial experts recommend is 12-15% of your income annually for retirement, including any employer match you receive. Think of it this way: if your employer matches 3% and you contribute 9%, you’ve hit that sweet spot of 12%.

But here’s the reality check—if you’re starting later in your career, you might need to save 20% or more to catch up. It sounds daunting, but catch-up contributions after age 50 help bridge this gap.

The 70-80% income replacement rule provides a helpful target. Let’s say you earn $75,000 annually and want to replace 75% of that income ($56,250) in retirement. Since Social Security typically covers only 40% of pre-retirement income, your retirement savings plans need to fill a substantial gap.

Don’t let perfect be the enemy of good, though. Start with whatever you can afford—even 1% is infinitely better than nothing. The beautiful thing about retirement savings is that you can increase your contribution rate by 1% annually or whenever you receive a raise. Many people don’t even notice these gradual increases, but compound interest certainly does.

What happens to my retirement savings plans when I change jobs?

Good news—your retirement savings plans belong to you, not your employer. The money you’ve saved is portable, though the process depends on what type of account you have.

With employer-sponsored plans like 401(k)s, you typically face four choices when leaving a job. You can keep the account with your former employer if the balance exceeds $5,000 and they allow it. You might roll the money into your new employer’s plan if they accept rollovers. Many people choose to roll the funds into an IRA for maximum investment flexibility and control. The option we strongly discourage? Cashing out the account, which triggers taxes and penalties.

IRAs move with you automatically since they’re individual accounts—no paperwork required when switching jobs. The golden rule here is avoiding cash-outs that trigger taxes and penalties, especially if you’re under age 59½.

Here’s a pro tip: direct rollovers are your friend. They move money directly between custodians without you touching it, avoiding the 20% mandatory withholding that applies to indirect rollovers.

Are early withdrawals always penalized?

The short answer is usually yes, but there are more exceptions than you might think. Most retirement savings plans impose a 10% federal penalty on withdrawals before age 59½, plus you’ll owe regular income taxes on the withdrawn amount.

However, several notable exceptions exist that could save you money in genuine emergencies. 457(b) plans offer a unique advantage—they allow penalty-free withdrawals after leaving your job, regardless of your age. This makes them particularly valuable for government workers considering early retirement.

Roth IRA contributions (but not earnings) can be withdrawn penalty-free at any time since you already paid taxes on that money. Traditional and Roth IRAs also waive penalties for first-time home purchases up to $10,000 lifetime, higher education expenses for you or family members, and medical expenses exceeding 7.5% of your adjusted gross income.

The SECURE Act added another exception—withdrawals up to $5,000 for births or adoptions avoid penalties, though you’ll still owe taxes. Some 401(k) plans offer hardship withdrawals for specific emergencies, but these vary by employer and require documentation.

Even when penalties are waived, you’ll typically still owe income taxes on traditional account withdrawals. The key is understanding your options before you need them.

Conclusion

Building wealth for retirement doesn’t have to feel overwhelming. Retirement savings plans give you the tools to transform small, consistent contributions into substantial financial security over time. Whether you’re 22 or 52, the strategies we’ve covered can help you create a retirement you’ll actually want to live.

The math is simple, even if the execution takes discipline. A 25-year-old saving just $75 monthly can build over $260,000 by retirement. That’s the power of starting early and letting compound interest work its magic.

Start today, even if it’s small. Don’t wait for the “perfect” amount or the “right” time. Open that 401(k) account, claim your employer match, or set up an IRA with whatever you can afford. Time in the market beats timing the market every single time.

Grab that free money. Your employer’s matching contribution is literally free money sitting on the table. If your company matches 50% of your first 5% contributed, you’re getting an immediate 50% return. No investment strategy can guarantee returns like that.

Think about taxes now and later. Smart retirement savers use both traditional and Roth accounts to create flexibility. You’re essentially diversifying your tax treatment, giving yourself options when you actually need the money.

Bump up your savings regularly. Every raise, every bonus, every tax refund is a chance to boost your retirement contributions. Even increasing by 1% annually makes a huge difference over decades.

Review your strategy yearly. Your 30s strategy shouldn’t be your 50s strategy. As your income grows and life changes, your retirement savings plans should evolve too. What worked when you were single might need adjusting after marriage, kids, or career changes.

At Finances 4You, we believe everyone deserves to retire with dignity and financial peace of mind. Our mission is helping you align your net worth with your age group through practical, actionable financial guidance. The best retirement plan isn’t the fanciest one—it’s the one you’ll actually stick with for the long haul.

Your future self is counting on the decisions you make today. The sooner you start, the easier the journey becomes. And remember, you don’t have to figure this out alone.

Ready to dive deeper into retirement strategies? Check out our Comprehensive list of retirement articles for more insights, tips, and actionable advice to help you build the retirement you deserve.