Taking Control of Your Financial Future

Wealth management for 30s is about building a strategic framework to grow your assets, protect what you’ve built, and enjoy your life today. For professionals in their 30s seeking immediate guidance, here are the essential components:

- Emergency Fund: Build 3-6 months of expenses

- Retirement Savings: Aim for 10-15% of income (increase by 1% annually)

- Debt Management: Prioritize high-interest debt while investing

- Insurance: Secure term life and disability coverage

- Diversification: Maintain 60-80% stocks for long-term growth

- Estate Planning: Create basic will and powers of attorney

Your 30s represent a critical decade for wealth building with potentially higher income than your 20s but fewer responsibilities than your 40s and beyond.

“We spend a good deal of our childhood wishing our youth away. We tell ourselves, ‘I can’t wait to be an adult so I can do whatever I want!’ By the time we reach our 30’s we’ve come to learn that with the power of choice, comes the burden of responsibility,” notes one financial expert.

The Social Security Administration reports young workers have a 26.8% chance of being disabled for 12 months or longer before reaching retirement age—highlighting why protection strategies matter alongside growth goals.

Find more about wealth management for 30s:

– Building wealth in 30s

– Life insurance 30s

– Saving for kids college

Why Wealth Management Matters in Your 30s

Your 30s mark a genuine turning point in your financial life. This decade brings career momentum, climbing earnings, and big life decisions that will echo through your financial future. Those with a plan pull ahead, while those without one often struggle to catch up.

For women especially, wealth management for 30s carries extra weight. The gender pay gap (82 cents to each dollar earned by men in 2021) combined with women’s longer average lifespans creates a compelling case for maximizing every financial opportunity during this critical decade.

The Social Security Administration’s research shows younger workers face a 26.8% chance of experiencing disability for 12+ months before retirement age – a stark reminder that protection strategies need to sit alongside growth goals.

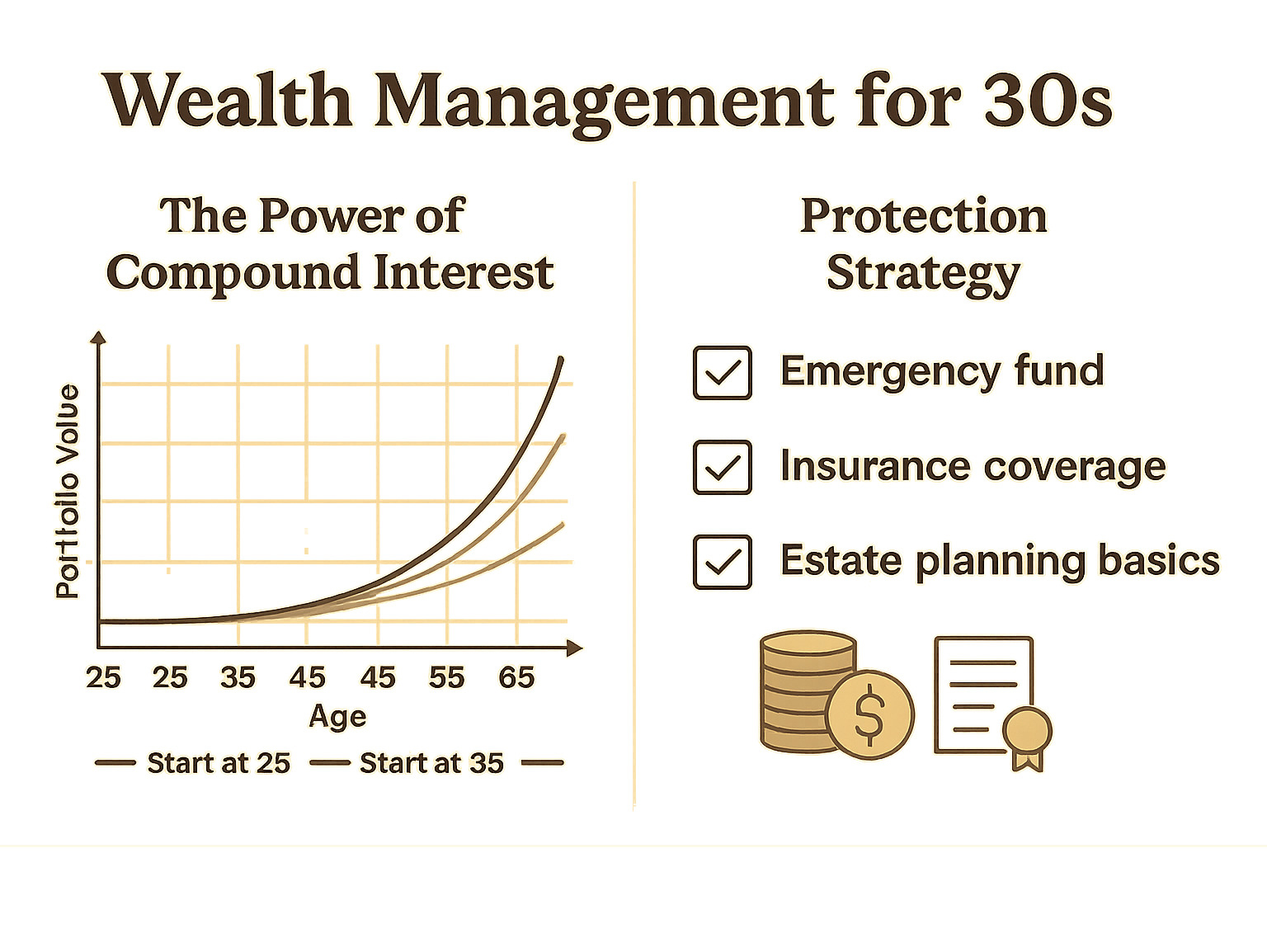

The Power of Time & Compound Returns

The most magical wealth-building tool in your 30s is time. Even if you feel behind compared to peers who started investing earlier, you still have 30+ years until traditional retirement.

This runway lets you harness compound returns. The Rule of 72 shows this beautifully – divide 72 by your expected annual return to see how quickly your money doubles:

- At 7% annual returns, your money doubles every 10.3 years

- At 9% annual returns, your money doubles every 8 years

This means money invested at 30 could potentially double 3-4 times before you hit 65!

Major Life Milestones Arrive Fast

Your 30s often bring significant life events with major financial implications: home purchases with substantial down payments, weddings (average cost: $26,645), starting families (raising a child to 18 averages $245,000), and career pivots.

Each milestone deserves celebration – but without thoughtful wealth management for 30s, these joyful life changes can become sources of financial stress. The key is creating a financial framework that supports your life choices rather than constrains them.

Crafting a Comprehensive Financial Plan

A comprehensive financial plan is your personal roadmap to building wealth that aligns with what truly matters to you. At Finances 4You, we recommend reviewing your plan at least annually, plus extra check-ins whenever major life events happen.

Set & Price Your Short-, Mid-, Long-Term Goals

Effective wealth management for 30s starts with specific targets and real numbers. Vague goals like “save more” don’t work.

Short-term goals (1-3 years) might include building an emergency fund, saving for a wedding, or planning a vacation. Mid-term goals (3-10 years) could focus on education funds, buying property, or funding a career pivot. Long-term goals (10+ years) typically center around financial independence and retirement.

For each goal:

1. Calculate the actual cost (including inflation)

2. Set a target date

3. Rank it against other priorities

4. Determine the monthly savings needed

Budgeting & Managing Expenses Without Lifestyle Inflation

The silent wealth-killer in your 30s is lifestyle inflation – upgrading your life as your paycheck grows.

We recommend zero-based budgeting for wealth management for 30s, giving every dollar a specific job before the month begins. If that’s too intense, try the 50/30/20 rule: 50% toward necessities, 30% for discretionary spending, and 20% for savings and debt payoff.

Today’s budgeting apps make tracking almost effortless. The magic happens when you review your numbers monthly, noticing patterns and making adjustments.

Build Safety Nets: Emergency Fund & Core Insurance

Before chasing investment returns, build proper financial safety nets.

Your emergency fund should cover 3-6 months of must-pay expenses in a high-yield savings account. If you’re self-employed or have unpredictable income, aim for the higher end of that range.

Insurance is crucial to wealth management for 30s. Your protection portfolio should include comprehensive health insurance, term life insurance if others depend on your income, and disability coverage (remember, over 25% of today’s 20-year-olds will experience a disability before retirement).

Complete your protection with appropriate property insurance, auto coverage with adequate liability limits, and consider an umbrella policy once your net worth exceeds $500,000.

Learn more about creating your financial plan with our guides on financial advice for 30s and life insurance 30s.

Saving & Investing Strategy for 30-Somethings

Your 30s are the sweet spot for investment growth. With retirement still in the distance, you can accept strategic risks that fuel long-term wealth while leveraging tax advantages.

How Much Should You Be Saving & Investing?

Most financial pros suggest saving 10-15% of your gross income during this decade. At Finances 4You, we believe in gradual improvement: start where you are and increase your savings rate by 1% each year, aiming for 20% by the end of your 30s.

Capture raises and bonuses for your savings before lifestyle inflation takes hold. By 35, try to have approximately 1.5 times your annual salary saved for retirement, increasing to 3 times your salary by 40.

Picking the Right Accounts & Order of Operations

For optimal wealth management for 30s, follow this investment strategy:

- Contribute to your employer’s retirement plan up to the match (free money)

- Maximize contributions to a Health Savings Account (HSA) if eligible (triple tax advantage)

- Fund a Roth or Traditional IRA based on your tax situation

- Max out your employer retirement plan beyond the match

- Consider 529 College Savings Plans if you have children

- Direct additional investments to taxable brokerage accounts

Asset Allocation & Diversification for Growth

With 25-35 years until retirement, your portfolio should lean toward growth. For most people in their 30s, this means allocating 70-90% to stocks.

Consider spreading your stock investments across U.S. large-cap stocks (40-50%), U.S. small/mid-cap companies (10-15%), international developed markets (15-25%), and emerging markets (5-10%). The remaining 10-30% can go toward bonds, primarily through total bond market funds.

For additional diversification, consider allocating up to 10% in alternative assets like Real Estate Investment Trusts (REITs).

Many successful investors in their 30s use “lazy portfolios” with low-cost index funds or ETFs that provide broad market exposure with minimal management. Simply rebalance annually to maintain your target allocation.

For more guidance on building a diversified portfolio, check out our guide on how to diversify your investment portfolio.

Debt, Risk Management & Asset Protection

Effective wealth management for 30s requires finding the balance between paying down debt, growing assets, and protecting your financial future.

Crushing High-Interest Debt Strategically

Not all debt deserves the same treatment. Credit cards charging 18-24% interest are financial emergencies, while a mortgage at 3.5% is less urgent. Financial experts typically recommend allocating up to 20% of your income toward accelerated debt repayment, focusing first on the most toxic debts.

“I always tell my clients to think of high-interest debt as an investment opportunity in reverse,” says one financial advisor. “Paying off a credit card with 20% interest is like getting a guaranteed 20% return on your money.”

For tackling multiple debts, use either the debt avalanche method (highest-interest first) or the debt snowball method (smallest balances first). Check your credit reports annually through annualcreditreport.com to catch errors and monitor your financial reputation.

Insurance & Legal Shields for Your Growing Net Worth

As your assets grow, evolve your insurance and legal safeguards:

Insurance needs mature with you. Consider increasing liability coverage as your net worth grows and raising deductibles once your emergency fund is solid. Term life insurance becomes especially important if others depend on your income, with most financial planners recommending coverage of 10-12 times your annual salary for primary breadwinners.

Legal protections aren’t just for the wealthy. Basic estate planning documents become essential in your thirties:

– A will (critical if you have children)

– Financial power of attorney

– Healthcare directive

– Updated beneficiary designations on all accounts

Laying Groundwork for Generational Wealth

Your thirties are perfect for thinking beyond your immediate financial horizon. Opening 529 college savings plans early maximizes tax-free growth potential. Consider whether a trust might benefit your family situation as your assets grow.

Don’t overlook digital asset planning for your online financial accounts and digital property. Building generational wealth isn’t just about passing down money—it’s about passing down financial wisdom and opportunities. Learn more about creating lasting financial legacies through building generational wealth through smart planning.

Boosting Income & Career Capital

While controlling expenses is important, the real financial magic happens when you focus on growing your income—and your 30s are the perfect time to boost your earning potential.

Pivoting or Leveling-Up Your Career in Your 30s

Your 30s are often the perfect moment for career reinvention. By now, you know what energizes you, and you still have decades to benefit from a strategic pivot.

Before pursuing advanced education, calculate the ROI by comparing potential income increases against costs and time investment. Sometimes targeted certifications deliver better returns than full degree programs.

Salary negotiations become increasingly important in this decade. Come prepared with market research and documented achievements. Studies show professionals who stay at companies longer than two years earn about 50% less over their lifetime than those who strategically change positions.

For women especially, addressing the gender pay gap requires proactive negotiation to prevent the disparity from compounding over decades.

Monetizing Skills & Hobbies for Extra Cash Flow

Creating multiple income streams diversifies your finances and can provide fulfillment outside your day job.

Gig economy platforms like Upwork and Fiverr connect you with clients worldwide for flexible opportunities to monetize your skills.

Passive income streams deserve special attention in your wealth management for 30s strategy. Unlike trading time for money, these revenue sources work while you sleep—think dividend stocks, rental properties, or digital products.

Content creation through YouTube, podcasting, or blogging can generate advertising revenue, sponsorships, and product sales opportunities.

Even an extra $750 monthly—invested consistently with compound growth—could add hundreds of thousands to your retirement nest egg. More importantly, multiple income streams provide a safety net should your primary income be disrupted.

Frequently Asked Questions about Wealth Management for 30s

How often should I update my financial plan?

We recommend a thorough review once a year, ideally with a financial professional who can provide objective insights. Between annual check-ups, quarterly mini-reviews help you stay on track.

The most critical times to revisit your plan are during major life changes: marriage, divorce, having children, career changes, home purchases, receiving inheritances, or facing health challenges.

What’s the best way to balance short-term fun with long-term saving?

Wealth management for 30s is about building a life you enjoy today while preparing for tomorrow. Automate your savings before you see the money, then create dedicated “fun funds” for guilt-free spending on things that truly bring you joy.

For bigger experiences, save a little each month in a dedicated account. Focus your spending on what genuinely matters to you, not what social media suggests should matter. Practice gratitude for what you have rather than constantly looking at what others possess.

Do I really need estate planning documents already?

“I’m too young to need a will” might be the most expensive assumption of your 30s. If you have children, estate documents are absolutely critical—without a will naming guardians, courts will decide who raises your kids if something happens to you.

Even without children, basic documents serve crucial purposes:

– Powers of attorney allow someone you trust to handle your finances if you’re temporarily unable to

– Healthcare directives ensure medical decisions align with your wishes

– Proper beneficiary designations prevent your assets from being distributed according to generic state laws

Wealth management for 30s isn’t just about building assets; it’s about protecting what matters most.

Conclusion

Your 30s are a balancing act—enjoying life today while building for tomorrow, tackling debt while growing investments, and protecting your assets while embracing strategic risks for growth. This is what makes wealth management for 30s both challenging and rewarding.

At Finances 4You, we’ve seen how the habits established during this pivotal decade can compound dramatically over time. The financial systems you build now aren’t just short-term solutions—they’re the foundation for your future financial independence.

Think of wealth management as a journey rather than a destination. Life evolves, markets shift, and your financial plan needs regular tune-ups to stay aligned with your changing circumstances and goals.

By implementing these strategies—from creating a comprehensive financial roadmap to investing strategically, managing debt wisely, and growing your income—you’re creating space for what truly matters in life.

Perfect is the enemy of good when it comes to wealth management for 30s. You don’t need to implement every strategy at once. The simple act of starting—wherever you are, with whatever resources you have—puts you ahead of most of your peers.

Explore our additional resources for more specific guidance:

- How to diversify your investment portfolio

- Building generational wealth through smart planning

- Browse all wealth management resources

Take that first step today. Your journey to financial confidence starts right where you are.