Why Socially Responsible Investing is Reshaping Modern Finance

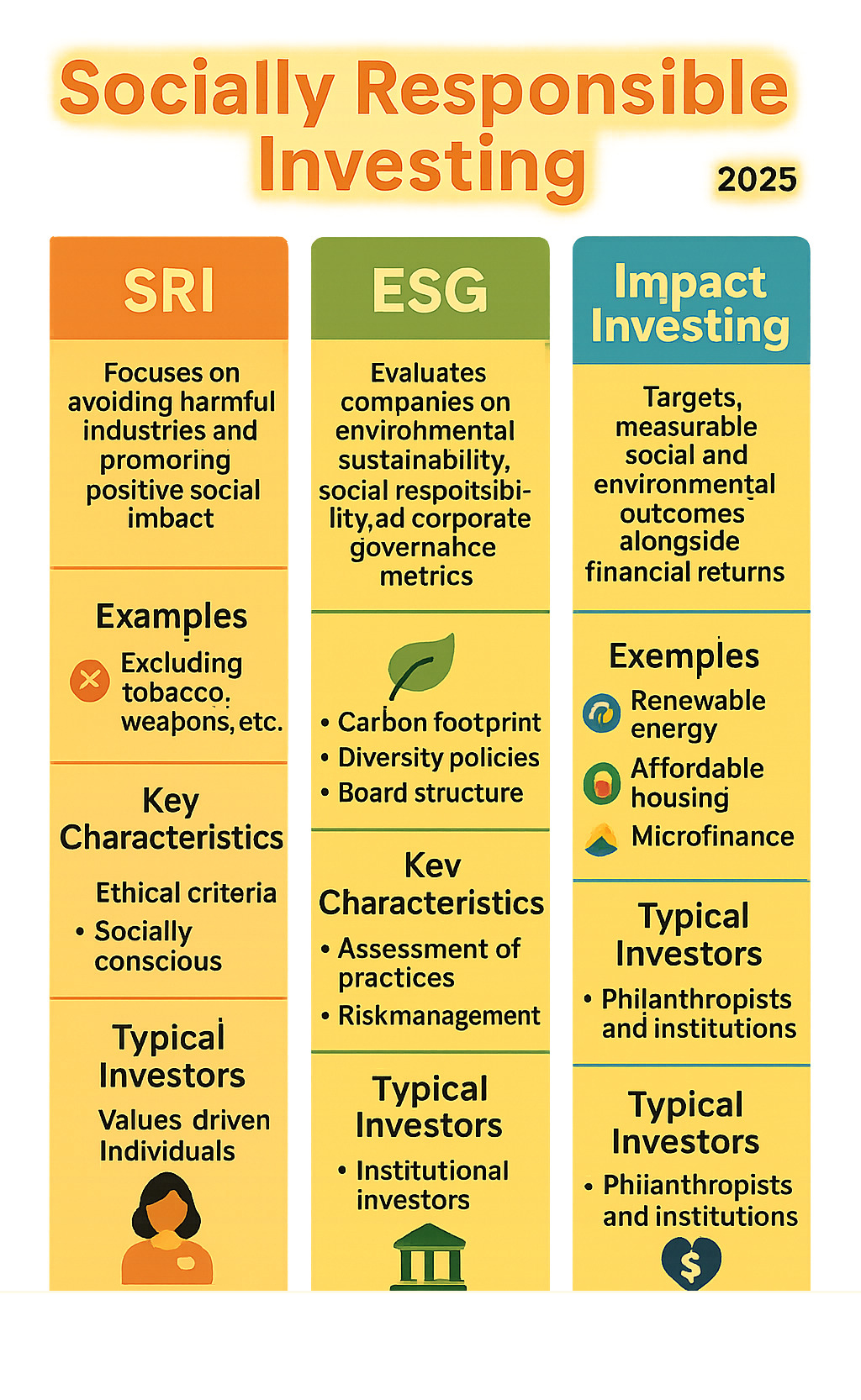

Socially responsible investing (SRI) is an investment strategy that seeks to generate both financial returns and positive social or environmental impact by considering environmental, social, and governance (ESG) factors in investment decisions.

Quick SRI Overview:

- What it is: Investment approach combining financial goals with ethical values

- Key methods: Negative screening, positive investing, impact investing, shareholder advocacy

- Performance: Studies show 90% of ESG research indicates non-negative relationship with returns

- Market size: US$30.7 trillion in global sustainable investing assets as of 2018

- Access: Available through mutual funds, ETFs, individual stocks, and robo-advisors

Remember the 1960s when investors boycotted companies supporting the Vietnam War? Or the 1980s divestment movement that helped end South African apartheid? Those weren’t just protests – they were early examples of socially responsible investing in action.

Today’s SRI movement has evolved far beyond simple boycotts. It’s become a sophisticated investment approach that lets you align your money with your values while still pursuing solid returns. Whether you care about climate change, social justice, or corporate governance, you can now invest in ways that reflect your beliefs.

The numbers tell the story. Global sustainable investing assets reached US$30.7 trillion in 2018, marking a 34% increase in just two years. That’s not activist money – that’s mainstream investment capital flowing toward companies that do good while doing well.

For young professionals like you, SRI offers something powerful: the chance to build wealth while supporting the changes you want to see in the world. No more choosing between your conscience and your portfolio.

This guide will walk you through everything you need to know about ethical investing. We’ll cover the strategies, debunk the myths about performance, and show you exactly how to get started.

Easy Socially responsible investing glossary:

What is Socially Responsible Investing (SRI) and How Does It Work?

Socially responsible investing is like having a conversation with your money about what matters to you. Instead of just asking “Will this make me richer?” you’re also asking “Will this make the world better?”

The magic happens through something called the ESG framework – three simple letters that pack a powerful punch. Environmental, Social, and Governance factors become your investment compass, guiding you toward companies that align with your values while still aiming for solid returns.

Here’s what makes this approach so compelling: you’re not just a passive investor anymore. Through stewardship and active ownership, you become part of the solution. When you vote on shareholder proposals or support companies that prioritize sustainability, you’re wielding your financial power to create change.

The numbers back this up beautifully. About 90% of academic studies show that ESG factors don’t hurt your returns – and often help them. That’s because companies with strong environmental, social, and governance practices tend to be better managed and more resilient over time.

If you’re exploring different investment strategies to build wealth, SRI offers something unique: the chance to sleep well at night knowing your money is working toward the future you want to see.

The UN Principles for Responsible Investment now has over 1,500 signatories managing more than US$60 trillion in assets. That’s not fringe investing – that’s mainstream money recognizing that good business and good values go hand in hand.

The “E”: Environmental Criteria

Think of environmental criteria as your portfolio’s climate report card. You’re looking at how companies treat the planet – their carbon emissions, renewable energy usage, waste management practices, and overall approach to pollution and resource depletion.

Climate change isn’t just an environmental issue anymore – it’s a financial one. Smart investors recognize that companies aligned with climate goals are positioning themselves for long-term success. The Paris Agreement aims to limit global temperature increase to 1.5°C above pre-industrial levels, and companies that accept this reality are often better investments.

The shift is already happening. Massive capital flows are moving toward clean energy and sustainable technologies. Companies with strong environmental practices enjoy lower regulatory risks, reduced operational costs, and easier access to capital. Meanwhile, fossil fuel companies increasingly face the challenge of stranded assets and changing regulations.

You can approach environmental screening in two ways. Some investors completely avoid coal, oil, and gas companies – a strategy called negative screening. Others actively seek out leaders in renewable energy, electric vehicles, and energy efficiency technologies. Both approaches can work, depending on your comfort level and investment goals.

The “S”: Social Criteria

The social pillar is where socially responsible investing gets personal. It’s about how companies treat people – and that includes everyone from employees and customers to suppliers and entire communities.

Employee relations form the foundation here. Companies that prioritize workplace safety, fair wages, and diversity and inclusion tend to have happier, more productive workforces. That translates into better business performance over time.

Human rights practices matter too, especially in global supply chains. The UN Guiding Principles on Business and Human Rights provide a framework for evaluating how companies handle these responsibilities. When a company respects human rights, it reduces legal risks and builds stronger relationships with stakeholders.

Customer satisfaction and product safety reveal a lot about a company’s values. Companies that prioritize data security and protect customer privacy are building trust – and trust is incredibly valuable in today’s economy.

Community relations show how companies interact with the places where they operate. Do they invest in local development? Do they support education and healthcare initiatives? These activities often correlate with long-term business success.

Research consistently shows that companies with diverse leadership teams and inclusive cultures outperform their peers. When you invest in socially responsible companies, you’re betting on businesses that understand the value of treating people well.

The “G”: Governance Criteria

Governance is the often-overlooked foundation that holds everything together. It’s about how companies are actually run – their leadership structure, decision-making processes, and transparency practices.

Board composition matters enormously. Independent directors who aren’t afraid to challenge management help prevent costly mistakes. Executive pay that’s aligned with long-term performance encourages leaders to think beyond quarterly results.

Shareholder rights protect your interests as an investor. Companies that respect voting procedures and maintain transparent communication tend to be more trustworthy partners for your money.

Strong governance becomes especially important when you’re analyzing financial statements. Companies with effective audit committee structure and clear reporting practices make it easier to understand what you’re investing in.

The risks of poor governance are real and expensive. Bribery and corruption can destroy shareholder value overnight. Excessive lobbying and questionable political contributions can create reputational damage that takes years to repair.

The 2020 Wirecard scandal showed how poor governance can make billions of dollars disappear. Meanwhile, companies with strong governance practices tend to weather crises better and maintain investor confidence through difficult times.

When you choose companies with strong governance, you’re essentially picking business partners you can trust with your money for the long haul.

The Rise of Conscious Capitalism: Why SRI is Gaining Momentum

The surge in socially responsible investing (SRI) is no longer a side note—it is redefining mainstream finance. Global sustainable assets hit US$30.7 trillion in 2018, propelled by three forces:

- Financial materiality – ESG risks (from climate regulations to labor disputes) can dent profits, while ESG leaders often enjoy lower costs of capital and stronger brand loyalty.

- Client demand – Surveys show 85% of individual investors—especially millennials—prefer sustainable options when building wealth through investing.

- Regulation & fiduciary duty – Many jurisdictions now require ESG disclosure, and fiduciaries increasingly treat ESG as part of prudent risk management.

A Condensed History of Ethical Investing

- 1700s – Quakers and Methodists shun investments tied to slavery or weapons.

- 1960s–1980s – Vietnam War and South-African apartheid divestment prove investor pressure can drive social change.

- 1990 – Launch of the Domini 400 (now MSCI KLD 400) gives SRI its first performance benchmark.

- 2000s–Today – Climate-focused campaigns and fossil-fuel divestment accelerate, turning SRI into a global US$30 trillion market. For details, see the evolution of SRI.

Key Drivers and Global Frameworks

Global initiatives give socially responsible investing structure:

- UN Principles for Responsible Investment (PRI) – 1,500+ signatories, US$60 trillion AUM, six principles for ESG integration. Guidance: UN PRI.

- UN Sustainable Development Goals (SDGs) – 17 goals create investable themes such as clean energy or quality education.

- Paris Agreement – Net-zero pledges are redirecting capital away from high-carbon assets toward climate solutions.

The takeaway is simple: SRI has moved from moral choice to financial imperative. Ignoring ESG factors now poses a bigger risk than embracing them.

How to Build Your Ethical Portfolio: Key SRI Strategies

Building a socially responsible investing portfolio doesn’t have to be complicated. Think of it like choosing a restaurant – you can avoid places that don’t match your values, seek out ones that do great things, or even invest in opening a restaurant that serves exactly what your community needs.

The key is knowing what matters most to you. Maybe you want to avoid industries that harm people or the planet. Perhaps you’d rather focus on companies leading positive change. Or you might want your investments to create measurable impact in areas you care about.

For those just starting their journey with how to invest money, the good news is that SRI works across all asset classes and global markets. You can start simple and build complexity as you learn what works for your situation.

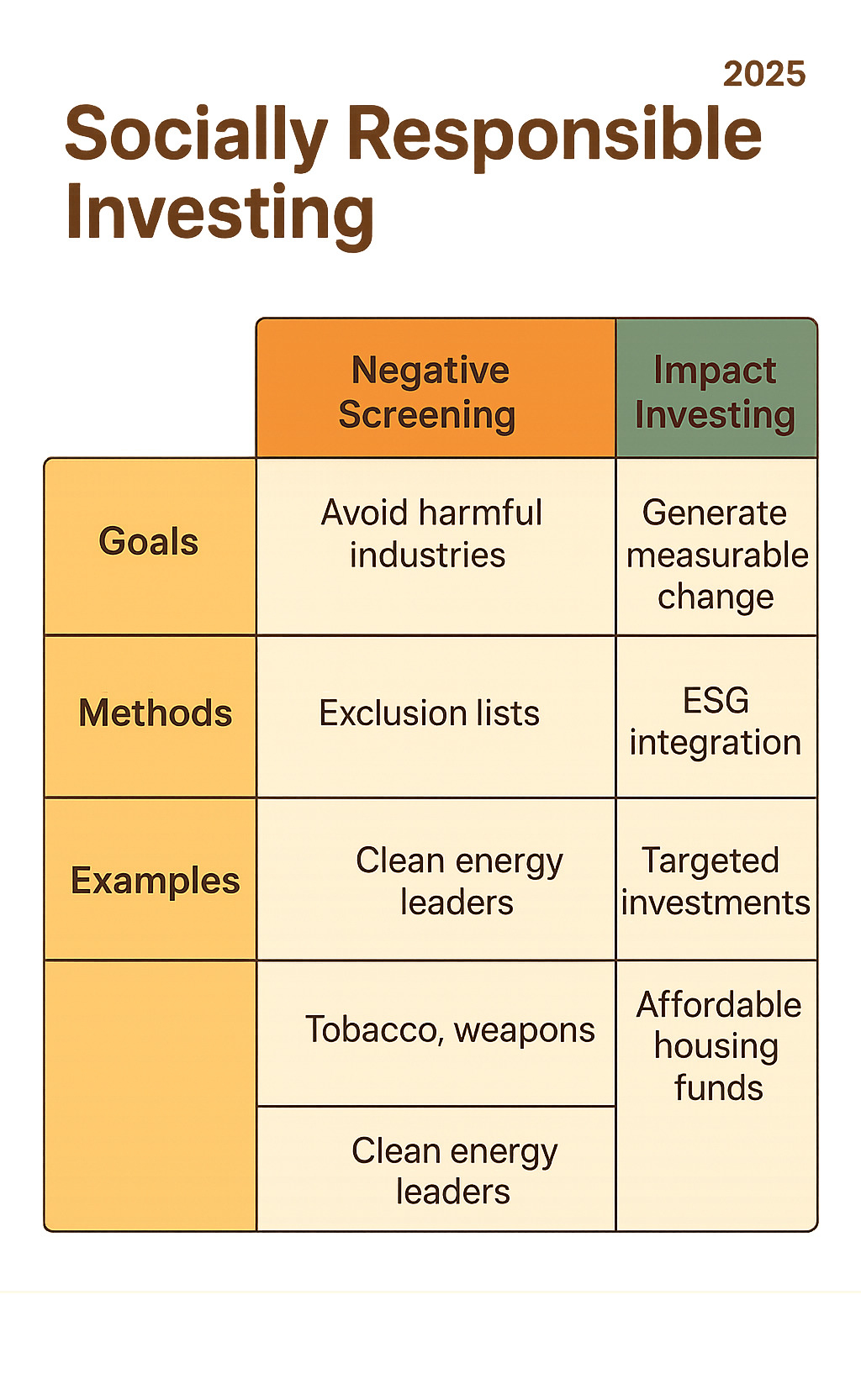

Negative Screening: Investing by Exclusion

Negative screening is like having a “no-fly list” for your portfolio. It’s the oldest form of socially responsible investing and still accounts for the largest chunk of SRI assets worldwide. The concept is beautifully simple: if you wouldn’t want to own a business, don’t invest in it.

This approach typically involves avoiding “sin” stocks – companies in industries that conflict with your values. The most common exclusions include tobacco companies, alcohol producers, gambling operations, weapons manufacturing, and increasingly, fossil fuels.

The power of divestment campaigns shows this strategy works. Over 220 educational institutions have committed to divesting their endowments from fossil fuels as of 2021. This collective action has made it harder and more expensive for these companies to raise capital, while pushing more money toward cleaner alternatives.

Getting started is easier than ever. Most major fund companies now offer screened versions of popular index funds that automatically exclude problematic companies. You can implement this strategy without picking individual stocks or doing extensive research.

Positive and Thematic Investing: Seeking Out the Good

While negative screening focuses on what to avoid, positive investing actively hunts for companies doing exceptional work. This best-in-class approach selects the top ESG performers within each industry, giving you broader diversification while maintaining your ethical standards.

The most sophisticated version is ESG integration – weaving environmental, social, and governance factors directly into investment analysis. Instead of just screening companies, this approach recognizes that strong ESG practices often signal better long-term business prospects.

Thematic investing takes this further by focusing on specific solutions the world needs. Popular themes include clean energy, sustainable agriculture, gender equality, and water conservation. These investments align perfectly with how to diversify your investment portfolio while targeting areas you’re passionate about.

This strategy works particularly well for investors who want to be part of the solution. Rather than just avoiding problems, you’re actively funding companies working to solve them.

Impact Investing: Generating Measurable Change

Impact investing is where socially responsible investing gets really exciting. This approach targets investments specifically designed to generate measurable social or environmental benefits alongside financial returns. Think of it as investing with a mission.

The market has exploded to an estimated $1.2 trillion as of 2022, according to the Global Impact Investing Network. That’s serious money flowing toward serious solutions.

Key Impact Investing Areas:

- Renewable Energy Infrastructure – Solar farms, wind projects, and energy storage

- Sustainable Agriculture – Vertical farming, precision agriculture, and food security

- Healthcare Access – Telemedicine, medical devices for developing markets

- Affordable Housing – Community development and housing finance

- Microfinance – Small loans for entrepreneurs in developing countries

Impact investing often involves direct investments in projects or companies specifically created to address challenges. As the New York Times noted, with impact investing, a focus on more than returns becomes the primary goal.

This approach appeals to investors who want to see concrete results from their money. You’re not just hoping your investments do good – you’re measuring the actual change they create.

Shareholder Advocacy and Community Investing

Sometimes the best way to create change is from the inside. Shareholder advocacy uses your ownership rights to influence corporate behavior through proxy voting, engaging with management, and filing shareholder resolutions on ESG issues.

The Interfaith Center on Corporate Responsibility leverages over $100 billion in combined portfolios to sponsor ESG shareholder resolutions. When shareholders speak with one voice, companies listen.

Community investing takes a different approach by directing capital toward underserved communities through Community Development Financial Institutions (CDFIs). These organizations provide financing for affordable housing, small businesses, and community services in areas traditional banks often overlook.

Both strategies work beautifully alongside traditional portfolio approaches. They’re particularly effective when combined with other SRI methods. If you’re interested in implementing these more advanced strategies, consider working with professionals who understand the role of financial advisors in wealth management.

The beauty of modern SRI is that you can mix and match these approaches based on your values, financial goals, and desired level of involvement. Start with what feels comfortable, then expand as you gain experience and confidence.

The Performance Question: Does Socially Responsible Investing Sacrifice Returns?

The data say no—you can pursue strong returns and stick to your principles. Roughly 90% of academic studies find a neutral or positive link between ESG factors and performance.

- The MSCI KLD 400 Social Index averaged 9.51% annually (1990–2009) versus 8.66% for the S&P 500.

- A 2020 Arabesque review showed 80% of studies tied good sustainability practices to superior returns.

- Morgan Stanley’s analysis of 10,000 funds concluded that “strong-sustainability” portfolios outperformed “weak-sustainability” peers.

Why ESG Can Boost, Not Hurt, Returns

- Risk reduction – Companies with solid ESG programs face fewer fines, lawsuits, and reputational hits.

- Operational efficiency – Energy savings, lower turnover, and better stakeholder relations improve margins.

- Cost of capital – Investors increasingly reward ESG leaders with cheaper financing.

The Hidden Cost of Ignoring ESG

Neglecting ESG can devastate shareholder value:

- Vale dam collapse (2019) – Environmental negligence triggered at least US$7 billion in costs.

- Wirecard fraud (2020) – Governance failures wiped out the firm overnight.

Such episodes highlight why socially responsible investing is as much about managing downside risk as it is about doing good.

For newcomers, the lesson is clear: aligning your money with your values does not mean settling for less—it can actually be the smarter financial choice.

Frequently Asked Questions about Socially Responsible Investing

Is SRI only for wealthy or institutional investors?

Not at all! This is one of the biggest misconceptions about socially responsible investing. The truth is that SRI has become incredibly accessible to everyday investors through mutual funds, ETFs, and robo-advisors. Many options come with low investment minimums and reasonable fees, making it a viable strategy for anyone interested in investing 101: A beginner’s guide to growing your money.

Today’s SRI landscape looks completely different than it did even a decade ago. You can find low-cost ETFs with expense ratios as low as 0.09%, mutual funds with reasonable minimums, and robo-advisors offering automated SRI portfolios. Individual stock screening tools are now available through most online brokers, and many target-date funds incorporate ESG factors automatically.

The democratization of SRI means that investors with modest portfolios can access the same strategies previously available only to institutions. Whether you’re starting with $100 or $10,000, you can build a socially responsible portfolio that reflects your values without breaking the bank.

How can I be sure a fund is truly “socially responsible” and not just “greenwashing”?

This is a smart question that every conscious investor should ask. The key is doing your homework and looking for transparency in a fund’s methodology and holdings. Start by reading the prospectus carefully – legitimate SRI funds provide detailed explanations of their screening criteria and investment process.

Check independent ESG ratings from firms like Morningstar or MSCI, and look for adherence to recognized standards like the CFA Global ESG Disclosure Standards for Investment Products. Review the fund’s complete holdings list to see what companies they actually own, not just what they claim to avoid.

Be wary of funds that use vague language about “sustainability” without specific criteria. Legitimate SRI funds will tell you exactly how they define “socially responsible” and provide regular impact reporting. Understanding the fund manager’s track record and examining their ESG activities over time can also help you separate genuine commitment from marketing fluff.

Can I practice socially responsible investing in my 401(k) or retirement account?

Absolutely! Many retirement plans now offer SRI or ESG fund options as standard choices. The growth of socially responsible investing in retirement plans reflects increasing demand from participants who want to align their long-term savings with their values.

If your current plan doesn’t offer SRI options, don’t give up. You can advocate for their inclusion by contacting your plan administrator or HR department. Many companies are responsive to employee requests, especially when multiple people express interest.

Another option is using a self-directed IRA to have more control over your investment choices. This allows you to invest in a broader range of SRI funds and individual stocks that might not be available in your employer’s plan.

You can also supplement with SRI investments in taxable accounts while keeping conventional investments in your retirement plan. Many investors find that target-date funds that incorporate ESG factors provide a simple way to get started with socially responsible retirement investing without having to manage individual fund selections.

Conclusion

Socially responsible investing proves that you don’t have to choose between profits and principles. After diving deep into the strategies, performance data, and real-world examples, one thing becomes crystal clear: you can build wealth while supporting the changes you want to see in the world.

The evidence speaks for itself. With 90% of studies showing a non-negative relationship between ESG factors and financial performance, and global sustainable investing assets reaching US$30.7 trillion, this isn’t some fringe movement anymore. It’s become mainstream investing.

Think about what we’ve covered together. SRI has evolved from simple exclusions of “sin stocks” to sophisticated strategies that help you identify tomorrow’s winners. The companies leading on environmental sustainability, social responsibility, and good governance aren’t just doing the right thing – they’re often the smartest long-term investments.

Your portfolio can now reflect your values without sacrificing returns. Whether you choose negative screening to avoid industries you don’t support, positive investing to back ESG leaders, or impact investing to generate measurable change, you have options that fit your comfort level and goals.

The accessibility revolution means you don’t need millions to get started. Low-cost ETFs, robo-advisors, and mutual funds have democratized socially responsible investing. You can begin with whatever amount you have and gradually build a portfolio that grows your wealth responsibly.

What excites us most at Finances 4You is how socially responsible investing empowers you to vote with your dollars every day. Every investment decision becomes a chance to support companies building a better future while building your own financial security.

The risks of ignoring ESG factors are becoming clearer too. From the Vale dam collapse to the Wirecard fraud, we’ve seen how poor environmental, social, and governance practices can destroy shareholder value overnight. Smart investors are recognizing that ESG isn’t just about values – it’s about identifying material risks that could impact their returns.

Ready to align your portfolio with your principles? The strategies and tools we’ve shared give you everything you need to start investing responsibly today. Building wealth and supporting positive change aren’t competing goals – they’re complementary ones.

Your financial future and the world’s future are connected. By choosing socially responsible investing, you’re not just growing your net worth – you’re investing in the kind of world you want to leave behind.

Explore our comprehensive Resource Guide for Investors to continue your journey toward building wealth that matters.