Why Understanding USD to AUD Exchange Rates Matters for Your Financial Goals

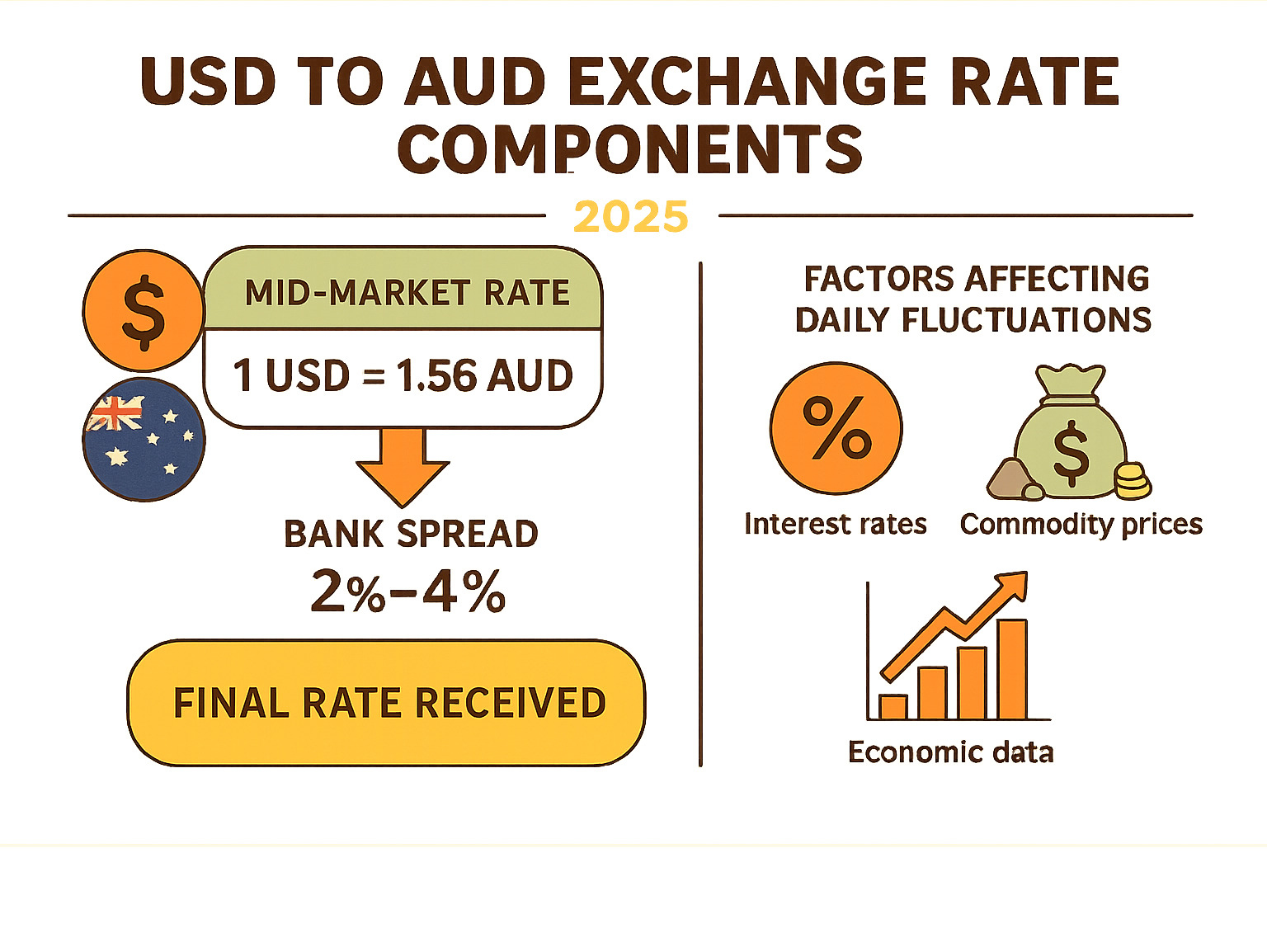

The usd to aud exchange rate determines how many Australian dollars you’ll receive for every US dollar you exchange. As of recent data, this rate fluctuates around 1.56 AUD per USD, but it changes constantly throughout the trading day.

Quick USD to AUD Facts:

- Current Rate: Approximately 1 USD = 1.56 AUD (mid-market rate)

- 30-Day Range: 1.5561 to 1.6794 AUD per USD

- Annual Change: Down 2.78% over the past year

- Best Conversion Time: Weekdays during market hours (3-4 PM GMT)

Whether you’re planning a trip to Australia, sending money overseas, or managing investments, the USD to AUD exchange rate directly impacts your purchasing power. Small rate differences can mean hundreds of dollars on larger transactions.

The rate you see quoted online (called the mid-market rate) isn’t always what you’ll pay. Banks and money transfer services add their own fees and margins, which can reduce your actual conversion by 2-4%.

Three main factors drive USD to AUD movements:

- Interest rate differences between the Federal Reserve and Reserve Bank of Australia

- Commodity prices (especially iron ore and coal, which Australia exports heavily)

- Economic data from both countries, including inflation and employment reports

Understanding these basics helps you time your conversions better and avoid costly mistakes. For high earners dealing with lifestyle inflation, getting the best exchange rate on international transactions can free up hundreds of dollars for debt reduction or wealth building.

Global Forces Driving the USD/AUD Pair

The usd to aud exchange rate responds to real economic forces happening in both the United States and Australia. Think of it like a financial tug-of-war between two economies.

Interest rates are the biggest player in this game. When the Federal Reserve raises rates faster than the Reserve Bank of Australia, US investments become more attractive. Money flows toward higher returns, strengthening the USD against the AUD.

Inflation data from both countries creates immediate ripple effects. If prices rise faster in America than Australia, the Fed might need to raise rates more aggressively than the RBA, usually meaning a stronger dollar.

Commodity prices tell Australia’s story. The country exports tons of iron ore and coal overseas, so when these prices climb, the Australian economy benefits and the currency often strengthens.

The trade balance between exports and imports affects both currencies differently. Australia’s heavy reliance on commodity exports to China makes the AUD particularly sensitive to Chinese economic news.

Risk sentiment plays a fascinating role. When global markets get nervous, investors rush to the US dollar like a financial security blanket. The AUD doesn’t get the same “safe haven” treatment.

Scientific research on currency volatility confirms that commodity currencies like the AUD show higher volatility than traditional reserve currencies. This explains why the USD/AUD pair has maintained volatility of about 0.48% over the last 30 days.

How Inflation and Interest Rates Shape usd to aud

Interest rate differences between countries are like magnets for international money. When the Federal Reserve raises rates faster than the Reserve Bank of Australia, it creates a “yield advantage” for US investments.

Here’s how it works: If you can earn 5% on a US government bond but only 3% on an Australian one, most investors choose the higher return. That demand strengthens the USD against the AUD.

Consumer Price Index (CPI) data from both countries directly influences central bank decisions. When US inflation runs hotter than Australian inflation, the Fed often needs to raise rates more aggressively.

The yield spread between US and Australian government bonds has become a reliable predictor of currency movements. When US 10-year Treasury yields exceed Australian 10-year bond yields by more than 1%, the USD tends to strengthen significantly against the AUD.

Commodities and China’s Demand Curve

Australia’s economy runs on what comes out of the ground. Iron ore and coal represent a massive portion of the country’s export earnings, making the AUD incredibly sensitive to global commodity price swings.

China purchases roughly 40% of Australia’s iron ore exports. When Chinese GDP growth accelerates, it typically increases demand for Australian commodities, which strengthens the AUD against the USD.

A 10% increase in iron ore prices typically correlates with a 2-3% strengthening of the AUD against the USD over the following month. This relationship has been particularly strong over the past decade as China’s infrastructure development accelerated.

This commodity connection explains why the usd to aud rate can move dramatically on Chinese economic announcements, even when US and Australian economic data remains unchanged.

Tracking the usd to aud Live Rate

Getting the best usd to aud exchange rate starts with understanding the mid-market rate – the fair price between what buyers and sellers are willing to pay.

Currently, the usd to aud pair trades around 1.5207 to 1.5746 AUD per USD. Over the past year, this rate has swung from 1.4454 to 1.6794 – a significant range if you’re moving serious money.

Recent 30-day numbers show the high hit 1.6794 AUD per USD while the low touched 1.5561, with a 2.60% drop over this period. The 90-day window shows a 3.03% decline, with volatility at about 0.48%.

USD to AUD Exchange Rate data from Bloomberg provides institutional-grade pricing that updates throughout the trading day.

| Time Period | Change | High | Low | Average |

|---|---|---|---|---|

| Daily | -0.05% | 1.5408 | 1.5307 | 1.5360 |

| Weekly | -1.07% | 1.5715 | 1.5376 | 1.5603 |

| Monthly | -0.40% | 1.6794 | 1.5561 | 1.5922 |

| Yearly | +2.16% | 1.6794 | 1.4454 | 1.5268 |

Best Tools to Monitor usd to aud

Mobile apps have changed the game, putting professional-grade usd to aud tracking in your pocket. Most update every few seconds during market hours, so you’re never working with stale information.

Rate alerts are your secret weapon for timing conversions perfectly. Instead of obsessively checking rates, set up notifications that ping you when the market hits your target.

API feeds offer the most accurate information available, providing institutional-quality data that updates constantly during trading hours.

For those managing multiple currencies alongside crypto, our Crypto Calculator helps you see how currency movements affect your entire portfolio.

Setting Alerts for Favorable usd to aud Levels

Smart alert strategies help you catch favorable usd to aud movements without constant monitoring. Set realistic targets that actually happen, not fantasy rates.

For travelers, setting alerts about 2-3% better than current rates often captures good movements within 30-60 days. Business owners making regular payments might want tighter ranges around 0.5-1%.

Combine rate targets with time limits. Set an alert for 1.58 AUD per USD, but also decide you’ll convert within 30 days regardless. This prevents waiting for perfect rates that might never come.

Converting USD to AUD: Methods, Fees, and Practical Tips

The method you choose for converting USD to AUD can dramatically impact how much money ends up in your pocket. The difference between best and worst options can cost hundreds of dollars on larger transactions.

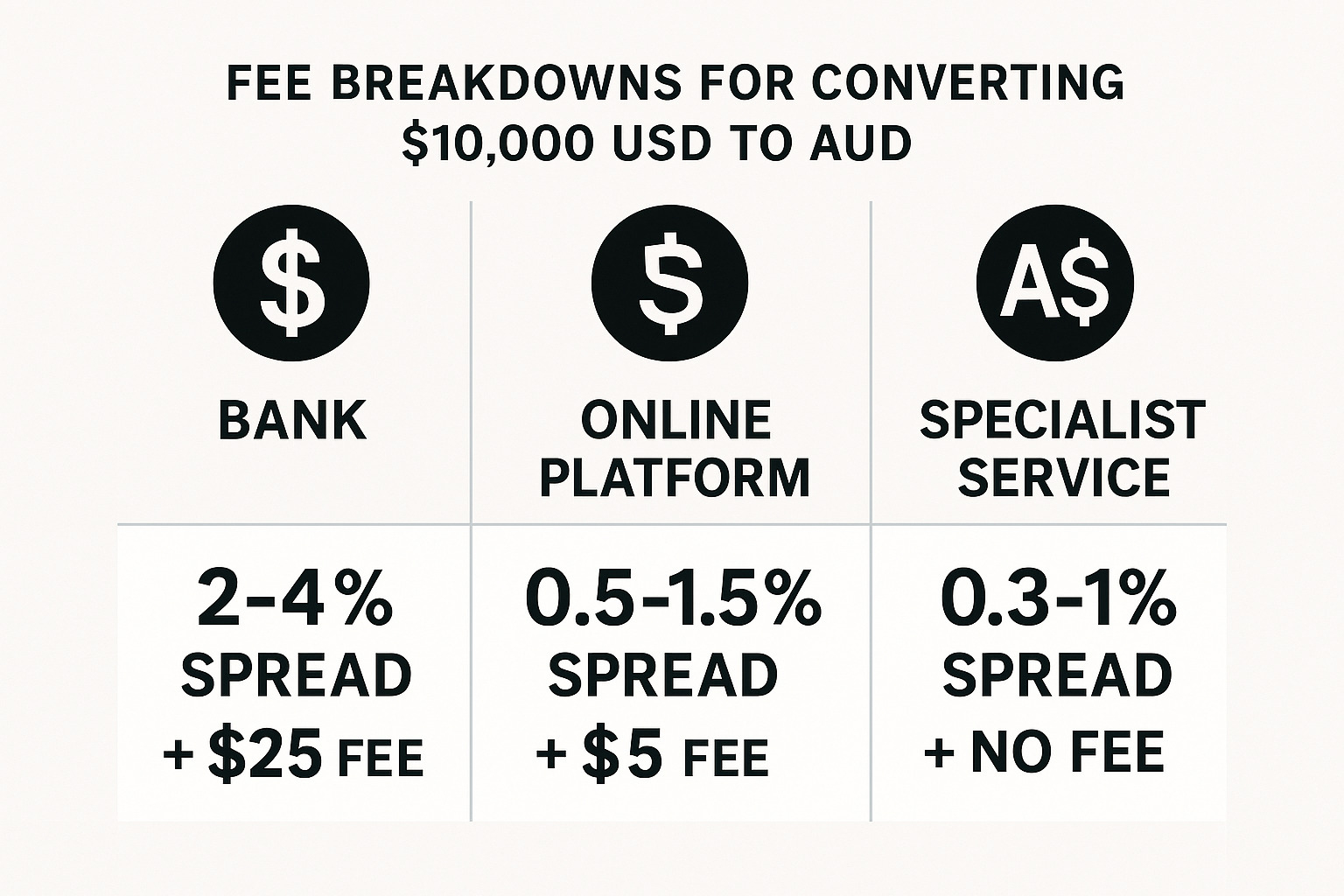

Banks are familiar but expensive. They typically provide some of the worst usd to aud exchange rates, charging spreads of 2-4% above mid-market rates, plus transfer fees of $15-50.

Online platforms offer better rates. These specialized services often provide rates within 0.5-1.5% of the mid-market rate. The trade-off is account creation and verification, with transfers taking a day or two longer.

Money transfer operators split the difference. They provide competitive rates with transparent fees, particularly good for regular transfers or larger amounts.

The spread is where providers make money. A bank might offer 1.51 AUD per USD when the mid-market rate is 1.56, pocketing that difference. On $10,000, that’s $500 less in your pocket.

Our guide on Best Online Calculators for Your Financial Planning includes tools to compare true costs of different currency exchange options.

Step-by-Step: How to Convert Cash or Send Money

Airport kiosks offer convenience but typically charge 5-8% worse than mid-market rates. Fine for $100-200 immediate expenses, but avoid for larger amounts.

ATMs in Australia often offer better rates than airport exchanges. However, your US bank might charge international fees of $3-5 per withdrawal plus percentages.

Digital platforms now offer rates within 1-2% of mid-market rates and complete transfers within hours. You can initiate transfers from your phone anytime.

Here’s a real $5,000 USD conversion example:

- Mid-market rate at 1.56 AUD per USD: $7,800 AUD

- Your bank at 1.51 AUD per USD: $7,550 AUD (lose $250 AUD)

- Good online platform at 1.55 AUD per USD: $7,750 AUD (save $200 AUD vs bank)

Cutting Costs & Getting the Best Rate

Compare providers – calculate total Australian dollars you’ll receive after all fees, not just advertised rates.

Avoid weekend trades. Currency markets close weekends, so rates are often less favorable and transactions get delayed.

Bulk transfers open better rates. Some providers offer significant improvements for transfers over $25,000, sometimes within 0.3% of mid-market rates.

Smart timing matters. Convert during high-liquidity hours between 3-4 PM GMT when both markets overlap. For large transfers, consider splitting across multiple days to average out fluctuations.

Forecasts, Historical Trends & Investment Strategies

The usd to aud exchange rate has danced between 1.4454 and 1.6794 over the past year – a 16% swing that could make or break financial plans. On $10,000, timing could save over $1,500.

The decade view reveals dramatic movements. In March 2020, the rate shot to 1.7406 as investors dumped everything for US dollars. We saw rates drop to around 1.20 in 2021 when commodity prices surged.

Hedging strategies become essential with regular currency exposure. Forward contracts let you lock in today’s rate for future transactions.

Diversification across currencies reduces risk. Our insights on Digital Currency Investment show how cryptocurrency might fit this strategy.

What Analysts Expect for usd to aud in the Next 12 Months

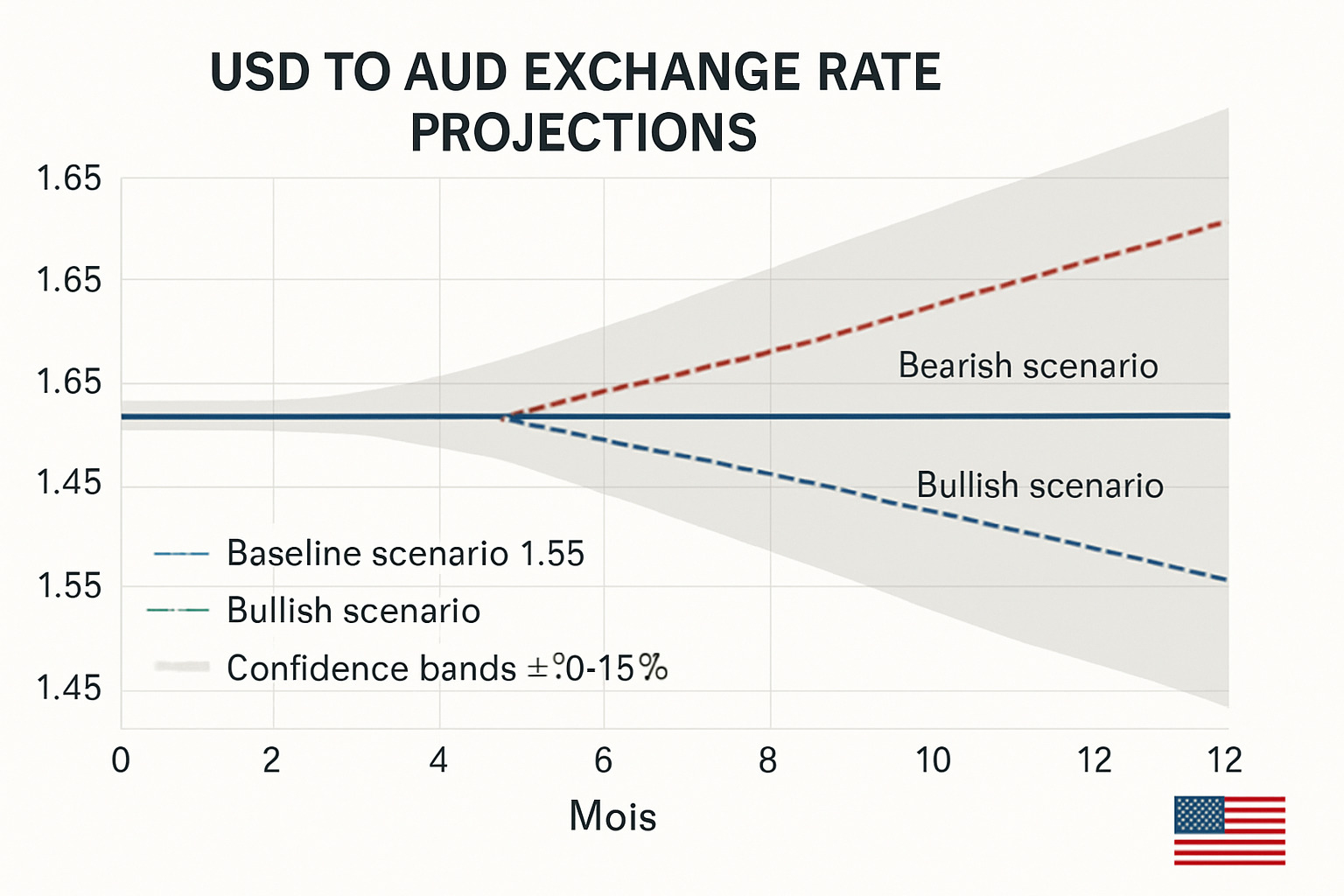

Major investment banks expect the usd to aud rate to trade between 1.50-1.60, assuming modest Fed rate cuts while the RBA stays put.

Bullish scenarios for the Australian dollar depend on China’s economy strengthening and increased demand for Australian commodities. Add surprise RBA rate hikes, and the AUD could strengthen significantly.

Bearish scenarios see continued US outperformance while other economies struggle. Global tensions typically drive investors back to dollar safety.

Confidence bands around forecasts typically run ±10-15%. Professional forecasters get direction right about 60% of the time.

Impact on Travelers, Businesses, and Investors

Currency swings hit wallets unexpectedly. A 10% usd to aud rate move could add or subtract $500 from a $5,000 vacation budget.

Import costs create business headaches. A company importing $100,000 monthly essentially gambles $10,000 every time rates move 10%.

Portfolio returns tell complex stories. Australian stock investments might gain 10%, but adverse currency moves can wipe out gains.

Forward contracts offer businesses certainty by locking in rates for future payments. Invoice timing becomes strategic – speed up collections when currencies favor you, slow payments when rates work against you.

Frequently Asked Questions about USD to AUD

What is the current USD to AUD exchange rate?

The usd to aud exchange rate changes constantly, typically hovering around 1.52 to 1.57 AUD per USD, with the mid-market rate at approximately 1.561 AUD per USD.

This mid-market rate updates every few seconds during trading hours (Sunday evening through Friday evening US time). However, you won’t get this exact rate when exchanging money – banks and services add 1-4% margins for profit.

For accurate, real-time rates, financial data providers like Bloomberg or Reuters show actual professional market activity.

Why do rates differ between providers?

Providers offer different rates due to varying business models and cost structures.

Banks typically offer worst rates because they run expensive operations and view currency exchange as a profit center. Their overhead costs get passed to customers through wider spreads.

Online money transfer services offer better usd to aud rates because they’ve built entire businesses around currency exchange with lower operating costs.

The spread tells the story – banks charge 3-4% spreads while specialized services often charge just 0.5-1.5%. On $10,000, that difference saves $150-250.

Watch for “no fees” traps. Some advertise great rates but charge high transfer fees. Always calculate total amount received.

Are there limits on transferring USD to AUD?

Yes, limits exist but aren’t overly restrictive. They depend on transfer method and provider.

Bank wire transfers typically allow $25,000-$100,000 daily for individual accounts. Higher amounts usually require a phone call and documentation.

Money transfer services often start new customers at $2,500-$10,000 limits, increasing quickly with verification.

Government reporting kicks in over $10,000 under the Bank Secrecy Act (US) and similar Australian rules. You can send larger amounts – there’s just more paperwork.

Cash transactions face strictest rules. Both countries require declaring amounts over $10,000 when crossing borders.

Conclusion

Getting the best usd to aud exchange rate isn’t just about saving a few dollars here and there – it’s about making smart financial decisions that add up over time. Whether you’re planning that dream Australian vacation or managing international business payments, understanding how currency markets work puts money back in your pocket.

The timing game really does matter. We’ve seen how converting during weekday market hours, especially around 3-4 PM GMT, typically gives you better rates than weekend or holiday exchanges. Those airport kiosks might be convenient, but they’re also convenient ways to lose hundreds of dollars on larger transactions.

Your choice of provider makes a bigger difference than you might think. While your local bank feels safe and familiar, specialized currency services often save you 2-3% on every transaction. On a $10,000 conversion, that’s $200-300 staying in your account instead of going to bank fees.

The usd to aud pair moves for real reasons – interest rate changes, commodity price swings, and global economic shifts. You don’t need to become a currency trader, but understanding these basics helps you spot good opportunities. When iron ore prices surge or the Federal Reserve hints at rate cuts, these events ripple through to exchange rates.

Setting up rate alerts is like having a personal assistant watching the markets for you. Instead of checking rates obsessively, let technology notify you when favorable movements happen. This approach captures opportunities without the stress of constant monitoring.

We’ve shown you how the pair’s 16% range over the past year created real opportunities for savvy converters. Some people saved thousands just by timing their exchanges better.

At Finances 4You, we know that smart currency decisions are part of building wealth that aligns with your life stage. Every dollar you save on exchange rates is another dollar working toward your financial goals. Our curated insights help you see these connections between seemingly small financial decisions and your bigger wealth-building picture.

Ready to dive deeper into investment strategies? Check out our comprehensive resources on investing to see how currency movements fit into your overall portfolio strategy.

Here’s the bottom line: Currency markets never sleep, but you don’t need to lose sleep over them. With the right tools, a basic understanding of what moves rates, and some patience, you can optimize your USD to AUD conversions and focus on what really matters – achieving your financial dreams.