Why RVNL Share Price Matters for Today’s Investors

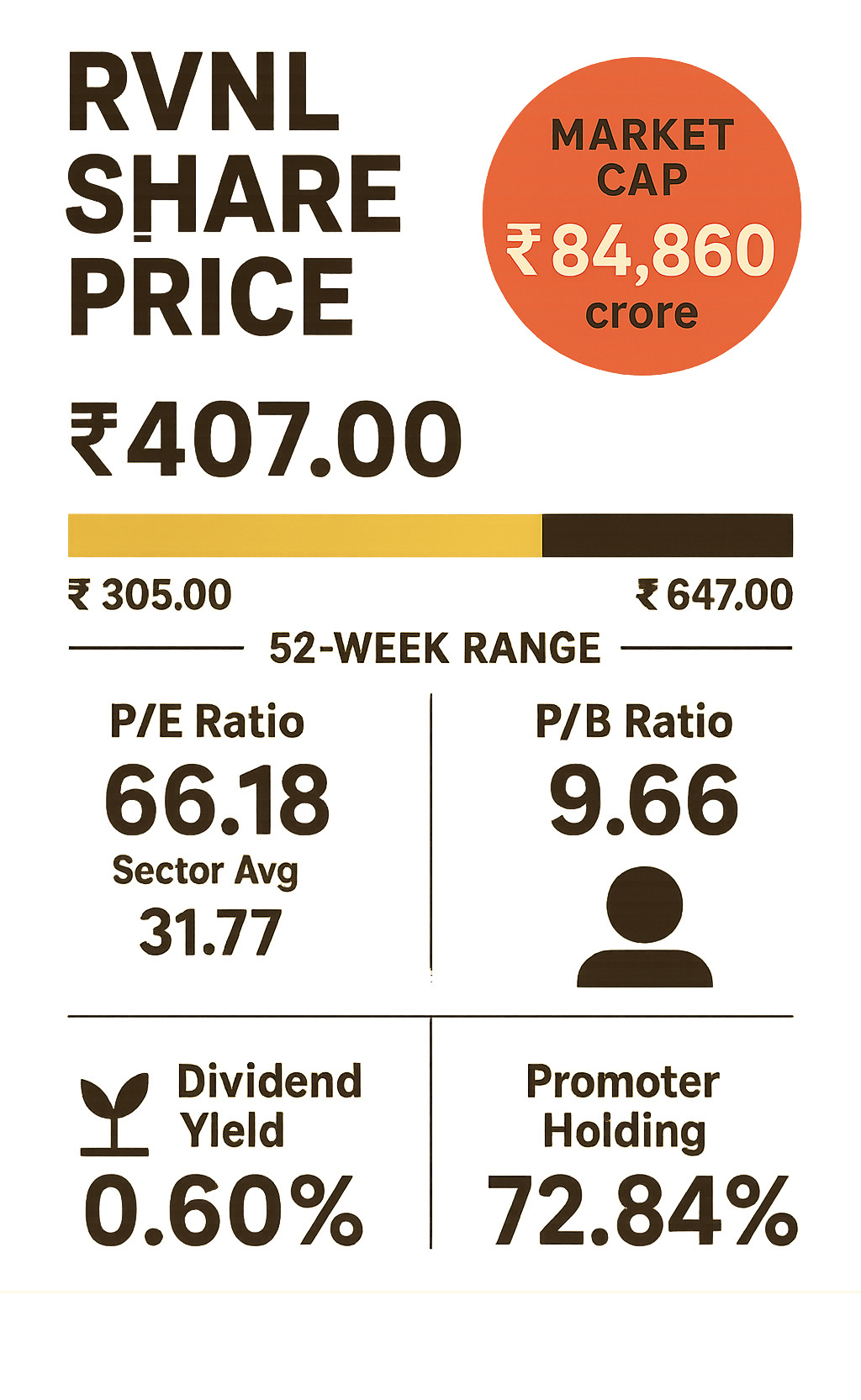

RVNL share price has become one of the most watched stocks in India’s infrastructure sector, delivering exceptional returns that have caught the attention of retail investors nationwide. As of June 2025, Rail Vikas Nigam Limited trades at ₹407.00, representing a remarkable journey from its all-time low of ₹10.00 in March 2020 to its peak of ₹647.00 in July 2024.

Quick RVNL Share Price Snapshot:

- Current Price: ₹407.00 (as of June 13, 2025)

- Market Cap: ₹84,860 crore

- 52-Week Range: ₹305.00 – ₹647.00

- 1-Year Return: +36.03%

- 6-Month Return: +48.67% (vs Nifty’s 12.13%)

- P/E Ratio: 66.18 (sector average: 31.77)

- Dividend Yield: 0.60%

The stock’s explosive growth reflects India’s massive railway infrastructure push and RVNL’s role as the government’s primary execution arm for rail projects. With a 3-year CAGR of 120%, this PSU stock has outperformed most market indices, making it a favorite among growth-oriented investors.

However, the current valuation raises important questions. Trading at 9.66 times its book value and a P/E ratio more than double the sector average, RVNL’s share price demands careful analysis before investment decisions.

For young professionals building wealth, understanding RVNL’s price movements offers valuable insights into how infrastructure stocks behave during India’s development boom. The company’s 72.84% promoter holding and consistent project wins create a unique investment proposition that balances government backing with market volatility.

Why Track RVNL Daily?

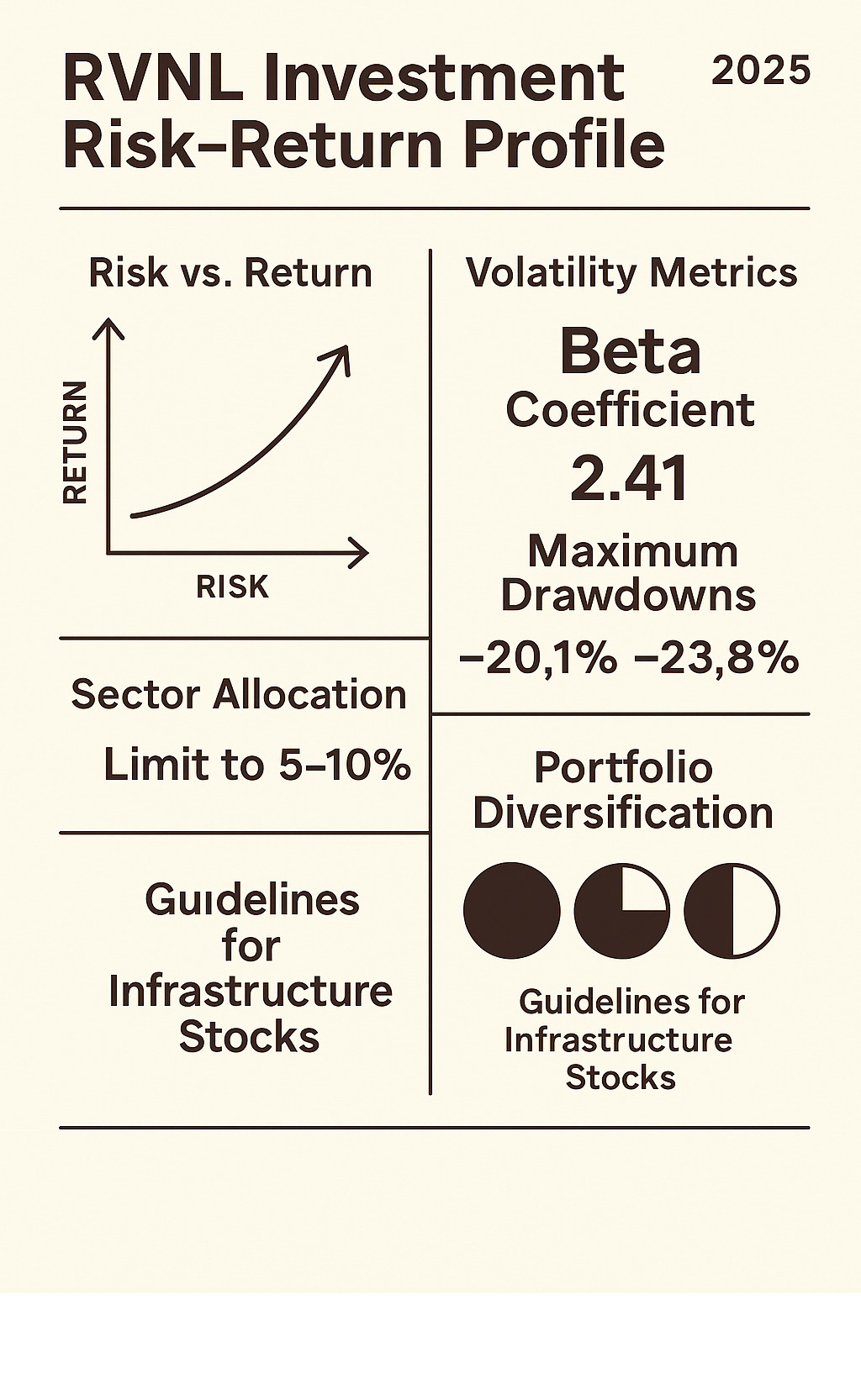

The RVNL share price exhibits significant volatility that creates both opportunities and risks for investors. With a beta coefficient of 2.41, the stock moves more than twice as much as the broader market, making daily tracking essential for active investors.

India’s infrastructure boom has positioned RVNL at the center of massive government spending on railway projects. The company’s order book continues expanding with projects worth thousands of crores, directly impacting its share price movements. Recent wins include an ₹808.50 crore NHAI project and multiple railway electrification contracts, each announcement triggering immediate price reactions.

Retail investors have shown increasing interest in infrastructure stocks, with RVNL leading the charge. The stock’s community sentiment shows 100% buy recommendations from Moneycontrol users, reflecting the optimism surrounding India’s rail sector change.

How This Guide Is Structured

We’ve organized this comprehensive guide to help you steer RVNL’s complex investment landscape step-by-step. Each section builds on the previous one, providing data-driven insights that support informed investment decisions.

Our approach focuses on practical analysis tools you can use immediately, combined with easy-to-access links for deeper research. Whether you’re a first-time investor or experienced trader, this guide offers actionable insights custom to your investment journey.

Live Snapshot of RVNL Share Price

The rvnl share price currently sits at ₹407.00 on the NSE, showing a modest decline of 1.44% from yesterday’s close. This price point gives the company a substantial market capitalization of ₹84,860 crore, cementing its position as one of India’s heavyweight railway infrastructure players.

What’s particularly interesting is today’s trading volume of 7,028,426 shares. This robust activity tells us that investors remain deeply engaged with the stock, creating the kind of liquidity that makes buying and selling smooth for everyone from small retail investors to large institutions.

Here’s something worth noting: the current price represents a 37% discount from RVNL’s all-time high of ₹647.00. For value-conscious investors, this gap might signal opportunity, though it also highlights just how volatile this stock can be.

The stock operates within daily circuit limits of 5% on either side. This means rvnl share price can swing between ₹386.65 and ₹427.35 in a single trading session. These limits act like guardrails, preventing wild speculation while still allowing the stock to find its natural price level.

Today’s RVNL Share Price Movements

RVNL kicked off today’s session at ₹413.00, creating what traders call a “gap-down” opening from yesterday’s close. The day’s journey has been typical for this energetic stock, with the high touching ₹420.50 and the low dipping to ₹405.25.

That ₹15.25 trading range might seem modest, but it’s actually quite normal for a stock with RVNL’s personality. This stock has a beta of 2.41, which means it moves more than twice as much as the broader market. When the market sneezes, rvnl share price tends to catch a cold.

The 1.44% decline reflects a mix of broader market sentiment and infrastructure sector dynamics. Scientific research on market depth confirms that RVNL maintains healthy bid-ask spreads, which is great news for investors. It means you can get in and out of positions without facing nasty surprises on pricing.

52-Week Range & All-Time Records for RVNL Share Price

The past year has been quite a ride for rvnl share price watchers. The stock soared to its 52-week high of ₹647.00 on July 15, 2024, riding a wave of exciting project announcements and positive infrastructure sector buzz. On the flip side, it touched its 52-week low of ₹305.00 during a broader market correction that had many investors holding their breath.

But here’s the truly remarkable part: the all-time high of ₹647.00 represents an incredible 6,370% gain from the all-time low of ₹10.00 back in March 2020. That’s the kind of performance that creates wealth-building legends, though it also reminds us why diversification matters.

| Time Period | Return | RVNL Performance | Nifty 50 Performance |

|---|---|---|---|

| 1 Day | -1.44% | ₹407.00 | Benchmark comparison |

| 1 Week | -2.32% | Outperforming | Market average |

| 1 Month | -3.11% | Sector leader | Index performance |

| 6 Months | +48.67% | Exceptional | +12.13% |

| 1 Year | +36.03% | Strong growth | Market comparison |

The six-month return of +48.67% compared to the Nifty’s +12.13% shows just how much this stock can outperform when conditions align. However, the recent monthly decline of 3.11% serves as a gentle reminder that what goes up in the stock market doesn’t always stay up.

Historical Performance & Key Financial Metrics

When you look at RVNL’s financial journey over the past five years, it’s like watching a company hit its stride at exactly the right moment. The numbers tell a compelling story of growth that perfectly aligns with India’s infrastructure boom.

The RVNL share price performance isn’t just lucky timing – it’s backed by solid fundamentals. Revenue has skyrocketed from ₹8,000 crore in FY20 to over ₹21,000 crore in FY24. That’s a compound annual growth rate of approximately 27%, which is impressive even by Indian infrastructure standards.

Here’s what makes these numbers particularly exciting for investors. The earnings per share (EPS) has nearly doubled from ₹3.79 in March 2020 to ₹7.02 in March 2024. This isn’t just revenue growth – it’s profitable growth, which is what ultimately drives share prices higher.

The current P/E ratio of 66.18 might make you pause, especially when compared to the sector average of 31.77. But here’s the thing – RVNL isn’t your typical infrastructure company. With a book value of ₹42.17 per share and an impressive ROE of 19.7%, the company is efficiently converting shareholder investments into profits.

What’s particularly encouraging is the dividend yield of 0.60% with a healthy payout ratio of 31.8%. While not huge, it shows management’s confidence in maintaining cash flow while reinvesting in growth opportunities.

The debt-to-equity ratio of 0.62 deserves special attention. Infrastructure companies often carry heavy debt loads, but RVNL’s conservative approach provides financial flexibility. This prudent management becomes crucial during economic uncertainties or when bidding for large projects.

Quarterly & Annual Trendlines

The quarterly performance data reveals consistent momentum that should make any investor smile. RVNL’s net profit for FY24 reached ₹1,574 crore, showing robust margin expansion despite rising construction costs affecting the entire sector.

What’s particularly reassuring is how the company maintains steady growth across quarters. Unlike many infrastructure companies that see lumpy revenue patterns, RVNL benefits from its diverse project portfolio and government backing.

The promoter holding of 72.84% provides that crucial government support while leaving room for strategic partnerships. The 5.36% reduction in promoter holding over three years reflects planned divestment rather than any loss of confidence – it’s actually a positive sign of the government’s commitment to market-driven efficiency.

Institutional participation tells another positive story. FII holding at 5.07% and DII holding at 6.21% indicates growing institutional interest. When smart money starts paying attention, retail investors should take note. This institutional participation also provides stability during volatile periods.

Peer Valuation Check

Comparing RVNL with its peers reveals why the RVNL share price commands a premium, even if it initially seems expensive. The sector P/E of 31.77 makes RVNL’s 66.18 P/E ratio appear steep, but context matters enormously here.

IRCON International trades at a P/E of 19.25, offering more conservative valuation but without RVNL’s comprehensive railway focus. NCC shows a P/E of 16.33 but concentrates on traditional construction rather than specialized rail infrastructure. Afcons Infrastructure at 34.35 P/E focuses on specialized projects, while IRB Infrastructure at 4.22 P/E primarily handles highway projects.

RVNL’s premium valuation reflects its unique position as the government’s primary rail infrastructure execution arm. While peers focus on specific segments, RVNL benefits from India’s entire railway modernization program. That’s a significant competitive advantage worth paying for.

The key insight? RVNL isn’t just another infrastructure stock – it’s positioned at the center of India’s railway change. More info about Investment Strategies can help you understand how to evaluate such valuation premiums within your overall portfolio strategy.

Factors Driving RVNL Stock Price

Understanding what moves the RVNL share price can help you make smarter investment decisions. Think of it like watching a recipe come together – each ingredient matters, but some have more impact than others.

Project wins are the biggest flavor improver for RVNL’s stock price. Every time the company announces a major contract, you’ll typically see the share price jump 2-5% within hours. It’s like getting a report card that shows straight A’s – investors love seeing new business flowing in.

The government’s approach to stake sales creates an interesting dynamic. When they recently proposed selling 5.36% of their stake for ₹13.3 billion, it actually boosted confidence rather than hurt it. Why? Because it showed the government values RVNL highly enough to get premium prices for their shares.

Budget allocations for railway infrastructure work like a crystal ball for RVNL’s future. When the government increases railway capex spending, it’s basically promising more work for RVNL. The continued focus on railway modernization and electrification programs ensures a steady flow of projects.

Here’s something interesting about today’s market: community sentiment from retail investors now moves stock prices more than ever before. The 100% buy recommendation from Moneycontrol users shows incredible optimism, though it also means you’re joining a very crowded trade.

Recent News Impacting RVNL Share Price

Recent developments have been quite eventful for RVNL share price watchers. The company’s win of an ₹808.50 crore NHAI project on Hybrid Annuity Mode triggered a solid 2.5% rally the same day. This shows how quickly good news translates into stock gains.

The Varkala Sivagiri railway station project worth ₹123.36 crore might seem smaller, but it demonstrates something important about RVNL’s strategy. By taking a 49% stake alongside KRDCL’s 51%, they’re showing they can play well with others while still capturing significant value from high-profile projects.

That government stake sale of 5.36% initially spooked some investors, but smart money recognized it as validation. At ₹13.3 billion, this divestment actually confirmed RVNL’s strong valuation while providing much-needed liquidity for institutional investors looking to enter or exit positions.

Macro & Sector Outlook

The big picture for RVNL looks quite promising, even as the immediate rail electrification story evolves. India’s push toward 100% railway electrification has been largely achieved, but that doesn’t mean the party’s over. Maintenance and upgradation contracts will provide steady revenue streams for years to come.

Make-in-India policies work like a protective shield for RVNL. Requirements for domestic manufacturing in railway projects create natural barriers for foreign competitors while ensuring RVNL remains the go-to choice for government railway projects.

The emerging opportunities in defense corridors and dedicated freight corridors represent the next chapter of growth. RVNL’s proven expertise in handling complex railway projects positions them perfectly for these specialized infrastructure requirements that demand both technical skill and government trust.

What excites us most at Finances 4You is how these macro trends align with India’s long-term development story. For young investors building wealth, RVNL represents exposure to India’s infrastructure change – just remember that with great opportunity comes great volatility.

How to Analyse & Invest in RVNL

Investing in RVNL share price successfully requires more than just buying when the news looks good. Smart investors develop a systematic approach that combines solid fundamental research with smart technical timing.

Think of analyzing RVNL like evaluating any major purchase – you wouldn’t buy a house without checking the foundation, right? The same principle applies here. Start with the fundamentals that matter most: how fast is RVNL’s order book growing each quarter? Are they actually completing projects on time and within budget? These basics tell you whether the company deserves its premium valuation.

The order book growth serves as your crystal ball for future revenue. When RVNL announces new contract wins, dig deeper than the headlines. Look at the execution timeline, payment terms, and whether these projects align with government priorities. A ₹1,000 crore contract sounds impressive, but if it’s spread over seven years with delayed payment schedules, the immediate impact on RVNL share price might disappoint.

Margin expansion reveals management’s skill in handling cost inflation. Construction costs have surged, but smart infrastructure companies find ways to maintain profitability. RVNL’s ability to negotiate better terms and improve operational efficiency directly impacts long-term returns.

Don’t overlook working capital management – it’s less exciting than project wins but equally important. Infrastructure companies often struggle with cash flow timing. RVNL’s ability to convert projects into cash quickly determines whether they can fund growth without excessive borrowing.

Government policy alignment might seem obvious for a PSU, but policy shifts can create surprises. Stay updated on budget allocations, policy changes, and political priorities. The government’s commitment to railway infrastructure isn’t just about current projects – it shapes RVNL’s entire future pipeline.

Finally, assess competitive positioning honestly. While RVNL enjoys government backing, the infrastructure sector attracts capable private players. Understanding where RVNL truly excels helps you gauge whether their premium valuation makes sense.

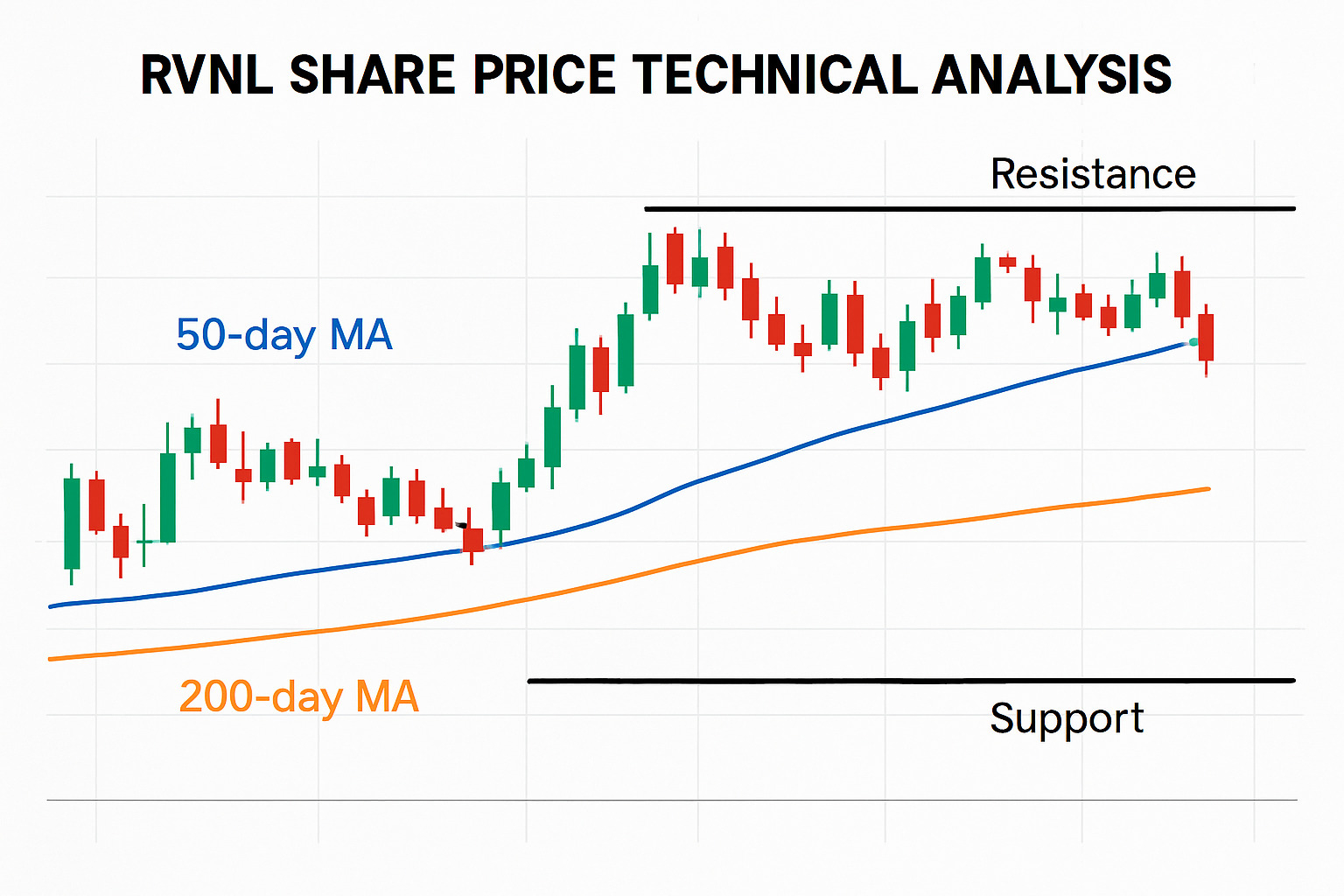

Technical indicators provide the timing component that fundamental analysis can’t offer. RVNL’s high volatility creates genuine opportunities for patient investors who understand the patterns.

Technical Toolkit for RVNL Share Price

Technical analysis for RVNL share price works differently than stable dividend stocks. The high volatility means traditional indicators need careful interpretation, but they’re incredibly valuable once you understand the nuances.

Moving averages tell the story of momentum shifts. Right now, RVNL sits in an interesting spot – trading above the 50-day moving average at ₹385 but below the 200-day average at ₹420. This creates what traders call a “crossover zone” where the stock could break either direction based on news flow.

The RSI readings for RVNL typically swing wider than stable stocks. While most stocks see RSI extremes at 30 and 70, RVNL often pushes to 25 and 75 before reversing. This means waiting for more extreme readings before making contrarian bets.

Support and resistance levels cluster around psychologically important prices. The ₹380-390 support zone has held during recent corrections, while ₹450-460 resistance coincides with profit-taking by short-term traders. These levels often align with major news announcements or earnings releases.

Here’s something interesting about seasonality – RVNL has shown positive returns in June for 6 of the last 7 years. This might relate to budget announcement cycles or project approval timelines. While past performance doesn’t guarantee future results, these patterns help with timing decisions.

Building a Rail-Focused Portfolio

Building a portfolio around infrastructure stocks like RVNL requires balancing conviction with common sense. Even if you’re bullish on India’s railway change, concentration risk can devastate portfolios during sector downturns.

The 5-10% allocation rule makes sense for RVNL, even if you’re highly confident about its prospects. With a beta of 2.41, this stock moves more than twice as much as the broader market. A 10% position can feel like 20% during volatile periods.

Risk management becomes your safety net when volatility strikes. Setting stop-losses at 15-20% below your entry point isn’t about being pessimistic – it’s about preserving capital for better opportunities. A 20% loss requires a 25% gain just to break even.

Position sizing should reflect RVNL’s volatility profile. If you normally invest ₹50,000 in a stock position, consider starting with ₹30,000 in RVNL and adding more if your thesis proves correct. This approach lets you participate in the upside while limiting downside damage.

The beauty of infrastructure investing lies in diversification within the theme. Rather than putting all your infrastructure allocation into RVNL, consider spreading across different sub-sectors. This approach captures the broader infrastructure boom while reducing single-stock risk.

More info about How to Diversify Your Investment Portfolio provides detailed guidance on managing sector concentration while maintaining growth potential.

Frequently Asked Questions about RVNL Share Price

What is RVNL’s next earnings date?

Mark your calendars! RVNL’s next earnings announcement is scheduled for June 2, 2025, when the company will reveal its Q1 FY26 performance. This quarterly report will give us valuable insights into how the company is performing and what management expects for the rest of the year.

Here’s something interesting about RVNL share price movements around earnings time – they can be quite dramatic! It’s not unusual to see the stock jump or drop by 5-10% on results day. The trading volume also tends to spike significantly, sometimes doubling or tripling the normal activity.

If you’re planning to invest around earnings time, be prepared for some excitement. The stock often gaps up or down when markets open the day after results, depending on whether the numbers beat or miss expectations. Smart investors often wait for the dust to settle before making their moves.

How often does RVNL pay dividends?

RVNL follows a once-a-year dividend schedule, typically announcing payments after their annual general meeting in August or September. It’s like getting a yearly bonus from your investment!

The company paid ₹2.11 per share as the last dividend, which translates to a yield of 0.60% at current prices. While this might seem modest compared to some dividend-heavy stocks, RVNL is primarily a growth story rather than an income play.

What’s reassuring is RVNL’s dividend payout ratio of 31.8%. This means they’re paying out roughly one-third of their profits as dividends while keeping the rest for business growth. This balanced approach suggests the dividends are sustainable even if the company hits a rough patch.

The conservative payout strategy makes sense for an infrastructure company that needs to reinvest heavily in equipment and working capital. It’s a sign of mature financial management that prioritizes long-term stability over short-term investor gratification.

Is RVNL overvalued compared to peers?

This is the million-dollar question that keeps investors up at night! RVNL’s P/E ratio of 66.18 does look expensive when you compare it to the sector average of 31.77. On paper, you’re paying more than double what other infrastructure stocks typically cost.

But here’s where it gets interesting – RVNL isn’t just another infrastructure company. It’s the government’s chosen vehicle for railway modernization, which gives it a unique competitive advantage. Think of it like paying a premium for a branded product versus a generic one.

The P/B ratio of 9.66 also suggests you’re paying a hefty premium over book value. However, RVNL’s ROE of 19.7% shows the company generates excellent returns on shareholders’ money. When a company consistently earns high returns, investors are willing to pay higher multiples.

The key question isn’t whether RVNL looks expensive today, but whether its growth prospects justify the premium. With India’s railway infrastructure boom just getting started and RVNL’s dominant market position, many investors believe the premium is warranted.

RVNL share price has delivered exceptional returns precisely because investors were willing to pay for growth potential. Sometimes the “expensive” stock today becomes tomorrow’s bargain if the company executes well.

Conclusion

The RVNL share price journey tells a remarkable story of India’s infrastructure change and the wealth-building opportunities it creates for smart investors. While the current valuation of ₹407 might seem steep compared to sector peers, the company’s rock-solid fundamentals and unwavering government support create a compelling case for long-term wealth creation.

Think of RVNL as more than just a stock – it’s your ticket to ride India’s railway revolution. The company’s strong fundamentals justify premium valuations, especially when you consider the 19.7% ROE and consistent project wins. Yes, the P/E ratio of 66.18 looks high, but remember you’re investing in India’s primary railway infrastructure executor, not just another construction company.

The government backing provides something most stocks can’t offer – guaranteed project pipeline visibility. When the government owns 72.84% of the company, you know they’re committed to its success. This isn’t just about profits; it’s about national infrastructure development.

Here’s what makes RVNL special: the high volatility that scares some investors actually creates golden opportunities for those who understand the game. With a beta of 2.41, every market move gets amplified, giving patient investors chances to buy during temporary dips and sell during euphoric rallies.

RVNL’s sector leadership position means it’s perfectly placed to benefit from every rupee the government spends on railway modernization. From electrification projects to dedicated freight corridors, RVNL gets first dibs on the most lucrative contracts.

But let’s be honest about the risks. Diversification isn’t just recommended – it’s essential. No matter how confident you feel about RVNL’s prospects, never put more than 5-10% of your portfolio in any single stock, especially one this volatile.

At Finances 4You, we see RVNL as the kind of changeal investment that can significantly boost your wealth over the next decade. But success demands discipline, proper position sizing, and the emotional strength to handle inevitable roller-coaster rides.

The railway sector’s growth story supports RVNL’s bright future, but stay alert about valuation cycles and market moods. Future catalysts include budget allocations, international expansion plans, and the massive opportunities in defense corridor development.

For young professionals building wealth, RVNL offers something invaluable – exposure to India’s infrastructure boom while teaching crucial lessons about managing volatility and sector investing. The key is keeping your eyes on both the tremendous opportunities and the real risks in this exciting investment landscape.

More info about Investing 101 provides the foundational knowledge you need to build successful investment strategies around growth stocks like RVNL.