Why Understanding Zomato Share Price Matters for Your Investment Journey

The Zomato share price has become one of the most watched stocks among young professionals looking to build wealth through equity investments. As of February 2025, Zomato trades at around ₹215-220 on both NSE and BSE, marking a significant journey from its IPO days.

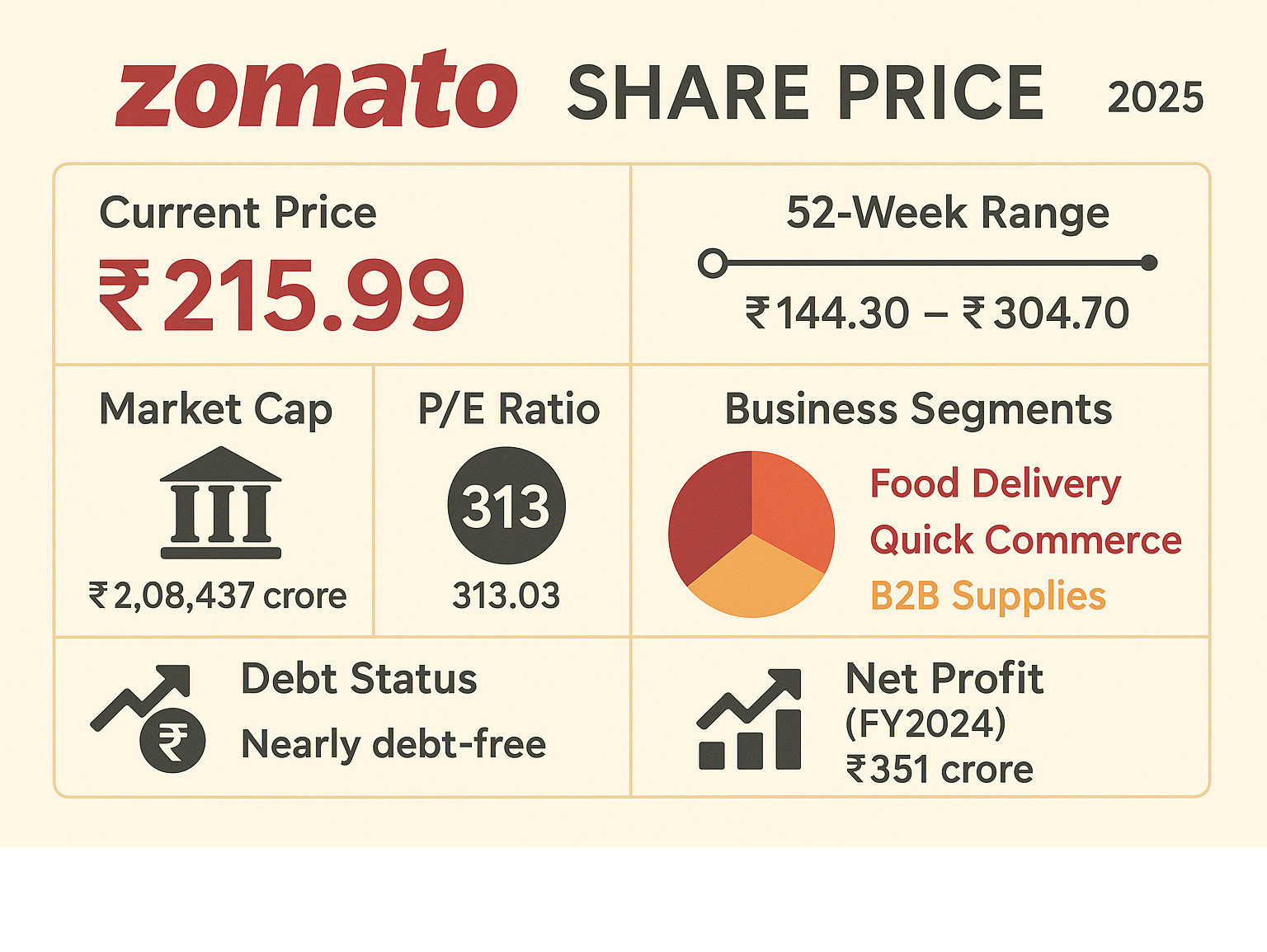

Quick Zomato Share Price Facts:

- Current Price: ₹215.99 (NSE) as of February 14, 2025

- 52-Week Range: ₹144.30 – ₹304.70

- Market Cap: ₹2,08,437 crore

- P/E Ratio: 313.03 (TTM)

- Debt Status: Nearly debt-free company

- 1-Year Return: +41.87%

For high-earning professionals in their 30s, Zomato represents an interesting case study in new-age tech investing. The company has evolved from a simple restaurant findy platform to a diversified digital commerce ecosystem spanning food delivery, quick commerce (Blinkit), and B2B supplies (Hyperpure).

What makes Zomato particularly relevant for wealth-building is its zero-debt balance sheet and improving profitability metrics. The company turned profitable in FY2024 with a net profit of ₹351 crore, compared to losses in previous years.

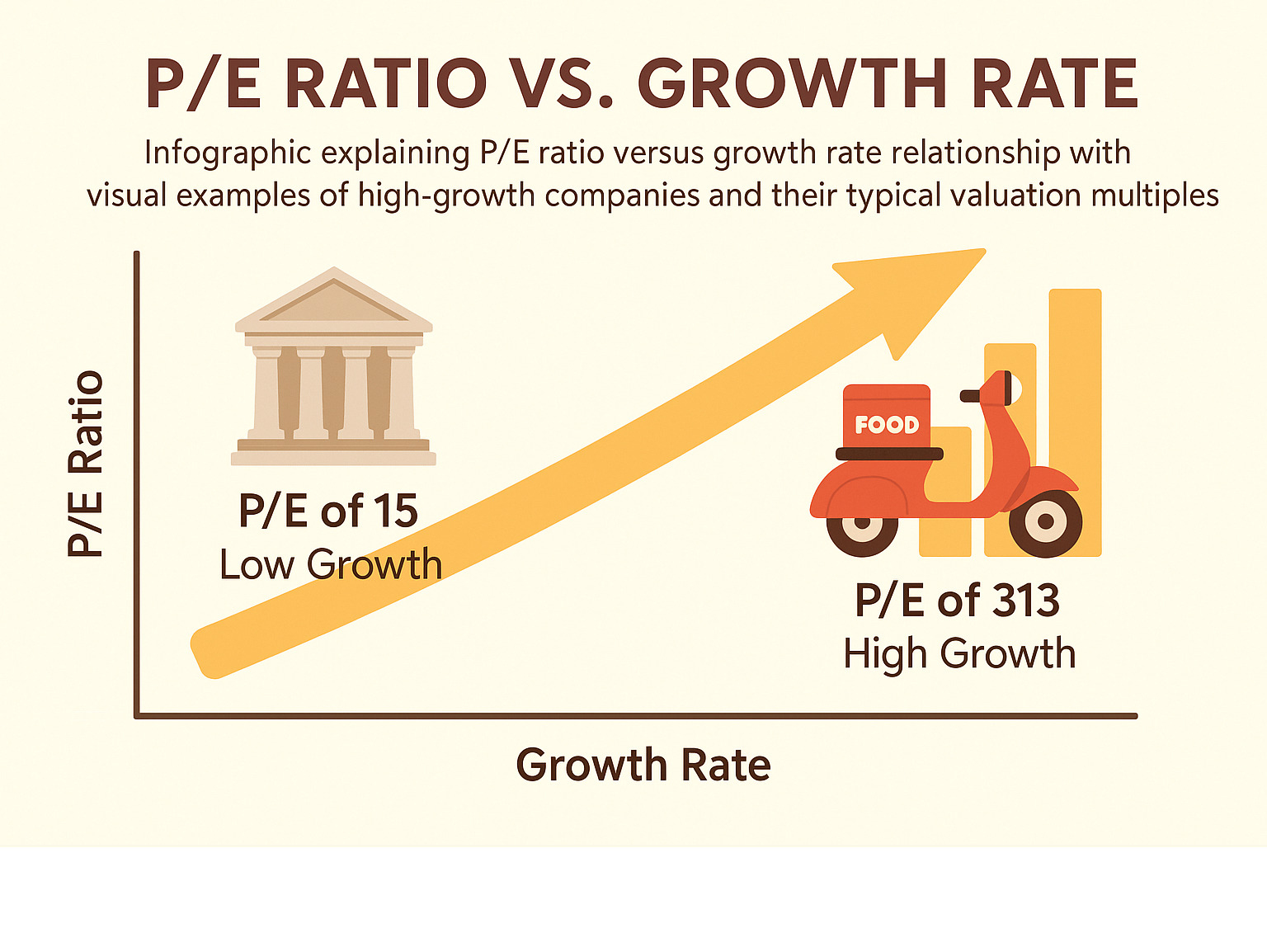

However, with a P/E ratio of over 300, the stock trades at premium valuations that require careful analysis. Understanding how to track and evaluate the Zomato share price becomes crucial for making informed investment decisions that align with your financial goals.

This guide will walk you through everything you need to know about monitoring Zomato’s share price, from real-time tracking tools to fundamental analysis techniques that can help you time your investments better.

Relevant articles related to zomato share price:

Real-Time Zomato Share Price Snapshot

Getting a real-time pulse on the Zomato share price is easier than you might think. The stock trades on both NSE and BSE under the ticker “ZOMATO,” and here’s what the numbers are telling us right now.

As of our latest check, Zomato sits at ₹215.99 on NSE, down about 0.86% from yesterday’s close. What’s interesting is how consistently the price moves between both exchanges – you won’t see wild differences that might confuse your investment decisions.

Let’s break down what these numbers actually mean for your portfolio. The market cap of ₹2,08,437 crore puts Zomato firmly in the large-cap territory, which is reassuring for investors who prefer stability over wild swings. The daily trading volume of 32.7 million shares shows there’s plenty of liquidity – you won’t have trouble buying or selling when you need to.

The 52-week journey has been quite a ride. From a low of ₹144.30 in March 2024 to a high of ₹304.70 in December, that’s more than a 100% swing. Right now, we’re sitting comfortably in the middle of that range.

Here’s something that really stands out: Zomato’s debt-free status with a debt-to-equity ratio of just 0.04. When many companies are drowning in debt, this is like finding a unicorn. The beta of 0.53 means it’s actually less volatile than the broader market – surprising for a tech stock, right?

What moves the Zomato Share Price daily?

Ever wonder why the Zomato share price jumps around during the day? It’s not random – there are specific forces at play that you can actually track and understand.

The big money moves first. Foreign investors (FIIs) own about 44% of Zomato shares, while domestic institutions like mutual funds hold another 23%. When these players decide to buy or sell, it’s like watching elephants dance – everyone notices. If you see unusual volume spikes, there’s probably institutional activity behind it.

Corporate news hits hard and fast. When Zomato announces quarterly results or shares updates about Blinkit’s growth (like that impressive 100% year-on-year jump in orders), the market reacts immediately. Smart investors keep their news alerts on for exactly this reason.

Sector sentiment spreads like wildfire. If global tech stocks are having a rough day, or if there’s news about food delivery regulations, Zomato often moves in sympathy. It’s part of being in the interconnected world of modern investing.

The beautiful thing about Zomato is that there’s no promoter holding – it’s purely market-driven. With retail investors holding about 26%, there’s a nice balance between institutional stability and retail enthusiasm.

Intraday tools to track the Zomato Share Price

Tracking the Zomato share price throughout the day doesn’t have to be a full-time job. Here are the tools that actually work for busy professionals.

Price alerts are your best friend. Set them at key levels – maybe ₹200 for a potential buying opportunity and ₹250 for profit-taking. Your phone will buzz when something important happens, so you can focus on your actual work.

Pivot levels tell you where the action is. These are mathematical support and resistance levels based on previous trading. Right now, strong support sits around ₹210, with resistance near ₹230. Think of these as the stock’s comfort zones.

Volume is the secret sauce. When you see trading volume above 50 million shares (compared to the 20-day average of 86 million), something big is usually happening. High volume confirms price moves – low volume moves are often just noise.

The key is not to get overwhelmed by all the data. Pick one or two tools that fit your investment style and stick with them. Successful investing is more about patience and discipline than about having the fanciest charts.

Historical Performance & Valuation Benchmarks

Looking at the Zomato share price journey since its public listing, we can see why it’s captured the attention of so many investors. The numbers tell a compelling story of growth, though they also highlight the importance of understanding what you’re paying for.

Over the past three years, Zomato has delivered an impressive 48% compound annual growth rate (CAGR) – the kind of returns that can significantly accelerate your wealth-building journey. Even more encouraging is the 41.87% return over the past year, showing the stock’s momentum despite market volatility.

However, 2025 has started with some turbulence. The stock is down 22.08% year-to-date, which might actually present an opportunity for patient investors who understand the company’s fundamentals.

When we dive into the valuation metrics, the picture becomes more nuanced. The trailing twelve-month P/E ratio of 313.03 is undeniably high, reflecting investor optimism about future growth. The company’s earnings per share (EPS) of ₹0.69 and book value per share of ₹22.19 give us a P/B ratio of 9.7.

What’s particularly interesting is how the company’s operational efficiency has transformed. The operating profit margin has improved dramatically from negative 44% in March 2022 to a positive 4% in December 2024. This shift toward profitability is crucial for justifying the premium valuation.

The return on equity (ROE) of 1.12% and return on capital employed (ROCE) of 1.14% are still modest, but they’re moving in the right direction. For a company transitioning from growth-at-all-costs to sustainable profitability, these metrics matter more than absolute numbers.

| Metric | Zomato | Paytm | Nykaa |

|---|---|---|---|

| P/E Ratio | 313.03 | N/A (Loss-making) | 89.2 |

| P/B Ratio | 9.7 | 2.1 | 12.4 |

| Revenue Growth (TTM) | 69% | 34% | 23% |

| Debt-to-Equity | 0.04 | 0.51 | 0.02 |

Comparing Zomato Share Price to Peers

The Zomato share price doesn’t exist in isolation – it’s part of a broader ecosystem of new-age tech companies. When we compare it to the sector average P/E of 172.61, Zomato clearly trades at a premium. But there’s good reason for this.

Unlike many of its peers, Zomato has successfully diversified beyond its core food delivery business. The rapid expansion of Blinkit’s quick commerce operations and the steady growth of Hyperpure’s B2B supplies create multiple revenue streams that many competitors lack.

The company’s 69% trailing twelve-month sales growth significantly outpaces most peers in the “Other Information Service Activities” category. More importantly, this growth is increasingly profitable, with improved unit economics across all business segments.

What sets Zomato apart is its near debt-free status with a debt-to-equity ratio of just 0.04. This financial flexibility allows the company to invest aggressively in growth opportunities without the burden of interest payments that weigh down many competitors.

52-Week Review of the Zomato Share Price

The Zomato share price reached its 52-week high of ₹304.70 on December 9, 2024, driven by exceptional quarterly results and Blinkit’s remarkable performance. The subsequent correction to current levels around ₹215 represents a 29% decline from peak levels – a substantial move that reflects both profit-taking and market recalibration.

Several factors contributed to that December peak. Blinkit’s expansion to 1,301 stores and its 100% year-on-year growth in gross order value demonstrated the company’s ability to scale new business lines effectively. The improved unit economics across all segments also gave investors confidence that the path to sustained profitability was becoming clearer.

The journey to the 52-week low of ₹144.30 in March 2024 feels like ancient history now, but it’s worth remembering. That low point came during broader market uncertainty about tech valuations and profitability timelines. The recovery from those levels shows how quickly sentiment can shift when fundamentals improve.

Seasonality analysis reveals some interesting patterns. Historically, April has been Zomato’s strongest month with an average gain of 9.42%, while February typically sees modest gains of around 3%. This seasonal strength often aligns with increased consumer spending and positive business updates.

The current price levels offer an interesting entry point for long-term investors who believe in the company’s diversification strategy and path to profitability. The correction from December highs has improved the risk-reward equation, though the premium valuation still requires careful consideration of your investment timeline and risk tolerance.

Business Drivers Behind the Price

The Zomato share price tells a fascinating story of business change. What started as a simple restaurant findy platform has grown into something much bigger – a digital commerce powerhouse that touches multiple aspects of our daily lives.

Think about it: when you order dinner through Zomato, grab groceries from Blinkit in 10 minutes, or notice your favorite restaurant’s fresh ingredients coming from Hyperpure, you’re experiencing an interconnected ecosystem. This diversification is exactly what makes the company’s valuation so interesting for investors.

The revenue story has completely changed over the past few years. Food delivery, while still important at 32.8% of revenue, now shares the spotlight with quick commerce through Blinkit (27.6% of revenue) and B2B supplies via Hyperpure (16.3% of revenue). The remaining portion comes from their going-out services vertical.

The numbers behind this ecosystem are impressive. Zomato serves approximately 20.5 million monthly users through 292,000 restaurant partners. This creates what we call a network effect – the more users join, the more valuable the platform becomes for restaurants, and vice versa.

What’s driving growth right now? Blinkit’s expansion stands out as the most exciting story. From 1,301 stores currently, they’re targeting 2,000 stores with an additional 1 million square feet of warehousing. That’s serious infrastructure investment that should support the Zomato share price in the long term.

Hyperpure, their B2B arm, delivered 93% year-over-year revenue growth in Q4 FY25. Meanwhile, the core food delivery business maintains steady momentum with 28% year-over-year Gross Order Value growth and improving margins.

More info about Investment Strategies

Segment-wise revenue impact

Each piece of Zomato’s business puzzle affects the Zomato share price in different ways, and understanding this helps us see the bigger investment picture.

Food ordering and delivery remains the steady cash cow. With 20% year-over-year growth guidance, it provides the reliable income stream that funds other ventures. The beauty of this segment lies in its network effects – once you’ve built relationships with restaurants and customers, it becomes harder for others to break in.

Quick commerce through Blinkit is where the real excitement happens. This segment expanded 121% year-over-year and serves 13.7 million monthly customers who’ve gotten used to 10-minute grocery delivery. Yes, it requires significant capital investment, but the margins are potentially higher than traditional food delivery.

Hyperpure creates something special – it makes restaurants sticky. When a restaurant gets used to Zomato’s farm-to-fork supply chain, they’re less likely to switch to another delivery platform. It’s a smart strategic move that strengthens the entire ecosystem while generating 93% growth rates.

Key risks & opportunities

Every investment story has two sides, and the Zomato share price reflects both the opportunities and challenges ahead.

The opportunity side looks compelling. Zomato’s zero debt advantage gives them financial flexibility that many growth companies lack. While others worry about interest payments, Zomato can focus purely on growth and profitability. The quick commerce market in India is still in its early days, offering massive expansion potential.

There’s also operational leverage at play. Most of the fixed costs – technology infrastructure, brand building, regulatory compliance – are already absorbed. This means incremental revenue should flow more directly to profits, supporting higher valuations.

The risk side requires honest assessment. With a P/E ratio of 313, the current Zomato share price leaves little room for execution mistakes. Investors are betting heavily on future growth, which means any disappointment could lead to sharp corrections.

Competition remains intense across all segments. The food delivery space, quick commerce, and B2B supplies all face aggressive rivals with deep pockets. Additionally, regulatory changes in food delivery and quick commerce could impact operations and profitability.

The key is finding the right balance between growth potential and valuation reality when considering Zomato for your portfolio.

How to Analyse & Invest in Zomato Shares

Making smart investment decisions about the Zomato share price requires more than just looking at daily price movements. You need a solid framework that combines both fundamental analysis and technical insights to time your investments effectively.

Understanding the fundamentals starts with examining Zomato’s impressive 69% TTM revenue growth, which shows the company is expanding rapidly across all business segments. The operating margin improvement to 4% in December 2024 demonstrates management’s focus on profitability rather than just growth at any cost.

What makes Zomato particularly attractive is its debt-free balance sheet with ₹17,501 crore in total assets. This financial strength gives the company flexibility to invest in growth opportunities without worrying about debt servicing costs. The improving free cash flow trajectory also suggests the business is becoming self-sustaining.

From a market position perspective, Zomato maintains leadership in food delivery while building a strong presence in quick commerce through Blinkit. This diversification reduces dependence on any single revenue stream.

Technical analysis provides additional timing insights for the Zomato share price. Currently, the stock trades below key exponential moving averages, suggesting some caution is warranted. Smart investors monitor the RSI indicator for oversold conditions below 30, which often present good buying opportunities.

Volume analysis is equally important – when daily trading volume exceeds 50 million shares, it often signals significant price movements ahead. Key technical levels to watch include support around ₹210 and resistance near ₹250.

The broker consensus shows 84% buy ratings, though target prices range dramatically from ₹130 to ₄00. This wide disagreement among professionals highlights why doing your own analysis matters.

Scientific research on behavioural finance

Step-by-step: buying at the right Zomato Share Price

Getting started with investing in the Zomato share price doesn’t have to be overwhelming. Here’s a practical approach that works for busy professionals.

Setting up your investment infrastructure begins with opening a demat account with a reputable broker. The entire KYC verification process can now be completed online within 24 hours, making it incredibly convenient. Once your account is active, linking your bank account enables seamless transactions.

Developing your price strategy is where many investors go wrong. Instead of trying to time the perfect entry point, consider setting price alerts at key levels like ₹200, ₹220, and ₹250. This removes emotion from your decision-making process.

Systematic Investment Plans (SIP) work particularly well for volatile growth stocks like Zomato. By investing a fixed amount monthly regardless of price, you benefit from rupee cost averaging. This approach has historically delivered better returns than trying to time the market perfectly.

Portfolio diversification remains crucial even when you’re excited about a particular stock. Starting with a 2-5% position in Zomato allows you to participate in its growth while maintaining overall portfolio balance.

The execution phase involves monitoring quarterly results and business updates without getting caught up in daily price fluctuations. Regular portfolio reviews help you decide when to add more shares or take profits based on your wealth-building timeline.

More info about Best Investments for Beginners

DIY vs analyst recommendations

The Zomato share price attracts significant analyst coverage, but blindly following recommendations isn’t always the best approach. Understanding when to rely on professional research versus your own analysis can make a meaningful difference in your investment outcomes.

Professional analysts bring valuable insights through their company access and industry expertise. They conduct detailed peer comparisons and provide regular updates on business developments that individual investors might miss. Their research reports often contain information that’s difficult to gather independently.

However, analyst recommendations come with inherent limitations. Many analysts work for firms that have investment banking relationships with the companies they cover, creating potential conflicts of interest. Target prices can also vary wildly – the current range of ₹130 to ₹400 for Zomato shows how subjective valuations can be.

Your personal investment approach should align with your specific risk tolerance and investment horizon. If you’re building wealth over 10-15 years, short-term analyst upgrades and downgrades matter less than the company’s long-term competitive position.

The most effective strategy combines both approaches. Use analyst research as valuable input while making independent decisions based on your own financial goals. This balanced approach helps you stay informed while maintaining control over your investment destiny.

Successful investing isn’t about finding the perfect stock or timing the market perfectly. It’s about consistently making informed decisions that align with your wealth-building objectives while managing risk appropriately.

Frequently Asked Questions about Zomato Share Price

Let’s address the most common questions we receive about the Zomato share price from investors like you. These are the real concerns that keep coming up in our community discussions.

What is the current Zomato share price?

The Zomato share price is currently trading at ₹215.99 on NSE as of February 14, 2025. That’s a slight dip of 0.86% from yesterday’s closing price of ₹217.80.

You can easily track the live price through several channels. The NSE website gives you real-time quotes, and most broker apps send instant notifications when the price moves. Many of our readers set up price alerts on their phones – it’s a simple way to stay updated without constantly checking.

The stock trades on both NSE and BSE under the ticker “ZOMATO,” so you’ll see consistent pricing across both exchanges. Prices fluctuate throughout trading hours, so what you see at 9 AM might be different by lunch time.

Is Zomato profitable now?

Yes, and this is actually a big deal! Zomato turned the corner in FY2024 with a net profit of ₹351 crore. Compare that to the ₹971 crore loss they posted in FY2023 – that’s quite a turnaround.

What’s even more impressive is how their operating profit margin improved. Back in March 2022, they were burning money with a -44% margin. Fast forward to December 2024, and they’re posting a healthy 4% operating margin.

This profitability shift is one of the key reasons many investors are watching the Zomato share price closely. A company that can demonstrate sustainable profits tends to attract more institutional money, which can support higher stock prices over time.

The path wasn’t easy – they had to optimize delivery costs, improve restaurant partnerships, and scale their newer businesses like Blinkit. But the numbers show they’re on the right track.

How does Blinkit affect the share price?

Blinkit is honestly the star of the show right now. This quick commerce arm is growing at 100% year-over-year in gross order value, which is phenomenal growth by any standard.

Here’s why Blinkit matters so much to the Zomato share price: it now contributes 27.6% of total revenue and serves 13.7 million monthly customers. That’s not a small side business anymore – it’s becoming a major revenue driver.

The expansion plans are equally exciting. Zomato is targeting 2,000 Blinkit stores with an additional 1 million square feet of warehousing space. Each new store potentially means more customers, more orders, and better unit economics.

Investors pay close attention to Blinkit’s quarterly updates because quick commerce is still a relatively new market in India. If Blinkit can maintain this growth trajectory while improving profitability, it could significantly boost the overall Zomato share price in the coming years.

The beauty of Blinkit is that it leverages Zomato’s existing customer base and delivery infrastructure. It’s not starting from scratch – it’s building on proven foundations, which makes the growth story more believable to investors.

Conclusion

The Zomato share price journey we’ve explored together tells a fascinating story about modern India’s digital change and the wealth-building opportunities it creates for smart investors. At Finances 4You, we’ve seen how understanding companies like Zomato can help you align your investment portfolio with the country’s evolving economic landscape.

Think about it this way: when you track the Zomato share price at around ₹215, you’re not just watching numbers fluctuate. You’re observing a company that’s successfully steerd from startup losses to sustainable profitability, all while maintaining a debt-free balance sheet that many established companies would envy.

The 29% correction from December highs might feel concerning, but it actually presents what many consider a more reasonable entry point for patient investors. The company’s diversified revenue streams spanning food delivery, quick commerce, and B2B supplies create multiple growth engines that reduce single-business dependency risks.

Here’s what makes this particularly relevant for your wealth-building journey: Zomato operates in markets that are still expanding rapidly. India’s digital commerce story is far from complete, and companies positioned at the intersection of technology and consumer behavior often reward long-term investors handsomely.

The premium valuation with a P/E ratio over 300 does require careful consideration. This isn’t a stock you buy impulsively or invest your entire portfolio in. Instead, it’s the type of quality growth story that benefits from systematic investment plans and gradual accumulation over time.

For professionals looking to build wealth through equity investments, starting with a small position and using rupee cost averaging makes perfect sense. Successful investing isn’t about perfectly timing the market – it’s about spending time in the market with quality companies that align with your financial goals.

Your investment journey begins with understanding your own risk tolerance and timeline. Whether the Zomato share price fits your portfolio depends on how comfortable you are with growth-stage valuations and your belief in India’s digital commerce future.